公司簡介

| Monex Europe 評論摘要 | |

| 成立年份 | 1985 |

| 註冊國家/地區 | 墨西哥 |

| 監管 | FCA(已撤銷) |

| 產品與服務 | 現貨外匯、遠期交易、外匯衍生品、外匯對沖、全球支付、API整合、多幣種帳戶 |

| 模擬帳戶 | ❌ |

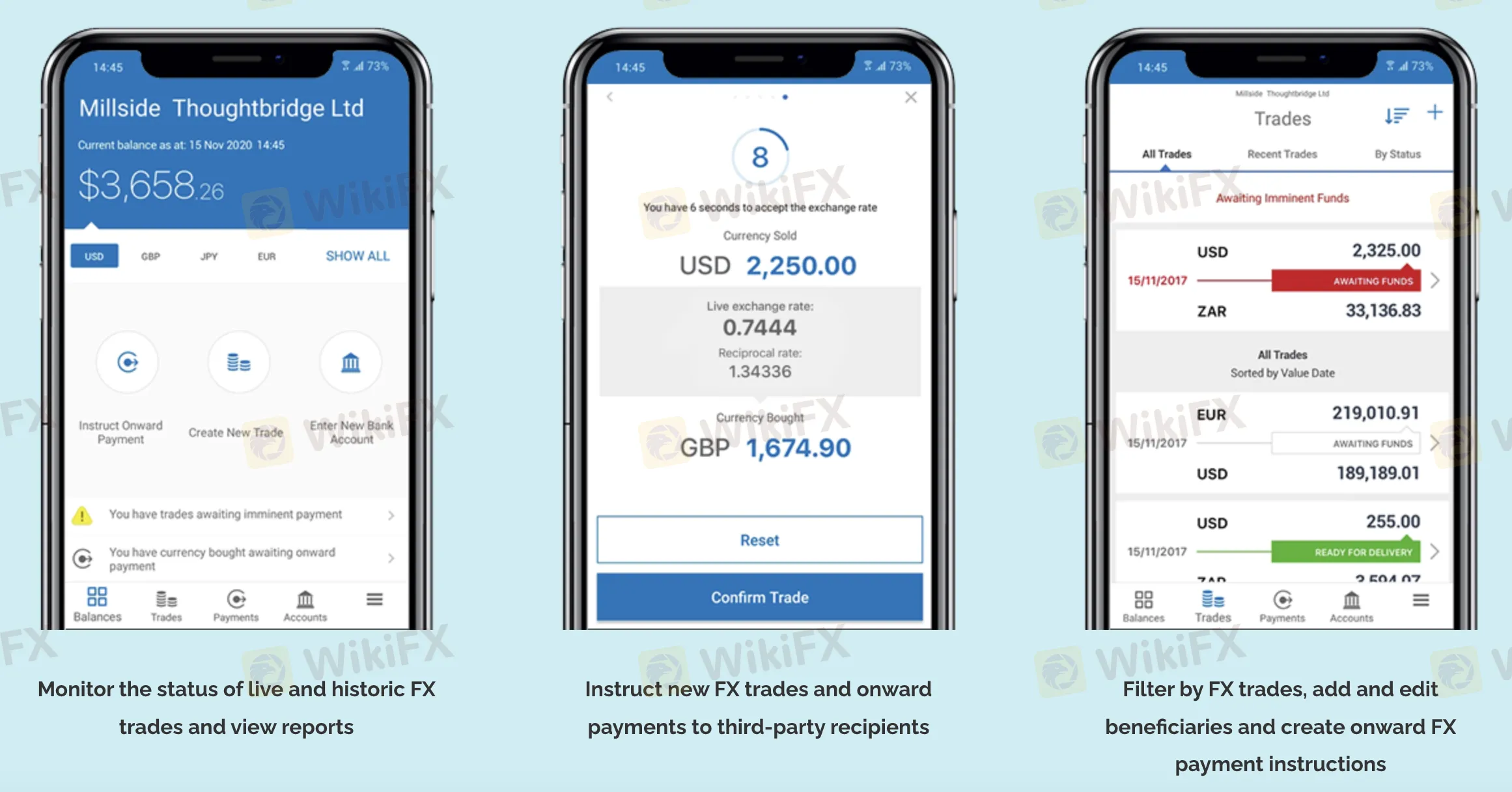

| 交易平台 | Monex Pay 平台(Web、iOS、Android)、Monex REST API |

| 客戶支援 | 電話/WhatsApp:+44 (0) 203 650 6400 |

| 電郵:support@monexpay.com | |

Monex Europe 資訊

Monex Europe 成立於1985年,總部設於墨西哥,曾受英國FCA監管,但後來被撤銷執照。該公司為企業客戶提供完整的外幣和跨境支付服務。他們的解決方案包括Monex Pay平台和用於整合和自動化的REST API。

優缺點

| 優點 | 缺點 |

| 提供機構級外匯和支付解決方案 | FCA執照已撤銷 |

| 支援60多種貨幣和最多40個多幣種錢包 | 沒有模擬帳戶 |

| 提供基於手機和API的交易和支付平台 | 有關費用的信息有限 |

Monex Europe 是否合法?

不,它沒有受到監管。Monex Europe 有限公司曾受英國金融行為監管局(FCA)監管。他們的支付許可證號碼為463951。但是,由於執照狀態顯示為“已撤銷”,因此不再有效。

產品與服務

Monex Europe 提供多種不同的外匯產品、風險管理工具和全球支付服務。他們提供即期和遠期外匯、外匯衍生品、集成API解決方案和多幣種帳戶服務。這些服務支援超過60種貨幣,並為遍布全球的企業提供多達40個貨幣錢包。

| 類別 | 產品與服務 |

| 商業外匯產品 | 即期外匯、可交割遠期、市場訂單(限價和止損)、保證金信貸 |

| 外匯衍生品 | 外匯期權、非可交割遠期(NDFs)、自訂遠期、外匯對沖策略、外匯諮詢 |

| 全球支付 | Monex Pay 平台、多幣種帳戶(40多種貨幣)、批量/個別支付、SWIFT整合 |

| 技術解決方案 | Monex REST API、客戶和開發者支援、開發者門戶、可自訂客戶門戶 |

交易平台

| 交易平台 | 支援 | 可用設備 | 適用對象 |

| Monex Pay 平台 | ✔ | Web、iOS(App Store)、Android(Google Play) | 管理全球支付的企業客戶 |

| Monex REST API | ✔ | 伺服器端/API整合 | 需要自動化的企業和開發者 |