公司简介

| KKR 评论摘要 | |

| 成立时间 | 1976 |

| 注册国家/地区 | 英国 |

| 监管 | 已撤销 |

| 产品和服务 | 私募股权、基础设施、房地产、信贷、资本市场、保险和战略合作伙伴关系 |

| 客户支持 | Client.Services@kkr.com |

| +1 (212) 230-9700 | |

KKR 信息

KKR成立于1976年,总部位于英国,提供私募股权、基础设施、房地产、信贷、资本市场、保险和战略合作伙伴关系等多样化产品和服务。尽管该平台曾持有FCA投资咨询许可证,但目前已被撤销,他们管理着庞大的资产(截至2025年3月为2840亿美元),为机构和个人投资者提供服务。

优缺点

| 优点 | 缺点 |

|

|

|

|

KKR 是否合法?

KKR曾持有由英国金融行为监管局(FCA)颁发的投资咨询许可证,许可证号为471885。但目前已被撤销。

| 监管状态 | 已撤销 |

| 监管机构 | 英国 |

| 许可机构 | 英国金融行为监管局(FCA) |

| 许可类型 | 投资咨询许可证 |

| 许可证号 | 471885 |

产品和服务

KKR在全球范围内提供资产管理、资本市场和保险解决方案。他们的主要领域包括私募股权、基础设施、房地产、信贷、资本市场、保险和战略合作伙伴关系。

公司统计数据

KKR 截至2025年3月31日的主要资产类别包括私募股权2090亿美元、信贷2540亿美元、基础设施830亿美元和房地产810亿美元。他们的总资产管理规模(AUM),包括流动策略,达到2840亿美元。

KKR 的客户群

KKR 为广泛的客户提供服务,包括为机构投资者提供量身定制解决方案以及通过其全球财富产品为符合条件的个人提供服务。该平台还为家庭、企业家以及他们投资的公司提供服务,旨在实现增长和运营改善。

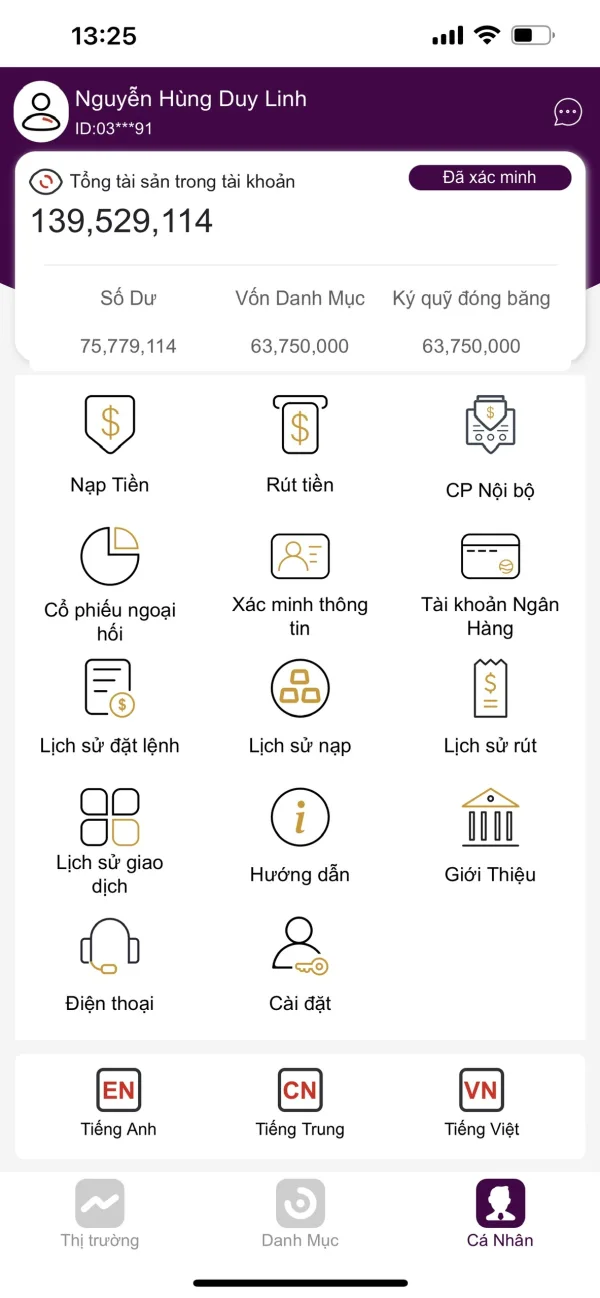

FX3862630966

越南

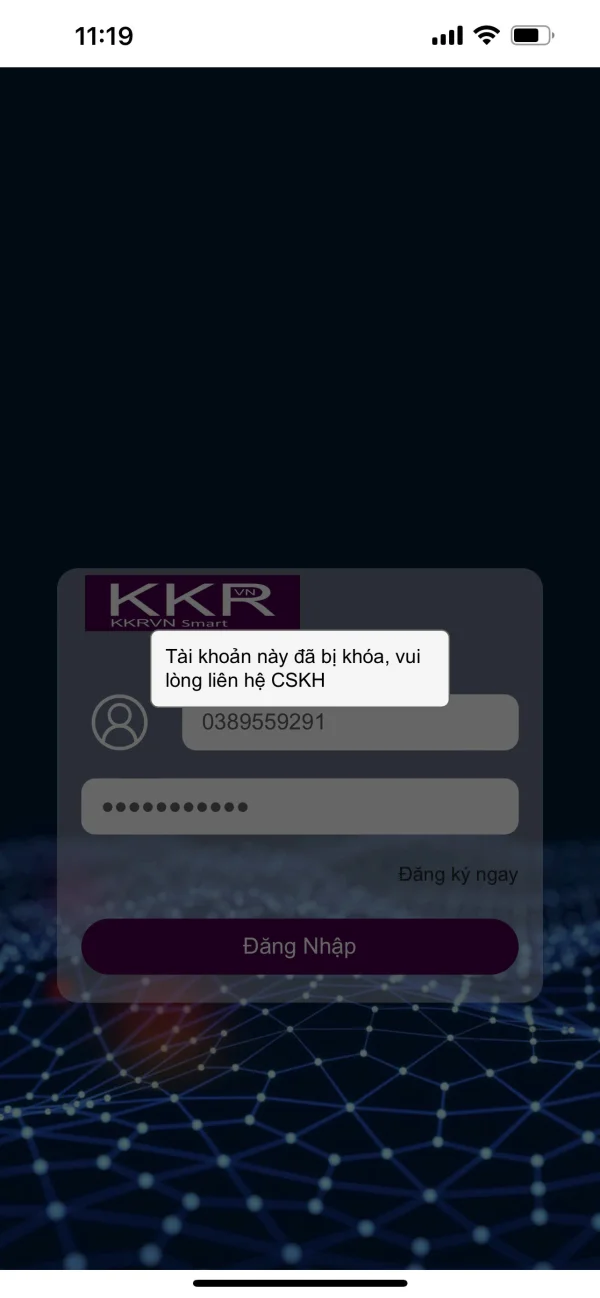

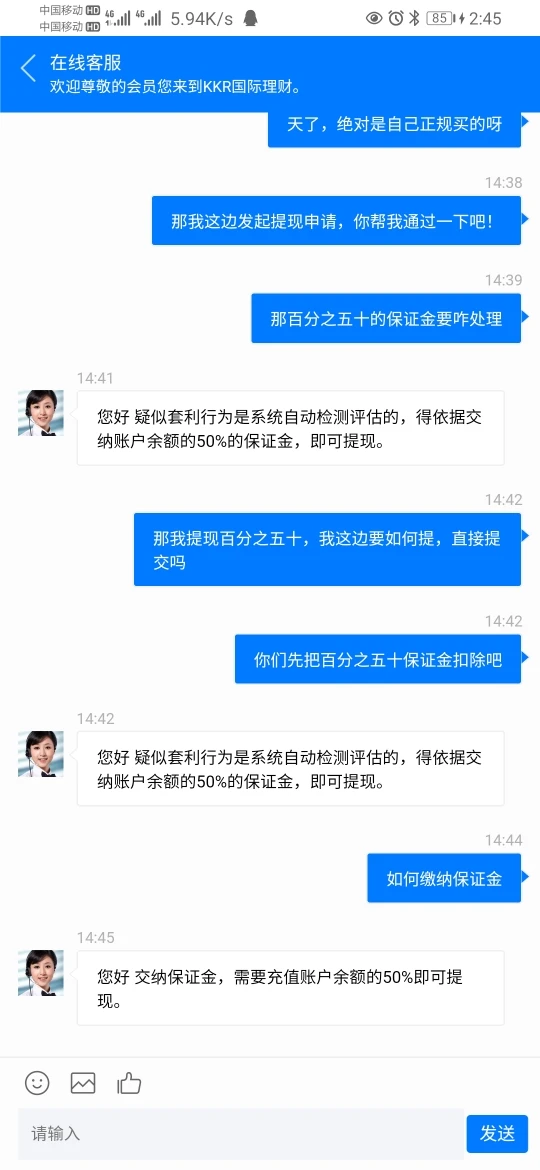

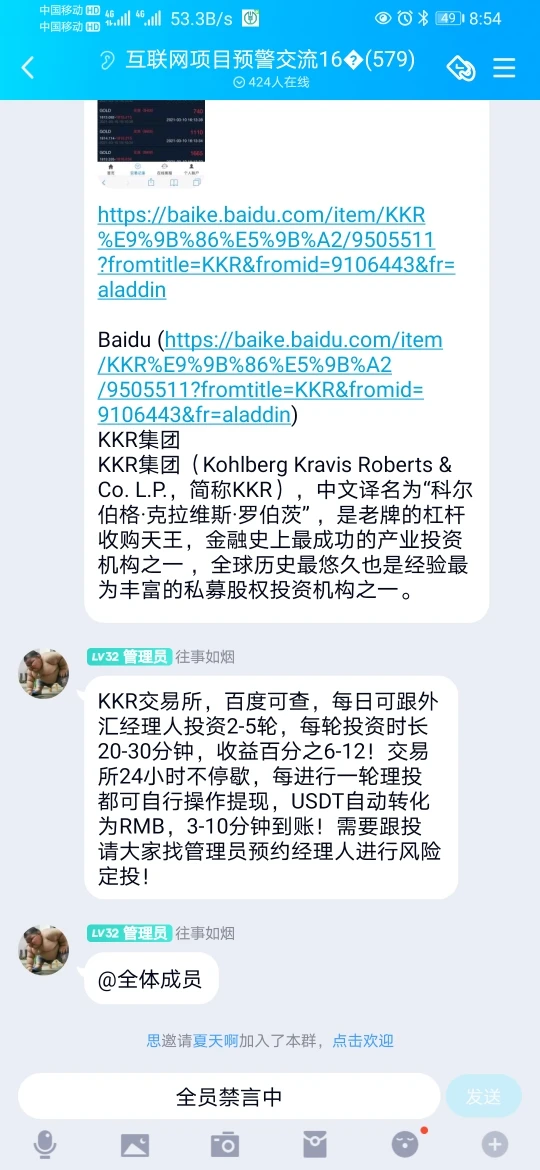

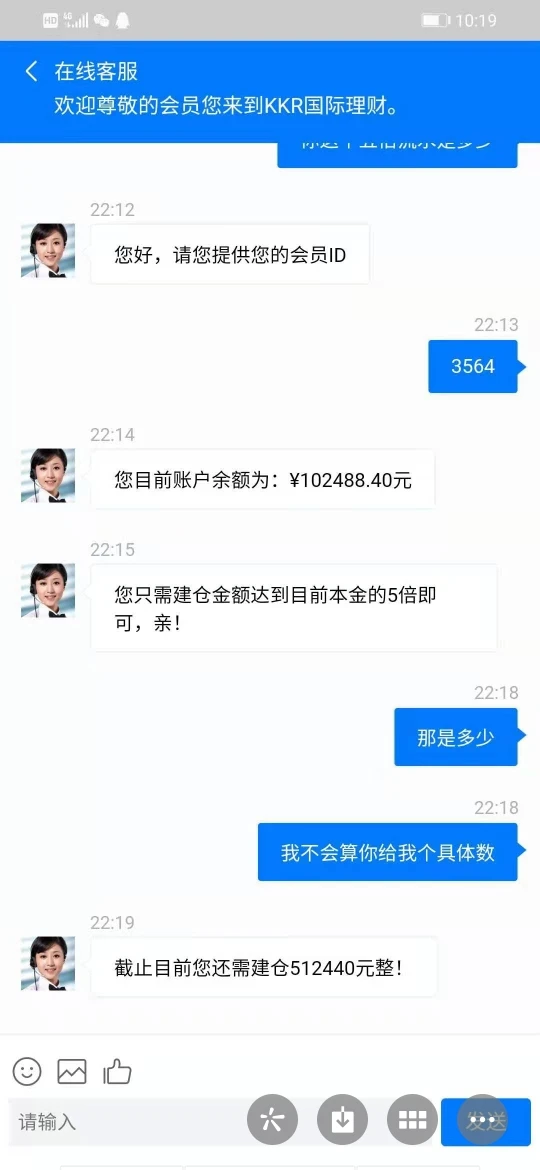

越南的朋友们,请注意不要投资KKR VN,他们是正式的100%骗局,旨在从投资者那里骗取钱财。他们有一个完整的国内外组织来欺骗和操纵小投资者,诱使他们进入陷阱,建立信任,并操纵他们的情绪。投资者将失去所有的钱财,并且无法追回。通常,他们使用他们的应用进行股市投资。最初,您可以存款,获利并提款。但是后来他们会诱使您购买折扣股票,当您存款购买与您资金相符的数量时,您将无法购买。他们的系统会分配大量虚拟股票,使您的账户余额变为负数,到这一点,您将意识到自己被欺骗了。他们会告诉您存款以清除负余额,以便进行购买,并强迫您循环资金购买大量股票。然后,当您卖出并想要提款时,您将无法提取全部金额,他们只允许您提取5%的资金。他们将继续将您推入陷阱,以耗尽您的资金。

曝光

123442698

香港

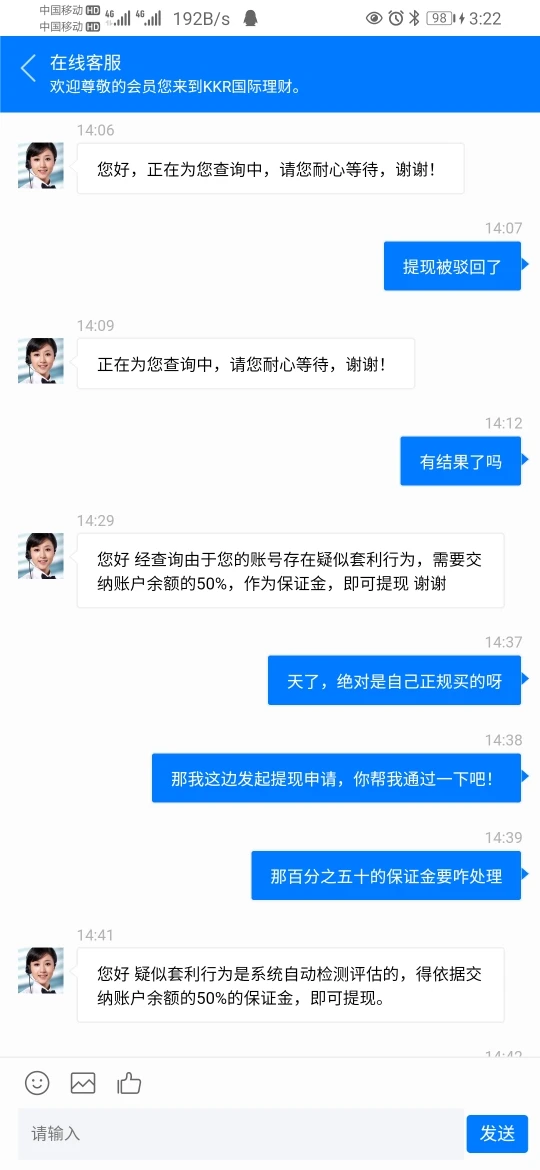

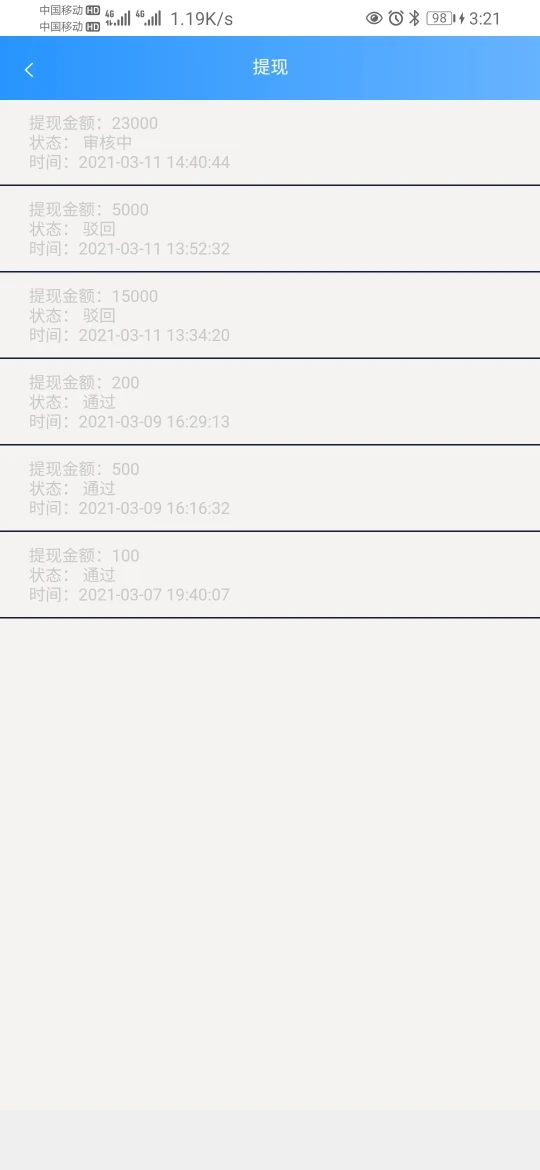

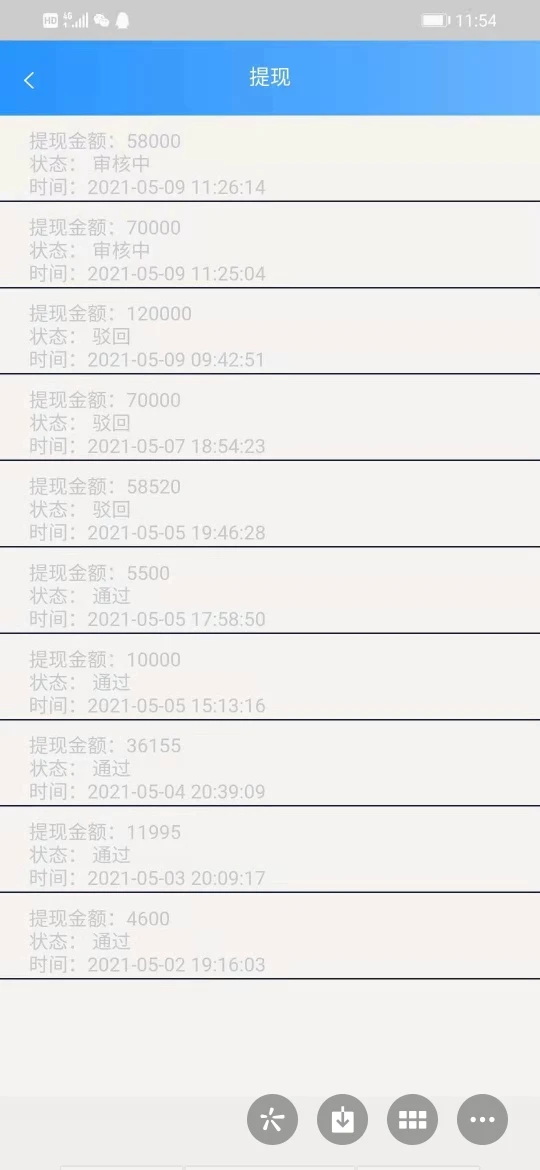

赚钱了不能出金,需要缴纳保证金,带玩的人突然把你踢群,远离。

曝光

FX4033457346

香港

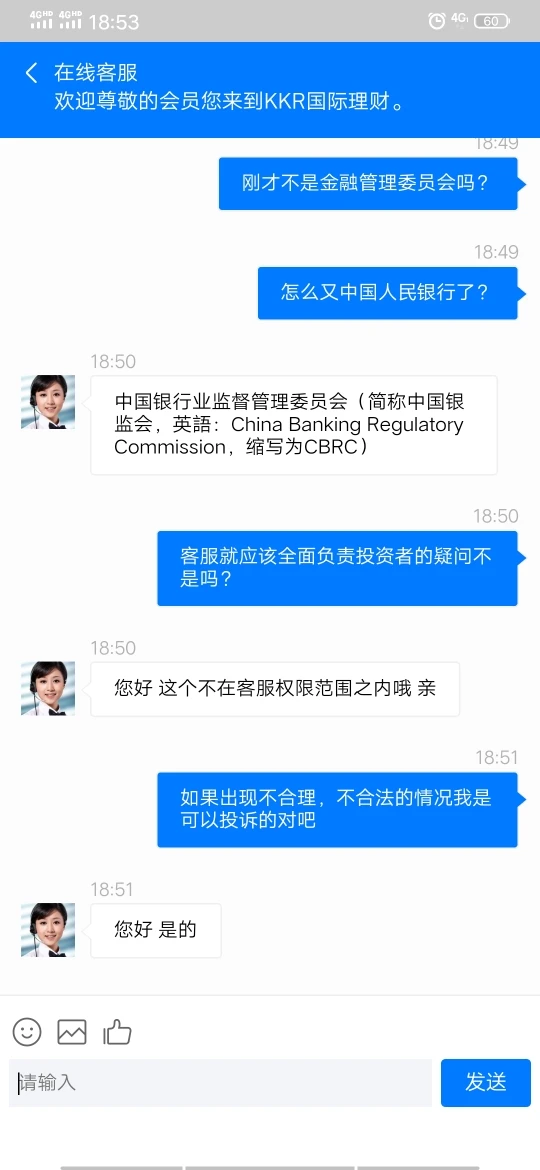

平台限制出金提现,引导客户一步步走进圈套,永各种理由拒绝出金

曝光

雨中飞燕

香港

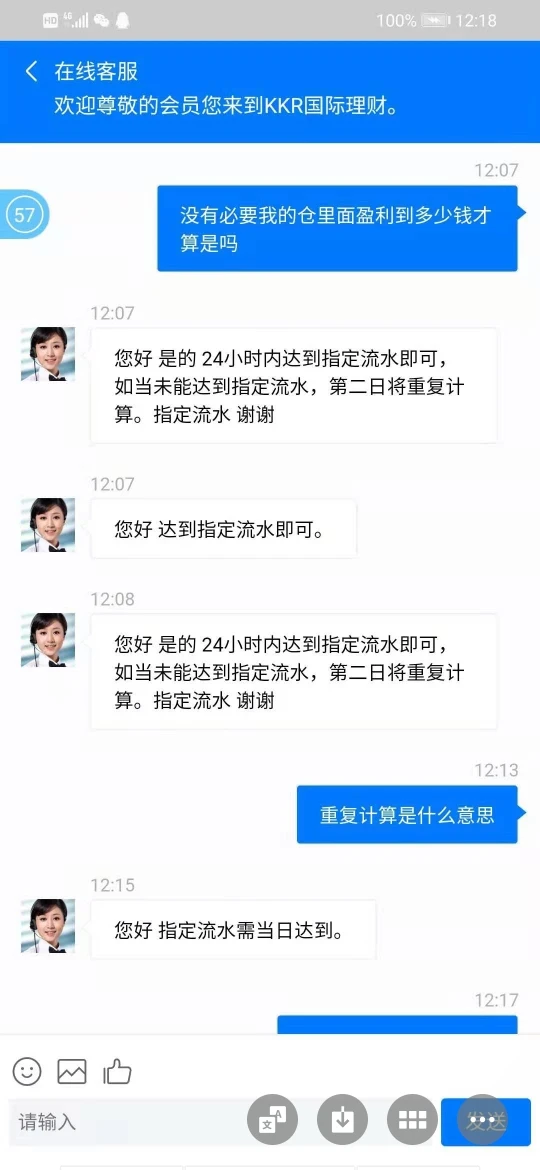

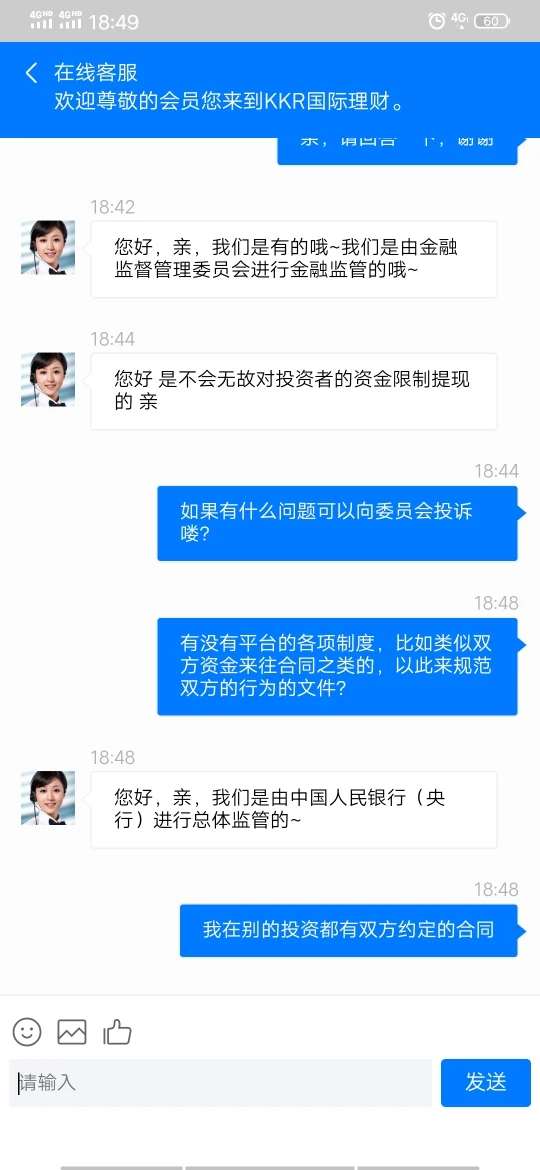

骗子平台,客服就谎话连篇,无法自圆,一会儿声称由金融监管委员会监管,一会儿又由中国银监会监管,天眼一查全露馅儿

曝光