公司簡介

| Access Bank Review Summary | |

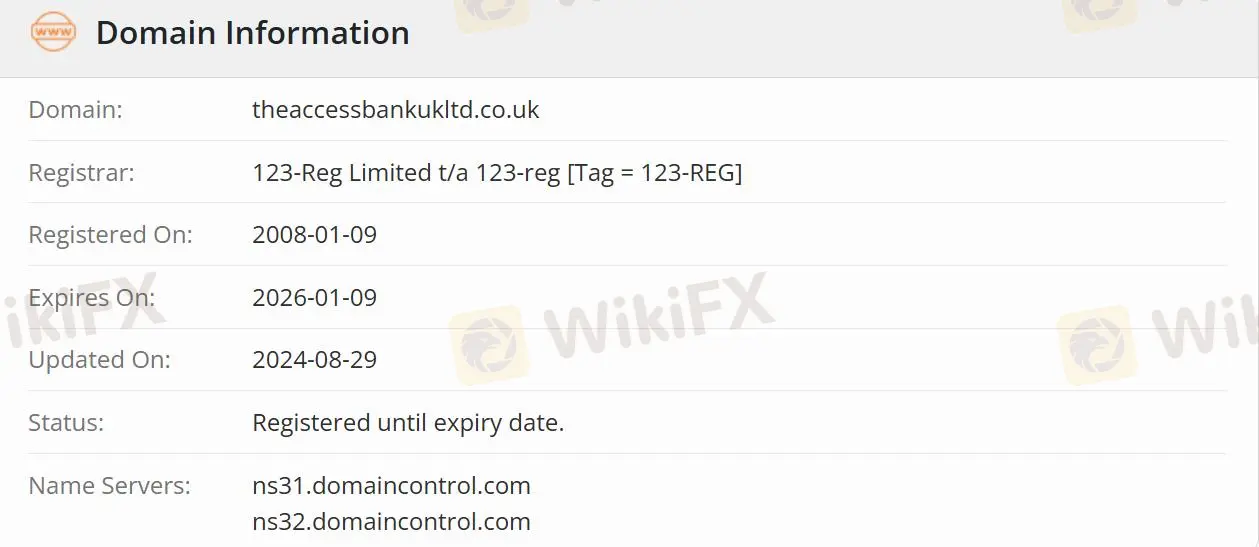

| 成立日期 | 2008-01-19 |

| 註冊國家/地區 | 英國 |

| 監管 | 受監管 |

| 服務 | 貿易金融/商業銀行/資產管理/投資 |

| 客戶支援 | 電子郵件:ccontactaaccessprivatebank.com |

| 電話:0333 222 4516(英國)/+44 1606 813020 | |

Access Bank 資訊

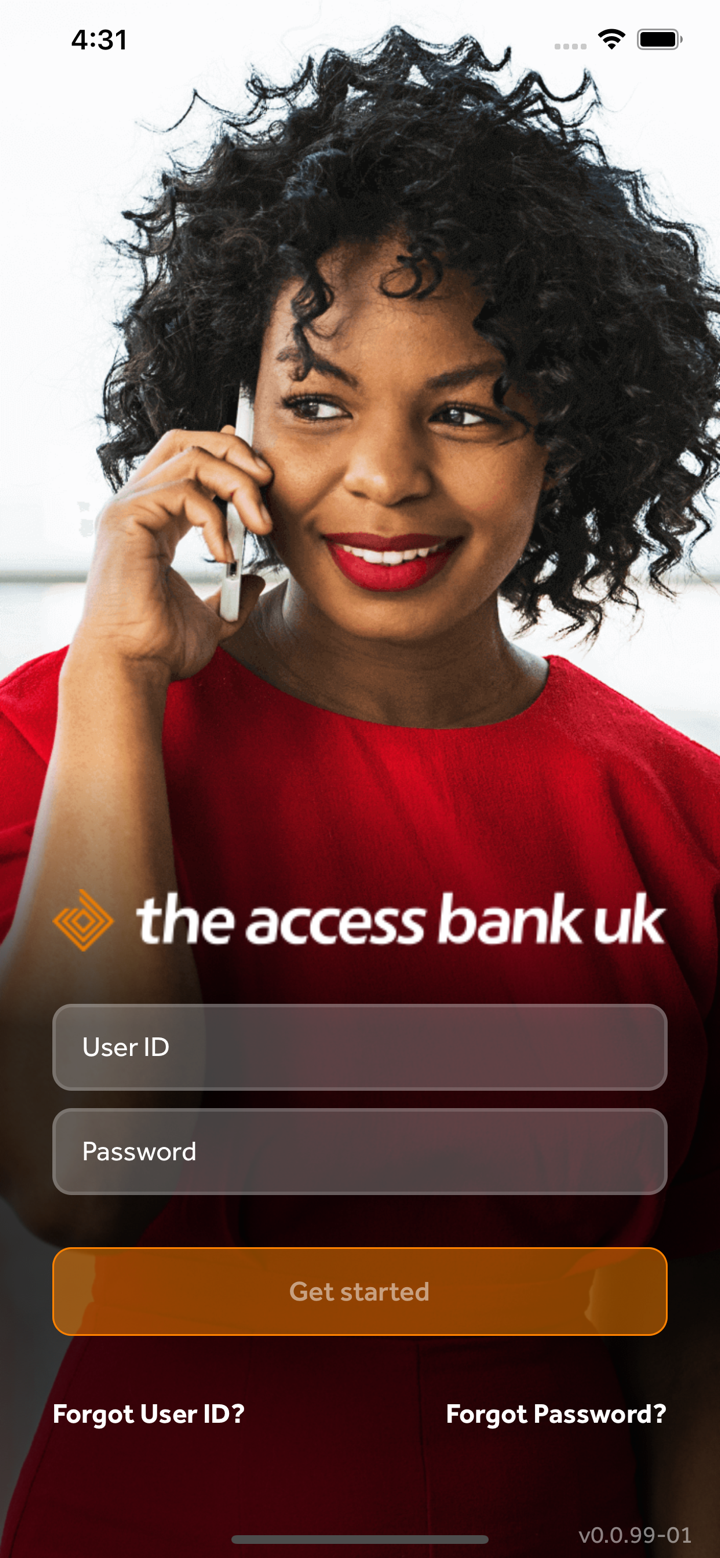

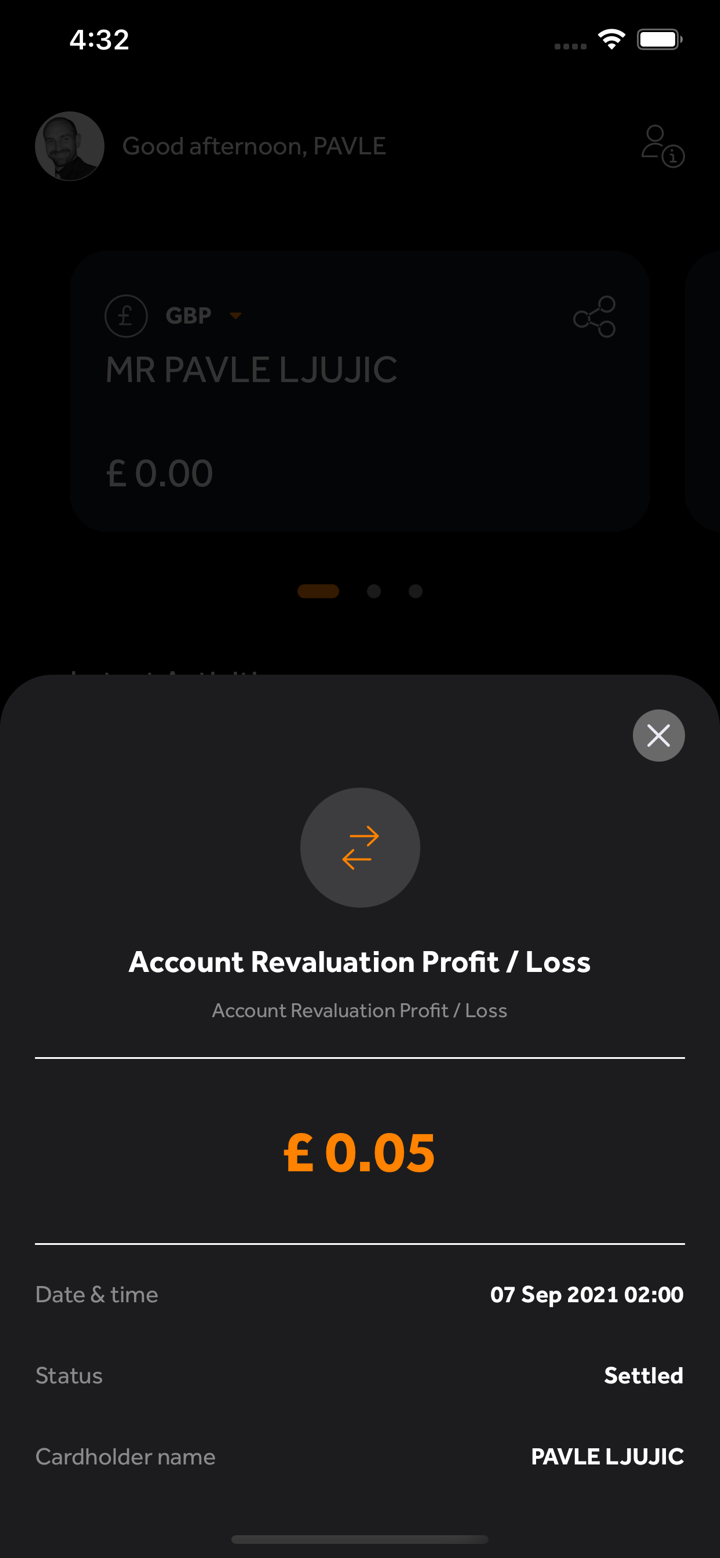

Access Bank 在英國註冊,提供廣泛的創新產品和服務,包括貿易金融、商業銀行和資產管理,並支持將投資流入尼日利亞、非洲和中東北非地區的市場。該銀行的目標是通過客戶服務和貿易金融、商業銀行和資產管理方面的創新解決方案,推動 Access Bank 集團的國際業務增長。

Access Bank 是否合法?

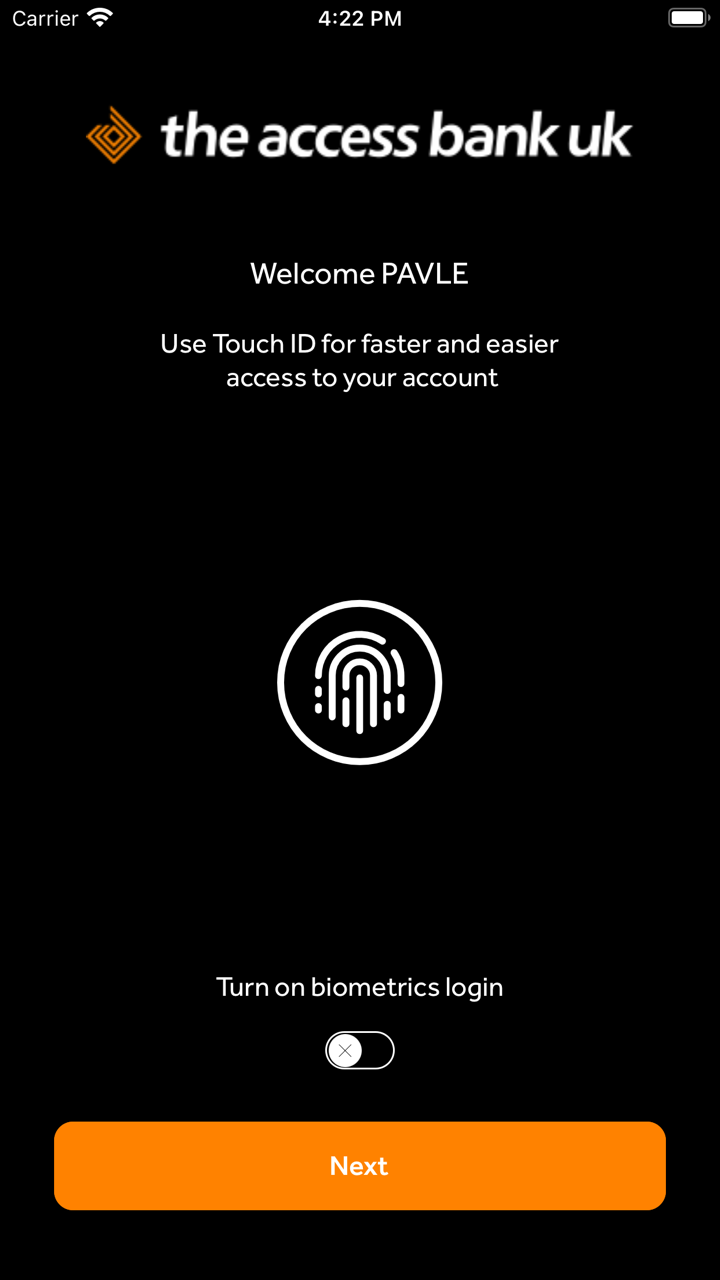

Access Bank 獲得英國金融行為監管局(FCA)授權和監管,許可證號為 478415。受監管的公司比未受監管的公司更安全。

Access Bank 提供哪些服務?

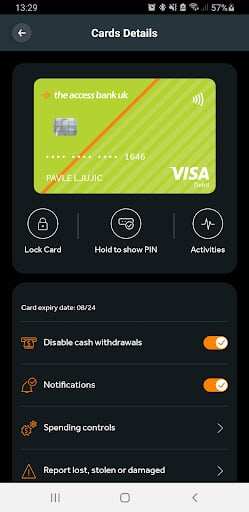

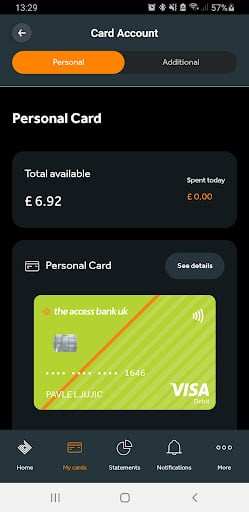

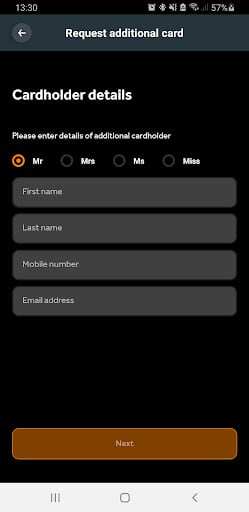

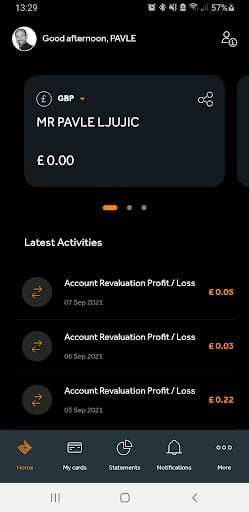

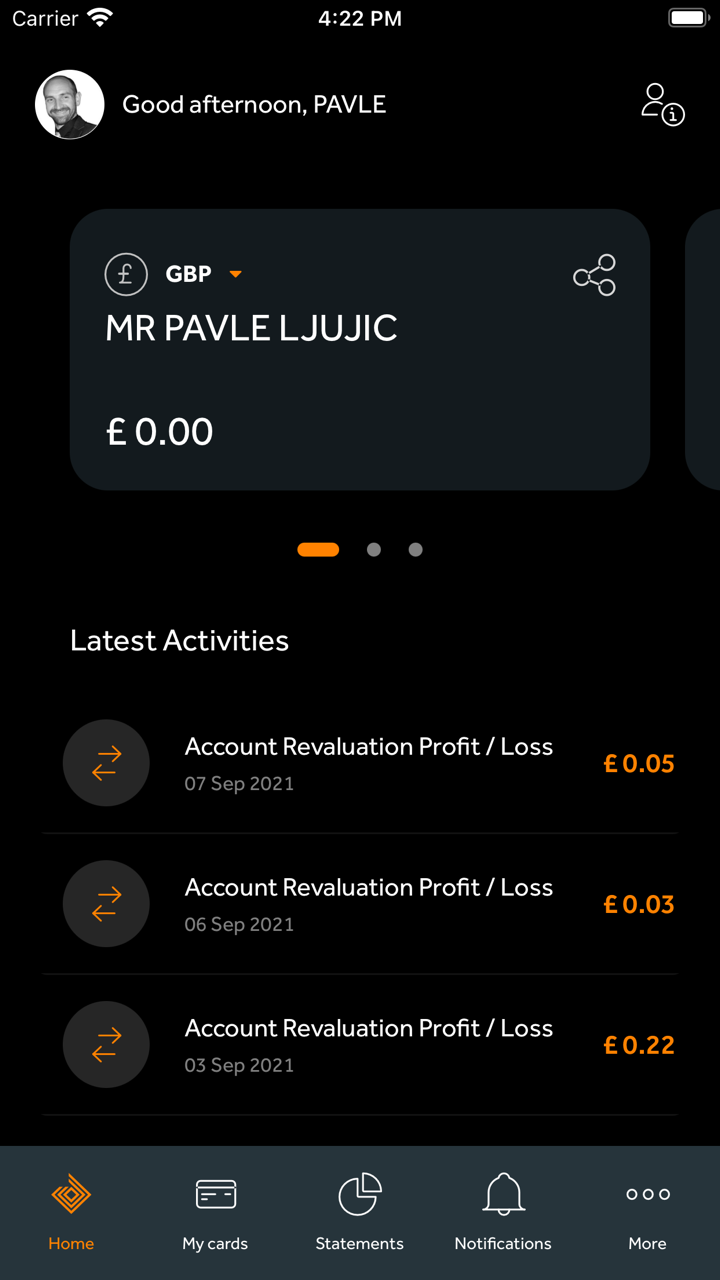

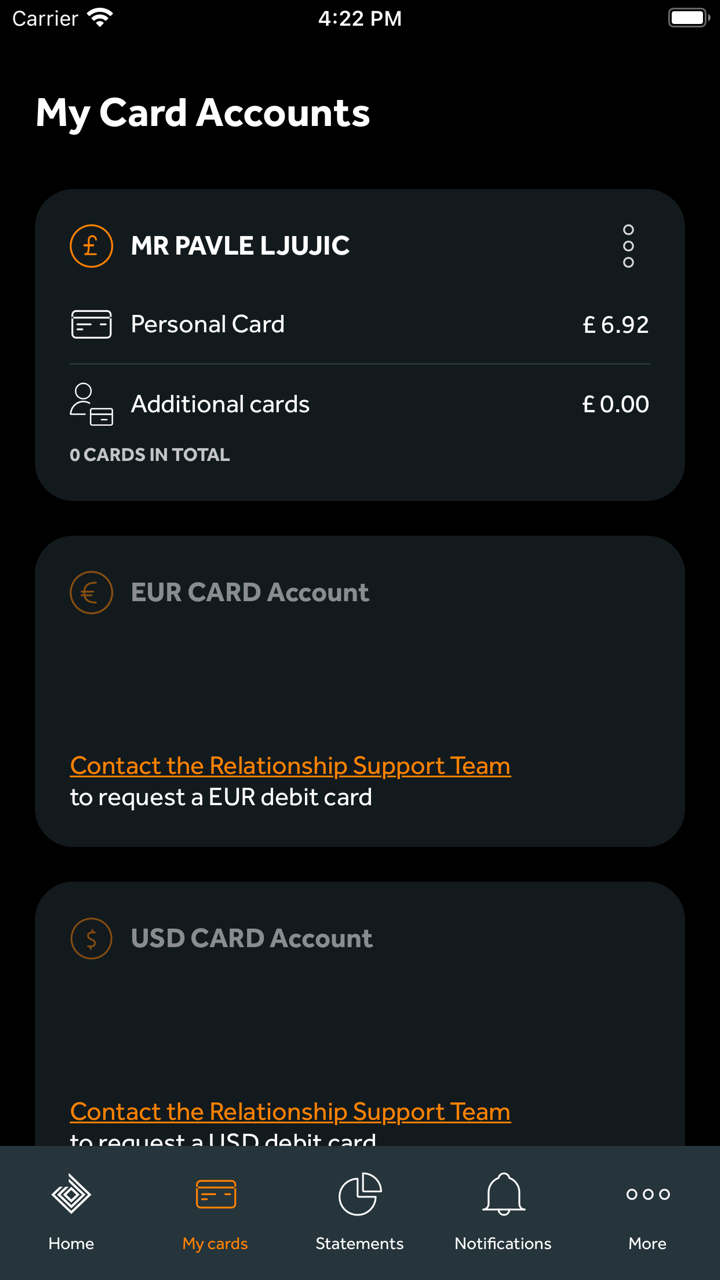

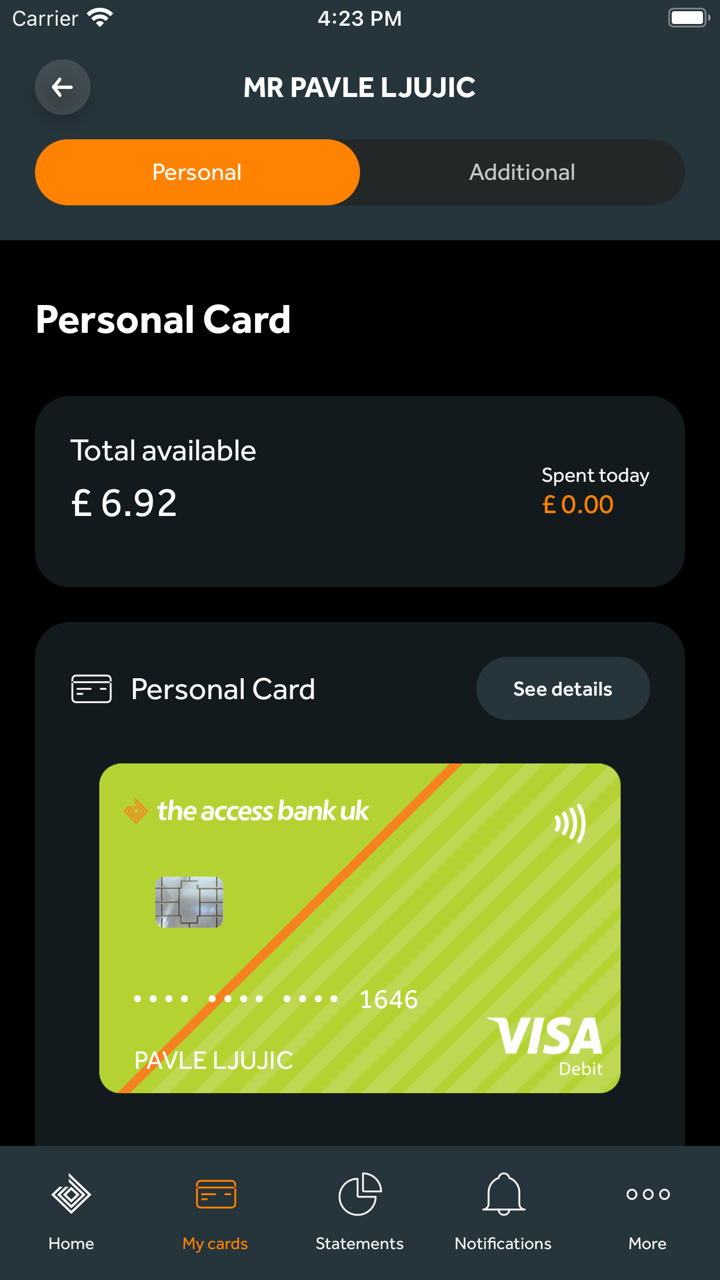

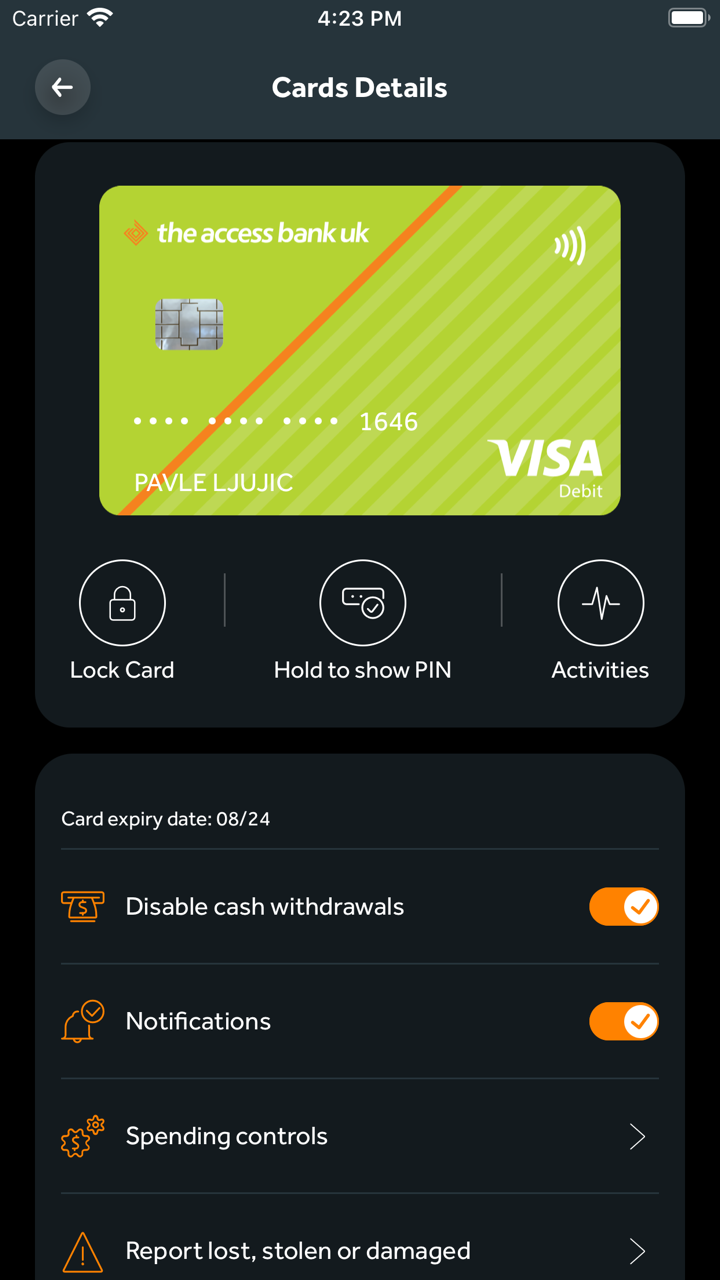

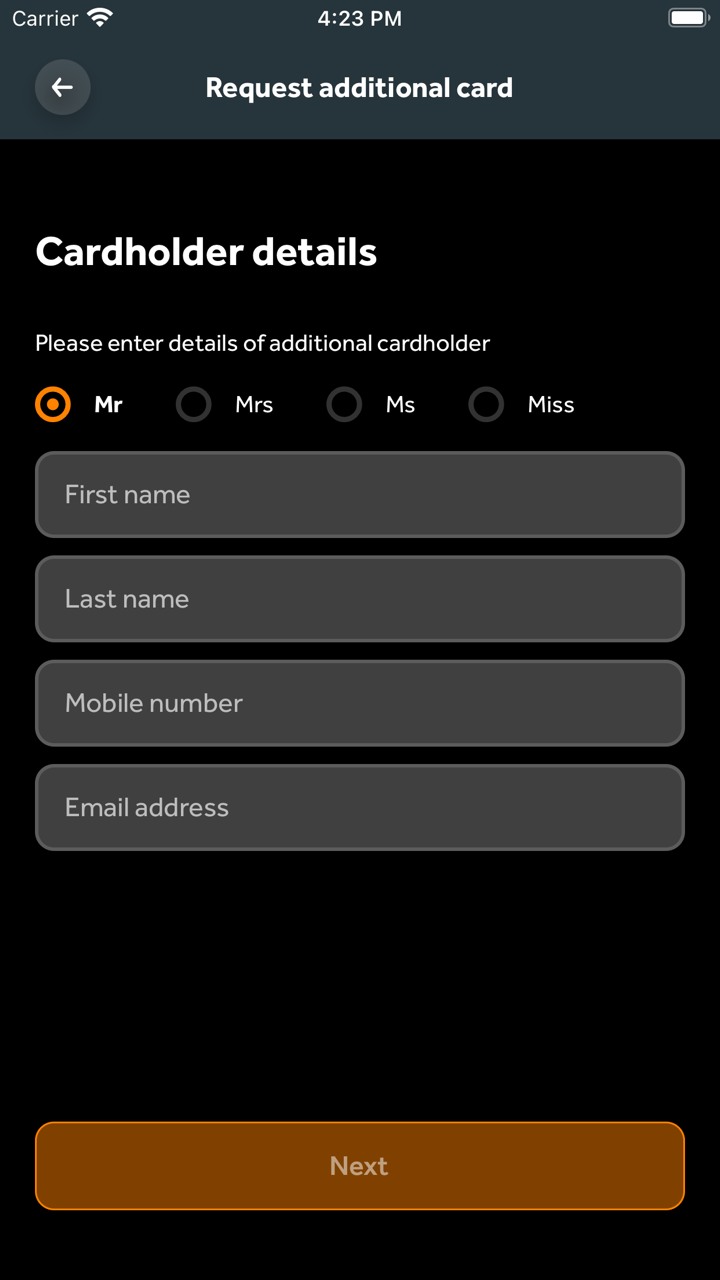

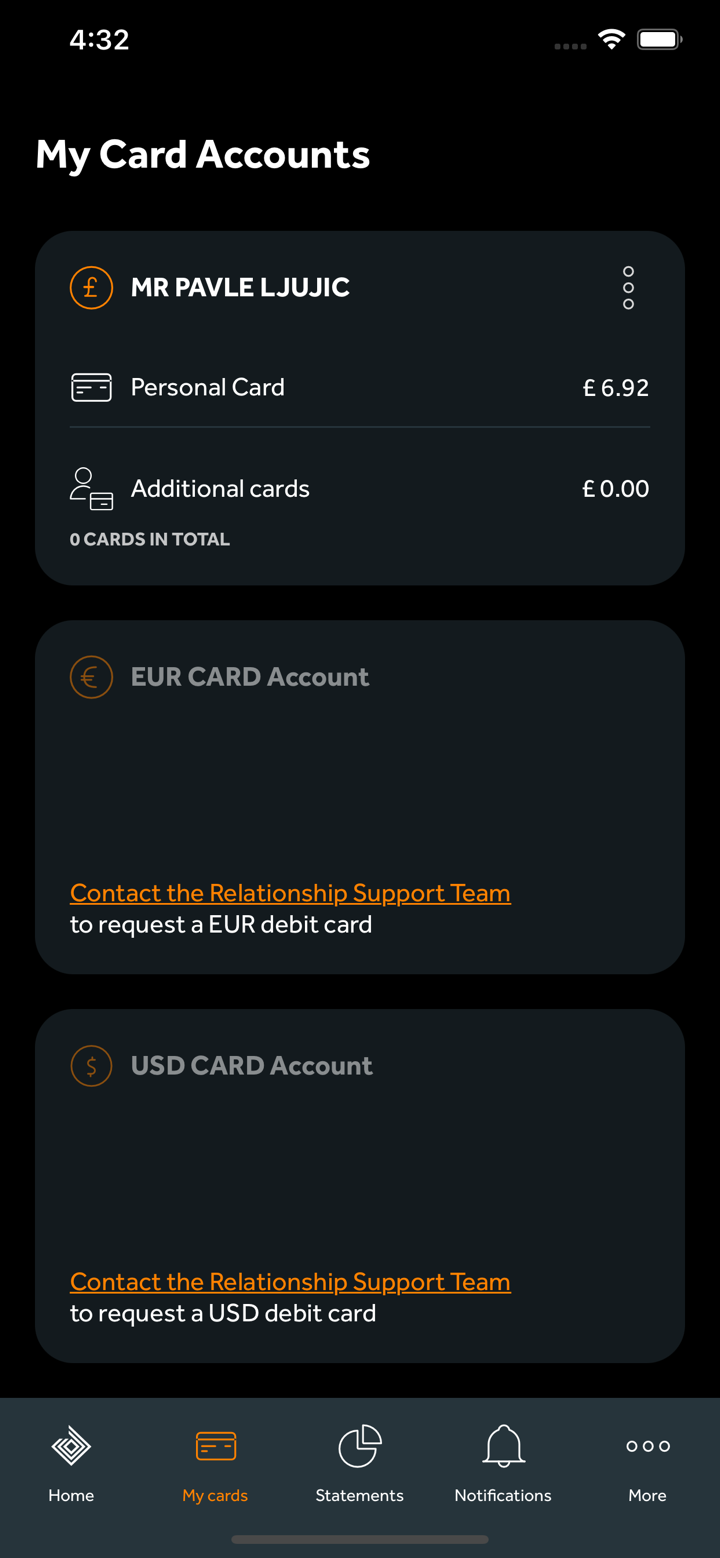

Access Bank 為英國的個人、企業和私人客戶提供各種金融服務。其他國際用戶可以享受商業銀行和貿易融資等服務。

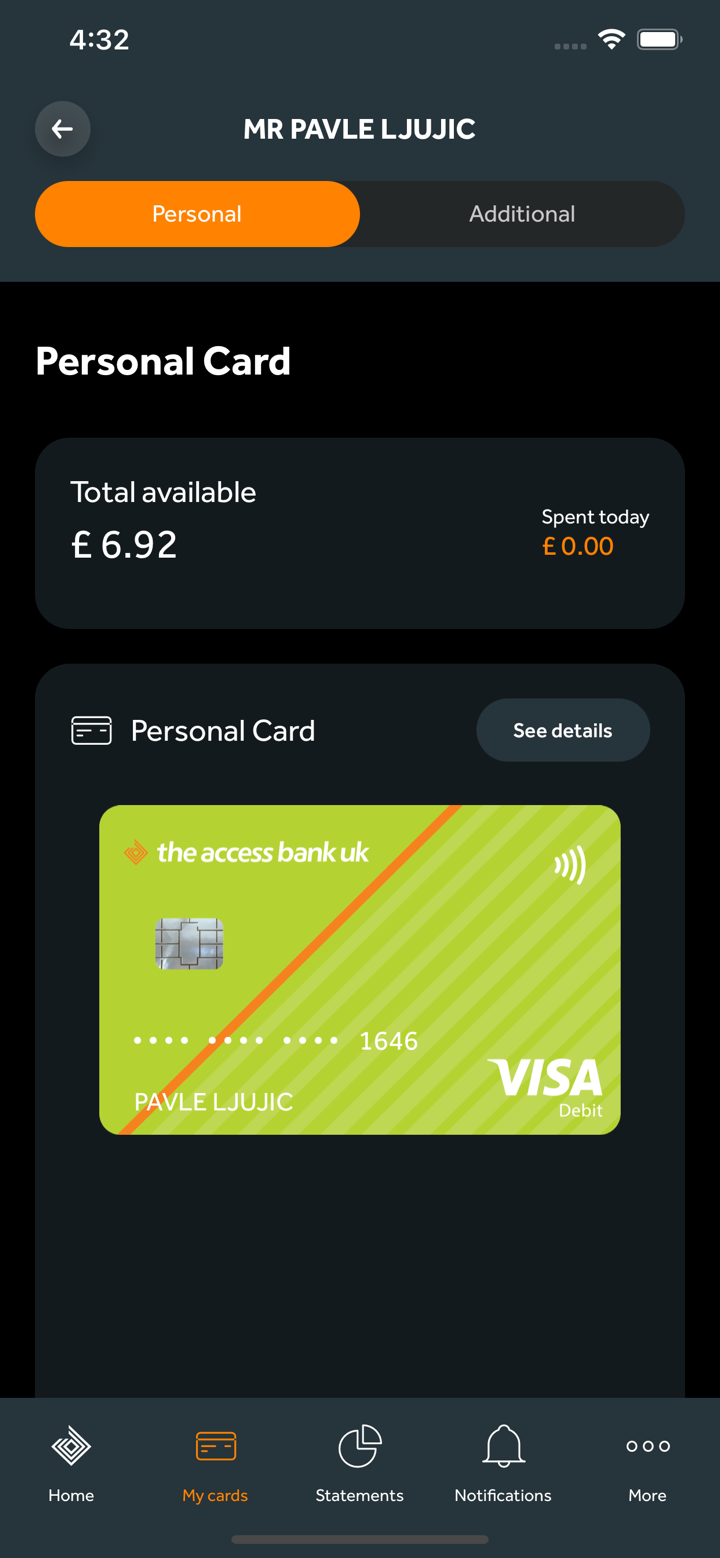

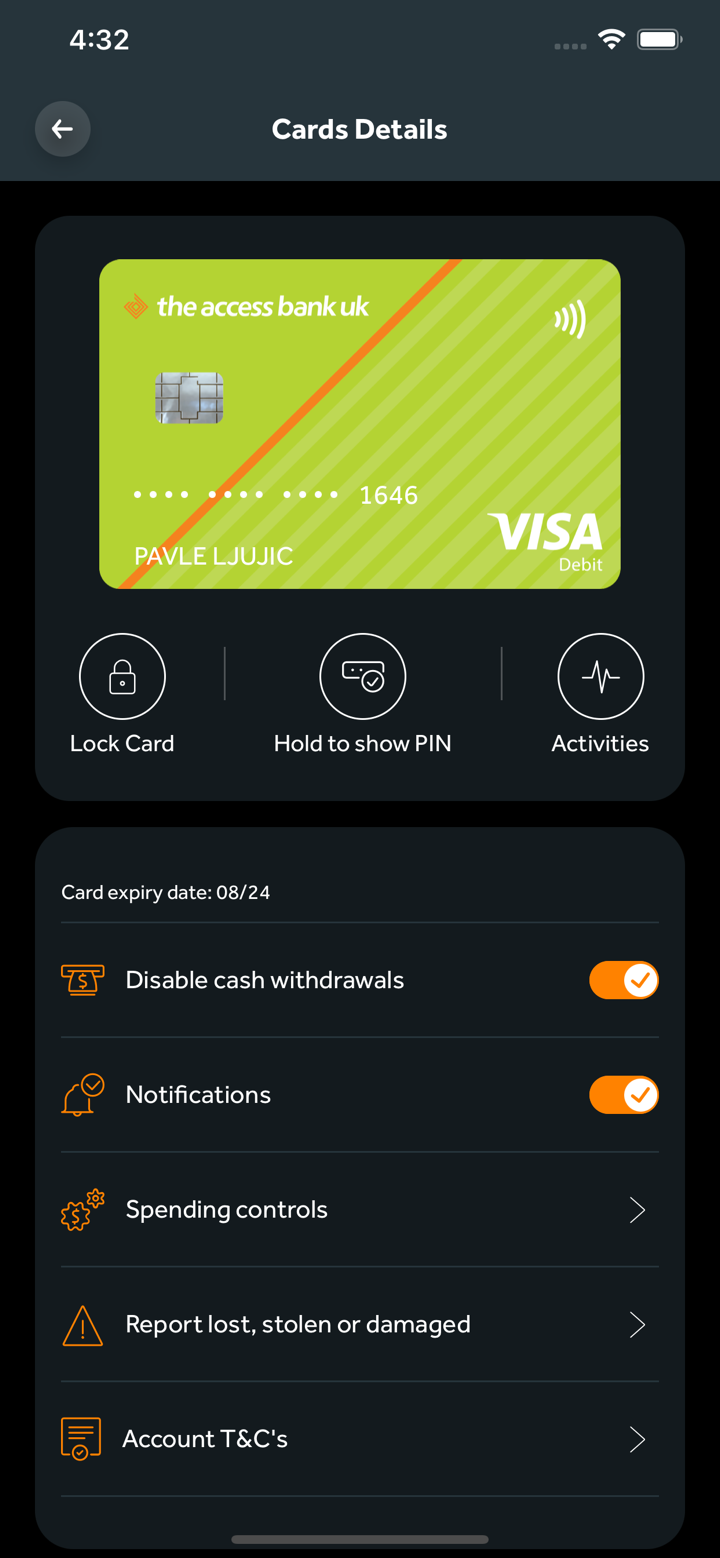

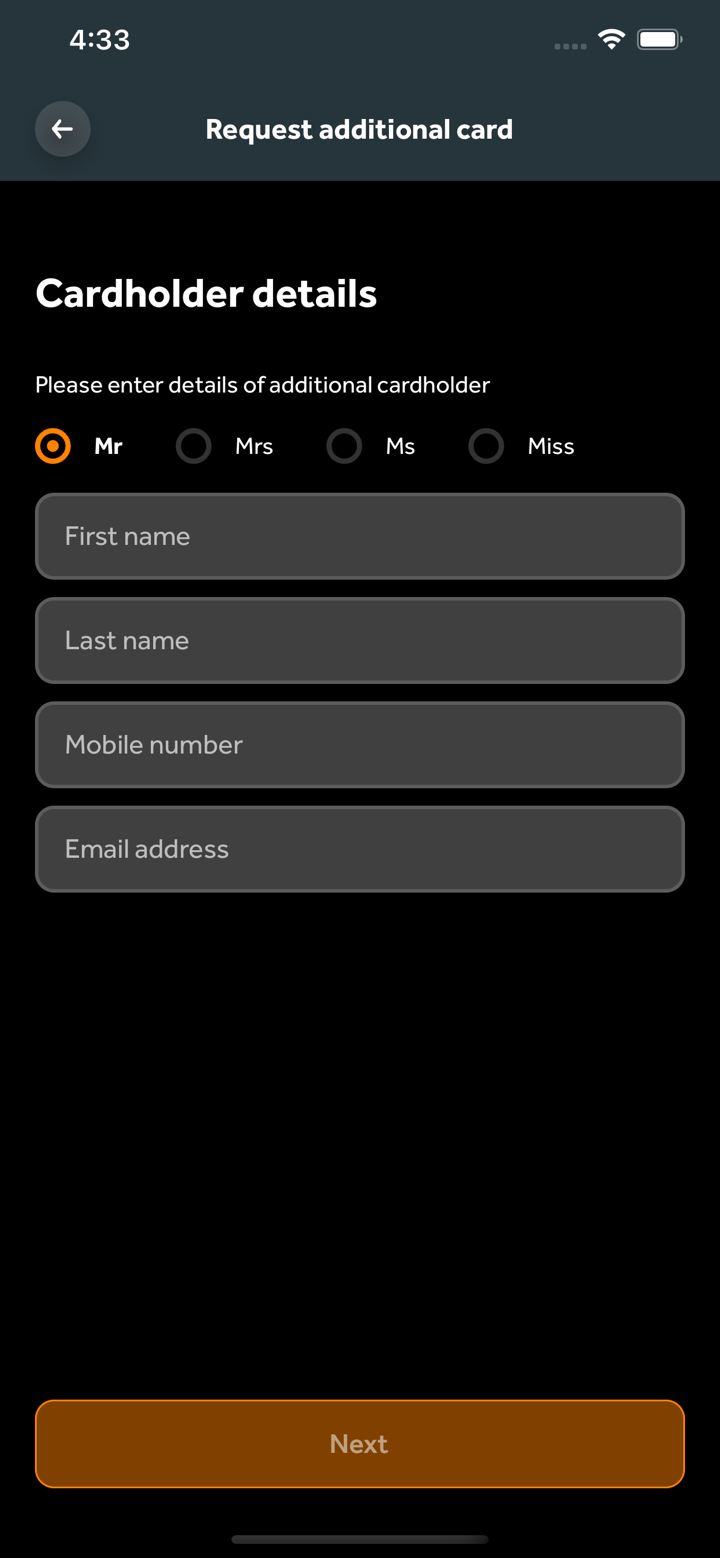

英國個人客戶可以選擇個人銀行業務、活期帳戶、物業貸款、外匯服務、快速支付、常見問題和通知存款帳戶。

該銀行為英國企業客戶提供商業銀行業務、企業帳戶、貿易融資、物業貸款、通知存款帳戶、直接貸款、快速支付和常見問題。

英國私人客戶專享私人銀行業務、自行決策投資組合、執行式投資組合、物業貸款、通知存款帳戶、快速支付和投資組合擔保貸款。

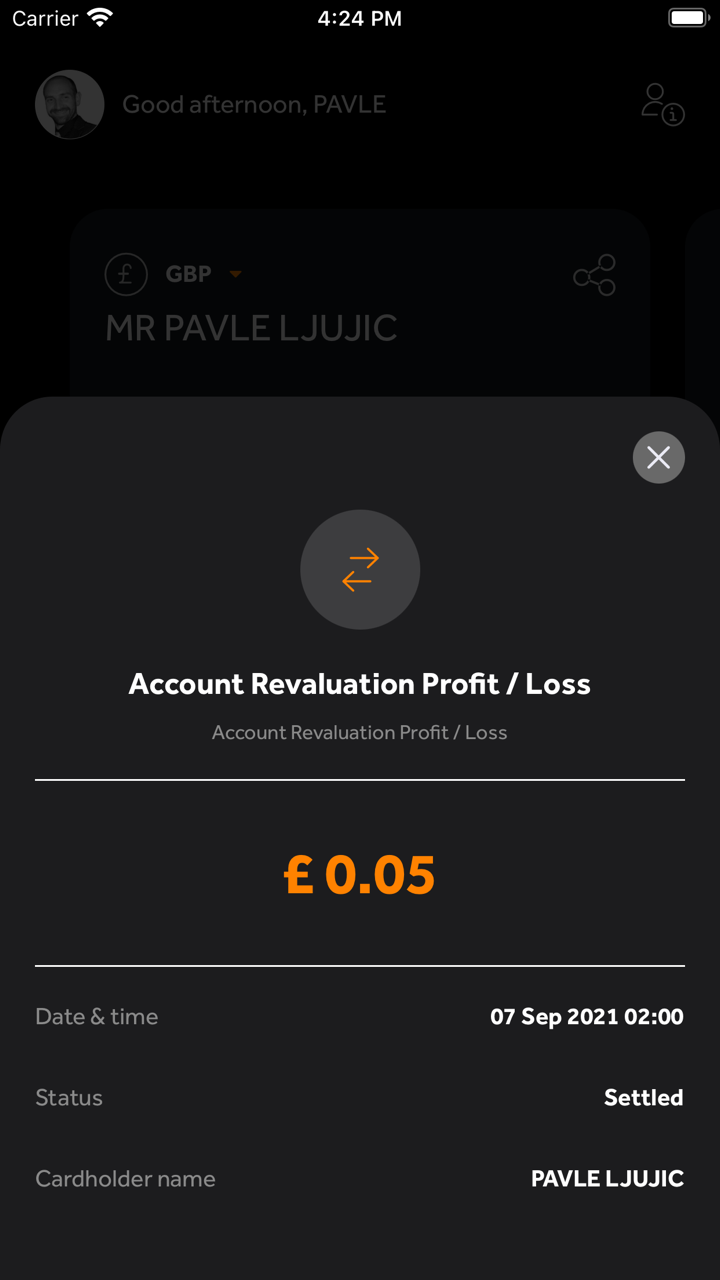

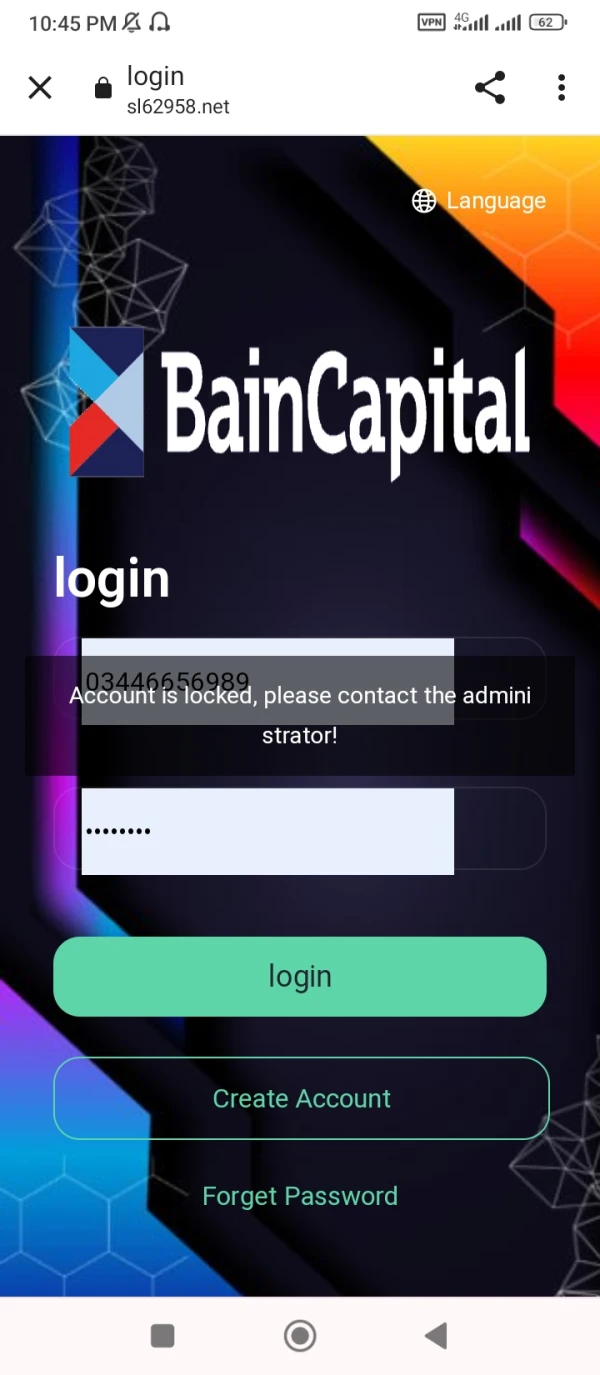

Ghazi6612

巴基斯坦

現在我的帳戶已被鎖定

爆料

sunny91

土耳其

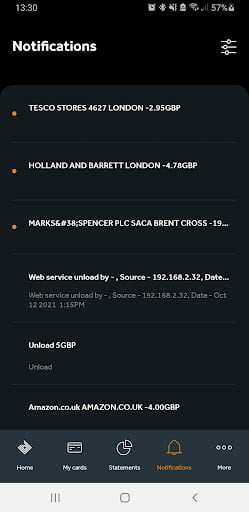

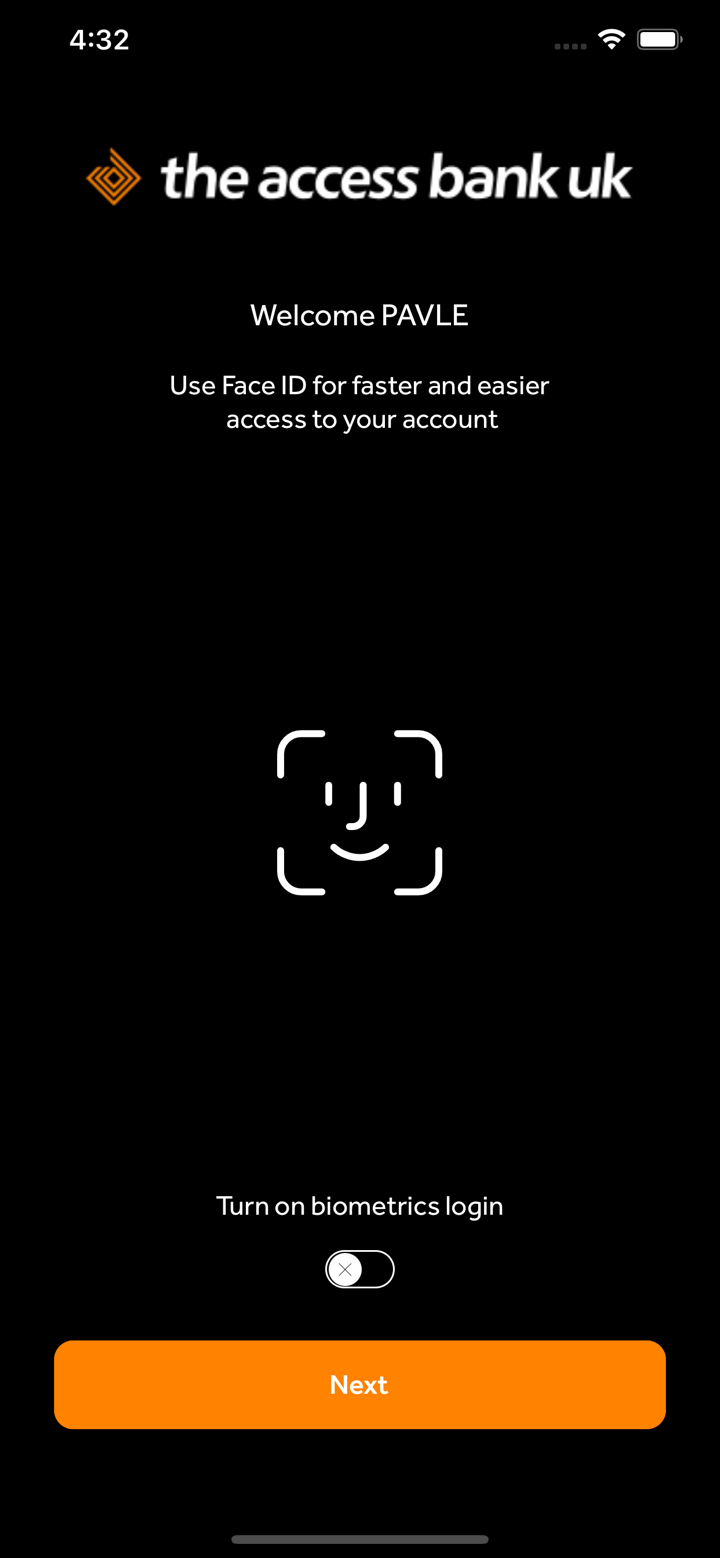

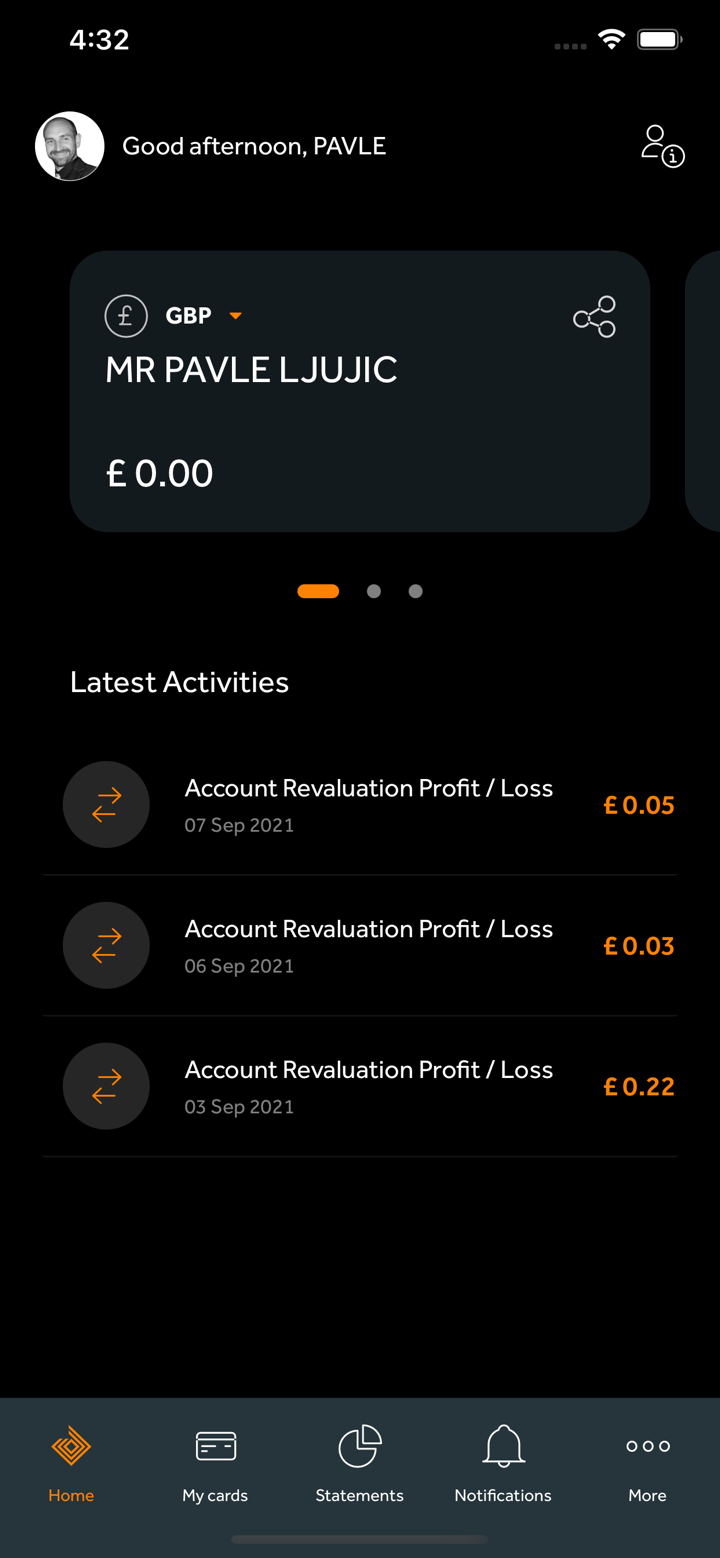

與Access Bank UK進行銀行業務感覺真正個人化。他們真正優先理解和滿足我的需求。他們的網上銀行業務簡單高效。

好評

拳

新加坡

值得信賴和可靠!一流的銀行服務!

好評

KASLAS

尼日利亞

經紀人的主要問題是網絡不好,但 Access Bank 經紀人的網絡非常好,交易簡單,利潤提取過程成功

好評

程安 -陶

阿根廷

這家公司的客戶服務非常好。發郵件一個小時就收到回复,客服耐心細緻的幫我解決了問題。

好評

Rith Rith

香港

我試過很多這種東西,從某種意義上說,我想嘗試,但潛意識裡我想,是的,是的,我想嘗試!!有人可以告訴我它有效嗎?

好評