公司简介

| Okigin评论摘要 | |

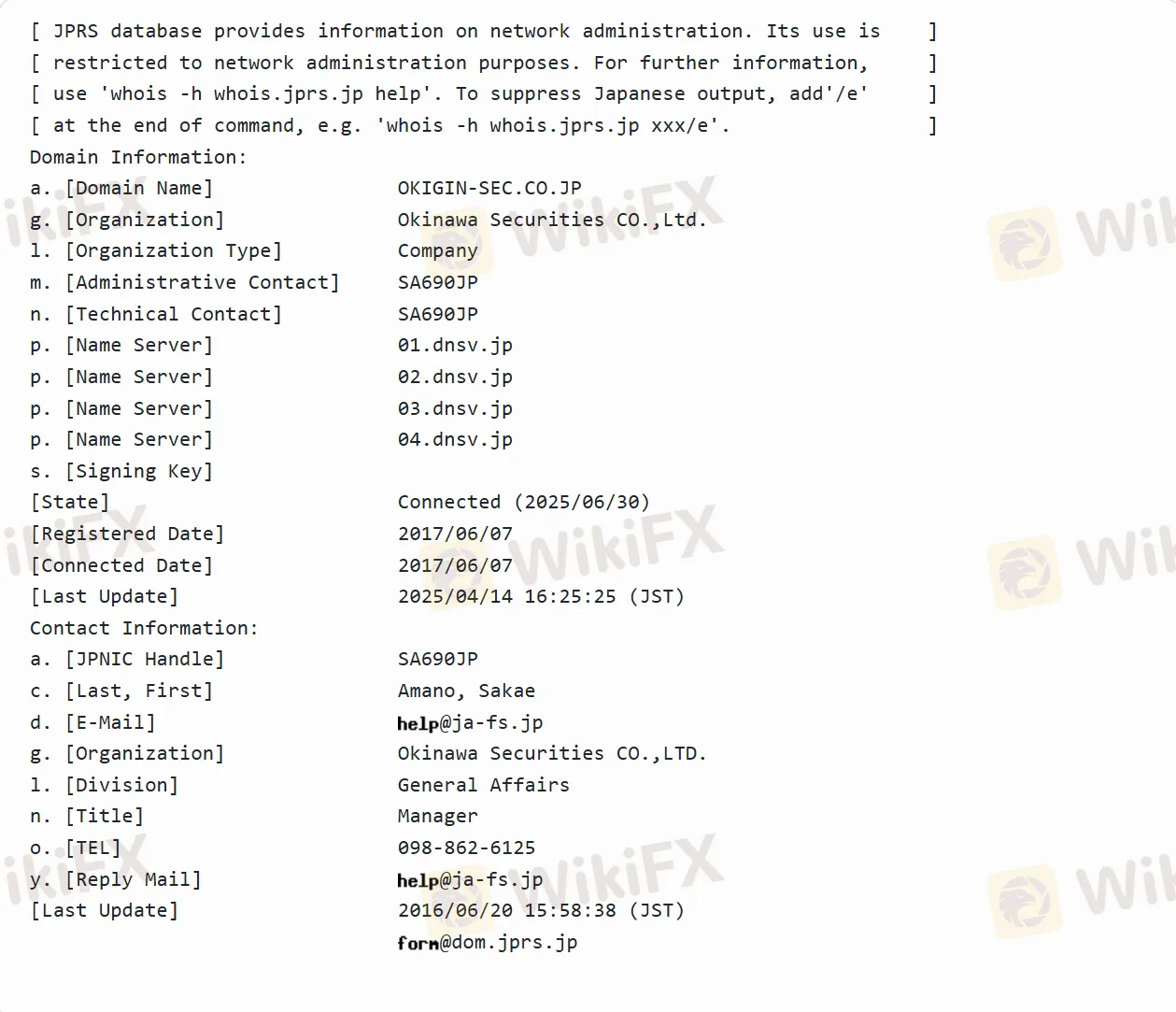

| 成立时间 | 2017-06-07 |

| 注册国家/地区 | 日本 |

| 监管 | 受监管 |

| 市场工具 | 股票、债券和投资信托 |

| 客户支持 | / |

Okigin 信息

Okigin 是一家日本金融服务提供商,其母公司是冲绳银行,在当地金融领域具有一定影响力。该平台致力于为投资者提供多样化的金融投资服务,涵盖股票、债券和投资信托等多种金融产品。该平台制定了一系列法律相关的准则,如招揽金融产品的准则、个人信息保护声明和处理准则等,以维护客户的权益,规范业务运作。

优缺点

| 优点 | 缺点 |

| 受监管 | 语言限制(日语) |

| 多样的金融产品 | 对投资者的国际业务存在限制 |

| 清晰的风险警示 | 复杂的费用标准 |

| 多元化的服务渠道(场外交易、电话接待、在线服务) | |

| 由冲绳银行支持 |

Okigin 是否合法?

Okigin 是一家合法合规的金融服务平台。其母公司冲绳银行在日本金融市场具有合法的运营资格。该平台本身也受到金融厅的监管,其监管许可证号为冲绳县综合事务局(金融商人)主任颁发的第1号。

Okigin 可以交易什么?

在 Okigin 平台上,投资者可以交易各种金融产品,包括股票(国内和国外股票)、债券和投资信托。

| 可交易工具 | 支持 |

| 股票 | ✔ |

| 债券 | ✔ |

| 投资信托 | ✔ |

Okigin 费用

股票交易 手续费 分为国内股票和国外股票。

对于国内股票,如果约定金额低于100万日元,则手续费率为约定金额的1.210%(最低为2,750日元);如果超过100万日元但低于或等于300万日元,则手续费率为约定金额的0.880%加上3,300日元,依此类推。

对于国外股票,在委托买卖时,将收取约定金额的2.20%的国内代理手续费(含税,最低为5,500日元);对于场外国内交易,只需支付购买金额,外币 交易所 按公司确定的 交易所 汇率进行。

此外,对于债券交易手续费,如果约定的金额低于100万日元,则手续费率为约定金额的1.045%(最低为2,750日元);如果超过100万日元但不超过500万日元,则手续费率为约定金额的0.935%加上1,100日元,依此类推。通过募集和出售等相关交易购买债券时,只需支付购买金额。