Company Summary

| KKR Review Summary | |

| Founded | 1976 |

| Registered Country/Region | United Kingdom |

| Regulation | Revoked |

| Products and Services | Private Equity, Infrastructure, Real Estate, Credit, Capital Markets, Insurance, and Strategic Partnerships |

| Customer Support | Client.Services@kkr.com |

| +1 (212) 230-9700 | |

KKR Information

KKR, founded in 1976 in the UK, offers diverse products and services spanning private equity, infrastructure, real estate, credit, capital markets, insurance, and strategic partnerships. While the platform previously held an FCA Investment Advisory License, which is now revoked, they manage significant assets ($284B AUM as of March 2025) and serve wide clients, including institutional and individual investors.

Pros and Cons

| Pros | Cons |

|

|

|

|

Is KKR Legit?

KKR once had an Investment Advisory License regulated by the Financial Conduct Authority (FCA) in the United Kingdom with a license number of 471885. But it is revoked now.

| Regulatory Status | Revoked |

| Regulated by | United Kingdom |

| Licensed Institution | The Financial Conduct Authority (FCA) |

| Licensed Type | Investment Advisory License |

| Licensed Number | 471885 |

Products and Services

KKR delivers asset management, capital markets, and insurance solutions globally. Their key areas include Private Equity, Infrastructure, Real Estate, Credit, Capital Markets, Insurance, and Strategic Partnerships.

Company Statistics

KKR's key asset classes as of March 31, 2025, include $209B in Private Equity, $254B in Credit, $83B in Infrastructure, and $81B in Real Estate. Their total Assets Under Management (AUM), including liquid strategies, reached $284B.

KKR's Clientele

KKR serves a broad range of clients, including institutional investors with tailored solutions and eligible individuals through its global wealth offerings. The platform also serves families, entrepreneurs, and the companies they invest in, aiming for growth and operational improvement.

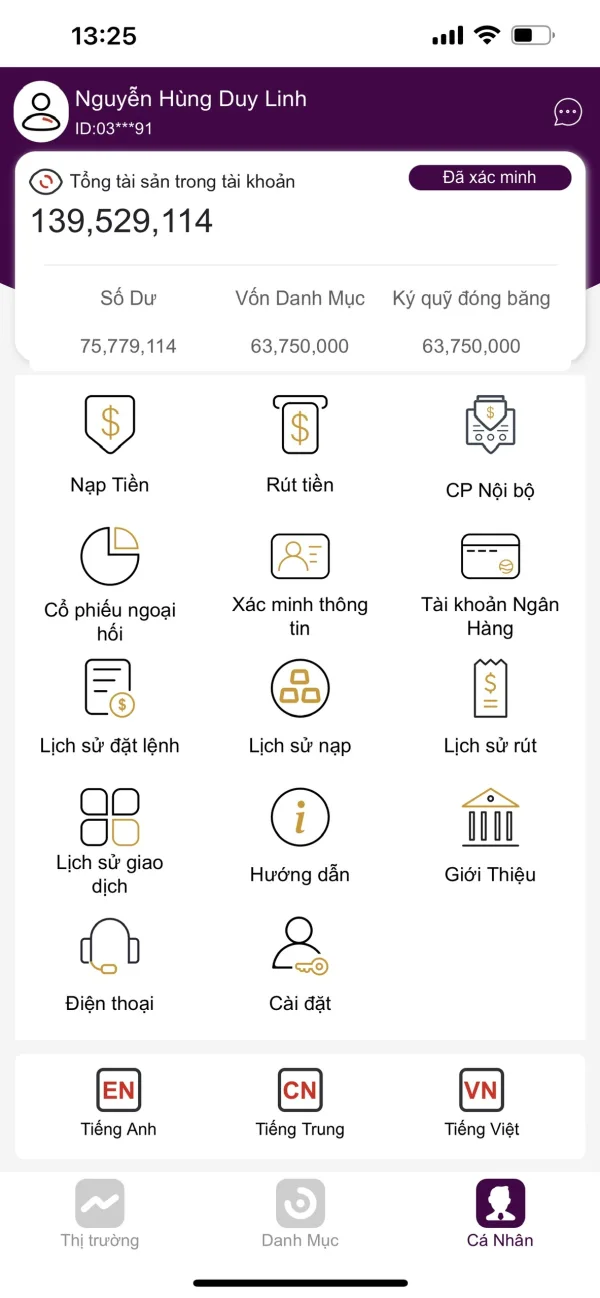

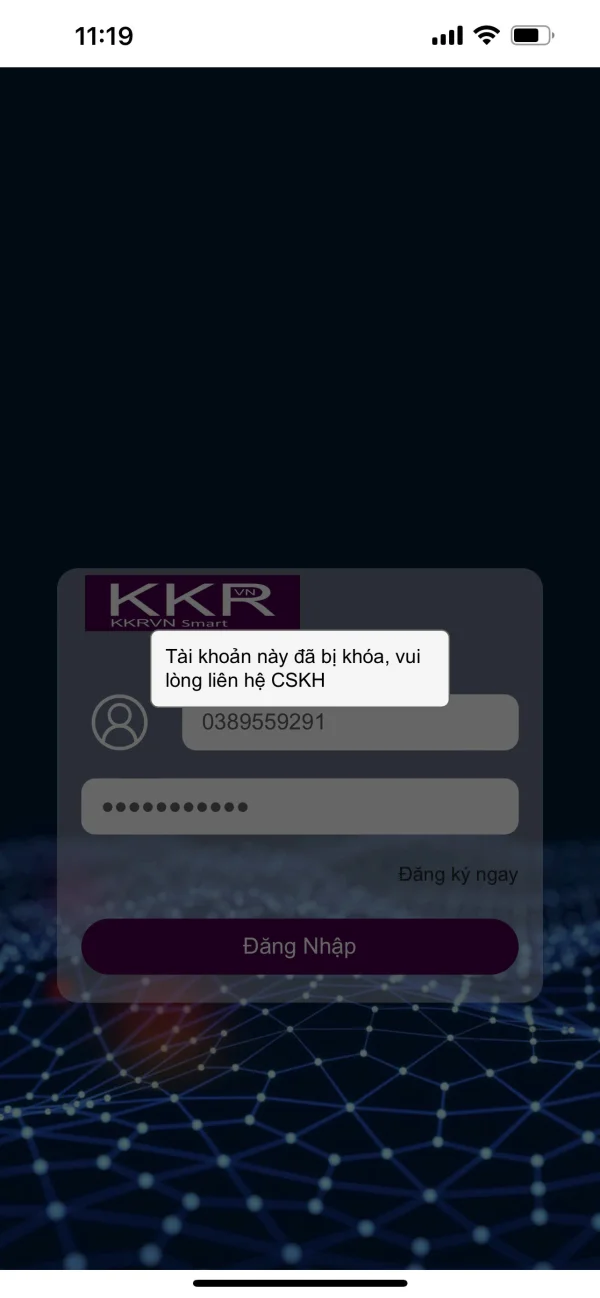

FX3862630966

Vietnam

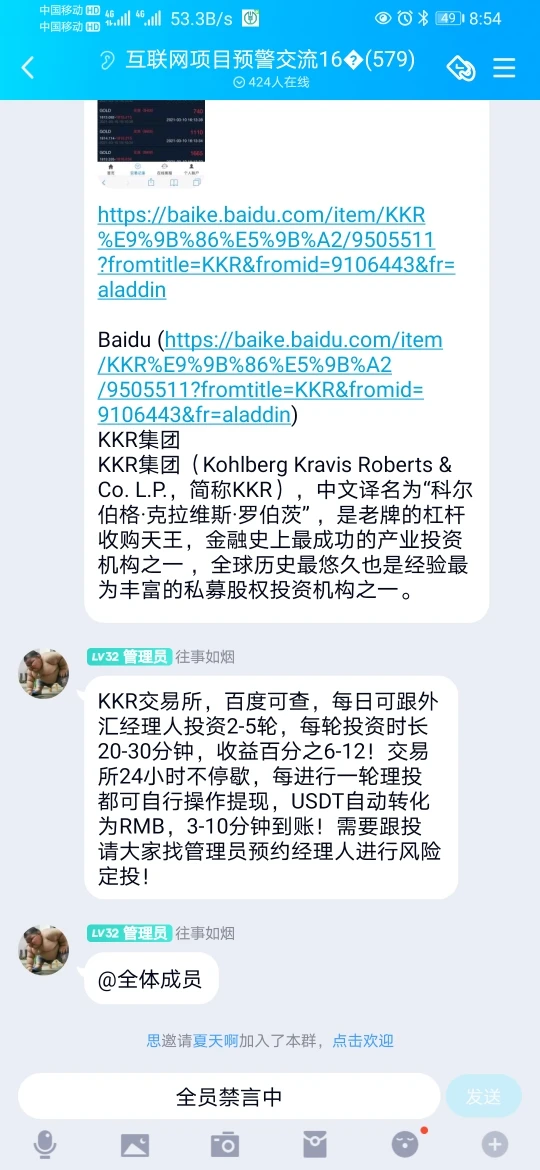

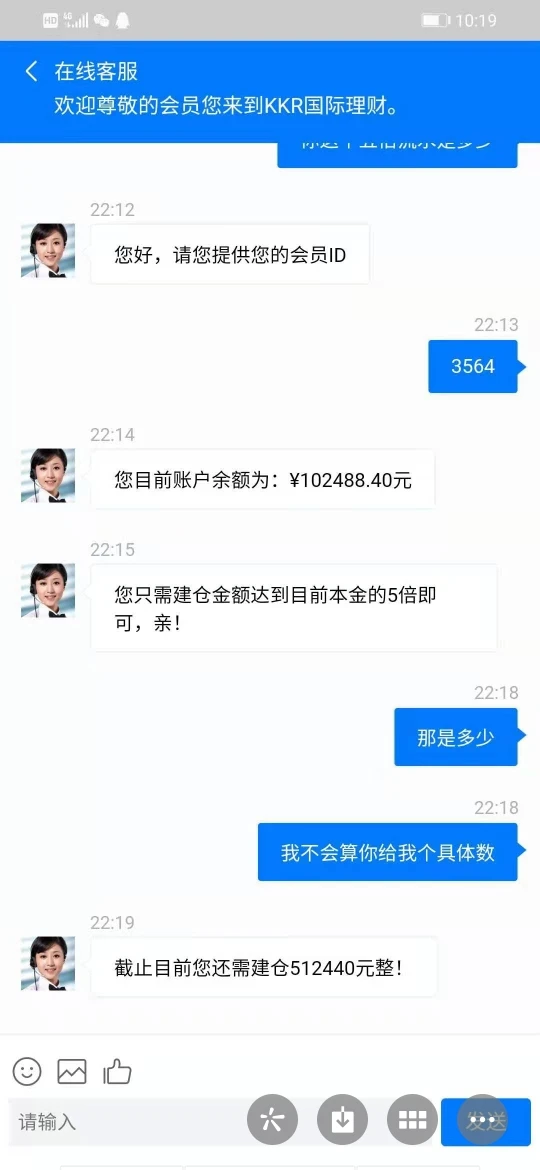

Everyone in Vietnam, please note that you should not invest in KKR VN, they are officially 100% a scam to take money from investors. They have a whole organization both domestically and internationally to deceive and manipulate small investors, lure them in, create trust, and manipulate their emotions. Investors will lose all their money and will not be able to recover it. Usually, they use their app for stock market investment. Initially, you can deposit, make profits, and withdraw. But then they will tempt you to buy discounted stocks and when you deposit to buy the quantity according to your capital, you won't be able to. Their system will distribute a large amount of virtual stocks to make your account balance negative, and at this point, you will know that you have been deceived. They will tell you to deposit money to clear the negative balance in order to make a purchase, and force you to rotate your capital to buy a huge amount. Then, when you sell and want to withdraw, you won't be able to withdraw the full amount, they will only allow you to withdraw 5% of the money. And they will continue to push you deeper into the trap to drain your money.

Exposure

123442698

Hong Kong

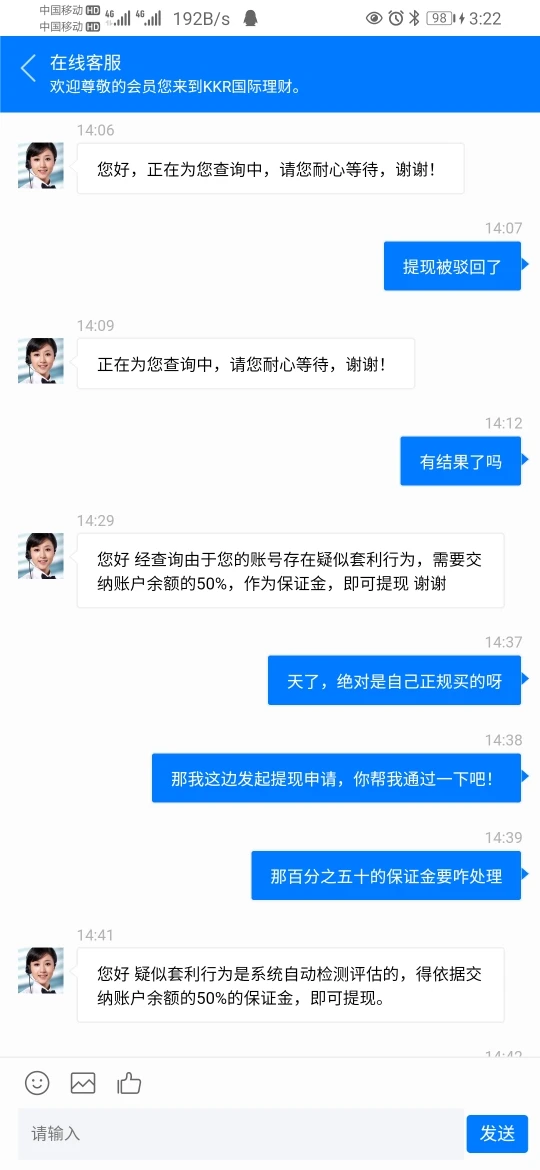

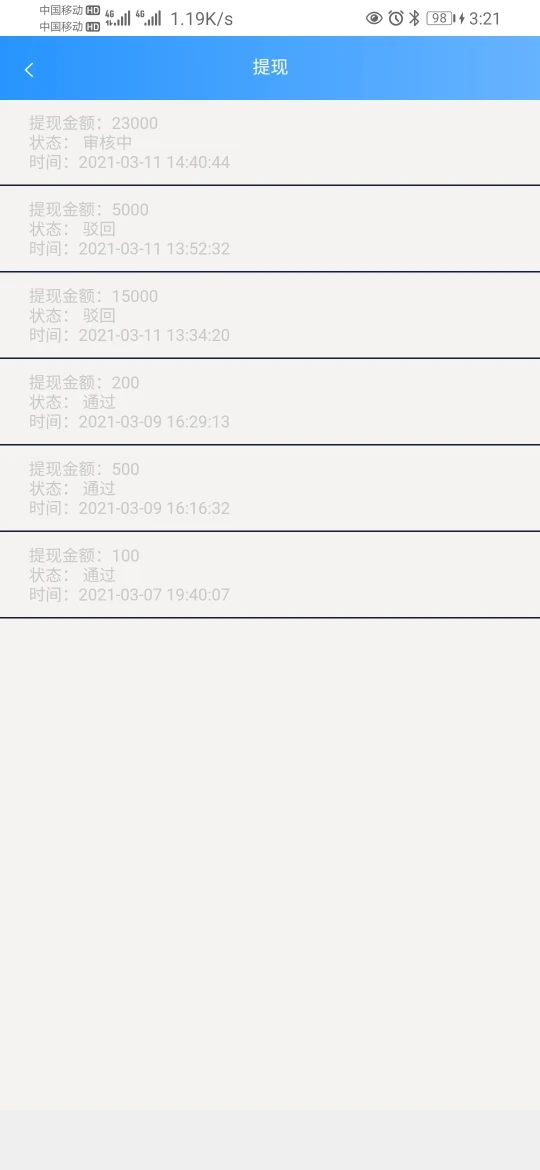

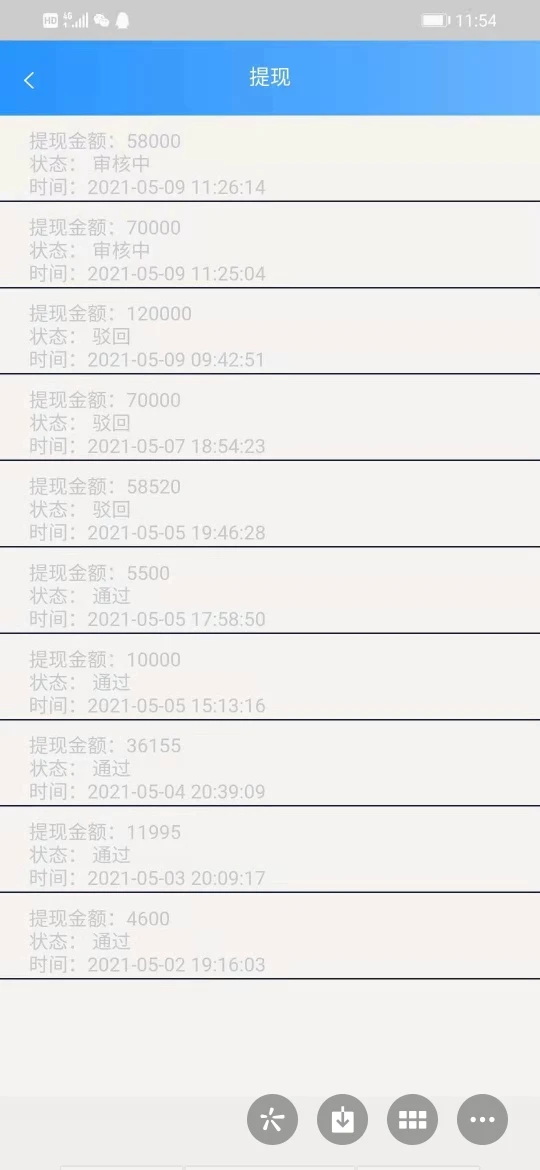

Can’t withdraw funds after profiting and margin is required. The guy who instructs u removes u from the group chat suddenly. Stay away.

Exposure

FX4033457346

Hong Kong

Limit the withdrawal. Trick customer.

Exposure

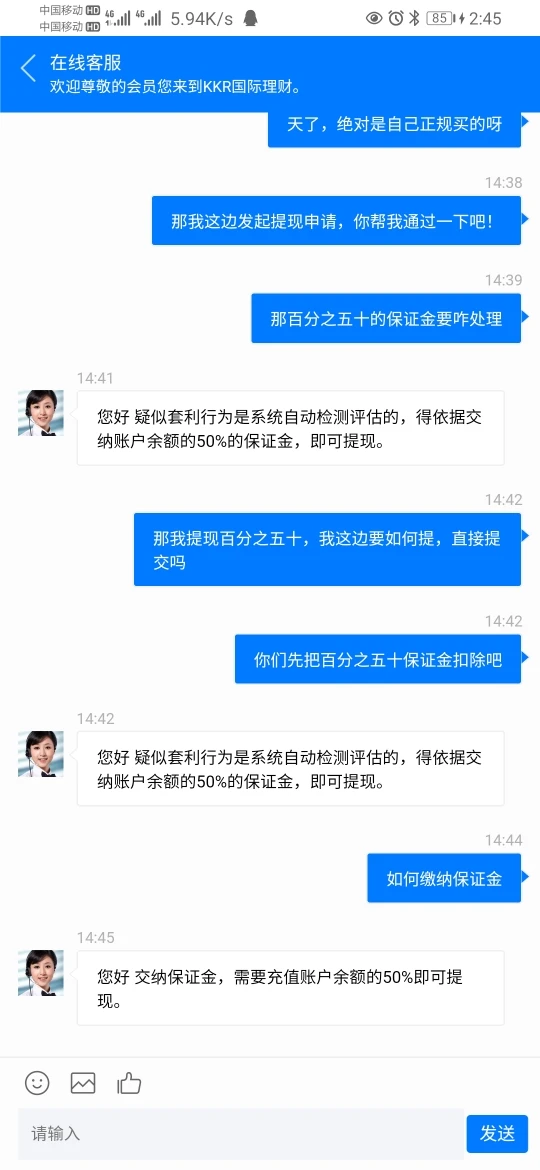

雨中飞燕

Hong Kong

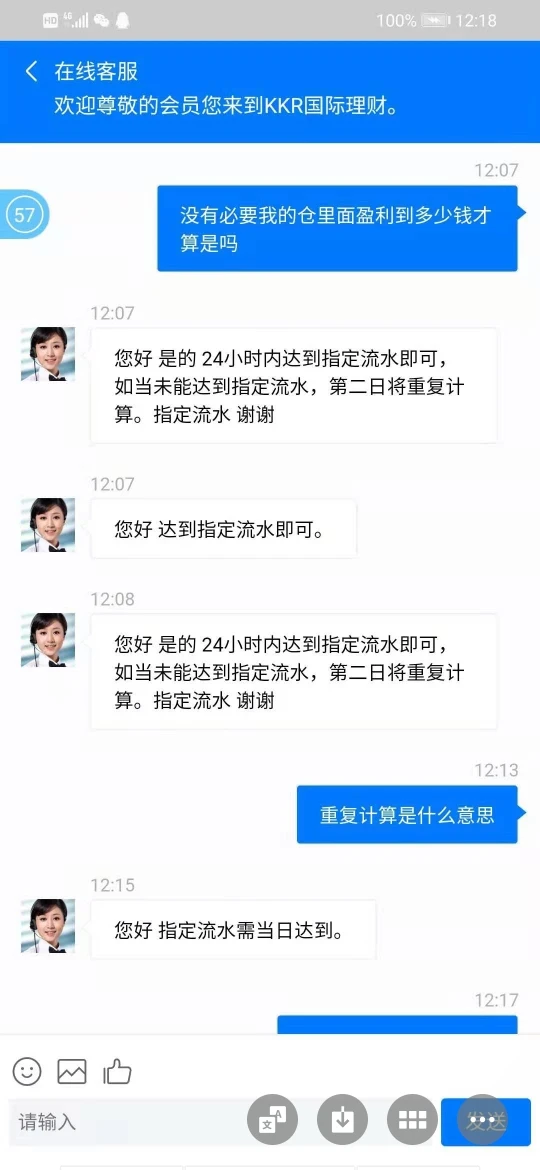

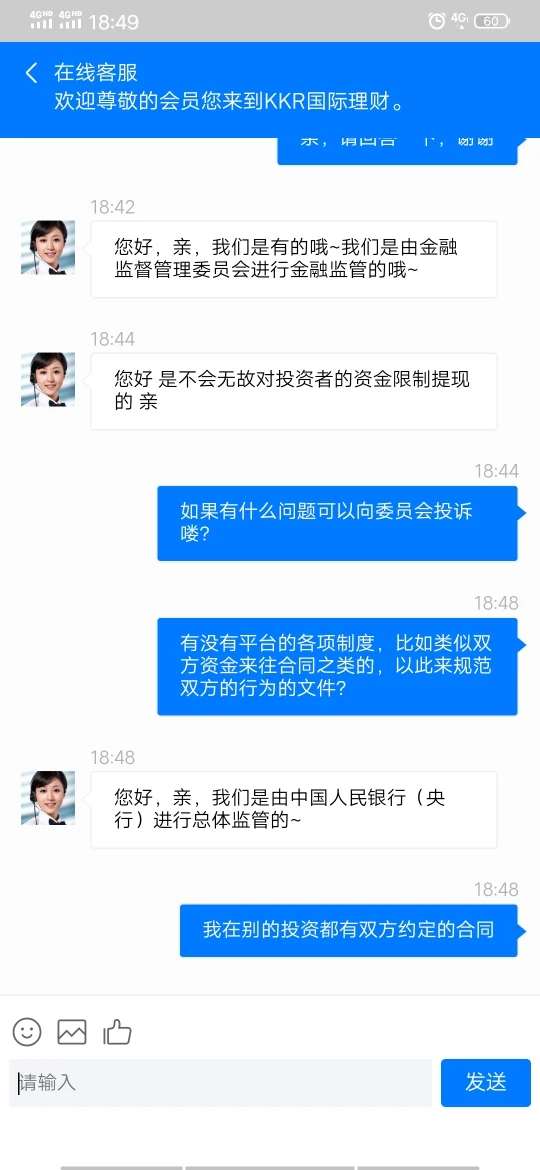

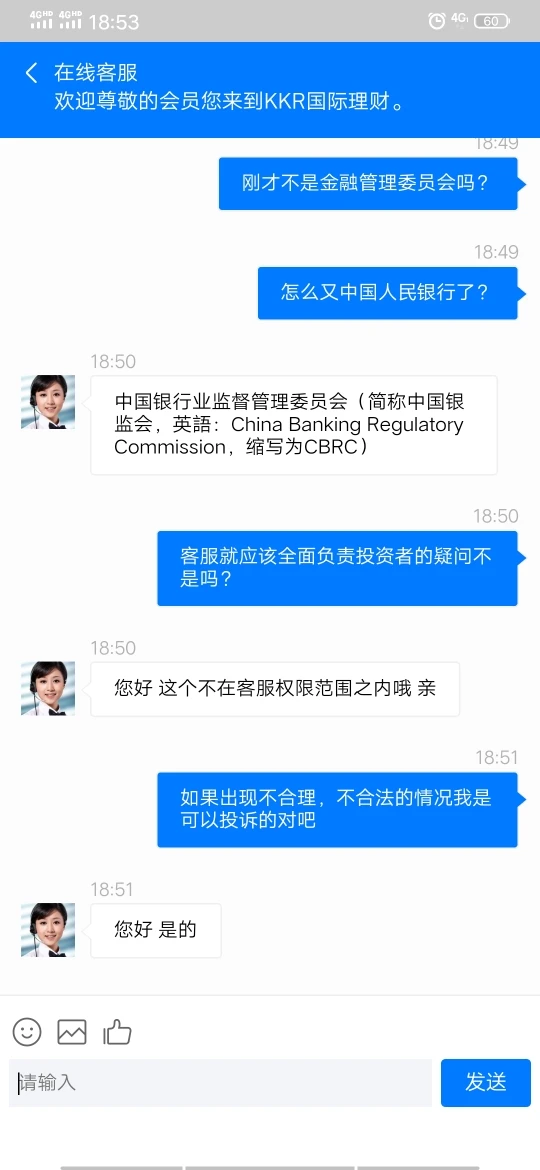

Fraud platform. The customer service tells lie after lie. Sometimes say they are regulated by FSC. Sometimes they say they are regulated by CBRC. But the giveaway is showed on the Wiki Global

Exposure