公司簡介

| 平証香港 評論摘要 | |

| 成立年份 | 2006 |

| 註冊地區/國家 | 香港 |

| 監管機構 | SFC |

| 產品與服務 | 企業融資與資本市場、全球股票、全球期貨、資產管理 |

| 模擬帳戶 | ❌ |

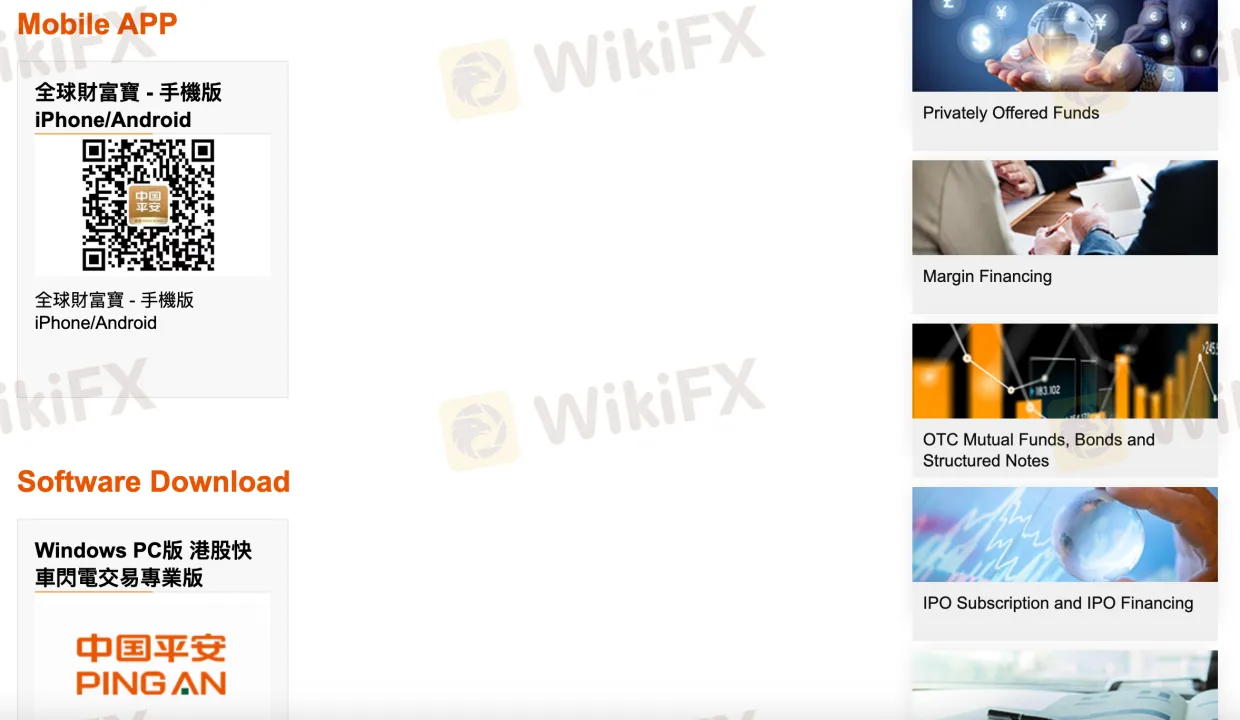

| 交易平台 | 全球財富寶 Mobile App、港股快車閃電交易專業版 (Windows) |

| 客戶支援 | 電話(香港):+852 3762 9688 |

| 電話(中國):+86 400 841 1061 | |

| 電郵:cs.pacshk@pingan.com | |

| 傳真:+852 3762 9668 | |

平証香港 資訊

專門從事期貨交易和投資服務的Ping An of China Securities (Hong Kong) Company Limited(“平証香港”)是平安證券有限公司的首家全資海外子公司(深圳總部成立於1991年8月)。它是香港SFC監管的許可金融機構。其專有平台和實體開戶流程包括保證金融資、私募基金訪問和首次公開募股解決方案。

優缺點

| 優點 | 缺點 |

| 香港SFC監管 | 沒有模擬帳戶或伊斯蘭帳戶 |

| 可訪問私募基金和結構性投資工具 | 僅限於親自開戶 |

| 提供移動和PC交易平台 | 不支援Mac或基於瀏覽器的交易 |

平証香港 是否合法?

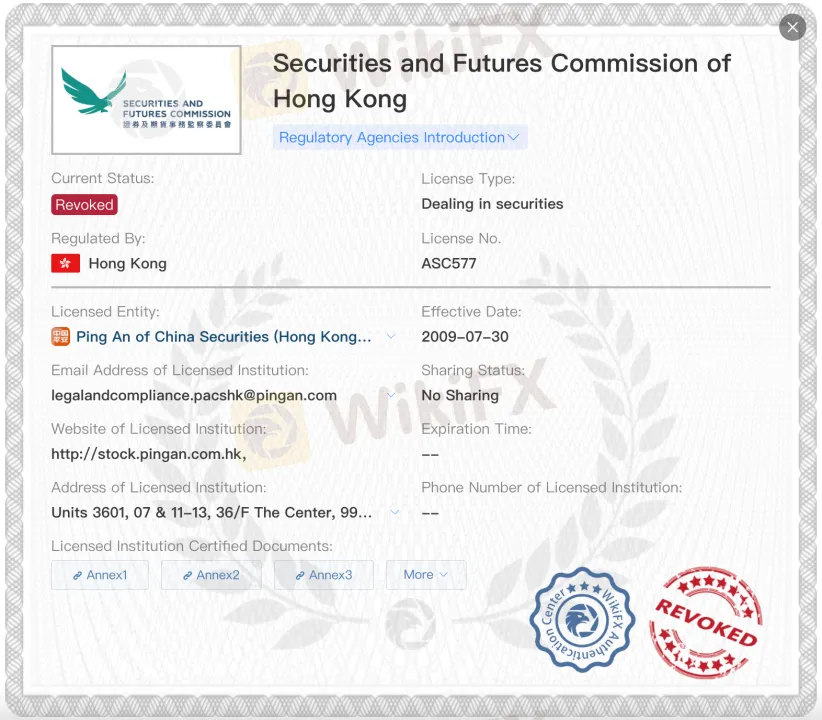

是的,平証香港受到監管。香港證券及期貨事務監察委員會(SFC)自2012年3月30日起授予其期貨合約交易許可證號碼AXR954。

然而,中國平安證券(香港)的證券交易牌照(牌照號碼ASC577)已被撤銷。在確認平安集團的服務或業務時,這種差異至關重要。

平証香港 可以交易什麼?

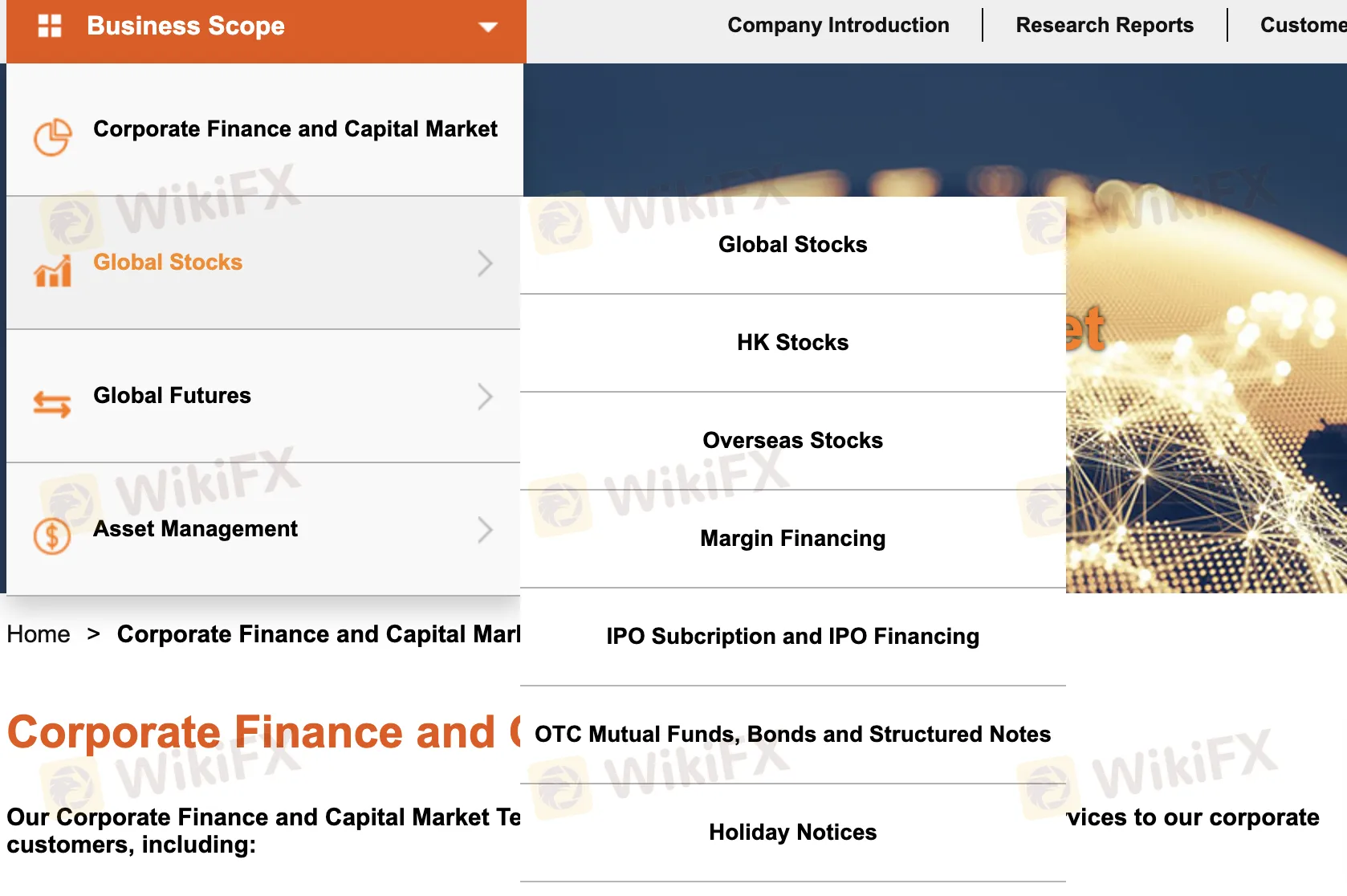

平証香港 提供廣泛的金融產品和服務,包括企業融資解決方案、全球證券交易、期貨和期權,以及資產管理。

| 類別 | 提供的產品/服務 |

| 企業融資與資本市場 | 首次公開募股贊助和承銷 |

| 債券和優先股發行 | |

| 可轉換債券發行 | |

| 二級市場配售 | |

| 併購財務諮詢 | |

| 私募股權 | |

| 全球股票 | 香港股票 |

| 海外/全球股票 | |

| 保證金融資 | |

| 首次公開募股認購和融資 | |

| 場外基金 | |

| 場外債券 | |

| 場外結構性產品 | |

| 全球期貨 | 香港期貨和期權 |

| 全球期貨 | |

| 資產管理 | 私募基金 |

帳戶類型

平証香港 提供兩種即時交易帳戶:企業帳戶和個人/聯名帳戶。不提供伊斯蘭(無掉期)帳戶或模擬帳戶。開立帳戶需親自辦理;每種帳戶類型均根據個人或機構需求進行定制。

| 帳戶類型 | 描述 | 適合對象 |

| 個人/聯名 | 適合親自開立的個人或聯名投資者 | 零售或私人投資者 |

| 企業 | 適合公司或機構投資者 | 企業或法人實體 |

| 模擬帳戶 | 不提供 | — |

| 伊斯蘭帳戶 | 不提供 | — |

交易平台

| 交易平台 | 支援 | 可用設備 | 適合何種交易者 |

| 全球財富寶手機應用程式 | ✅ | iOS、Android(智能手機) | 尋求便利的移動焦點交易者 |

| 港股快車閃電交易專業版(Windows PC 版本) | ✅️ | Windows PC | 需要桌面工具的專業交易者 |

| Mac 版本 | ❌ | — | 不支援 |

| 基於網頁的平台 | ❌ | — | 不支援 |

存款和提款

平証香港 不收取提款或存款費用。所有轉帳必須從/至註冊銀行帳戶進行;不允許第三方或現金存款。

存款選項

| 存款方式 | 最低存款額 | 費用 | 處理時間 |

| 中銀子賬戶(客戶特定) | 未提及 | 免費 | 1–2 個工作天 |

| 滙豐 / 渣打 / 中銀帳戶 | 未提及 | 免費 | 1–2 個工作天 |

提款選項

| 提款方式 | 最低提款額 | 費用 | 處理時間 |

| 至註冊銀行帳戶 | 未提及 | 免費 | 1–2 個工作天 |

| 至非註冊銀行帳戶(透過表格) | 未提及 | 免費 | 1–3 個工作天 |