회사 소개

| CurrencyFair 리뷰 요약 | |

| 설립 | 2008 |

| 등록 국가/지역 | 호주 |

| 규제 | ASIC |

| 서비스 | 자금 이체 |

| 플랫폼 | 모바일 앱 |

| 고객 지원 | 문의 양식 |

| 아일랜드: Colm House, 91 Pembroke Road, Ballsbridge, Dublin 4; +353 (0) 1 526 8411 (9am - 5pm Dublin/London time Monday - Friday) | |

| 영국: No. 1 Poultry, London ECR2 8EJ; +44 (0) 203 3089353 (9 AM-5 PM Monday-Friday) | |

| 싱가포르: 15 Beach Road, 2nd Floor, Singapore 189677; +65 (0) 3165 0282 (5 PM - 1 AM Monday–Saturday) | |

| 홍콩: Office 12100, 12/F, YF Tower, 33 Lockhart Road, Wan Chai, Hong Kong; +852 5803 2611 (5pm - 1am Monday - Saturday) | |

| 호주: Suite 26-109, 161 Castlereagh Street Sydney, NSW, 2000; +61 (0) 282 798 642 (8 PM - 4 AM Monday-Saturday) | |

CurrencyFair은 2008년에 호주에서 등록되었습니다. 이 플랫폼에서 고객은 해외로 자금을 송금할 수 있습니다. 또한 이 회사는 오랜 운영 기간을 가지고 있으며 호주에서 규제를 받고 있습니다.

장점과 단점

| 장점 | 단점 |

| 오랜 운영 기간 | 라이브 채팅 지원 없음 |

| 잘 규제됨 | |

| 투명한 수수료 구조 |

CurrencyFair이 신뢰할 만한가요?

네, CurrencyFair은 호주증권투자위원회(ASIC)에 의해 규제되고 있습니다.

| 규제 국가 | 규제 기관 | 현재 상태 | 규제 국가 | 라이선스 유형 | 라이선스 번호 |

| 호주증권투자위원회(ASIC) | 규제됨 | 호주 | 마켓 메이킹 (MM) | 402709 |

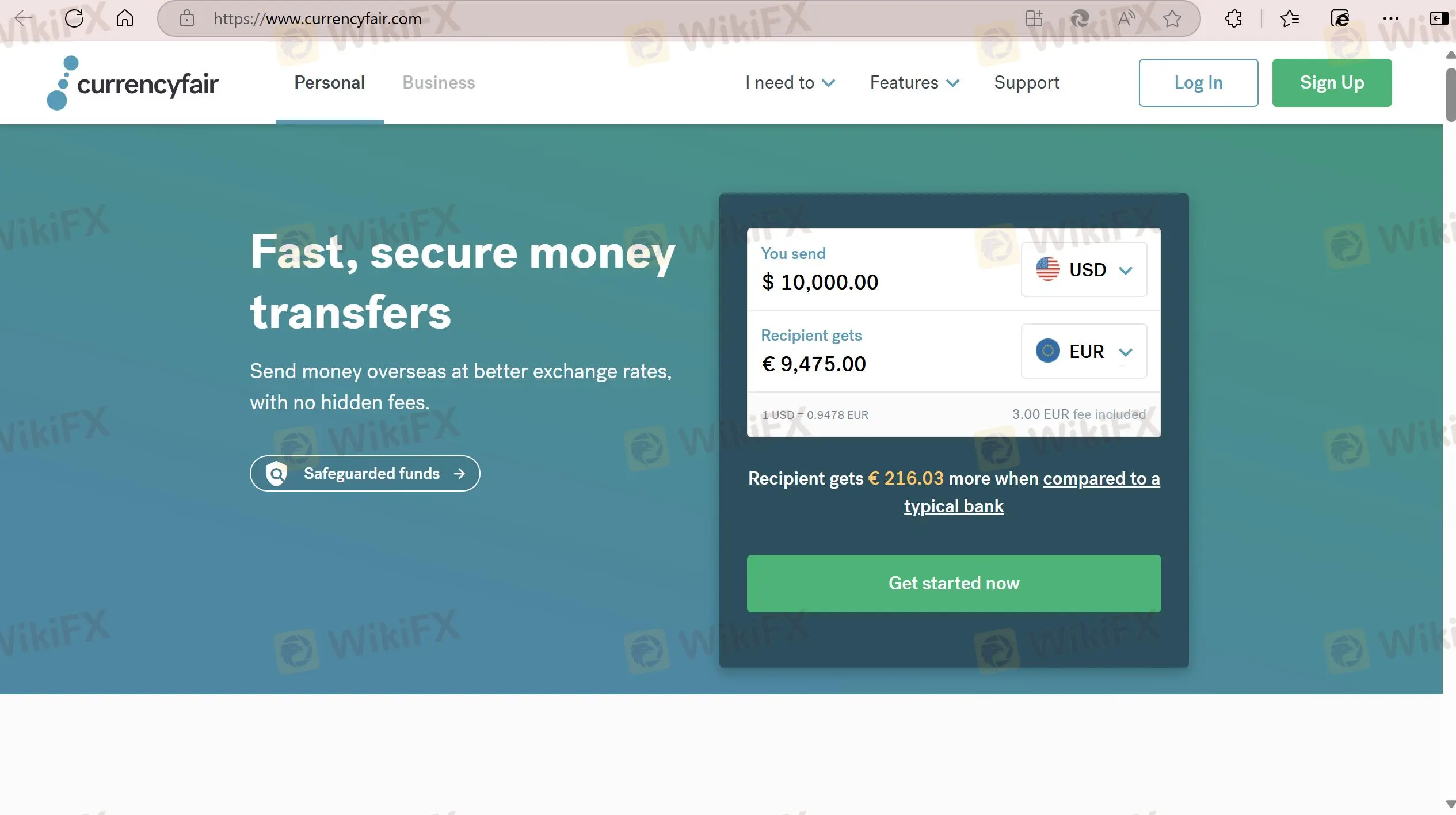

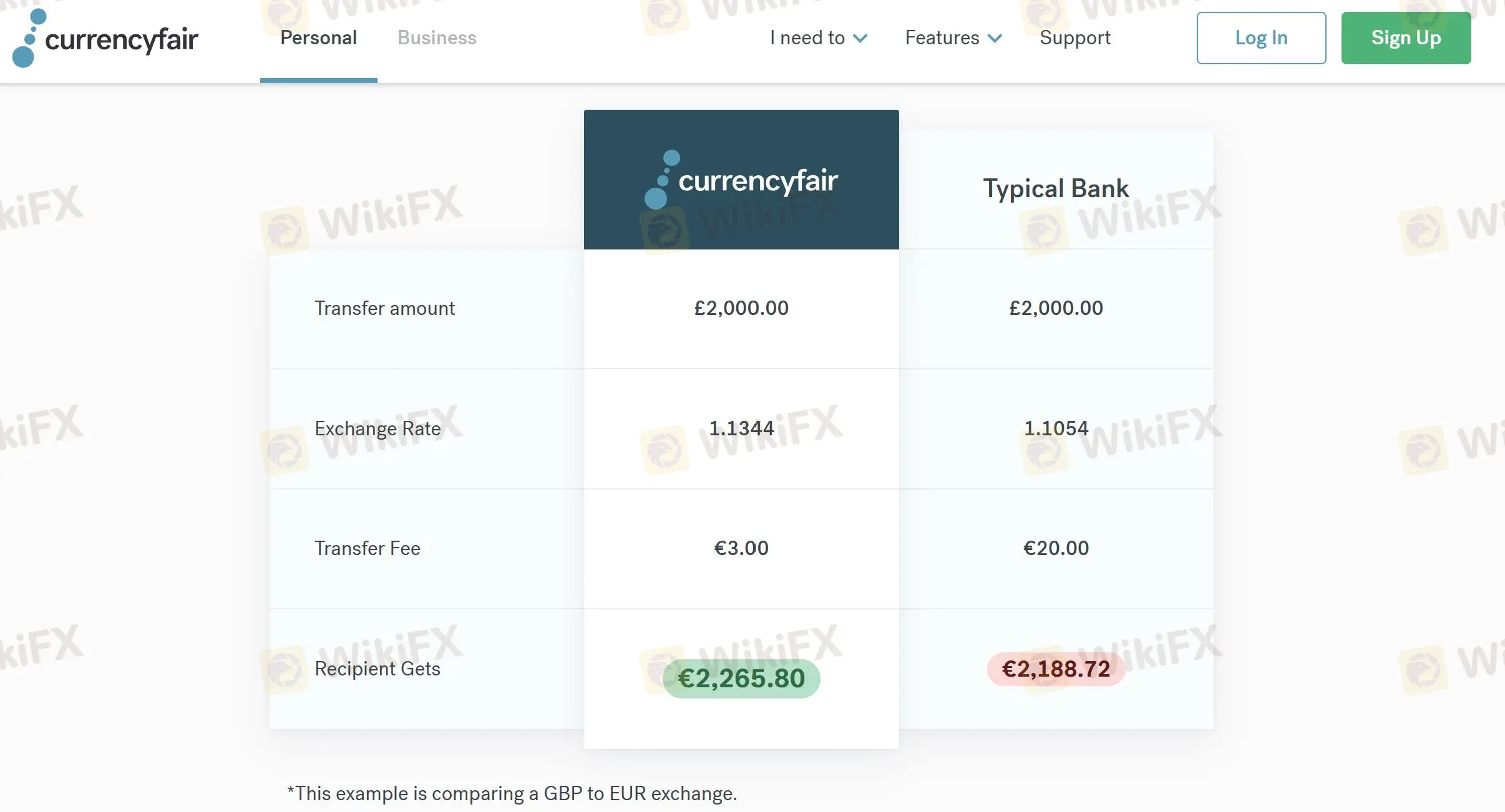

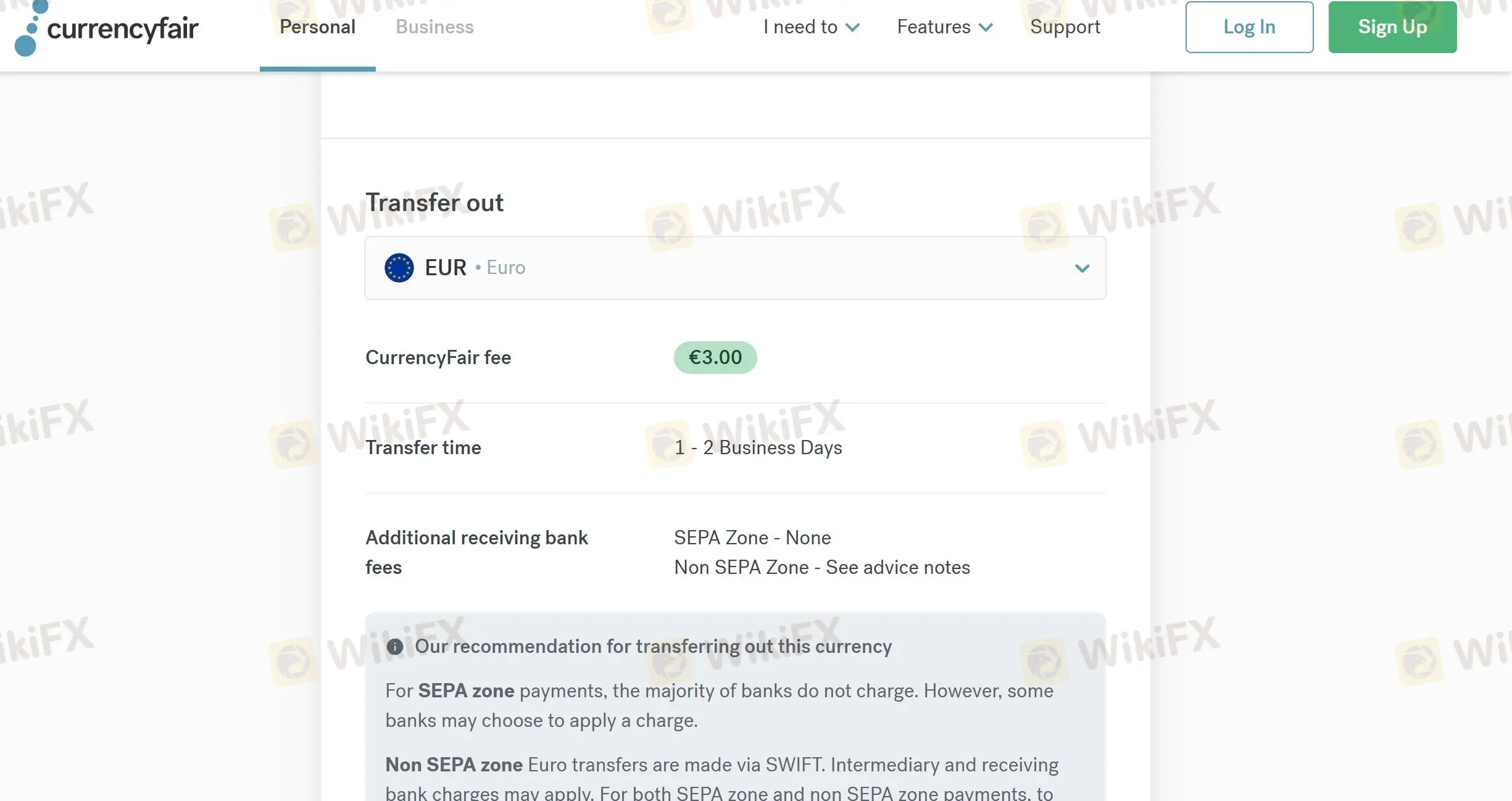

CurrencyFair 수수료

| 송금 금액 | 환율 | 송금 수수료 | 수취인이 받는 금액 |

| 2,000.00 GBP | 1.1344 | 3.00 EUR | 2,265.80 EUR |

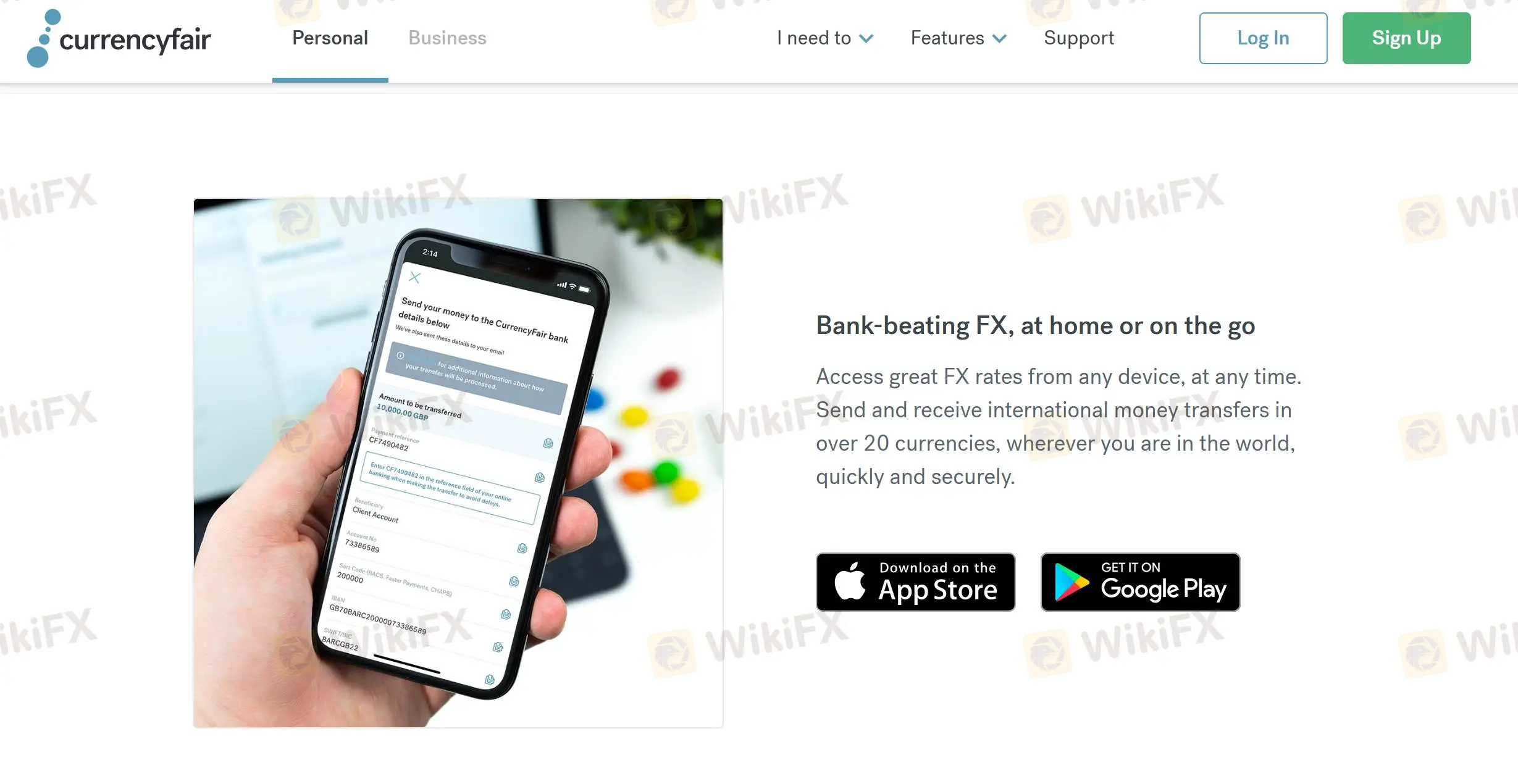

플랫폼

| 플랫폼 | 지원 | 사용 가능한 기기 |

| 모바일 앱 | ✔ | iOS, 안드로이드 |

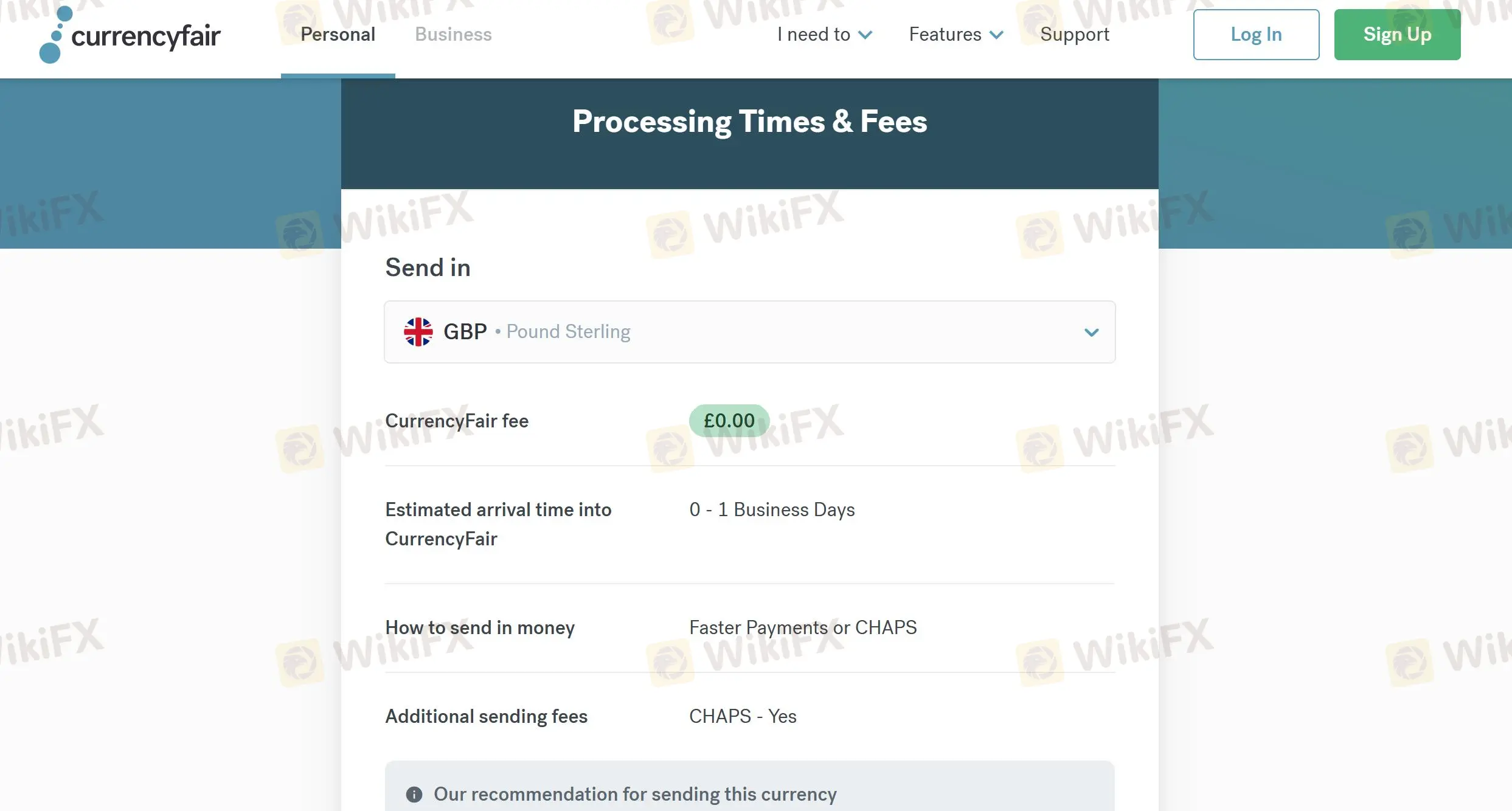

처리 시간 및 수수료

| 송금 | 수수료 | 옵션 | 시간 |

| GBP | ❌ | 빠른 지불 또는 CHAPS | 0-1 영업일 |

| EUR | ❌ | SEPA 신용 이체 | 1-2 영업일 |

| USD | ❌ | 은행 송금 | 1-2 영업일 |

| 송금 | 수수료 | 시간 |

| EUR | 3.00 EUR | 1~2 영업일 |

| GBP | 2.5 GBP | 0~1 영업일 |

| USD | 4.00 USD | 1 영업일 |

FX1240839140

뉴질랜드

해외로 송금할 때 은행 수수료가 정말 비싸요! 다행스럽게도 통화 박람회가 있어 신속하게 송금하고 돈을 절약할 수 있습니다. 보안이 많은 사람들의 관심사라는 것을 알지만 통화 박람회는 안전합니다!

좋은 평가

程安 -陶

아르헨티나

지금까지 저는 currencyfair가 훌륭한 회사라고 생각합니다. 국경 간 송금을 자주 해야 하기 때문에 업무가 훨씬 쉬워집니다!

좋은 평가

ONE I LOVE

홍콩

그들의 고객 지원은 훌륭하고 이 플랫폼은 사용하기 쉽습니다. 저는 이 서비스를 1년 이상 사용해 왔으며 문제나 문제가 발생하지 않았습니다. 이런 종류의 서비스가 필요하다면 이 회사를 추천합니다.

중간 평가

你好99363

홍콩

CurrencyFair는 은행보다 경쟁력 있는 금리를 제공합니다. 미국에서 호주로 돈을 보내기 위해 이 회사를 이용했던 기억이 납니다. 그런데 끔찍한 일이 벌어졌고, 알고 보니 CurrencyFair의 중개 은행이 실수를 한 것이었습니다. 이 회사는 대부분의 국제 전송이 24시간 이내에 완료된다고 주장하지만 운에 따라 달라집니다.

중간 평가