Company Summary

| BLUEMOUNT Review Summary | |

| Founded | 1996 |

| Registered Country/Region | China Hong Kong |

| Regulation | SFC (Exceeded) |

| Market Instruments | Securities, Shares |

| Trading Platform | BLUEMOUNT APP |

| Customer Support | Hotline: +852 2137 2688 |

| Fax: + 852 2137 2628 | |

| Email: cs@bluemount.com | |

BLUEMOUNT Information

BLUEMOUNT is a securities company based in China, Hong Kong, providing securities trading services for both the Hong Kong and Global markets. BLUE also offers various services, including collection of account management services, cash dividends, bonus shares/warrants, new shares subscription, shares subscription, exercise of warrants, and stock consolidation/splitting, etc. It currently operates without regulation.

Pros and Cons

| Pros | Cons |

| Transparent fee structure | Exceeded SFC License |

| Offers both Individual and Joint accounts | Demo accounts unavailable |

| Long operation time | Limited market instruments |

| Limited payment options |

Is BLUEMOUNT Legit?

No, BLUEMOUNT holds an exceededlicense from the Securities and Futures Commission (SFC) of Hong Kong, which means its current activities are being operated without regulatory oversight.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Securities and Futures Commission of Hong Kong (SFC) | Exceeded | Bluemount Securities Limited | Dealing in securities | BHR496 |

What Can I Trade on BLUEMOUNT?

Traders on BLUEMOUNT get access to shares and securities (cash and margin).

| Trading Asset | Available |

| securities | ✔ |

| shares | ✔ |

| forex | ❌ |

| commodities | ❌ |

| indices | ❌ |

| cryptocurrencies | ❌ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

| ETFs | ❌ |

Account Type

Traders are allowed to open both individual accounts and joint accounts on this platform.

Additionally, this platform offers Discretionary Account Services, which refers to investment management services where a financial advisor or portfolio manager is given the authority to make investment decisions on behalf of a client without needing to seek prior approval for each transaction.

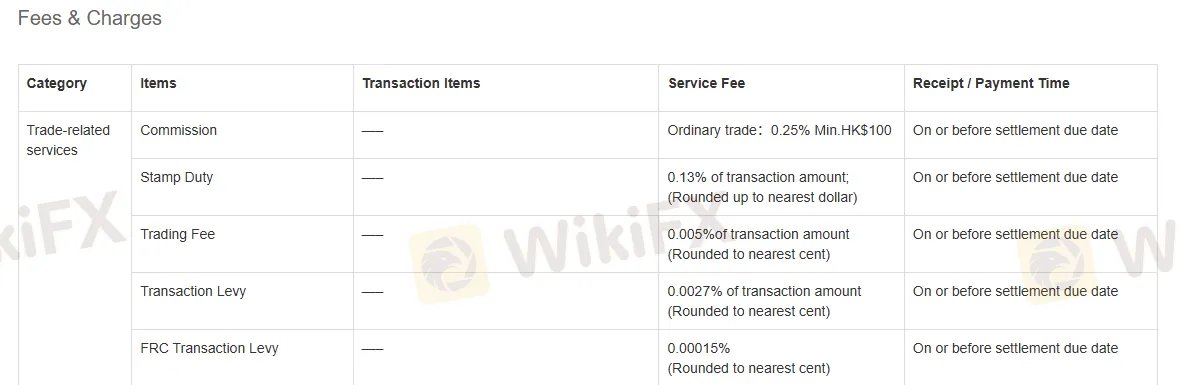

Fees

BLUEMOUNT provides traders with a clear fee structure, detailing its charges for each service. For instance, BLUEMOUNT charges a commission of 0.25%, and the minimum amount is HK$ $100.

For more information about fees and charges on this platform, please go to https://www.bluemount.com/fees-charges?lang=en.

Here are various fees related to the transaction, along with their calculation rules and payment timelines.

| Items | Service Fee | Receipt/Payment Time |

| Commission | Ordinary trade: 0.25%; Min. HK$100 | On or before the settlement due date |

| Stamp Duty | 0.13% of transaction amount; (Rounded up to nearest dollar) | |

| Trading Fee | 0.005% of transaction amount (Rounded to nearest cent) | |

| Transaction Levy | 0.0027% of transaction amount (Rounded to nearest cent) | |

| FRC Transaction Levy | 0.00015% (Rounded to nearest cent) |

Trading Platform

BLUEMOUNT offers a trading app that is accessible on both Google Play and the App Store.

| Trading Platform | Supported | Available Devices |

| BLUEMOUNT APP | ✔ | Mobile |

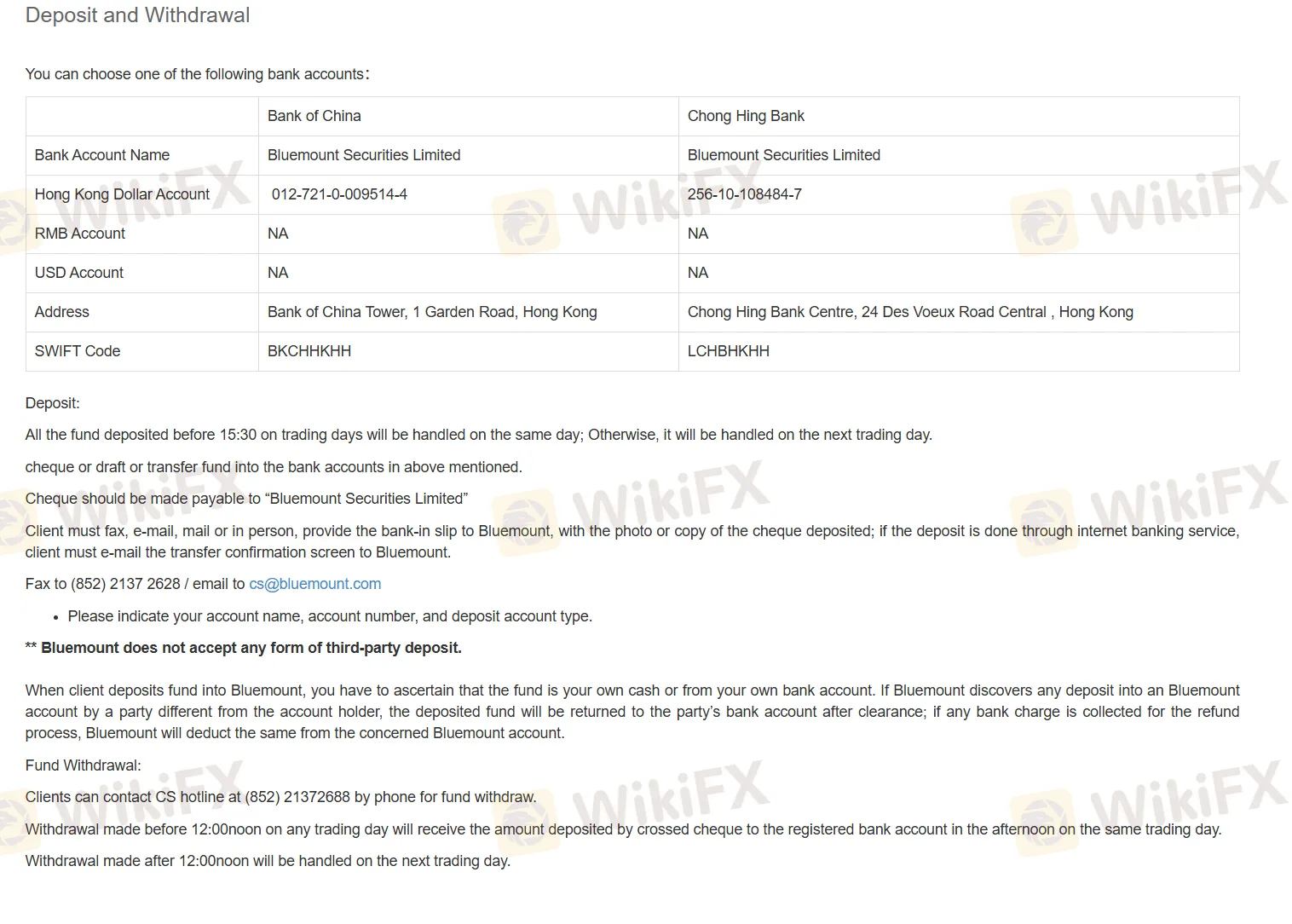

Deposit and Withdrawal

Deposit Process:

- Bank Accounts for Deposit:

- You can deposit funds into Bluemounts accounts at Bank of China or Chong Hing Bank. Available account types include Hong Kong Dollar Accounts, but there are no RMB or USD accounts. SWIFT Codes and addresses are provided for each bank.

- Deposit Timing:

- Before 15:30 on trading days: Processed the same day. After 15:30: Processed the next trading day.

- Deposit Methods:

- Cheque/Draft/Bank Transfer: Make payable to Bluemount Securities Limited. If depositing by cheque, you must provide the bank-in slip, a photo or copy of the cheque, or transfer confirmation.

Important Notes: Third-party deposits are not accepted. All deposits must come from your account. If Bluemount identifies a deposit from a third party, it will return the funds to the senders account (with any bank charges deducted).

Withdrawal Process:

- How to Withdraw:

- You can call Customer Service (CS) at (852) 2137 2688 to request a withdrawal.

- Withdrawal Timing:

- Before 12:00 PM: Withdrawals processed in the afternoon and deposited by crossed cheque into your registered bank account on the same trading day. After 12:00 PM: Withdrawals are processed the next trading day.