基础信息

澳大利亚

澳大利亚天眼评分

澳大利亚

|

10-15年

|

澳大利亚

|

10-15年

| https://www.currencyfair.com/

官方网址

评分指数

影响力

A

影响力指数 NO.1

捷克 4.68

捷克 4.68 监管信息

监管信息持牌机构:CURRENCYFAIR AUSTRALIA PTY LTD

监管证号:000402709

单核

1G

40G

1M*ADSL

澳大利亚

澳大利亚 爱尔兰

爱尔兰 currencyfair.com

currencyfair.com 美国

美国 爱尔兰

爱尔兰

| CurrencyFair 评论摘要 | |

| 成立时间 | 2008 |

| 注册国家/地区 | 澳大利亚 |

| 监管机构 | ASIC |

| 服务 | 汇款 |

| 平台 | 移动应用 |

| 客户支持 | 联系表单 |

| 爱尔兰:Colm House, 91 Pembroke Road, Ballsbridge, Dublin 4;+353 (0) 1 526 8411(周一至周五上午9点至下午5点,都柏林/伦敦时间) | |

| 英国:No. 1 Poultry, London ECR2 8EJ;+44 (0) 203 3089353(周一至周五上午9点至下午5点) | |

| 新加坡:15 Beach Road, 2nd Floor, Singapore 189677;+65 (0) 3165 0282(周一至周六下午5点至凌晨1点) | |

| 香港:Office 12100, 12/F, YF Tower, 33 Lockhart Road, Wan Chai, Hong Kong;+852 5803 2611(周一至周六下午5点至凌晨1点) | |

| 澳大利亚:Suite 26-109, 161 Castlereagh Street Sydney, NSW, 2000;+61 (0) 282 798 642(周一至周六晚上8点至凌晨4点) | |

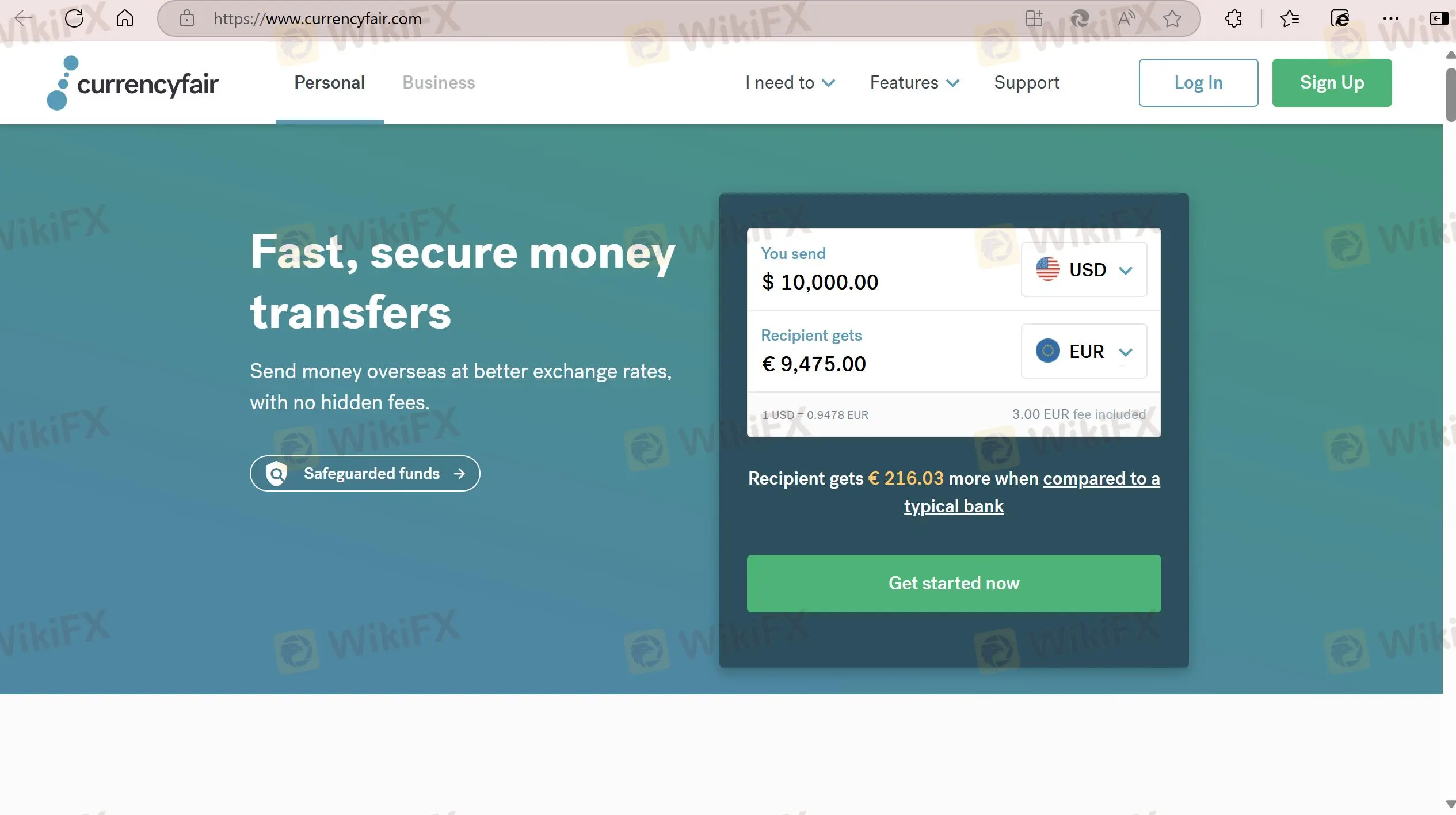

CurrencyFair于2008年在澳大利亚注册。在其平台上,客户可以向海外汇款。此外,该公司运营时间长,并在澳大利亚受到监管。

| 优点 | 缺点 |

| 运营时间长 | 无在线聊天支持 |

| 监管良好 | |

| 透明的费用结构 |

是的,CurrencyFair受澳大利亚证券和投资委员会(ASIC)监管。

| 监管国家 | 监管机构 | 当前状态 | 监管国家 | 许可证类型 | 许可证号码 |

| 澳大利亚证券和投资委员会(ASIC) | 监管 | 澳大利亚 | 做市商(MM) | 402709 |

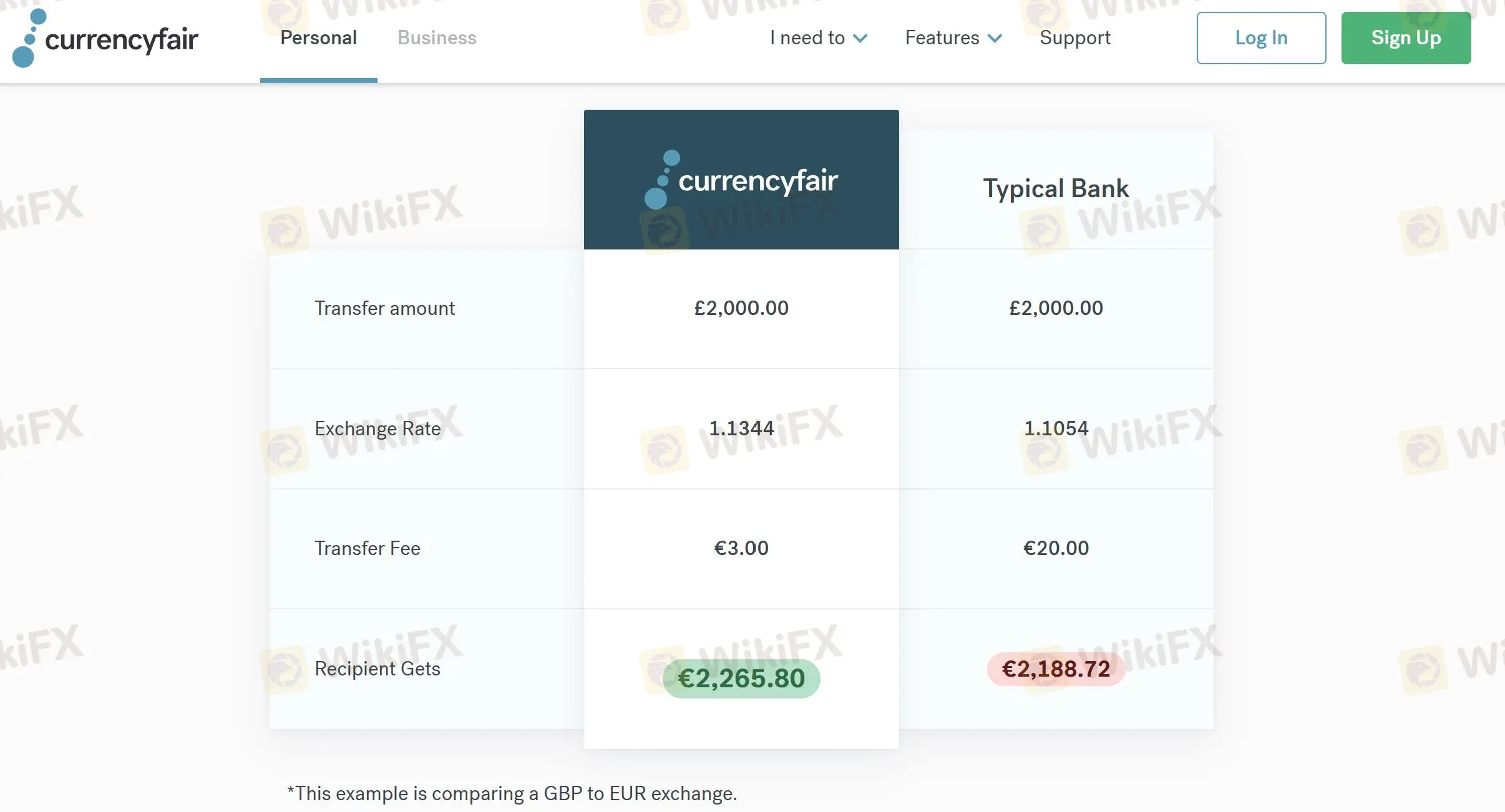

| 转账金额 | 汇率 | 转账费用 | 收款方获得 |

| 2,000.00 GBP | 1.1344 | 3.00 EUR | 2,265.80 EUR |

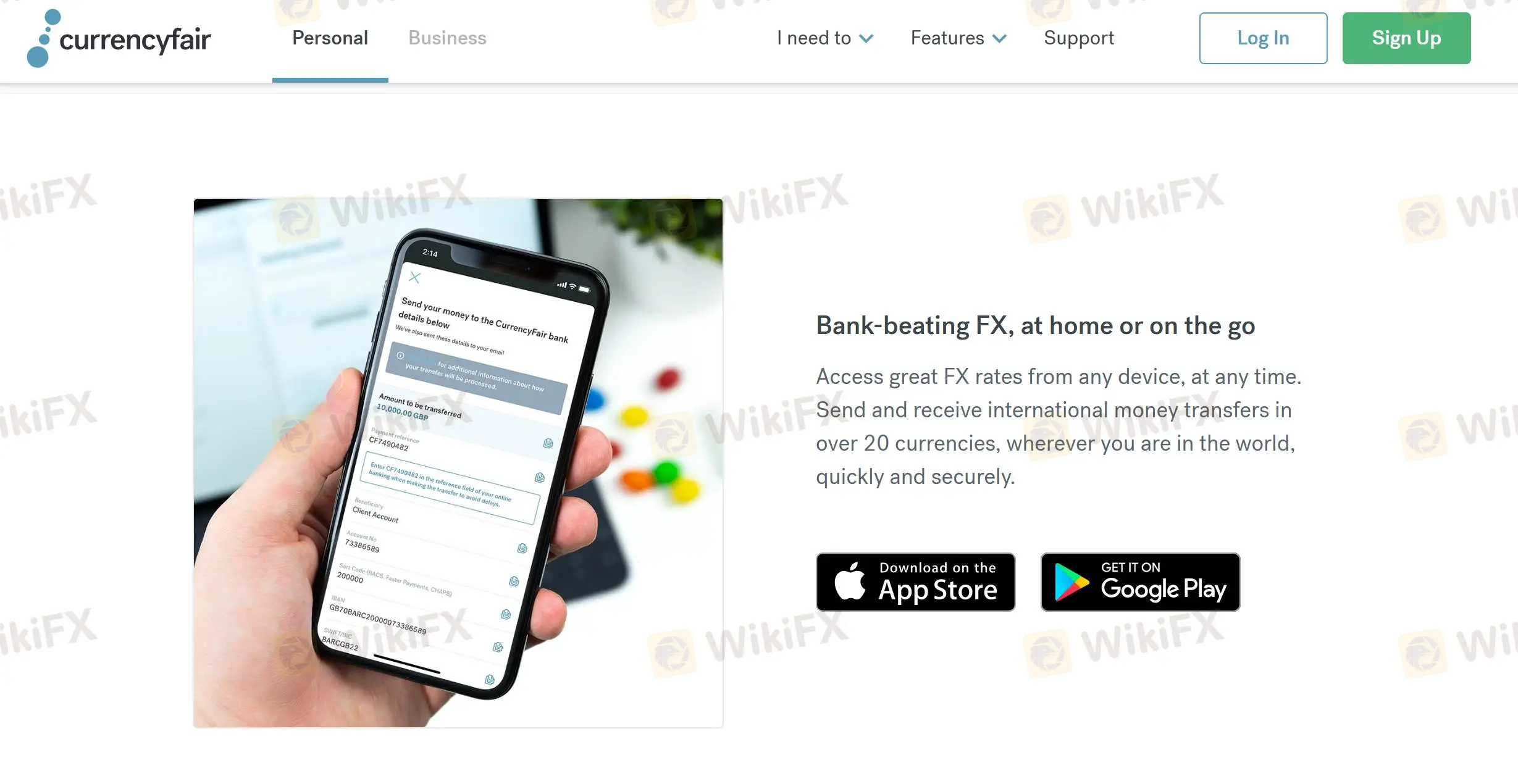

| 平台 | 支持 | 可用设备 |

| 移动应用程序 | ✔ | iOS, Android |

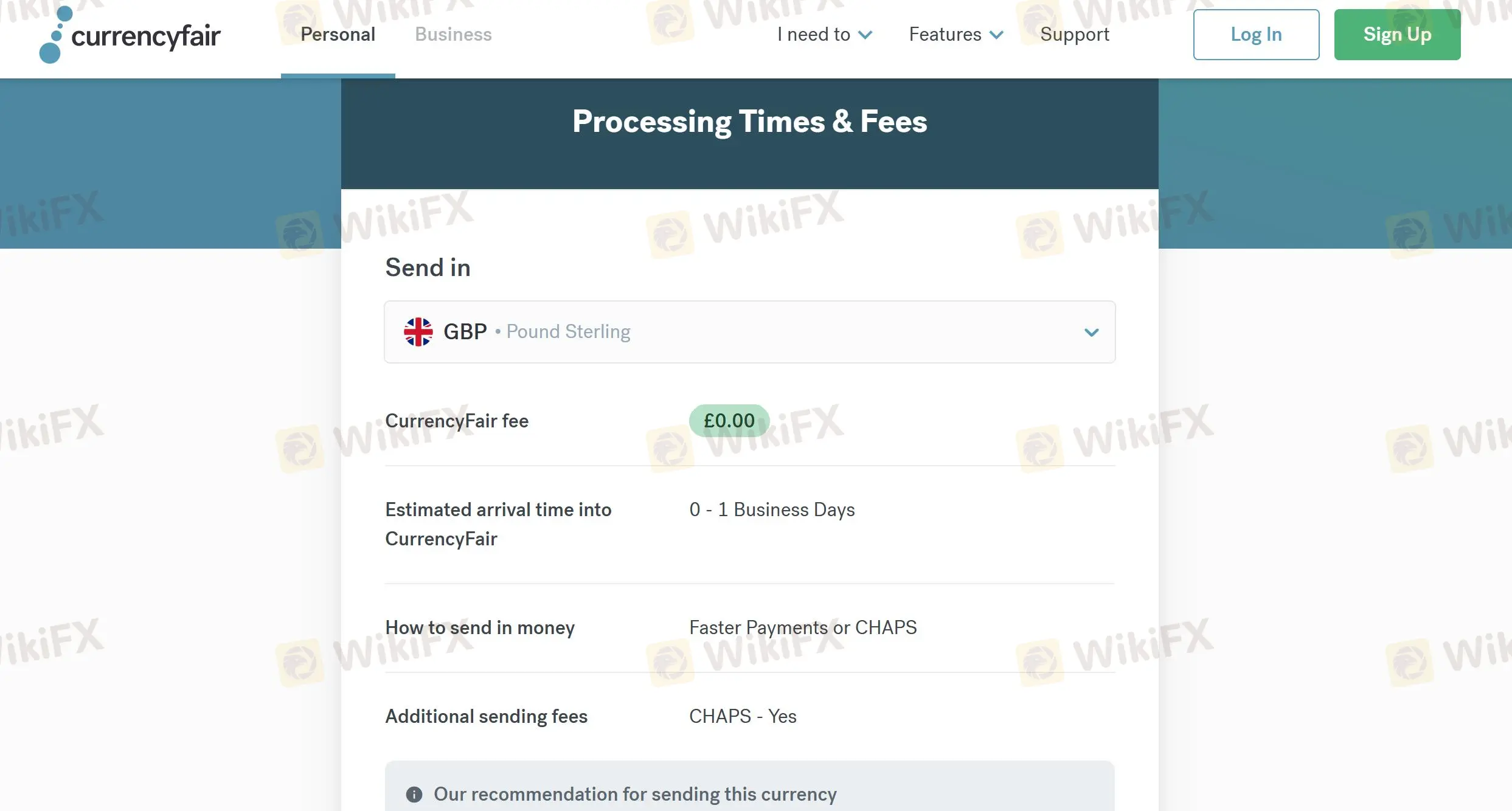

| 发送 | 费用 | 选项 | 时间 |

| GBP | ❌ | 更快的支付或CHAPS | 0-1个工作日 |

| EUR | ❌ | SEPA信用转账 | 1-2个工作日 |

| USD | ❌ | 银行转账 | 1-2个工作日 |

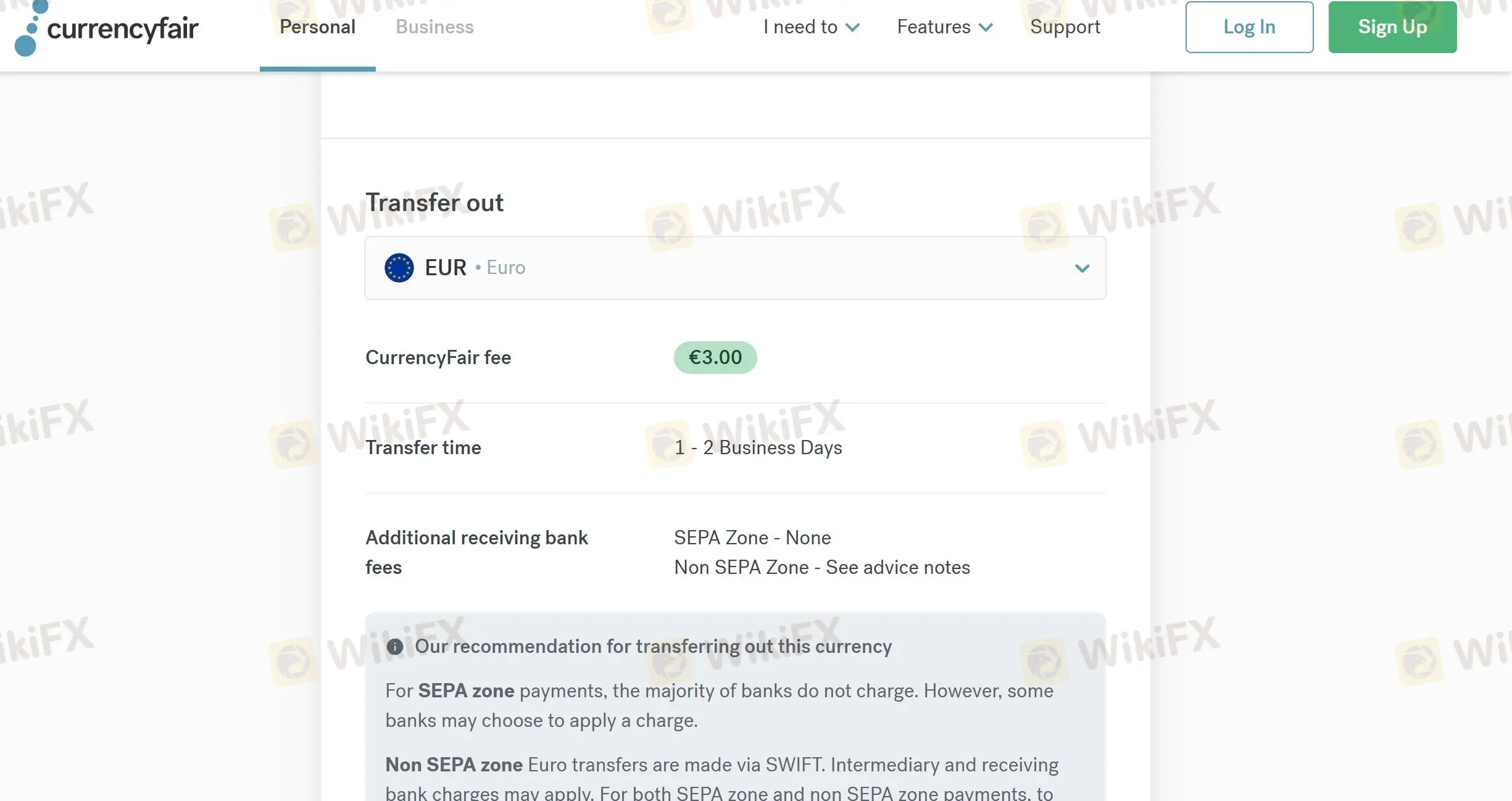

| 转出 | 费用 | 时间 |

| EUR | 3.00 EUR | 1至2个工作日 |

| GBP | 2.5 GBP | 0至1个工作日 |

| USD | 4.00 USD | 1个工作日 |

Drawing on my experience trading with various brokers, I approached CurrencyFair with an open mind, particularly interested in its potential for asset trading. However, after a thorough examination, I must clarify that CurrencyFair is primarily a money transfer service, not a forex or commodities trading broker in the sense that many traders might expect. While the platform is regulated by ASIC in Australia and has a relatively long track record, its core business is facilitating cross-border money transfers with competitive exchange rates and transparent fees. From what I’ve observed, there is no support for trading instruments like Gold (XAU/USD), Crude Oil, or other financial derivatives typically associated with trading platforms. CurrencyFair’s offerings center on exchanging one currency for another and transferring funds, usually within one to two business days, depending on the currencies involved. While this can certainly be useful for managing funds internationally, it is essential to recognize that CurrencyFair does not provide access to trading in commodities, CFDs, or forex pairs beyond standard money exchange. For me, as someone who often seeks exposure to gold or oil markets, I would need to turn to more specialized brokers that explicitly offer those trading options, as CurrencyFair’s services are not designed for speculative trading. In summary, if your goal is to trade assets like Gold or Crude Oil, CurrencyFair would not be suitable based on its stated services and features.

Based on my careful review of the available details about CurrencyFair, I have not found any explicit information regarding inactivity fees or the specific circumstances under which such fees might apply. As an experienced forex trader, I pay particular attention to these fees, as they can materially affect the long-term cost of holding an account, especially if I am not transacting frequently. In my due diligence process, I look for clear disclosures about all potential charges, including inactivity fees, since unexpected deductions can erode one's profits or even result in unwanted account closures. In the context of CurrencyFair, the information primarily emphasizes their regulated status under ASIC in Australia, their main business of overseas money transfers, and their transparent fee structure related to transfers themselves. The focus is on transfer fees, exchange rates, and processing times rather than any inactivity or dormancy charges. If such fees exist, they are not prominently communicated in the available materials, which, in my experience, reflects either their absence or a lack of transparency that should always be approached with caution. My practice in such situations is to reach out directly to a broker’s customer support for official clarification before funding an account or leaving an account dormant. Based on what I can see, there is no concrete evidence of inactivity fees at CurrencyFair, but I always advise verifying this directly, given the YMYL (Your Money or Your Life) implications for any trader’s finances.

Drawing from my own experience and careful research, I can say that CurrencyFair is fundamentally different from traditional forex brokers—it operates as a money transfer platform rather than a direct forex trading venue. Through their model, what matters most is the exchange rate offered when transferring currency. From all available details, CurrencyFair does not explicitly advertise fixed or variable spreads as brokers do; instead, their rates reflect the live market and their own marketplace dynamics. I’ve found that the transparency of their fees is a positive, but as someone who actively manages risk, I recognize the importance of understanding what can influence your final conversion rate. In periods of significant market volatility, like during major news releases, I would expect CurrencyFair’s offered rates (and therefore the effective “spread”) to widen in line with broader market liquidity conditions. This is consistent with how most platforms manage risk during unpredictable swings—it’s not guaranteed, but rates can become less favorable if volatility spikes. Ultimately, while CurrencyFair’s structure is suited for cost-conscious global money transfers, it may not provide the tight, predictable spreads that professional traders look for during volatile windows. For me, I always advise checking live rates before confirming any transaction, especially during high-impact events, as rapid market changes can impact your final deal.

From my own trading and money transfer experience, I have learned to pay close attention to all costs—fees and spreads can easily erode profits or increase the true cost of international transfers. With CurrencyFair, the transparency of their fee structure stands out to me. For international transfers, they charge a fixed commission: for instance, sending GBP, EUR, or USD typically incurs a fee of about 2.5 GBP, 3 EUR, or 4 USD depending on the currency. This flat-fee model is relatively straightforward, which makes it easier for me to anticipate direct costs before moving funds. However, in my view, a truly comprehensive fee assessment must address exchange rates as well. CurrencyFair presents rates that are generally more competitive than traditional banks; this is echoed by other users who report saving money on conversions. Still, it's important to remember that CurrencyFair acts as a market maker, so there is always a spread (the difference between their buy and sell rates and the actual market rate). The size of this spread can vary by currency pair and market conditions, so even though their base commission is clear, the overall cost is not always just the upfront fee. The lack of hidden fees is certainly a positive, but I remain mindful that both the fixed commission and the embedded spread together compose the true, all-in cost of each transfer. As with any broker or transfer service, I always compare the quoted rate—including both the spread and the fee—against mid-market rates to ensure I'm making informed decisions and not underestimating potential expenses.

请输入...

FX1240839140

新西兰

往海外汇款的时候,银行手续费真的很高!幸运的是,我有 currencyfair,这使我能够快速进行转帐并节省资金。我知道安全是很多人关心的问题,但 currencyfair 是安全的!

好评

程安 -陶

阿根廷

到目前为止,我认为currencyfair是一家很棒的公司,这让我的工作轻松了很多,因为我经常需要进行跨境转账!

好评

ONE I LOVE

香港

他们的客户支持非常好,而且这个平台易于使用。我使用这项服务已经一年多了,我没有遇到任何问题。如果您需要此类服务,我推荐这家公司。

中评

你好99363

香港

CurrencyFair 确实提供比银行更好的有竞争力的利率。我记得有一次我用这家公司把我的钱从美国汇到澳大利亚,但是很糟糕的事情发生了,原来是CurrencyFair的中介银行搞错了。虽然这家公司号称大部分的国际转账都是24小时内完成的,但是这要看你的运气,你看?

中评