公司简介

| 國家銀行財富管理 评论摘要 | |

| 成立时间 | 1902年 |

| 注册国家/地区 | 加拿大 |

| 监管机构 | 加拿大投资监管组织(CIRO) |

| 产品和服务 | 财富管理、投资组合管理、税务规划、遗产规划、银行解决方案 |

| 模拟账户 | ❌ |

| 交易平台 | 國家銀行財富管理WM在线平台,NBC财富应用 |

| 客户支持 | 电话:1-800-361-9522 |

國家銀行財富管理 信息

National Bank Financial(國家銀行財富管理)成立于1902年,是一家由CIRO管理的加拿大金融公司。尽管它不提供传统的外汇或加密货币等零售交易工具,但专注于银行解决方案、财务规划、财富和投资组合管理。

优点和缺点

| 优点 | 缺点 |

| 强大的监管监督(CIRO) | 无法访问外汇、差价合约、加密货币交易 |

| 全面的财富管理服务 | 相对于行业标准较高的综合费用 |

| 强大的移动和在线平台 | 没有模拟账户 |

國家銀行財富管理 是否合法?

National Bank Financial Inc.(國家銀行財富管理)是一家经加拿大投资监管组织(CIRO)授权的金融机构,持有做市商(MM)许可证。尽管具体的许可证号码是保密的,國家銀行財富管理保持受控状态,并按照加拿大金融规定运营。

产品和服务

國家銀行財富管理(National Bank Financial)主要提供全面的财富管理和财务咨询服务,包括投资组合管理、遗产规划、税务策略和银行解决方案。

| 产品和服务 | 支持 |

| 财富管理 | ✅ |

| 投资组合管理 | ✅ |

| 财务规划 | ✅ |

| 税务规划 | ✅ |

| 遗产规划 | ✅ |

| 银行解决方案 | ✅ |

| 离任管理 | ✅ |

| 外汇、差价合约、股票、加密货币、大宗商品 | ❌ |

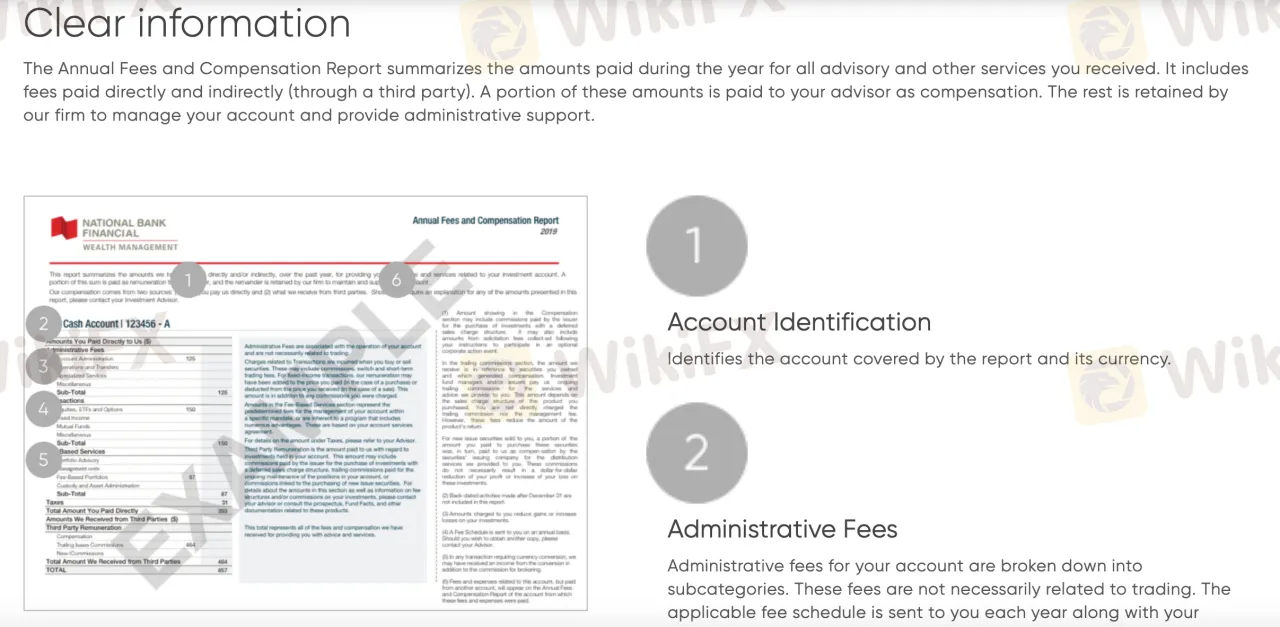

國家銀行財富管理 费用

特别是对于咨询和投资组合管理服务,國家銀行財富管理(National Bank Financial)的收费结构通常高于行业标准。虽然不公开具体的可交易项目的点差,但他们的方法将咨询和行政手续费置于交易费用之上。

交易平台

| 交易平台 | 支持 | 可用设备 | 适合何种交易者 |

| 國家銀行財富管理WM在线平台 | ✔ | Web浏览器(PC/Mac) | 希望通过详细洞察力管理和查看投资组合的客户 |

| NBC财富应用 | ✔ | iOS、Android移动设备 | 需要随时随地访问其投资的移动用户 |

| MetaTrader 4 / MT5 | ❌ | – | 不支持 |

| TradingView | ❌ | – | 不支持 |