Company Summary

| BP Prime Review Summary | |

| Founded | 2013 |

| Registered Country/Region | United Kingdom |

| Regulation | Regulated by FCA |

| Market Instruments | Forex, commodities, indices |

| Demo Account | ✅ |

| EUR/USD Spread | / |

| Leverage | Up to 1:30 (Standard account) |

| Trading Platform | MT5 |

| Min Deposit | $5,000 or equivalent |

| Customer Support | Inquiry form |

| Tel: +44 (0) 20 3745 7101 | |

| Email: support@bpprime.com | |

| Address: 28 King Street London EC2V 8EH United Kingdom | |

| Restricted Areas | United States, Canada, France, Afghanistan, Belgium, Guinea Bissau, Iran, Israel, Libya, North Korea, Russia, Somalia, South Sudan, Syria, Turkey and Yemen |

BP Prime Information

BP Prime is the trading name of Black Pearl Securities Limited, a brokerage company who was established in 2013 and deals in forex, commodities and indices tradings for both retail and professional clients. The minimum deposit requirement is pretty high from $5,000 or equivalent. A demo account and the availability of MT5 platform enhances customer experiences. While for institutional clients, the broker offers bespoke liquidity and technology solutions as well.

Furthermore, the broker currently operates under decent regulation from FCA, which to some extent guarantees customer protection and compliance to industry standard set by the institution.

Nevertheless, there are 5 pieces of WikiFX exposure to withdrawal issues, which indicates the necessity of service improvements of this broker. You should pay attention to this.

Pros and Cons

| Pros | Cons |

| FCA regulated | Limited trading asset classes |

| Demo accounts | High minimum deposit |

| Commission-free accounts offered | WikiFX exposures |

| MT5 platform | No services in several countries |

Is BP Prime Legit?

BP Prime is currently regulated by FCA (Financial Conduct Authority) in United Kingdom, with a license numbering at 688456, which guarantees legitimacy and credibility in a certain level.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| FCA | Regulated | Black Pearl Securities Limited | Straight Through Processing (STP) | 688456 |

What Can I Trade on BP Prime?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

BP Prime offers trading services in forex, commodities and indices for both retail and professional clients. While for institutional clients, customized liquidity and technology solutions are available to help companies to grow and develop their business scope and scale.

Account Type/Fees

BP Prime offers demo accounts for clients to practice and test trading strategies.

While for live accounts, the broker offers a Standard accountfor retail clients with a high minimum deposit of $5,000 or equivalent. In this account, the broker charges no commissions for trading, and claims competitive spread, but with no details.

Professional clients, on the other hand, are provided with a Professional account with higher leverage but less protection. To be eligible to open a professional account, you need to place 10 relavant trades of a significant size per quarter in last year, own a financial instrument portfolio exceeding $500,000, and have worked in the financial sector for at least one year.

Leverage

BP Prime offersa leverage level of up to 1:30 for some currency pairs in the Standard account, which means you can control a larger position of 30 times of your initial deposit.

Professional accounts have higher leverage, but are not currently disclosed per the broker's website. You need to check with the company directly to get precise information.

Moreover, you should always be very prudent to use such tool since leverage not only amplify profits, but losses will be augmented at same level as well.

Trading Platform

Victory indicates the use of the industry-leading MetaTrader 5 platform through web, which allows you to trade anywhere on the go.

The MT5 platform is renowned and recognized worldwidely for their advanced charting tools and robust functionalitiess such automated transaction execution.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web, mobile | Experienced traders |

| MT4 | ❌ | Web, mobile | Beginners |

一亇亻的靜綵

Hong Kong

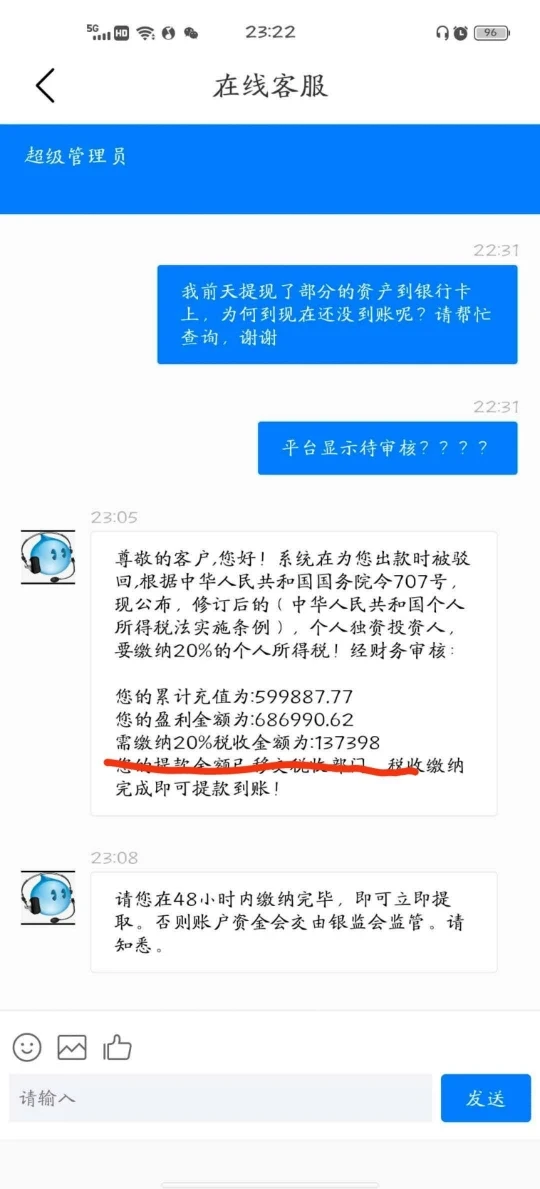

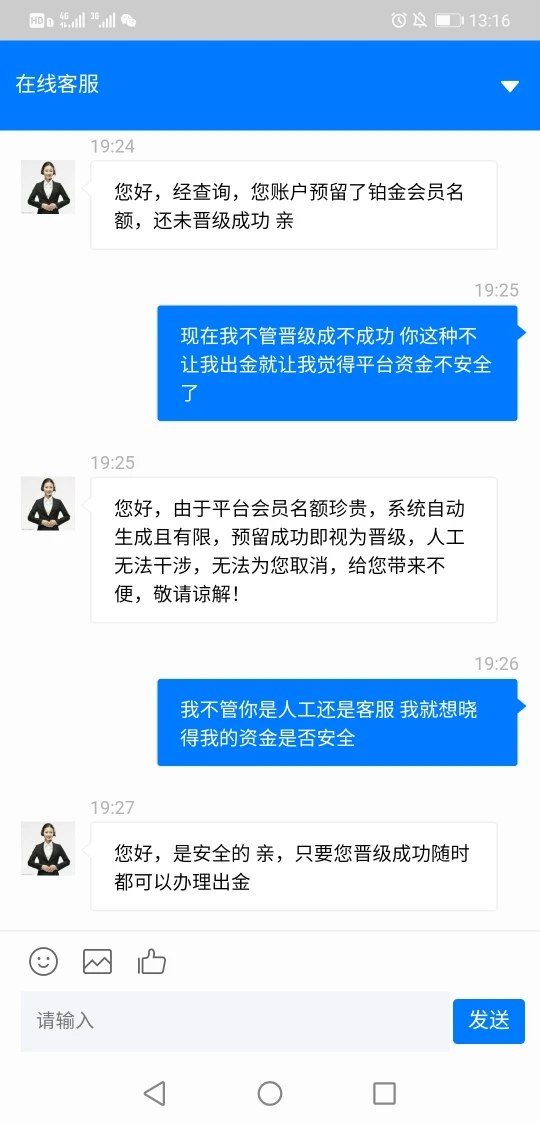

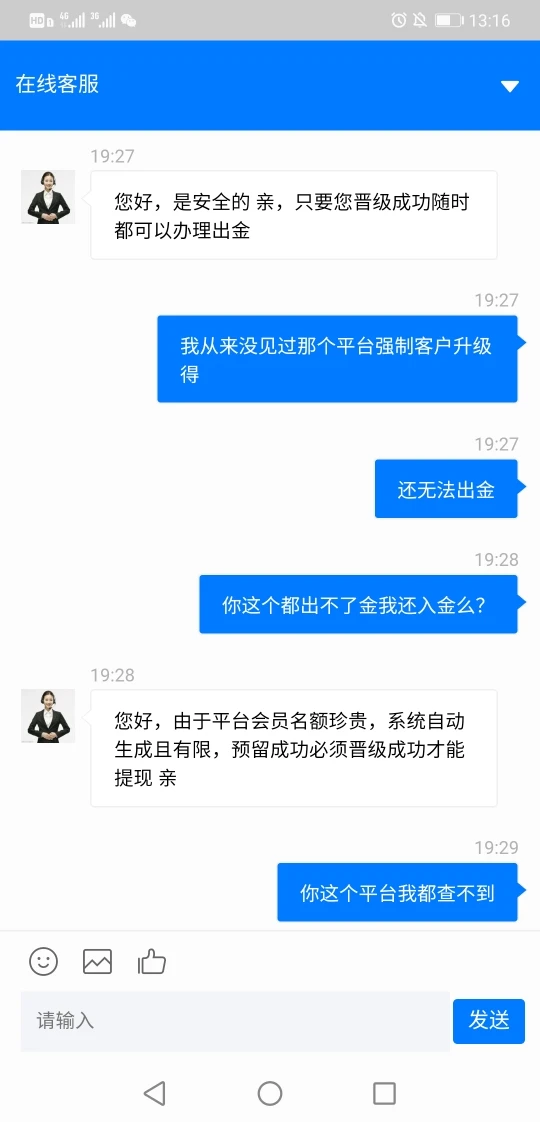

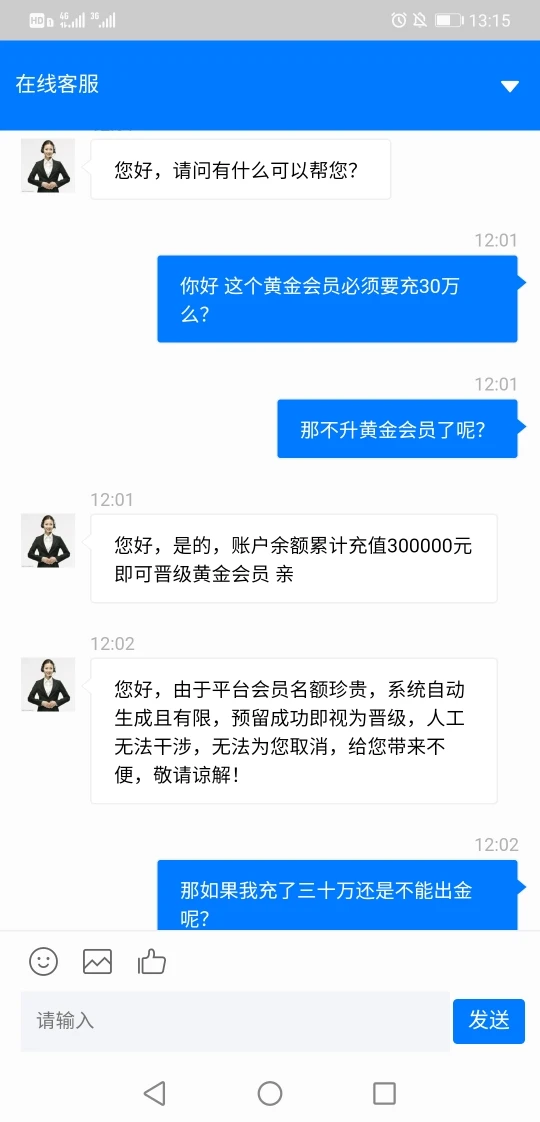

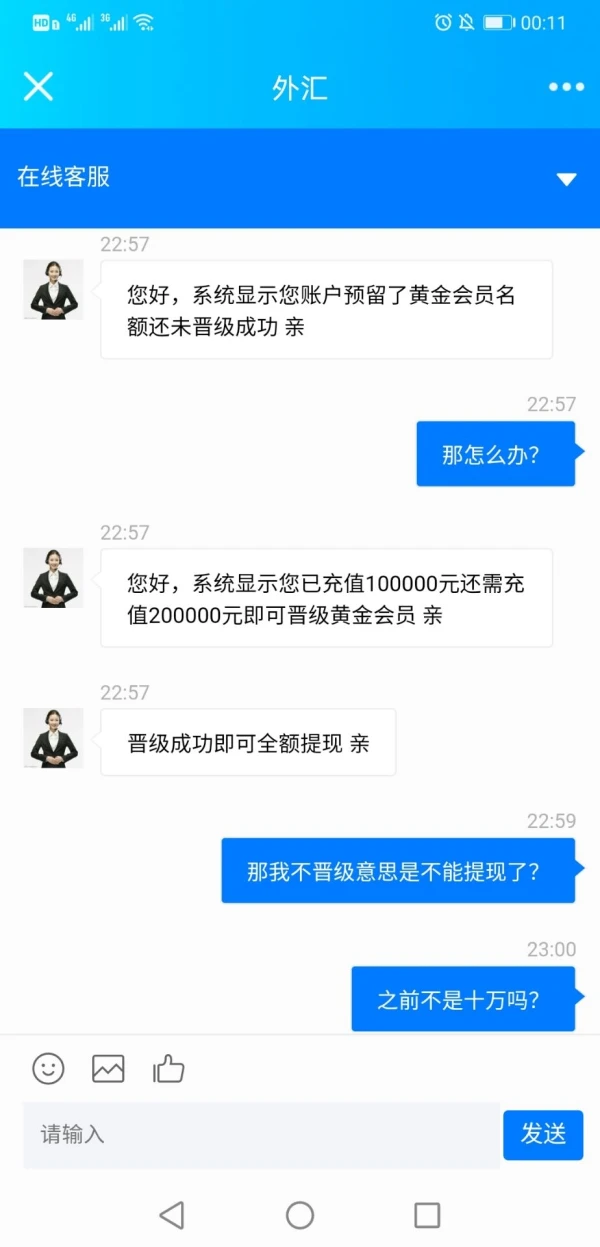

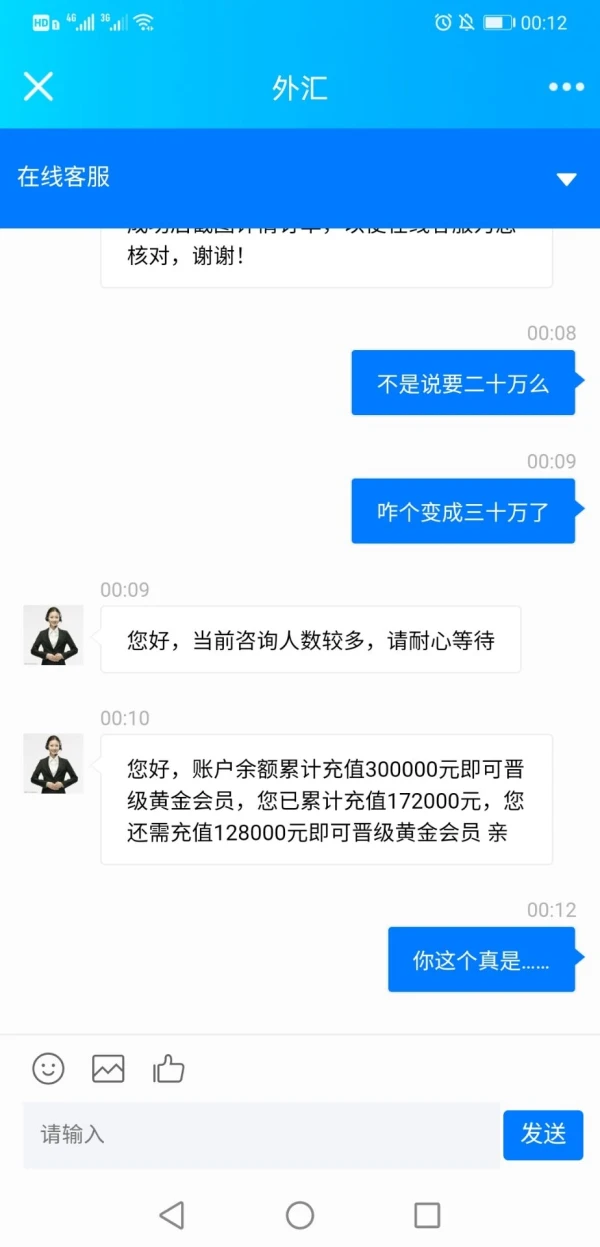

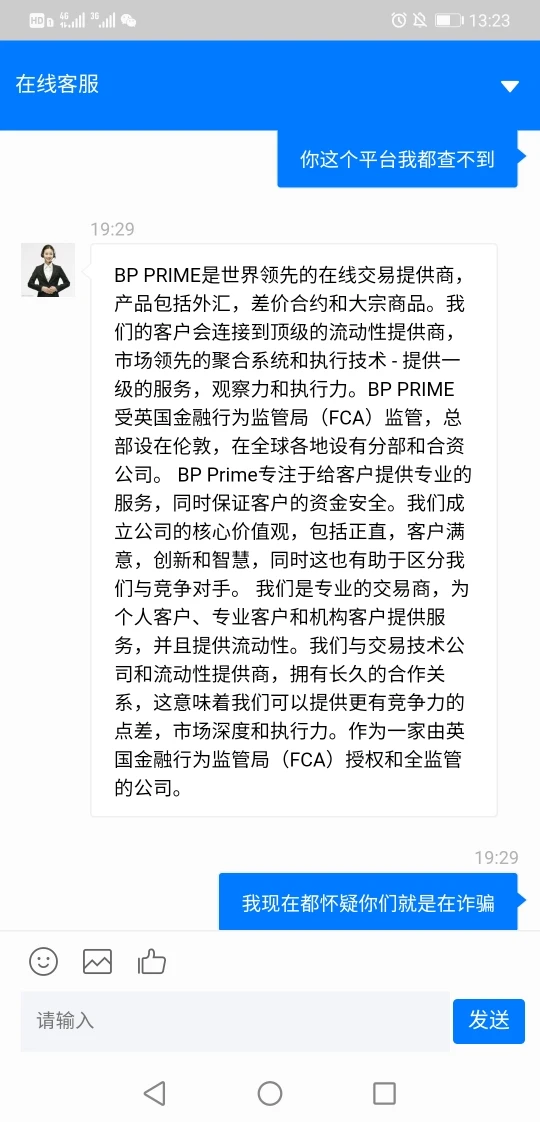

Cannot withdraw money! Is it a clone one?

Exposure

一亇亻的靜綵

Hong Kong

It has showed that the member was blocked! Is BP Prime a fraud platform?

Exposure

爱哭的晴娃娃

Hong Kong

The fraud platform prevents withdrawals and is suspected of induced fraud! ! Please deal with it!

Exposure

FX1367919021

Australia

Even though I can't read Chinese, I was able to understand that this company is actually a forex scammer! I really hope that forex traders can stay vigilant and these victims can recover their losses sooner.

Positive

FX1532132782

Hong Kong

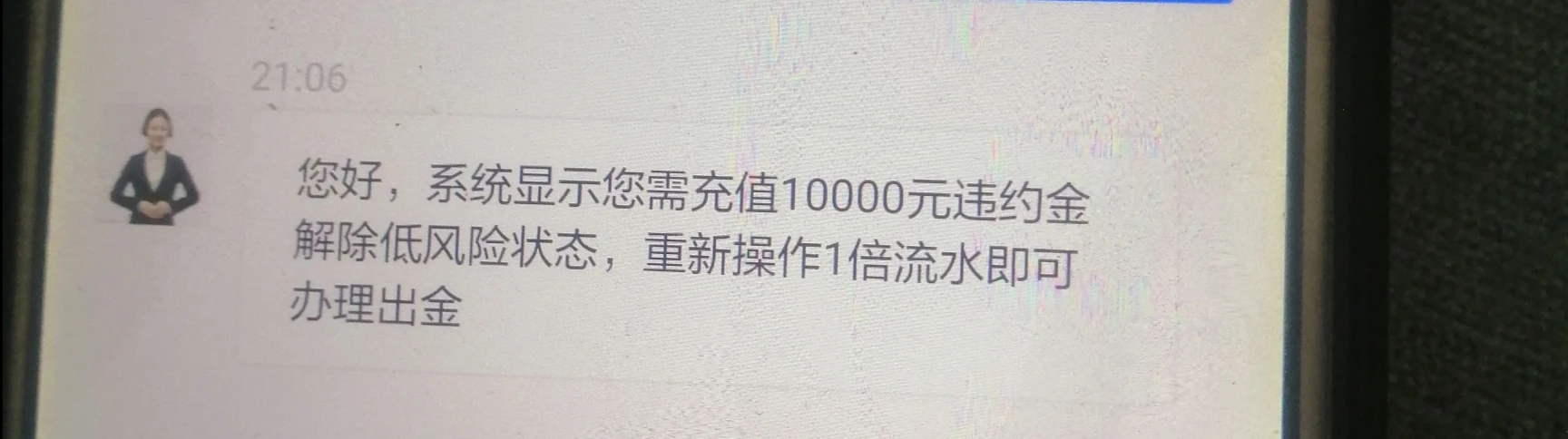

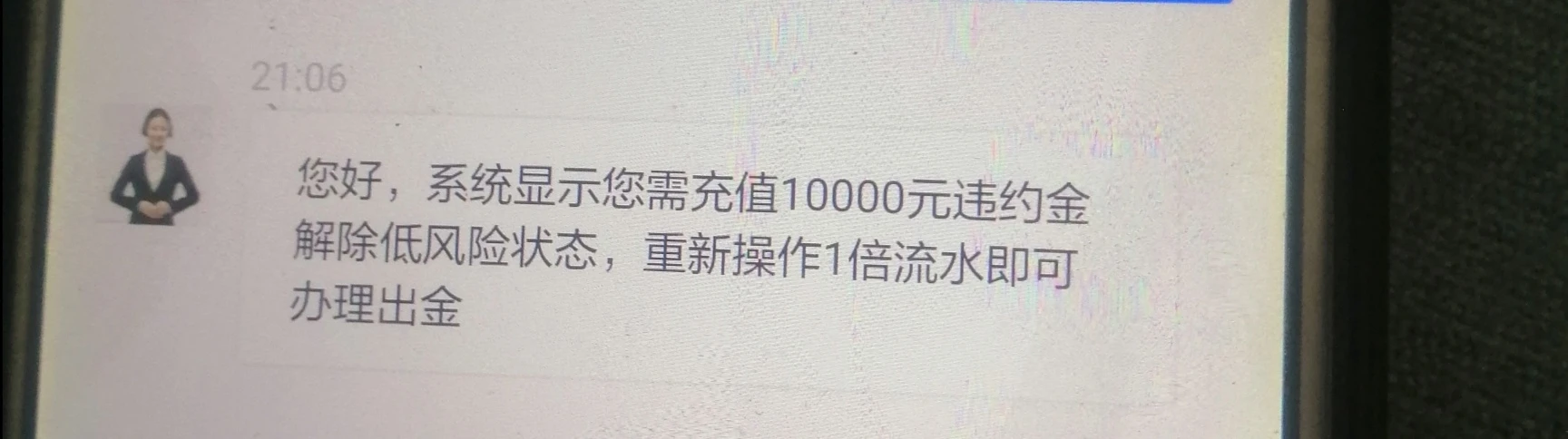

A netizen gave me the following link, informing me that there is a 7-day fixed deposit event, and 3% of the profit will be rebated every day, and then recharge 20% on the basis of the total amount of the principal of the day after the rebate to continue the rebate and the fixed deposit activity After it was over, I was told that I needed to pay 20% of the income and the tax department approved it before withdrawing it, and the platform could help or pay it to the tax department. It was too troublesome for the platform to pay more than 130,000 taxes. In the whole process of participating, I deposited more than 300,000 yuan in funds, and they were all online loans. Because I did not have much funds, this netizen helped me recharge more than 400,000 yuan (including tax payment) in total. I didn’t doubt him when I saw that he helped me recharge more than I did. On the second day after paying the tax, he said that he was a bit busy in the past few days and he might not contact me less, but he couldn't contact me on the third day. And every day I pay attention to the notifications after the platform approves the tax withdrawal so that I can repay the online loan. As a result, it is about to pass one week later, but it still shows that it is pending approval. I asked the customer service again and again and there was no reply. I suddenly realized if I was deceived by the routine? Is this website a formal platform? The investment of more than 300,000 yuan is all the various online loans I borrowed. This amount of money is the hard work of our ordinary people for half a lifetime, and we dare not let our parents know. Guiqiu for advice from experts from all walks of life, how can I recover my assets justly? Thank you so much, good people are safe and happy in their lives!

Exposure

广发银行 小余

Hong Kong

They don’t answer my questions directly.

Exposure