公司简介

| Grand Capital 评论摘要 | |

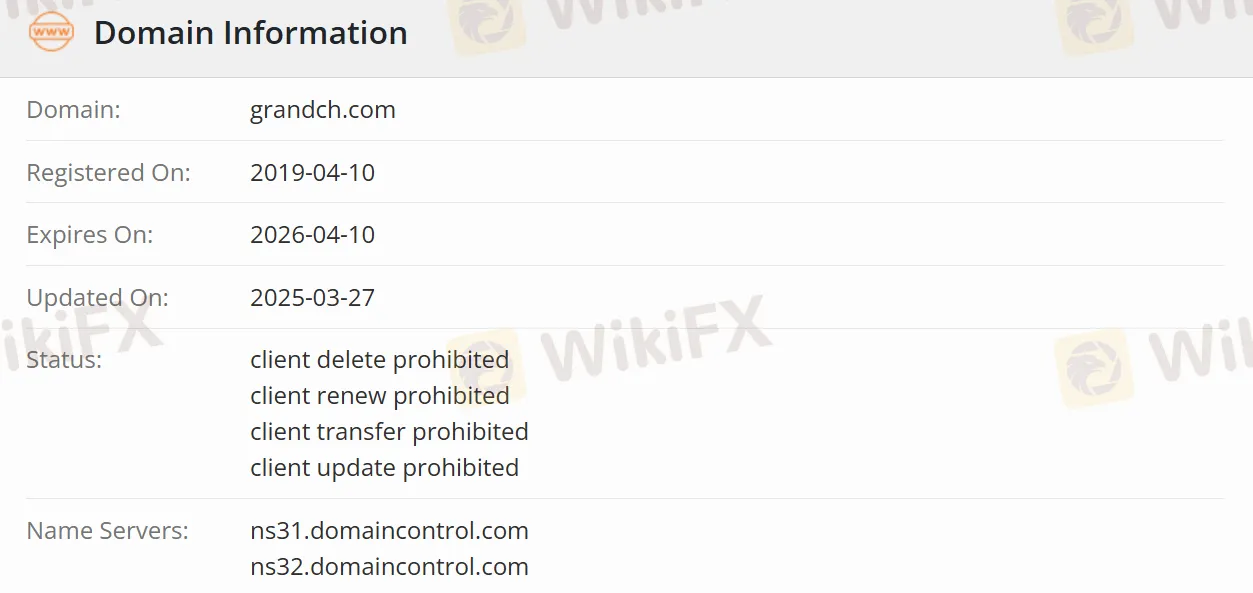

| 成立时间 | 2019-04-10 |

| 注册国家/地区 | 英国 |

| 监管 | 可疑克隆 |

| 市场工具 | 证券和固定收益产品 |

| 交易平台 | 多种类型的交易平台(桌面和移动) |

| 客户支持 | 电话:+852 3891 9888 |

| 传真:+852 2529 2899 | |

| 电子邮件:cs@grandch.com | |

Grand Capital 信息

Grand Capital Holdings Limited是一家总部位于香港的金融服务公司。其全资子公司Grand Capital Securities Limited通过其经纪、财富管理、资产管理和机构业务部门为个人、企业和机构提供执行和咨询服务。投资者可以通过其桌面、移动和基于Web的交易平台方便地访问全球23个交易市场。

优点和缺点

| 优点 | 缺点 |

| 全球市场准入 | 可疑克隆 |

| 多平台交易的便利性 | 费用信息不清楚 |

| 多元化业务 |

Grand Capital 是否合法?

Grand Capital 的合法性存在疑问。尽管它声称受香港监管机构监管,并声称持有香港证券及期货事务监察委员会(SFC)颁发的相关许可证,但它被怀疑是一家克隆公司,并没有实际证据支持其拥有合法许可证的说法。

Grand Capital 可以交易什么?

Grand Capital 提供证券产品,允许在全球20多个国家的上市股票进行交易。它还涵盖了诸如ETF(交易所交易基金)、REITs(房地产投资信托基金)、衍生权证和牛熊证等产品。还可以提供固定收益产品的交易服务,如各种政府和企业债券、投资级和高收益债券,以及多币种债券。

| 可交易产品 | 支持 |

| 证券 | ✔ |

| 固定收益 | ✔ |

账户类型

按账户持有人实体分类,Grand Capital 提供个人账户、联名账户和公司账户。按业务类型分类,Grand Capital 的证券账户分为现金账户和保证金账户。在现金账户中,交易使用账户持有人的资金进行。另一方面,保证金账户允许使用借入的资金进行交易,增加了投资杠杆,但也伴随着更高的风险。

此外,还有专注于专业资产管理的资产管理账户,以及为高净值客户提供定制金融服务的私人银行账户。

杠杆

Grand Capital 提供杠杆交易,这意味着投资者可以进行杠杆交易。杠杆可以放大投资回报,但同时也会放大风险。然而,Grand Capital 并未指定杠杆的具体细节。

交易平台

该公司提供多种类型的交易平台,包括桌面版、移动版(可从Play Store和App Store获取)以及基于Web的版本。这些平台配备了查看账户余额和持仓信息等功能,使投资者能够随时跟踪其投资状况。