公司簡介

| YM Securities 評論摘要 | |

| 成立年份 | 2007 |

| 註冊國家/地區 | 日本 |

| 監管機構 | FSA |

| 交易產品 | 股票、債券和投資信託 |

| 交易平台 | / |

| 最低存款 | / |

| 客戶支援 | / |

YM Securities 資訊

YM Securities 是日本山口金融集團(YMFG)旗下的證券公司,總部設於日本。主要提供股票、債券和投資信託交易。

優缺點

| 優點 | 缺點 |

| 受FSA監管 | 複雜的費用結構 |

| 悠久的運營歷史 | 高會員門檻 |

| 會員福利制度(超過10,000,000日圓預存資產可享80%折扣) | 主要內容為日文 |

| 交易產品種類有限 | |

| 客戶支援渠道不清晰 |

YM Securities 是否合法?

YM Securities 是日本合法註冊的證券經紀公司,由金融廳(FSA)監管。其註冊編號為中国財務局長(金商)第8号。

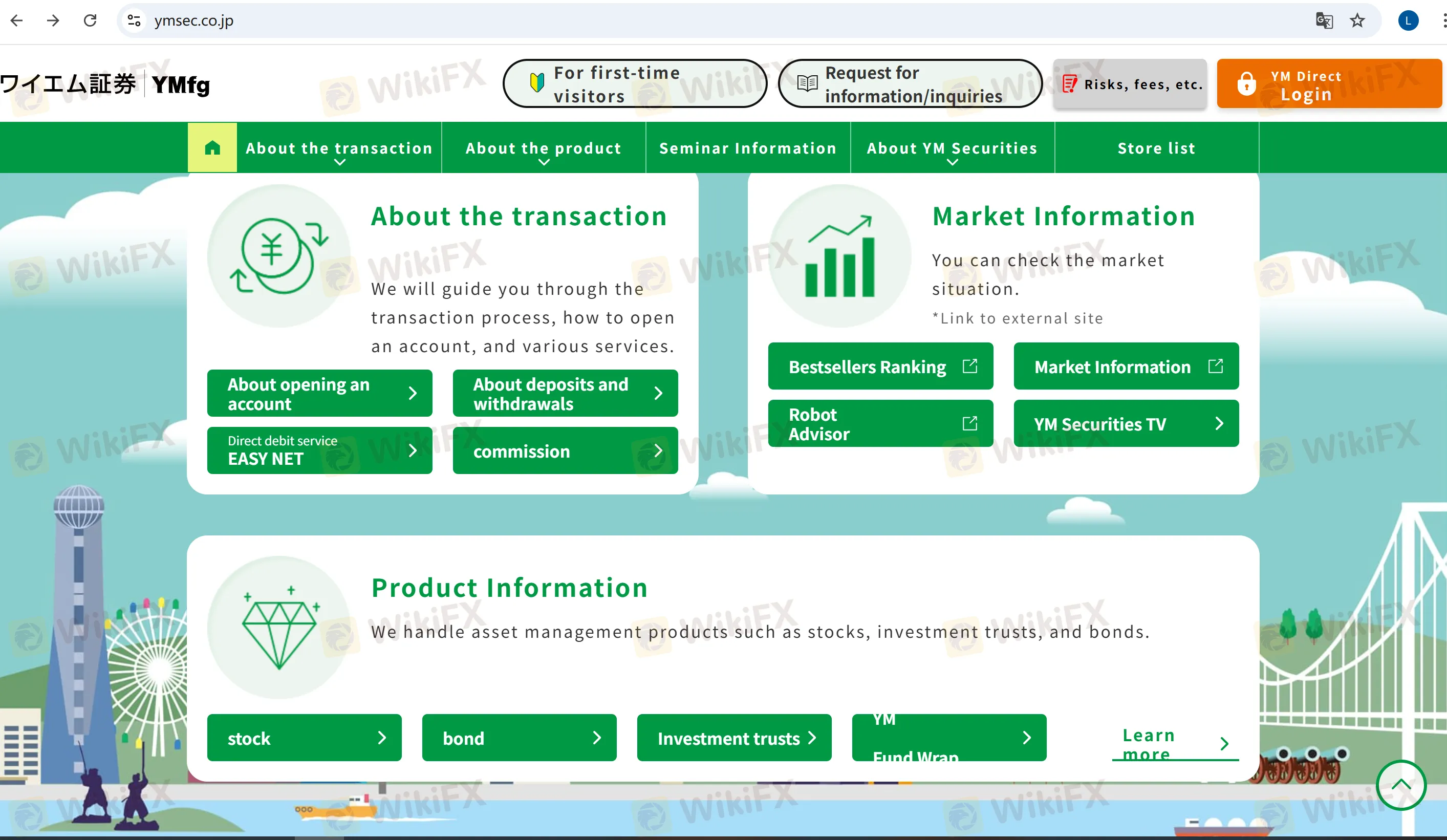

我可以在YM Securities上交易什麼?

YM Securities 提供國內外股票、債券和投資信託(基金),投資主題包括國內外股票、債券和房地產,支持定期儲蓄計劃(投資信託累積)。

| 交易產品 | 支援 |

| 股票 | ✔ |

| 債券 | ✔ |

| 投資信託 | ✔ |

| 外匯 | ❌ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

| ETFs | ❌ |

| 共同基金 | ❌ |

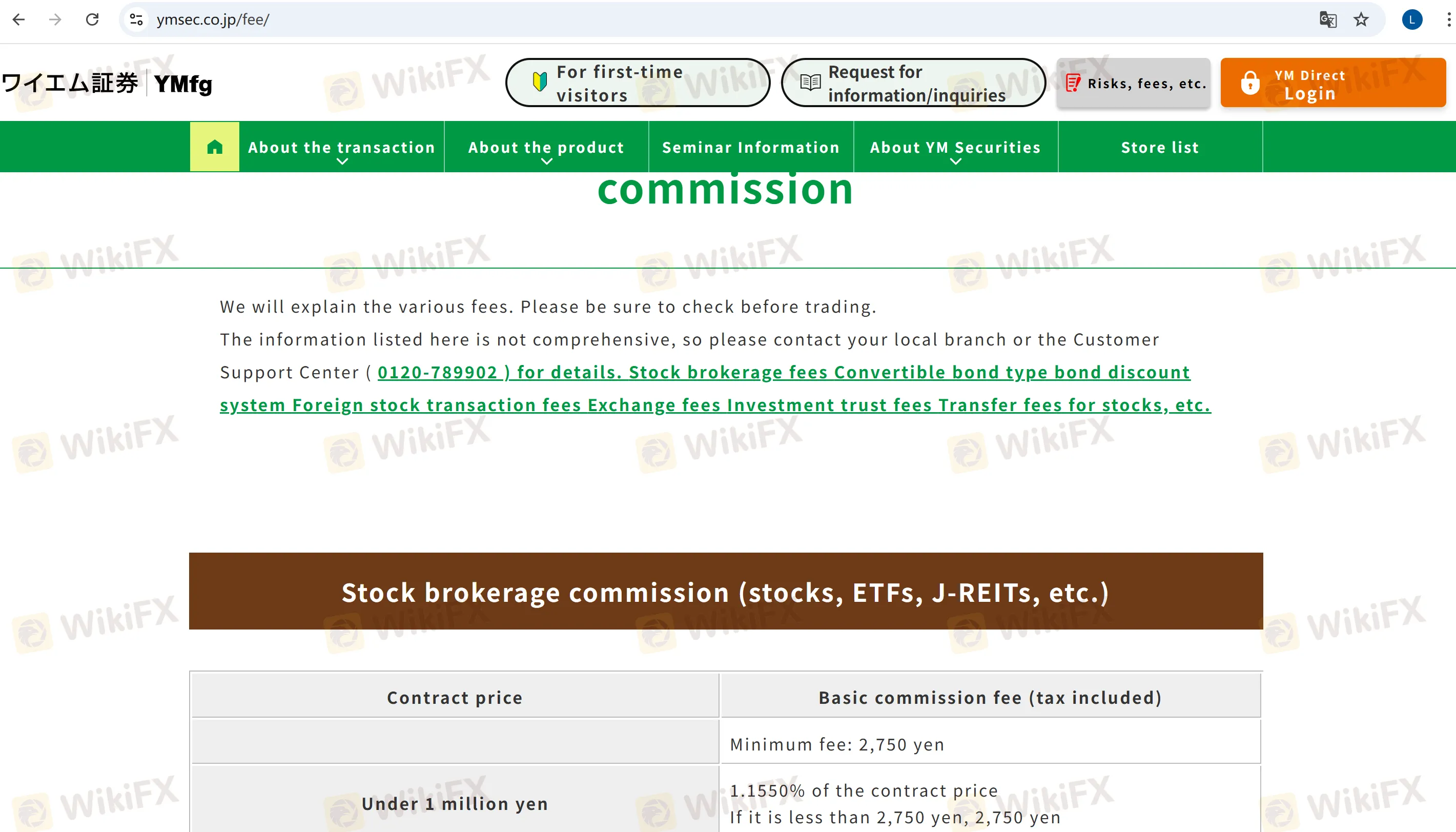

YM Securities 費用

YM Securities 的主要費用如下:

股票交易費用(國內股票、ETF等):最低2,750日圓(含稅),按交易金額分層收費(例如,交易金額低於1,000,000日圓的部分為1.155%,1,000,000–5,000,000日圓的部分為0.88% + 2,750日圓)。會員可享有20%折扣。

外匯交易費用:包括本地費用(例如,交易所費用)和國內代理費用(例如,1,000,000日元以下的費用為1.43%)。

債券交易費用:可轉換債券型產品最低費用為2,750日元,按交易金額分層收費(例如,1,000,000日元以下的費用為1.1%)。

其他費用:帳戶轉移費:每單位起始費用為1,100日元,最高為6,600日元。

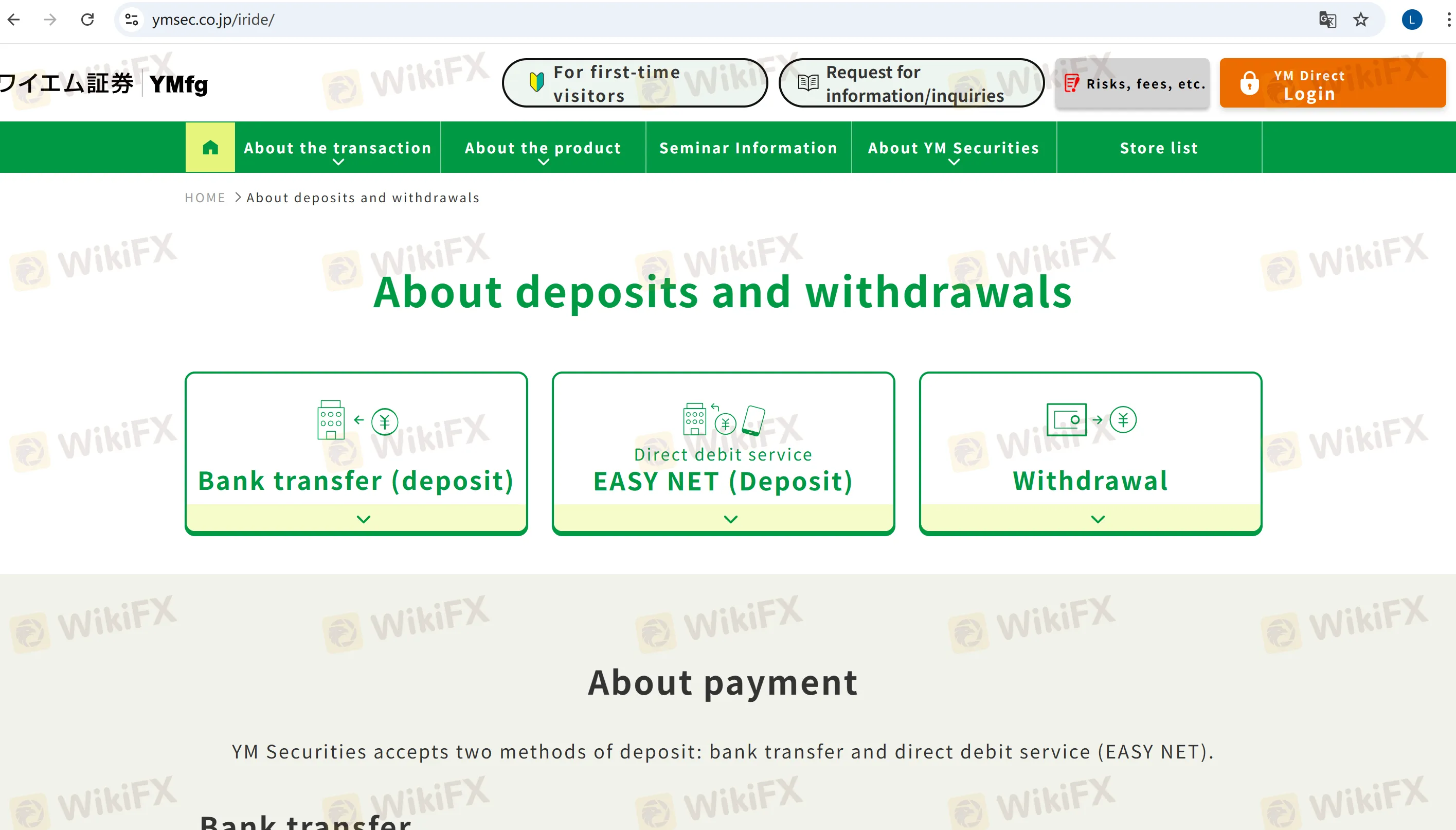

存款和提款

存款

銀行轉帳:支持山口銀行、紅葉銀行和北九州銀行的帳戶。一般由經紀公司支付手續費。

EASY NET:一項免費的即時資金轉帳服務,與集團銀行相連,可通過在線平台或電話指示操作。

提款

可透過在線平台或電話提出請求,資金將自動轉入預先註冊的銀行帳戶。您可以指定從次日起的工作日資金到帳。