회사 소개

| Maven 리뷰 요약 | |

| 설립 연도 | 2010 |

| 등록 국가/지역 | 영국 |

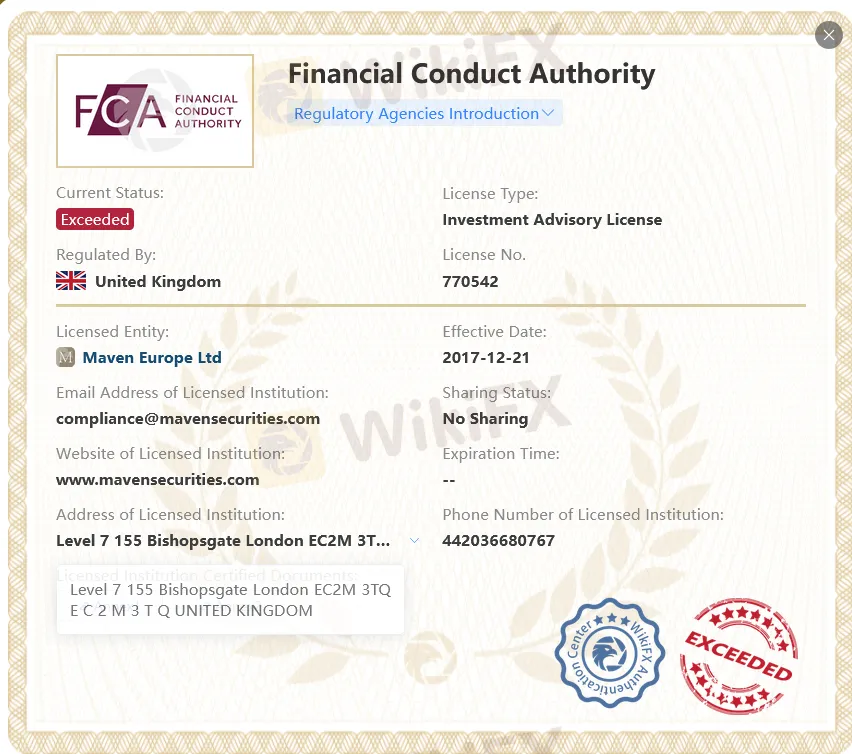

| 규제 | FCA (초과) |

| 고객 지원 | 전화: +44 203 668 0767 |

| 주소: Level 7, 155 Bishopsgate, London, EC2M 3TQ | |

Maven 정보

Maven은 2010년에 설립된 시장 선도적인 자체 거래 회사로 주식 시장을 전문으로 합니다. 금융행정청(FCA)이 발급한 라이선스가 초과되었습니다.

장단점

| 장점 | 단점 |

| 비교적 오랜 역사 | FCA 라이선스 초과 |

| 투명성 부족 |

Maven 합법 여부

아니요. Maven은 현재 유효한 규정이 없습니다. 초과된 FCA 라이선스만 보유하고 있습니다. 리스크를 인식해주십시오!

| 규제 상태 | 초과됨 |

| 규제 기관 | 금융행정청(FCA) |

| 라이선스 기관 | Maven Europe Ltd |

| 라이선스 유형 | 투자 자문 라이선스 |

| 라이선스 번호 | 770542 |