公司簡介

| CXMarkets 檢討摘要 | |

| 成立年份 | 1999 |

| 註冊國家/地區 | 美國 |

| 監管 | 無監管 |

| 市場工具 | 與天氣相關的金融保護產品 |

| 客戶支援 | 星期一至星期五,東部時間上午9:00至下午5:00 |

| 電話:+1 877-300-4555;+1 212-829-5455 | |

| 電郵:customerservice@cantorexchange.com | |

CXMarkets 資訊

CXMarket 是一家無監管的經紀商,提供專門用於交易與天氣相關的金融產品的平台,包括雨量、降雪、溫度和登陸合約。他們提供各種費率表,申請、存款或提款均不收取費用。

優缺點

| 優點 | 缺點 |

| 無申請或存取/提款費用 | 缺乏監管 |

| 針對天氣風險的特定產品 | |

| 操作時間長 | |

| 多種客戶支援渠道 |

CXMarkets 是否合法?

CXMarkets 是一家無監管的經紀商。WHOIS 搜尋顯示域名 cxmarkets.com 於1999年8月2日註冊。目前狀態為“客戶轉移禁止”,這表示該域名已鎖定,無法轉移到另一個註冊商。因此,請注意風險!

CXMarkets 產品和市場

CXMarkets 提供了一個交易平台和 API 存取權,用於與天氣相關的金融保護產品,提供市場信息、交易執行和結算/交收服務。

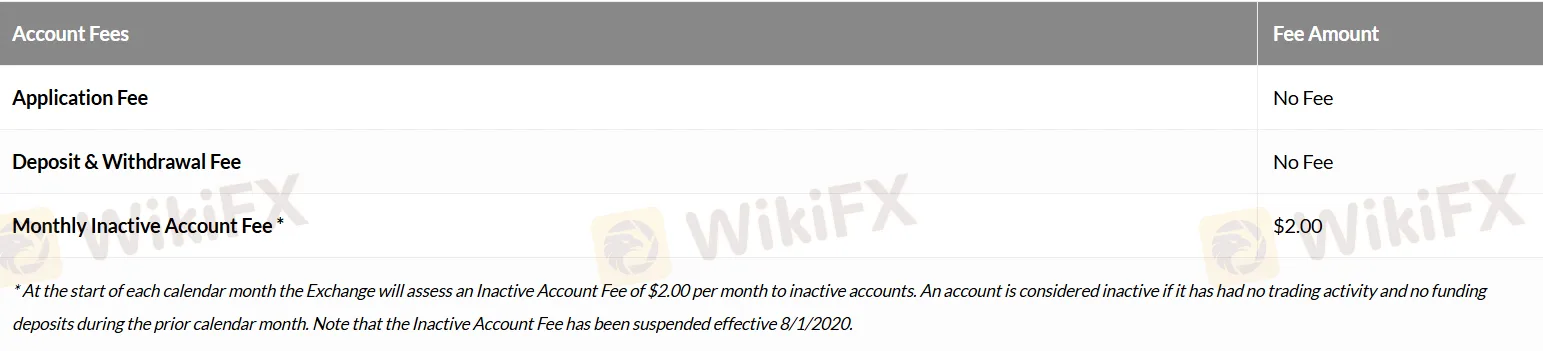

CXMarkets 費用

- 一般費用表

| 費用類型 | 費用金額 |

| 申請費 | ❌ |

| 存款和提款費 | ❌ |

| 月度不活躍帳戶費 | $2(2020年8月1日後暫停) |

- 每週雨市場費用表

| 交易費(所有已完成交易) | 費用金額(每份合約) |

| 執行買單 | ❌ |

| 執行賣單 | $0.02 |

| 結算費(所有合約結算時的所有持倉) | 費用金額(每份合約) |

| 所有結算 | ❌ |

- 外匯和金屬市場以及每月雨市場費用表

| 交易費(所有已完成交易) | 費用金額(每份合約) |

| 所有市價訂單 | ❌ |

| 執行市價的限價訂單 | ❌ |

| 其他限價訂單 | $0.01 |

| 結算費(所有合約到期時的所有持倉) | 費用金額(每份合約) |

| 虧損結算 | ❌ |

| 盈利結算 | $0.01 |

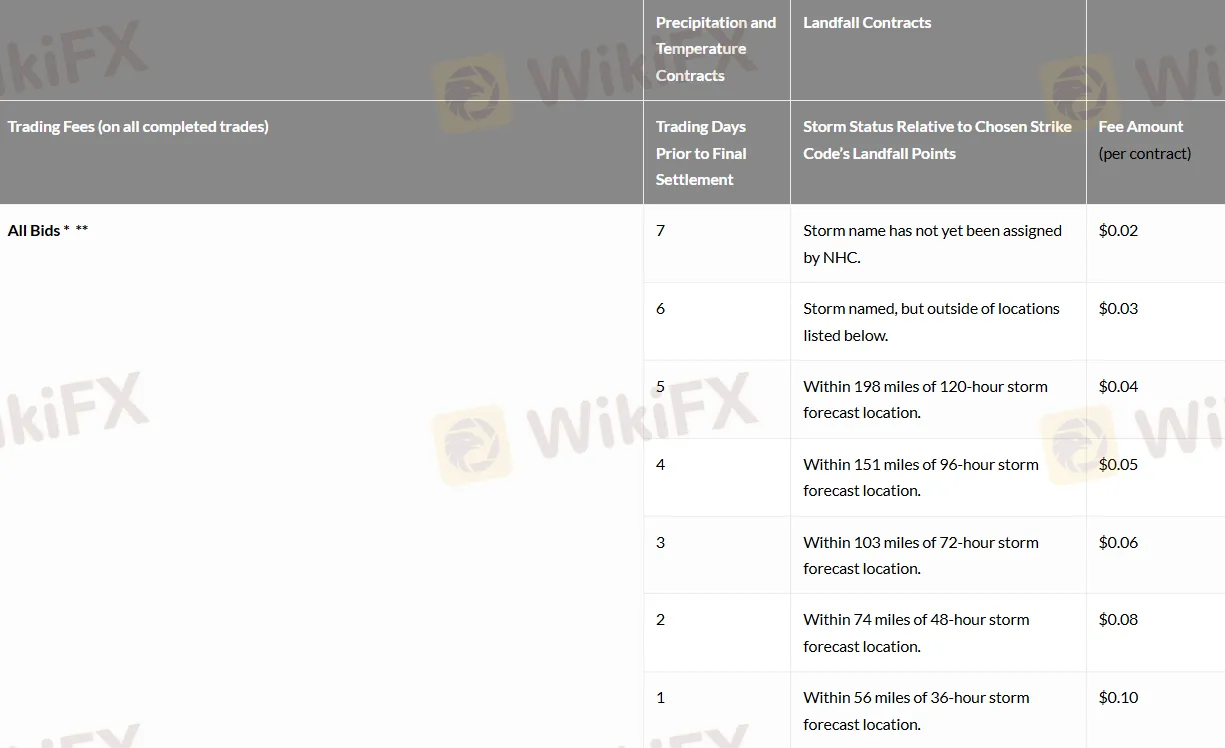

- 每日雨、雪、溫度和登陸市場費用表:

| 交易費(所有已完成交易) | 降水和溫度合約:最終結算前的交易日 | 登陸合約:風暴狀態相對於所選擊中代碼的登陸點 | 費用金額(每份合約) |

| 所有出價 ** | 7 | 尚未由 NHC 指定風暴名稱 | $0.02 |

| 6 | 已命名風暴,但在下列位置之外 | $0.03 | |

| 5 | 在預測風暴位置的 198 英里內 | $0.04 | |

| 4 | 在預測風暴位置的 151 英里內 | $0.05 | |

| 3 | 在預測風暴位置的 103 英里內 | $0.06 | |

| 2 | 在預測風暴位置的 74 英里內 | $0.08 | |

| 1 | 在預測風暴位置的 56 英里內 | $0.10 |