RichN

1-2年

What is the usual processing time for withdrawing funds from Shenwan Hongyuan to either a bank account or an e-wallet?

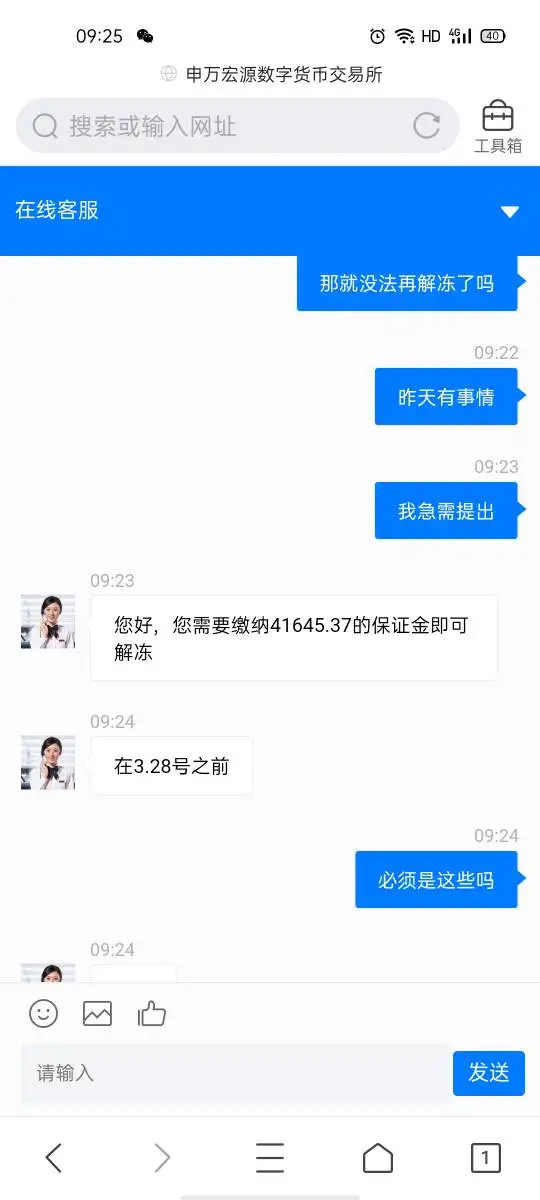

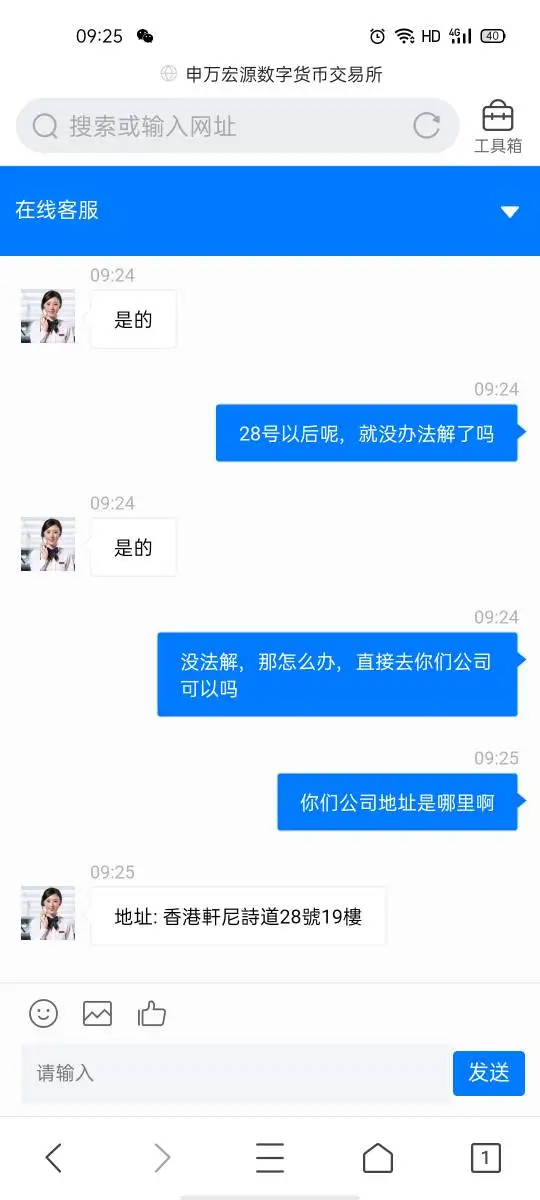

From my experience and research as a long-time trader reviewing Shenwan Hongyuan, their withdrawal process is fairly standard but has some important specifics to consider. According to the official information, once a withdrawal request has been properly submitted and the required forms have been sent (typically via fax), instructions received before 12:00 PM are processed on the same business day. In practical terms, this means that if you submit your withdrawal request in the morning and the company receives all the necessary documentation—especially the completed withdrawal form—your withdrawal should be processed by the end of that working day.

It’s important to understand, however, that actual receipt of funds in your bank account depends on interbank transfer times and could take an additional day or more depending on your bank’s processing. For telegraphic transfers, service fees and possible international transit times might further extend the total time before funds fully clear in your account. The broker does not mention supporting e-wallet withdrawals; the accepted methods are primarily traditional banking channels, including bank transfer, cheque, and similar means.

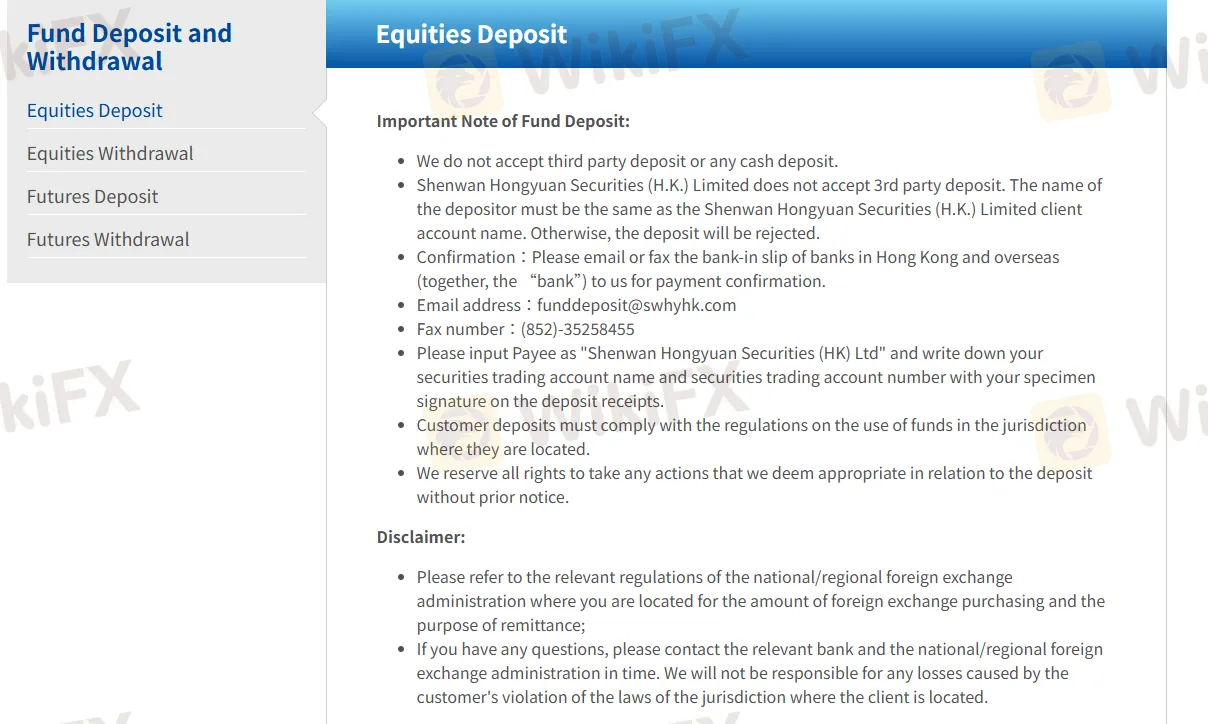

I always recommend that traders use their own bank accounts (as third-party deposits and cash are not accepted) and ensure the account name matches for compliance. In my view, while Shenwan Hongyuan appears transparent about their process, I remain cautious, especially in light of some user reports citing problems with withdrawals. Therefore, I would never assume instant processing or guaranteed timeframes—instead, I plan for at least 1–3 business days, and always confirm details with their customer service if speed is critical for my trading or funding needs.

Broker Issues

Withdrawal

Deposit

Tricia54

1-2年

Does Shenwan Hongyuan impose any fees when you deposit or withdraw funds?

Speaking from my own experience evaluating brokers, fee transparency is essential for both budget planning and risk management. With Shenwan Hongyuan, I spent time reviewing their official disclosures on funding procedures. For deposits, I did not come across any direct deposit fees imposed by Shenwan Hongyuan itself, whether via bank transfer, cheque, or cashier’s order—though, as with any brokerage, your bank might charge its own standard transfer fees. What's particularly important for me is that third-party and cash deposits aren’t accepted, reinforcing their compliance with local regulations.

When it comes to withdrawals, the process seems straightforward, but there is a cost consideration for telegraphic transfers; Shenwan Hongyuan specifically notes that service fees apply for these. The exact fees may vary depending on your bank and the method chosen, so I find it prudent to confirm these costs before executing larger or international withdrawals. In my view, the absence of hidden or excessive in-house funding fees appears to be a positive, but as always, I remain cautious and double-check fee schedules directly on their platform to avoid surprises. For me, a clear understanding of every cost involved is central before trusting any broker with my capital.

Broker Issues

Withdrawal

Deposit

Jezreel2

1-2年

Does Shenwan Hongyuan charge a commission per lot on their ECN or raw spread account types?

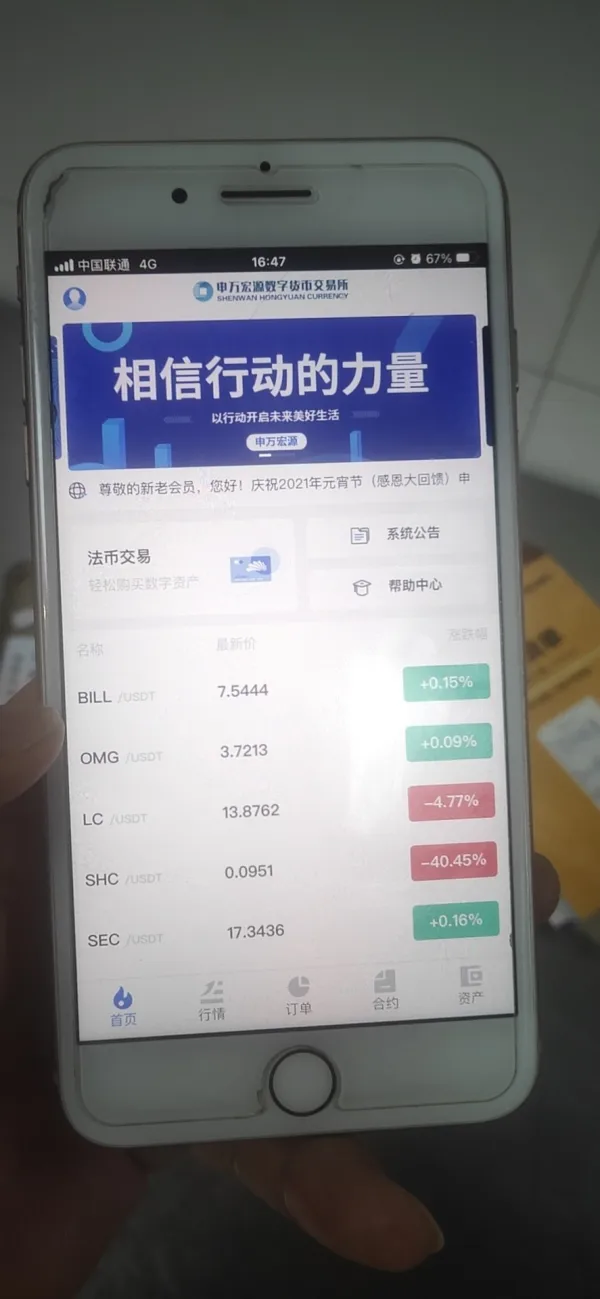

From my own experience and based on my research into Shenwan Hongyuan, it’s important to note that this broker is fundamentally different from typical forex providers offering ECN or raw spread accounts. Shenwan Hongyuan mainly facilitates equities and futures trading, not forex, and their published fee structure is tied directly to transactions in these markets rather than per-lot calculations found with ECN forex accounts.

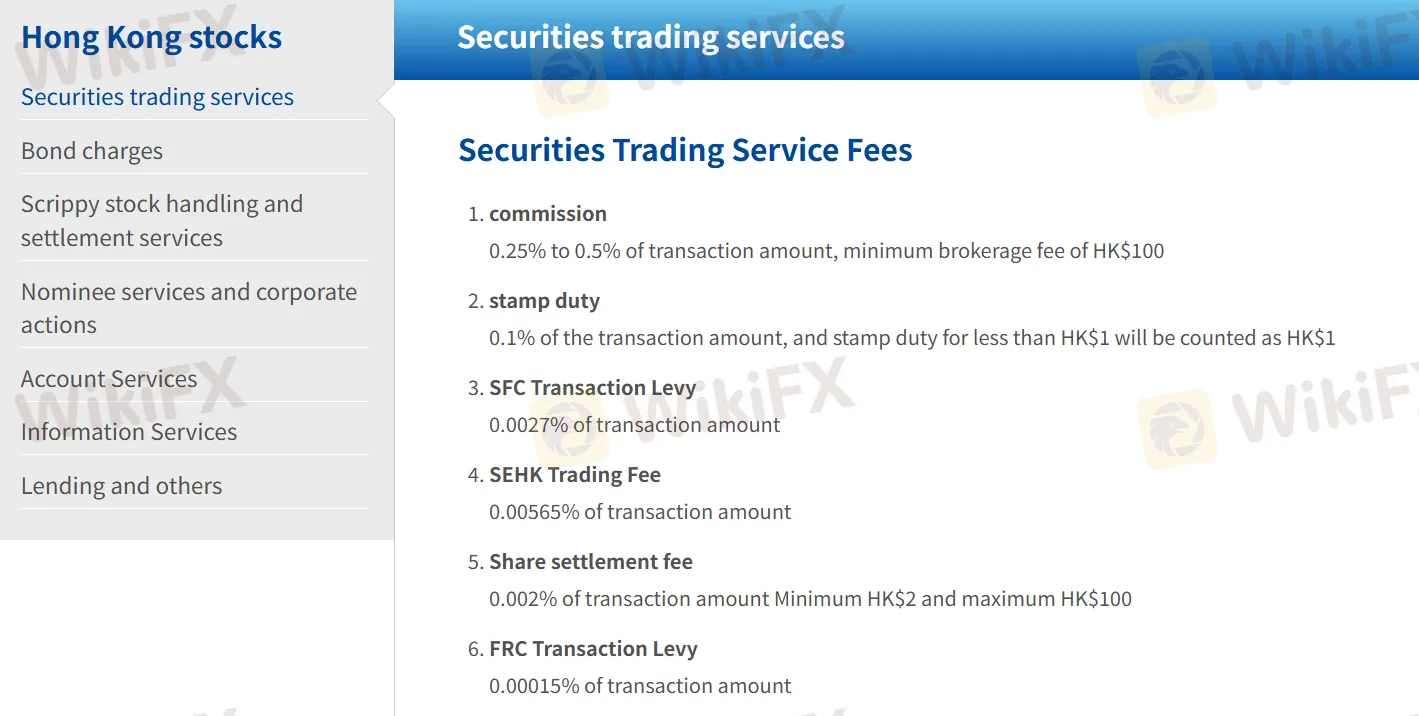

Their commission is charged as a percentage of the transaction amount—most notably, for equities the commission ranges from 0.25% to 0.5% with a minimum HK$100 brokerage fee per trade. There is no mention of per-lot commissions, which makes sense given that they don’t advertise standard forex accounts or platforms like MT4/MT5 with ECN or raw spread models. This fee approach is standard for Hong Kong-based securities brokers and reflects the structure of the equities and futures markets rather than spot forex.

For me, the absence of true ECN or “raw spread” account types means traders expecting a per-lot commission structure, as is common in forex trading, won’t find that here. Instead, all commissions are based on transaction values. I would urge anyone, especially those transitioning from forex to securities or futures, to carefully review their fee schedule and make sure it aligns with your trading expectations and style. Being regulated by the SFC for futures does provide some assurance, but the exceeded securities license is a red flag requiring extra caution before depositing substantial funds.

Broker Issues

Fees and Spreads

Sanford

1-2年

Is it possible to use Expert Advisors (EAs) for automated trading on Shenwan Hongyuan’s trading platforms?

Based on my direct review of Shenwan Hongyuan, I find that the broker relies on its own proprietary e-service trading platform, which is available for desktop, mobile, and web. From my experience as a trader, the compatibility with popular automated trading solutions—like MetaTrader’s Expert Advisors (EAs)—is a critical factor in evaluating a broker, especially for those who rely on algorithmic strategies. Shenwan Hongyuan does not offer the MetaTrader 4 or 5 platforms nor mention support for third-party automated trading tools or EAs on its proprietary system.

Why does this matter? Automated trading typically requires either built-in scripting capabilities or external bridge solutions. MetaTrader, for example, has a well-established infrastructure and global community supporting EAs; without such support, integrating automated systems with proprietary platforms can be complex, unreliable, or outright impossible. As a risk-conscious trader, I would exercise caution here—unless the broker specifically provides full documentation or support for algorithmic/automated trading, I do not assume compatibility.

For me, the absence of clear EA support means I would not consider Shenwan Hongyuan suitable for automated trading via EAs. This limitation might be a deal-breaker for traders like myself who depend on automation for consistency and scale. For manual futures or equities trading, the regulated status and long operating history offer some confidence, but in terms of automation, I require more transparency and compatibility before committing any capital.

Broker Issues

Leverage

Platform

Account

Instruments