Unternehmensprofil

| Berichtszusammenfassung | |

| Gegründet | 1997 |

| Registriertes Land/Region | Frankreich |

| Regulierung | SFC |

| Produkte | Immobilienaktien, Privatschulden & alternative Kredite, Private Equity & Infrastruktur; Aktien, Festverzinsliche Wertpapiere, Multi-Asset-Investitionen; Private Equity, Infrastrukturaktien, Privatschulden, Hedgefonds |

| Kundenbetreuung | Tel: +33144457000 |

| E-Mail: webmaster-COM@axa-im.com | |

| Hauptsitz: Tour Majunga La Défense, 6 Place de la Pyramide, 92800 Puteaux | |

| Link zur Adresse anderer Filialen: https://www.axa-im.com/contact-us | |

AXA Informationen

AXA Investment Managers (AXA IM) ist ein globales Vermögensverwaltungsunternehmen mit Niederlassungen auf der ganzen Welt. Es handelt hauptsächlich mit Finanzdienstleistungen und bietet Produkte wie Immobilienaktien, Privatschulden & alternative Kredite, Private Equity & Infrastruktur, Aktien, Festverzinsliche Wertpapiere, Multi-Asset-Investitionen, Private Equity, Infrastrukturaktien, Privatschulden, Hedgefonds usw. an.

Das Gute ist, dass das Unternehmen von der SFC reguliert wird, was bedeutet, dass seine finanziellen Aktivitäten streng von diesen Behörden überwacht werden, was in gewissem Maße einen gewissen Kunden schutz garantiert.

Vor- und Nachteile

| Vorteile | Nachteile |

| SFC reguliert | Begrenzte Informationen zu Handelsbedingungen auf seiner Website veröffentlicht |

| Weltweite Präsenz | |

| Verschiedene Handelsprodukte |

Ist AXA legitim?

AXA wird derzeit gut von der Securities and Futures Commission of Hong Kong (SFC)mit der Lizenznummer AAP809 reguliert.

| Reguliertes Land | Regulierungsbehörde | Aktueller Status | Reguliertes Unternehmen | Lizenztyp | Lizenznummer |

| SFC | Reguliert | AXA Investment Managers Asia Limited | Handel mit Futures-Kontrakten & Gehebelter Devisenhandel | AAP809 |

Produkte und Dienstleistungen

Kerninvestitionen

- Vermögensklassen: Aktien, Festverzinsliche Wertpapiere, Multi-Asset

- Schwerpunkt: Traditionelle Strategien mit nachgewiesener Erfolgsbilanz in verschiedenen Marktbedingungen.

ESG & Nachhaltige Strategien

- Ansatz: Integriert Umwelt-, Sozial- und Governance-Faktoren, um finanzielle Ziele mit realen Auswirkungen in Einklang zu bringen.

- Philosophie: Pragmatisch und kundenorientiert, betont langfristige nachhaltige Renditen.

Alternative Investitionen

- Säulen:

- Immobilienaktien

- Private Kredite & Alternative Kredite

- Private Beteiligungen & Infrastruktur

Private Märkte & Hedgefonds

- Instrumente: Primärmarkt, Sekundärmarkt, Co-Investments, NAV-Finanzierung, Minderheitsbeteiligungen von GP*.

- Abdeckung: Private Beteiligungen, Infrastruktur-Beteiligungen, private Kredite, Hedgefonds.

Auswahl (Multi-Manager & Beratungsdienstleistungen)

- Dienstleistungen: Fondsgebundene und Vermögensverwaltungslösungen.

- Regionen: Europa und Asien, zugeschnitten auf die spezifischen Anlagebedürfnisse der Kunden.

山27387

Hongkong

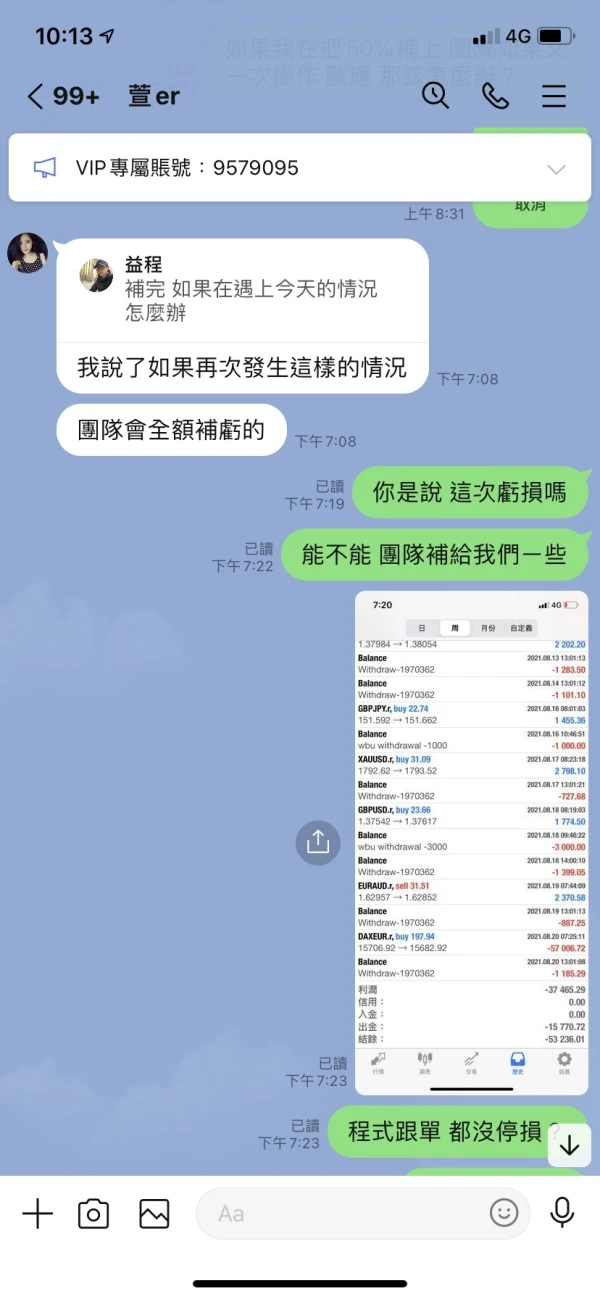

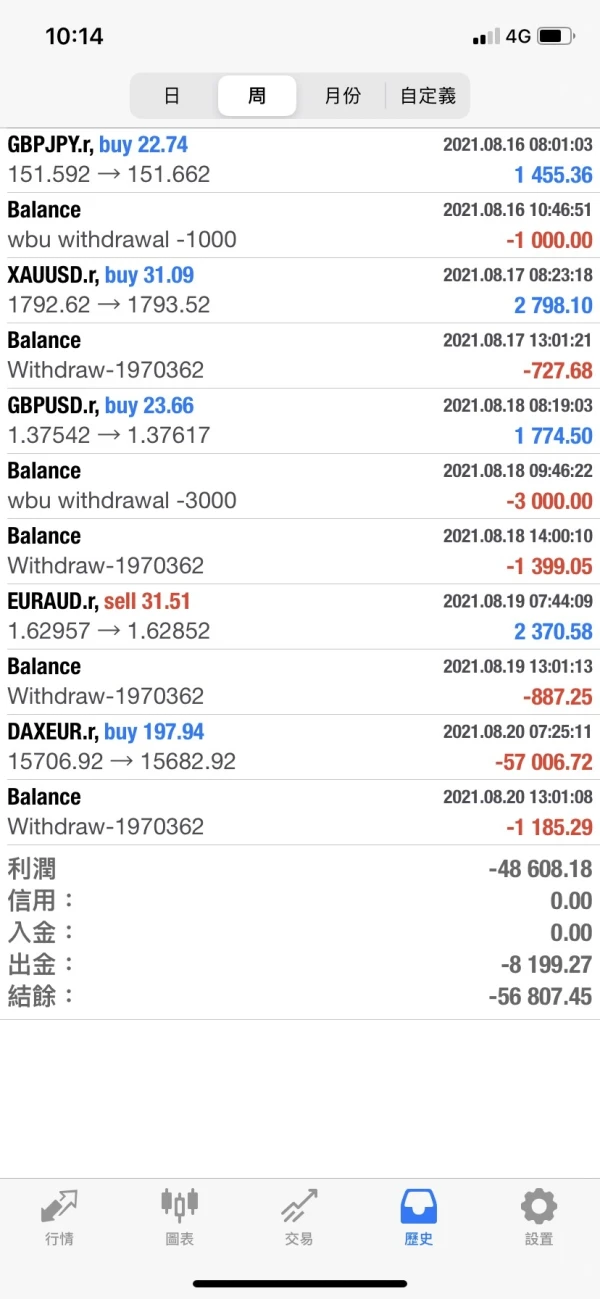

AXA friere mein Konto ein und ich kann nicht abheben. Der Kundenservice hat keinen Kontakt. Die Website kann geöffnet werden.

Exposition

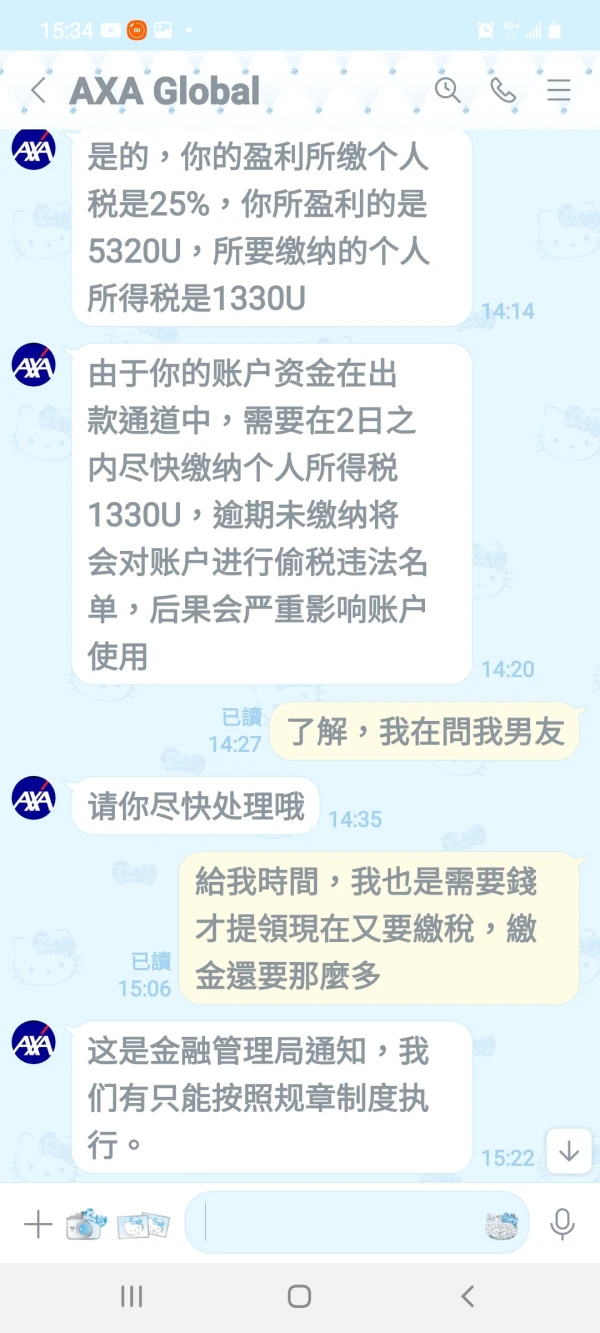

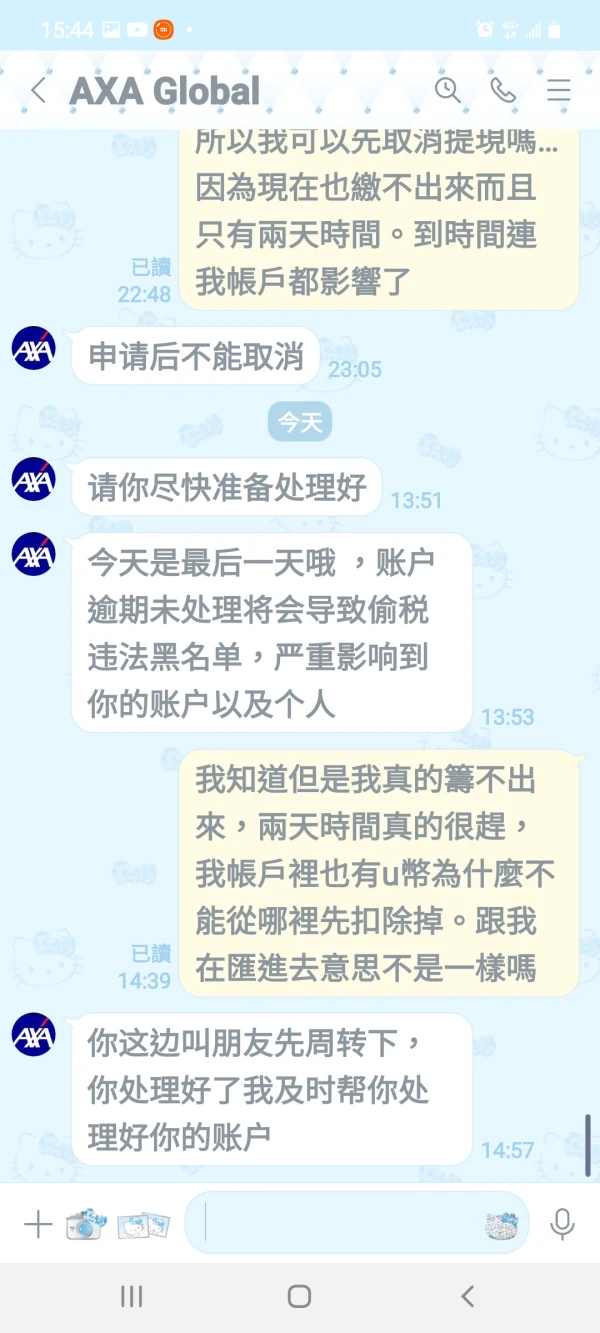

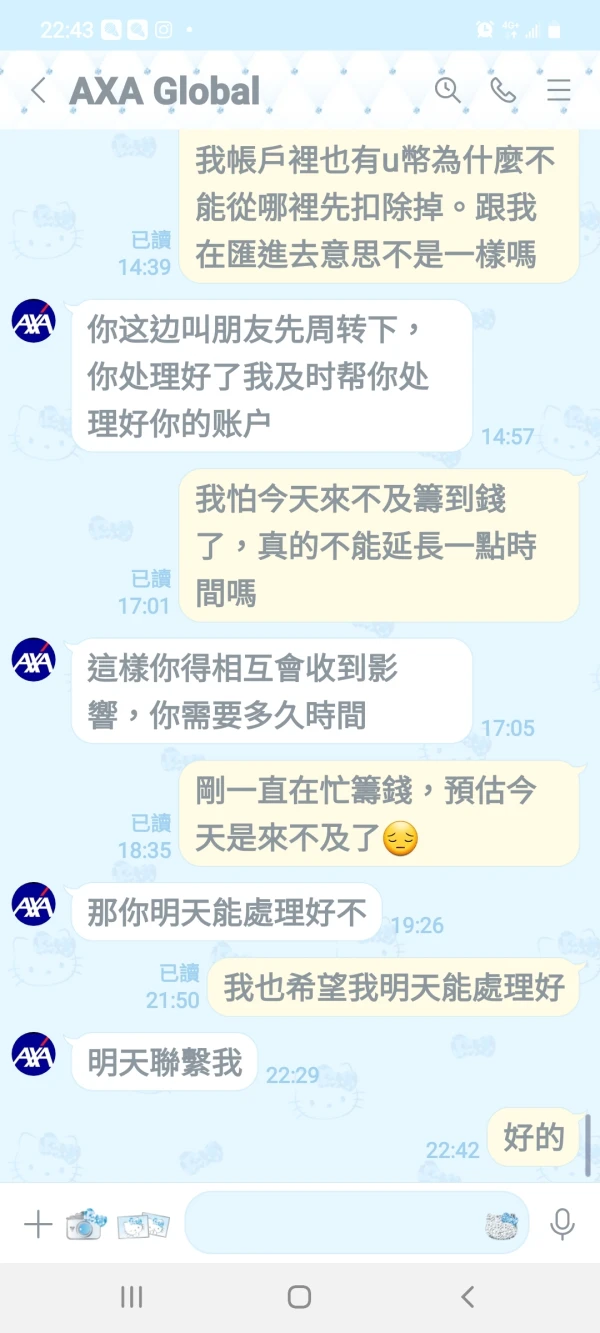

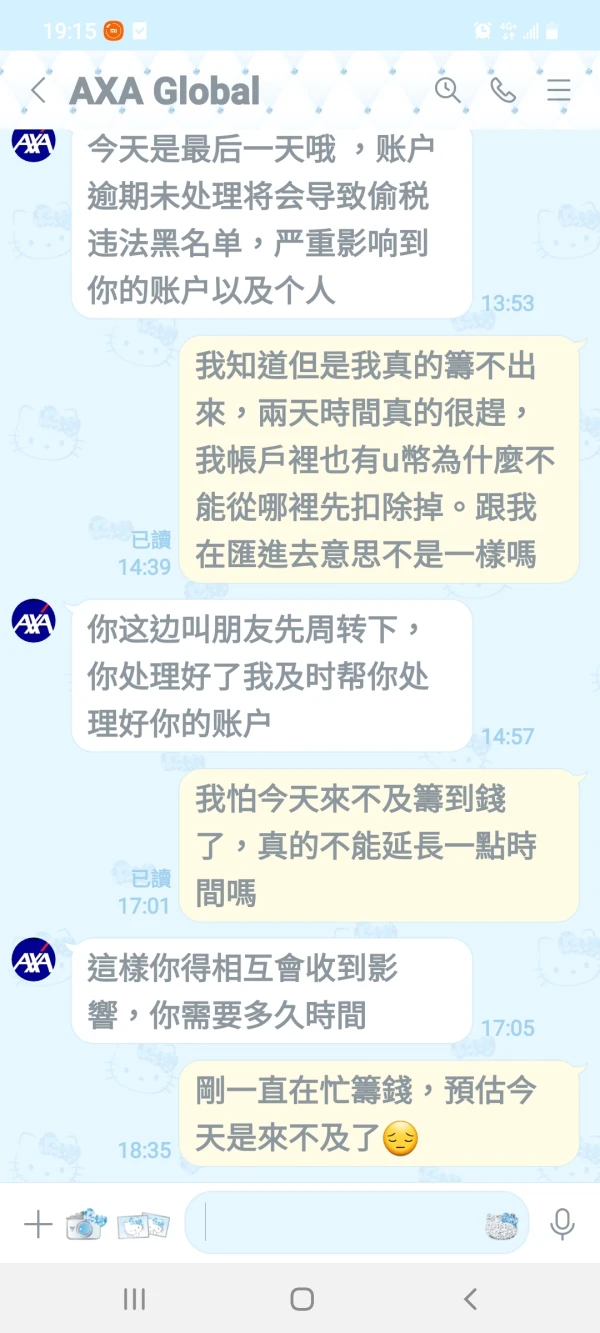

FX1236648509

Taiwan

Der Kundenservice hat sich geweigert, mir die Auszahlung zu zahlen.

Exposition

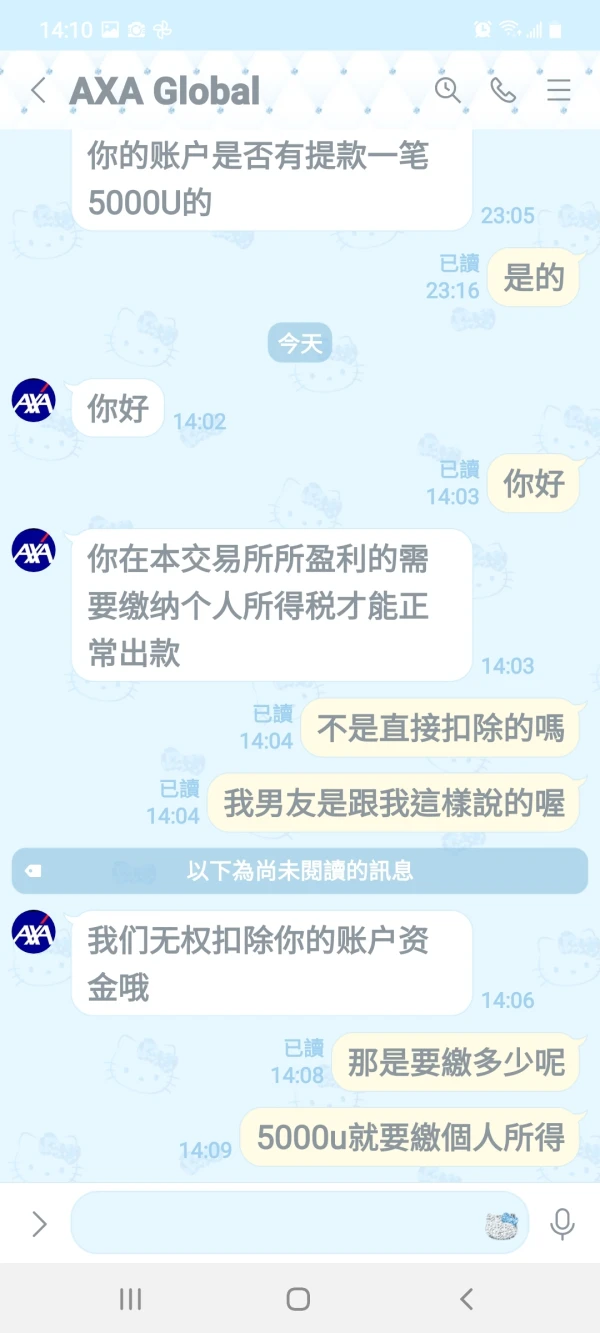

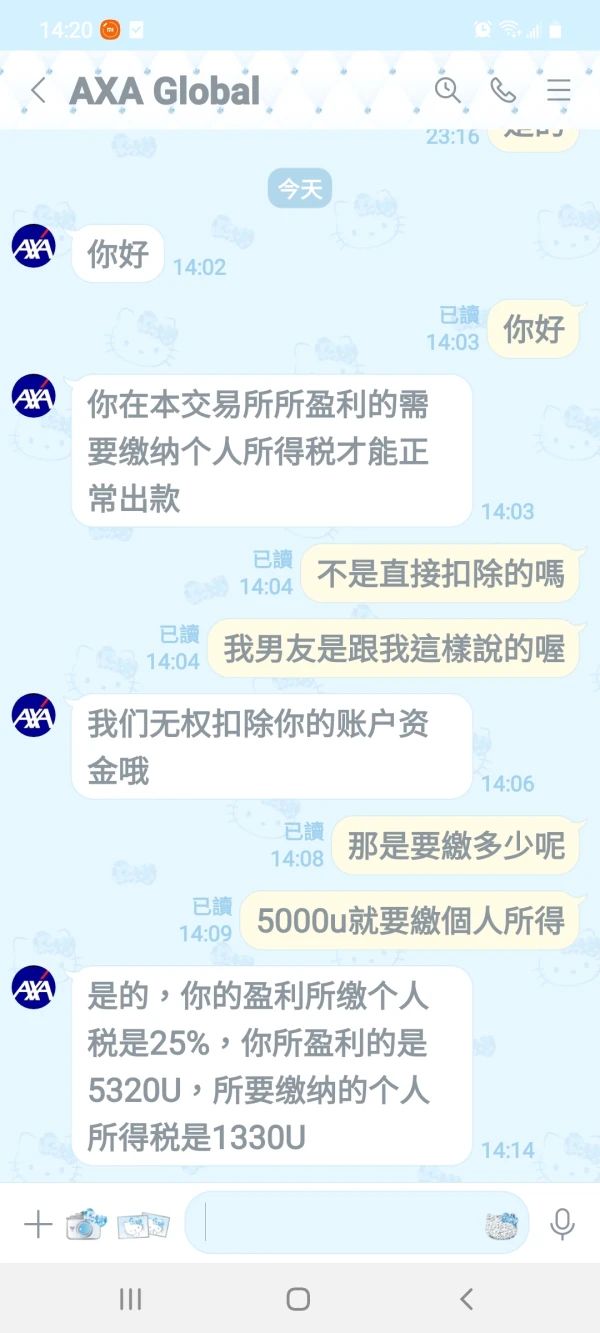

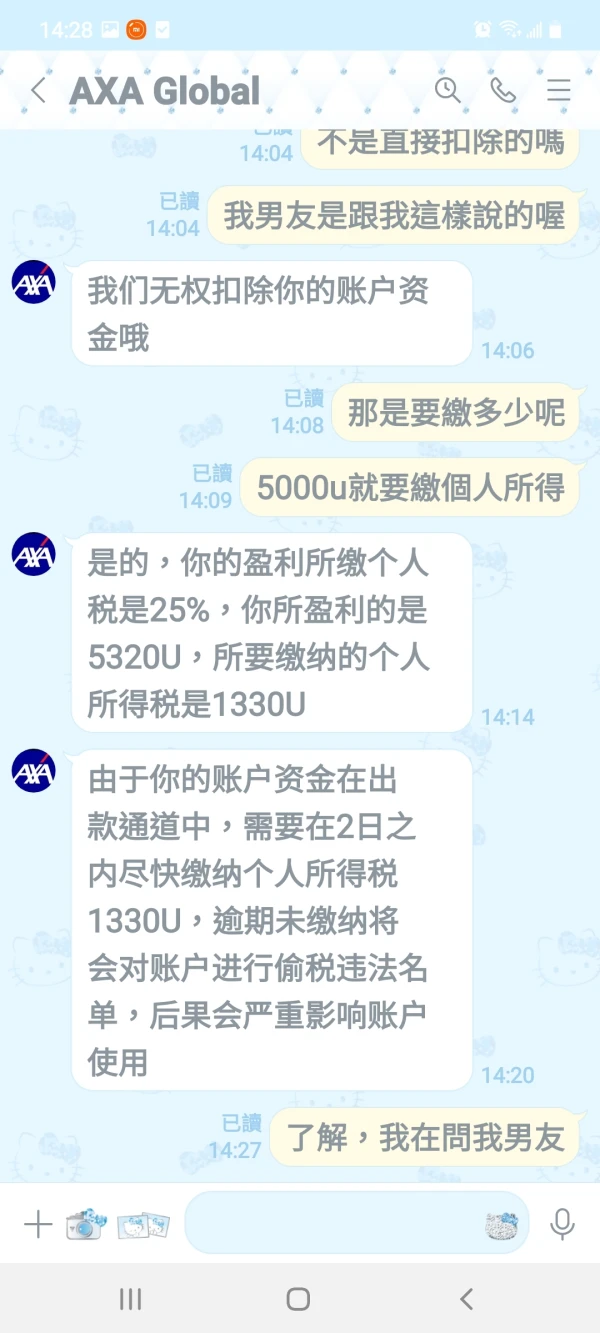

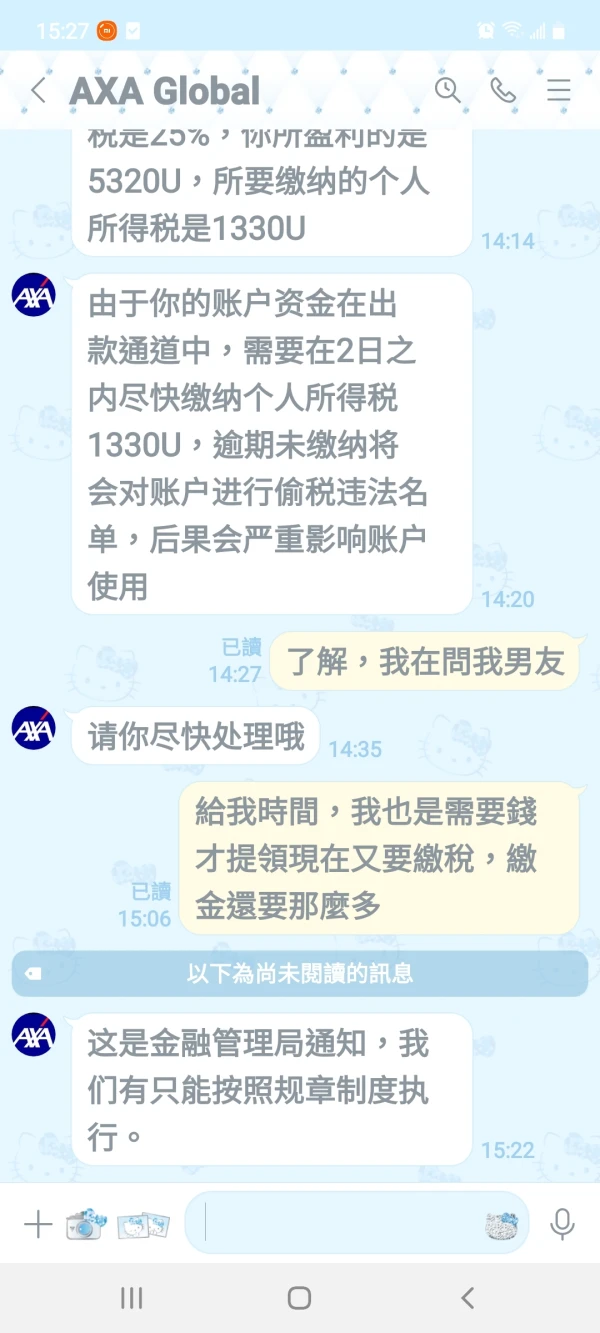

詹孟玟

Taiwan

Der Kundenservice hat es gesagt und ich war mir nicht sicher, ob es wirklich so ist. Könnte ich mein Geld zurückbekommen?

Exposition

FX1566795049

Zypern

Mein kürzliches Gespräch mit dem AXA-Kundendienst ergab, dass für Abhebungen eine Einkommenssteuer von 25 % erforderlich ist. Ich bin mir über den Prozess und die mögliche Rückerstattung nicht im Klaren und mache mir Sorgen um die Transparenz und Zuverlässigkeit der Dienstleistungen von AXA. Klarheit in diesen Angelegenheiten würde die Benutzererfahrung erheblich verbessern.

Neutral

贫僧悟道ing......

Vereinigte Staaten

Es bietet eine Vielzahl von Anlageprodukten, einschließlich Aktienfonds, Rentenfonds usw., Fondsprodukte sind ebenfalls umfassend und bieten detaillierte Fondsdaten und Chartanalysen, die Website-Seite ist einfach und leicht verständlich, der Transaktionsprozess ist relativ einfach eine erwägenswerte Anlageplattform.

Positive