公司簡介

| Review Summary Review | |

| Founded | 1997 |

| Registered Country/Region | 法國 |

| Regulation | SFC |

| Products | 房地產股權、私人債務及替代信貸、私人股本及基礎設施;股票、固定收益、多元資產投資;私人股本、基礎設施股本、私人債務、對沖基金 |

| Customer Support | 電話:+33144457000 |

| 電郵:webmaster-COM@axa-im.com | |

| 總部:Tour Majunga La Défense, 6 Place de la Pyramide, 92800 Puteaux | |

| 其他分公司地址連結:https://www.axa-im.com/contact-us | |

AXA 資訊

AXA 投資管理公司(AXA IM)是一家全球資產管理公司,在世界各地設有分支機構。主要從事金融服務,產品包括房地產股權、私人債務及替代信貸、私人股本及基礎設施、股票、固定收益、多元資產投資、私人股本、基礎設施股本、私人債務、對沖基金等。

好處是該公司受SFC監管,這意味著其財務活動受到這些機構的嚴格監督,在一定程度上保證了一定水平的客戶保護。

優缺點

| 優點 | 缺點 |

| 受SFC監管 | 網站上有關交易條件的信息披露有限 |

| 全球存在 | |

| 多樣的交易產品 |

AXA 是否合法?

AXA 目前受香港證券及期貨事務監察委員會(SFC)監管,牌照號碼為AAP809。

| 監管國家 | 監管機構 | 當前狀態 | 受監管實體 | 牌照類型 | 牌照號碼 |

| SFC | 受監管 | AXA 投資管理亞洲有限公司 | 從事期貨合約及槓桿外匯交易 | AAP809 |

產品和服務

核心投資

- 資產類別:股票、固定收益、多元資產

- 重點:在各種市場條件下具有經過驗證的傳統策略。

ESG 及可持續策略

- 方法: 將環境、社會和管治(ESG)因素納入,以實現財務目標與現實影響的一致性。

- 理念: 務實且以客戶為中心,強調長期可持續回報。

另類投資

- 支柱:

- 房地產股權

- 私人債務及另類信貸

- 私募股權及基礎設施

私人市場及對沖基金

- 工具: 主要、次要、共同投資、淨資產價值融資、基金管理公司少數股權。

- 涵蓋範圍: 私募股權、基礎設施股權、私人債務、對沖基金。

選擇(多管理人及諮詢服務)

- 服務: 單位連結及財富管理解決方案。

- 地區: 歐洲和亞洲,量身定制以滿足客戶特定的投資需求。

山27387

香港

安盛基金冻结账户,无法出金,客服失联,客服网站已无法打开

爆料

FX1236648509

台灣

錢提領不出來當初看ios商店評分那麼高想說五顆星一定安全誰知道現在什麼都沒了

爆料

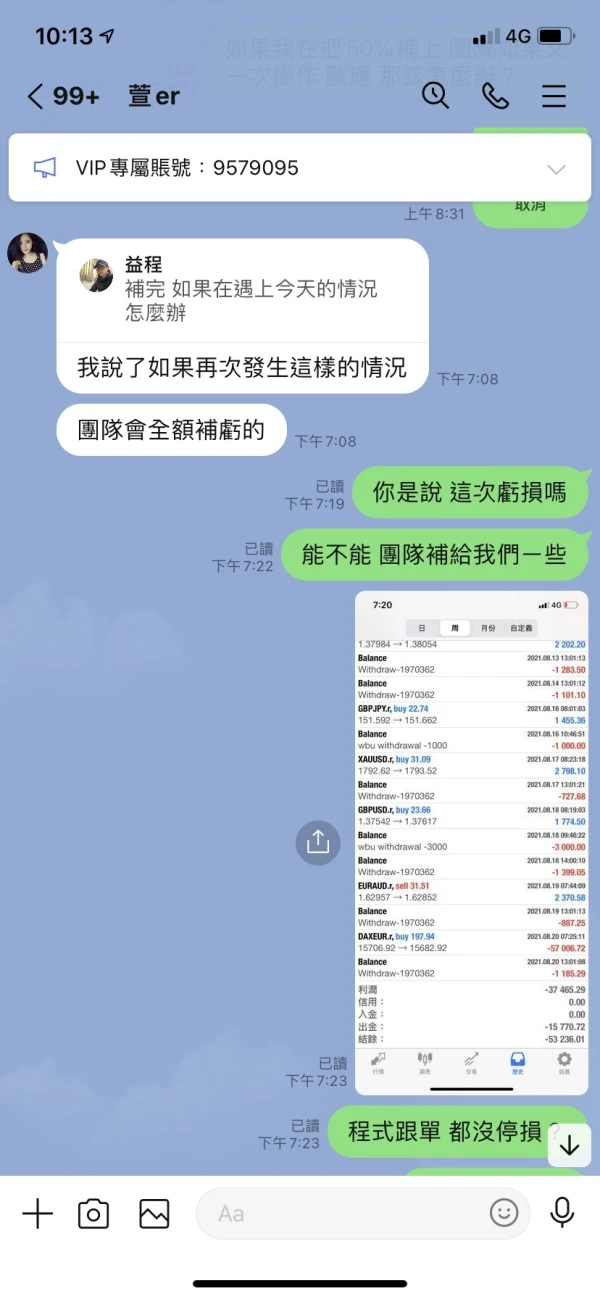

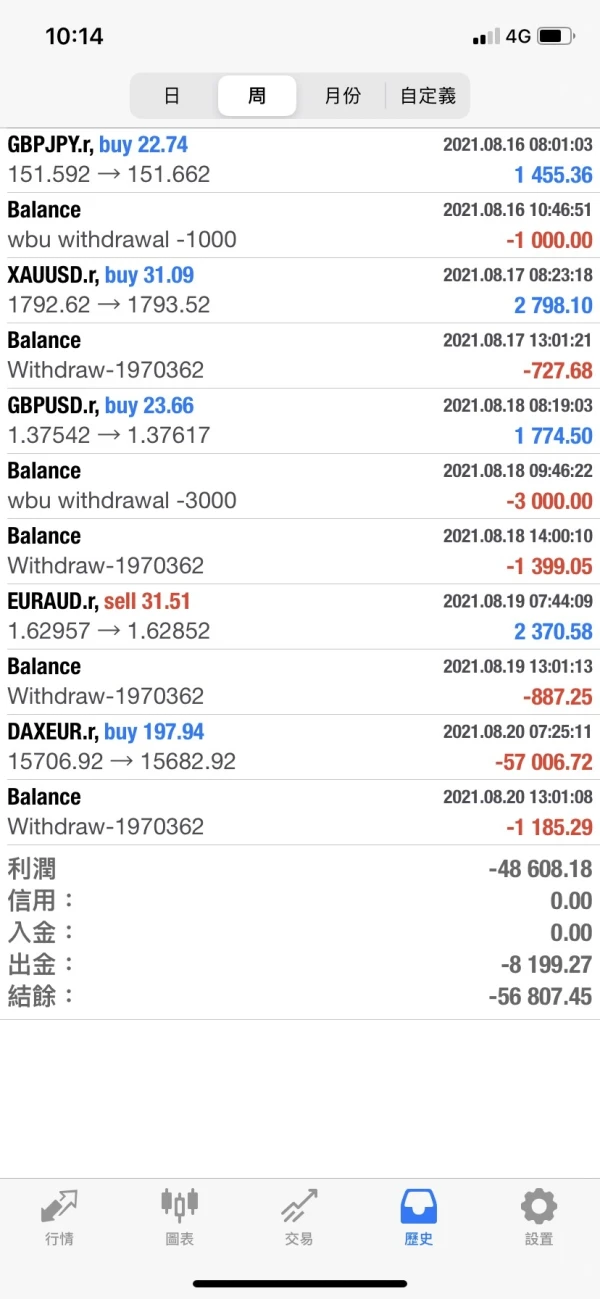

詹孟玟

台灣

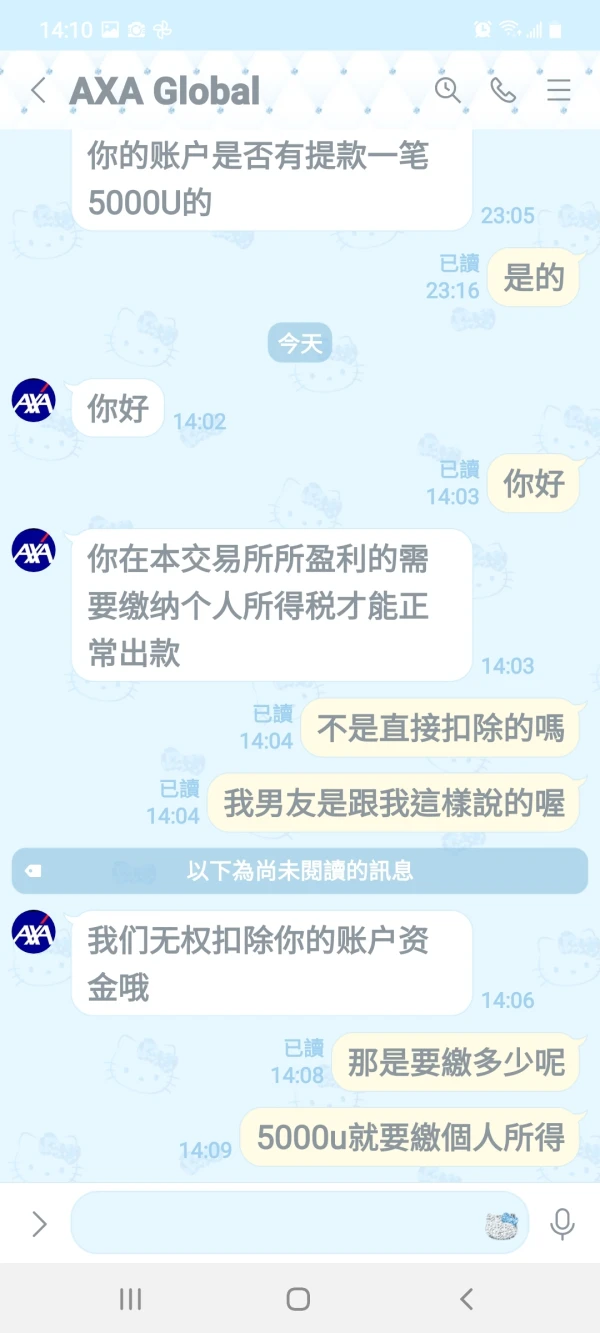

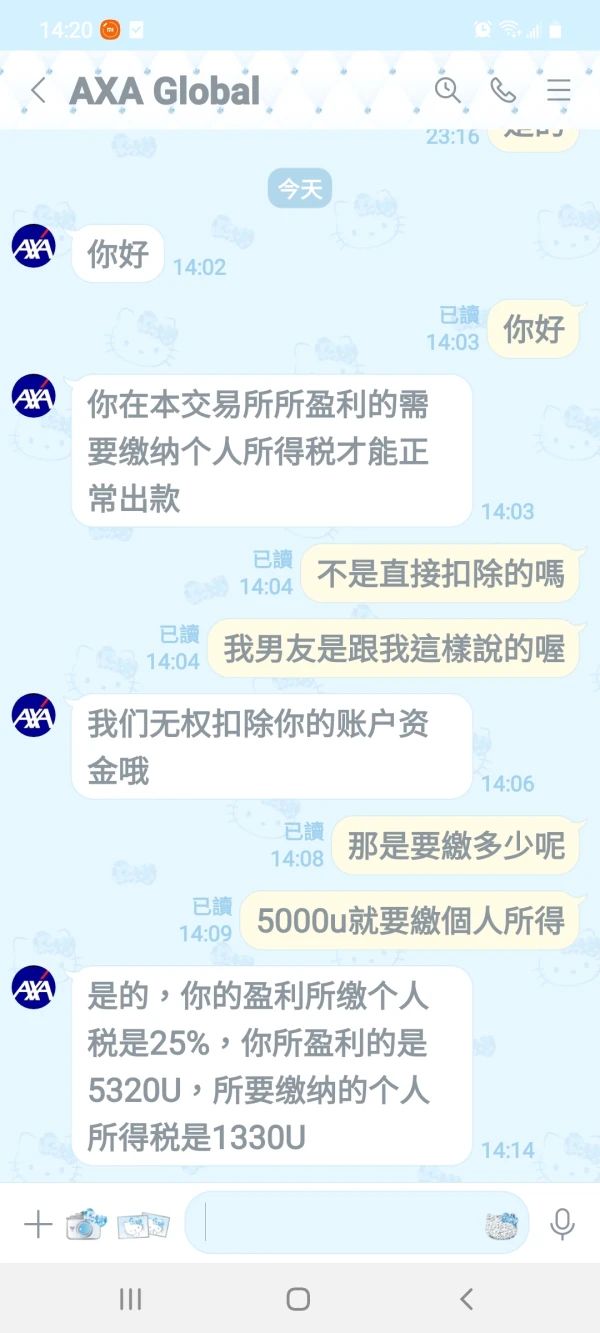

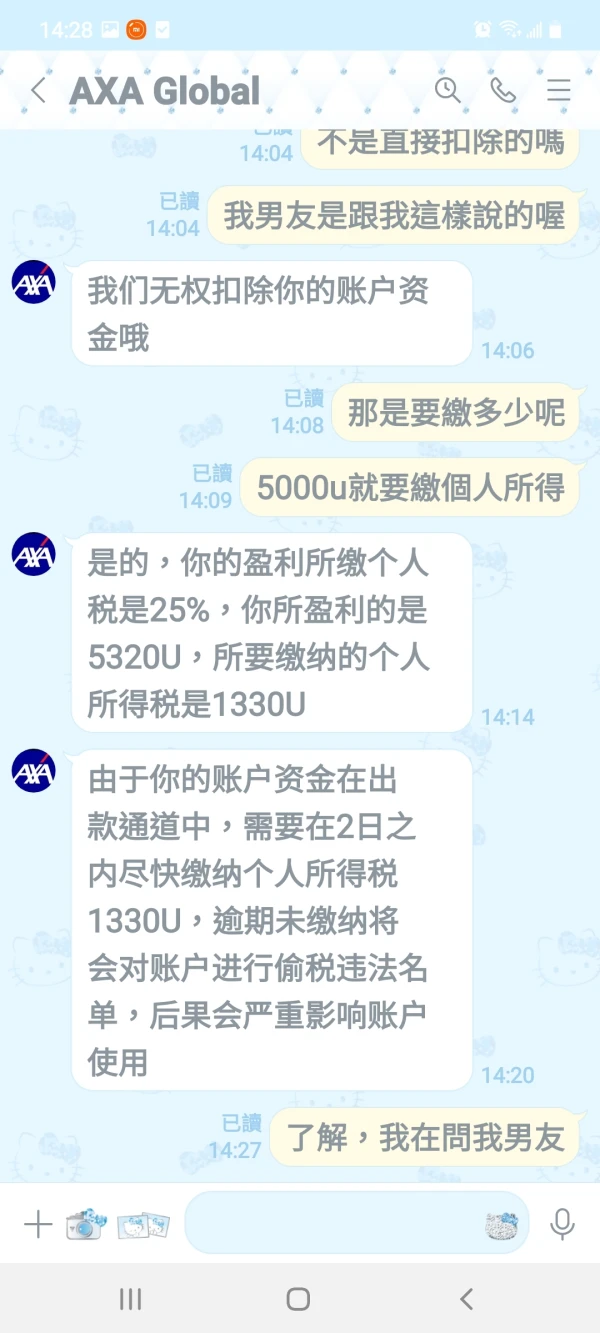

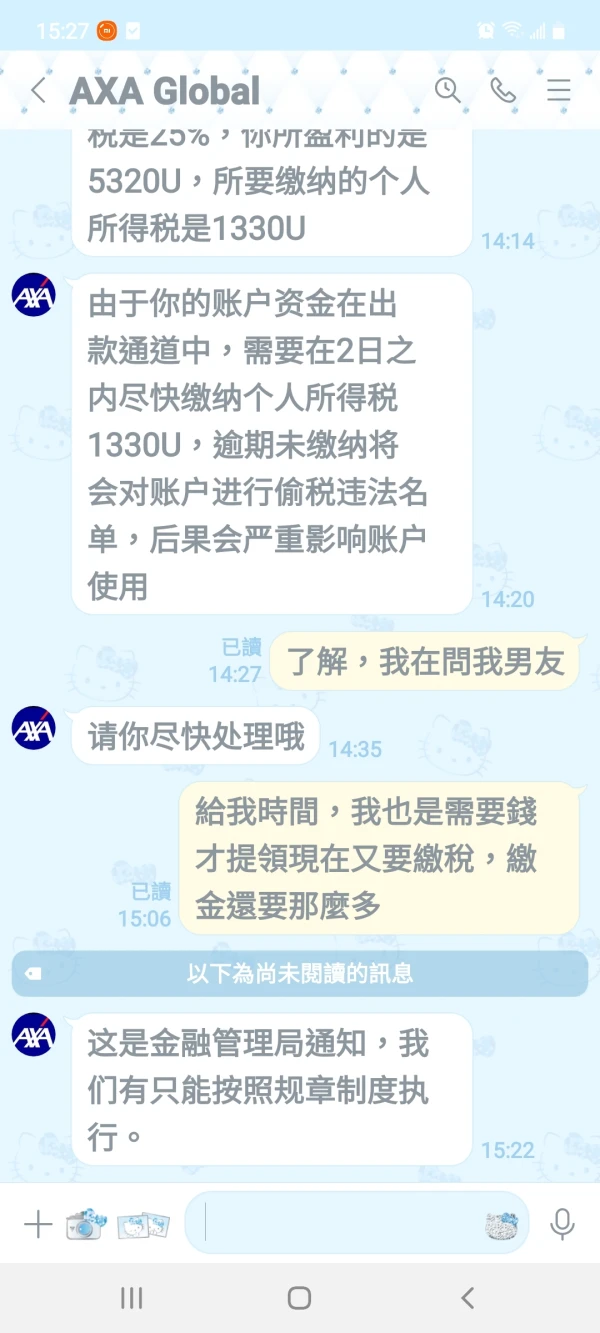

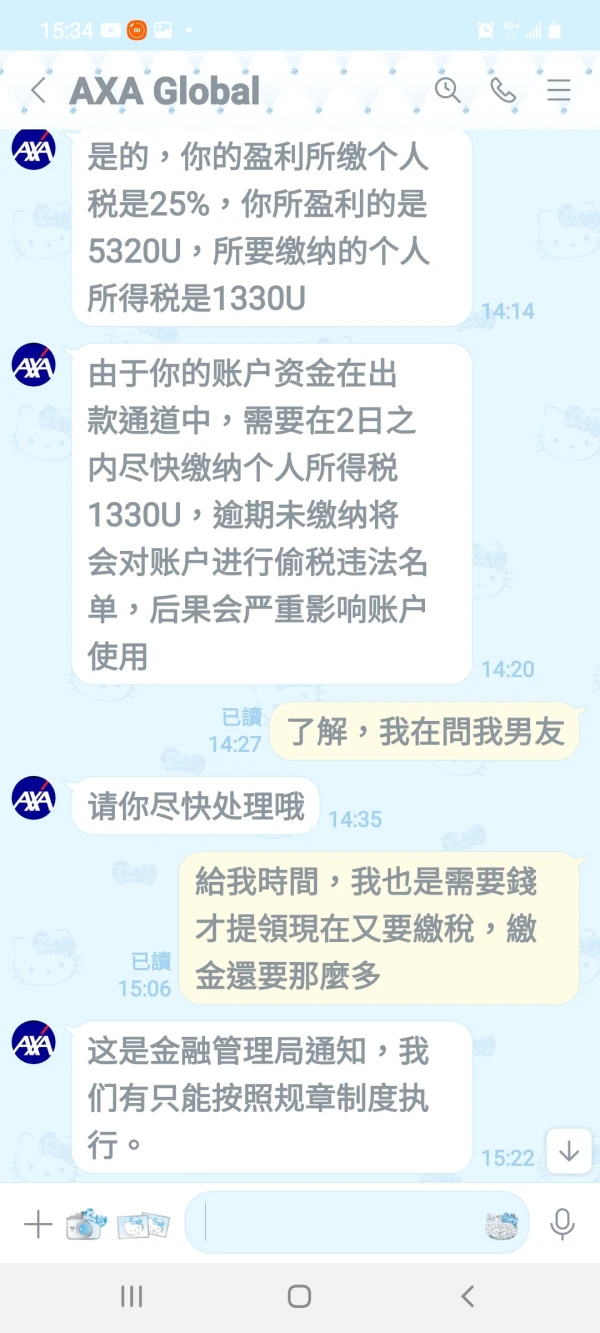

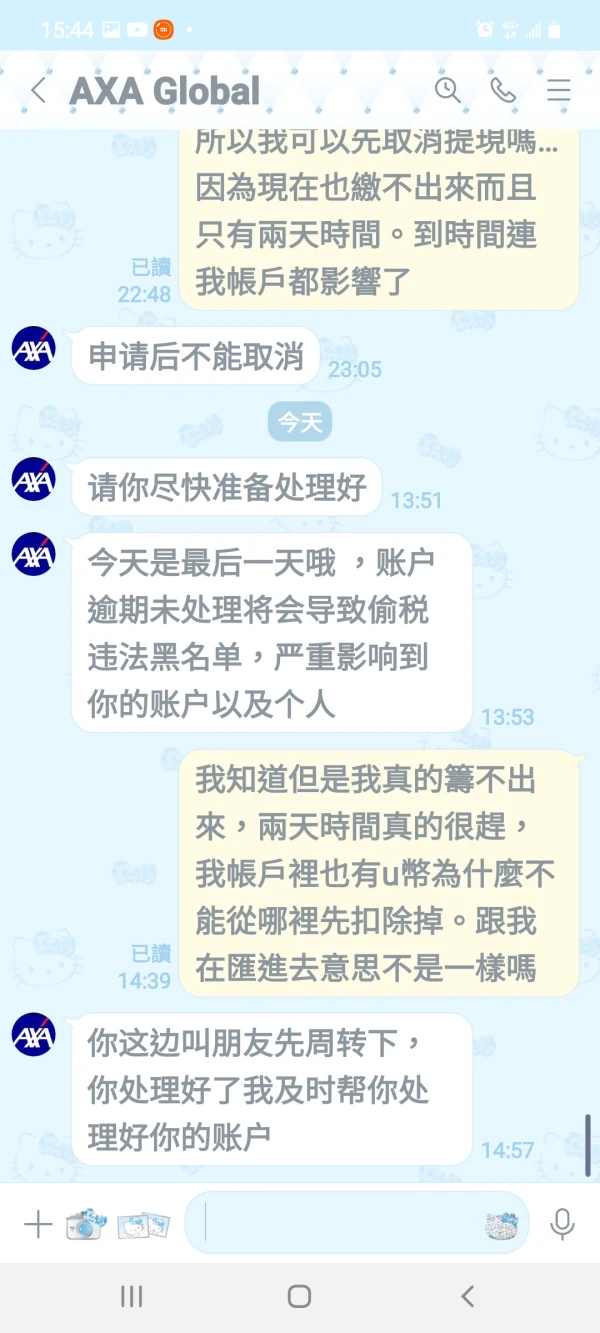

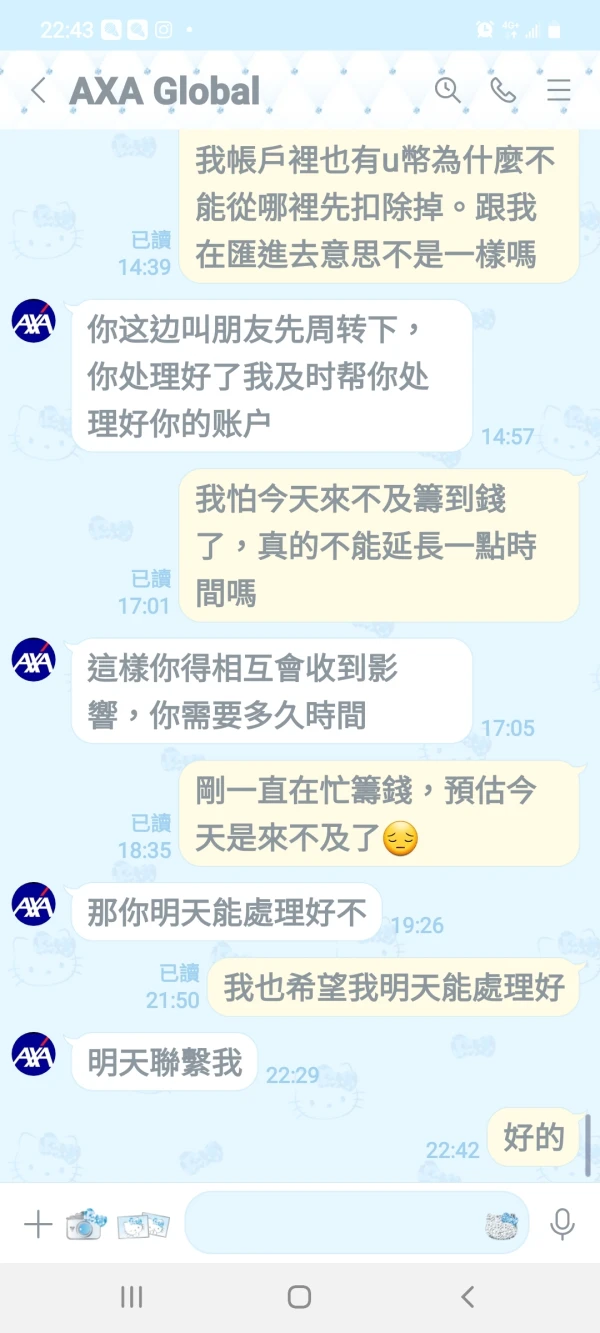

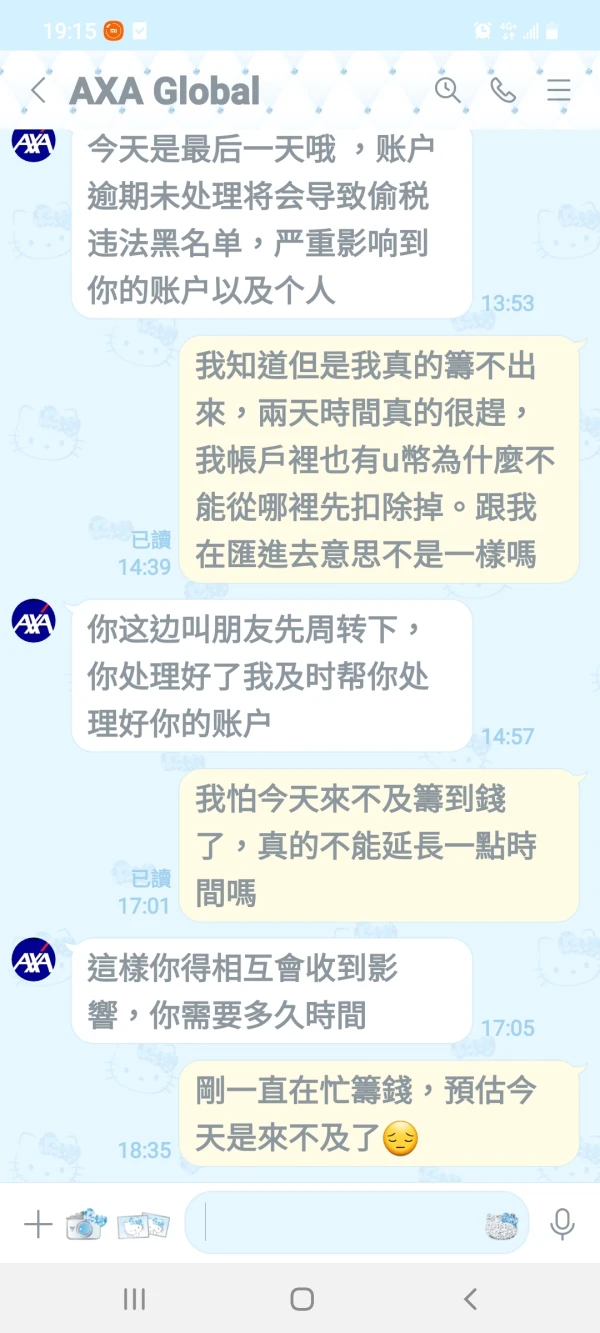

這是跟客服的對話,我不知道真實性有多高,錢繳下去錢還拿的回來嗎

爆料

FX1566795049

賽普勒斯

我最近與 AXA 客戶服務部的交談透露,提款時需要繳納 25% 的個人所得稅。由於不清楚流程和潛在的報銷,我擔心 AXA 服務的透明度和可靠性。這些問題的明確性將大大改善使用者體驗。

中評

贫僧悟道ing......

美國

提供多種投資產品,包括股票基金、債券基金等,基金產品也很全面,提供詳細的基金數據和圖表分析,網站頁面簡單易懂,交易流程比較簡單,是一個值得考慮的投資平台。

好評