公司简介

| YM Securities 评论摘要 | |

| 成立时间 | 2007 |

| 注册国家/地区 | 日本 |

| 监管 | FSA |

| 交易产品 | 股票、债券和投资信托 |

| 交易平台 | / |

| 最低存款 | / |

| 客户支持 | / |

YM Securities 信息

YM Securities 是日本山口金融集团(YMFG)旗下的证券公司,总部位于日本。主要提供股票、债券和投资信托交易。

优点和缺点

| 优点 | 缺点 |

| 受FSA监管 | 复杂的费用结构 |

| 悠久的运营历史 | 高会员门槛 |

| 会员福利制度(超过10,000,000日元的预存资产可享受80%折扣) | 主要以日语内容为主 |

| 交易产品类型有限 | |

| 客户支持渠道不明确 |

YM Securities 是否合法?

YM Securities 是日本合法注册的证券经纪公司,由日本金融厅(FSA)监管。其注册号为中国财务局长(金商)第8号。

我可以在YM Securities上交易什么?

YM Securities 提供国内外股票、债券和投资信托(基金)交易,投资主题包括国内外股票、债券、房地产,并支持定期储蓄计划(投资信托积累)。

| 交易产品 | 支持 |

| 股票 | ✔ |

| 债券 | ✔ |

| 投资信托 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |

| 期权 | ❌ |

| ETFs | ❌ |

| 共同基金 | ❌ |

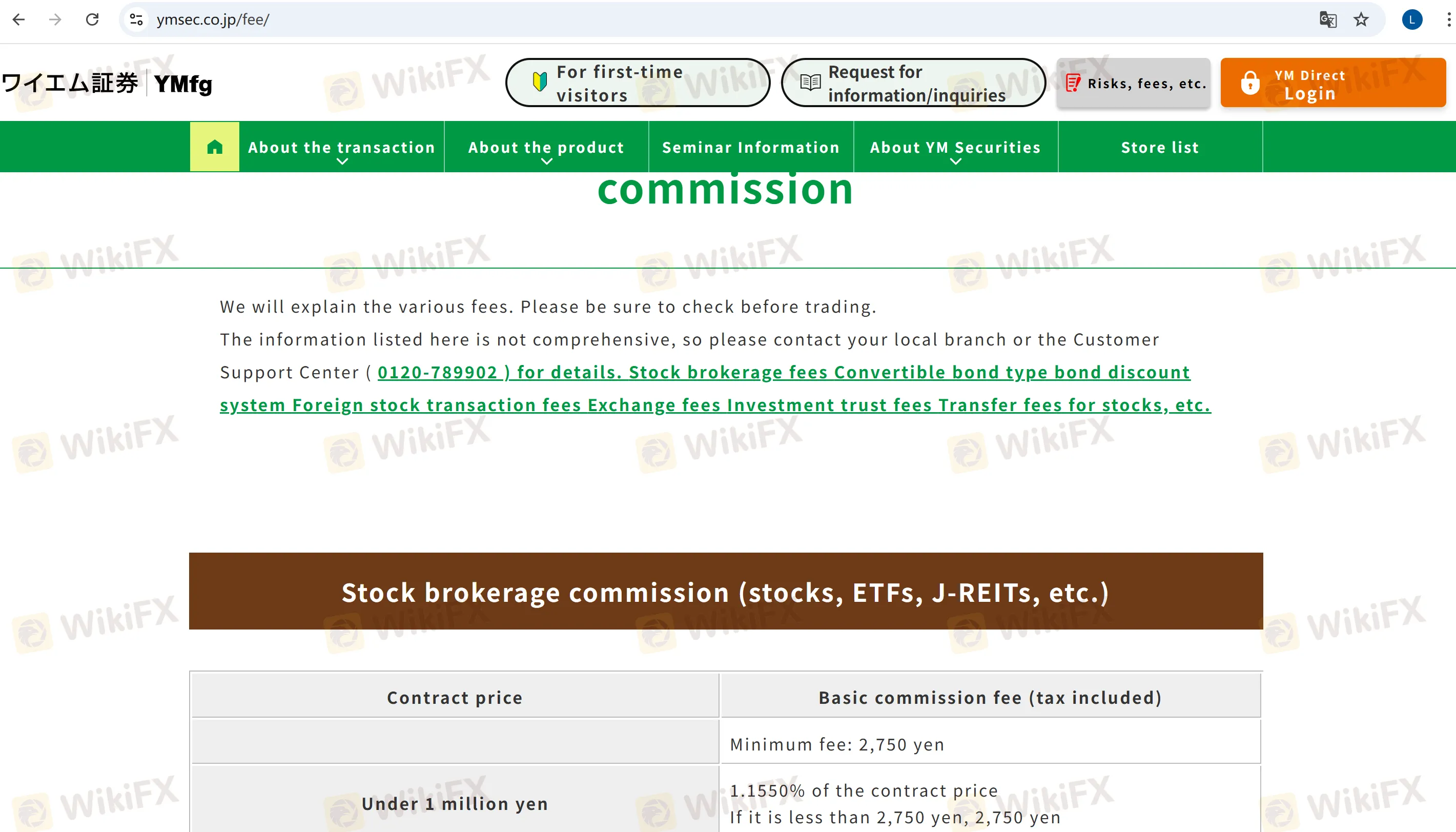

YM Securities 费用

YM Securities 的主要费用如下:

股票交易费用(国内股票、ETF等):最低2,750日元(含税),按交易金额分层收费(例如,交易金额低于1,000,000日元的为1.155%;1,000,000至5,000,000日元的为0.88% + 2,750日元)。会员可享受20%折扣。

外汇交易费用:包括本地手续费(例如,交易所 手续费)和国内代理手续费(例如,1,000,000日元以下的费用为1.43%)。

债券交易费用:可转换债券类产品最低费用为2,750日元,按交易金额分层收费(例如,1,000,000日元以下的费用为1.1%)。

其他费用:账户转移费:每单位起始费用为1,100日元,最高为6,600日元。

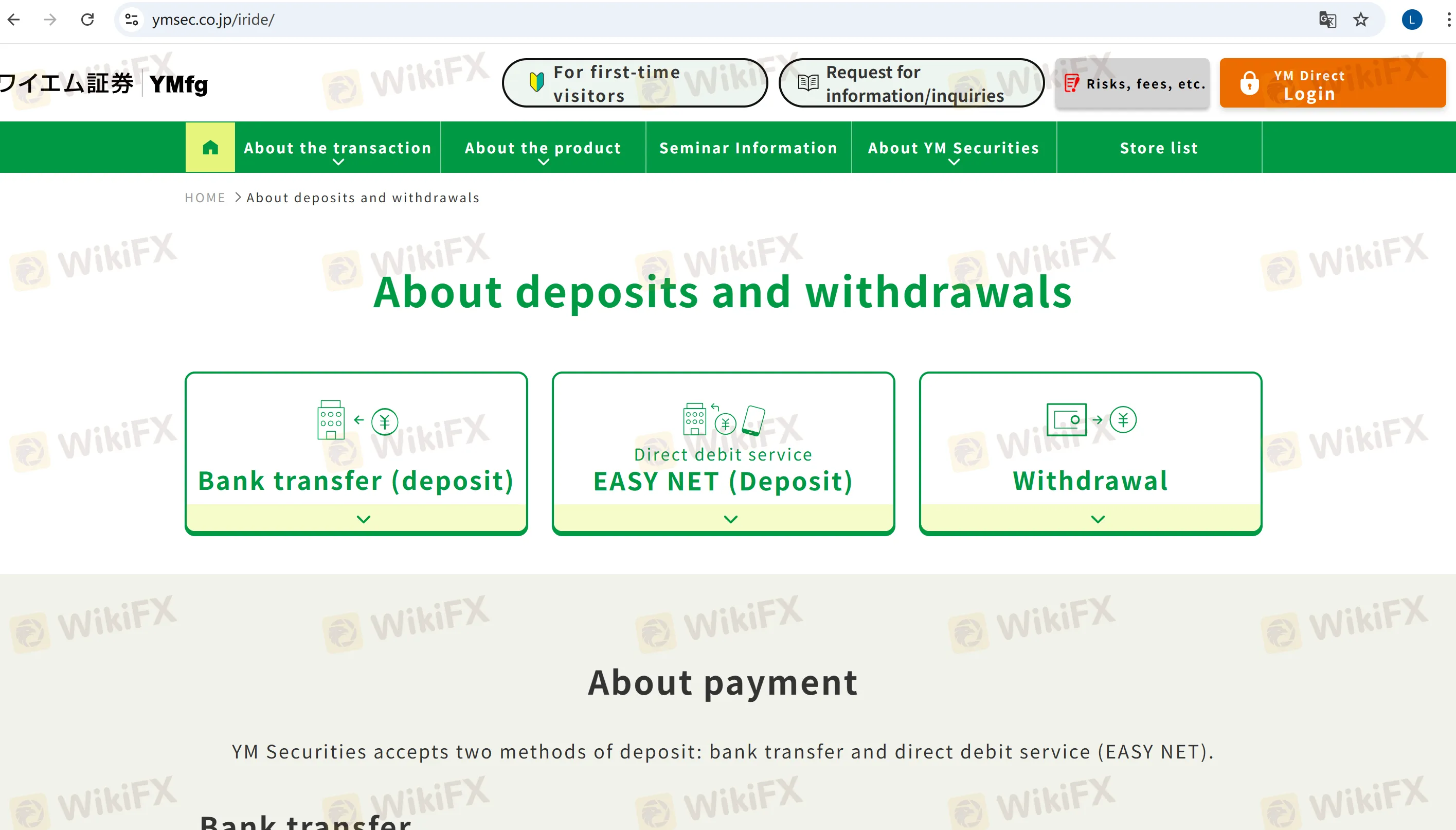

存款和取款

存款

银行转账:支持账户在山口银行、枫叶银行和北九州银行。通常由经纪公司承担处理费用。

EASY NET:与集团银行链接的免费即时资金转账服务,可通过在线平台或电话指令操作。

取款

可通过在线平台或电话发起取款请求,资金将自动转账至预先注册的银行账户。您可以指定从次日起的工作日到账。