회사 소개

| PhillipCapital 리뷰 요약 | |

| 설립 연도 | 1975 |

| 등록 국가 | 싱가포르 |

| 규제 | 규제 없음 |

| 시장 상품 | 증권, 외환, CFD, 펀드, 사모펀드, 보험 |

| 거래 플랫폼 | / |

| 고객 지원 | 전화: +65 6531 1555 |

| 이메일: talktophillip@phillip.com.sg | |

| 주소: 250 North Bridge Road, #06-00 Raffles City Tower, Singapore 179101 | |

PhillipCapital 정보

1975년에 설립된 PhillipCapital은 싱가포르에 본사를 두고 있습니다. 자산 범주 전반에 걸쳐 다양한 금융 서비스를 제공하지만 MAS는 중개업자로서 그를 통제하지 않습니다. 기업 금융부터 증권 중개까지 활동을 다루며, 회사는 4만개 이상의 금융 상품과 350억 달러 이상의 AUM을 운영한다고 합니다.

장단점

| 장점 | 단점 |

| 다양한 거래 상품 | 규제 없음 |

| 긴 운영 역사 | 수수료에 대한 제한된 정보 |

| 대규모 AUM(350억 달러 이상) 및 광범위한 시장 커버리지 |

PhillipCapital 합법적인가요?

싱가포르에 등록되어 있지만, Phillip은 싱가포르 통화 금융 규제청(MAS)에 의해 중개업자로 규제되지 않습니다.

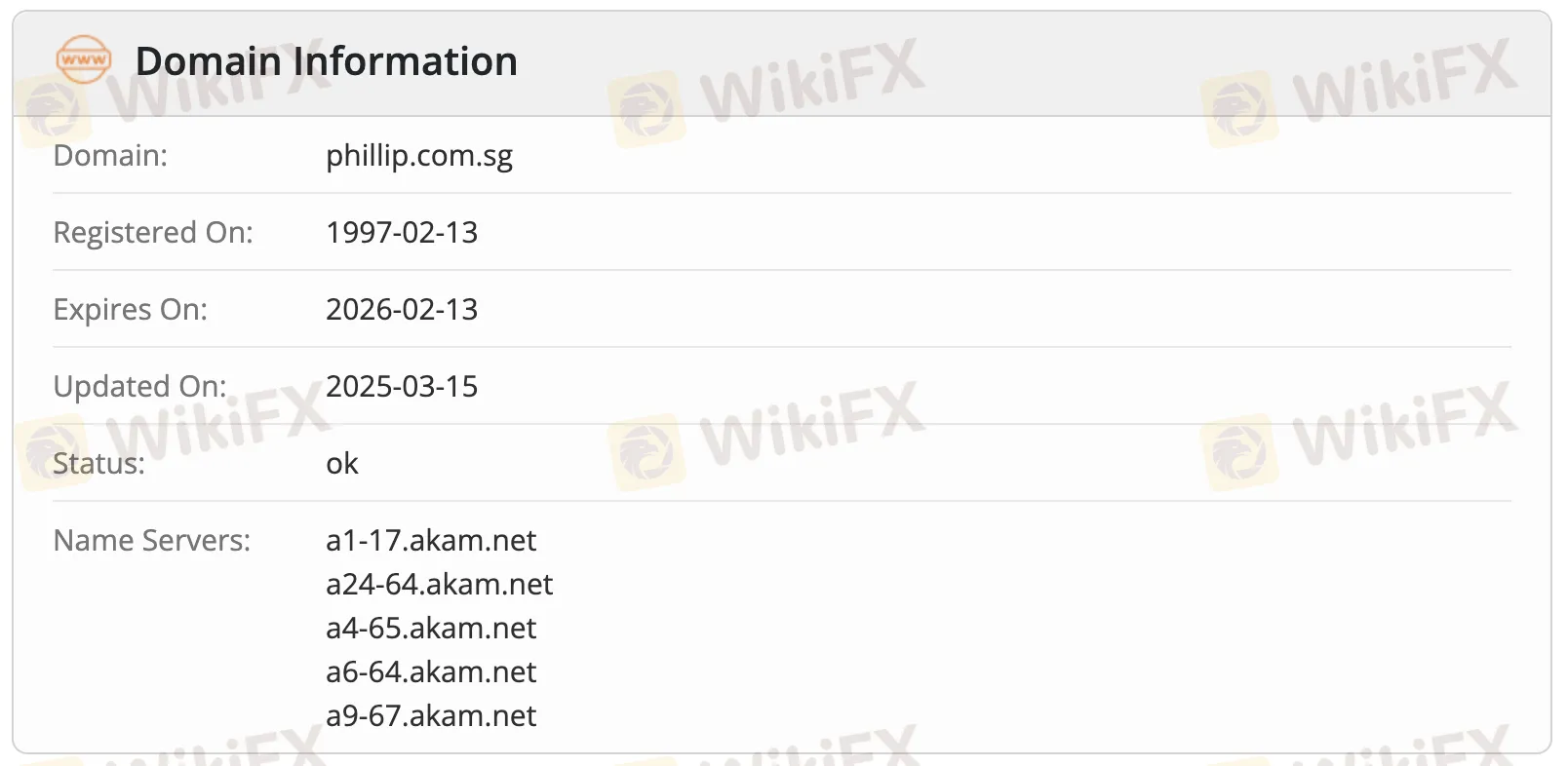

Whois 레코드에 따르면, 도메인 phillip.com.sg는 1997년 2월 13일에 등록되었으며, 2025년 3월 15일에 마지막으로 수정되었습니다. 현재 활성화되어 있으며, 2026년 2월 13일에 만료 예정입니다. 도메인 상태는 "ok"로 표시됩니다.

Although Phillip에서 무엇을 거래할 수 있나요?

4만개 이상의 금융 상품과 350억 달러 이상의 AUM을 보유한 Phillip은 증권, 통화, CFD, 펀드 관리 및 기업 금융을 포함한 자산 클래스 및 부문 전반에 걸친 다양한 금융 서비스를 제공합니다.

| 거래 상품 | 지원 |

| 증권 | ✔ |

| 외환 | ✔ |

| CFD | ✔ |

| 펀드 | ✔ |

| 사모펀드 | ✔ |

| 보험 | ✔ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |