基礎資訊

南非

南非

天眼評分

南非

|

2-5年

|

南非

|

2-5年

| https://eacapital.co.za/

官方網址

評分指數

MT4/5鑒定

主標

OverseaCapitalMarkets-Demo

影響力

D

影響力指數 NO.1

尼日利亞 2.36

尼日利亞 2.36

MT4/5鑒定

主標

英國

英國影響力

D

影響力指數 NO.1

尼日利亞 2.36

尼日利亞 2.36 監管資訊

監管資訊持牌機構:EA CAPITAL (PTY) LTD

監管證號:49425

南非

南非

正規的主標MT4/5交易商會有健全的系統服務與後續技術支持,一般情況下業務和技術都較為成熟、風險控制能力較強

eacapital.co.za

eacapital.co.za 南非

南非

| Aspect | 資訊 |

| 公司名稱 | EA Capital |

| 註冊國家/地區 | 南非 |

| 成立年份 | 2023 |

| 監管 | 由金融行業行為監管局(可疑克隆)監管 |

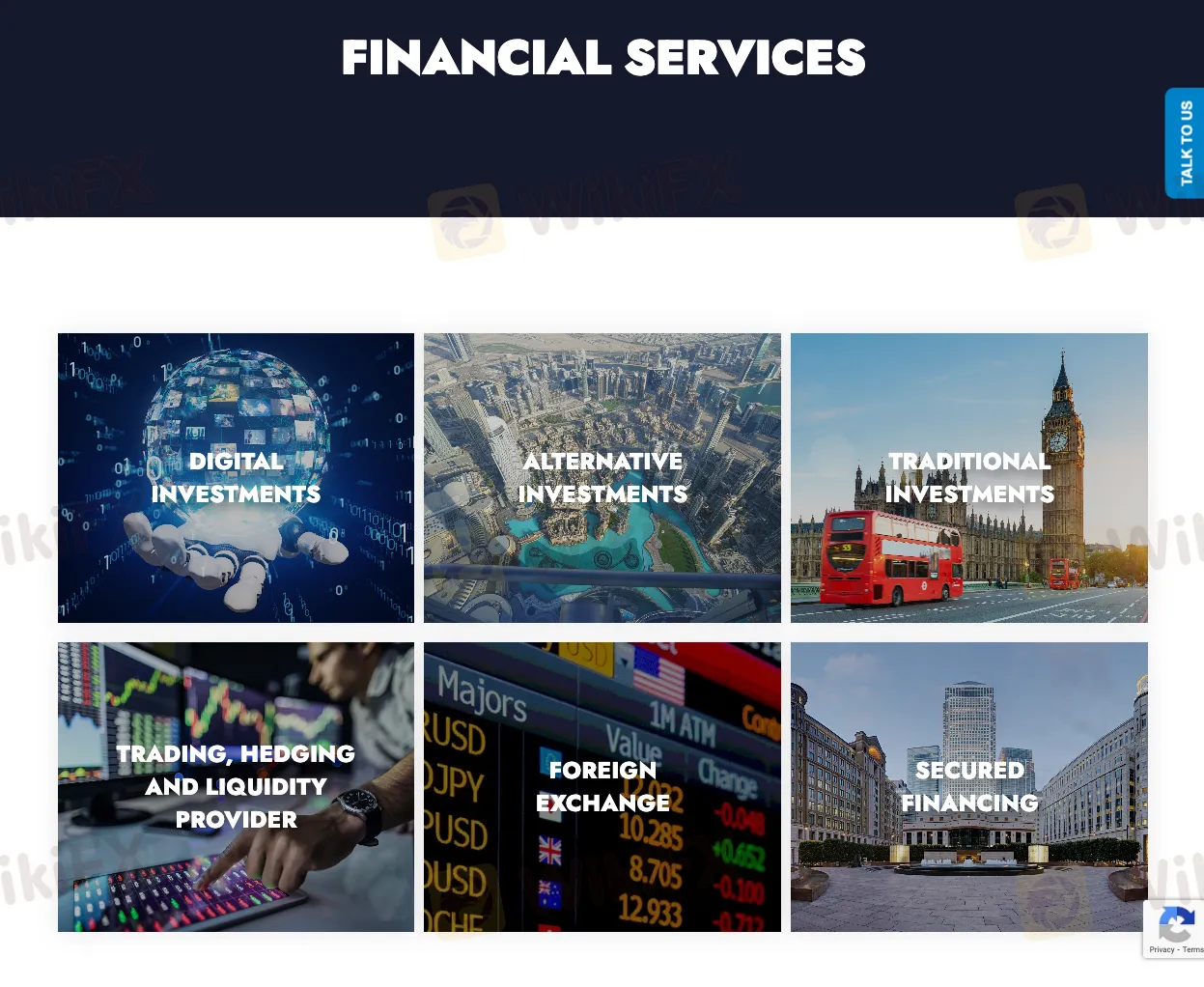

| 市場工具 | 加密貨幣、數字資產、替代、傳統投資、交易、對沖、流動性提供者、外匯、擔保融資 |

| 帳戶類型 | N/A |

| 交易平台 | N/A |

| 客戶支援 | 電話:+27 (83) 2553014、+27 (84) 3905157,電子郵件:info@eacapital.co.za |

| 存款和提款 | N/A |

EA Capital成立於2023年,總部位於南非,作為一個金融平台,提供包括加密貨幣、數字資產、替代、傳統投資等多種市場工具。該公司受金融行業行為監管局監管,其被標記為“可疑克隆”引發了對其合規性的質疑。

EA Capital (PTY) LTD在南非的管轄下,並受金融行業行為監管局監管,持有金融服務公司許可證,許可證編號為49425,於2018年10月9日獲得。

然而,作為一個“可疑克隆”,目前的狀態立即引發了對該平台合法性的問題。

| 優點 | 缺點 |

| 多種資產服務 | 監管狀態-“可疑克隆” |

| 多渠道客戶支援 | 有限的信息透明度 |

優點:

缺點:

EA Capital提供多元化的交易資產,涵蓋各個類別。在數字領域內,用戶可以探索數字投資的機會,利用數字資產的動態風景。

對於那些尋求非傳統途徑的人,EA Capital提供替代投資的機會,使用戶能夠在傳統選項之外實現投資組合的多樣化。同時,傳統投資者可以通過傳統投資參與更傳統的市場,利用已建立的行業。

EA Capital 為交易者提供交易、對沖和流動性提供者服務,增強管理投資策略的靈活性。該平台深入探索外匯的動態領域,使用戶可以參與全球貨幣市場。

此外,EA Capital 還提供擔保融資的選擇,為用戶提供以擔保物獲取資金的機會。這種全面的交易資產組合反映了EA Capital對各種投資者偏好和策略的承諾,包括傳統和創新的金融工具。

EA Capital 通過多個渠道提供客戶支援,包括電話聯繫:+27 (83) 2553014 和 +27 (84) 3905157,直接為用戶提供協助。此外,用戶還可以通過電子郵件info@eacapital.co.za聯繫進行查詢或支援相關事宜。位於南非開普敦克利夫頓維多利亞路52號San Michelle 401的實體地址進一步建立了一個切實的聯繫點。

總之,EA Capital 提供了一個範圍廣泛的投資服務和多渠道客戶支援的平台。然而,“可疑克隆”監管狀態和有限的信息透明度帶來了顯著的挑戰,可能影響用戶的信心。

EA Capital 是否受到監管?

是的,EA Capital 受到金融行業行為監管機構(可疑克隆)的監管。

如何聯繫 EA Capital 的客戶支援?

通過電話 +27 (83) 2553014 或 +27 (84) 3905157 聯繫 EA Capital 的客戶支援,或通過電子郵件 info@eacapital.co.za 聯繫。

EA Capital 提供哪些投資服務?

EA Capital 提供多種投資服務,涵蓋多個資產類別。

From my hands-on research and experience evaluating brokers, I always approach withdrawal policies cautiously, especially with firms like EA Capital that present several regulatory concerns. Based on the information I found, EA Capital does not provide clear, public details about its payment methods or withdrawal timelines on its website. This lack of transparency is a notable red flag for me as a trader, because it becomes extremely difficult to verify whether immediate—or even timely—withdrawals are realistically available. In my experience, legitimate and trustworthy brokers generally make their deposit and withdrawal methods, as well as expected processing times, very clear to clients before any funds are deposited. With EA Capital, I couldn't easily locate any such disclosures. The broker's regulatory status is also marked as a "suspicious clone," which makes me extra wary of potential withdrawal delays or complications. For me, the combination of a suspicious regulatory license and insufficient payment method transparency means I cannot confidently recommend EA Capital as a venue offering immediate withdrawals, or even reliable withdrawals at all. In my trading, I only engage with platforms where funds access is predictable, documented, and fully regulated. Given what I know about EA Capital, I recommend exercising great caution and waiting for concrete, independently-verified details before considering funding an account.

As an experienced forex trader who puts a premium on security and regulatory transparency, my evaluation of EA Capital is cautious and measured. While EA Capital offers access to various instruments like digital assets, forex, and alternative investments, there are several critical red flags that cannot be ignored. The most pressing concern for me is the broker’s regulatory status. Although EA Capital claims FSCA regulation under license number 49425, WikiFX identifies this as a “suspicious clone.” This means the license information does not match up with recognized regulatory standards, potentially exposing clients to greater risk. In my trading journey, I have learned that a broker's regulatory legitimacy is not just a formality—it is essential for safeguarding funds, ensuring fair trading conditions, and providing recourse in case of disputes. When a license is listed as “suspicious” or unverified, as in EA Capital’s case, it raises doubts about the platform’s oversight and accountability mechanisms. I also noticed the broker scores extremely low on independent assessments, and its online presence is limited by sparse information on its official website. The only available user review described an attentive support experience, but a single, neutral review is not enough for me to feel assured about the broker’s overall reliability, especially considering the high potential risk highlighted in the risk ratings. For me, a solid track record, verifiable regulation, and a transparent business model are non-negotiables. Due to these concerns, I personally would not be comfortable entrusting my funds to EA Capital at this time, especially given the availability of well-regulated alternatives.

Based on my research and experience reviewing trading platforms, I found that EA Capital does not provide transparent details about its spread structure—whether fixed or variable—on its official channels. This lack of clarity is already a warning sign for me, since spreads are a fundamental consideration for any trading strategy, especially in fast-moving forex environments. In general, brokers offering MT4 and MT5 typically provide variable spreads, particularly those servicing multiple asset classes and promising liquidity provision like EA Capital claims. What truly concerns me, however, is not just the absence of defined spread information, but the multiple high-risk flags associated with EA Capital itself. Its regulatory license is marked as a "suspicious clone," and the platform’s overall score is extremely low. In my personal trading experience, brokers with weak or questionable regulatory backing often have wide, unpredictable spreads that can significantly worsen during news-driven volatility. If past patterns in the industry hold true here, it is reasonable to expect that spreads at EA Capital could expand sharply when markets become volatile—potentially resulting in higher trading costs and slippage. Given these uncertainties and risk indicators, I personally would avoid trading with EA Capital until its basic trading conditions, such as spread type and behavior under market stress, are clarified and properly verified by reliable oversight. For traders who value stability and transparency—especially during major news events—using a broker with proven regulatory compliance and explicit cost disclosures is, in my opinion, the safer route.

Based on my experience as a forex trader and what I can gather about EA Capital, I would proceed with caution before expecting a straightforward withdrawal process. Given EA Capital’s “suspicious clone” regulatory status and the high potential risk indicated in the information available, I would prepare for requirements that are standard in the industry, but I would also remain alert for possible complications or requests that go beyond the usual. Typically, for an initial withdrawal, a broker will require personal identification documents, such as a government-issued ID (e.g., passport or national ID card) and a recent proof of address (like a utility bill or bank statement). Additionally, if I deposited funds using cards or bank transfers, brokers commonly ask for copies of the payment method (with sensitive details concealed for security). These documents serve to satisfy anti-money laundering (AML) and know-your-customer (KYC) procedures, both of which are industry best practices. However, because EA Capital’s regulatory credibility is in question—specifically, the license noted appears to be a suspicious clone—I would exercise extra care. I would only submit necessary, carefully redacted documents after confirming details directly with their official channels, and I’d document every interaction. I would avoid sharing more information than is industry standard, as an extra measure of self-protection. For me, being cautious with document submission is essential, especially when the broker’s regulatory situation is not fully transparent or reliable.

請輸入...