x1250

1-2年

Is PhillipCapital safe and legit for trading?

PhillipCapital is a legitimate financial institution with over 40,000 financial products and US$35+ billion in assets under management. However, its lack of regulation by the Monetary Authority of Singapore (MAS) or any other regulatory body makes it less safe for individual traders compared to regulated brokers. The firm has a long operational history and offers a wide range of products, including forex, CFDs, and securities, but the absence of regulatory oversight means that there is no guarantee of customer protection. As someone who values the security of my funds, I would be cautious about logging into my PhillipCapital login without regulatory assurance. Regulation provides a safety net for investors, ensuring that brokers follow strict rules to protect clients. Since PhillipCapital operates without such regulation, there is an inherent risk. For anyone looking to trade or invest, the lack of regulatory protection should not be ignored. While PhillipCapital may appear reputable due to its long-standing presence, the lack of oversight is a key factor to consider before deciding to engage with them.

Nali5689

1-2年

What are the cons of using PhillipCapital?

The primary downside of using PhillipCapital is its lack of regulation. Although the firm has been operational since 1975 and offers a broad spectrum of financial products, the absence of regulatory oversight raises concerns about the safety of funds and investor protection. Without regulation, clients may not have the same recourse options in case of disputes or issues related to their trades or investments. For individual traders, it’s crucial to have regulatory oversight to ensure that your funds are safe and that there is recourse in case of disputes. Moreover, the firm does not provide sufficient transparency regarding fees, which could lead to hidden charges or unexpected costs for traders. These factors make it harder to trust PhillipCapital entirely. If you plan to log in to PhillipCapital login, I would recommend exercising caution and thoroughly researching their fee structure before committing.

Prash_007

1-2年

Does PhillipCapital offer a demo account?

There is no information provided about the availability of demo accounts at PhillipCapital. Demo accounts are essential for beginners and experienced traders alike, as they provide a risk-free environment to practice strategies and familiarize oneself with a platform before committing real funds. Without a demo account, PhillipCapital makes it harder for potential traders to try out their services without financial risk. This is particularly concerning for anyone looking to log into their PhillipCapital login and trade with a new broker. For me, the absence of a demo account would be a major deterrent as it prevents traders from testing out strategies or the platform itself without risking money. Without this crucial feature, I would be more hesitant to start trading on their platform, as I value the ability to practice and gain confidence before making any financial commitments.

Broker Issues

Account

Platform

Leverage

Instruments

Vahid

1-2年

Is PhillipCapital regulated?

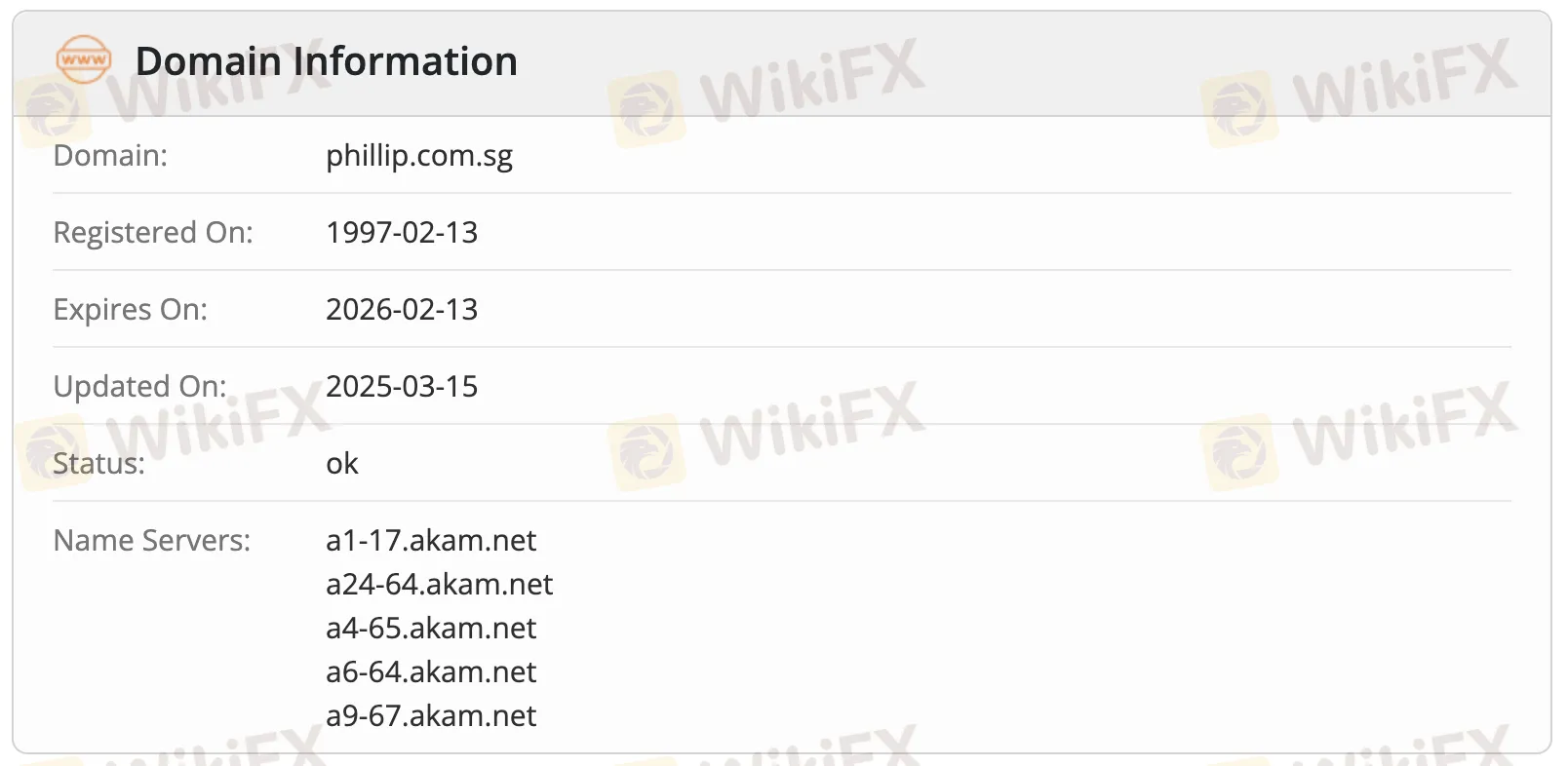

PhillipCapital, founded in 1975, is registered in Singapore but is not regulated by the Monetary Authority of Singapore (MAS) as a broker. The firm offers a broad range of financial services, including securities, forex, CFDs, funds, and private equities, but operates without the oversight of any major regulatory authority. The lack of regulation is a significant concern for anyone considering trading or investing with PhillipCapital. Regulatory bodies such as the MAS enforce rules that protect investors, ensure transparency, and help maintain the integrity of the financial markets. Without this oversight, there are no guarantees regarding the safety of your funds or fair trading practices. For traders, this means that the absence of proper regulation could lead to higher risks, including the potential for fraud or market manipulation. Additionally, the company’s unregulated status may make it more difficult to resolve disputes or claim compensation if anything goes wrong. If you're considering logging into your PhillipCapital login to manage your funds or make investments, keep in mind that the lack of regulatory protection makes it harder to feel secure about your trades and investments.