公司简介

| Guotai Junan Futures 评论摘要 | |

| 成立时间 | 2006-11-03 |

| 注册国家/地区 | 中国 |

| 监管 | 未受监管 |

| 产品和服务 | 期货 |

| 客户支持 | +8621 33038788, +8621 33038799 |

| +8621 33038895, +8621 33038891 | |

| qhgswfoez@gtht.com, Shenyan@gtht.com | |

| ibdtrading@gtjaqh.com, nitaoyong@gtht.com | |

Guotai Junan Futures 信息

Guotai Junan Futures 是国泰君安证券的全资子公司。自2007年成立以来,它成功地从主要从事经纪业务的期货公司转型为多元化的综合金融服务提供商。其业务范围涵盖期货和期权经纪、期货投资咨询、资产管理、风险管理和场外衍生品交易。它是中国金融期货交易所排名第一的综合结算会员,也是大连商品交易所、上海期货交易所、郑州商品交易所和上海国际能源交易中心的会员。

优缺点

| 优点 | 缺点 |

| 依赖国泰君安证券 | 未受监管 |

| 定制服务 | 业务覆盖范围有限 |

| 一站式系统解决方案 | 综合高端服务(部分费用较高) |

| 专业研究支持 |

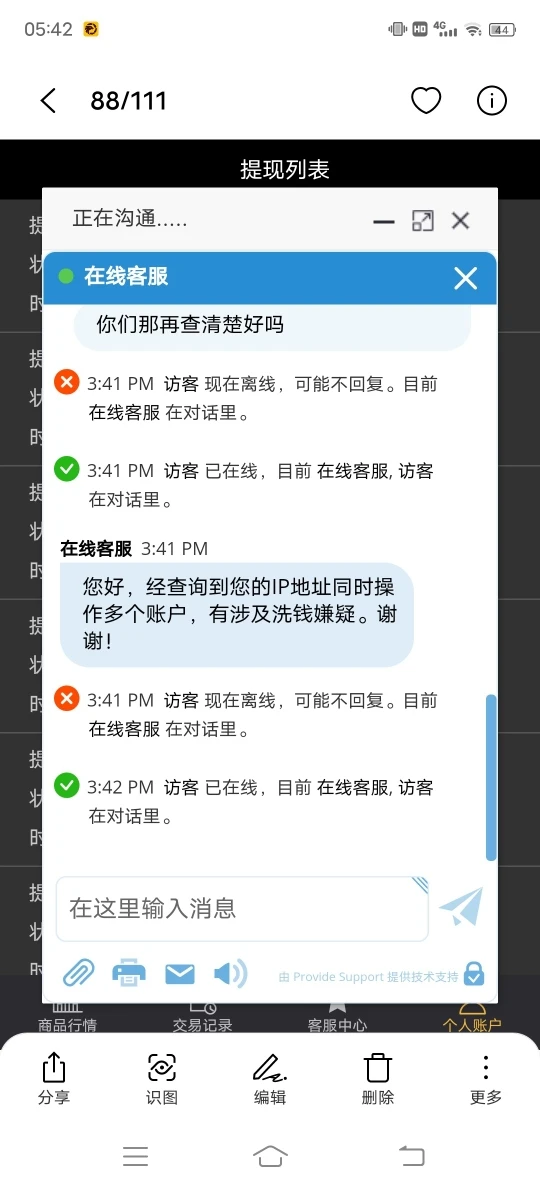

Guotai Junan Futures 是否合法?

尽管这家期货公司声称受中国证监会监管,但没有明确的监管证据表明Guotai Junan Futures受监督。

我可以在Guotai Junan Futures上交易什么?

Guotai Junan Futures 提供各种交易产品,如金融期货、商品期货(包括铁矿石、棕榈油、原油等)、商品期权、金融期权和场外衍生品。

Guotai Junan Futures 费用

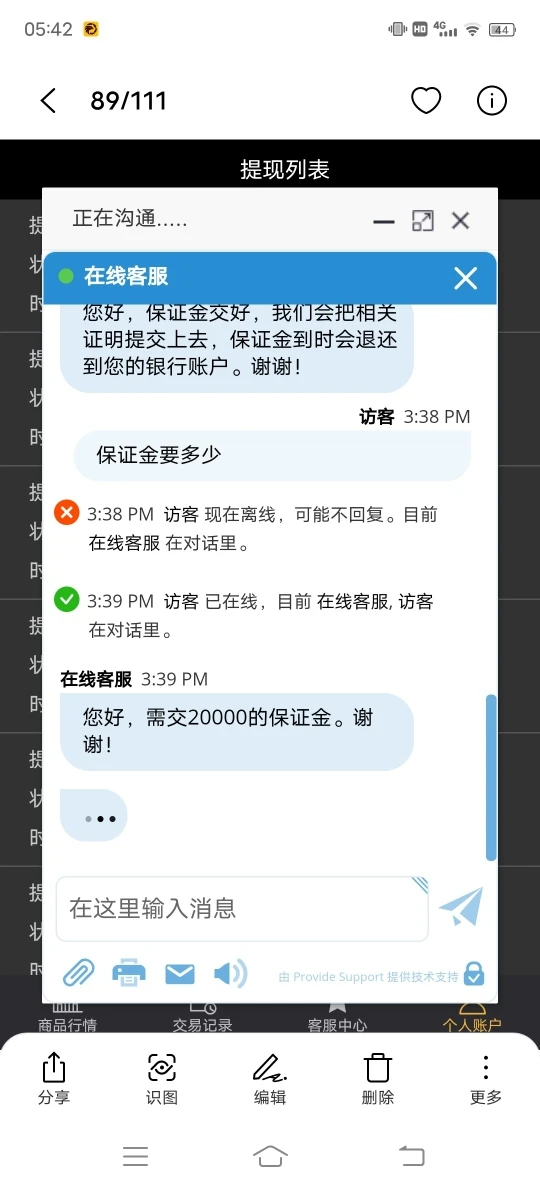

详细的费用标准尚未清楚公布。一般来说,期货交易的费用包括交易佣金、保证金等。建议投资者提前联系客户服务获取有关费用的信息。