Company Summary

| Connexar Capital Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Comoros |

| Regulation | Unregulated |

| Market Instruments | Forex, Precious Metals, Indices, CFDs, Cryptocurrencies |

| Demo Account | ✔ |

| Leverage | Up to 1:400 |

| Spread | From 0.2 pips |

| Trading Platform | MT5 (Windows, Mac, Android, iOS) |

| Min Deposit | $50 (Ultra Account) |

| Customer Support | Phone: +44 7308642365 |

| Email: support@connexarcapital.com | |

| 24/7 Online Chat: Available | |

Connexar Capital Information

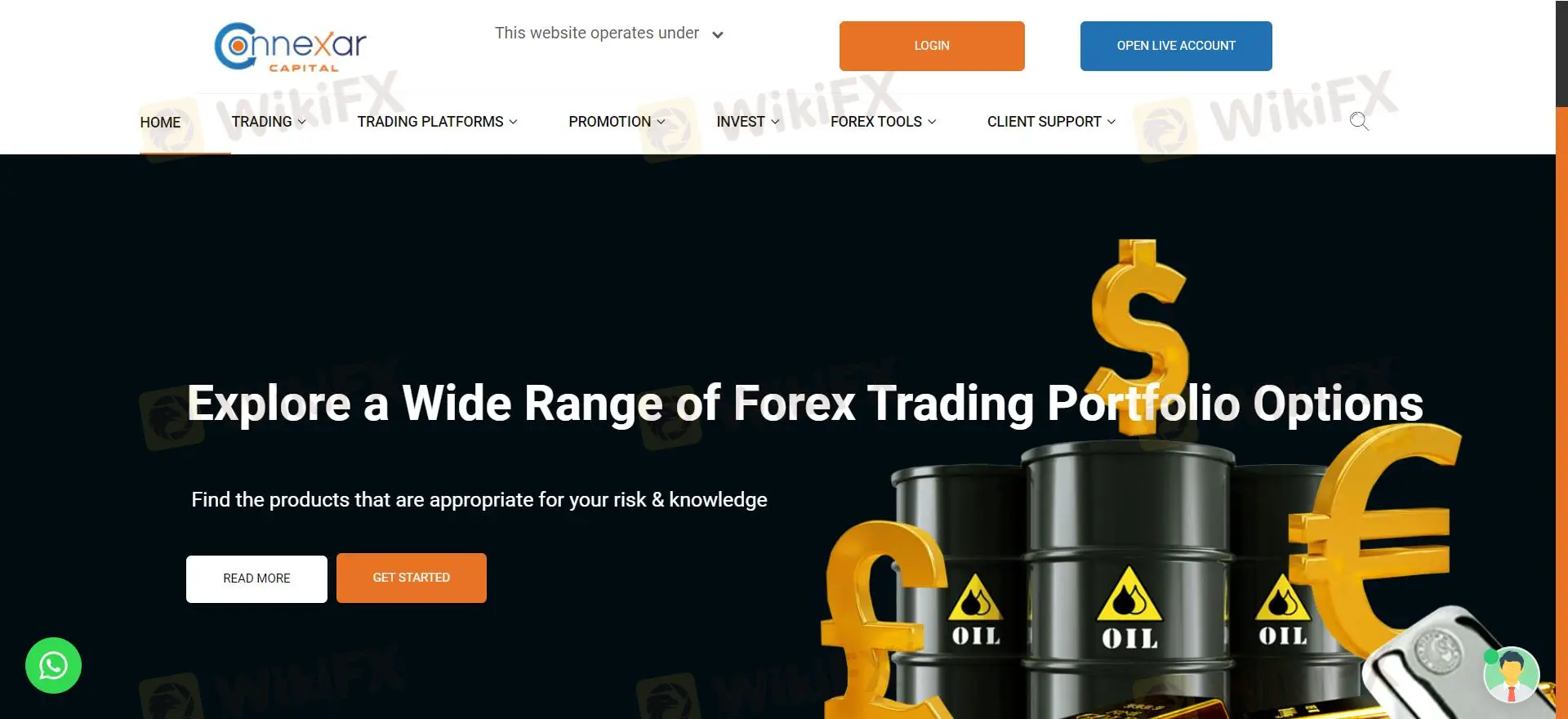

Connexar Capital is founded in 2022. It provides several trading possibilities among Forex, CFDs, indices, and cryptocurrencies. Their MT5 system supports several devices, and three account kinds serve traders with diverse preferences. Its minimum required deposit is $50.

Pros and Cons

| Pros | Cons |

| Many instruments, including Forex and CFDs | Unregulated |

| Low minimum deposit of $50 | Only provide one trading platform: MT5 |

| Provides 3 different account types | |

| Offers leverage up to 1:400 | |

| Provides bonus progaram |

Is Connexar Capital Legit?

Connexar Capital operates as an unregulated platform.

What Can I Trade on Connexar Capital?

Connexar Capital provides many trading instruments, including major, minor, and exotic currency pairs, precious metals, indices, and CFDs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Precious Metals | ✔ |

| Indices | ✔ |

| CFDs | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ❌ |

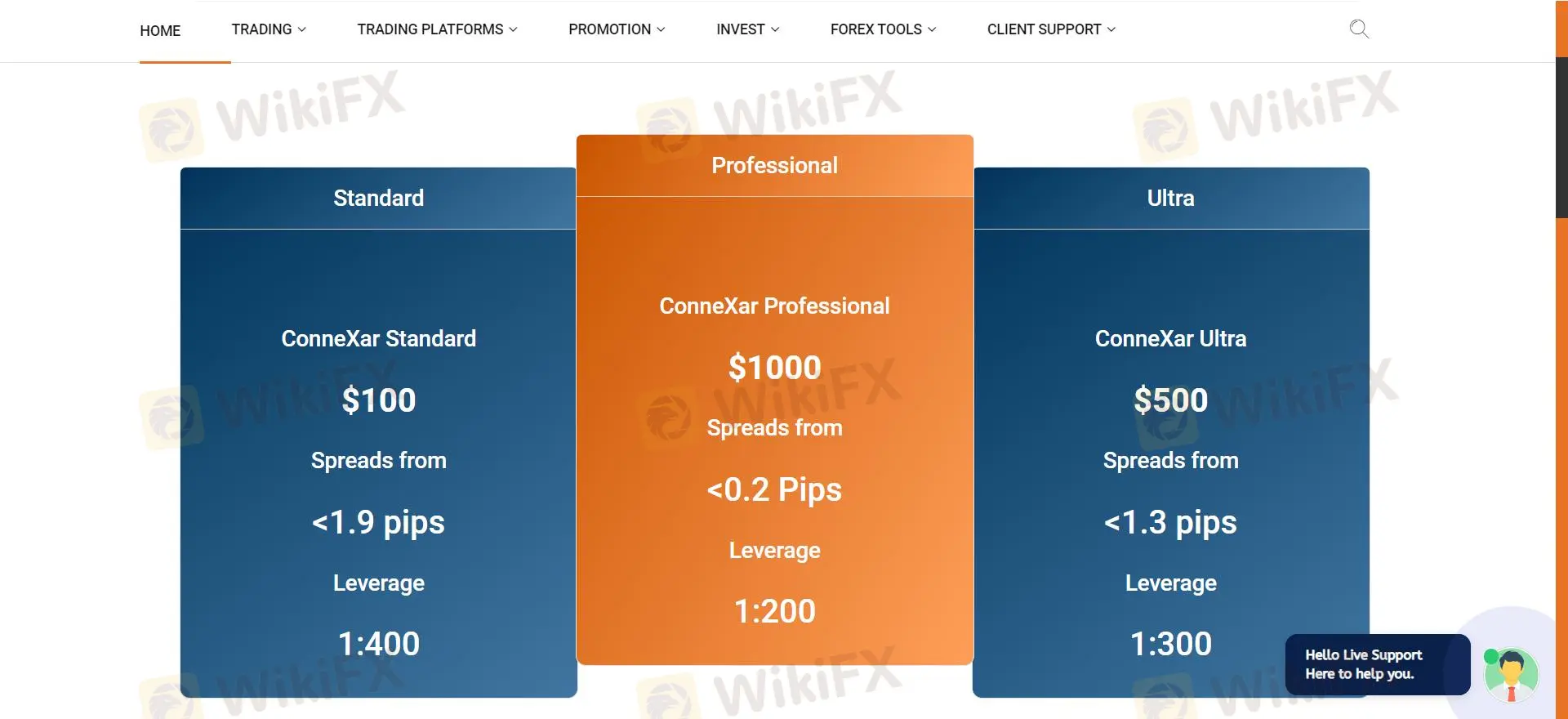

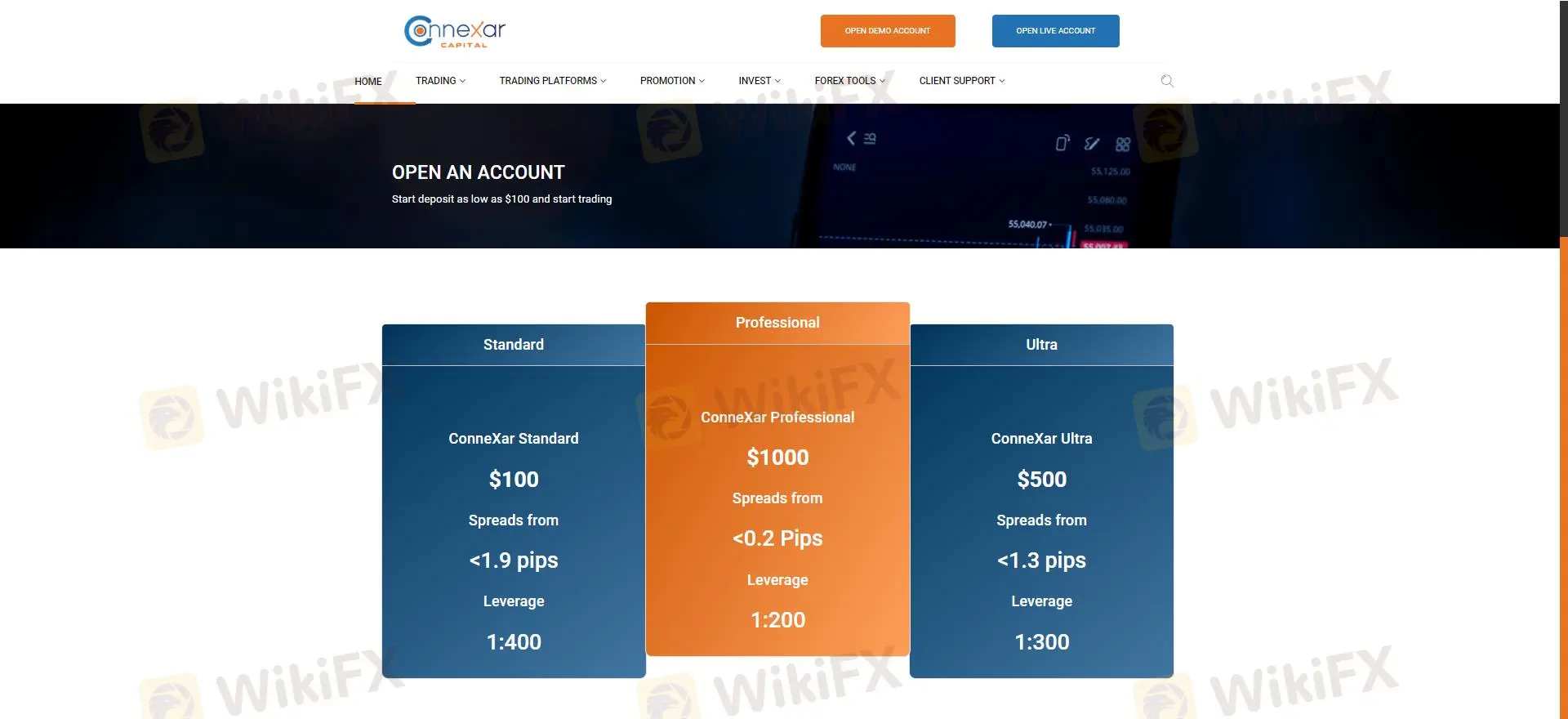

Account Types

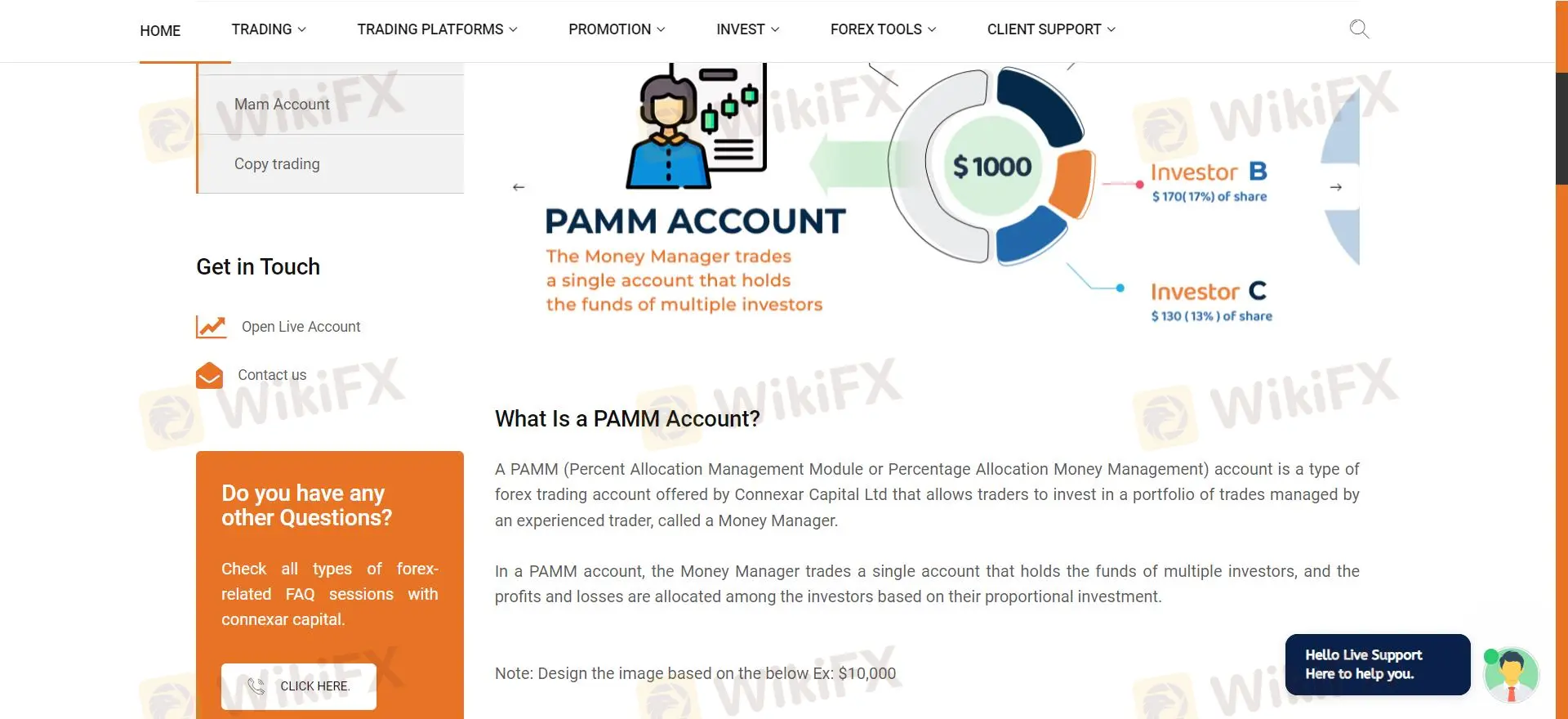

Connexar Capital offers 3 account types, designed for different levels of traders.

| Account Type | Minimum Deposit | Spread | Leverage | Additional Features |

| Standard | $100 | From 1.9 pips | Up to 1:400 | Swap-Free, MT5 |

| Professional | $1,000 | From 0.2 pips | Up to 1:200 | ECN Execution, MT5 |

| Ultra | $500 | From 1.3 pips | Up to 1:300 | PAMM/MAM Support |

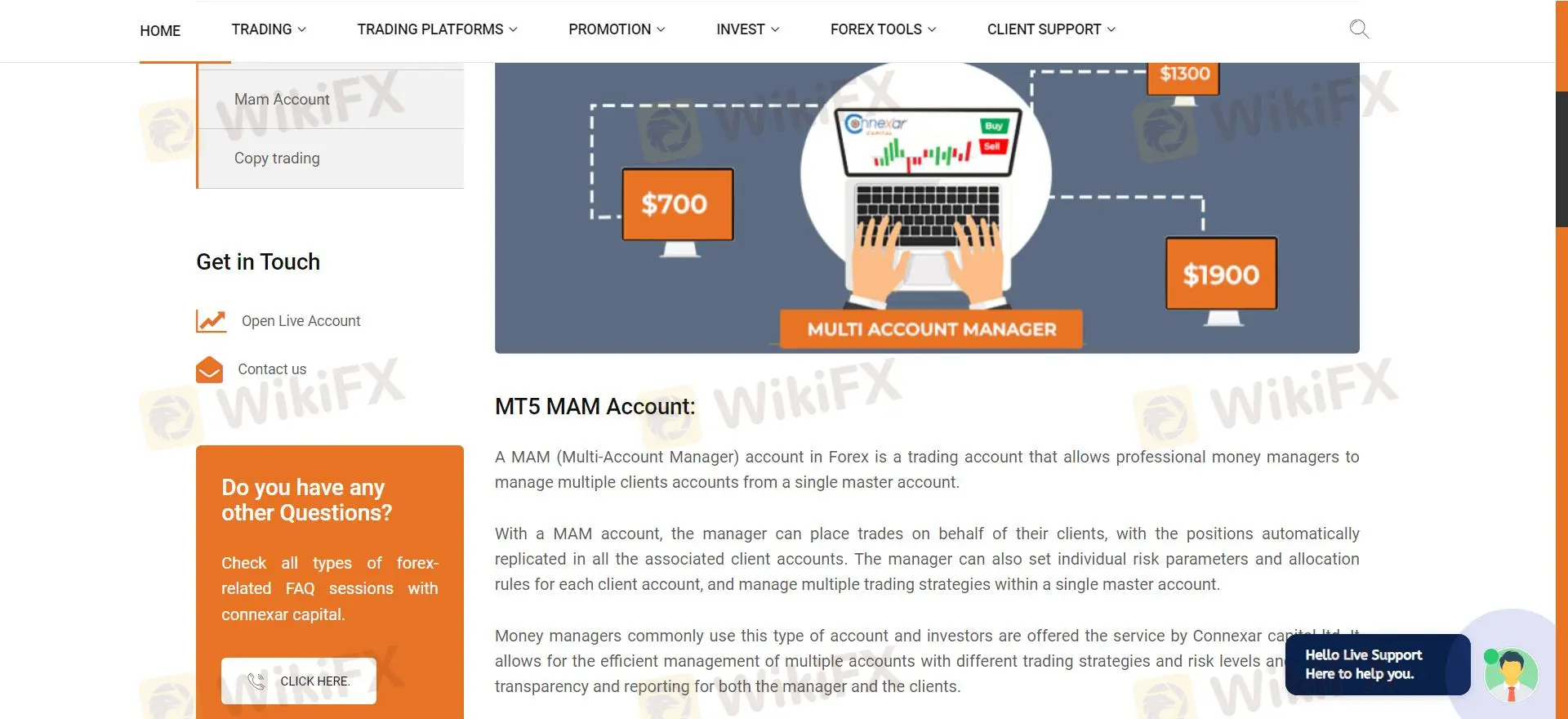

Meanwhile, it also provides PAMM account and MAM account.

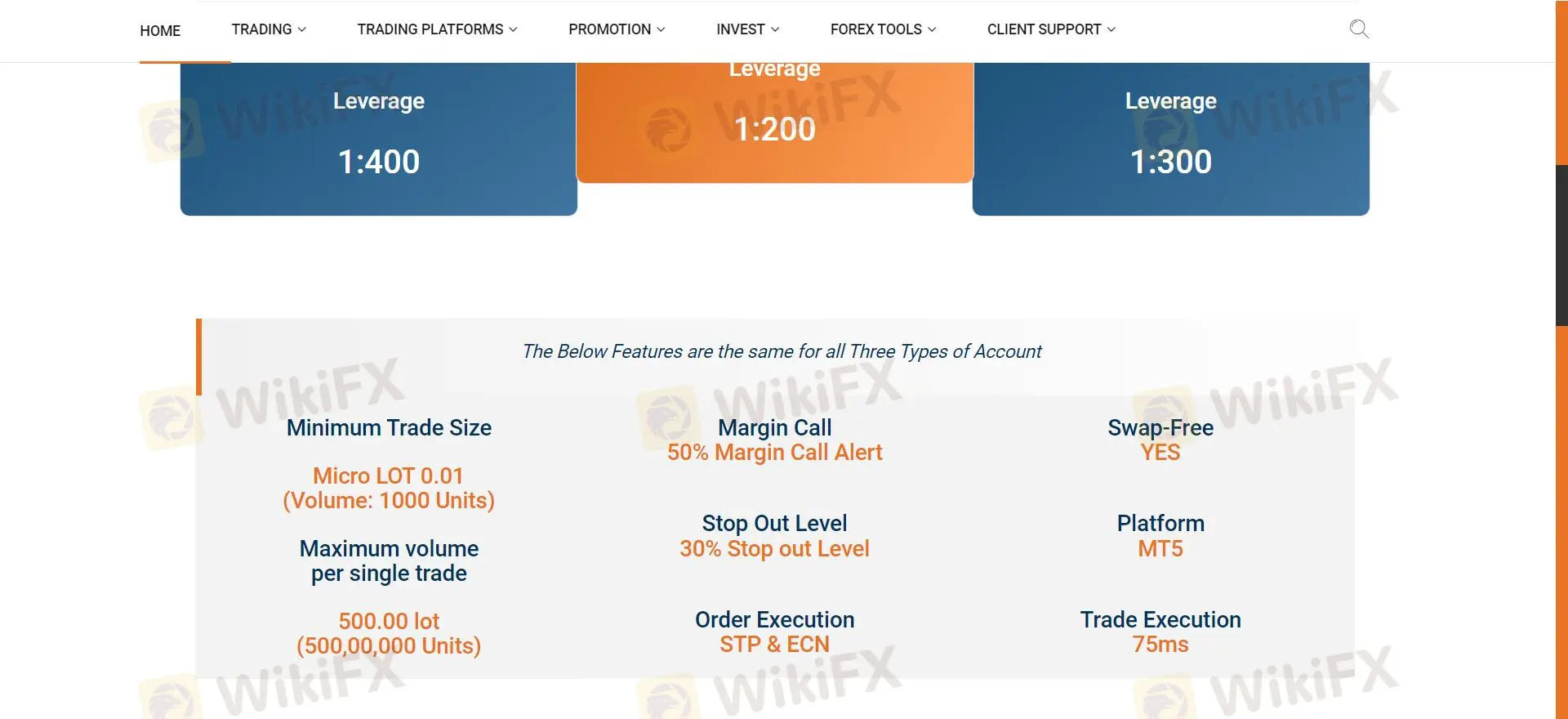

Leverage

Connexar Capital offers leverage from 1:200 to 1:400

| Account Type | Maximum Leverage |

| Connexar STD | 1:400 |

| Connexar ECN | 1:200 |

| Connexar PRO | 1:300 |

Connexar Capital Fees

Connexar Capital has three account options with different spreads, commissions, and swap costs. Here is a thorough breakdown:

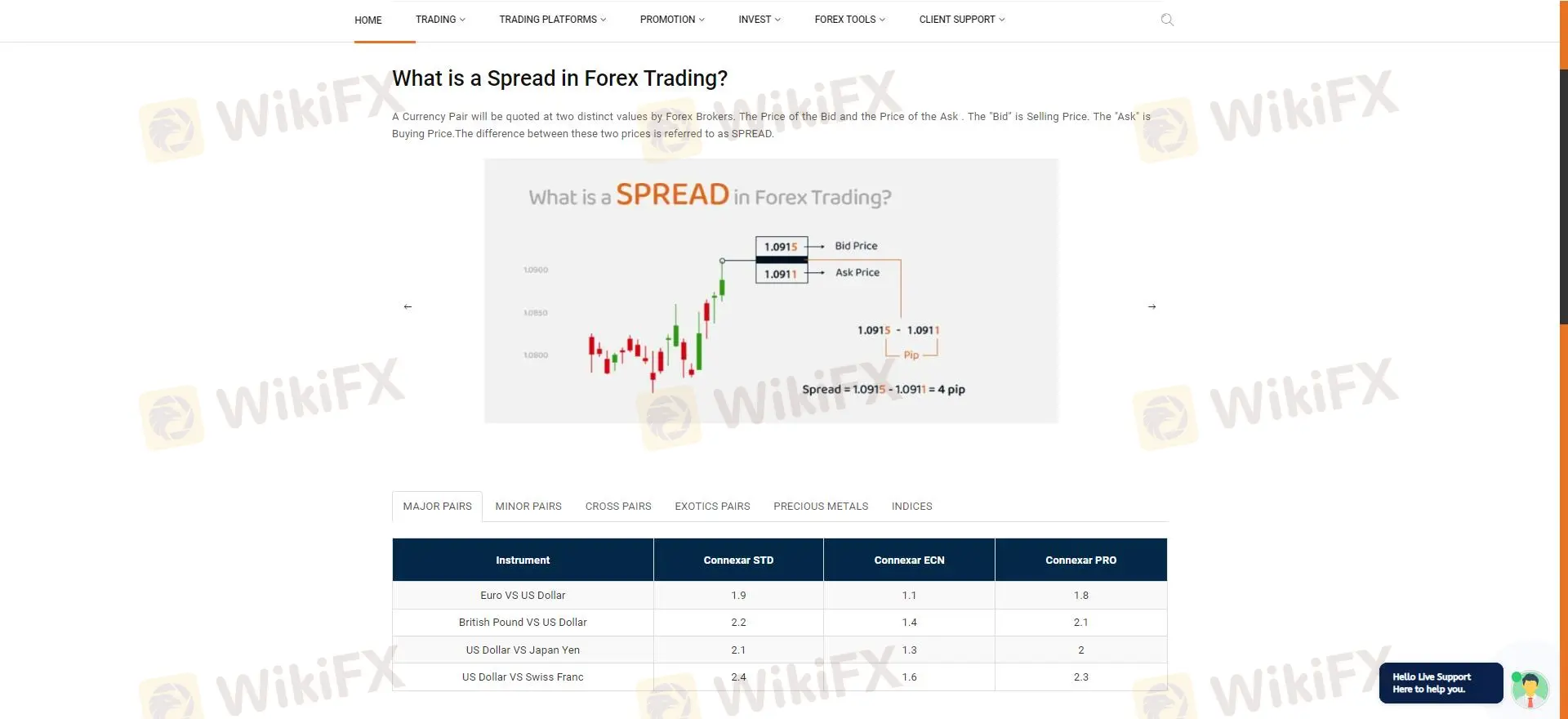

Spreads

Spreads are different based on the account type:

- Connexar STD: Spreads start from 1.9 pips.

- Connexar ECN: Spreads start from 1.1 pips.

- Connexar PRO: Spreads start from 1.8 pips.

Below are specific examples for common trading instruments:

| Instrument | Connexar STD | Connexar ECN | Connexar PRO |

| EUR/USD | 1.9 pips | 1.1 pips | 1.8 pips |

| GBP/USD | 2.2 pips | 1.4 pips | 2.1 pips |

| Gold/USD | 2.1 pips | 1.2 pips | 1.9 pips |

| JPN 225 Index | 65.5 pips | 55.5 pips | 60.5 pips |

| US Wall Street 30 Index | 81.5 pips | 71.5 pips | 76.5 pips |

Commissions

Connexar Capitals commissions depend on the account type, from 0 to $6 per lot:

| Account Type | Commission |

| Connexar STD | No commissions; costs included in spread. |

| Connexar ECN | $6 per lot (round turn). |

| Connexar PRO | No commissions; costs included in spread. |

Swap Refund

Commexar is swap free. For traders satisfying particular volume criteria, there is a swap reimbursement program:

| Volume Achieved | Refund Percentage |

| 0.1% of deposit | 20% refund of swap fees |

| 0.2% of deposit | 50% refund of swap fees |

Trading Platform

Connexar only offers MT5 as its trading platform.

| Trading Platform | Supported Devices | Suitable For |

| MT5 | Windows, Mac, Android, iOS | Advanced traders & professionals |

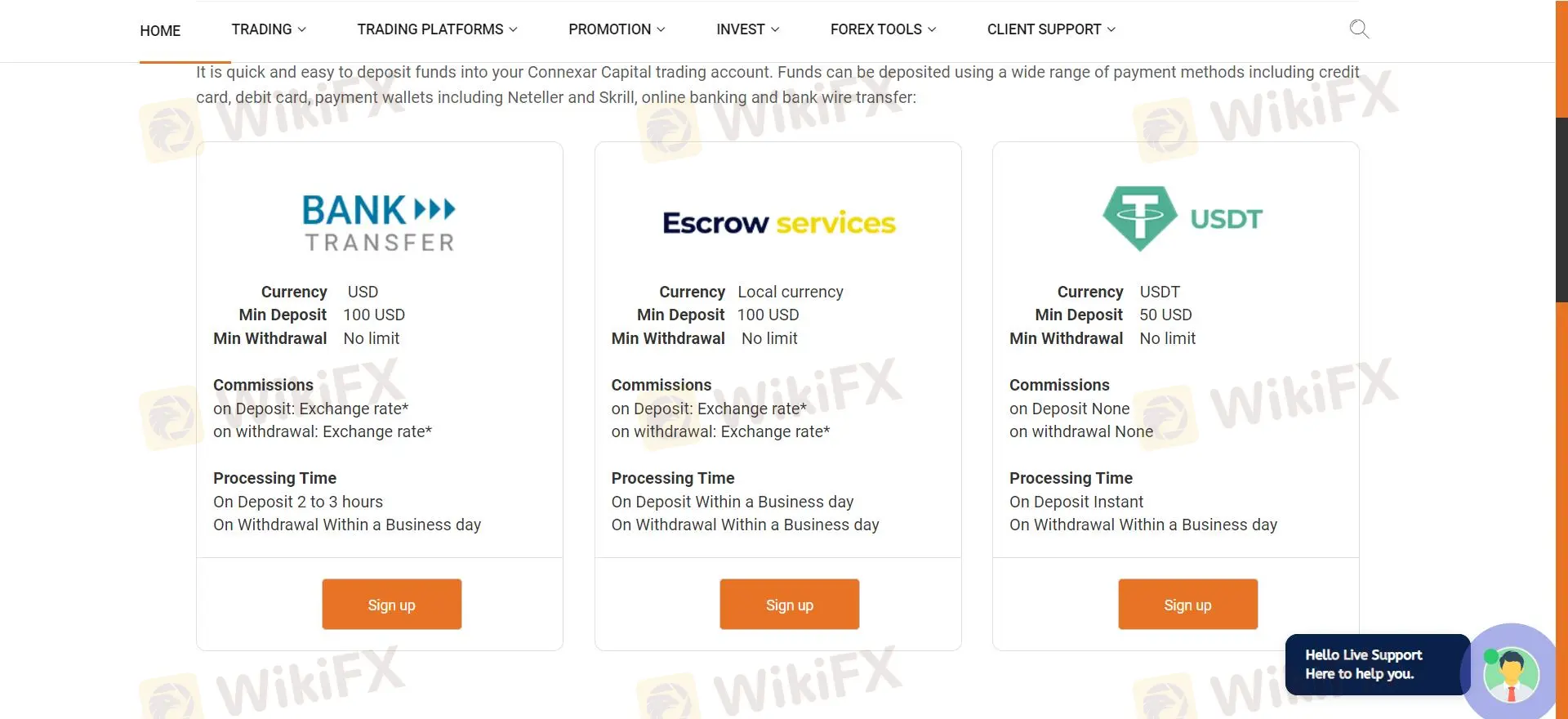

Deposit and Withdrawal

Connexar Capital offers 3 types of fee-free deposit and withdrawal options.

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Bank Transfer | $100 | None | 2-3 hours |

| E-Wallets | $100 | None | Instant |

| Cryptocurrencies | $50 | None | Instant |

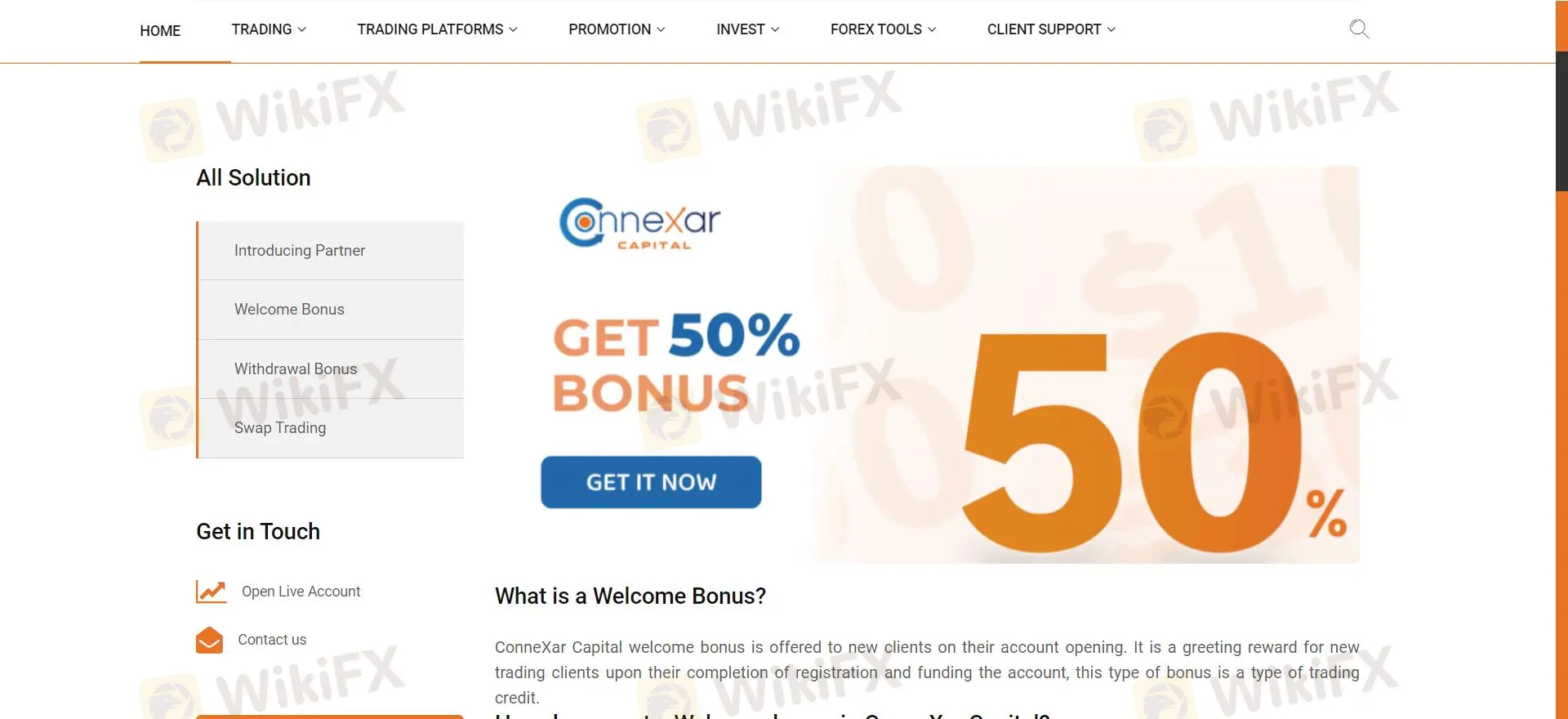

Bonus Programs

Connexar Capital provides a Welcome Bonus of up to 50% on first deposits and a 30% bonus on subsequent top-ups, capped at $5000 in total.