Company Summary

| Naito Securities Review Summary | |

| Founded | 1933 |

| Registered Country/Region | Japan |

| Regulation | Japan Securities Dealers Association(FSA) |

| Market Instruments | Forex, Commodities, Indices, Shares, Bonds, ETFs, REITs |

| Demo Account | × |

| Trading Platform | Proprietary trading platform, available for online trading |

| Customer Support | Phone: 0120-7110-76 (Toll-free) 06-4803-6617 (Mobile) |

| 24/5 customer support: Yes | |

Naito Securities Information

Naito Securities is a well-known Japanese brokerage company that deals in stocks, bonds, exchange-traded funds (ETFs), and real estate investment trusts (REITs). It gives market information on stocks from all over the world, including Japan, China, and the US.

Pros and Cons

| Pros | Cons |

| Established company with a long history(1933) | No demo account available |

| Offers a huge range of financial products(across fx to ETFs, China to U.S) | Too complicated fee structure |

| Regulated by FSA |

Is Naito Securities Legit?

| Regulatory Status | Regulated (Retail Forex License) |

| Regulated By | Japan |

| Licensed Institution | Naito Securities Co., Ltd. |

| License Number | Kinki Finance Bureau Director (Kinsho) No. 24 |

| Effective Date | 2007-09-30 |

| Address of Licensed Institution | 3-3-23 Nakanoshima, Kita-ku, Osaka, Japan |

| Phone Number of Licensed Institution | 06-4803-6501 |

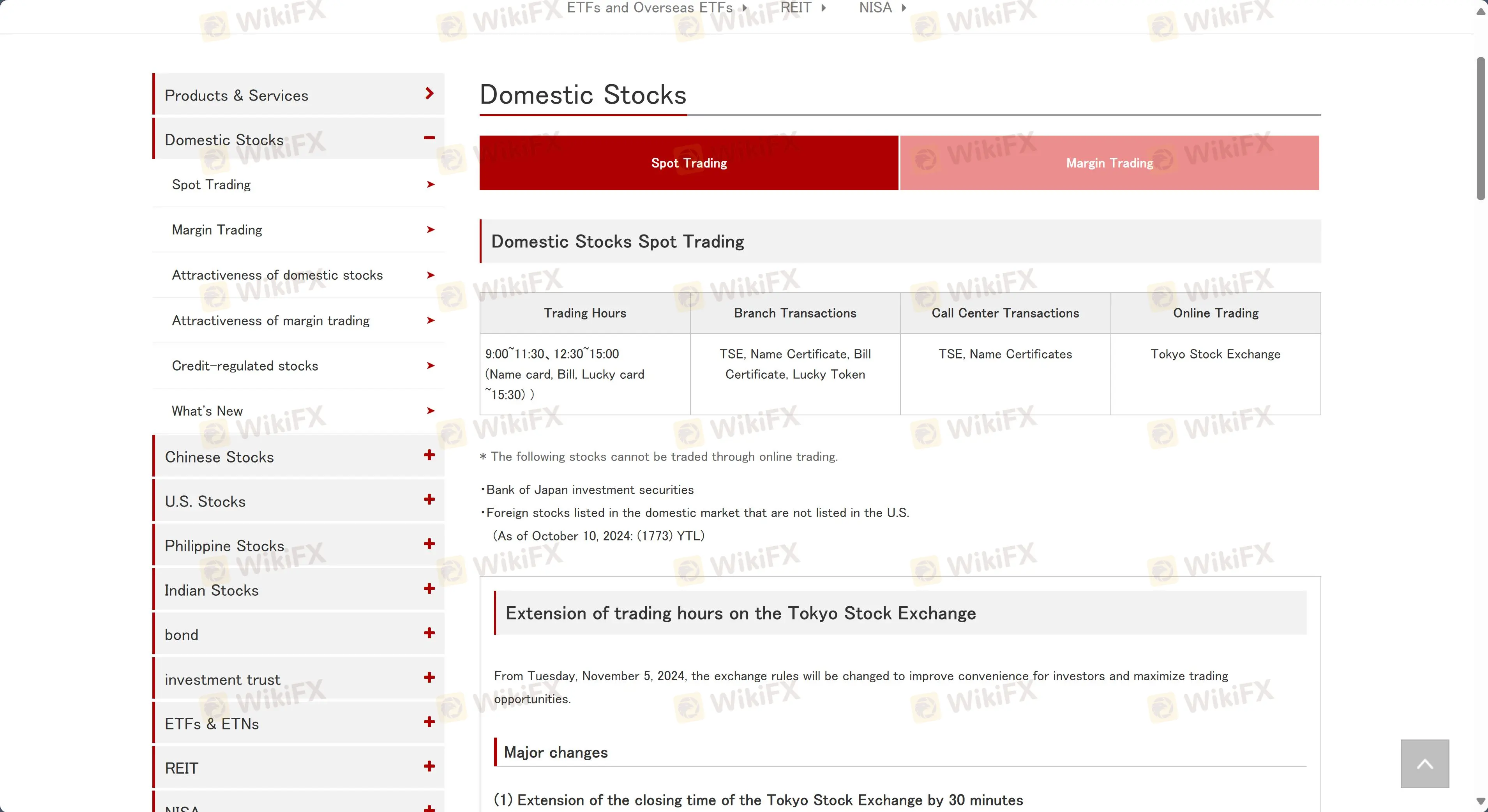

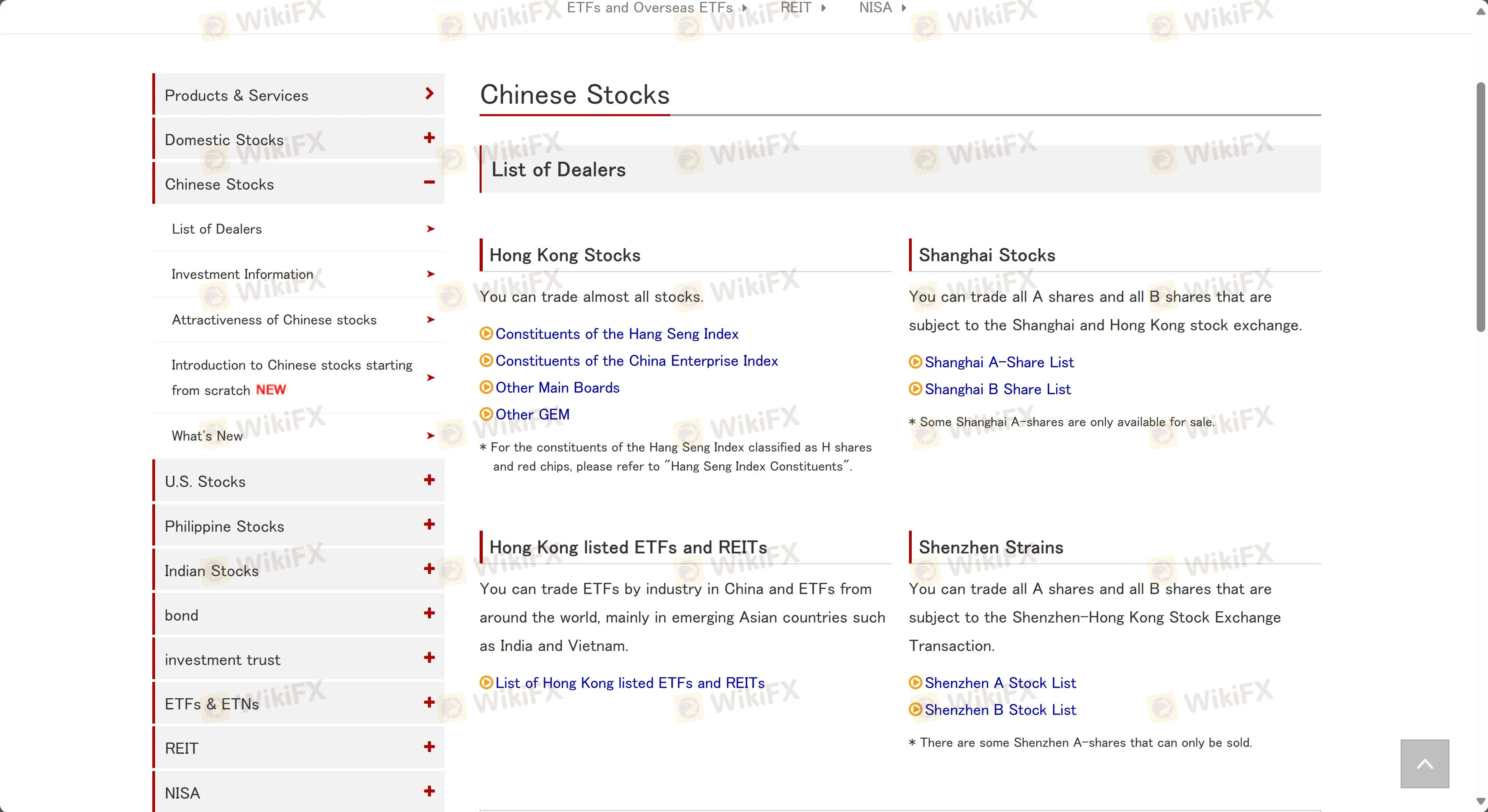

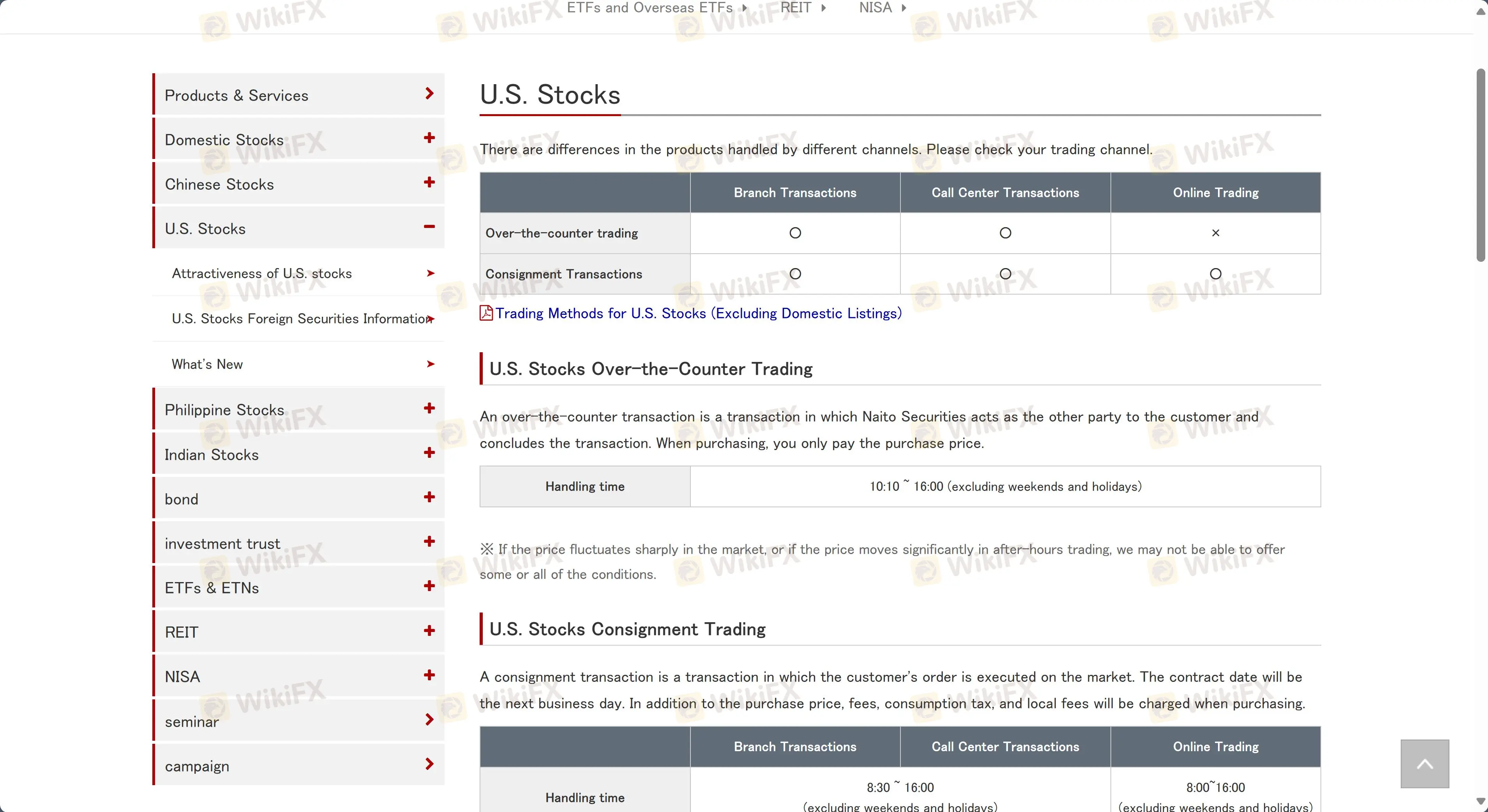

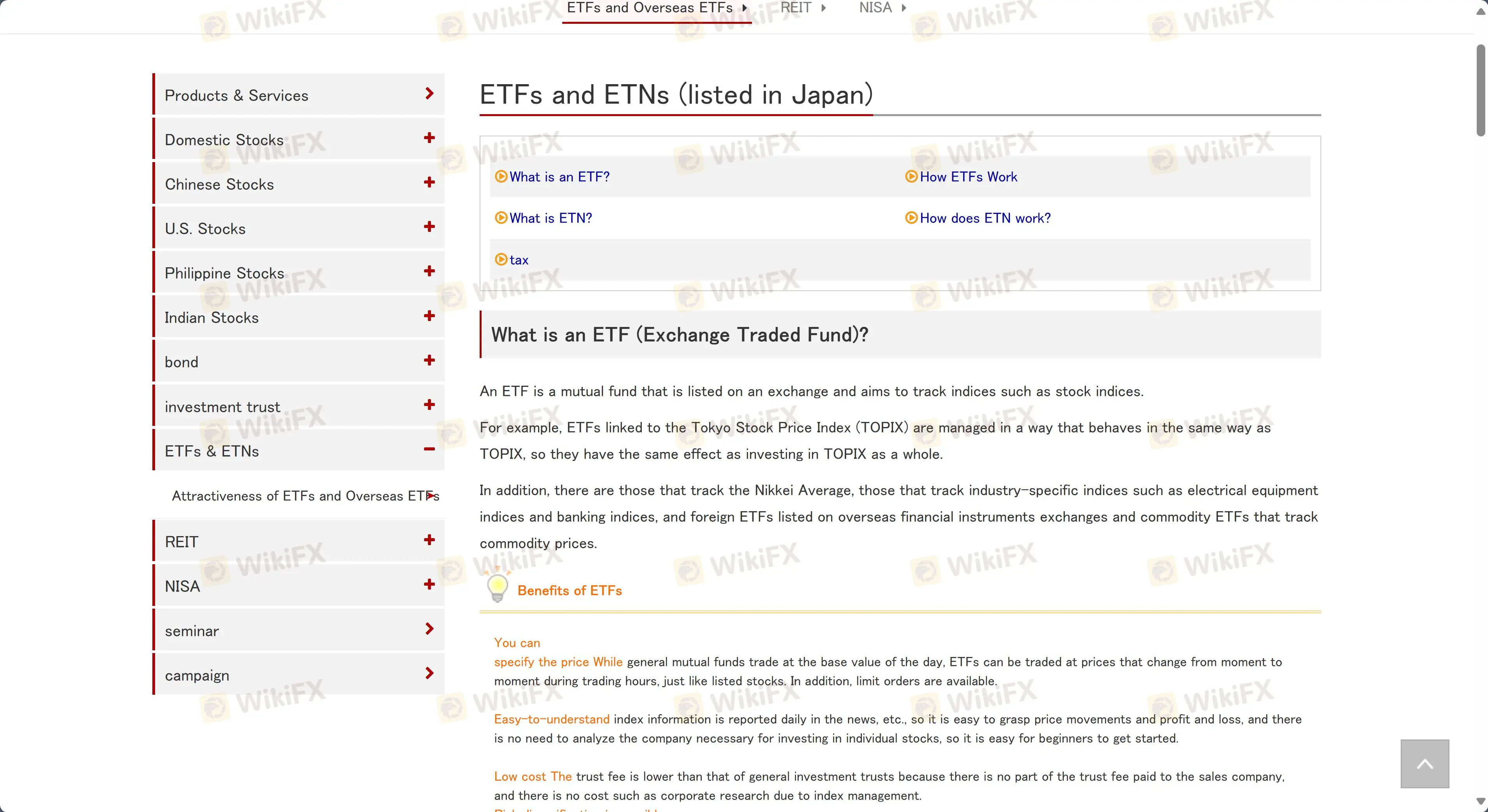

What Can I Trade on Naito Securities?

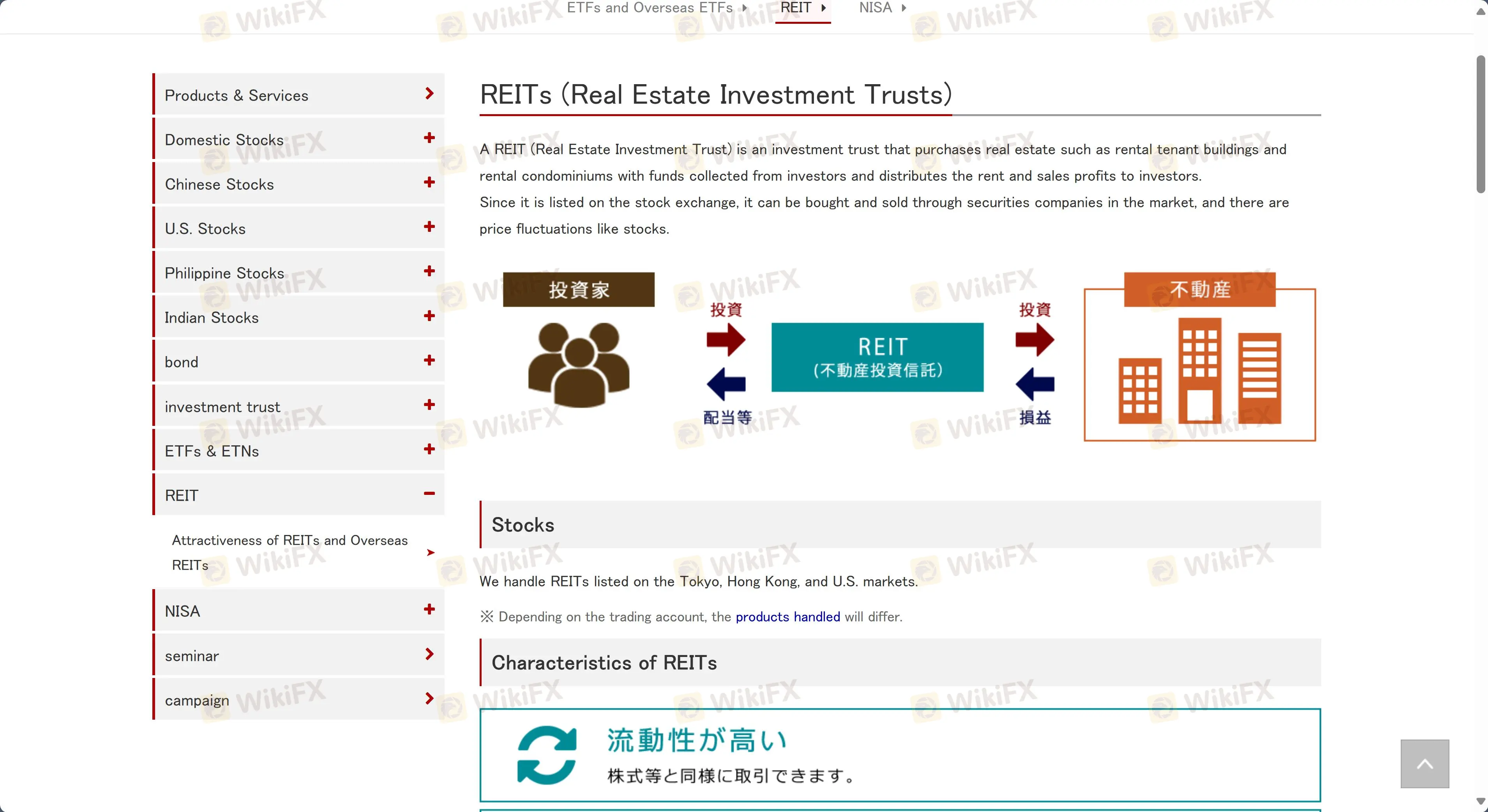

Naito Securities offers many financial products across different markets and types, including Japan, China, and the US.Assets include forex to REITS.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| ETFs | ✔ |

| REITs | ✔ |

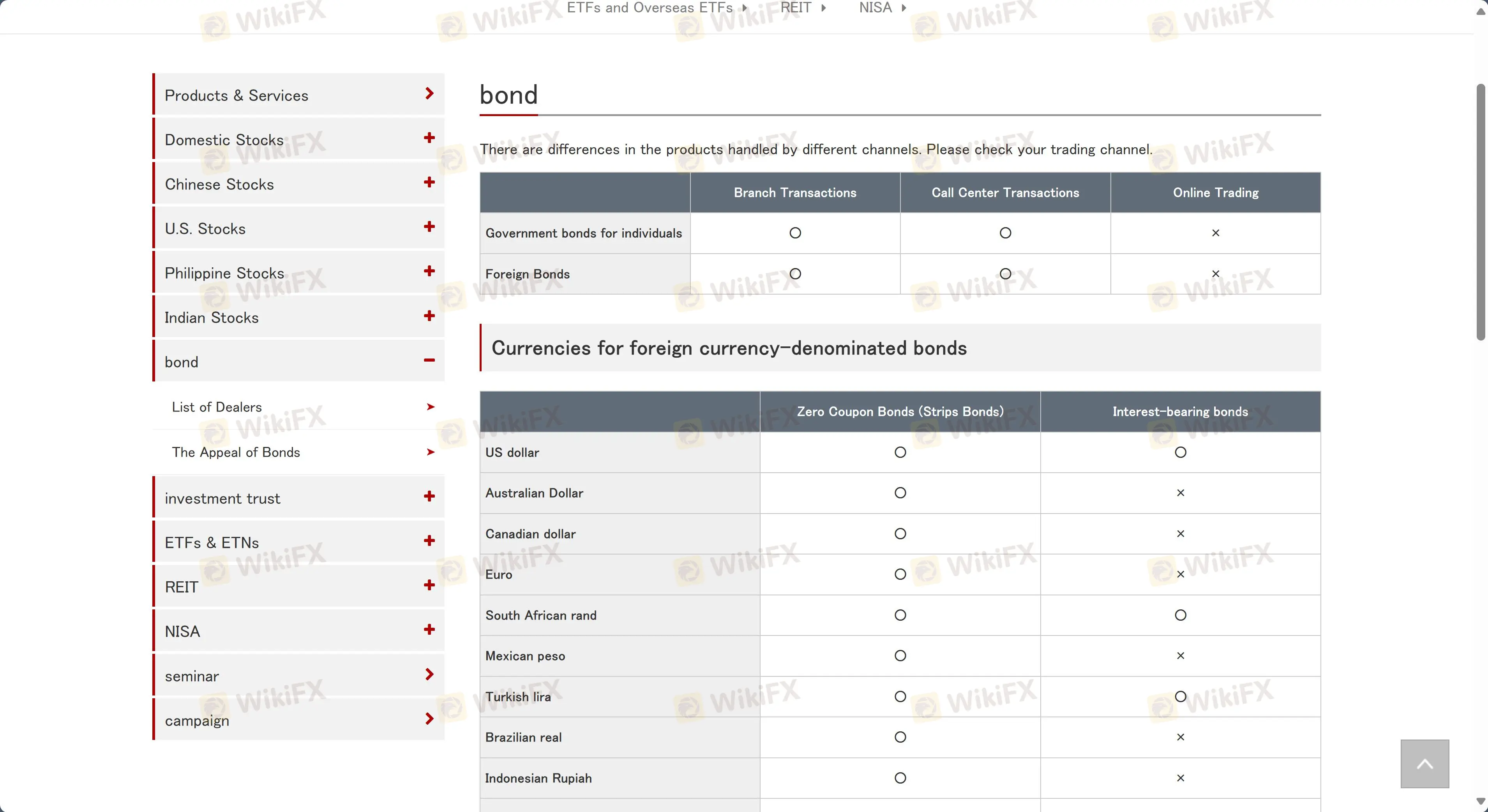

| Bonds | ✔ |

| Cryptocurrencies | ❌ |

Account Types

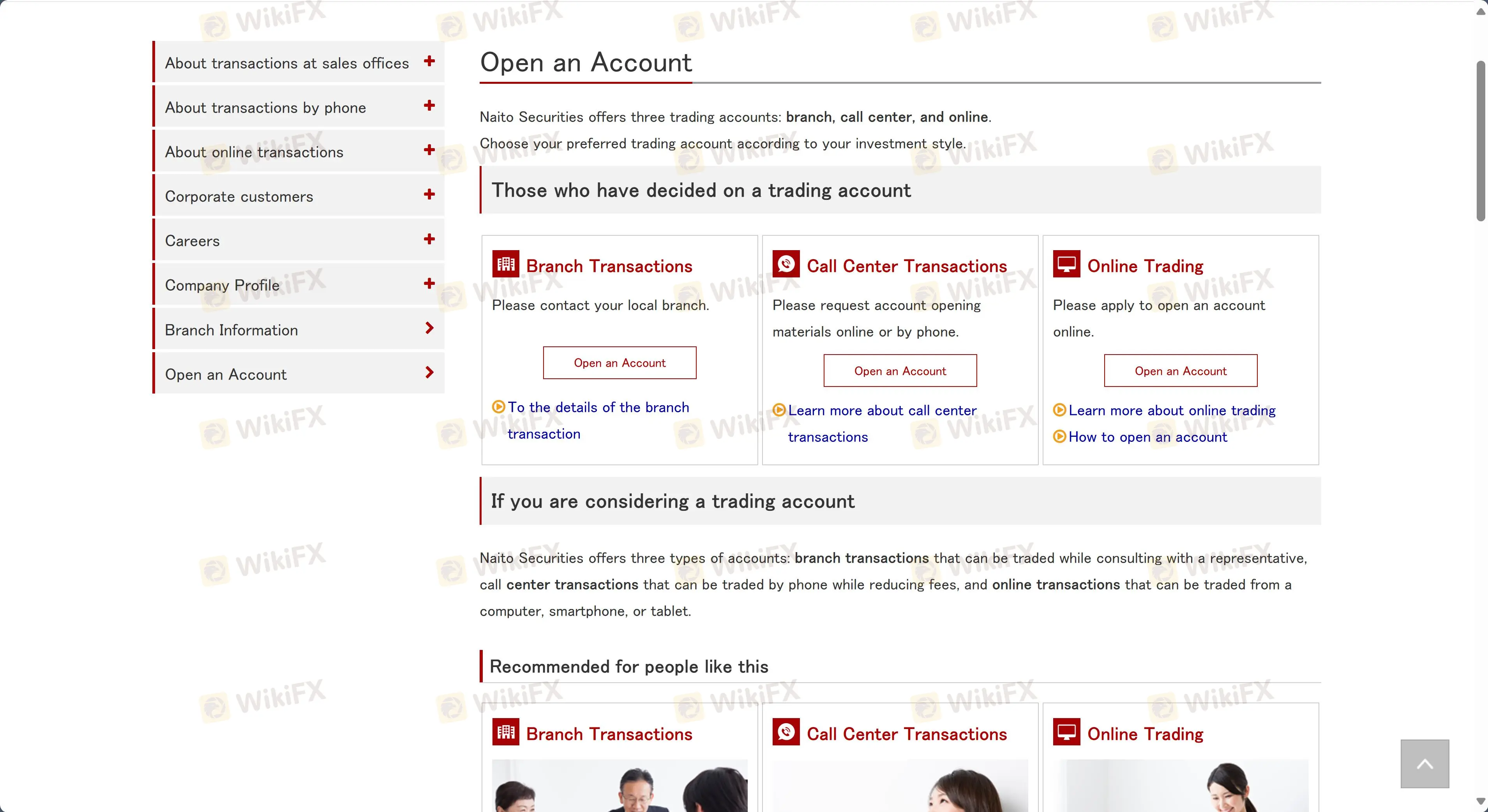

Naito Securities offers 3 types of accounts. It does not offer a demo account.

| Account Name | Fees | Key Features | Suitable for |

| Branch Transactions | Starting at JPY 2,750 for trades under JPY 500,000 | In-person consultations, comprehensive advice on asset management. | Investors seeking personalized, face-to-face service. |

| Call Center Transactions | Starting at JPY 3,300 for trades under JPY 500,000 | Trading by phone, reduced fees compared to branch transactions. | Traders prefer phone-based consultations with lower fees. |

| Online Trading | Starting at JPY 419 for trades under JPY 500,000 | Trading via computer, smartphone, or tablet with the lowest fees and 24/7 access to market orders. | Self-directed traders who want low fees and convenience. |

Naito Securities Fees

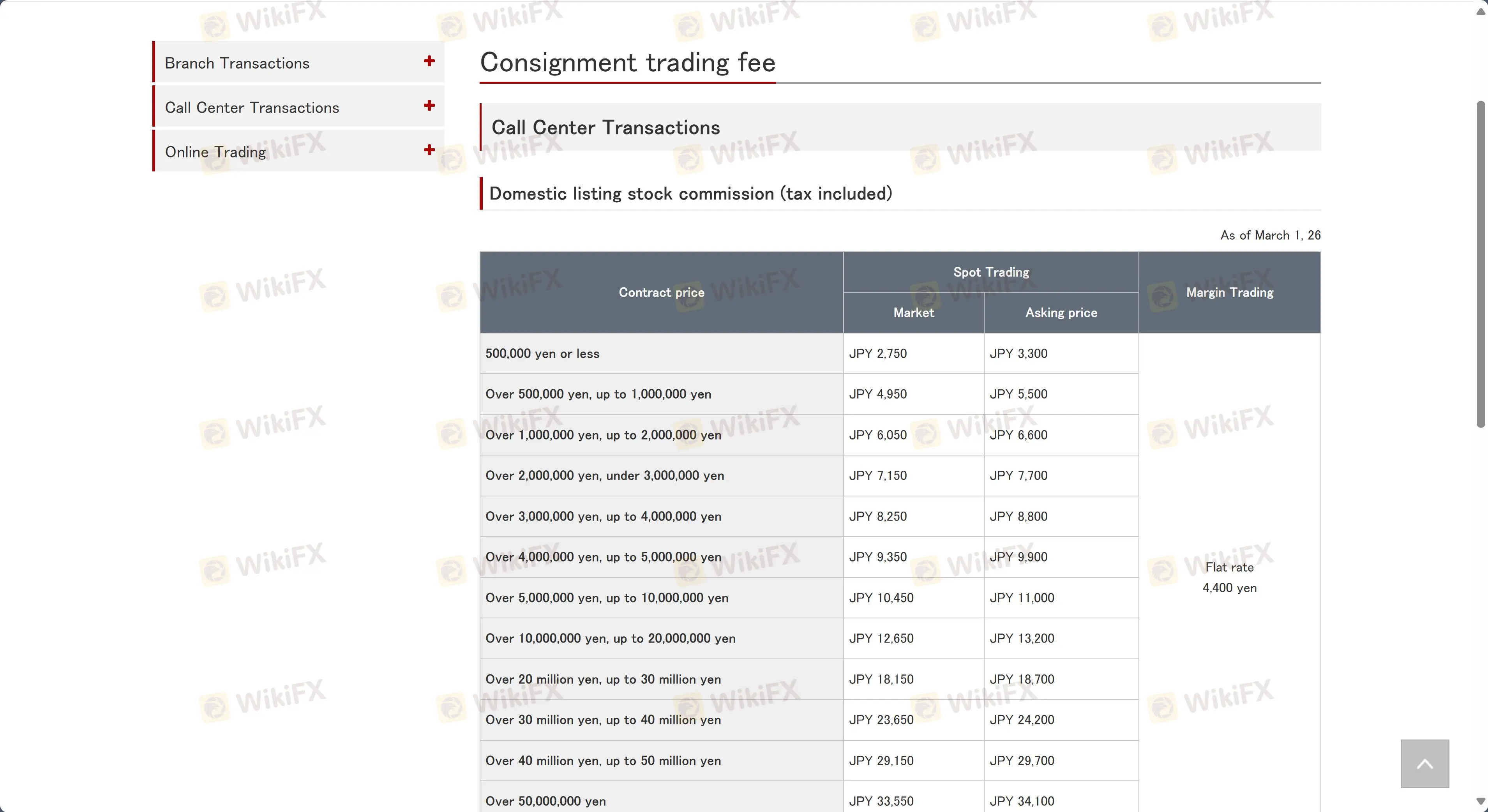

Naito Securities' fees are complicated, can be roughly divide to 3 typs:Consignment trading fees, Online trading fees and Branch transaction fees.

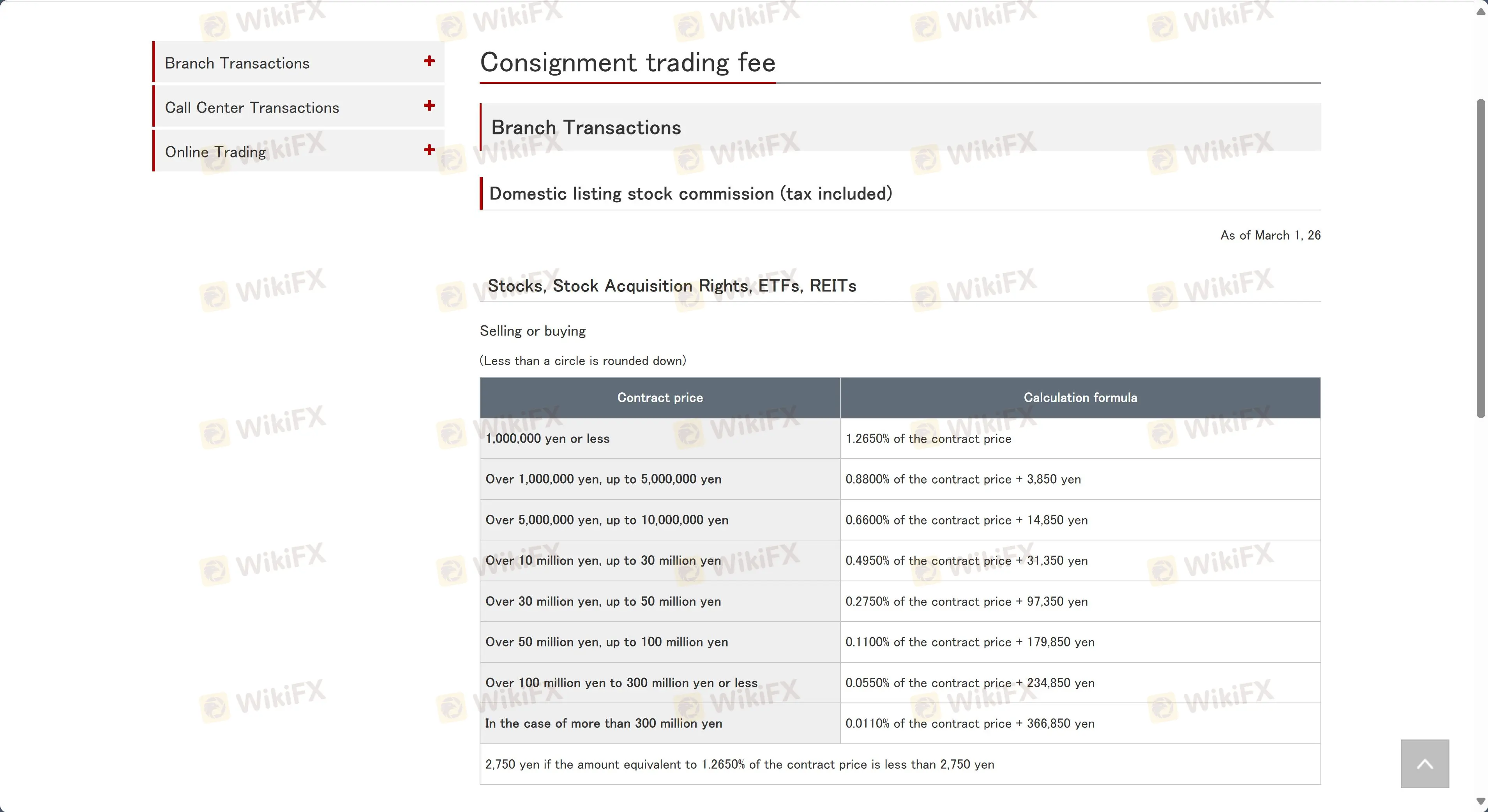

Consignment Trading Fees

The consignment trading fee for domestic listed stocks through Naito Securities' call center varies based on the contract price, ranging from JPY 2,750 to JPY 33,550 for spot trading and JPY 3,300 to JPY 34,100 for margin trading. These fees also apply to ETFs and J-REITs.

Listing stock

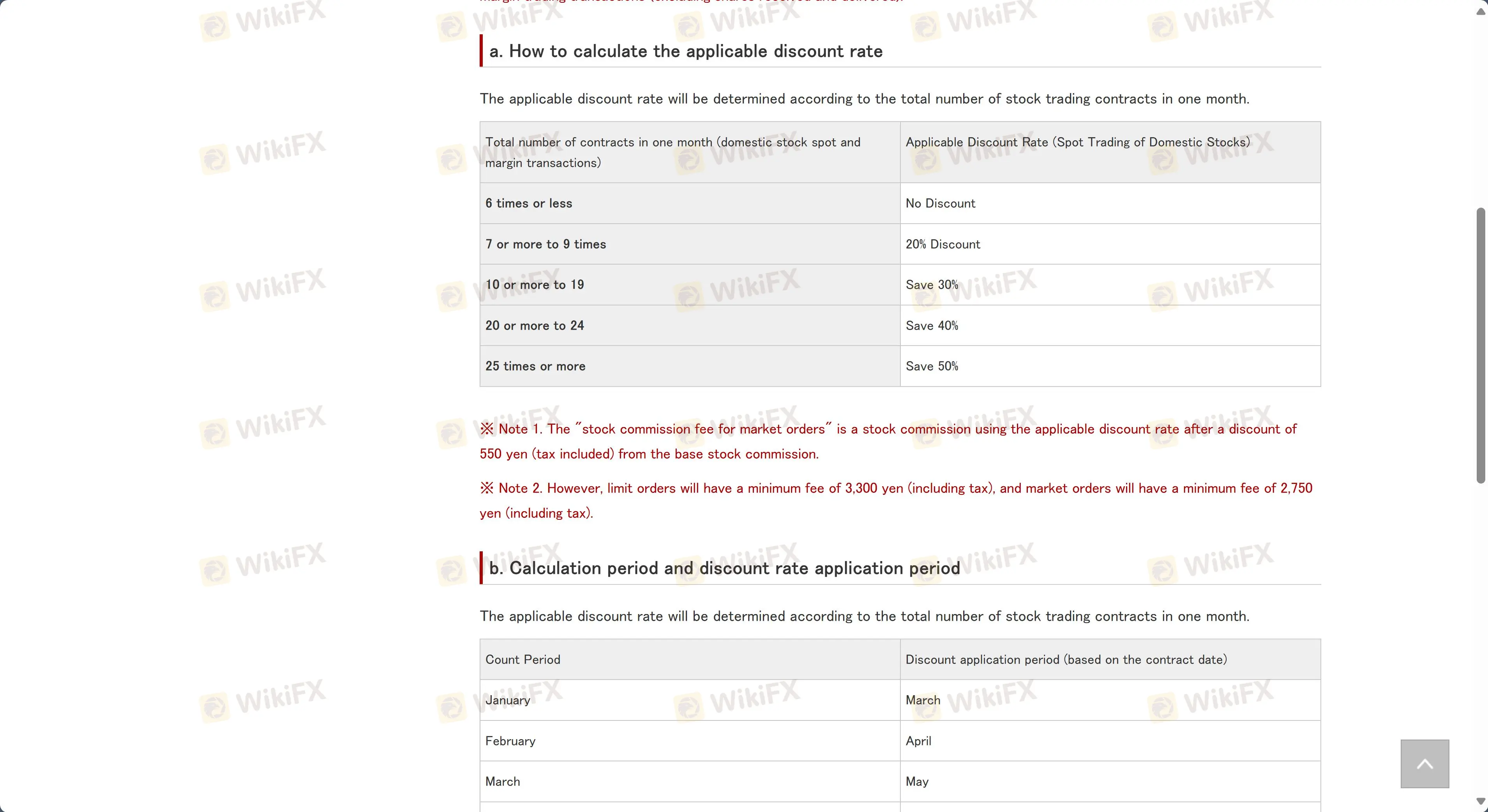

Discount system for the number of consignment fees for physical stocks

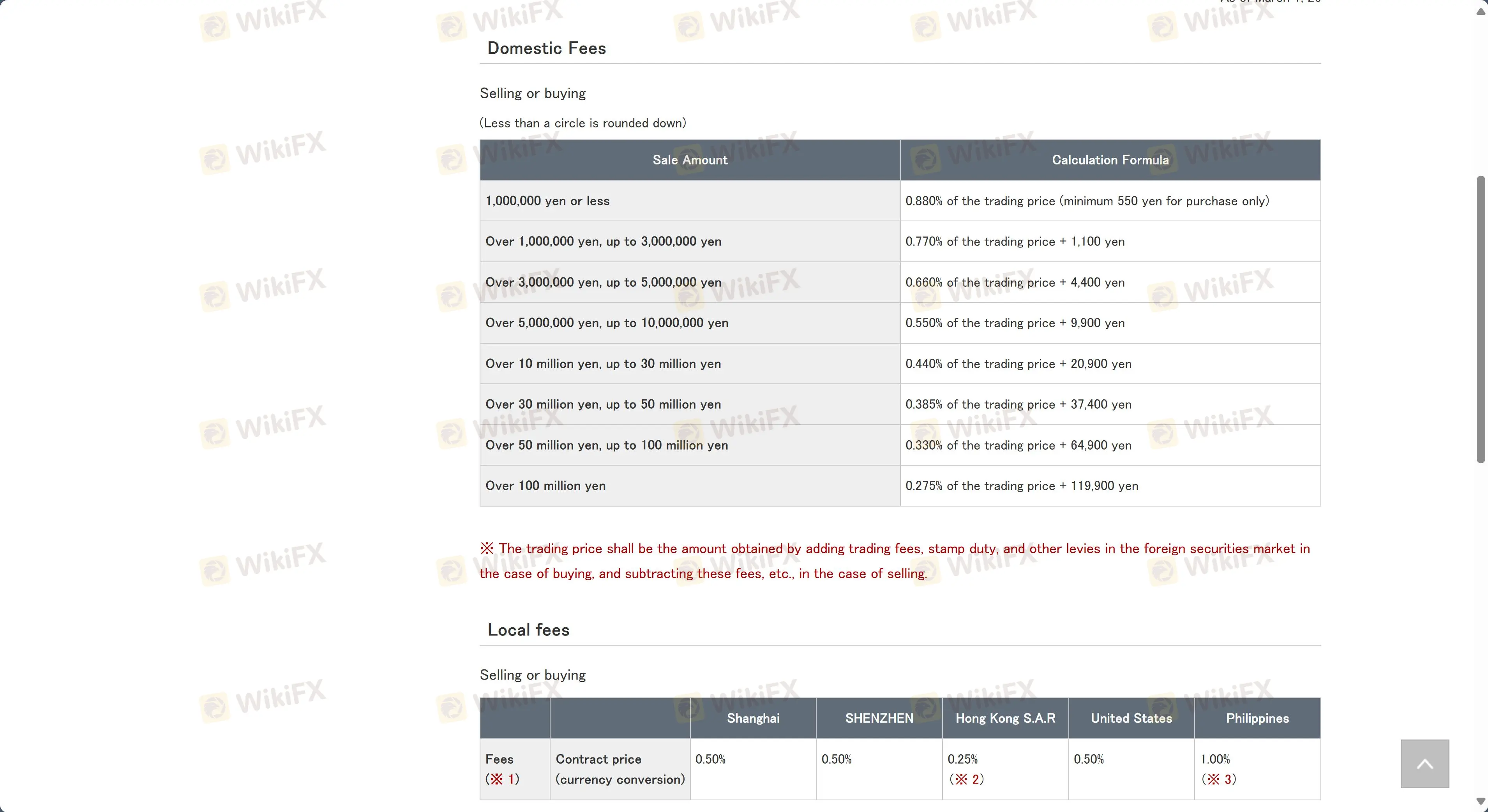

Foreign stock commission

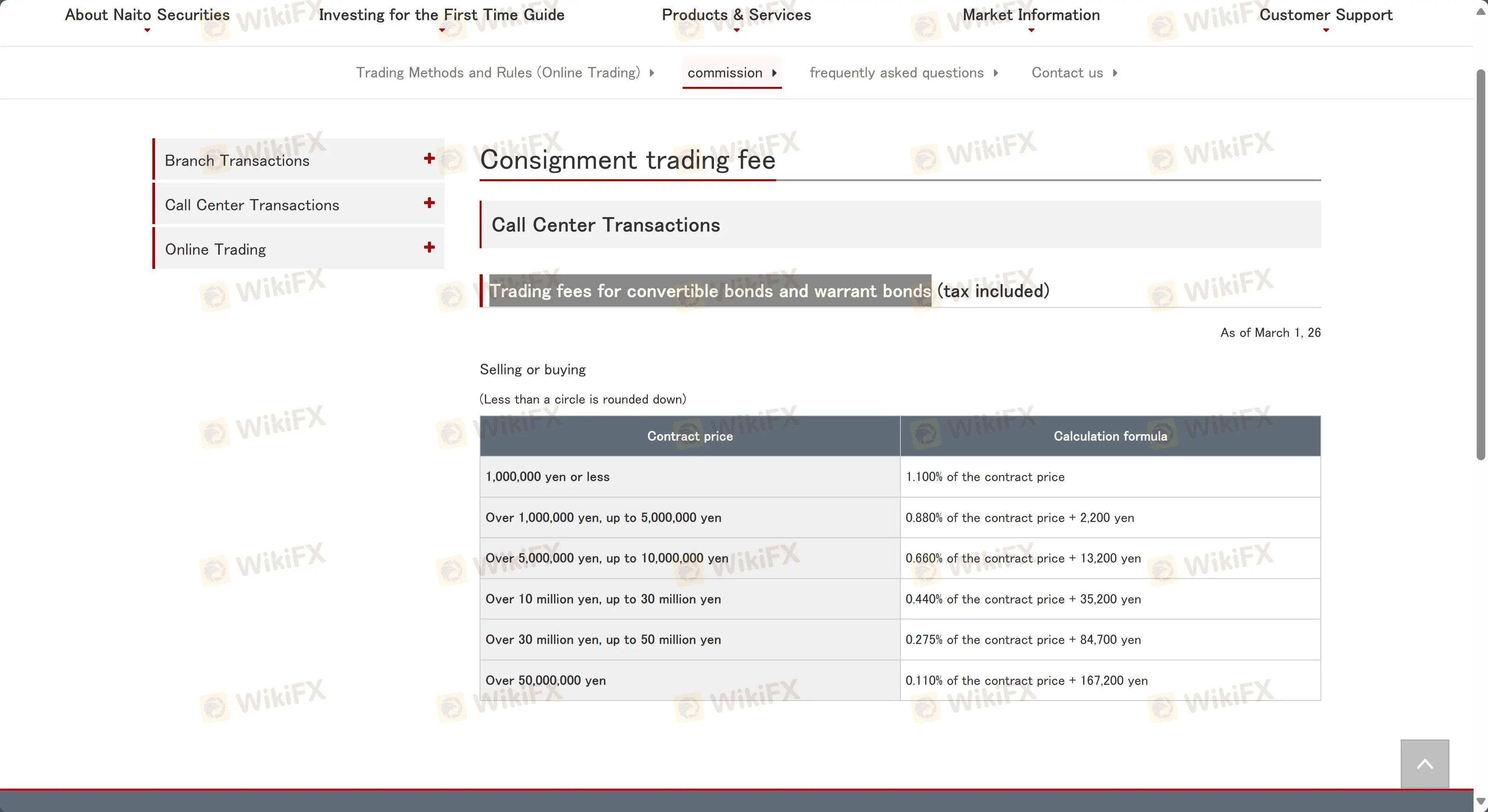

Trading fees for convertible bonds and warrant bonds

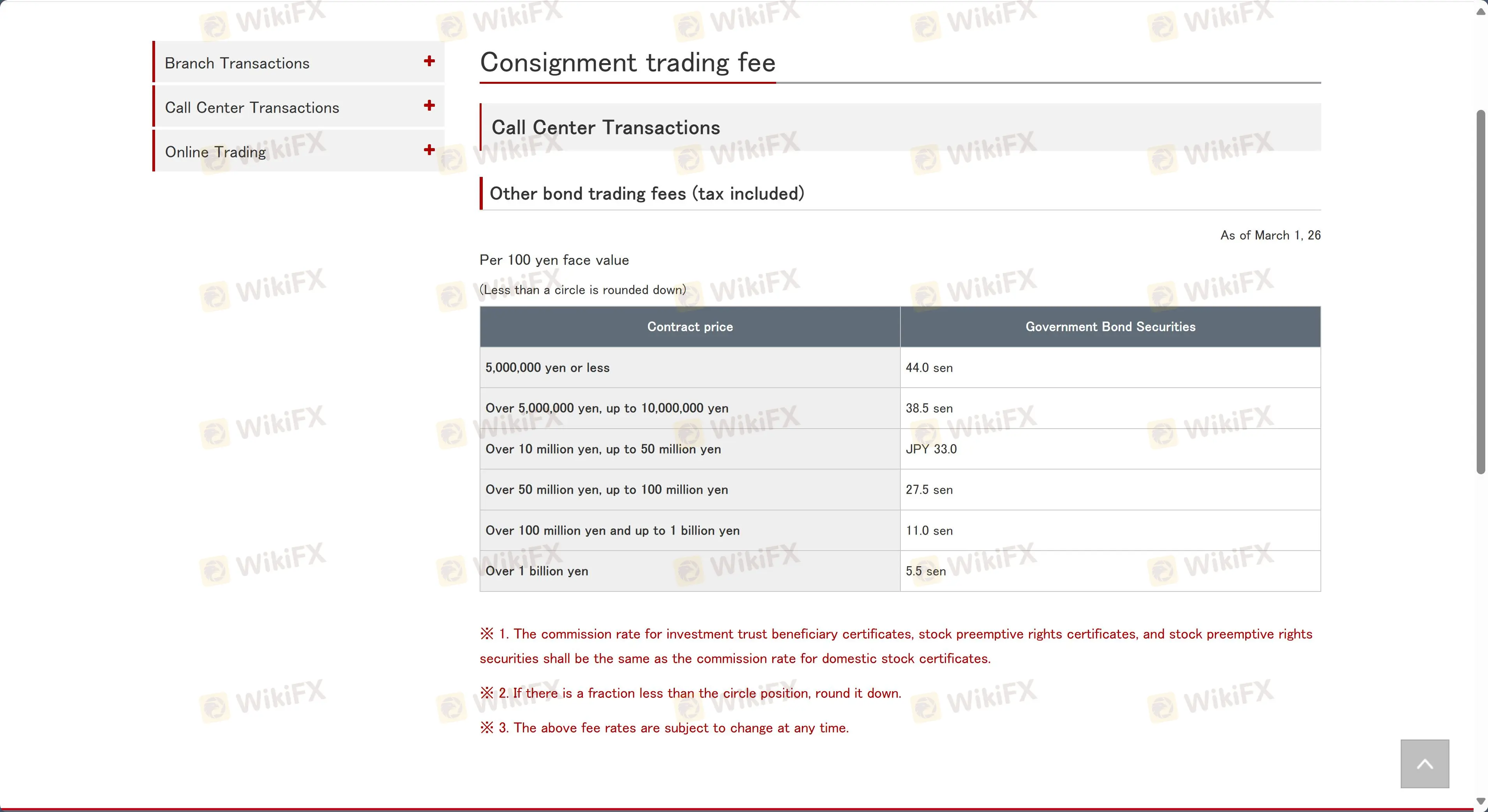

Other bond trading fees

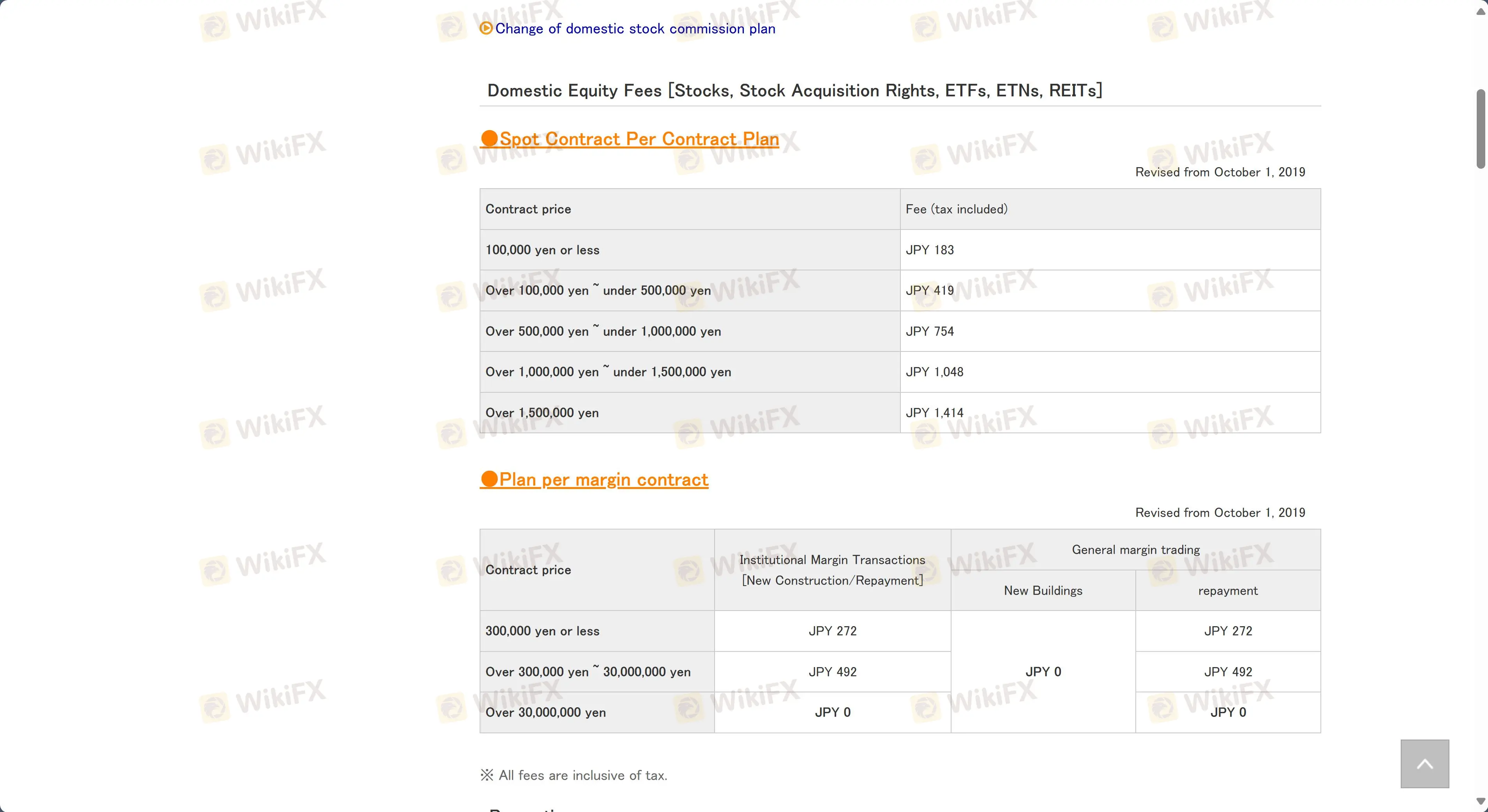

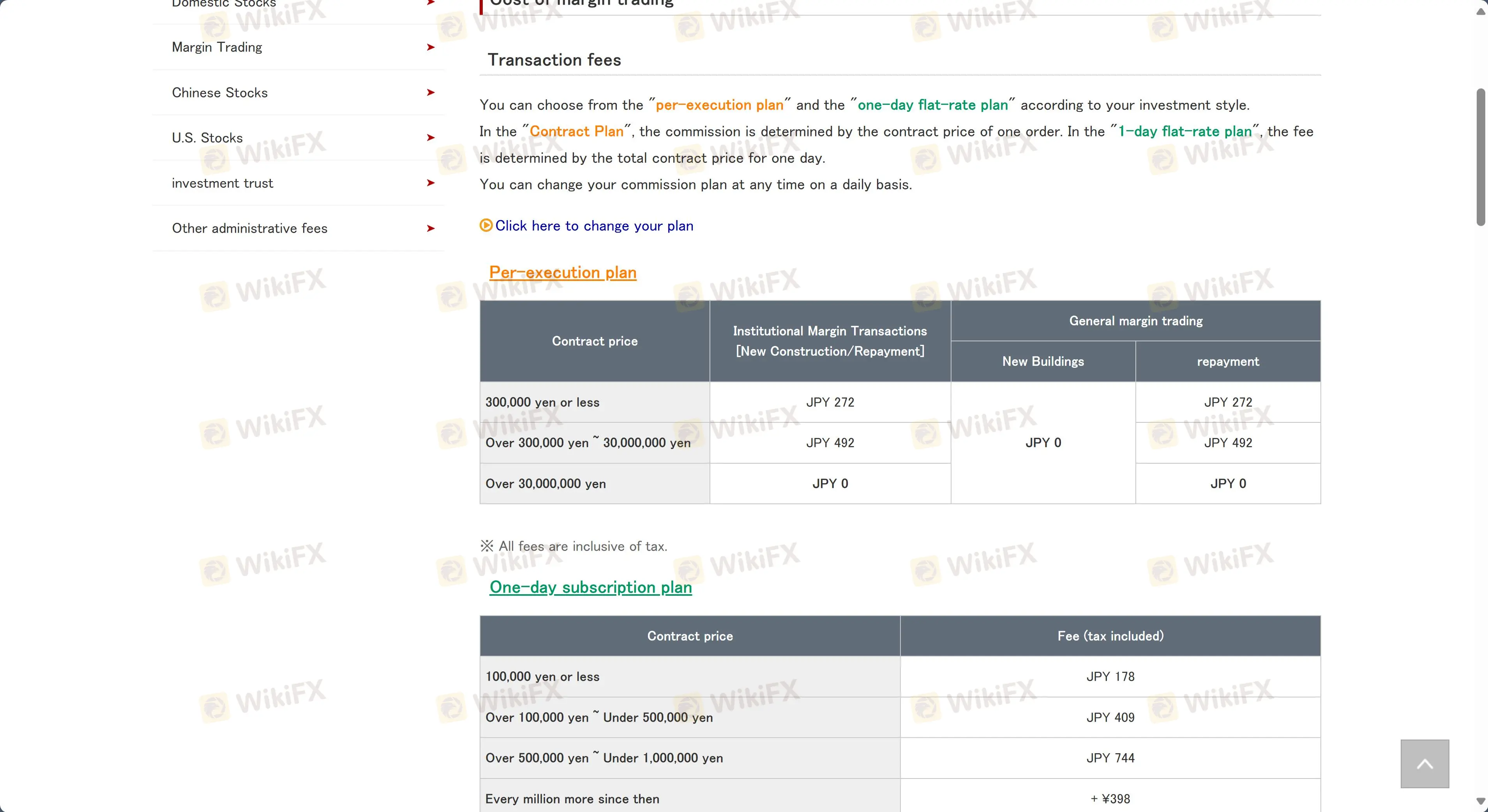

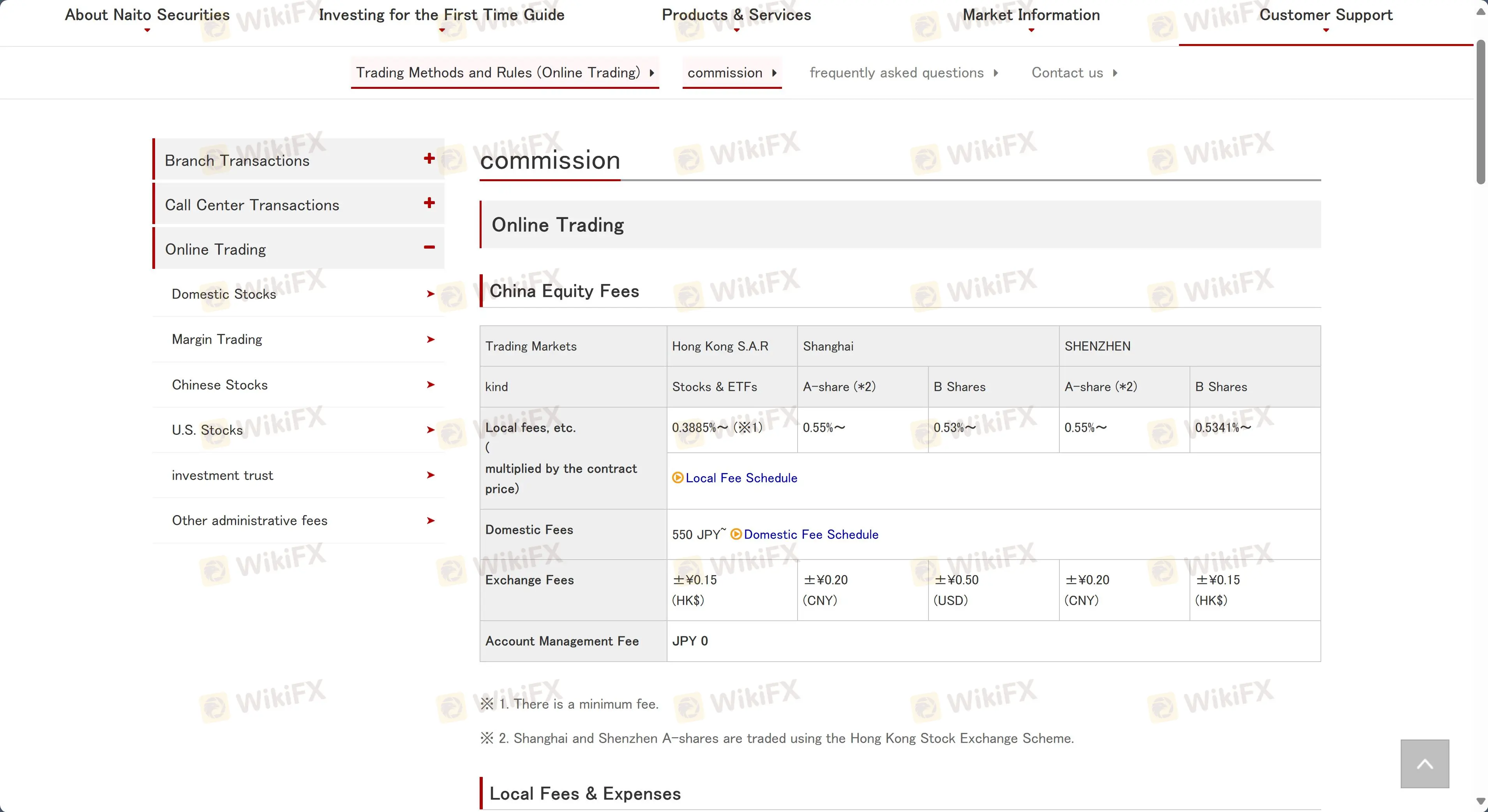

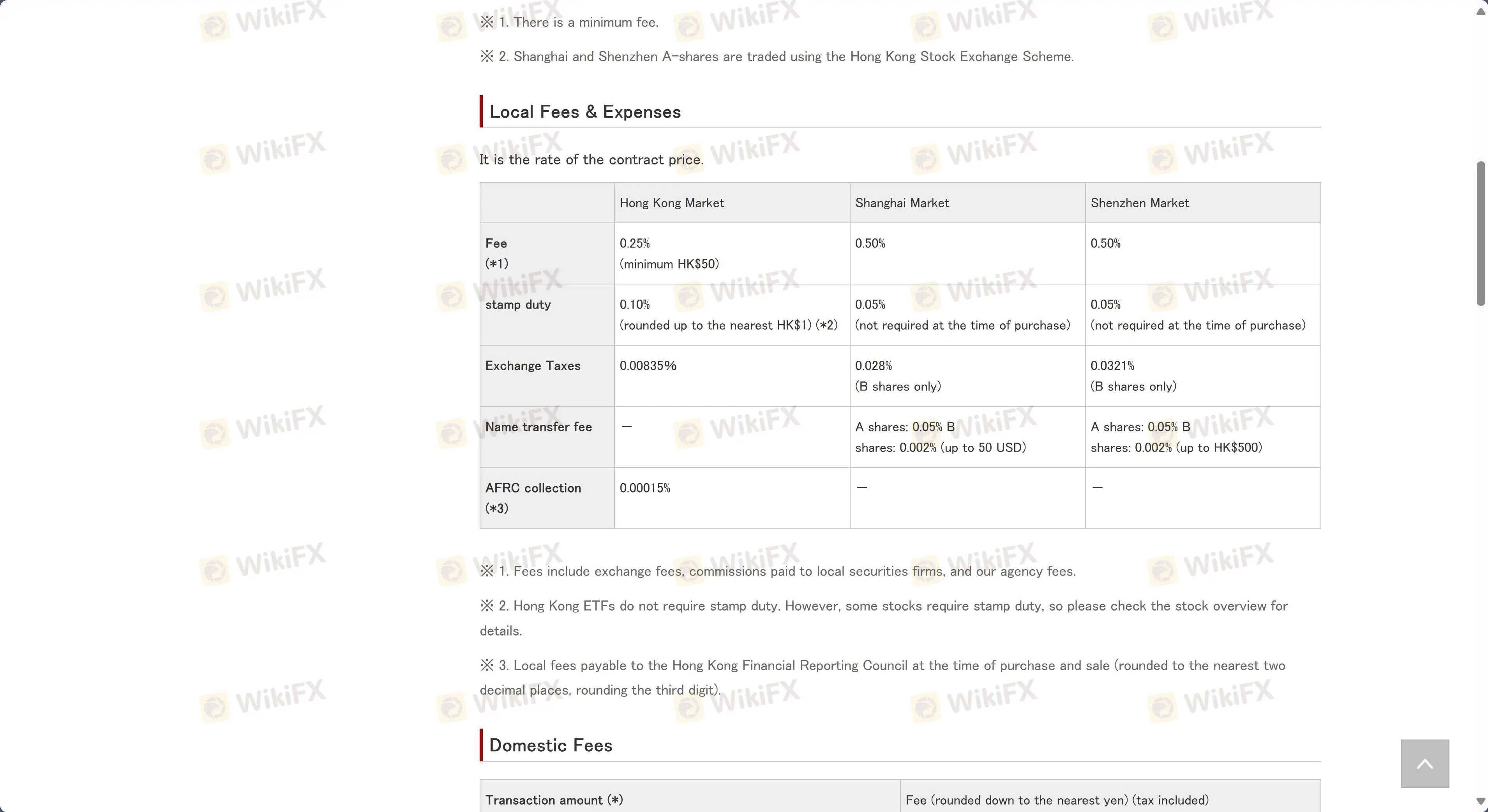

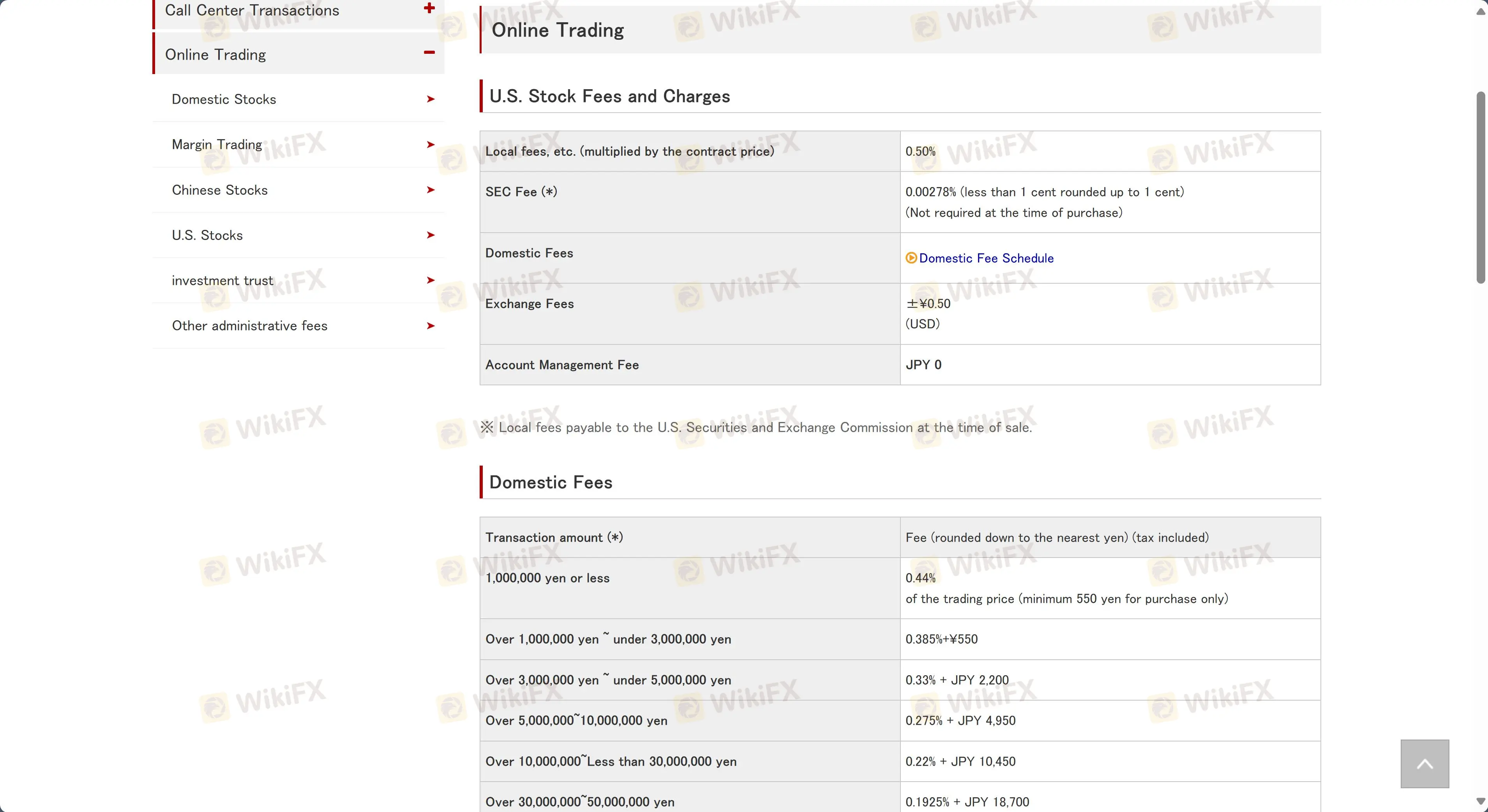

Online Trading Fees

Naito Securities' online trading fees offer two plans: the “Per-Execution Plan” charges JPY 272 to JPY 492 per order based on the contract price, while the “1-Day Flat-Rate Plan” starts at JPY 178 and increases with the total daily contract price.

Domestic Equity Fees

Cost of margin trading

Chinese stock

U.S Stock

Domestic fees

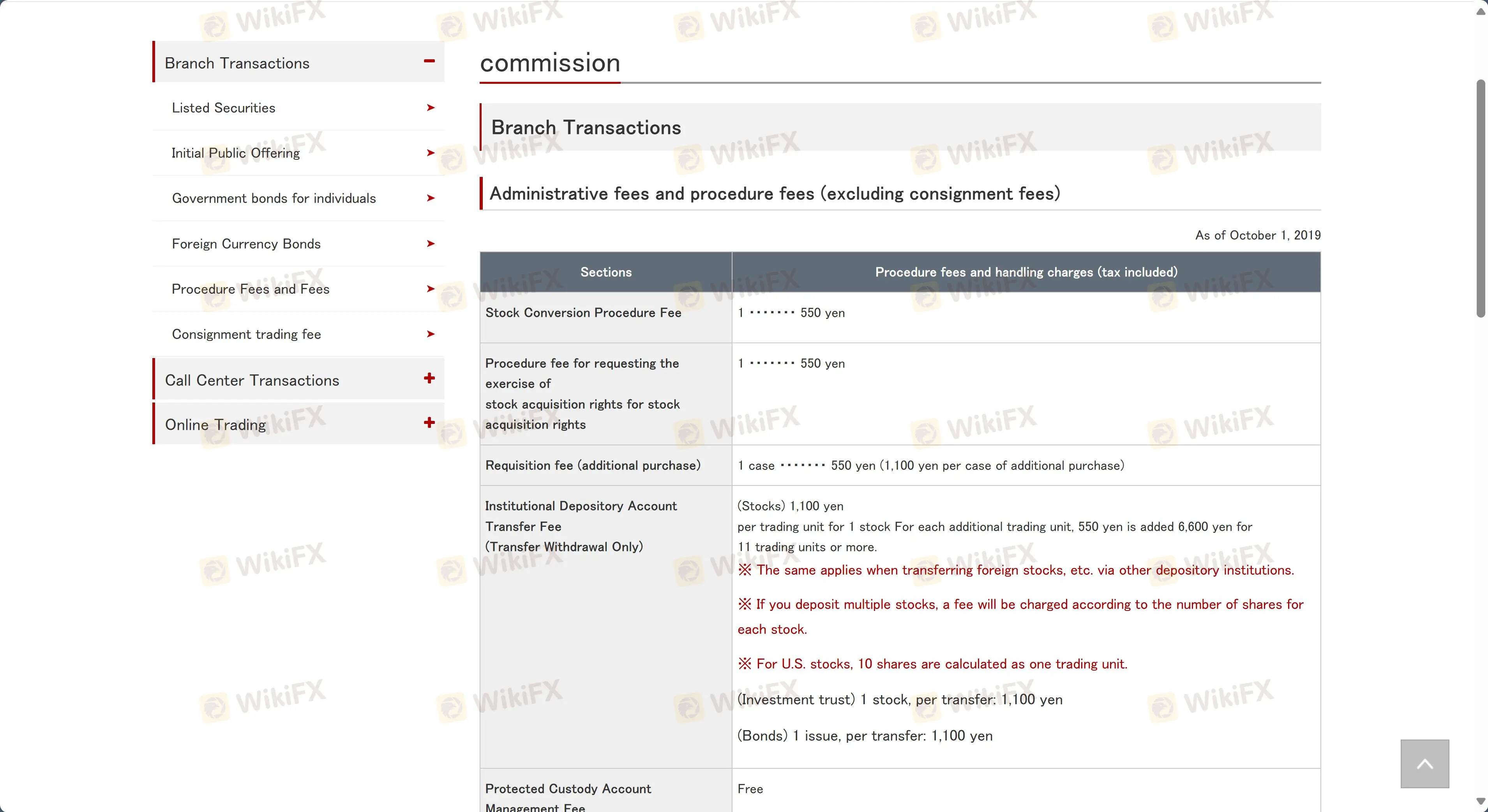

Branch Transactions Fees

Naito Securities branch transactions fees for domestic stocks range from 1.265% for contract prices up to 1 million yen, with decreasing percentages and additional fixed fees for higher amounts.

The minimum fee is JPY 2,750, and fractional share sales are calculated based on unit share prices, with a minimum of JPY 2,750 applied.

Consignment trading fees(stocks)

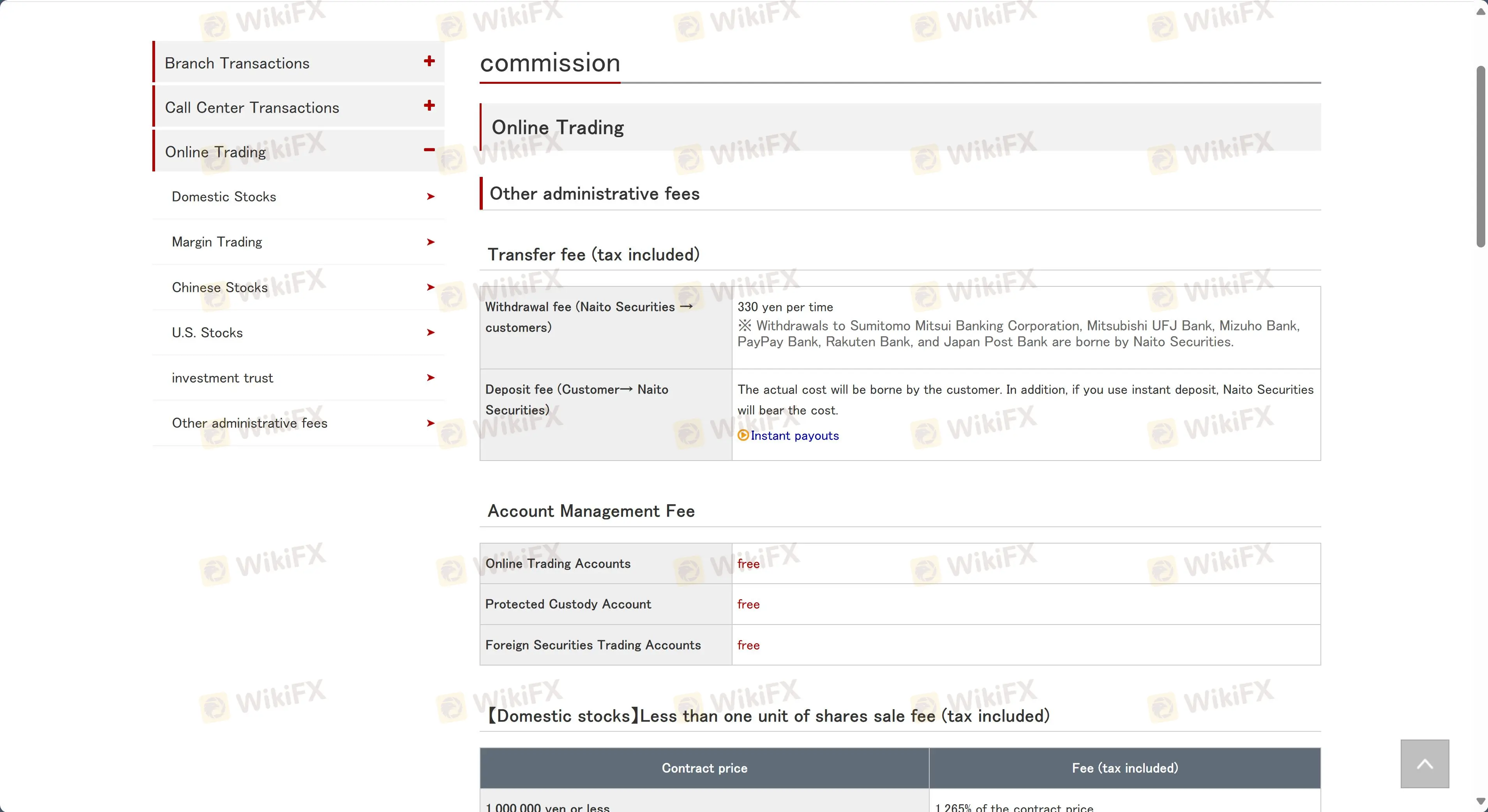

Administrative fees and procedure fees

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Proprietary Platform | ✔ | Desktop, Mobile | Both beginner and experienced traders |

| Online Trading | ✔ | Desktop, Mobile | Investors who prefer digital trading solutions |

Deposit and Withdrawal

Naito Securities does not mention clear things on deposit and withdrawal options.