公司简介

| Maven评论摘要 | |

| 成立时间 | 2010 |

| 注册国家/地区 | 英国 |

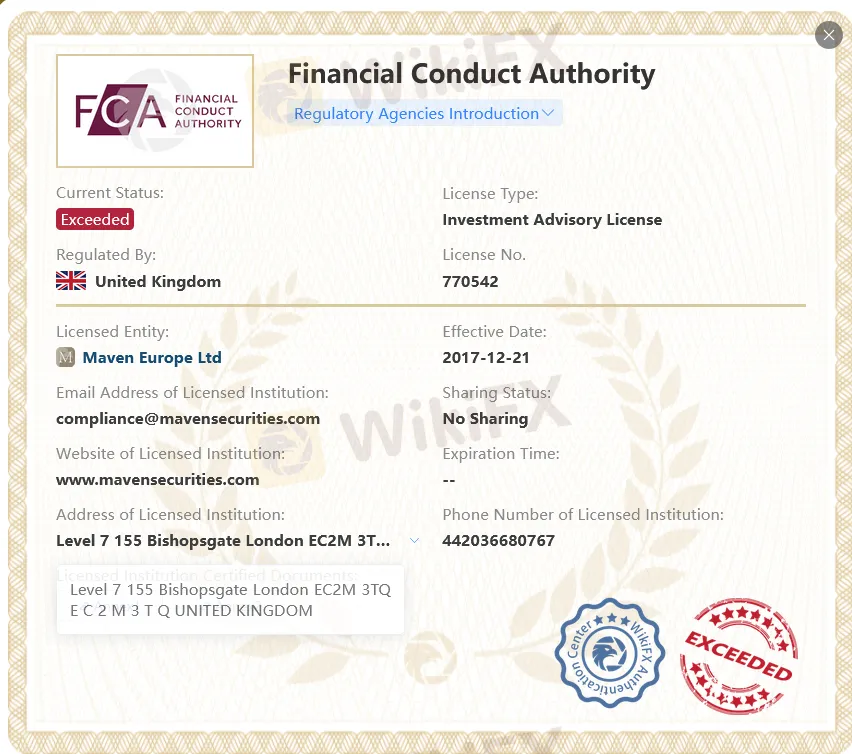

| 监管 | FCA(已超出) |

| 客户支持 | 电话:+44 203 668 0767 |

| 地址:伦敦,EC2M 3TQ,Bishopsgate 155号7楼 | |

Maven信息

Maven声称是一家市场领先的专营交易公司,成立于2010年,专注于安全市场。其由英国金融行为监管局(FCA)颁发的许可已超出。

优缺点

| 优点 | 缺点 |

| 历史悠久 | 超出FCA许可 |

| 缺乏透明度 |

Maven是否合法?

否。Maven目前没有有效的监管。它只持有超出的FCA许可。请注意风险!

| 监管状态 | 已超出 |

| 监管机构 | 英国金融行为监管局(FCA) |

| 持牌机构 | Maven欧洲有限公司 |

| 许可类型 | 投资咨询许可 |

| 许可号码 | 770542 |