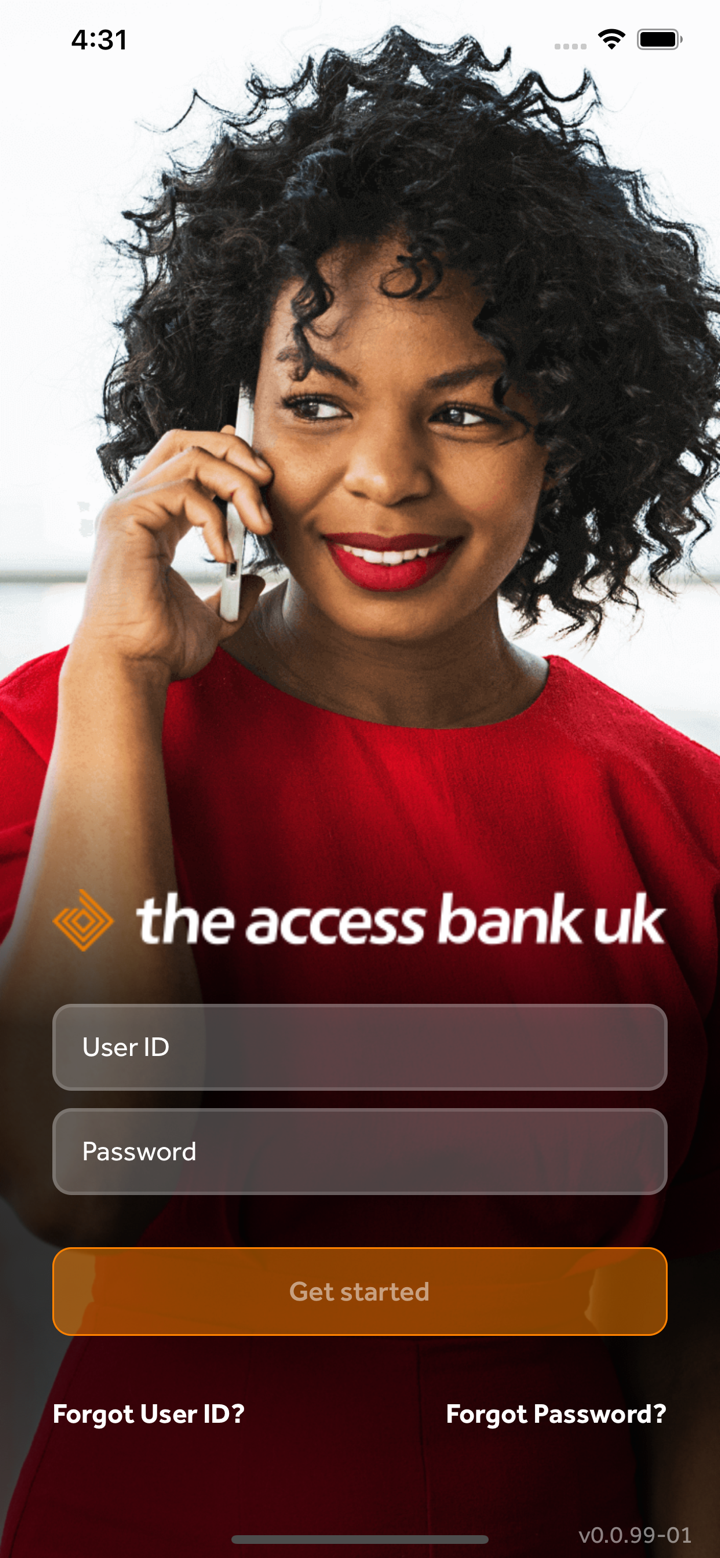

회사 소개

| Access Bank Review Summary | |

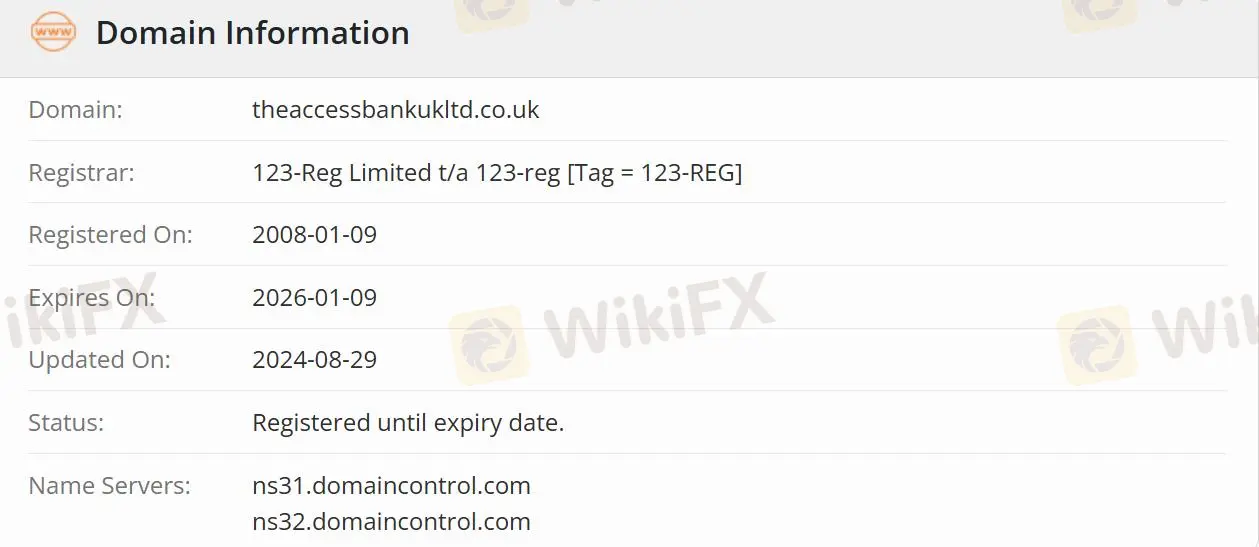

| 설립 | 2008-01-19 |

| 등록 국가/지역 | 영국 |

| 규제 | 규제됨 |

| 서비스 | 무역 금융/상업 은행/자산 관리/투자 |

| 고객 지원 | 이메일: ccontactaaccessprivatebank.com |

| 전화: 0333 222 4516 (영국)/+44 1606 813020 | |

Access Bank 정보

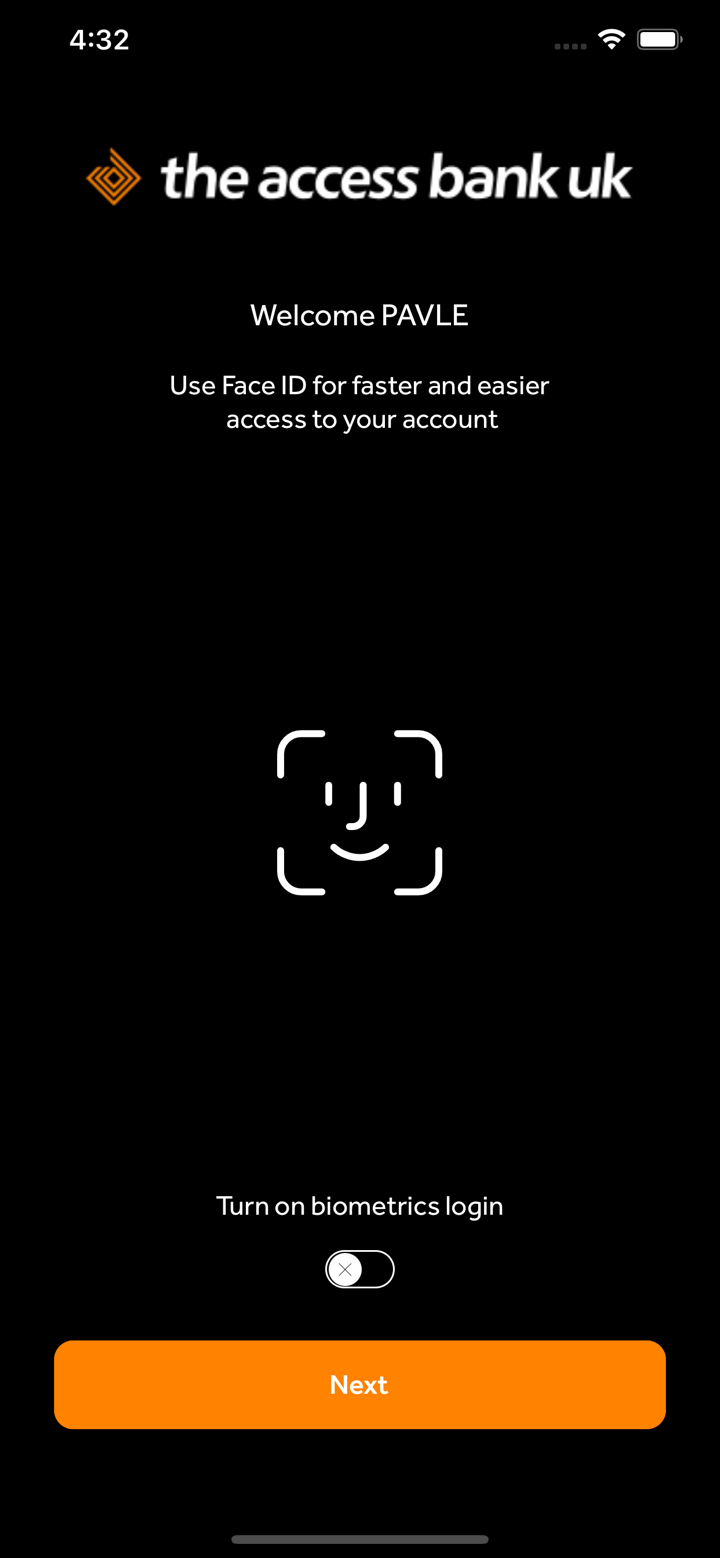

영국에 등록된 Access Bank은 무역 금융, 상업 은행 및 자산 관리를 포함한 다양한 혁신적인 제품과 서비스를 제공하며, 나이지리아, 아프리카 및 MENA 지역의 시장으로의 투자 유입을 지원합니다. 은행의 목표는 고객 서비스와 무역 금융, 상업 은행 및 자산 관리 분야에서의 혁신적인 솔루션을 통해 Access Bank 그룹의 국제 사업을 성장시키는 것입니다.

Access Bank이 신뢰할 만한가요?

Access Bank은 금융행정청(FCA)에 의해 승인 및규제되며 라이센스 번호는 478415입니다. 규제된 회사는 규제되지 않은 회사보다 안전합니다.

Access Bank은 어떤 서비스를 제공하나요?

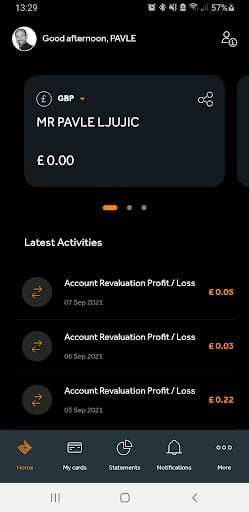

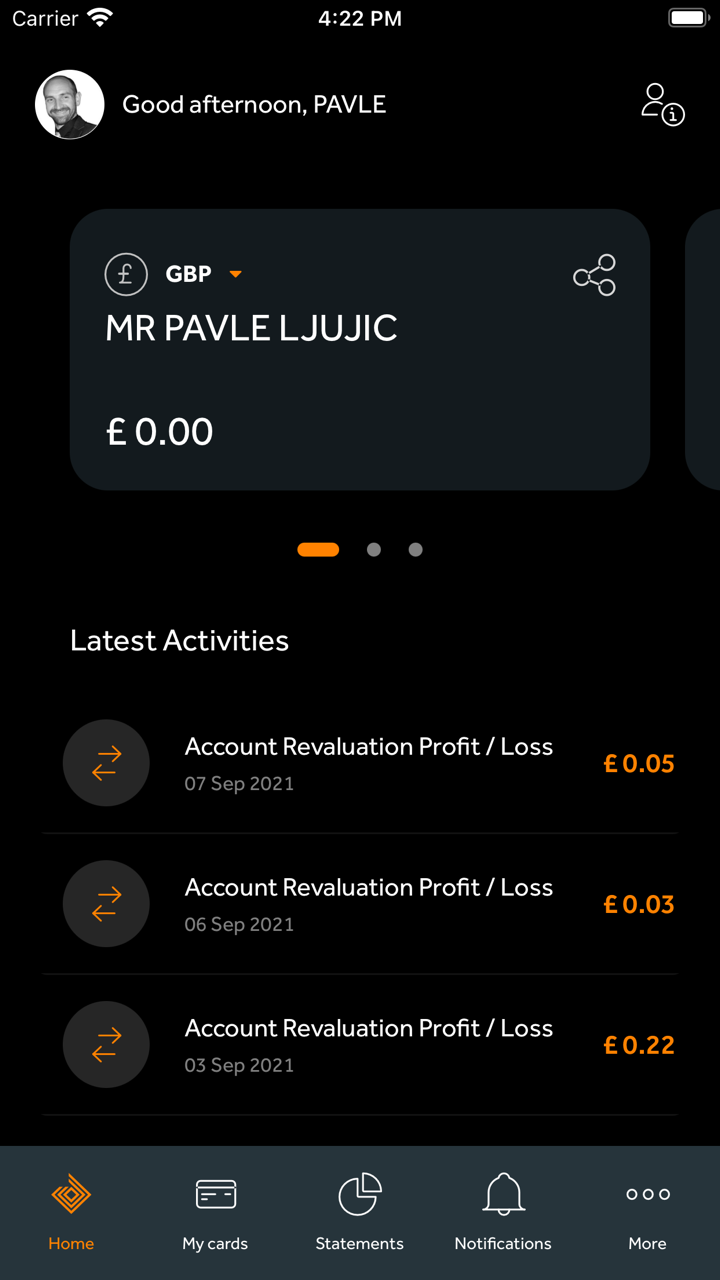

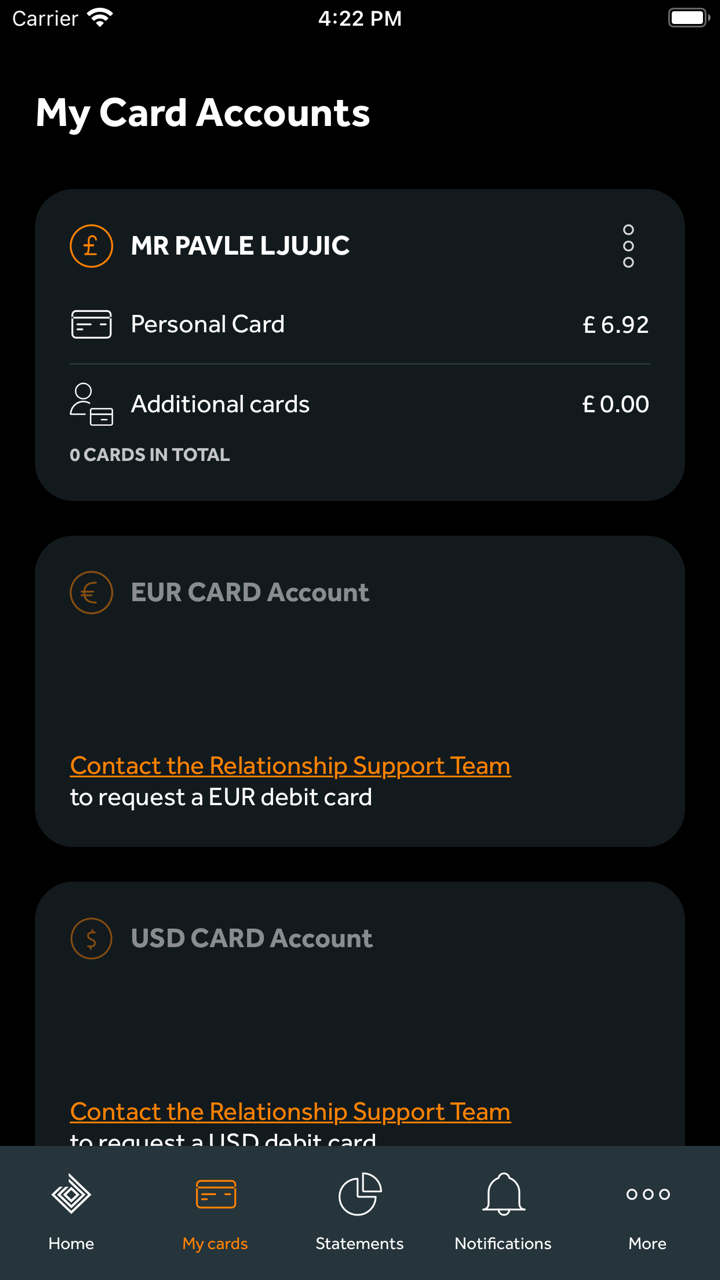

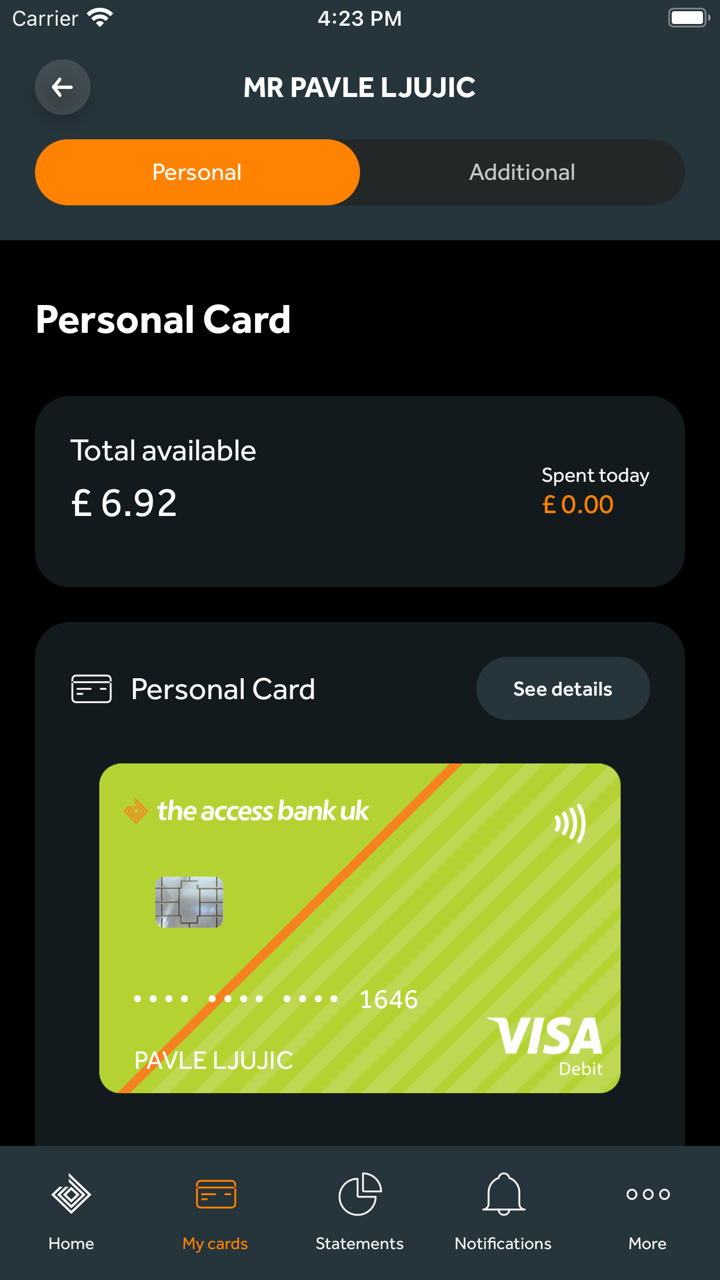

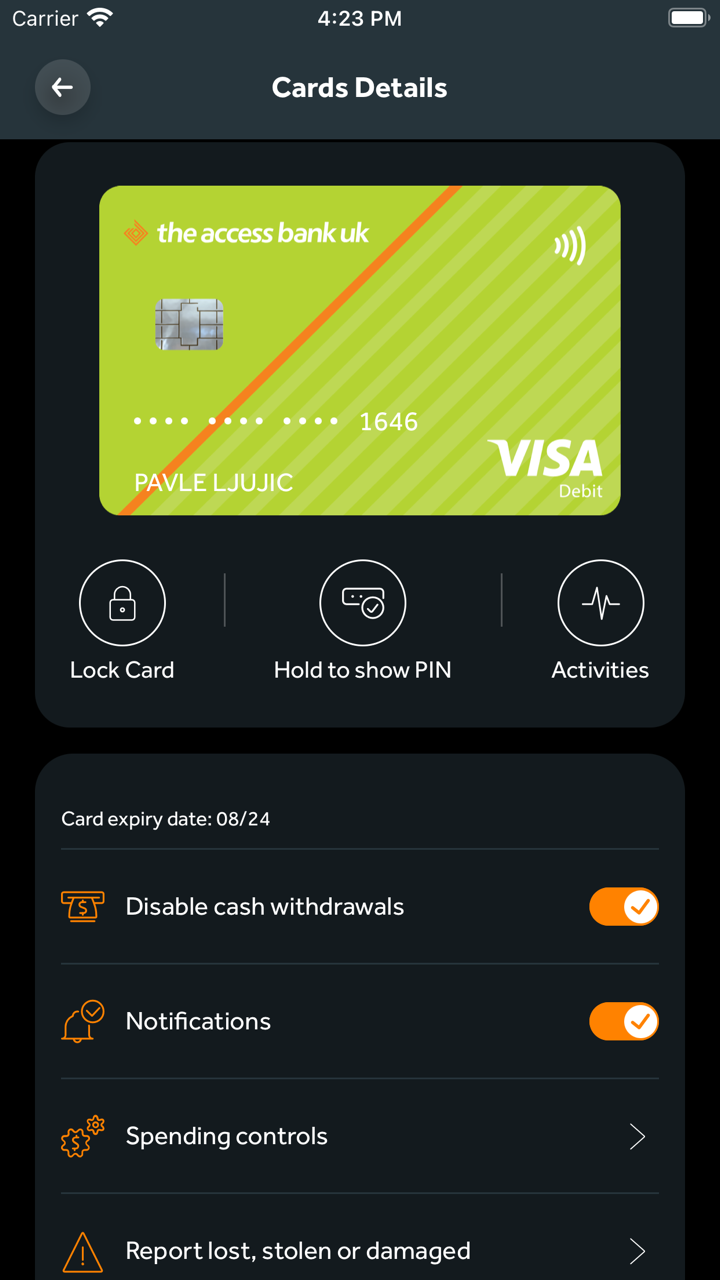

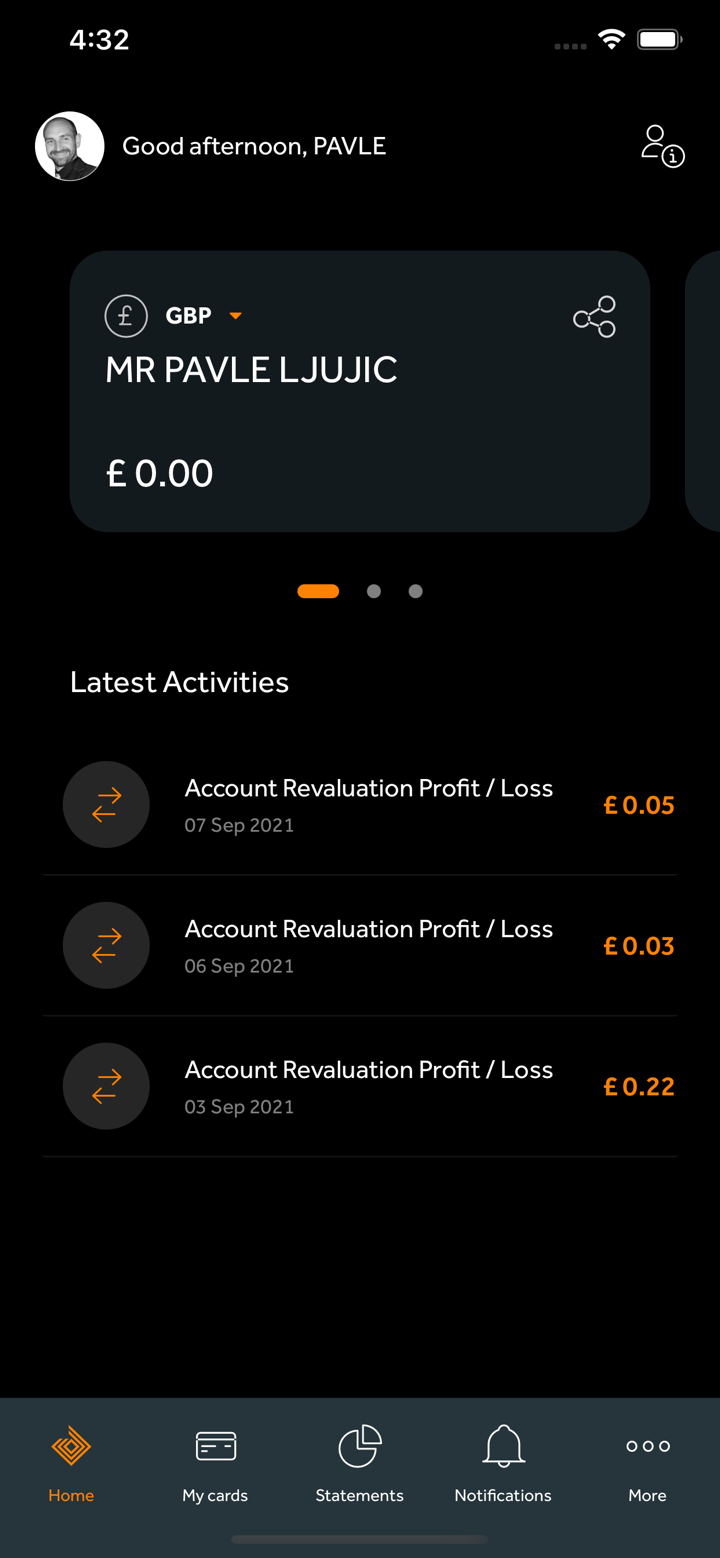

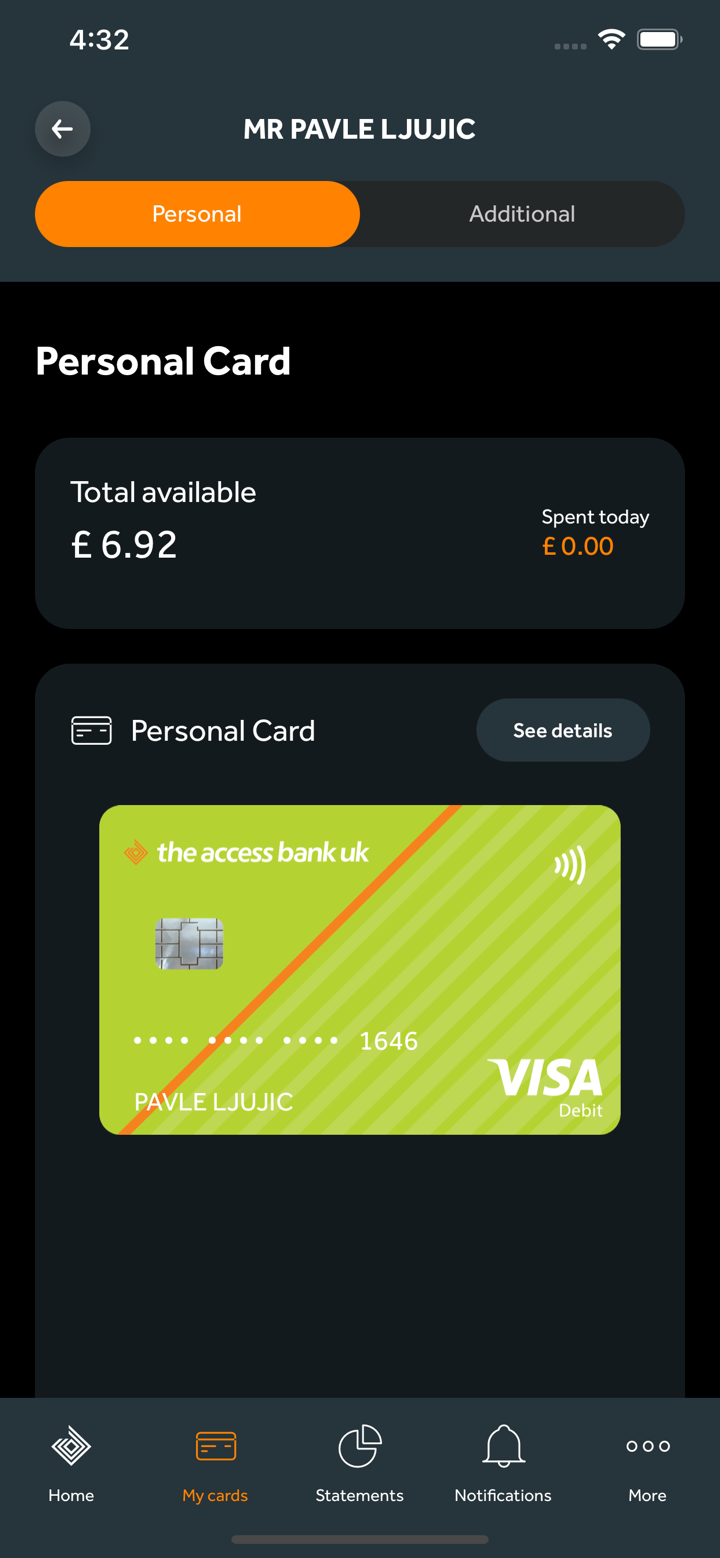

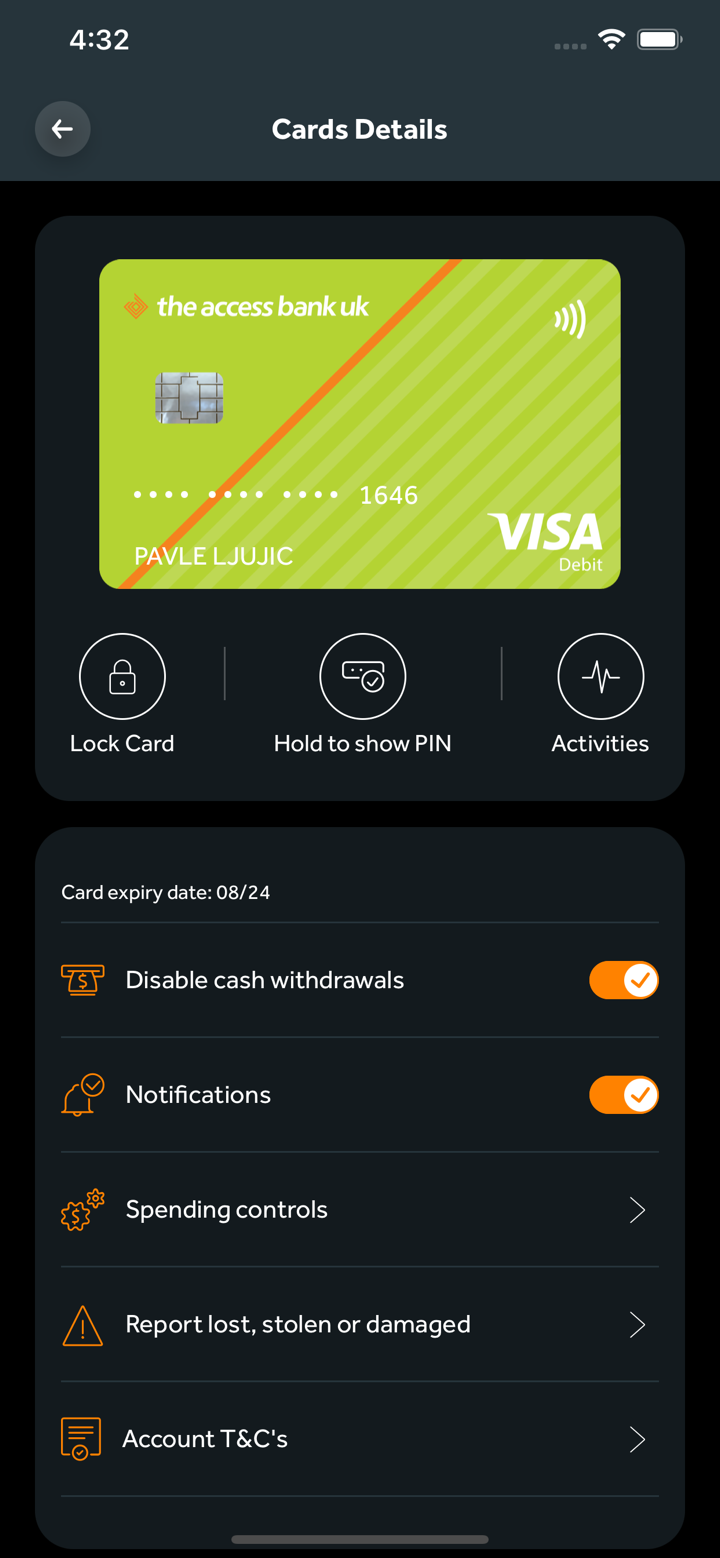

Access Bank은 영국의 개인, 기업 및 사적인 개인에게 다양한 금융 서비스를 제공합니다. 다른 국제 사용자들은 상업 은행 및 무역 금융과 같은 서비스를 이용할 수 있습니다.

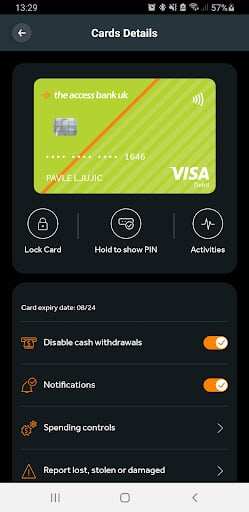

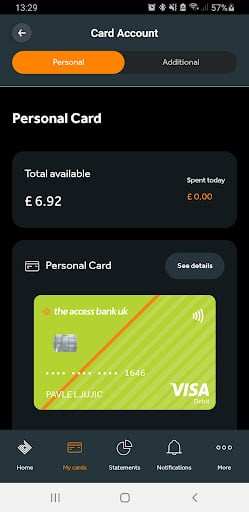

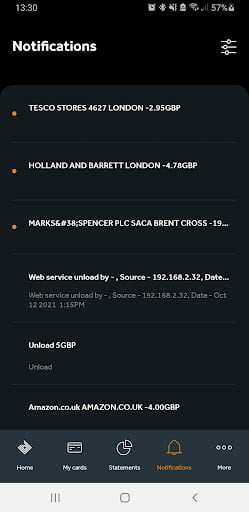

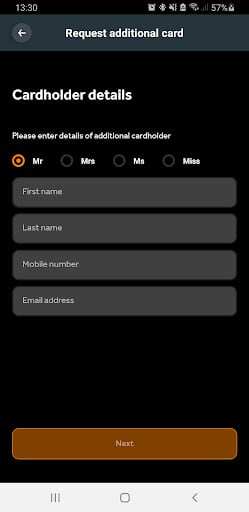

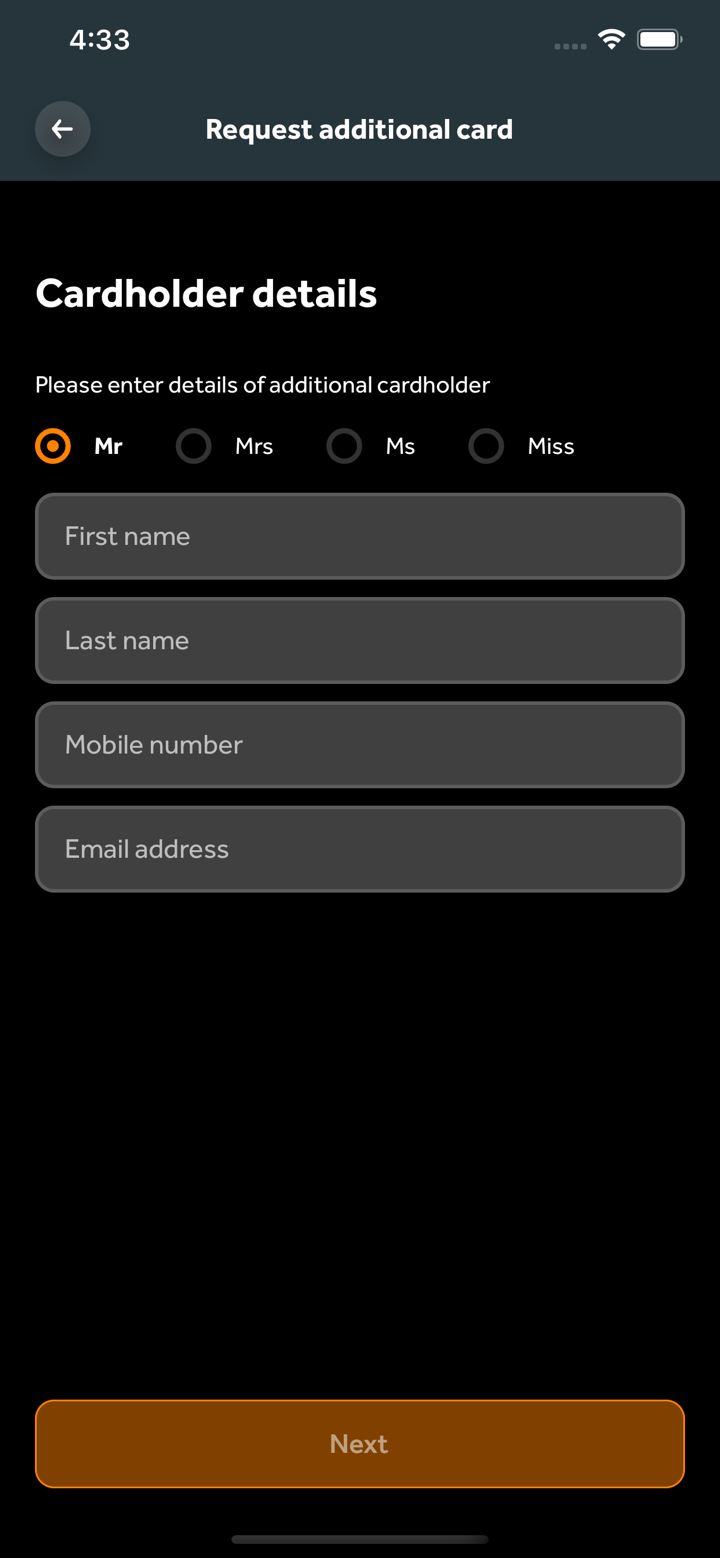

영국 개인 고객은 개인 은행, 일반 계좌, 부동산 대출, 외환 서비스, 빠른 결제, 자주 묻는 질문 및 예금 통지 계좌를 선택할 수 있습니다.

은행은 영국 기업 고객에게 기업 은행, 기업 계좌, 무역 금융, 부동산 대출, 예금 통지 계좌, 직접 대출, 빠른 결제 및 자주 묻는 질문을 제공합니다.

영국 사적 고객은 독점적인 사적 은행, 재량적 포트폴리오, 실행 전용 포트폴리오, 부동산 대출, 예금 통지 계좌, 빠른 결제 및 포트폴리오 담보 대출을 제공합니다.

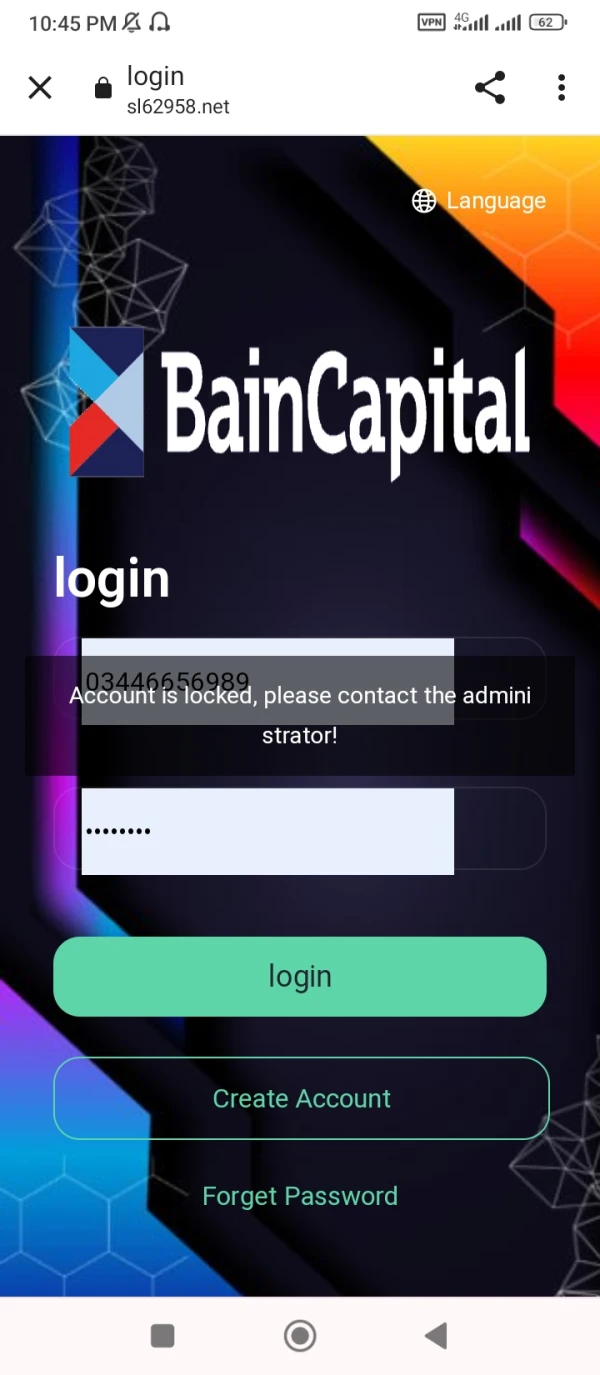

Ghazi6612

파키스탄

지금 내 계정도 잠겨 있어요.

신고

sunny91

터키

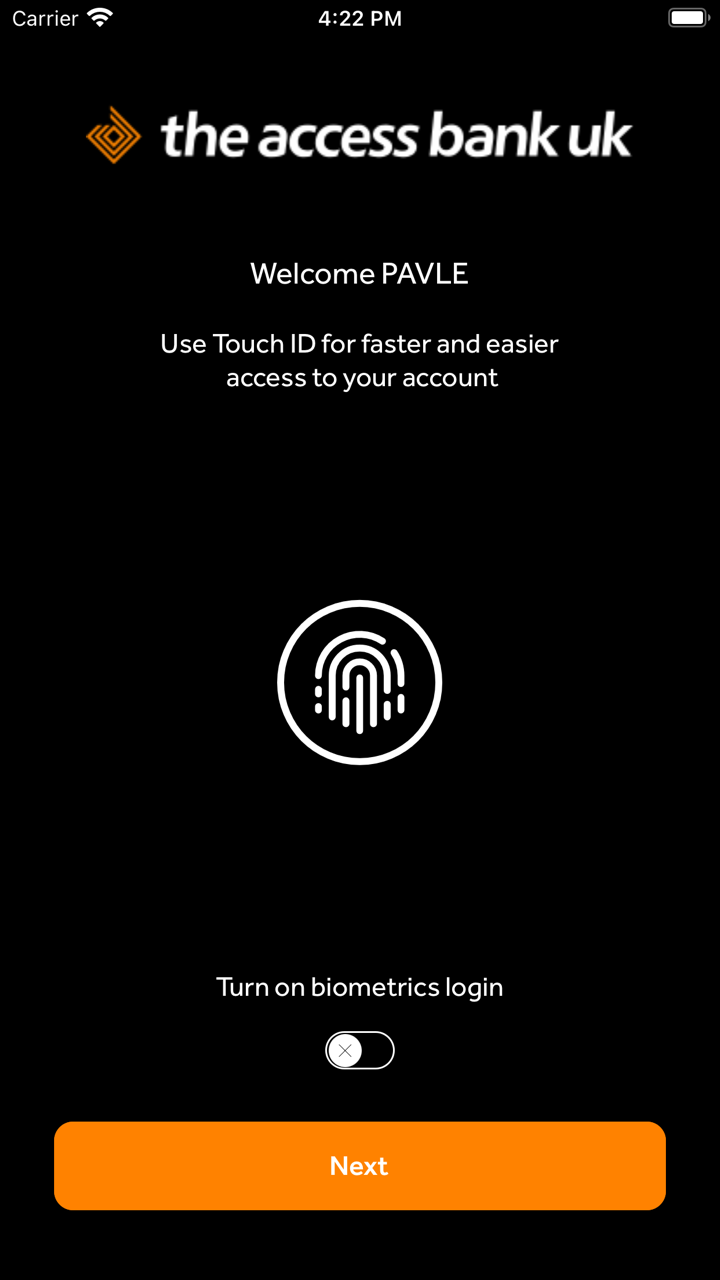

Access Bank UK와 함께하는 은행 업무는 정말로 개인적인 느낌이 듭니다. 그들은 진정으로 이해하고 제 요구를 충족시키는 것을 우선시합니다. 그들의 온라인 뱅킹은 간편하고 효율적입니다.

좋은 평가

拳

싱가포르

신뢰할 수 있고 신뢰성 있는! 일류 은행 서비스!

좋은 평가

KASLAS

나이지리아

중개인의 주요 문제는 나쁜 네트워크이지만 Access Bank 중개인은 네트워크가 매우 우수하여 거래가 간단하고 수익 인출 프로세스가 성공적이었습니다.

좋은 평가

程安 -陶

아르헨티나

이 회사의 고객 서비스는 매우 좋습니다. 이메일을 보낸 지 1시간 만에 답변을 받았고, 고객 서비스는 끈기 있고 꼼꼼하게 문제를 해결하는 데 도움을 주었습니다.

좋은 평가

Rith Rith

홍콩

이런거 많이 해봤는데 어떤 의미로는 해보고싶은데 무의식중에 네, 네, 해보고싶어요!! 누군가 그것이 작동한다고 말할 수 있습니까?

좋은 평가