基础信息

日本

日本天眼评分

日本

|

5-10年

|

日本

|

5-10年

| https://lightfx.jp

官方网址

评分指数

影响力

B

影响力指数 NO.1

日本 8.08

日本 8.08 监管信息

监管信息持牌机构:トレイダーズ証券株式会社

监管证号:関東財務局長(金商)第123号

单核

1G

40G

1M*ADSL

日本

日本 lightfx.jp

lightfx.jp 日本

日本

| LIGHT FX 评论摘要 | |

| 成立时间 | 2002 |

| 注册国家/地区 | 日本 |

| 监管 | 受日本金融厅(FSA)监管 |

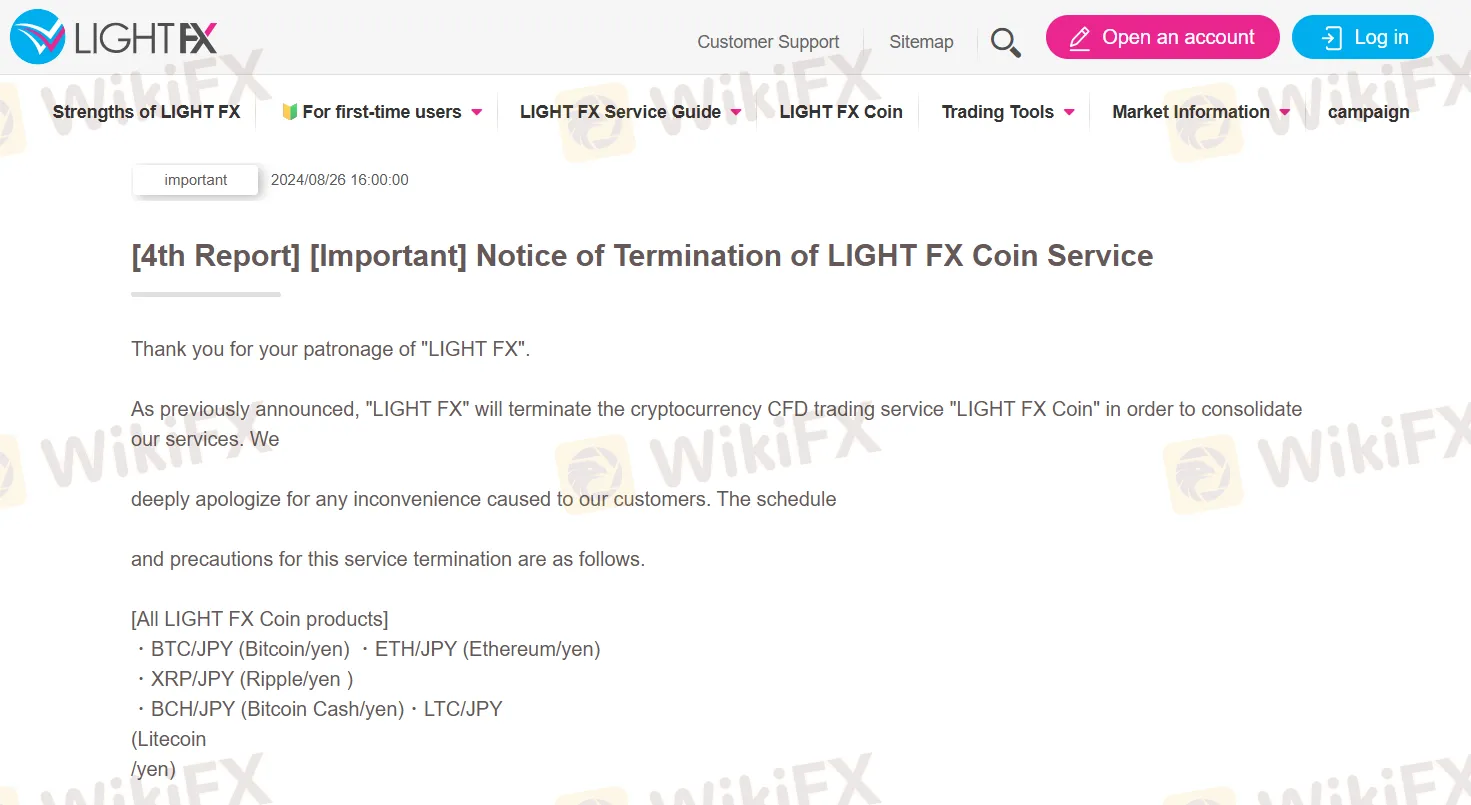

| 市场工具 | 外汇,加密货币 |

| 模拟账户 | / |

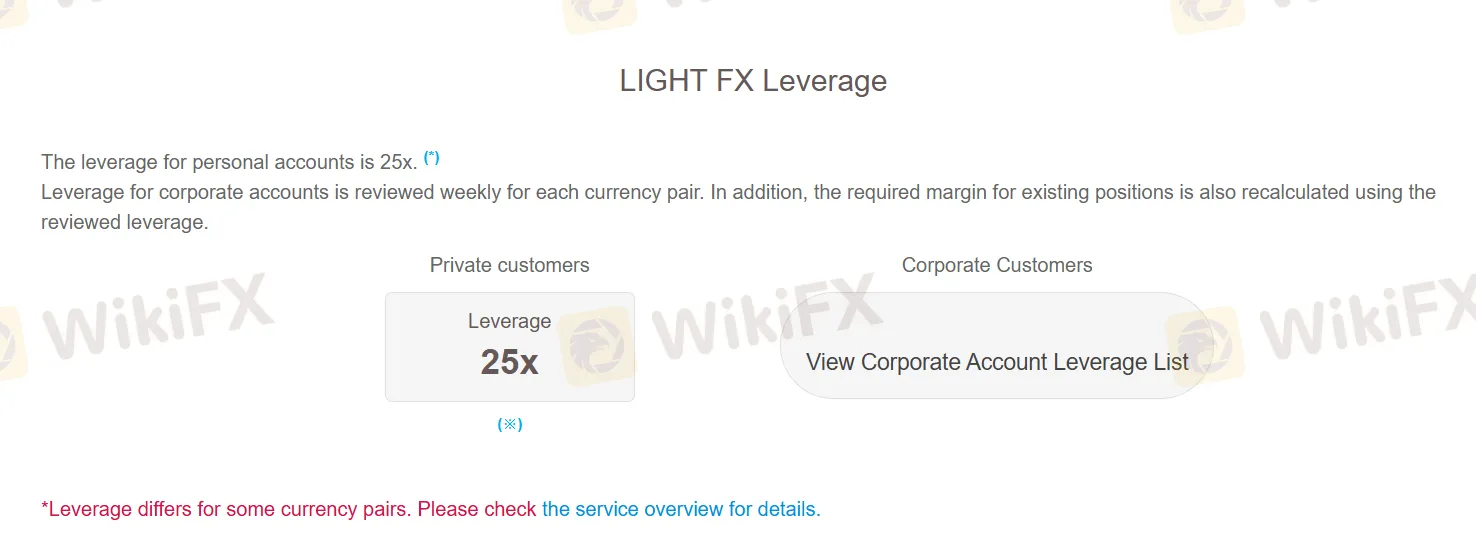

| 杠杆 | 最高达1:25 |

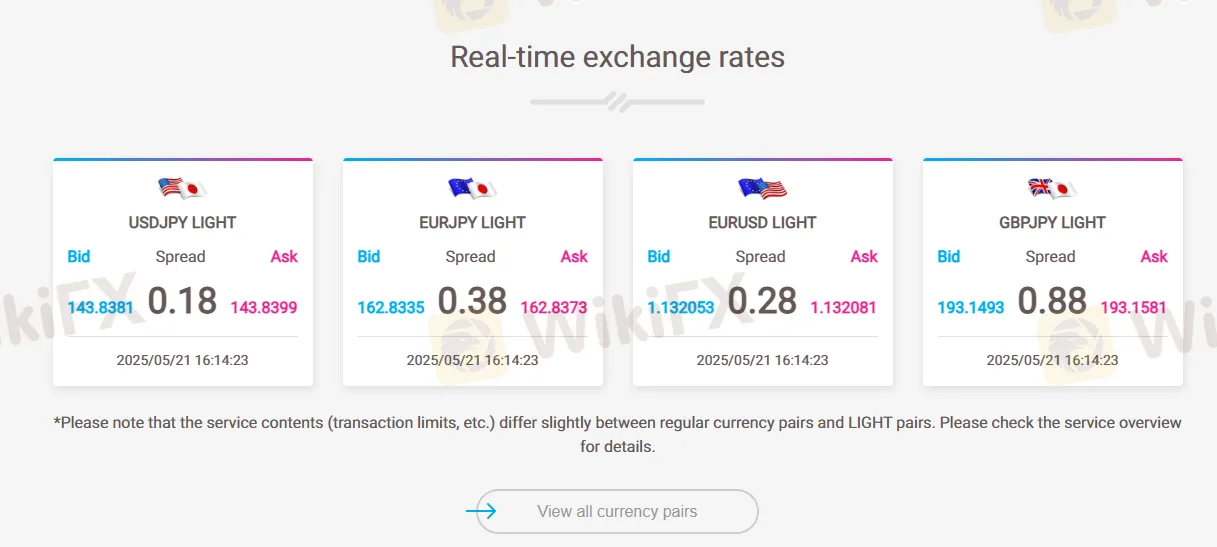

| 欧元/美元点差 | 大约0.28点 |

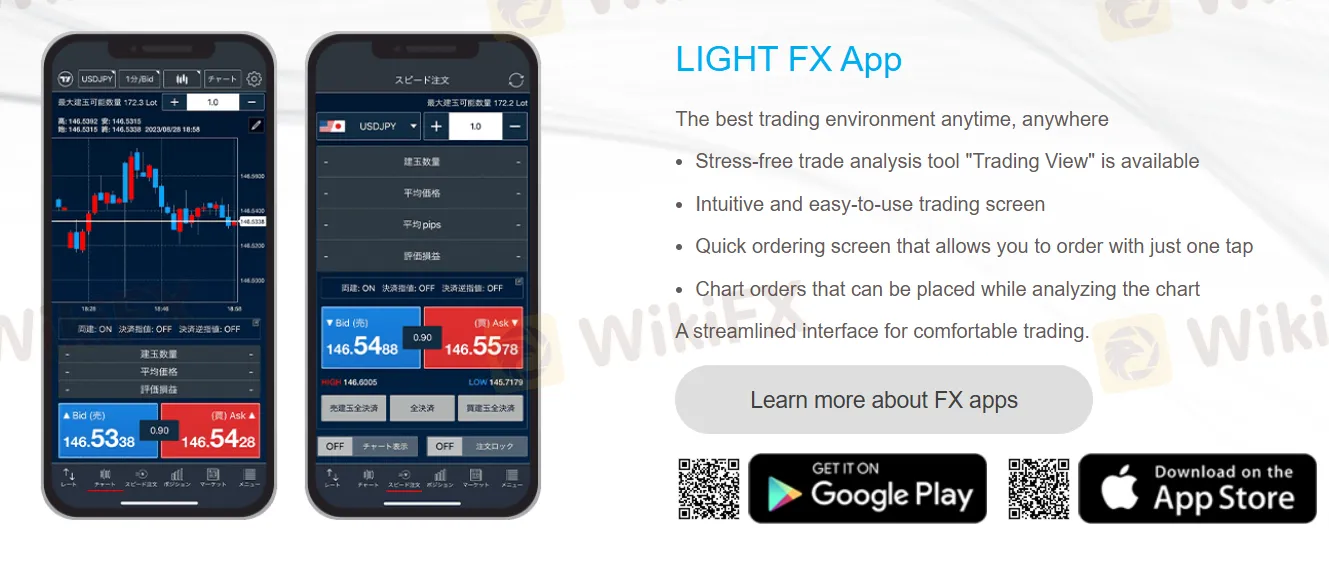

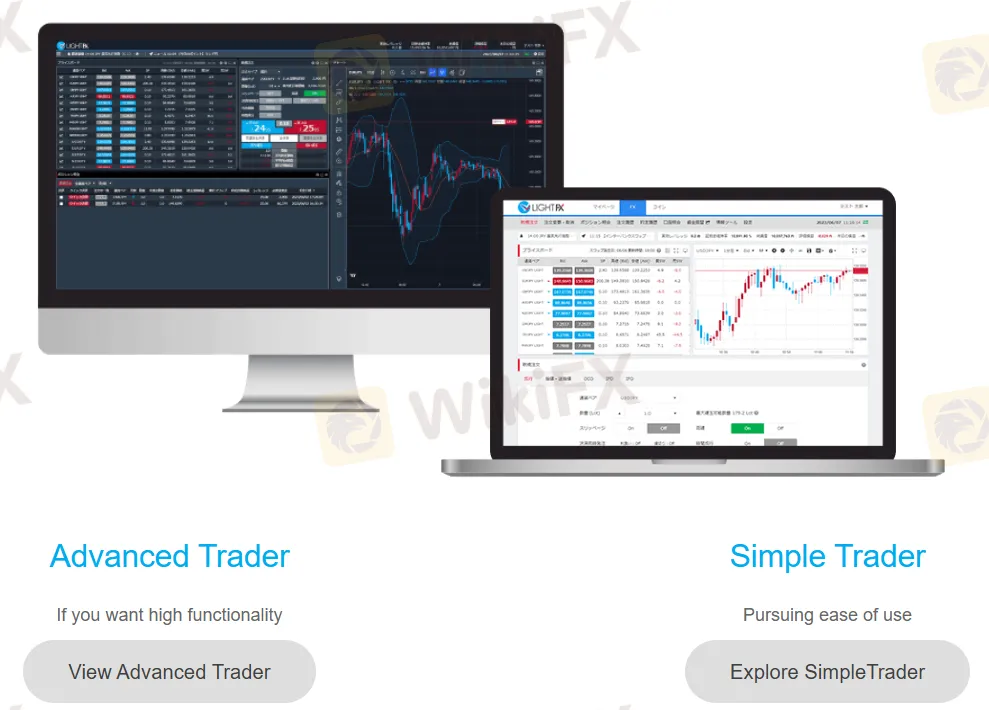

| 交易平台 | LIGHT FX 应用、Simple Trader、Advanced Trader |

| 最低存款 | 0 |

| 客服支持 | 联系表单 |

| 电话:0120-637-105 | |

| 地址:Traders Securities Co., Ltd. “LIGHT FX”东京都渋谷区恵比寿4丁目20-3 恵比寿花园塔28楼,邮编150-6028 | |

| 社交媒体:X | |

LIGHT FX 是一家成立于2002年的日本经纪商,受FSA监管。提供外汇和加密货币交易。

| 优点 | 缺点 |

| 受FSA监管 | 交易资产有限 |

| 多种交易平台 | 不支持MT4和MT5 |

| 无佣金费 | 无模拟账户 |

| 允许小额交易 | |

| 实体办公室验证 | |

| 营业时间长 |

LIGHT FX 受日本金融厅(FSA)监管,隶属于トレイダーズ証券株式会社,许可证号为関東財務局長(金商)第123号。

| 监管状态 | 监管机构 | 许可机构 | 许可类型 | 许可证号 |

| 受监管 | 日本金融厅(FSA) | トレイダーズ証券株式会社 | 零售外汇许可证 | 関東財務局長(金商)第123号 |

WikiFX实地调查团队访问了LIGHT FX的地址是日本,我们在现场发现了他们的办公室,这意味着该公司有实体办公室。

| 交易工具 | 支持 |

| 外汇 | ✔ |

| 加密货币 | ✔ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 股票 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| ETF | ❌ |

LIGHT FX提供最高1:25的杠杆,具体取决于工具和账户类型。杠杆允许交易者用较少的资金控制更大的头寸,放大潜在利润和损失。

| 交易平台 | 支持 | 可用设备 | 适合 |

| LIGHT FX 应用 | ✔ | iOS, Android | / |

| 简易交易员 | ✔ | Web(基于浏览器) | / |

| 高级交易员 | ✔ | Web(基于浏览器) | / |

| MT4 | ❌ | / | 初学者 |

| MT5 | ❌ | / | 经验丰富的交易者 |

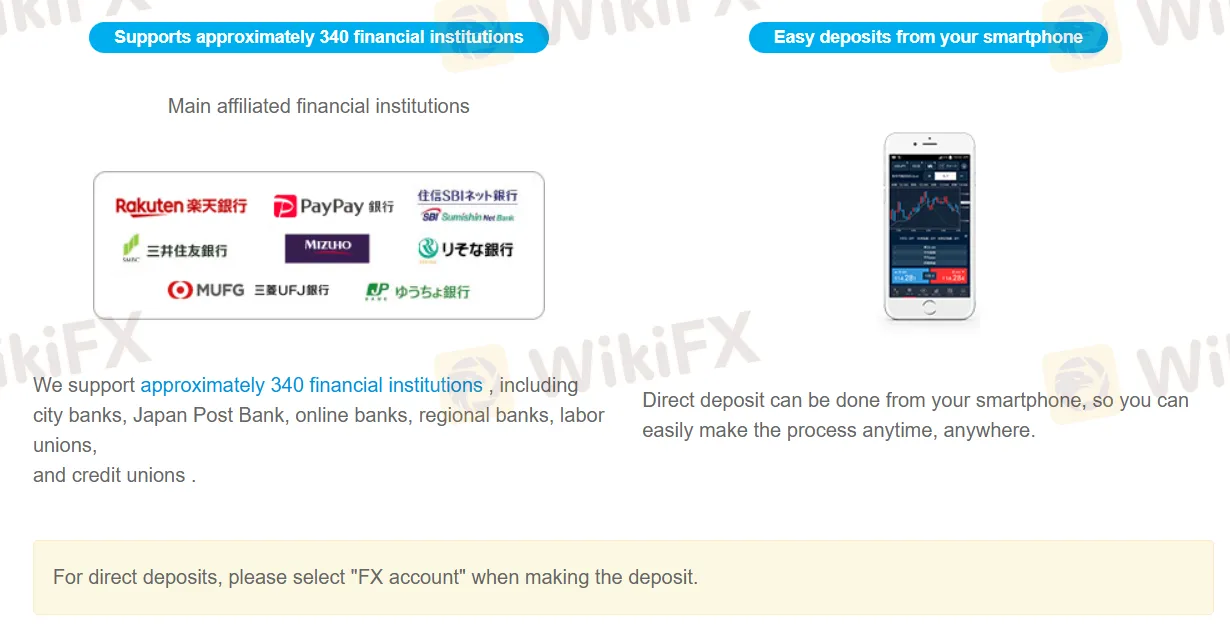

LIGHT FX 没有最低存款要求,非常适合新投资者和资金不多的人。

| 存款方式 | 最低存款 | 存款费用 | 存款时间 |

| 银行转账 | 0 | 0 | 24小时内 |

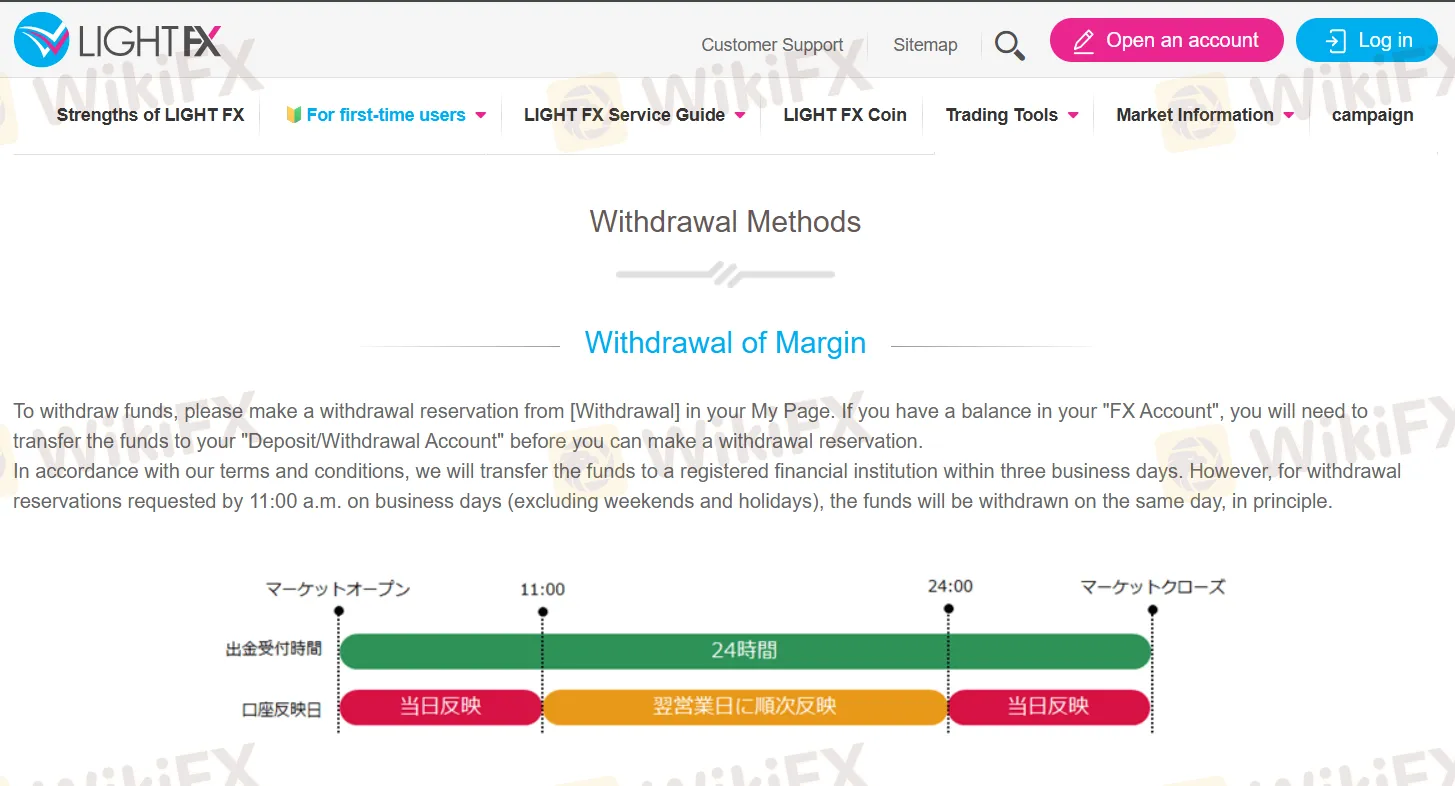

提供取款服务的是LIGHT FX,最低取款金额为JPY 2000,取款时间为3个工作日。

| 取款方式 | 最低取款 | 取款费用 | 取款时间 |

| 银行转账 | JPY 2000 | / | 3个工作日 |

From my direct experience trading with LIGHT FX, fees—or the lack thereof—for depositing and withdrawing funds have an important practical impact. One of the reasons I initially explored this broker was their explicit claim of no deposit fees when using bank transfers. In actuality, I’ve found this to be the case: I haven’t been charged by LIGHT FX for transferring money into my trading account, which is reassuring especially for those starting with smaller amounts. Withdrawals are a slightly different matter. While LIGHT FX does not list a specific withdrawal fee when transferring funds back to a Japanese bank account, I’m careful to monitor transaction terms each time. The platform does require a minimum withdrawal amount of JPY 2000 and processes requests within about three business days based on my past withdrawals. I have not seen LIGHT FX itself impose additional fees on these transfers, but, as a long-time trader, I always check with my banking provider for any external charges, as those can sometimes occur independently of the broker. Ultimately, for me, the absence of broker-imposed fees on deposits—and generally on withdrawals—reduces unnecessary costs in my trading activities. Still, I always remain cautious and recommend confirming current terms directly via their platform and with your bank before making significant transfers. This approach helps prevent surprises and aligns with the prudent management principles I follow as a forex trader.

In my experience with LIGHT FX, and after a thorough review of the key information available, I did not find any mention or indication that the broker offers a swap-free or Islamic account option. As a trader who pays close attention to account types for compliance with specific ethical or religious guidelines, such as Shariah law, I consider this an important factor. For me, the absence of clear information about Islamic accounts means I am cautious in assuming such an option is available, especially since Japanese brokers like LIGHT FX tend to focus on their domestic market, where demand for swap-free accounts is typically low. Additionally, the details about trading features, platform selection, and account requirements offered by LIGHT FX are clear in other areas, so the lack of transparency on Islamic account availability stands out. I always advise fellow traders to verify directly with the broker regarding swap-free options if these are essential to your trading or personal principles. Until LIGHT FX specifically lists or confirms support for Islamic accounts, I would not consider it suitable for those who require a swap-free solution for religious reasons.

Based on my experience as an independent trader, I always pay close attention to total trading costs when considering a broker, especially for popular indices like the US100. However, after reviewing the available information on LIGHT FX, I found that they do not offer trading in indices at all—this includes the US100. Their tradable instruments are strictly limited to forex and cryptocurrency; commodities, indices, stocks, and other asset classes are not available on their platform. This limited range is important to highlight for anyone, like myself, who relies on diversification or who specifically wants exposure to index CFDs. LIGHT FX’s regulated status with Japan’s FSA, physical office presence, and straightforward policies provide some confidence in terms of reliability, but their asset list is simply too narrow for index trading needs. For traders seeking US100 exposure, that’s a clear limitation—the platform will not meet those requirements, since there are no spreads, commissions, or swap charges to break down for indices. If your strategy centers on index trading, you’ll need to look elsewhere, always verifying regulatory credentials and costs directly through each broker’s official channels before committing any funds.

From my experience evaluating brokers, hidden fees can have a significant impact on trading results, so I always scrutinize deposit and withdrawal costs very closely before funding an account. With LIGHT FX, I found that they do not impose any deposit fees, and there is no minimum deposit required, which made the onboarding process more accessible for smaller traders like myself. For bank withdrawals, the platform specifies a minimum withdrawal amount of JPY 2000, with transactions processed within three business days. While the information provided by LIGHT FX clearly states the absence of deposit fees, it’s worth noting that the withdrawal fee details are not explicitly listed. In my own due diligence, I could not find explicit evidence of hidden withdrawal charges originating from LIGHT FX itself. That said, from my broader experience in the industry, I am always cautious of third-party bank fees, or intermediary charges outside the broker’s control, which could still apply depending on your chosen bank or payment provider. In summary, I have not encountered any undisclosed deposit or withdrawal fees directly with LIGHT FX so far. However, I recommend carefully checking with your local banks for any potential external costs and always reviewing the broker’s latest terms, as policies can change. Maintaining a conservative approach, I prefer to confirm all fund movement terms with customer support before transacting substantial amounts.

请输入...