Mansuber007

1-2年

How do the different account types provided by LiveTrade compare to each other?

Drawing on my experience as a forex trader evaluating brokers for safety and service quality, I approached LiveTrade with a focus on its account offerings and found myself immediately confronted with concerns. LiveTrade does not appear to clearly specify traditional account types—such as standard, ECN, or demo accounts—that are standard in the forex industry. Instead, the platform describes a collection of financial services, including crypto-backed credit lines, fundraising features, and consulting, but does not clarify how these translate to differentiated trading accounts for individual or institutional clients.

In my view, the lack of transparency or published detail about different account structures, minimum deposits, trading conditions, spreads, or leverage is concerning. Properly regulated brokers usually make such information accessible for traders to compare and make informed decisions about risk and suitability. The absence of this, combined with the broker’s unregulated status and WikiFX’s explicit warnings about high risk and suspicious regulatory licensing, makes me cautious—especially considering the critical importance of broker accountability and segregated client funds.

For me, the inability to compare clear account types or obtain reliable customer support (as reflected in the user review and my own attempts) means I would not consider LiveTrade a safe or transparent choice for trading, regardless of its purported innovative services. For any trader prioritizing security and clarity, these gaps in account information pose significant risks.

Broker Issues

Instruments

Account

Leverage

Platform

ritzyshona

1-2年

Is it possible to deposit funds into my LiveTrade account with cryptocurrencies such as Bitcoin or USDT?

As someone who has evaluated numerous brokers over the years, I always start by prioritizing regulatory status and transparent information when considering any financial service, especially those in the crypto and forex space. With LiveTrade, what stood out immediately for me was that they are unregulated and carry a "high potential risk" warning. Their business appears to center on crypto-related services, such as instant crypto credit lines and lending products that leverage digital assets, which suggests that cryptocurrencies like Bitcoin or USDT are likely integral to their operations.

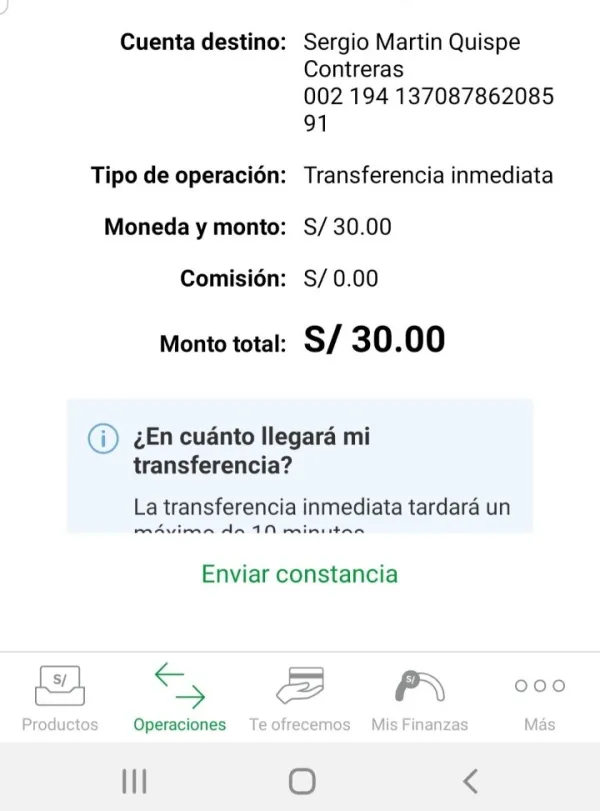

However, given that there is no valid regulatory oversight and a specific user review referencing poor service and lack of response from LiveTrade, I personally approach any funding process—especially with irreversible crypto assets—with extra caution. From my investigation, LiveTrade mentions offering loans collateralized by multiple cryptocurrencies and tailoring their services to digital assets. While this implies that depositing via Bitcoin or USDT should be possible, I have not seen explicit, up-to-date guidance or detailed deposit instructions directly from their side.

In my experience, I would not proceed with funding an account, particularly via crypto, on a platform with such a high risk profile and absent regulatory protection, unless absolute clarity and responsive customer support are demonstrated. For anyone considering this, I strongly recommend reaching out to their official support channels for explicit confirmation before taking any financial step, and consider the inherent risks before moving forward.

Broker Issues

Withdrawal

Deposit

Aman A

1-2年

In what ways does LiveTrade’s regulatory status help safeguard my funds?

As a trader who is always diligent about assessing broker risk, I need to be clear that, based on all my research and hands-on experience, LiveTrade’s current regulatory status does not provide safeguards for my funds. The firm is not regulated by any recognized financial authority, and WikiFX explicitly flags their regulatory license as suspicious with a high potential risk warning. In my trading journey, I have learned that regulatory oversight is not just a formality—it establishes mechanisms for fund protection, ensures the reliability of withdrawal processes, and offers recourse in case of disputes. Without any such regulation, LiveTrade does not offer these critical layers of security. For me, this lack of oversight is a significant concern, as it means there is no independent body monitoring the broker’s actions or holding them accountable to industry standards. Especially with financial products involving crypto credit, lending, or asset management, the absence of regulation magnifies potential risks. My conservative approach leads me to prioritize brokers with transparent regulatory histories because they help build genuine trust and set clear operational boundaries. With LiveTrade, I did not find this confidence due to its current unregulated status.

maseko

1-2年

Can you outline the main benefits of LiveTrade in terms of its available trading instruments and how its fee structure compares?

In my own experience and after investigating LiveTrade, I must approach its offerings with considerable caution. LiveTrade is not regulated by any recognized financial authority, which significantly increases the level of risk for traders—especially compared to other brokers I’ve used that are under established regulatory oversight. While LiveTrade highlights a range of services, such as instant crypto credit lines, fundraising through security-based tokens, and lending or borrowing tied to real estate and digital assets, these features fall outside the standard forex and CFD trading instruments that many traders might expect. For me, this unconventional business scope makes it difficult to assess trading-specific advantages, including access to currency pairs or traditional assets.

Another important consideration is the absence of clear information on trading fees, commissions, or spreads. Transparent cost structures are crucial for prudent financial planning and risk management. Without regulatory oversight and explicit fee disclosures, it’s challenging for me to gauge overall trading costs or compare them fairly to regulated brokers, where such disclosures are mandatory. Based on my experience, this opacity, combined with a high-risk label and warnings from independent reviews, means I personally would not be comfortable allocating significant capital or recommending LiveTrade for those seeking reliable, well-understood trading conditions. As always, I strongly advise others to prioritize regulated platforms with transparent fee structures to protect both their investments and peace of mind.