公司简介

| Naito Securities Review Summary | |

| 成立年份 | 1933 |

| 注册国家/地区 | 日本 |

| 监管机构 | 日本证券交易商协会(FSA) |

| 市场工具 | 外汇、商品、指数、股票、债券、ETF、REITs |

| 模拟账户 | × |

| 交易平台 | 专有交易平台,可进行在线交易 |

| 客户支持 | 电话:0120-7110-76(免费)06-4803-6617(手机) |

| 24/5客户支持:是 | |

Naito Securities 信息

Naito Securities 是一家知名的日本经纪公司,涉及股票、债券、交易所交易基金(ETF)和房地产投资信托(REITs)。它提供来自世界各地的股票市场信息,包括日本、中国和美国。

优点和缺点

| 优点 | 缺点 |

| 成立时间较长的公司(1933年) | 没有模拟账户可用 |

| 提供广泛的金融产品(从外汇到ETF,从中国到美国) | 费用结构过于复杂 |

| 受FSA监管 |

Naito Securities 是否合法?

| 监管状态 | 受监管(零售外汇牌照) |

| 监管机构 | 日本 |

| 许可机构 | Naito Securities Co., Ltd. |

| 许可证号码 | 近畿金融局局长(金商)第24号 |

| 生效日期 | 2007-09-30 |

| 许可机构地址 | 日本大阪市北区中之岛3-3-23 |

| 许可机构电话号码 | 06-4803-6501 |

我可以在 Naito Securities 上交易什么?

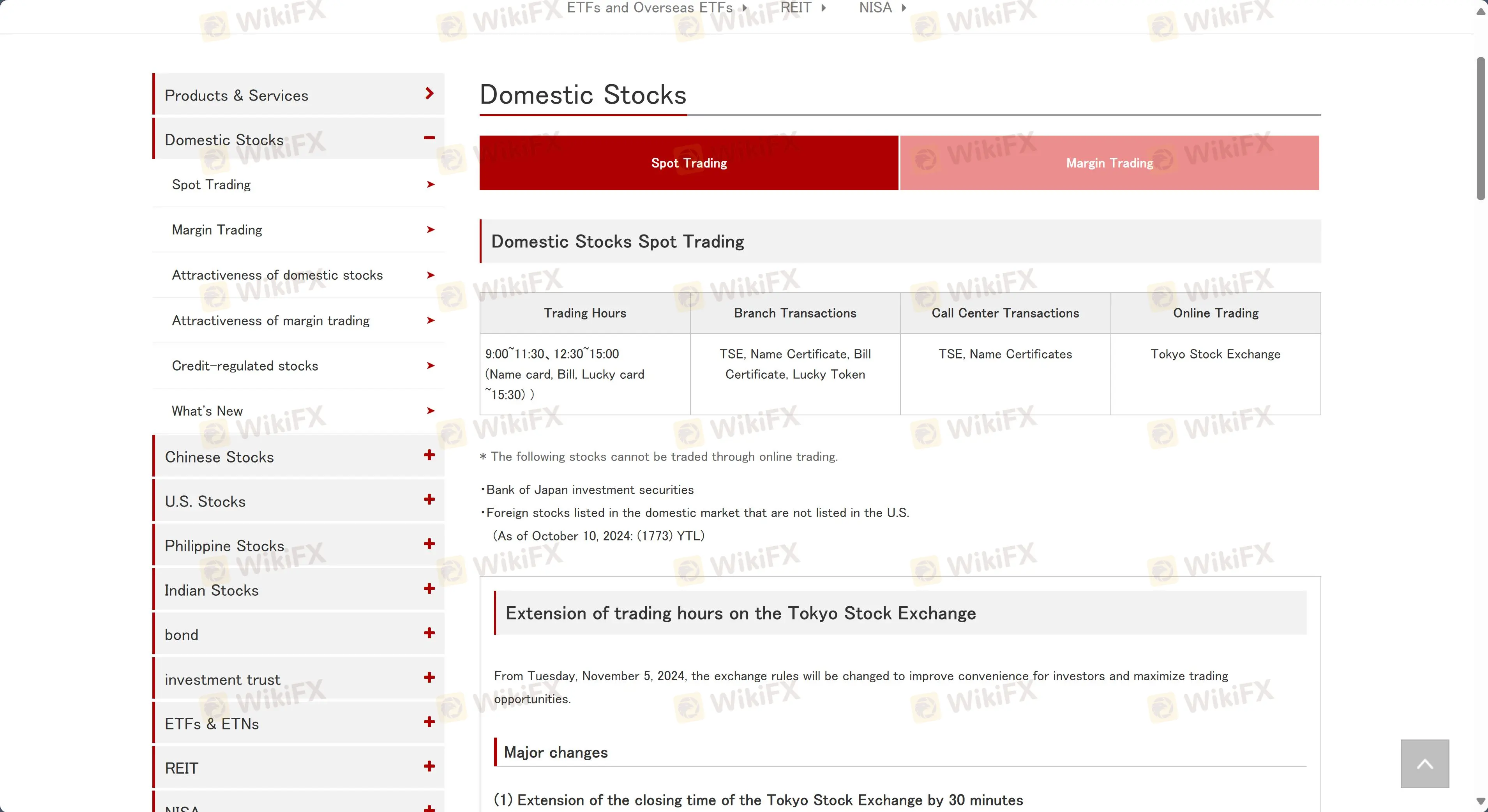

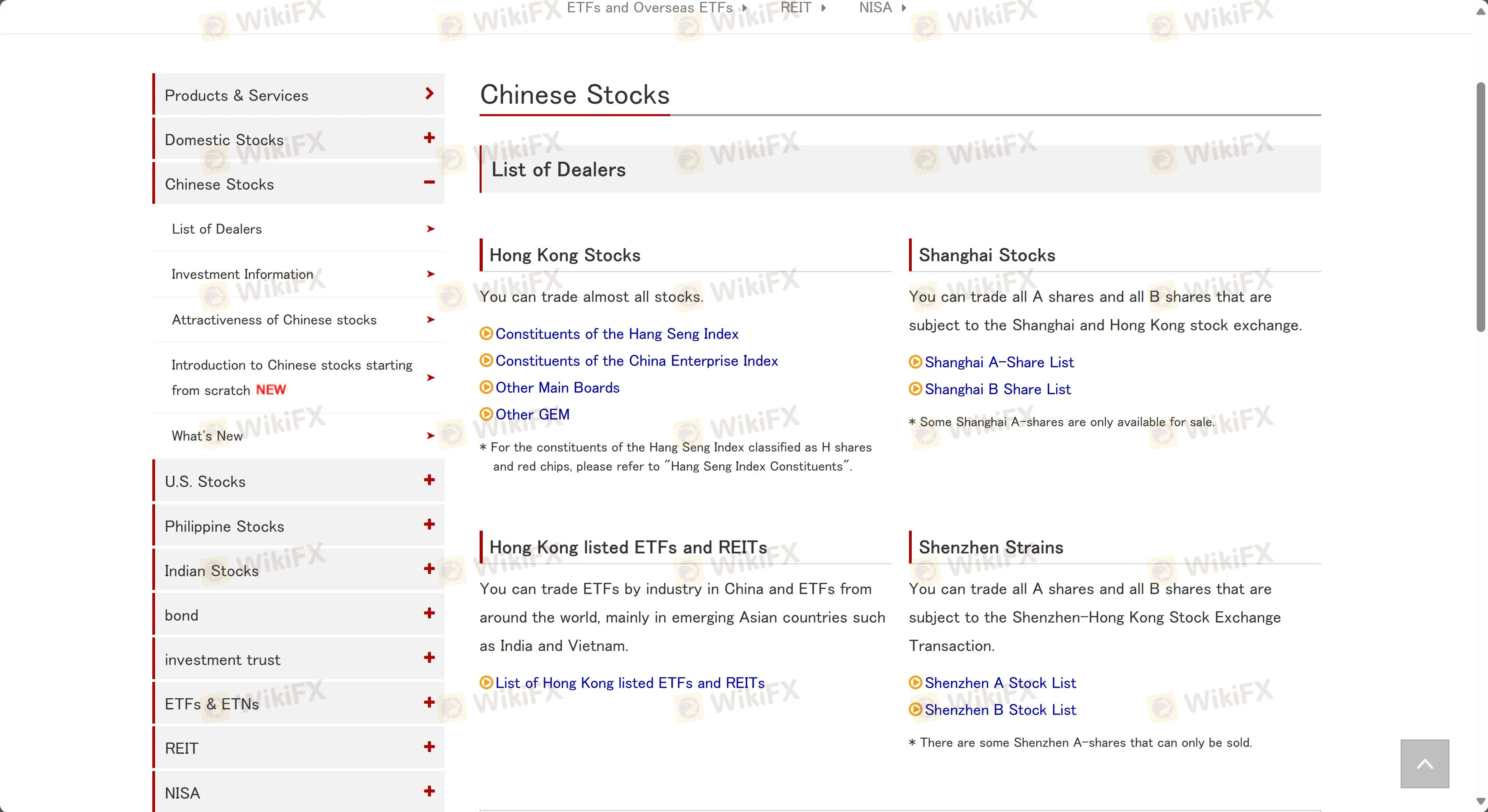

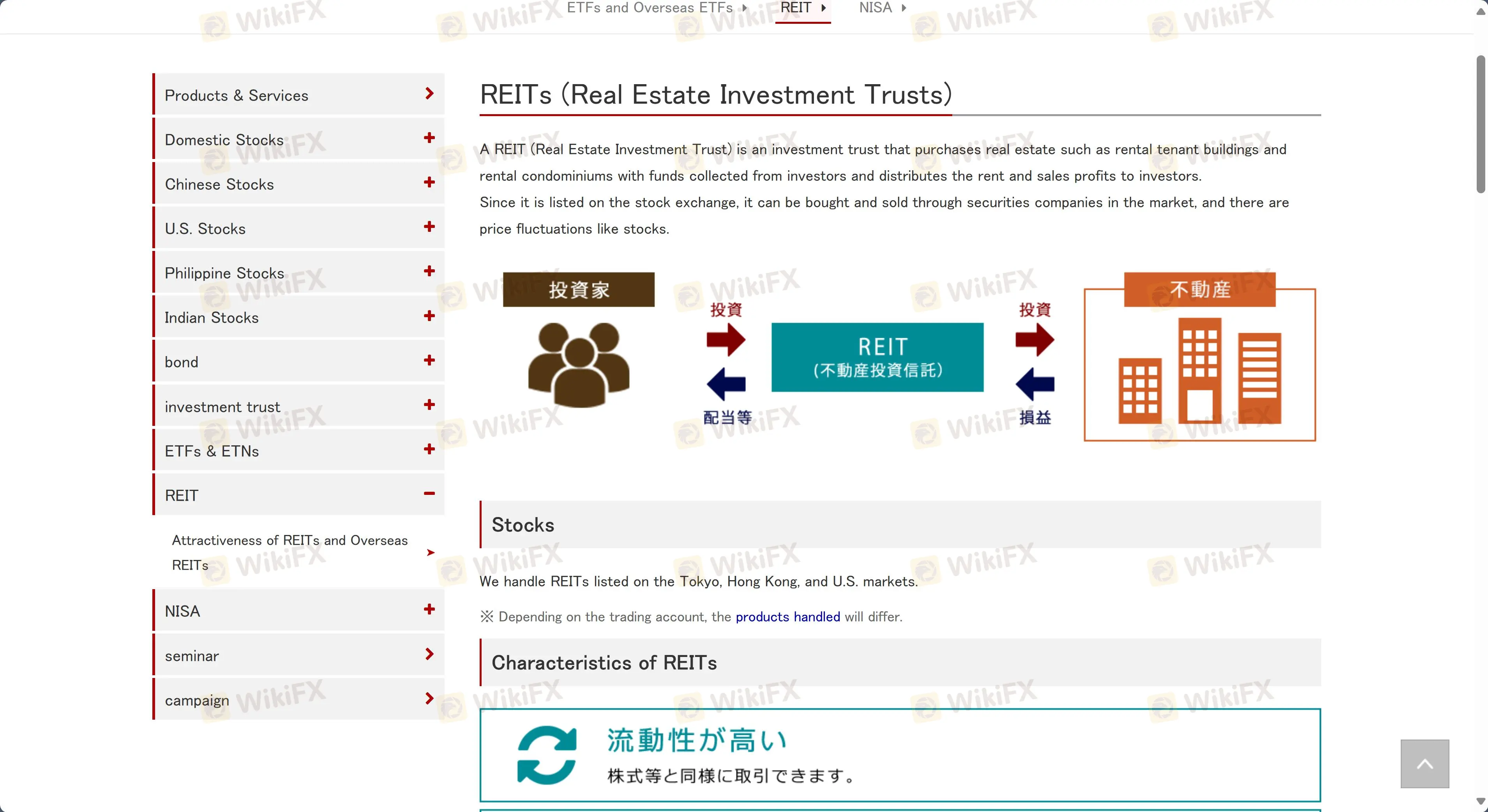

Naito Securities提供多种金融产品,涵盖不同的市场和类型,包括日本、中国和美国。资产包括外汇和REITs。

| 可交易工具 | 支持 |

| 外汇 | ✔ |

| 商品 | ✔ |

| 指数 | ✔ |

| 股票 | ✔ |

| ETFs | ✔ |

| REITs | ✔ |

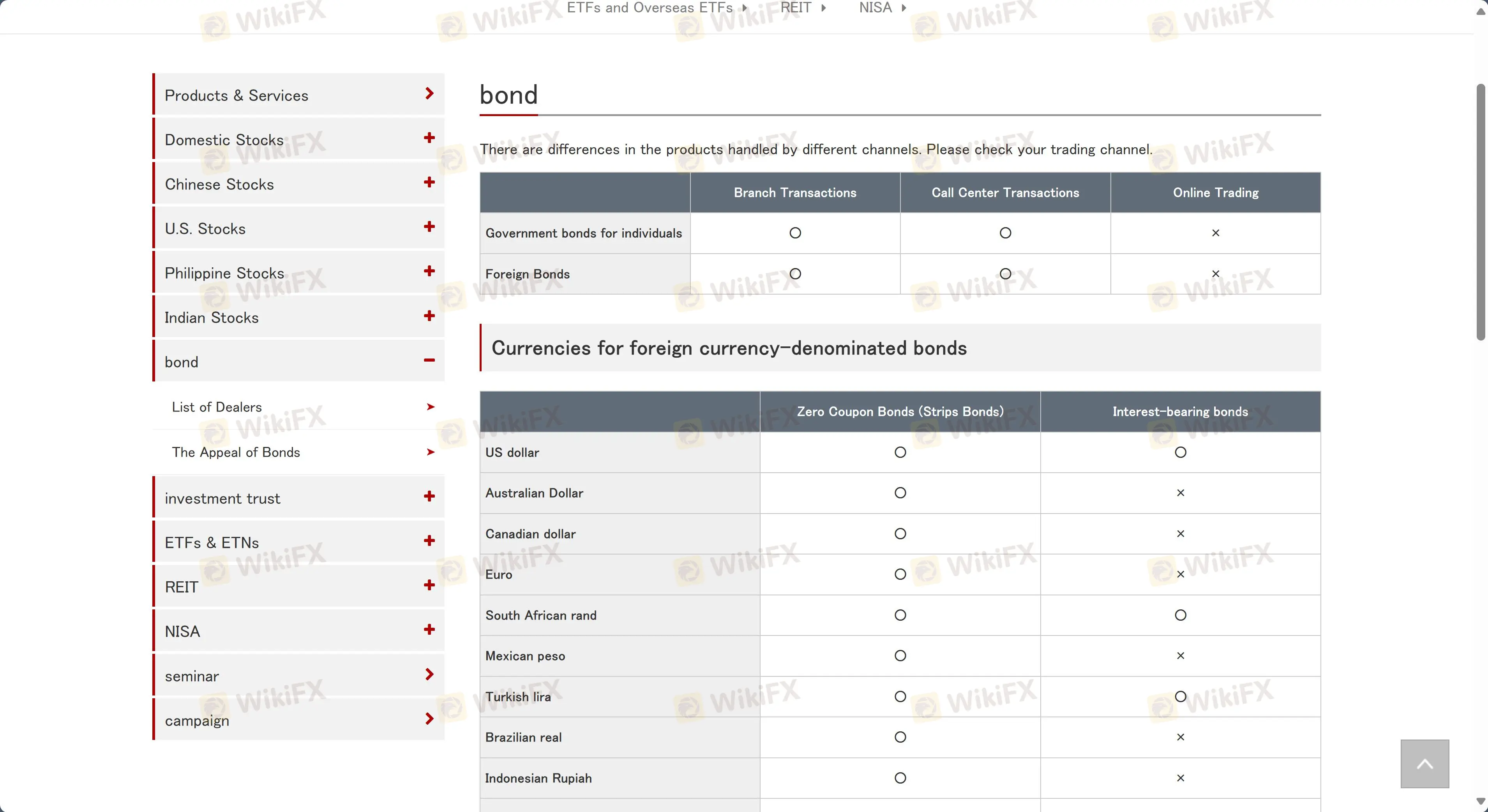

| 债券 | ✔ |

| 加密货币 | ❌ |

账户类型

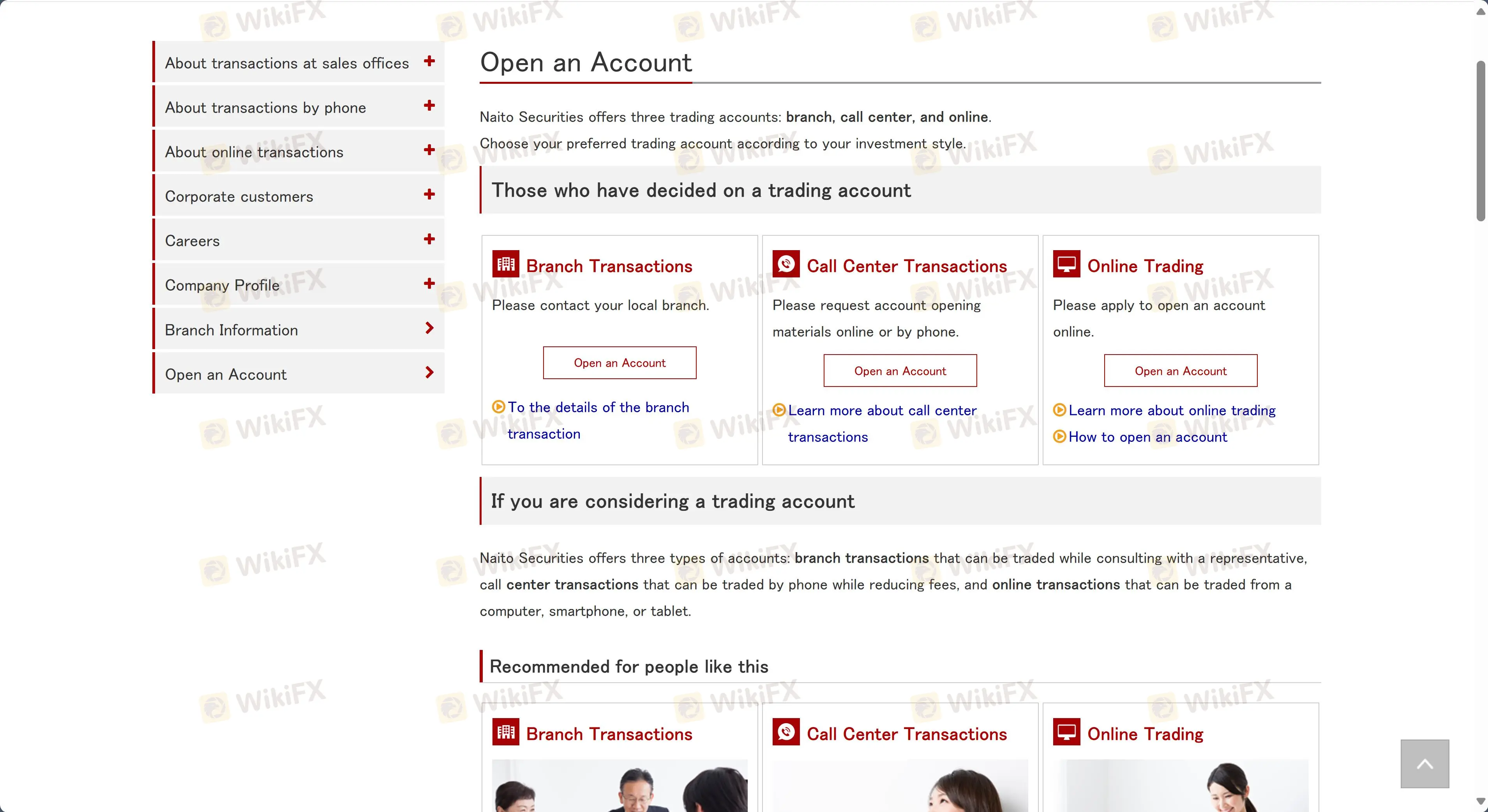

Naito Securities提供3种账户。它不提供模拟账户。

| 账户名称 | 费用 | 主要特点 | 适用于 |

| 柜台交易 | 交易额低于JPY 500,000的交易起始费用为JPY 2,750 | 面对面咨询,全面的资产管理建议。 | 寻求个性化、面对面服务的投资者。 |

| 电话交易中心 | 交易额低于JPY 500,000的交易起始费用为JPY 3,300 | 电话交易,相比柜台交易降低手续费。 | 交易者更喜欢基于电话的咨询,费用较低。 |

| 在线交易 | 交易额低于JPY 500,000的交易起始费用为JPY 419 | 通过计算机、智能手机或平板电脑进行交易,具有最低的手续费和全天候市场订单访问。 | 自主交易者,希望费用低廉且方便。 |

Naito Securities费用

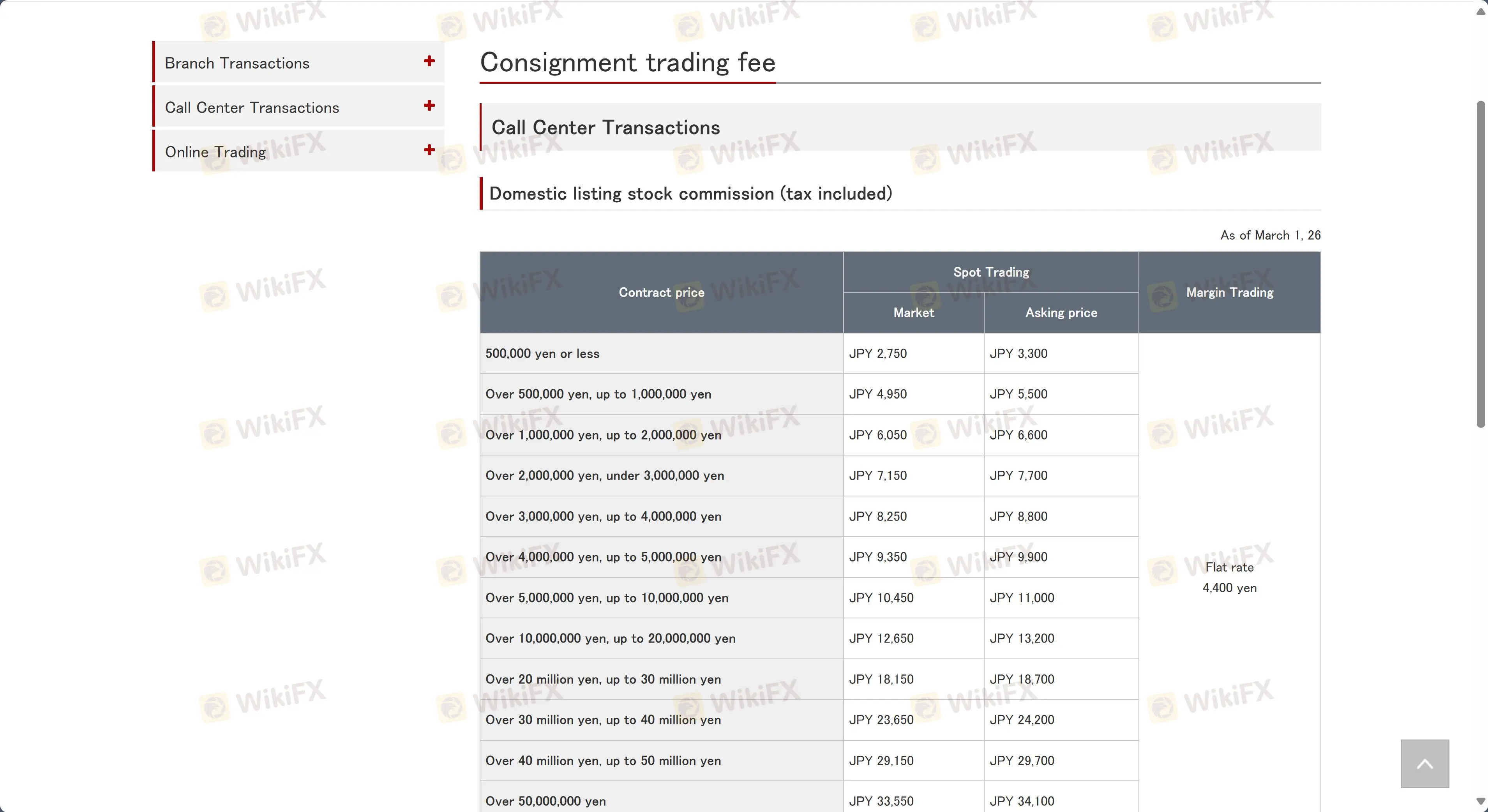

Naito Securities的手续费很复杂,大致可以分为3种类型:委托交易手续费、在线交易手续费和柜台交易手续费。

委托交易费用

通过Naito Securities的调用中心进行国内上市股票的委托交易费用根据合同价格而异,现货交易范围为JPY 2,750至JPY 33,550,保证金交易范围为JPY 3,300至JPY 34,100。这些手续费也适用于ETF和J-REITs。

上市股票

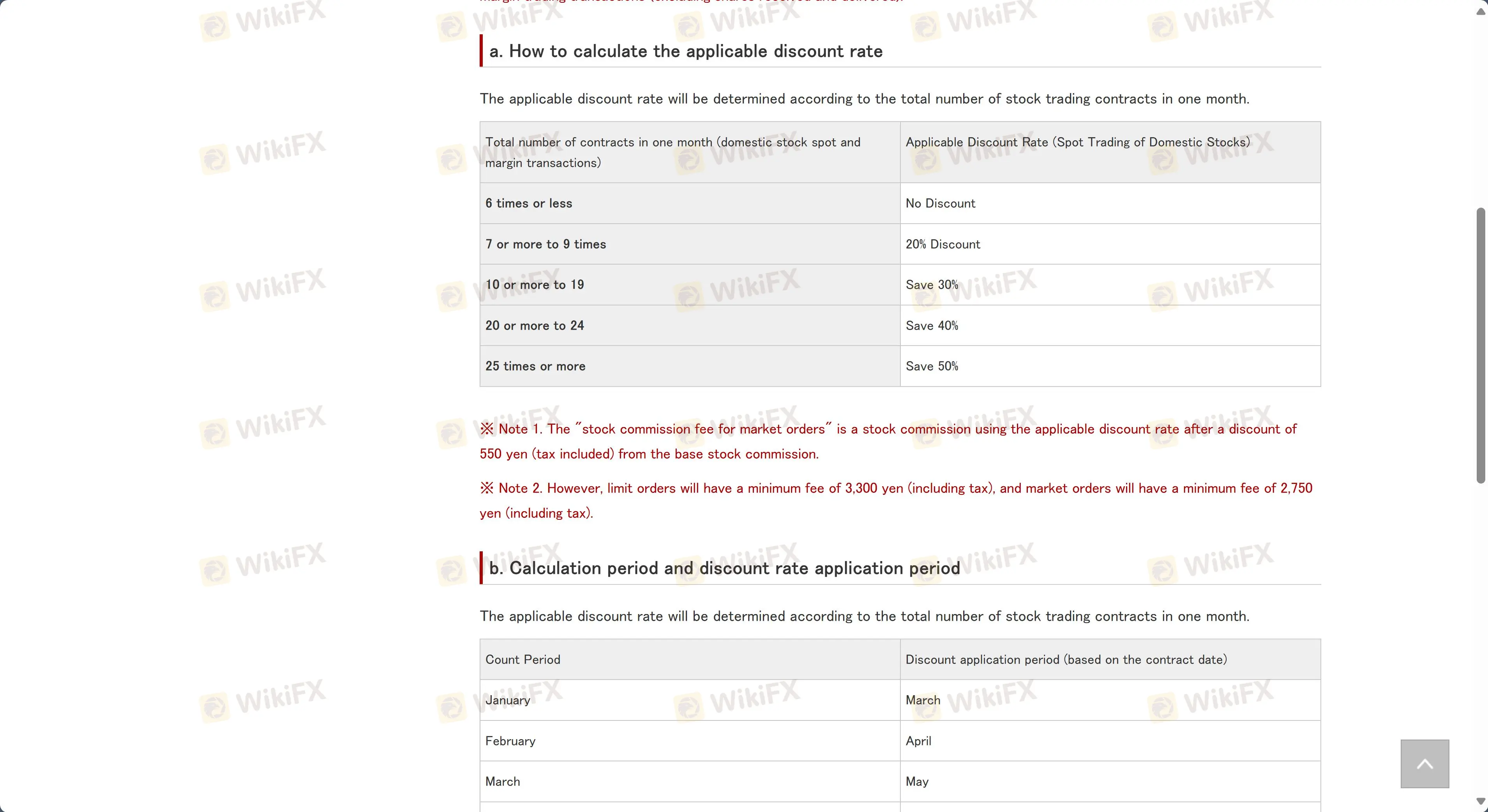

实物股票委托数量手续费的折扣制度

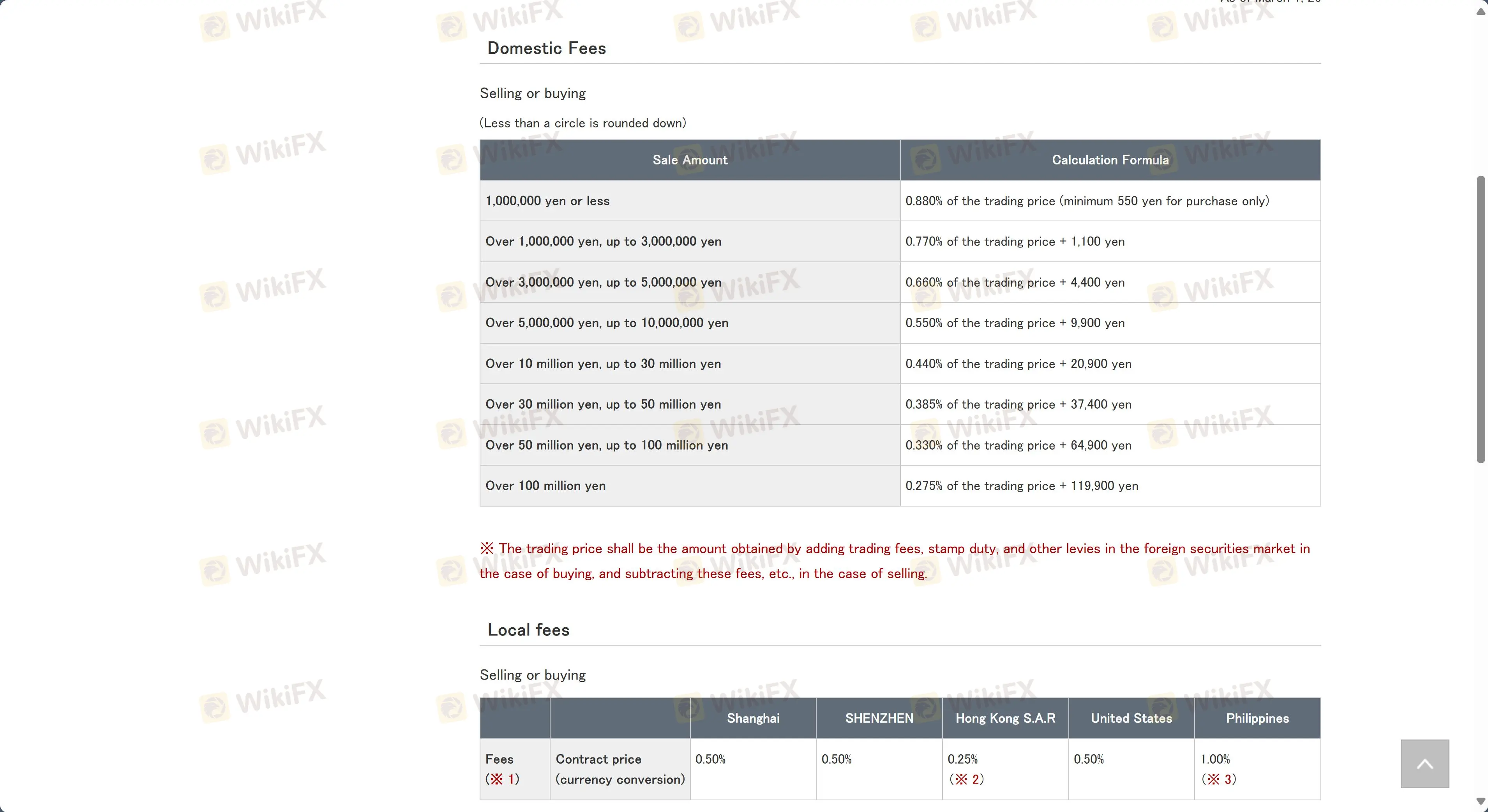

外国股票佣金

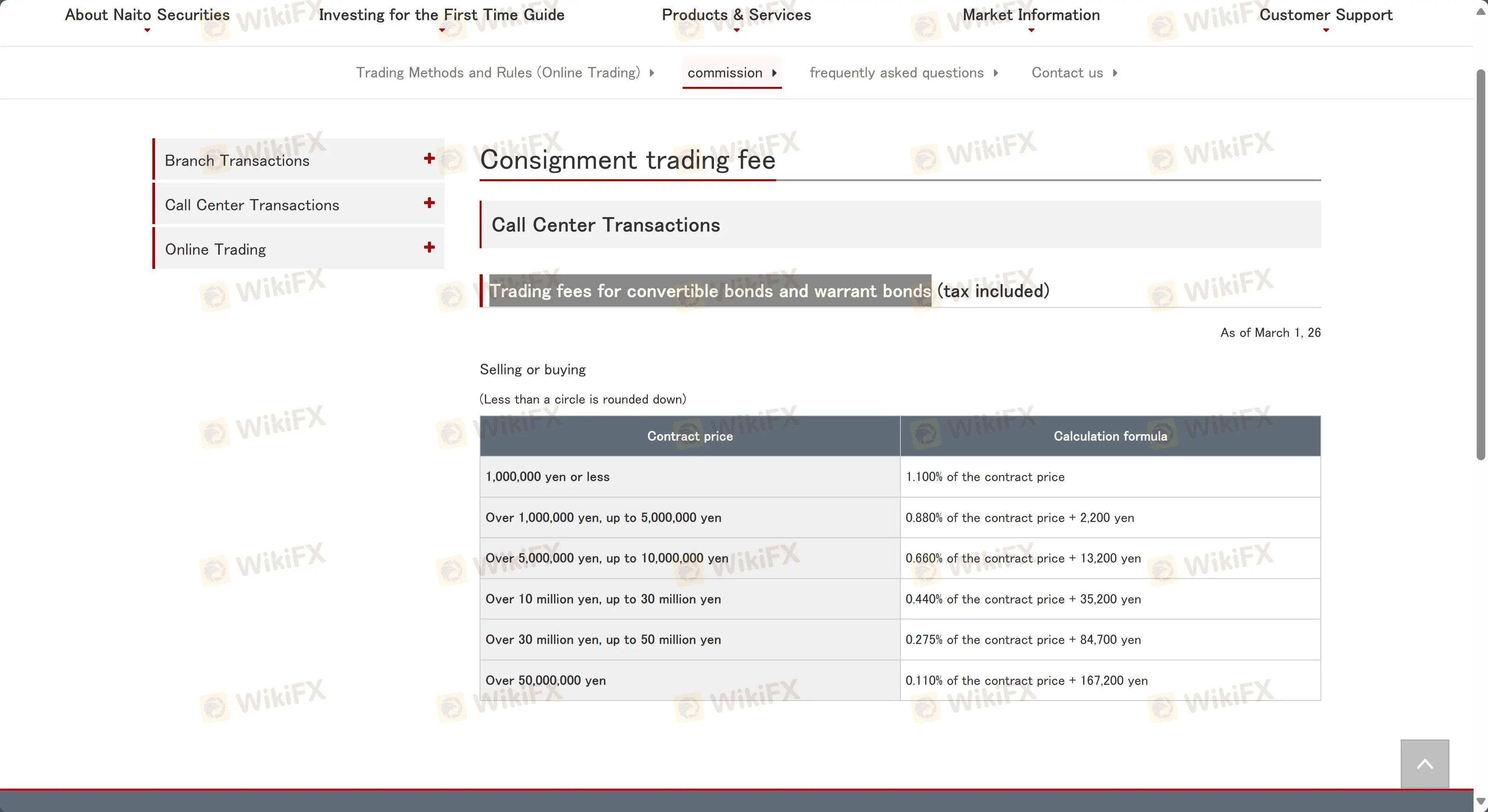

可转债和权证债券的交易手续费

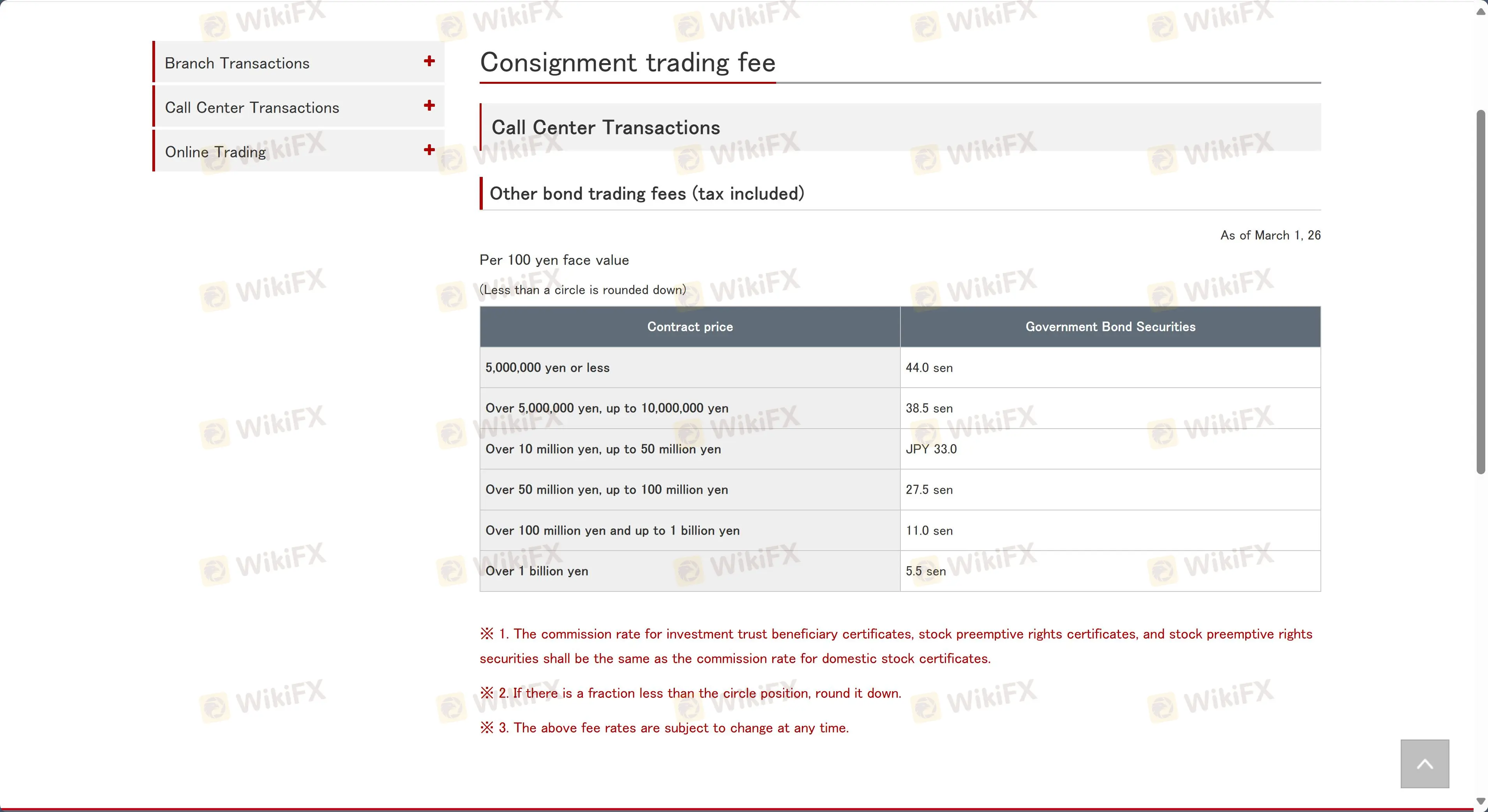

其他债券交易手续费

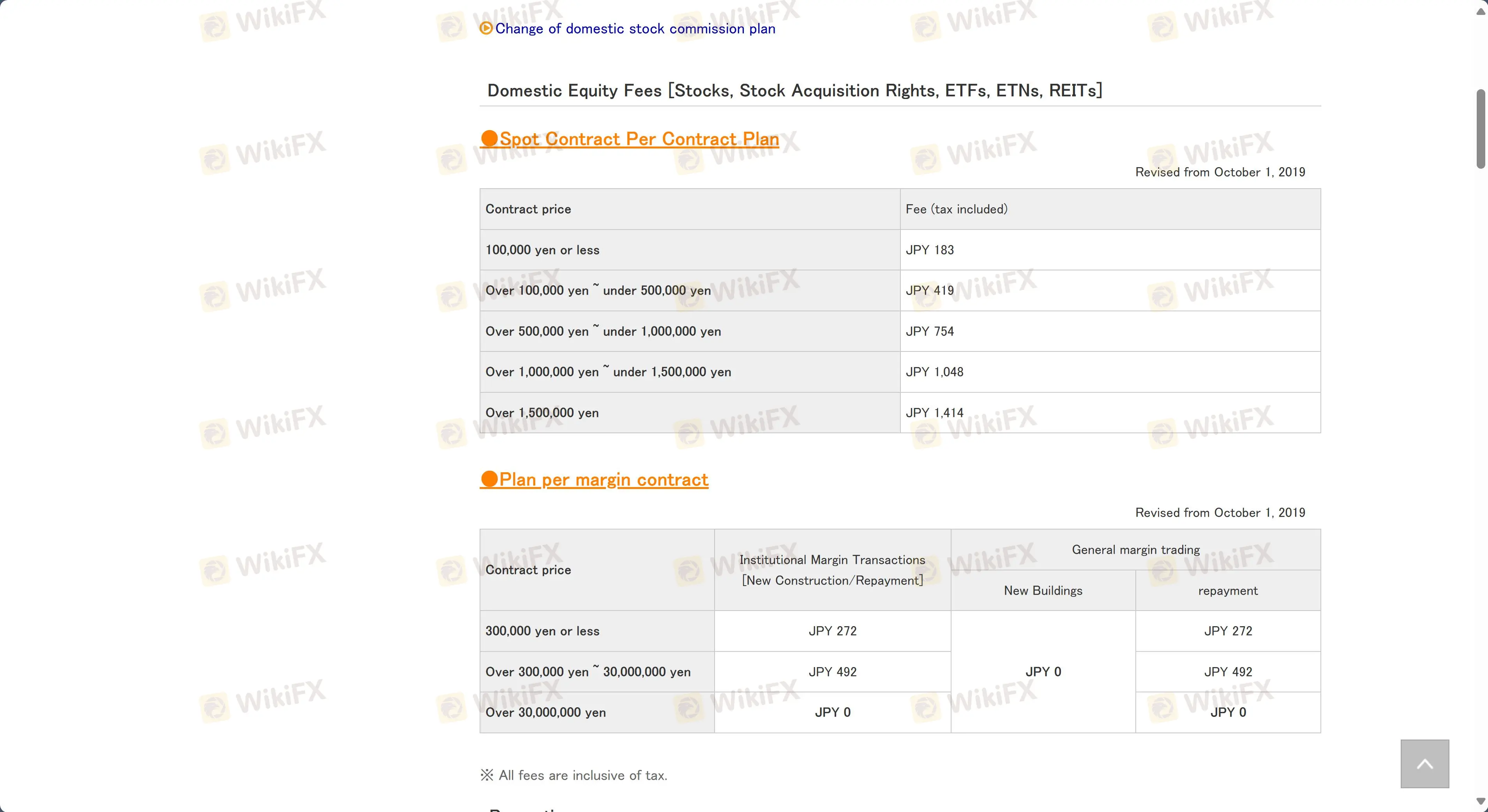

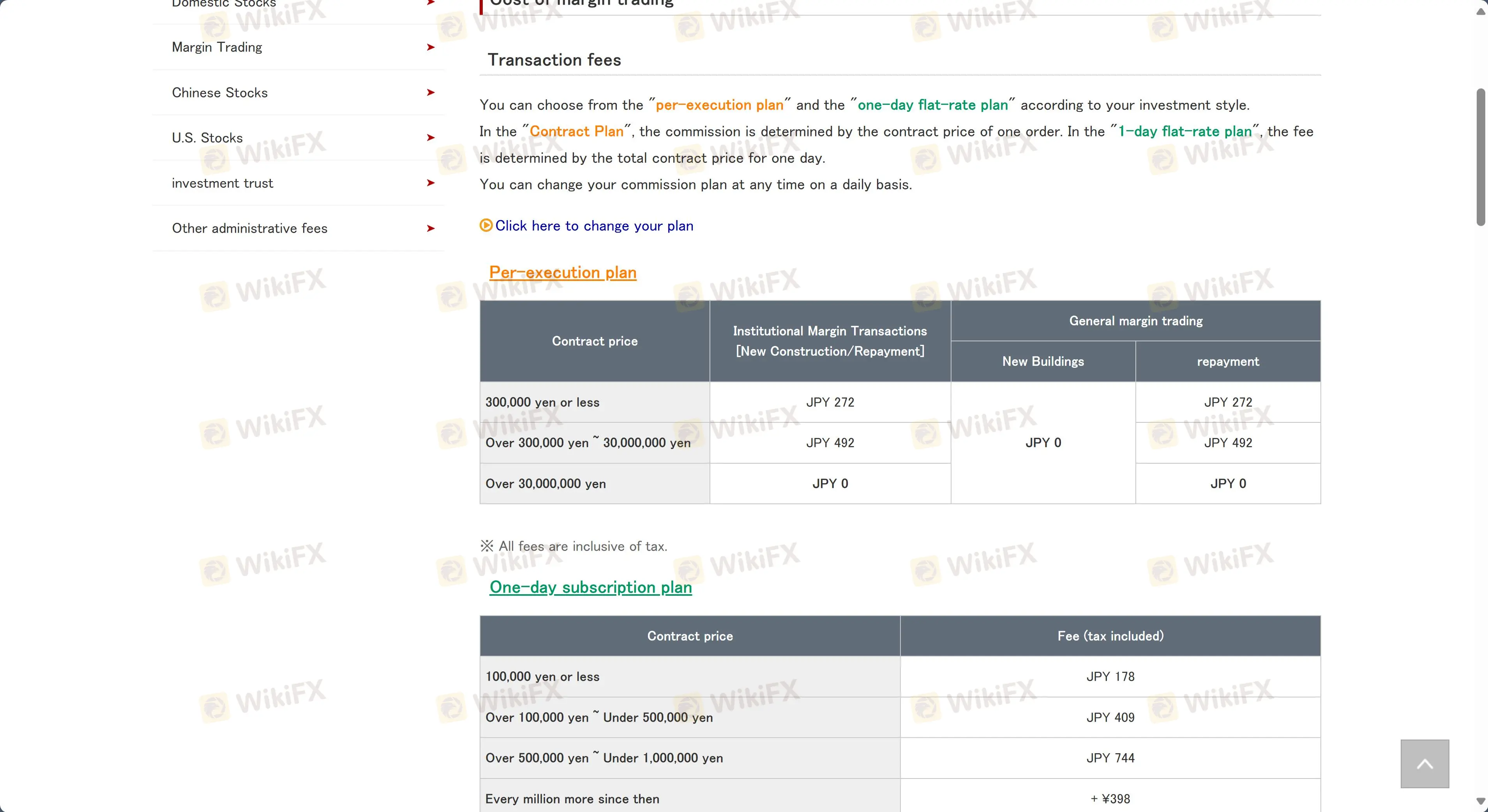

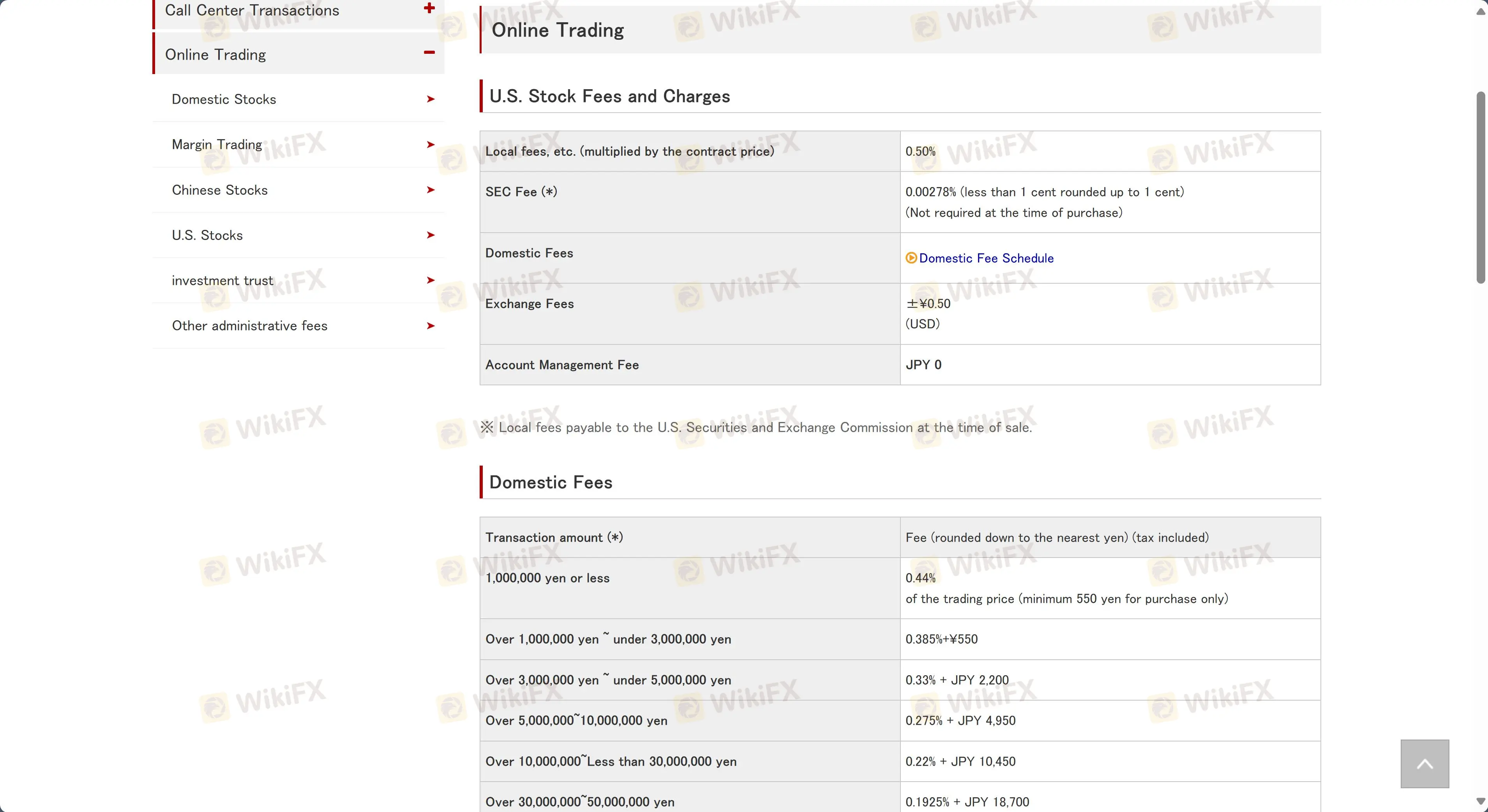

在线交易费用

Naito Securities的在线交易手续费提供两种方案:根据合同价格,"每次执行计划"收取JPY 272至JPY 492的订单费用,而"1日统一费率计划"从JPY 178起,随着每日合同总额的增加而增加。

国内股票费用

融资融券费用

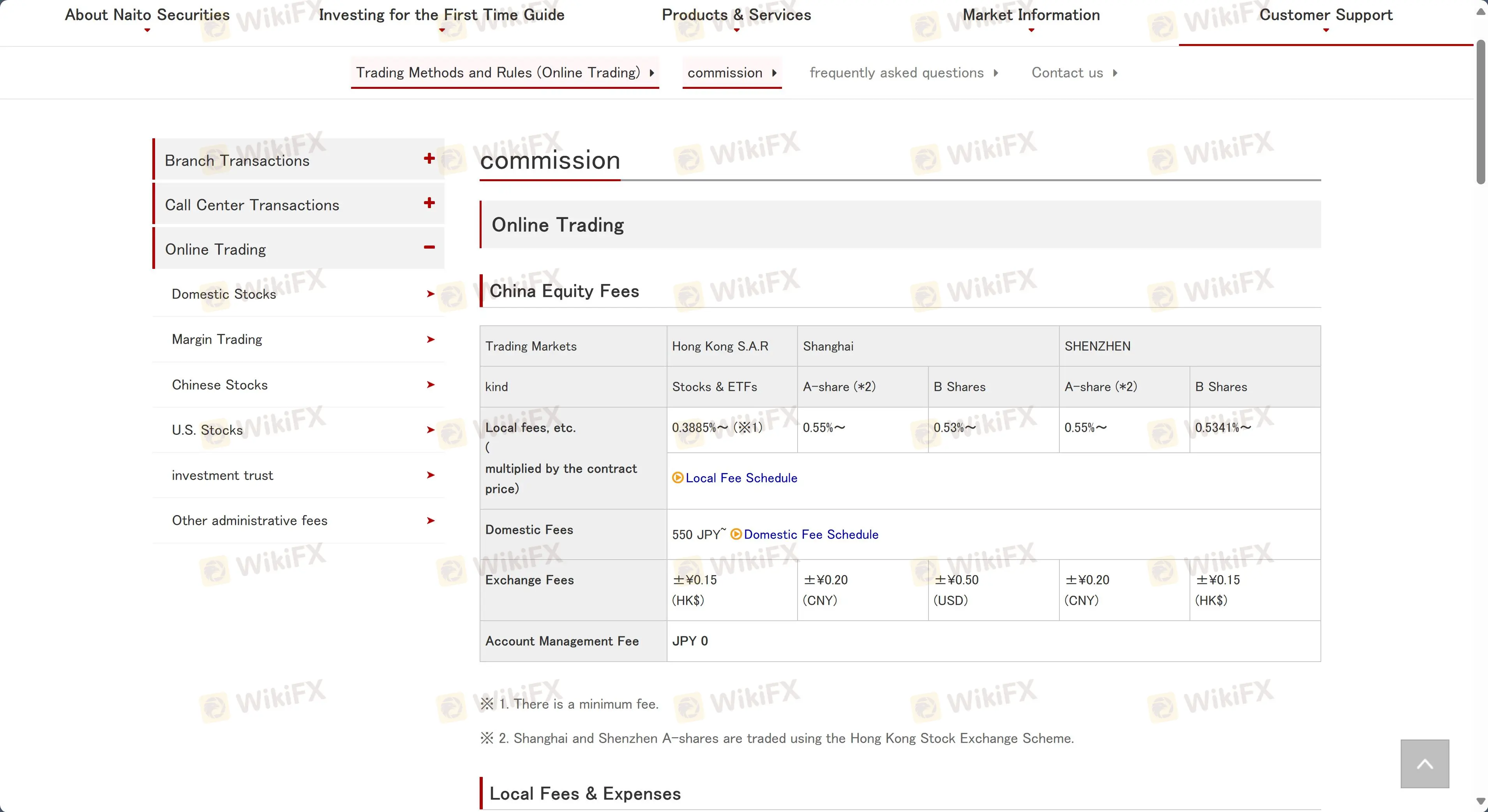

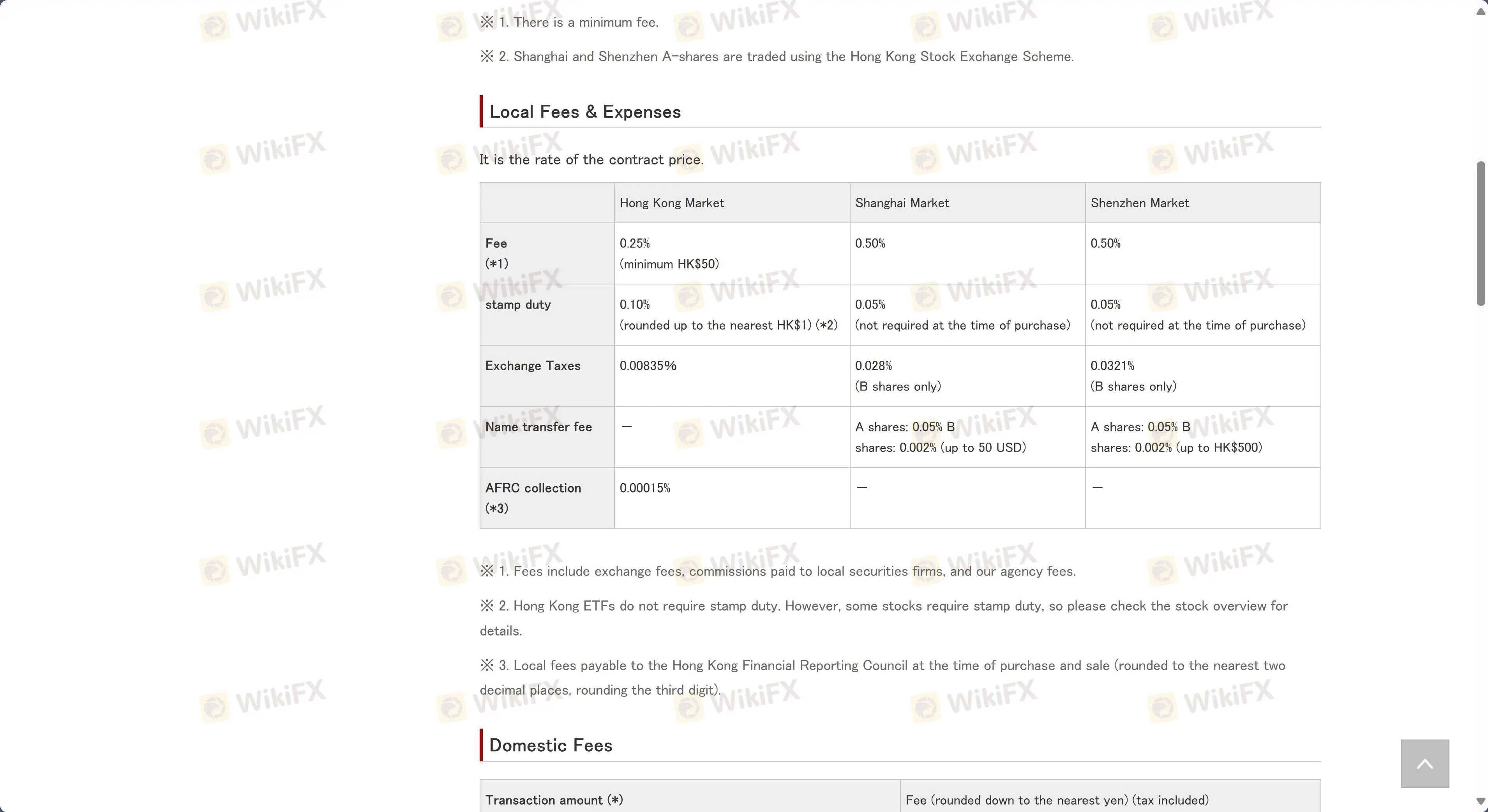

中国股票

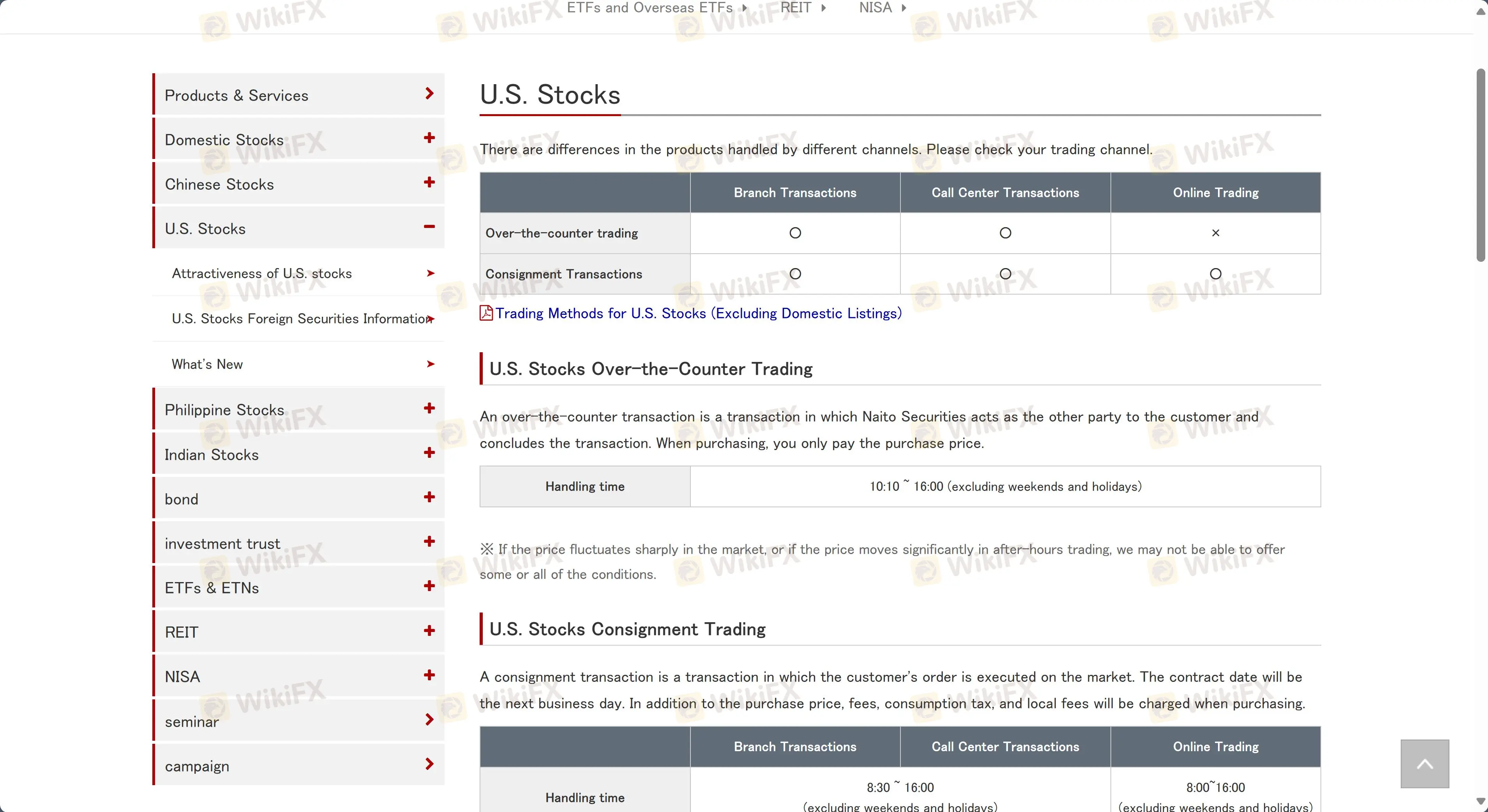

美国股票

国内手续费

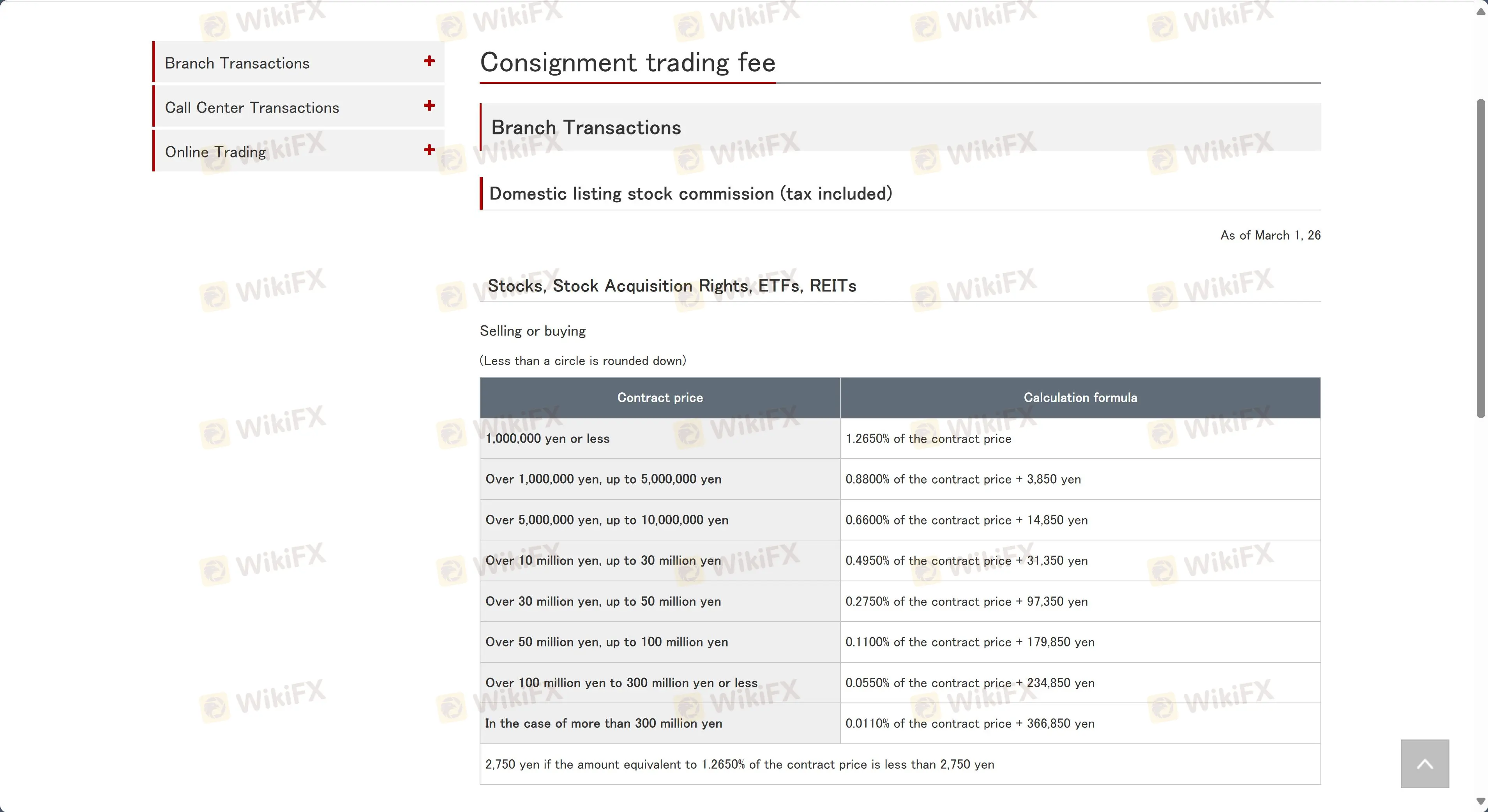

分行交易费用

Naito Securities的国内股票分行交易手续费范围从合同价格为100万日元的1.265%开始,随着金额增加,百分比递减并增加额外的固定手续费。

最低费用为JPY 2,750,按单位股价计算零股销售,最低费用为JPY 2,750。

委托交易费用(股票)

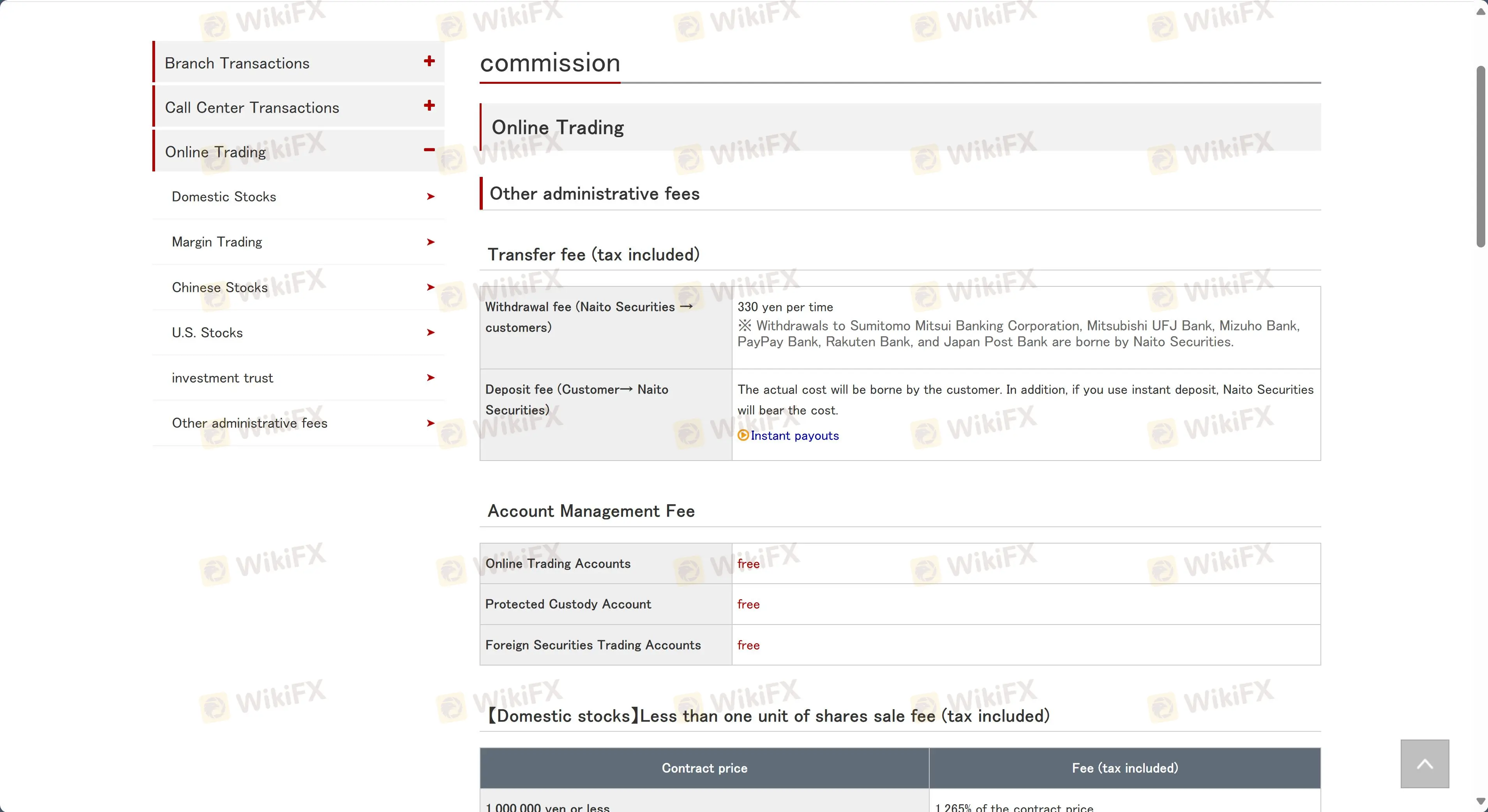

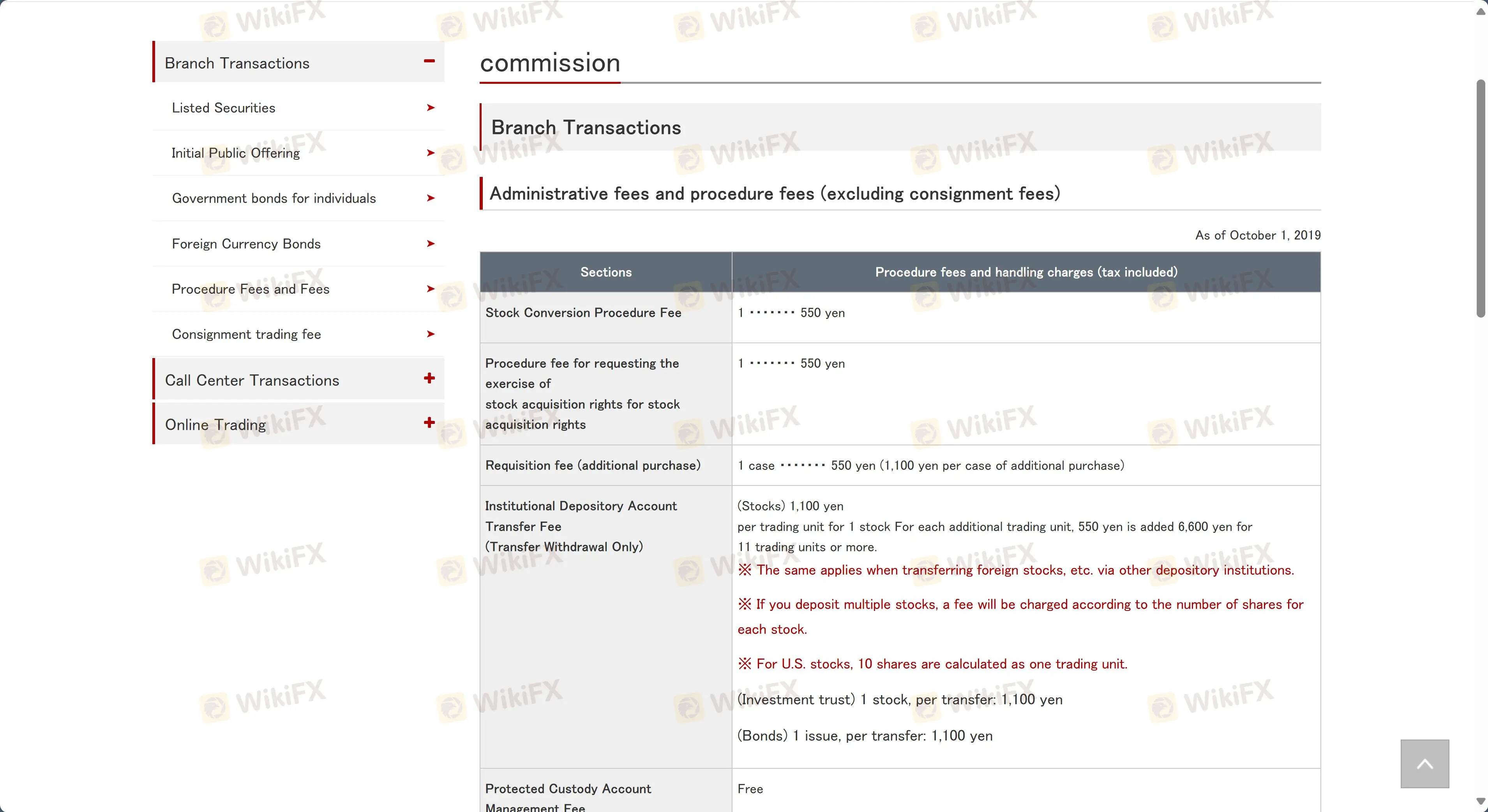

行政手续费和手续手续费

交易平台

| 交易平台 | 支持 | 可用设备 | 适用于 |

| 自有平台 | ✔ | 桌面,移动设备 | 初学者和有经验的交易者 |

| 在线交易 | ✔ | 桌面,移动设备 | 偏好数字交易解决方案的投资者 |

存款和取款

Naito Securities在存款和提款选项上没有明确说明。