公司簡介

| BP Prime 綜述 | |

| 成立年份 | 2013 |

| 註冊國家/地區 | 英國 |

| 監管機構 | FCA 監管 |

| 市場工具 | 外匯、商品、指數 |

| 模擬帳戶 | ✅ |

| EUR/USD 點差 | / |

| 槓桿 | 最高可達 1:30(標準帳戶) |

| 交易平台 | MT5 |

| 最低存款 | $5,000 或等值貨幣 |

| 客戶支援 | 查詢表格 |

| 電話:+44 (0) 20 3745 7101 | |

| 電郵:support@bpprime.com | |

| 地址:英國倫敦金街28號 EC2V 8EH | |

| 受限地區s | 美國、加拿大、法國、阿富汗、比利時、幾內亞比紹、伊朗、以色列、利比亞、北韓、俄羅斯、索馬里、南蘇丹、敘利亞、土耳其和葉門 |

BP Prime 資訊

BP Prime 是 Black Pearl Securities Limited 的交易名稱,該經紀公司成立於2013年,為零售和專業客戶提供外匯、商品和指數交易。最低存款要求相當高,為$5,000 或等值貨幣。模擬帳戶和 MT5 平台的可用性提升了客戶體驗。對於機構客戶,該經紀商還提供定制的流動性和技術解決方案。

此外,該經紀商目前受到 FCA 的良好監管,在一定程度上保證了客戶的保護和遵守機構設定的行業標準。

然而,有 5 個 WikiFX 曝光的提款問題,這表明該經紀商需要改善服務。您應該注意這一點。

優點與缺點

| 優點 | 缺點 |

| 受 FCA 監管 | 交易資產類別有限 |

| 模擬帳戶 | 高最低存款 |

| 無佣金帳戶 | WikiFX 曝光 |

| MT5 平台 | 在多個國家無服務 |

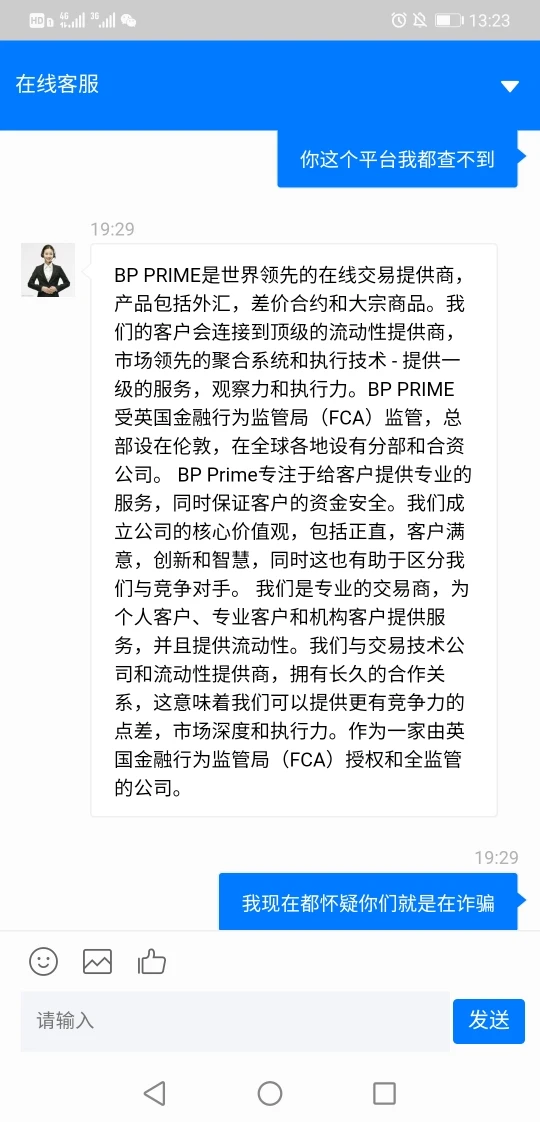

BP Prime 是否合法?

BP Prime 目前受到英國金融行為監管局(FCA)的監管,許可證編號為688456,這保證了一定程度上的合法性和可信度。

| 監管國家 | 監管機構 | 當前狀態 | 受監管實體 | 許可證類型 | 許可證號碼 |

| FCA | 受監管 | Black Pearl Securities Limited | 直通式處理(STP) | 688456 |

BP Prime 可以交易什麼?

| 可交易工具 | 支援 |

| 外匯 | ✔ |

| 商品 | ✔ |

| 指數 | ✔ |

| 股票 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| ETF | ❌ |

BP Prime 為零售和專業客戶提供外匯、商品和指數交易服務。對於機構客戶,提供定制的流動性和技術解決方案,幫助公司擴大和發展業務範圍和規模。

帳戶類型/費用

BP Prime 為客戶提供模擬帳戶,供其練習和測試交易策略。

對於實盤帳戶,該經紀商為零售客戶提供標準帳戶,最低存款高達$5,000或等值貨幣。在該帳戶中,經紀商不收取交易佣金,並聲稱具有競爭力的點差,但沒有提供詳細信息。

另一方面,專業客戶可以獲得更高的槓桿比例,但保護程度較低。要符合開設專業帳戶的資格,您需要在過去一年內進行10筆具有重要規模的相關交易,擁有超過$500,000的金融工具組合,並在金融行業工作至少一年。

槓桿比例

BP Prime 在標準帳戶中提供最高1:30的槓桿比例,這意味著您可以控制30倍於您初始存款的更大頭寸。

專業帳戶的槓桿比例較高,但根據該經紀商的網站,目前未公開具體信息。您需要直接與公司聯繫以獲取準確信息。

此外,您在使用這種工具時應該非常謹慎,因為槓桿不僅可以放大利潤,同樣地也會放大損失。

交易平台

勝利使用行業領先的MetaTrader 5平台通過網絡,讓您可以隨時隨地進行交易。

MT5平台以其先進的圖表工具和強大的功能而享譽全球,例如自動交易執行等。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| MT5 | ✔ | 網絡、移動設備 | 經驗豐富的交易者 |

| MT4 | ❌ | 網絡、移動設備 | 初學者 |

一亇亻的靜綵

香港

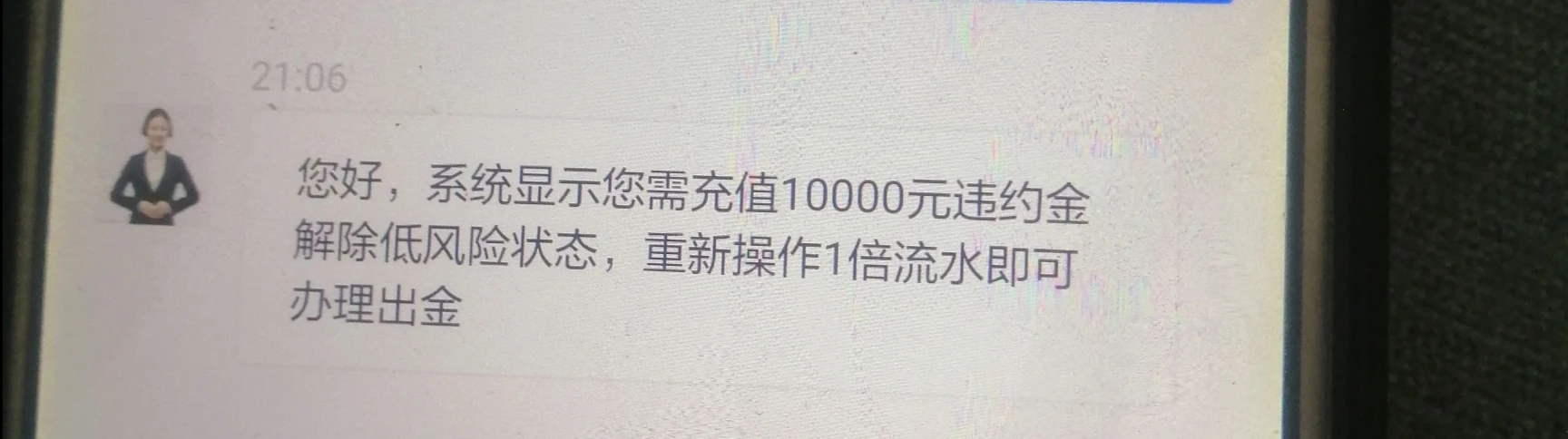

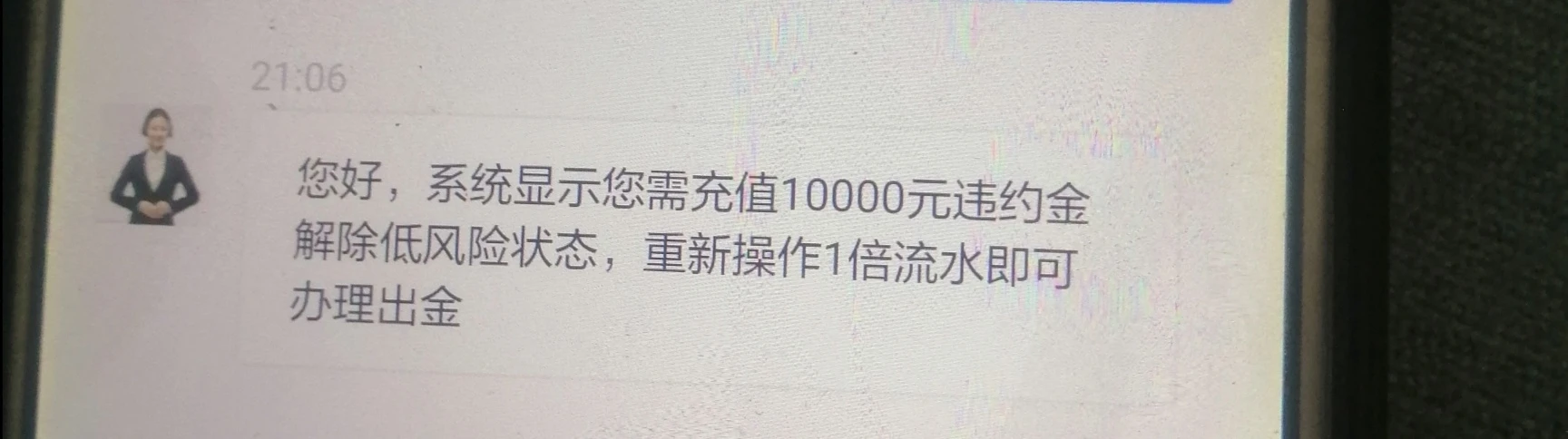

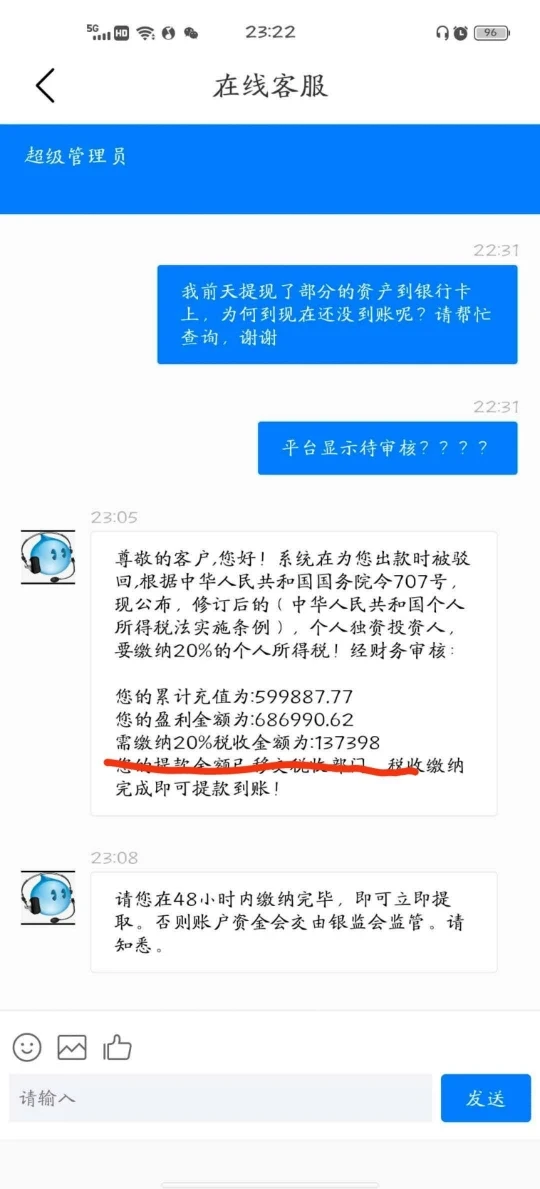

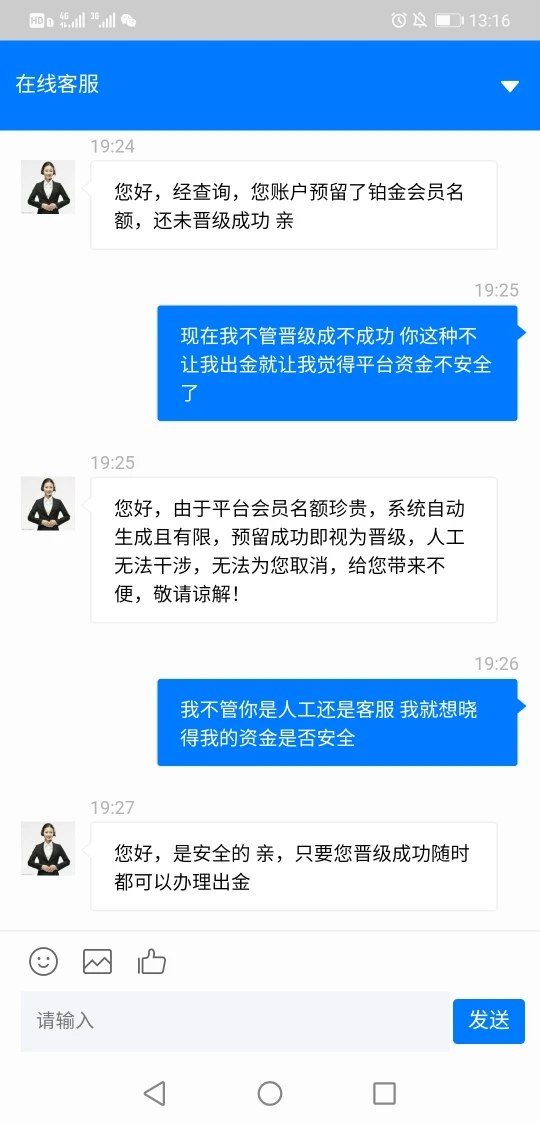

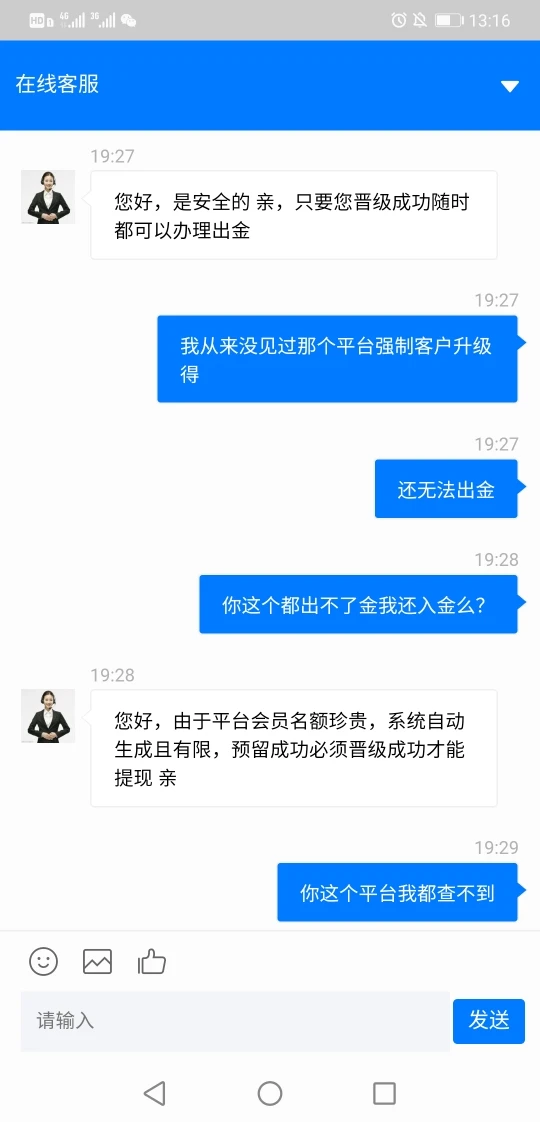

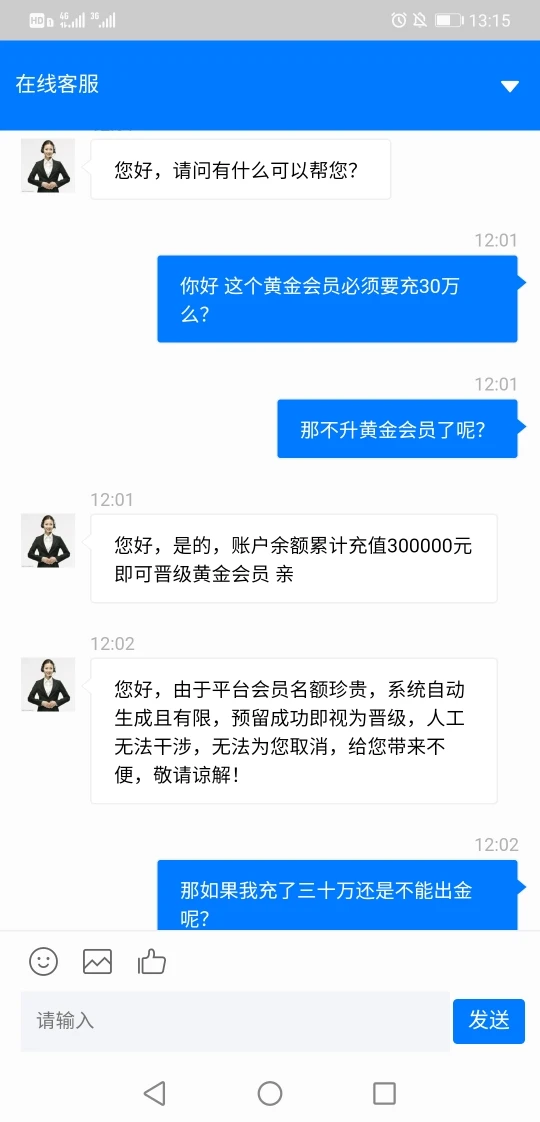

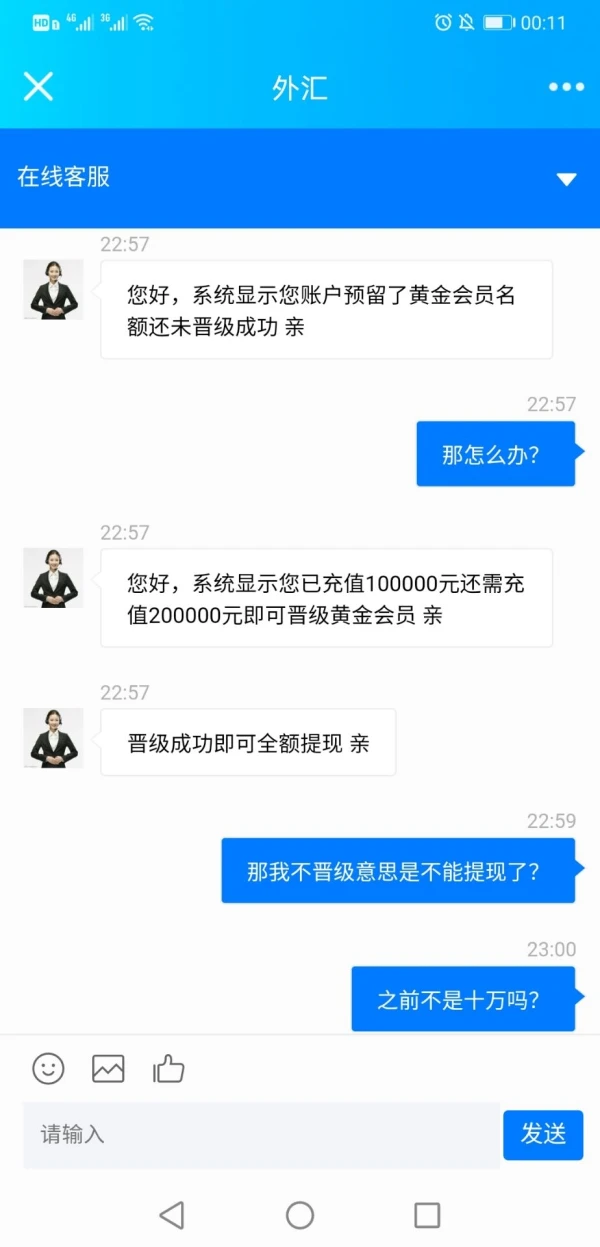

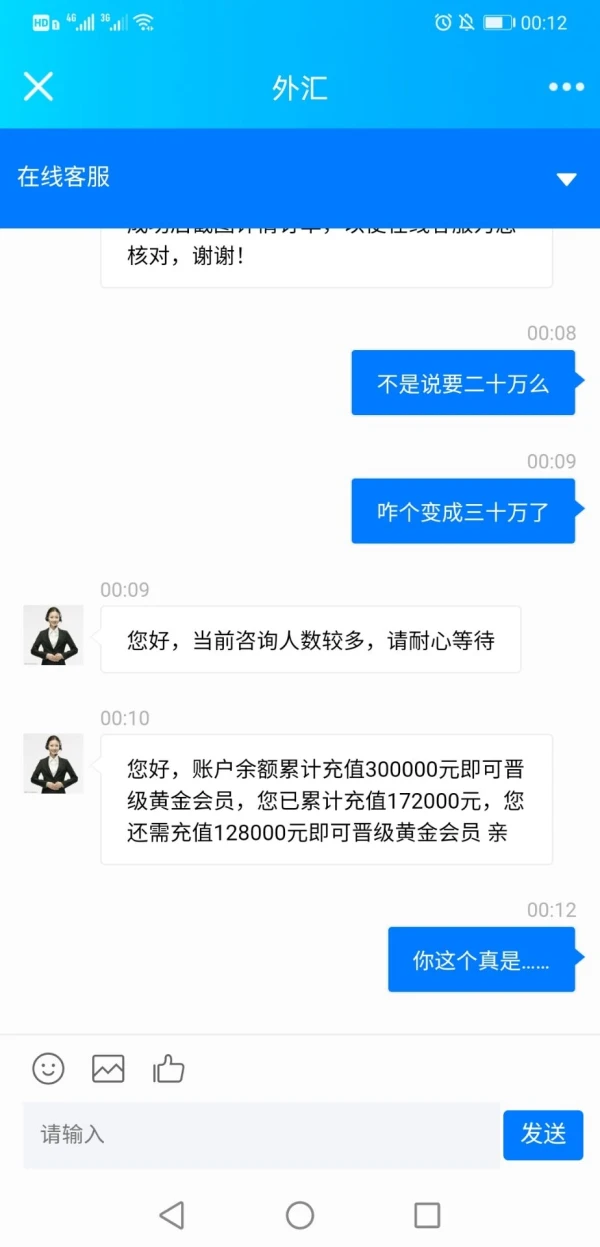

BP PRIME黑平台无法出金!是不是盗版啊!

爆料

一亇亻的靜綵

香港

无法出金,显示会员已被禁用!是不是黑平台!

爆料

爱哭的晴娃娃

香港

黑平台无法出金,有诱导诈骗嫌疑!!请监管部门有效处理!

爆料

FX1367919021

澳大利亞

雖然我看不懂中文,但我能明白這家公司實際上是一個外匯騙子!我真的希望外匯交易者能夠保持警惕,讓這些受害者能夠早日挽回損失。

好評

FX1532132782

香港

一个网友给我以下链接,告知平台有个7天定存活动,每天将返利3%,然后在返利后+当天的本金合计总金额的基础上再充值20%到平台继续返利,定存活动结束后,被告知需缴纳收益部分的20%且税务部审批后才能提现,而且平台可帮忙代缴或自己交税务部,嫌麻烦就让平台代缴了13万多的税收。在整个参与的过程中,我入金充值了30多万,而且都是网贷的,因我没有多的资金,这个网友前前后后总共帮我充值了40多万(含缴纳税收),就因此举动,见他帮我充值比我自己充值了还多,我就没怀疑他。缴纳税收后的第二天,他说近几天有点忙,可能会少些联系我了,第三天就联系不上了。而我每天关注到平台审批税收后的通知提现以便我还网贷,结果即将一周过去,还是显示待审批,三番五次追问客服那边也没有回复。我才恍然大悟自己是不是被套路给骗了?这个网站是不是不是正规平台?投资的30多万可全是我借的各种网贷,这么多钱可是我们普通人半辈子的心血啊,也不敢让父母知道。跪求求各路高手指点,还我公道如何追回资产?万分感谢,好人一生平安幸福!

爆料

广发银行 小余

香港

无法出金诱导强制充值不正面回答问题请监管部门核实平台真实正规性

爆料