Company Summary

| NBF Review Summary | |

| Founded | 1902 |

| Registered Country/Region | Canada |

| Regulation | Canadian Investment Regulatory Organization (CIRO) |

| Products and Services | Wealth management, portfolio management, tax planning, estate planning, banking solutions |

| Demo Account | ❌ |

| Trading Platform | NBFWM Online Platform, NBC Wealth App |

| Customer Support | Phone: 1-800-361-9522 |

NBF Information

Established in 1902, National Bank Financial (NBF) is a Canadian financial company run by CIRO. Though it doesn't provide conventional retail trading tools like forex or crypto, it focuses on banking solutions, financial planning, and wealth and portfolio management.

Pros and Cons

| Pros | Cons |

| Strong regulatory oversight (CIRO) | Not access to forex, CFD, crypto trading |

| Comprehensive wealth management services | Higher overall fees compared to industry standards |

| Robust mobile and online platforms | No demo account |

Is NBF Legit?

Authorized by the Canadian Investment Regulatory Organization (CIRO) under a Market Maker (MM) license, National Bank Financial Inc. (NBF) is a recognized and regulated financial body. Though the particular license number is confidential, NBF keeps a controlled status and runs according to Canadian financial rules.

Products and Services

NBF (National Bank Financial) mainly provides comprehensive wealth management and financial advisory services, including portfolio management, estate planning, tax strategies, and banking solutions.

| Products and Services | Supported |

| Wealth Management | ✅ |

| Portfolio Management | ✅ |

| Financial Planning | ✅ |

| Tax Planning | ✅ |

| Estate Planning | ✅ |

| Banking Solutions | ✅ |

| Discretionary Management | ✅ |

| Forex, CFDs, Stocks, Crypto, Commodities | ❌ |

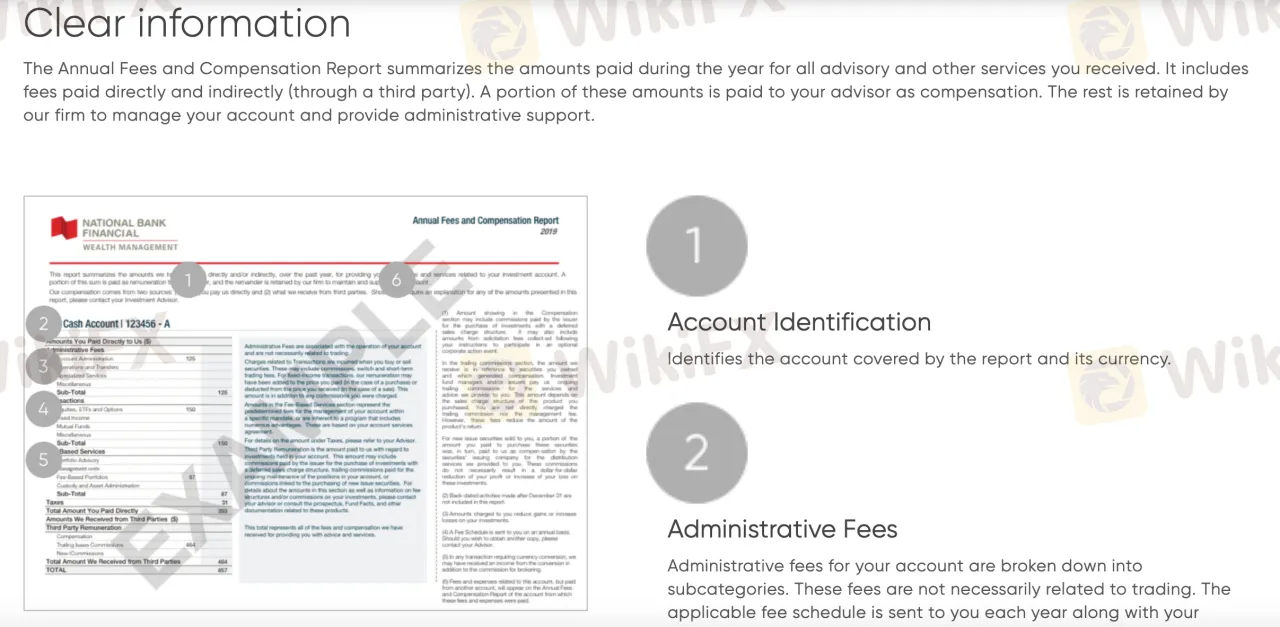

NBF Fees

Especially for advising and portfolio management services, NBF's (National Bank Financial) charge structure is usually greater than the industry norm. Although specific spreads for individual tradable items are not made public, their approach prioritizes advising and administrative fees above trading expenses.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for What Kind of Traders |

| NBFWM Online Platform | ✔ | Web browsers (PC/Mac) | Clients who want to manage and view portfolios with detailed insights |

| NBC Wealth App | ✔ | iOS, Android mobile devices | Mobile users who need on-the-go access to their investments |

| MetaTrader 4 / MT5 | ❌ | – | Not supported |

| TradingView | ❌ | – | Not supported |