公司简介

| 华金国际 评论摘要 | |

| 成立时间 | 2013 |

| 注册国家/地区 | 中国香港 |

| 监管 | SFC |

| 交易产品 | 证券、期货 |

| 交易平台 | ET Trade在线交易平台、TradeGo在线交易平台 |

| 客户支持 | 办公时间:周一至周五(上午09:00至下午06:00),周六、周日及公共假期(关闭) |

| 电话:(852) 31 033 030 | |

| 邮箱:csdept@hjfi.com.hk | |

| 地址:香港中环花园道3号冠君大厦11楼1101室 | |

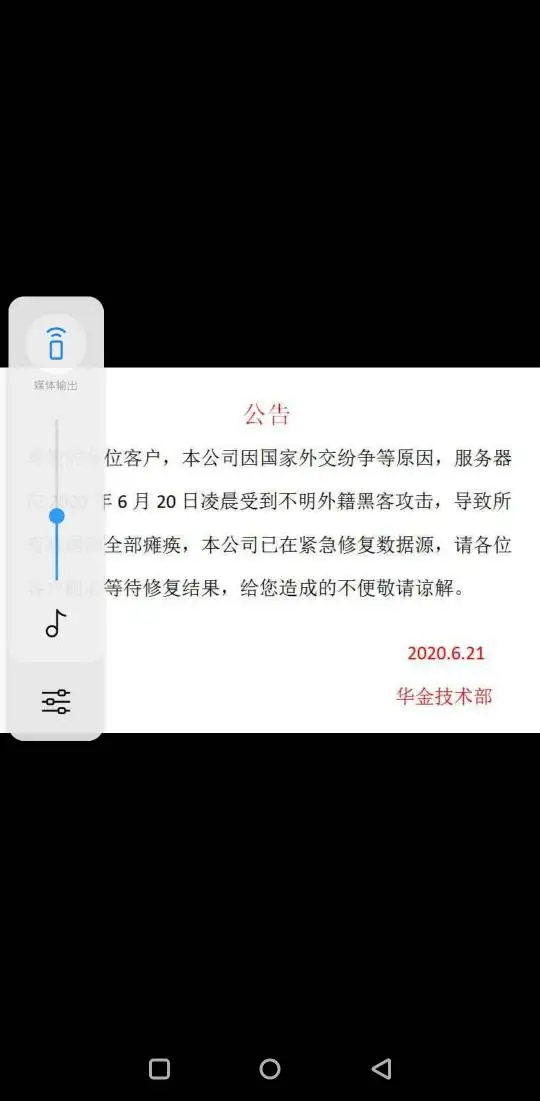

华金国际成立于2013年,注册于中国香港,是一家受证券期货监督委员会(SFC)监管的金融公司,持有BFJ369牌照。公司提供一系列证券和期货交易。该公司提供三种主要账户类型:证券现金账户、证券保证金账户和期货账户,满足个人、联合和公司客户的需求。此外,公司提供两个在线交易平台:ET Trade和TradeGo。

优点和缺点

| 优点 | 缺点 |

| 受SFC监管 | 复杂的费用结构 |

| 多样的账户类型 |

华金国际是否合法?

是的,华金国际目前受SFC监管,持有期货合同交易牌照。

| 监管国家 | 监管机构 | 当前状态 | 持牌实体 | 牌照类型 | 牌照号码 |

| 证券期货监督委员会(SFC) | 受监管 | 华金期货(国际)有限公司 | 期货合同交易 | BFJ369 |

我可以在华金国际上交易什么?

华金国际为客户提供证券和期货交易。

| 交易产品 | 支持 |

| 证券 | ✔ |

| 期货 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 交易所交易基金 | ❌ |

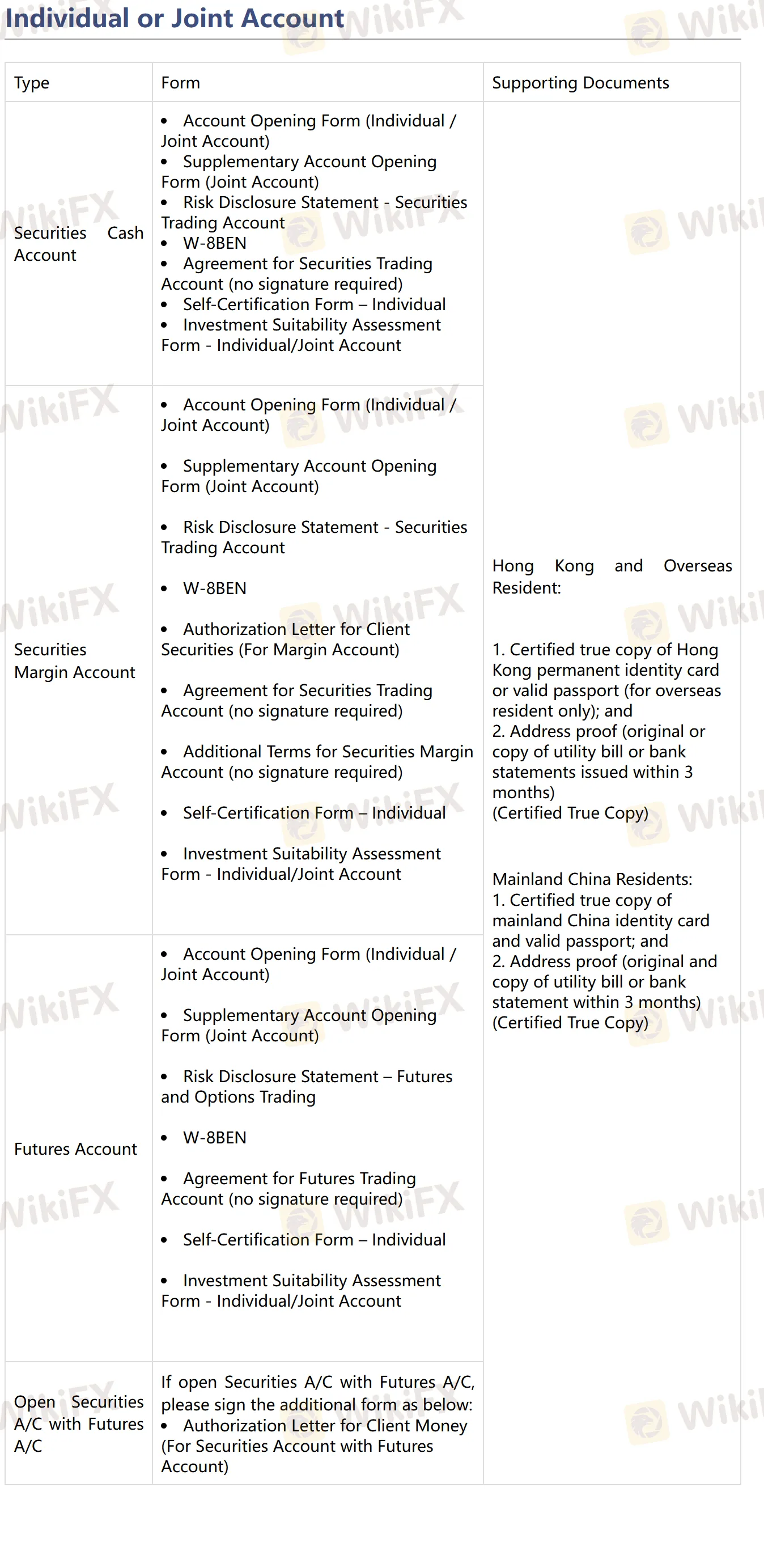

账户类型

华金国际提供三种主要账户类型:证券现金账户、证券保证金账户和期货账户,以及个人、联名和公司开户。

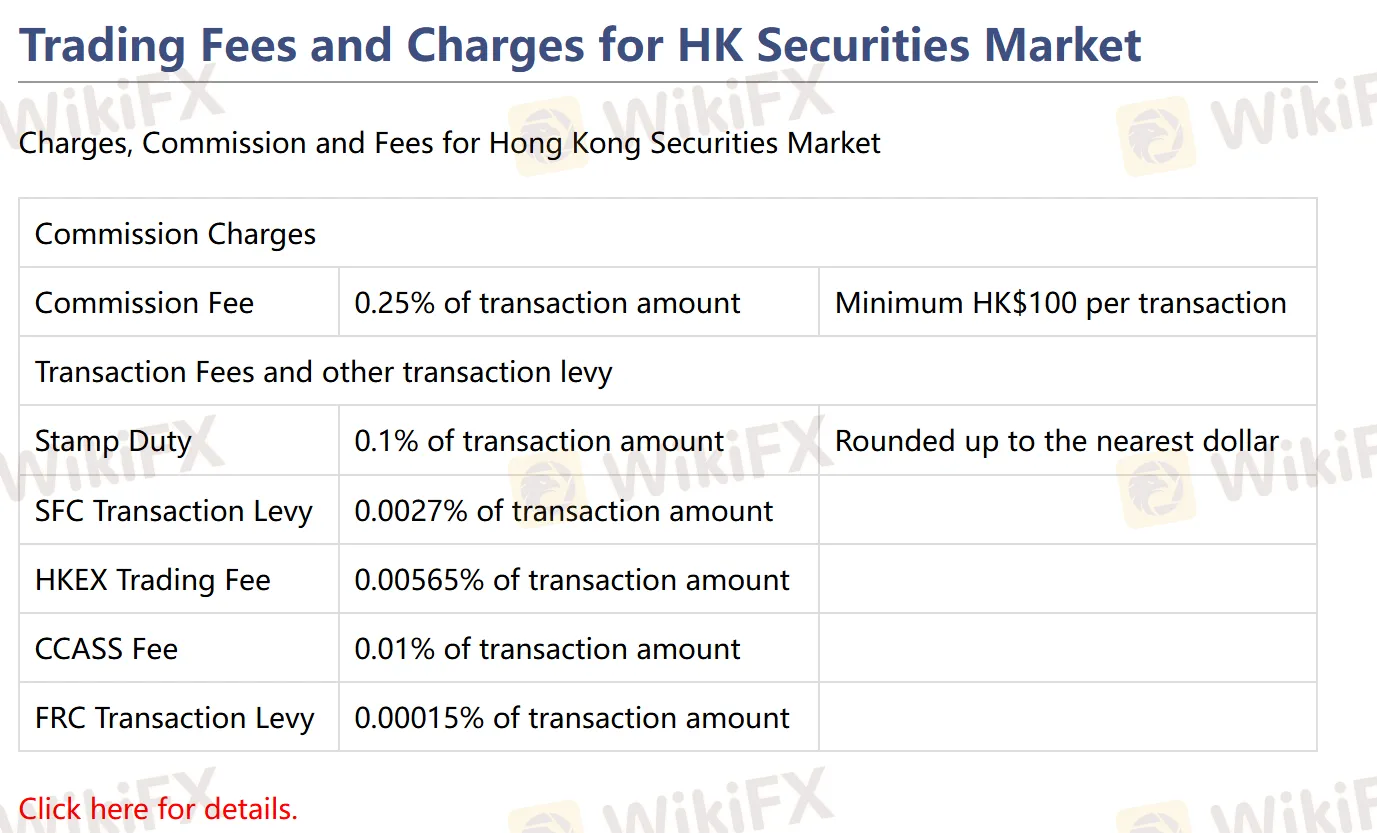

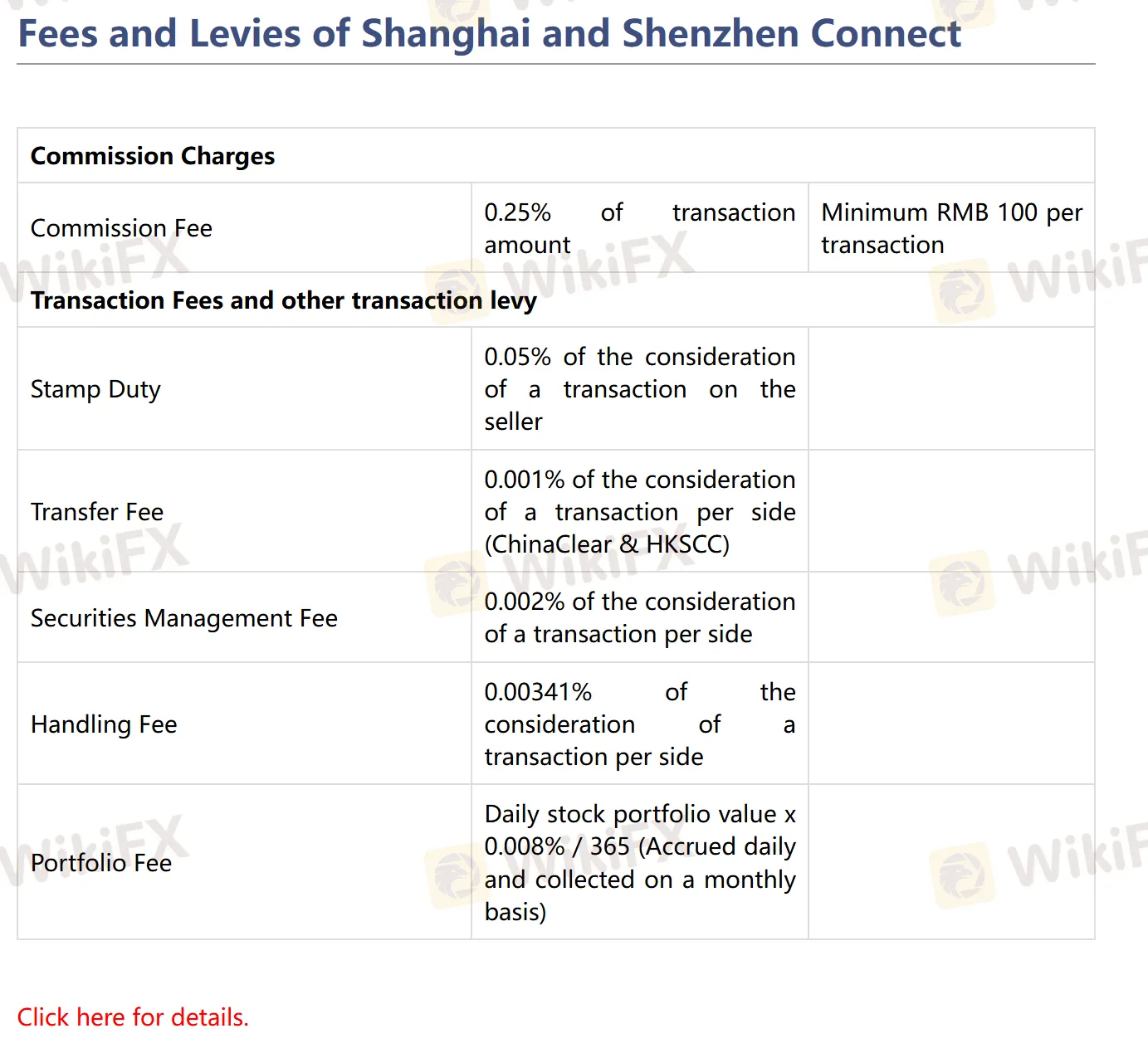

费用

佣金:根据市场和产品的不同,佣金率在0.15%至0.25%之间,最低费用为HK$100 / RMB 100 / US$15。

其他手续费:包括印花税、证监会征费、交易所手续费、结算手续费等,具体费率和最低额因市场和产品而异。

欲了解更多详情,请访问官方网站:https://www.hjfi.hk/EN/ffssc.php

交易平台

| 交易平台 | 支持 | 可用设备 |

| ET Trade在线交易平台 | ✔ | iPhone/iPad, Android |

| TradeGo在线交易平台 | ✔ | iPhone/iPad, Android |

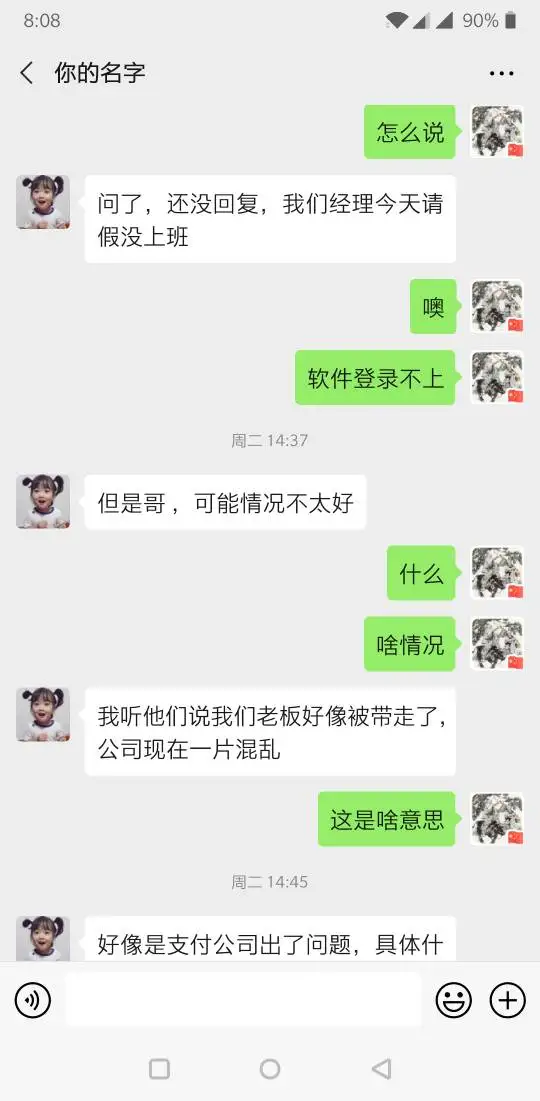

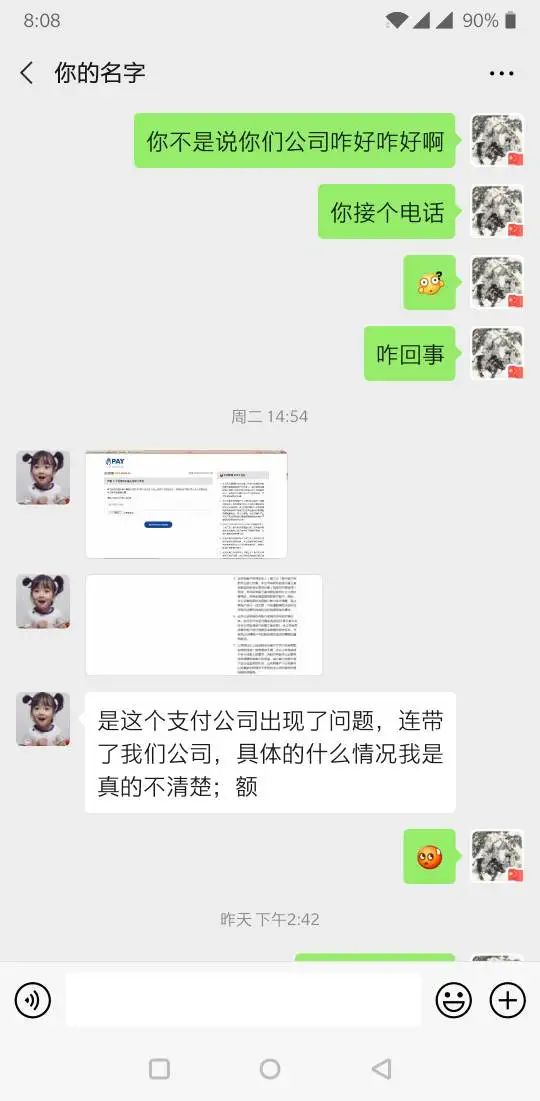

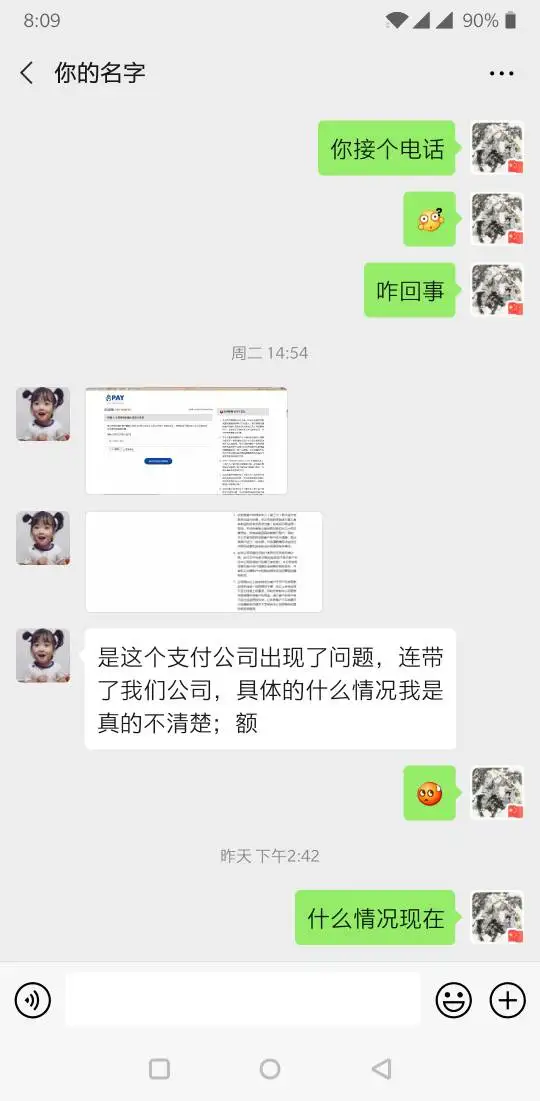

存取款

| 账户类型 | 存款方式 | 取款方式 |

| 证券账户 | 更快支付系统(FPS) | 在线交易系统 |

| 银行转账 | 通过电子邮件联系客户服务部门:csdept@hjfi.com.hk | |

| 支票存款 | ||

| 期货账户 | 银行转账 | 通过电子邮件联系客户服务部门:csdept@hjfi.com.hk |

| 支票存款 |