公司简介

| MTFX 评论摘要 | |

| 注册日期 | 2016-03-04 |

| 注册国家/地区 | 加拿大 |

| 监管 | 未受监管 |

| 服务 | 货币兑换,跨境支付,风险对冲 |

| 交易平台 | MTFX (iOS 和 Android 应用) |

| 客户支持 | Facebook,Twitter,Instagram |

MTFX 信息

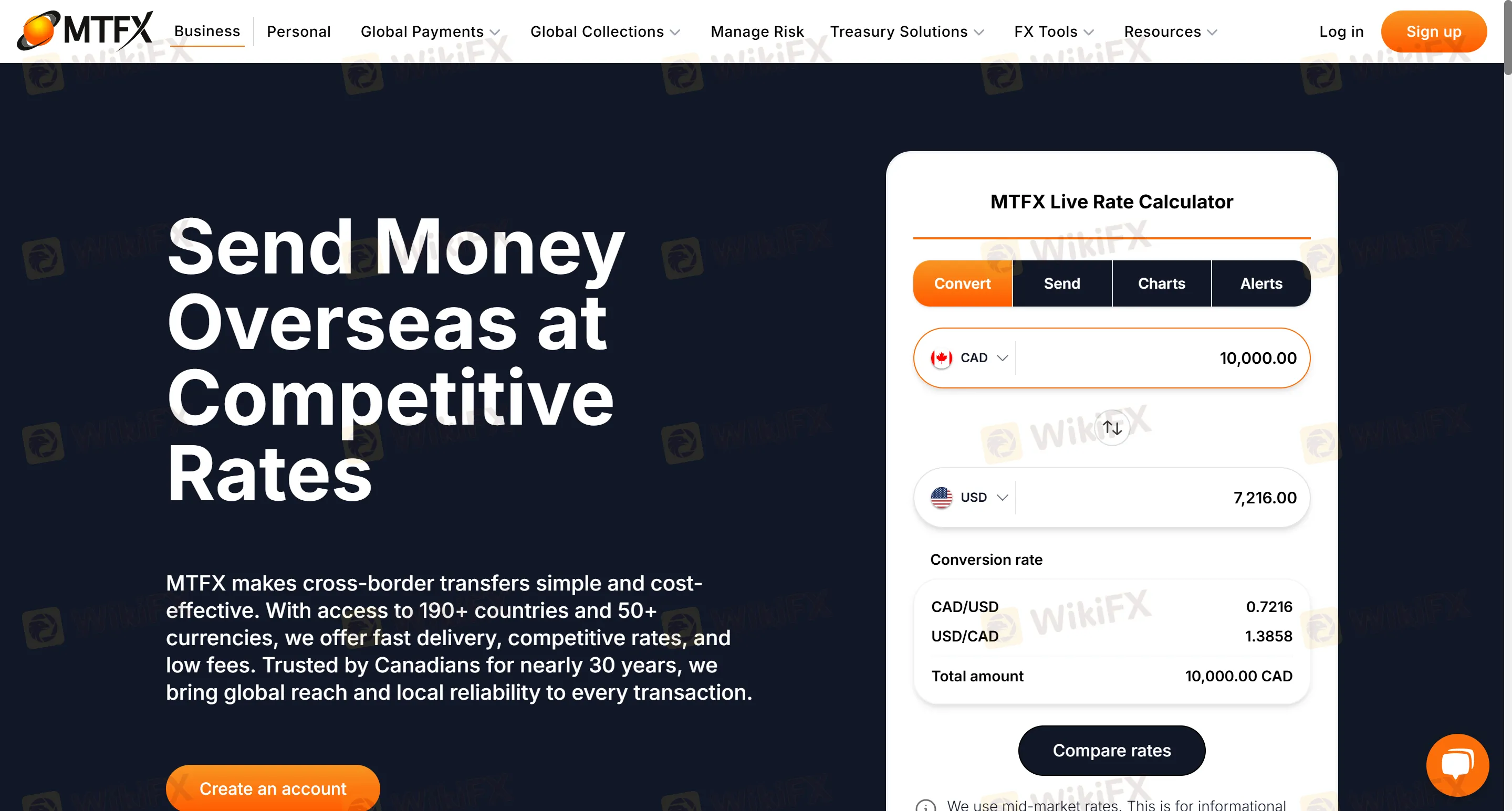

MTFX 是一家专注于跨境支付的知名平台,支持将50多种货币转账至190多个国家。它提供个人和企业的跨境转账、电子商务资金收款、大额资金转账(如海外房产购买和奢侈品收购)、多币种账户管理以及货币风险对冲。适合需要频繁跨境转账并重视交易所费用和资金安全的用户,尤其是在大额支付和企业场景中。

优缺点

| 优点 | 缺点 |

| 4% 交易所 费率 | 未受监管 |

| 全天候在线门户访问 | 货币对限制(主要关注主要货币) |

| 多场景覆盖 | 费用信息不清晰 |

MTFX 是否合法?

MTFX 未受监管,尽管MTFX 声称受加拿大金融交易和报告分析中心(FINTRAC)监管。该经纪商存在监管问题,建议交易者优先选择受监管的经纪商。

MTFX 提供哪些服务?

MTFX 主要提供跨境资金转账和外汇交易所服务,而不是传统的金融衍生品交易平台。服务包括:

货币兑换:50多种货币的实时兑换,如主流货币对如CAD/USD和EUR/GBP。

跨境支付:个人汇款(学费手续费、生活费、购房资金)和企业支付(供应商结算、工资、电子商务收款)。

风险对冲:锁定交易所汇率和定制对冲策略,适用于国际贸易和投资场景。

账户类型

MTFX 提供两种账户。个人账户适用于个人跨境转账、国际学费支付和定期汇款(如租金和养老金),而企业账户则专为企业跨境支付、供应链结算、多币种资金管理和电子商务平台集成(如亚马逊和 eBay)而设计。

交易平台

在线门户支持全天候移动应用,包括 iOS 和 Android 应用。

存款和取款

资金直接存入收款人的银行账户。对于企业转账,资金将在24-48小时内到账(优先处理当日电汇)。大多数个人转账在当天或下一个工作日完成。