公司簡介

| Connexar Capital Review Summary | |

| 成立年份 | 2022 |

| 註冊國家/地區 | 科摩羅 |

| 監管 | 未受監管 |

| 市場工具 | 外匯、貴金屬、指數、差價合約、加密貨幣 |

| 模擬帳戶 | ✔ |

| 槓桿 | 最高1:400 |

| 點差 | 從0.2點 |

| 交易平台 | MT5(Windows、Mac、Android、iOS) |

| 最低存款 | $50(Ultra帳戶) |

| 客戶支援 | 電話:+44 7308642365 |

| 電郵:support@connexarcapital.com | |

| 24/7 在線聊天:可用 | |

Connexar Capital 資訊

Connexar Capital 成立於2022年。它提供多種交易可能性,包括外匯、差價合約、指數和加密貨幣。他們的MT5系統支援多種設備,並提供三種不同的帳戶類型以滿足交易者的不同偏好。最低存款要求為$50。

優點與缺點

| 優點 | 缺點 |

| 包括外匯和差價合約在內的多種工具 | 未受監管 |

| 低最低存款要求$50 | 只提供一個交易平台:MT5 |

| 提供3種不同的帳戶類型 | |

| 提供最高1:400的槓桿 | |

| 提供獎金計劃 |

Connexar Capital 是否合法?

Connexar Capital 是一個未受監管的平台。

我可以在 Connexar Capital 上交易什麼?

Connexar Capital 提供多種交易工具,包括主要、次要和異國貨幣對、貴金屬、指數和差價合約。

| 可交易工具 | 支援 |

| 外匯 | ✔ |

| 貴金屬 | ✔ |

| 指數 | ✔ |

| 差價合約 | ✔ |

| 加密貨幣 | ✔ |

| 股票 | ❌ |

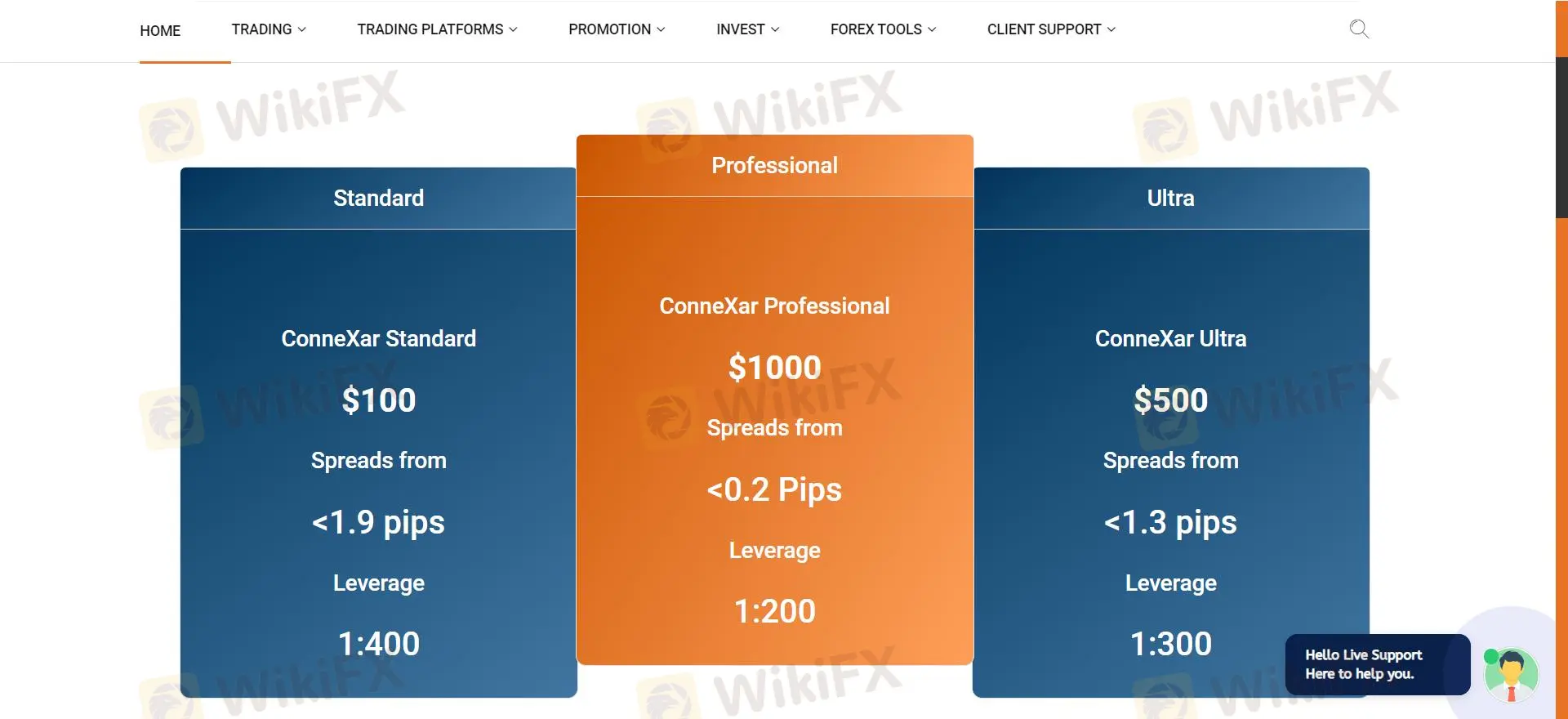

帳戶類型

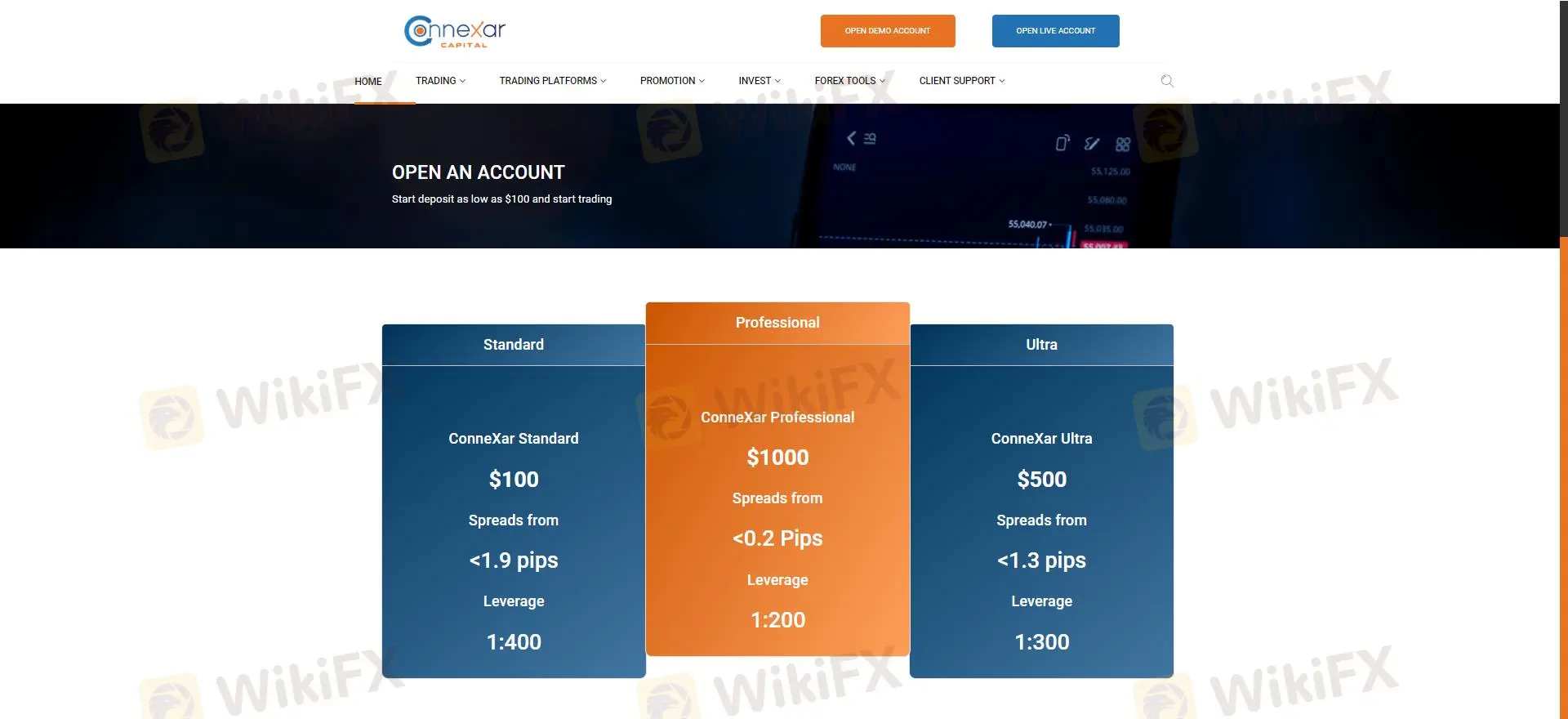

Connexar Capital 提供3種帳戶類型,針對不同層次的交易者設計。

| 帳戶類型 | 最低存款 | 點差 | 槓桿 | 其他特點 |

| 標準帳戶 | $100 | 從1.9點 | 最高1:400 | 無掉期利息、MT5 |

| 專業帳戶 | $1,000 | 從0.2點 | 最高1:200 | ECN執行、MT5 |

| 超級帳戶 | $500 | 從1.3點 | 最高1:300 | PAMM/MAM支援 |

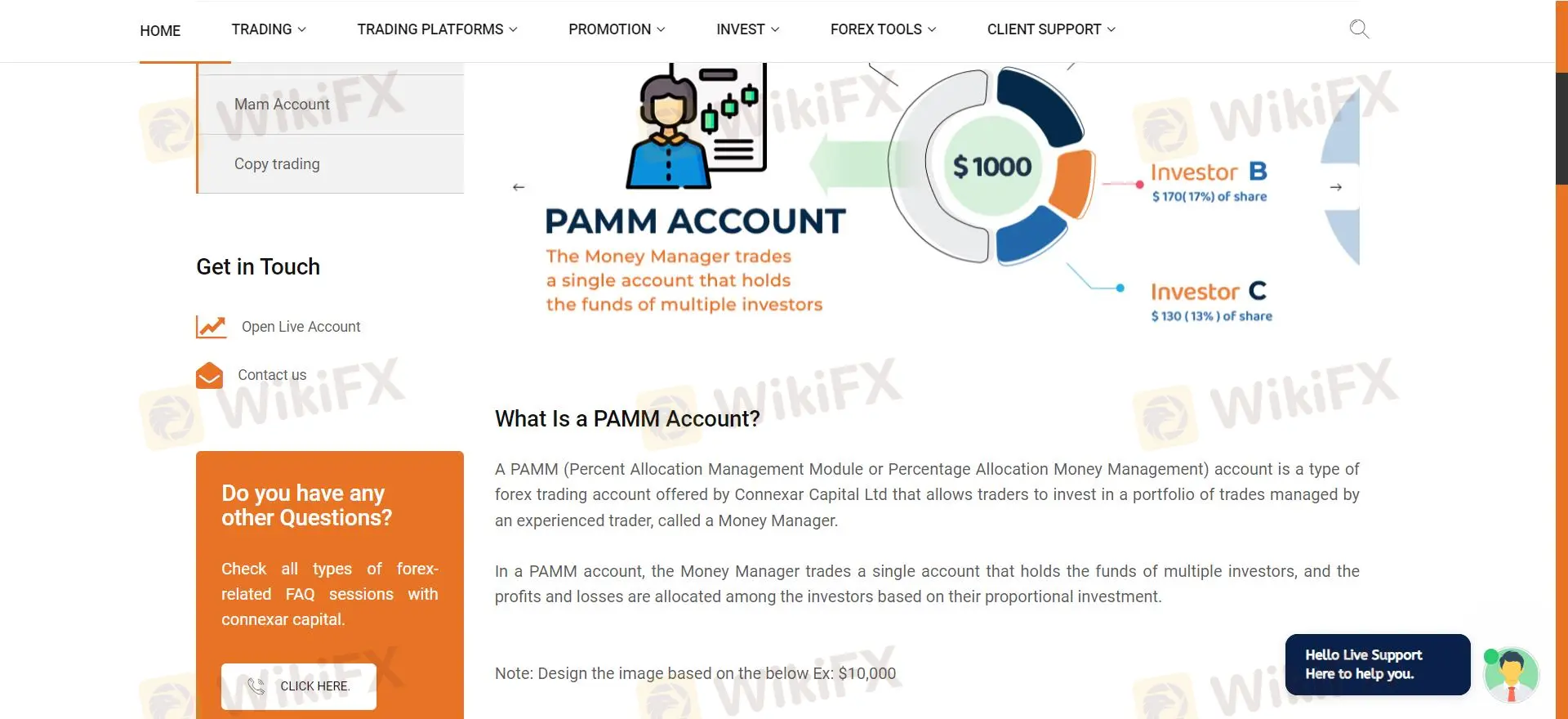

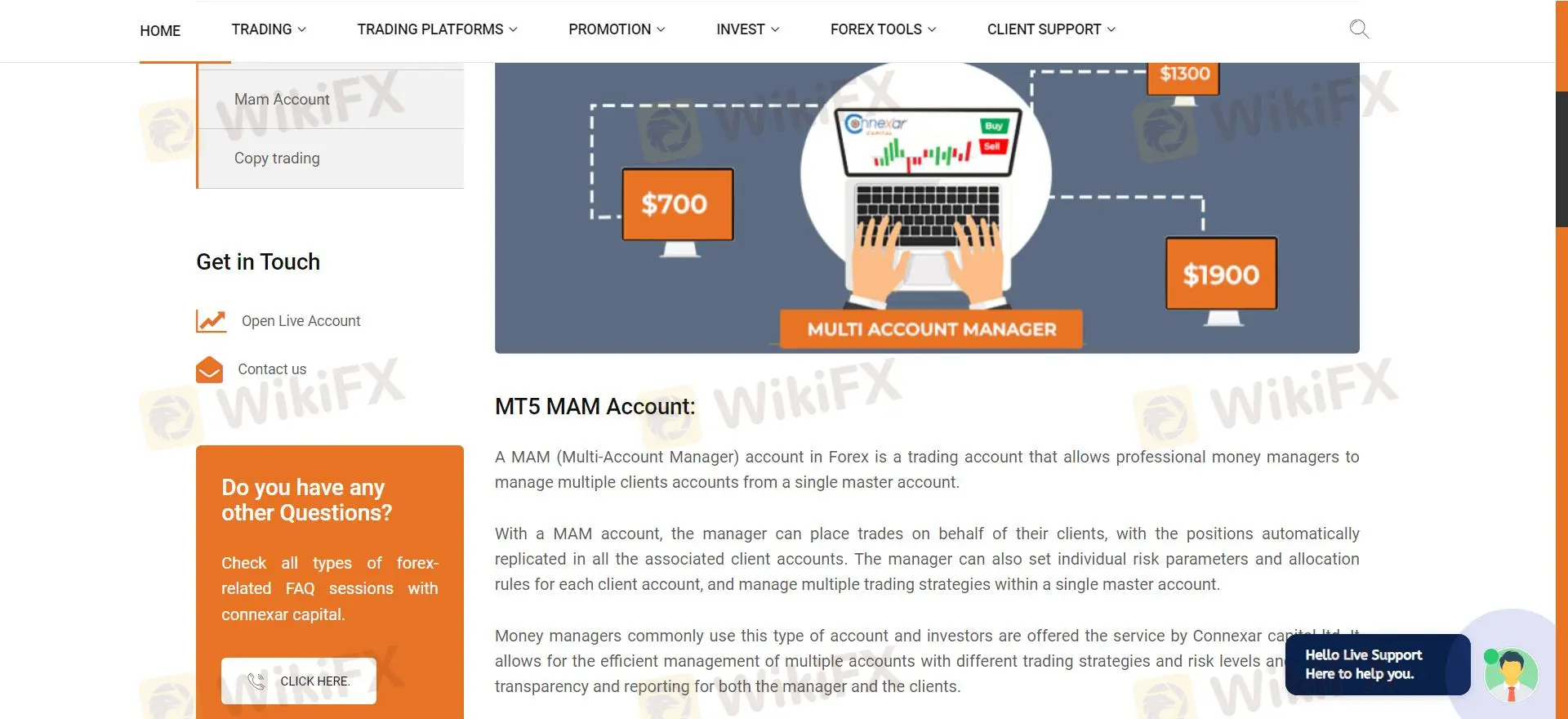

同時,它還提供PAMM帳戶和MAM帳戶。

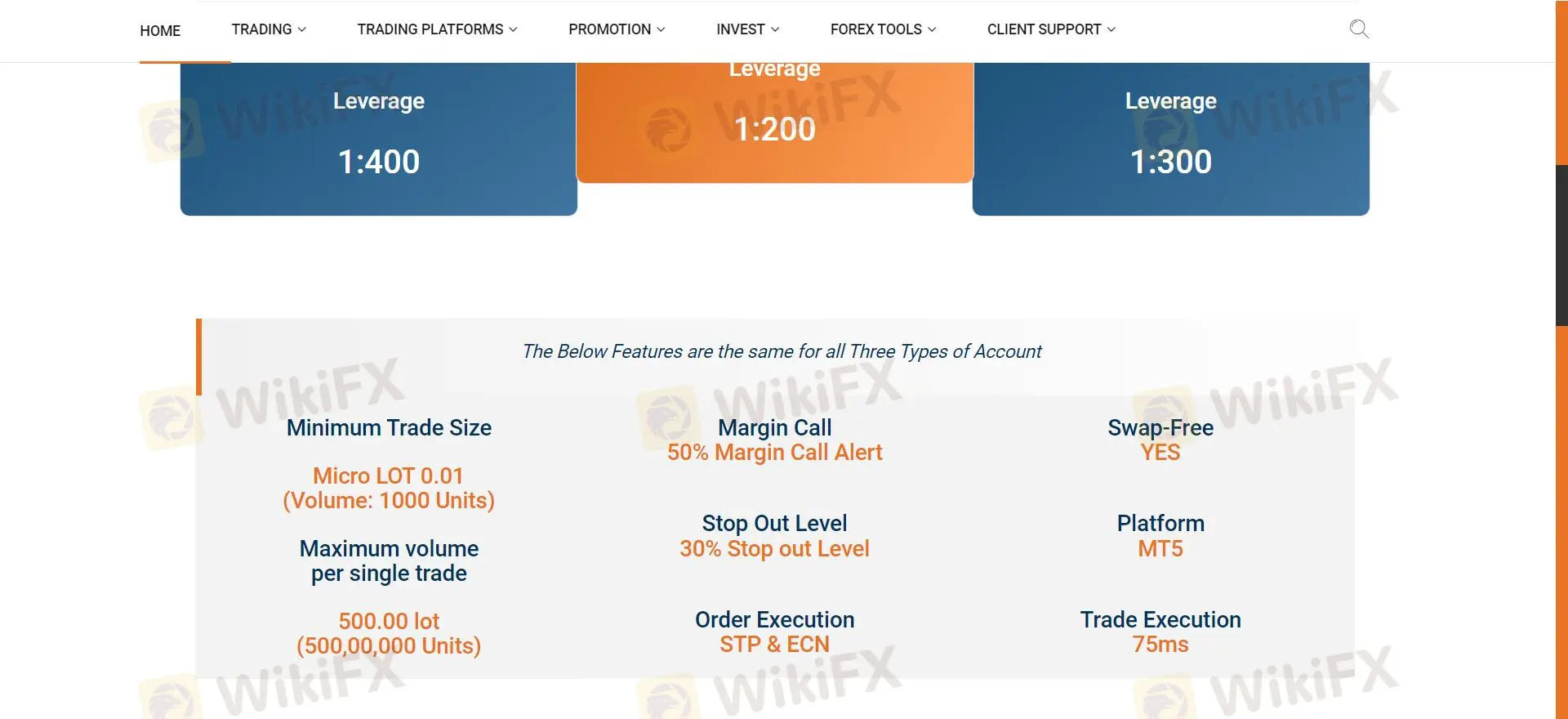

槓桿

Connexar Capital 提供1:200至1:400的槓桿。

| 帳戶類型 | 最大槓桿 |

| Connexar STD | 1:400 |

| Connexar ECN | 1:200 |

| Connexar PRO | 1:300 |

Connexar Capital 費用

Connexar Capital 提供三種不同點差、佣金和掉期成本的帳戶選項。以下是詳細的分析:

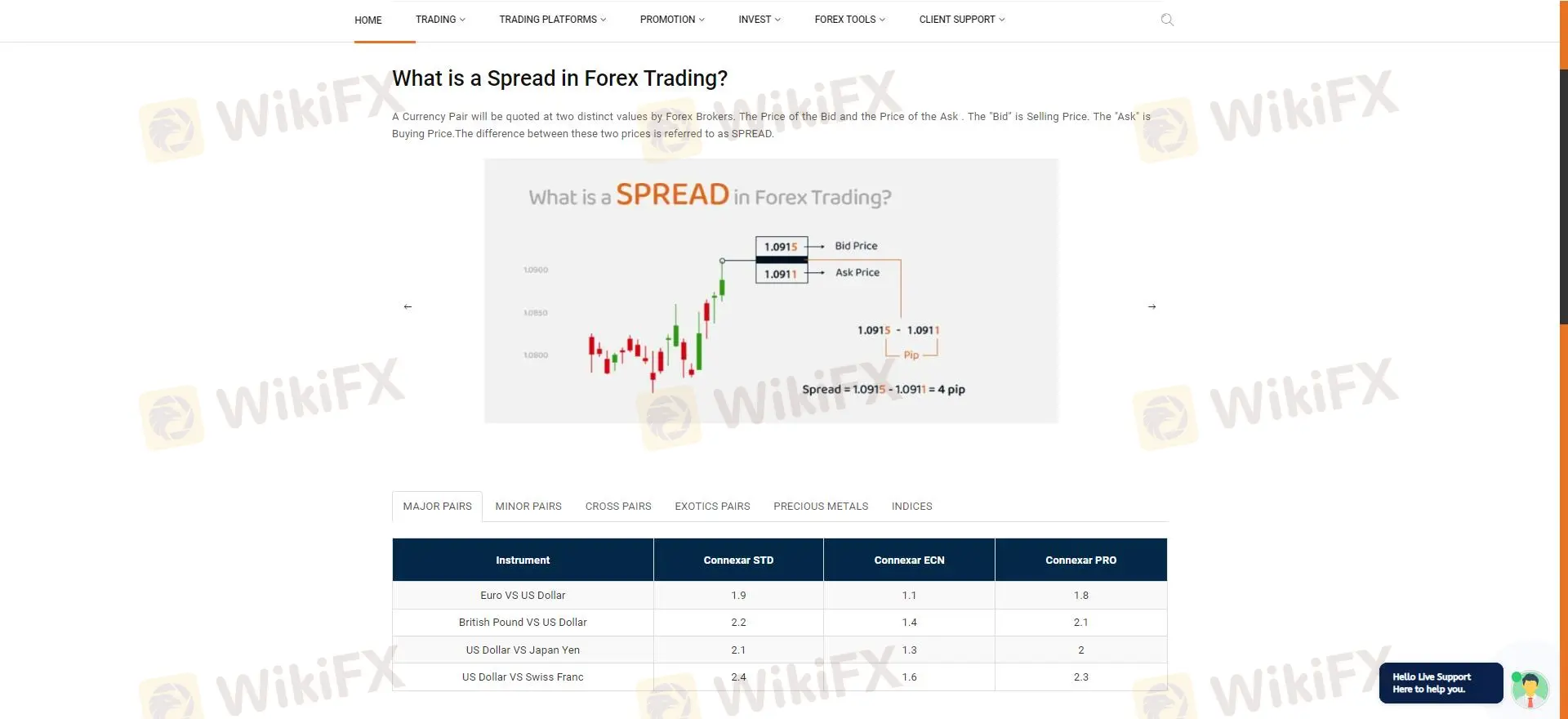

點差

點差根據帳戶類型而有所不同:

- Connexar STD:點差從1.9點起。

- Connexar ECN:點差從1.1點起。

- Connexar PRO:點差從1.8點起。

以下是常見交易工具的具體示例:

| 工具 | Connexar STD | Connexar ECN | Connexar PRO |

| EUR/USD | 1.9點 | 1.1點 | 1.8點 |

| GBP/USD | 2.2點 | 1.4點 | 2.1點 |

| 黃金/美元 | 2.1點 | 1.2點 | 1.9點 |

| 日經225指數 | 65.5點 | 55.5點 | 60.5點 |

| 美國道瓊斯30指數 | 81.5點 | 71.5點 | 76.5點 |

佣金

Connexar Capitals 的佣金根據帳戶類型而定,每手交易0至6美元:

| 帳戶類型 | 佣金 |

| Connexar STD | 無佣金;成本包含在點差中。 |

| Connexar ECN | 每手交易6美元(往返)。 |

| Connexar PRO | 無佣金;成本包含在點差中。 |

掉期退款

Commexar 是無掉期的。對於滿足特定交易量標準的交易者,有一個掉期退款計劃:

| 達到的交易量 | 退款百分比 |

| 存款的0.1% | 掉期費用的20%退款 |

| 存款的0.2% | 掉期費用的50%退款 |

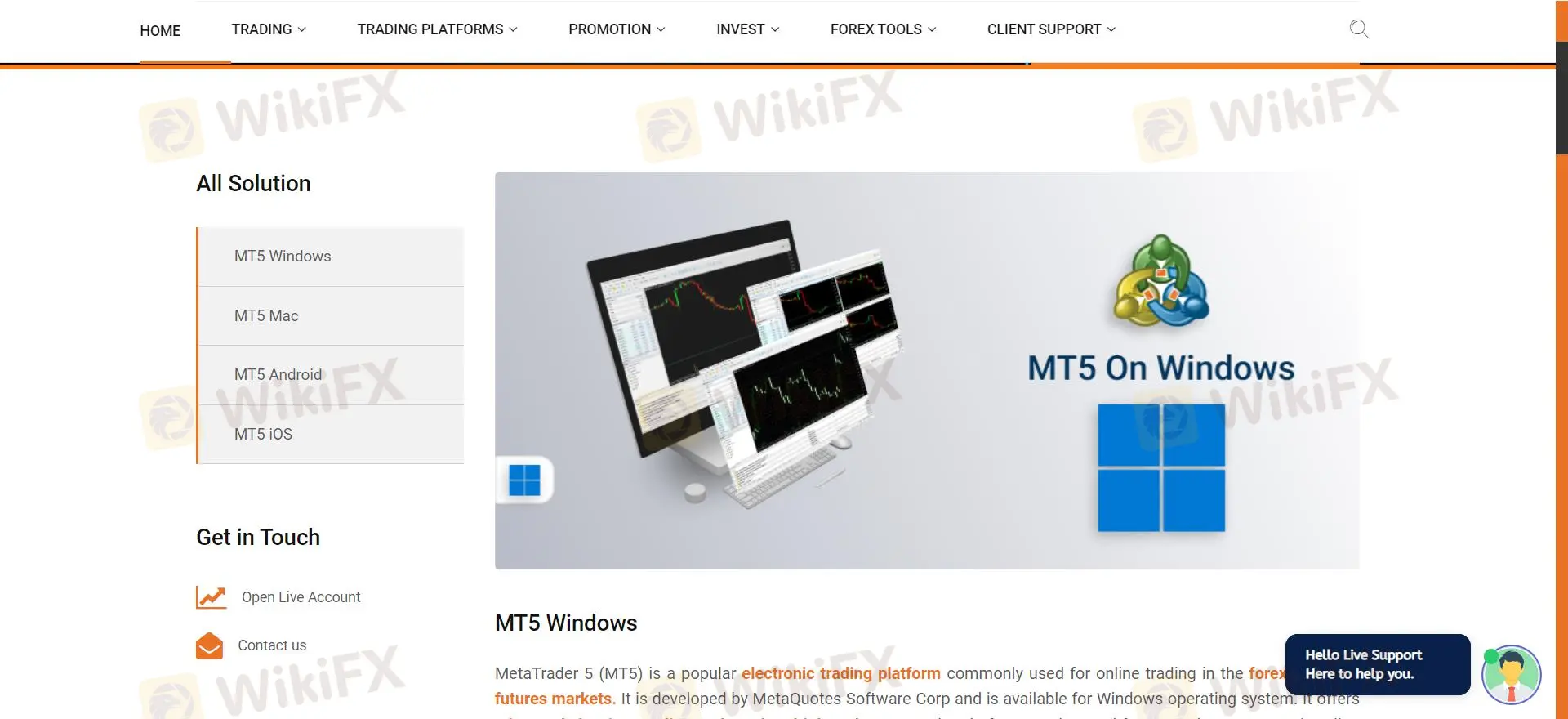

交易平台

Connexar 只提供MT5作為其交易平台。

| 交易平台 | 支援的設備 | 適合對象 |

| MT5 | Windows、Mac、Android、iOS | 高級交易者和專業人士 |

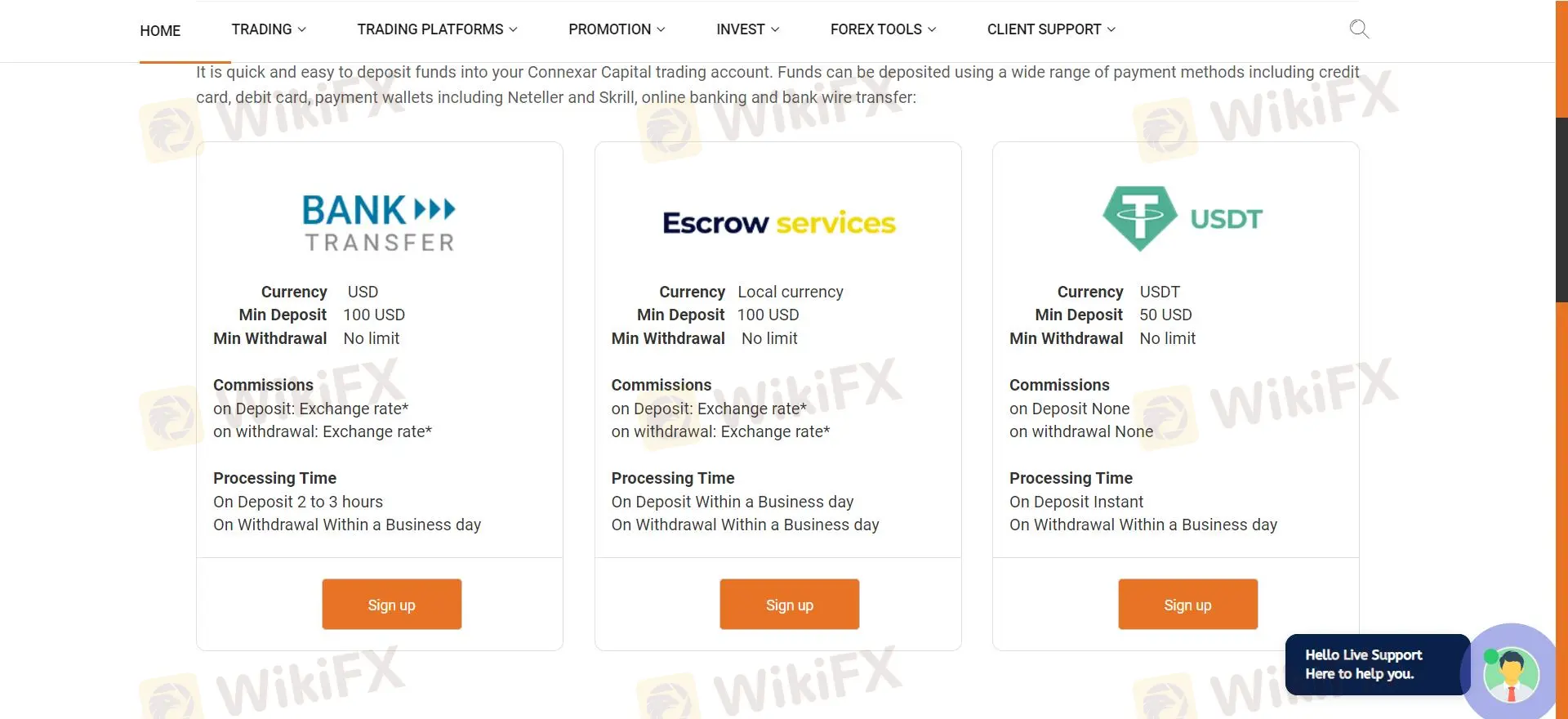

存款和提款

Connexar Capital 提供3種免費的存款和提款方式。

| 存款選項 | 最低存款金額 | 費用 | 處理時間 |

| 銀行轉帳 | 100美元 | 無 | 2-3小時 |

| 電子錢包 | 100美元 | 無 | 即時 |

| 加密貨幣 | 50美元 | 無 | 即時 |

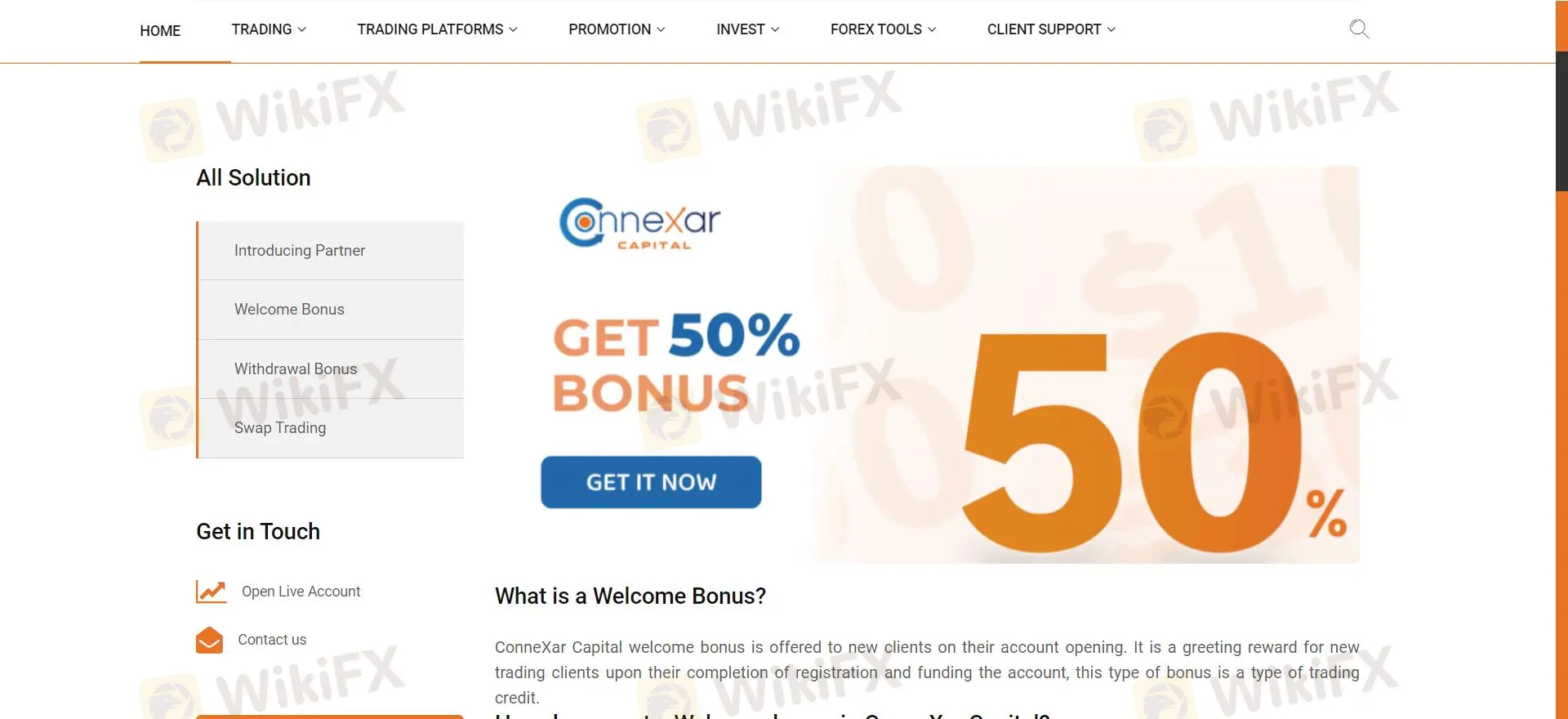

獎金計劃

Connexar Capital 提供高達50%的歡迎獎金給首次存款,以及30%的獎金給後續充值,總額上限為$5000。