Company Summary

| Review Summary Review | |

| Founded | 1997 |

| Registered Country/Region | France |

| Regulation | SFC |

| Products | Real estate equity, private debt & alternative credit, private equity & infrastructure; Equities, Fixed Income, Multi Asset investments; Private equity, infrastructure equity, private debt, hedge funds |

| Customer Support | Tel: +33144457000 |

| Email: webmaster-COM@axa-im.com | |

| Headquarters: Tour Majunga La Défense, 6 Place de la Pyramide, 92800 Puteaux | |

| Link for address of other branch companies: https://www.axa-im.com/contact-us | |

AXA Information

AXA Investment Managers (AXA IM) is a global asset management company who has branch offices all over the world. It mainly deals in financial services with products including real estate equity, private debt & alternative credit, private equity & infrastructure, Equities, Fixed Income, Multi Asset investments, Private equity, infrastructure equity, private debt, hedge funds, etc.

The good thing is that the company is regulated by SFC, which means its financial activities are strictly watched by these authorities, to some extent guarantees a certain level of customer protection.

Pros and Cons

| Pros | Cons |

| SFC regulated | Limited info disclosed for trading conditions on its website |

| Global presence | |

| Various trading products |

Is AXA Legit?

AXAis currently being well regulated by Securities and Futures Commission of Hong Kong (SFC)with license no. AAP809.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| SFC | Regulated | AXA Investment Managers Asia Limited | Dealing in futures contracts & Leveraged foreign exchange trading | AAP809 |

Products and Services

Core Investments

- Asset Classes: Equities, Fixed Income, Multi-Asset

- Focus: Traditional strategies with a proven track record across various market conditions.

ESG & Sustainable Strategies

- Approach: Integrates environmental, social, and governance (ESG) factors to align financial goals with real-world impact.

- Philosophy: Pragmatic and client-focused, emphasizing long-term sustainable returns.

Alternative Investments

- Pillars:

- Real Estate Equity

- Private Debt & Alternative Credit

- Private Equity & Infrastructure

Private Markets & Hedge Funds

- Instruments: Primaries, secondaries, co-investments, NAV financing, GP* minority stakes.

- Coverage: Private equity, infrastructure equity, private debt, hedge funds.

Select (Multi-Manager & Advisory Services)

- Services: Unit-linked and wealth management solutions.

- Regions: Europe and Asia, tailored to client-specific investment needs.

山27387

Hong Kong

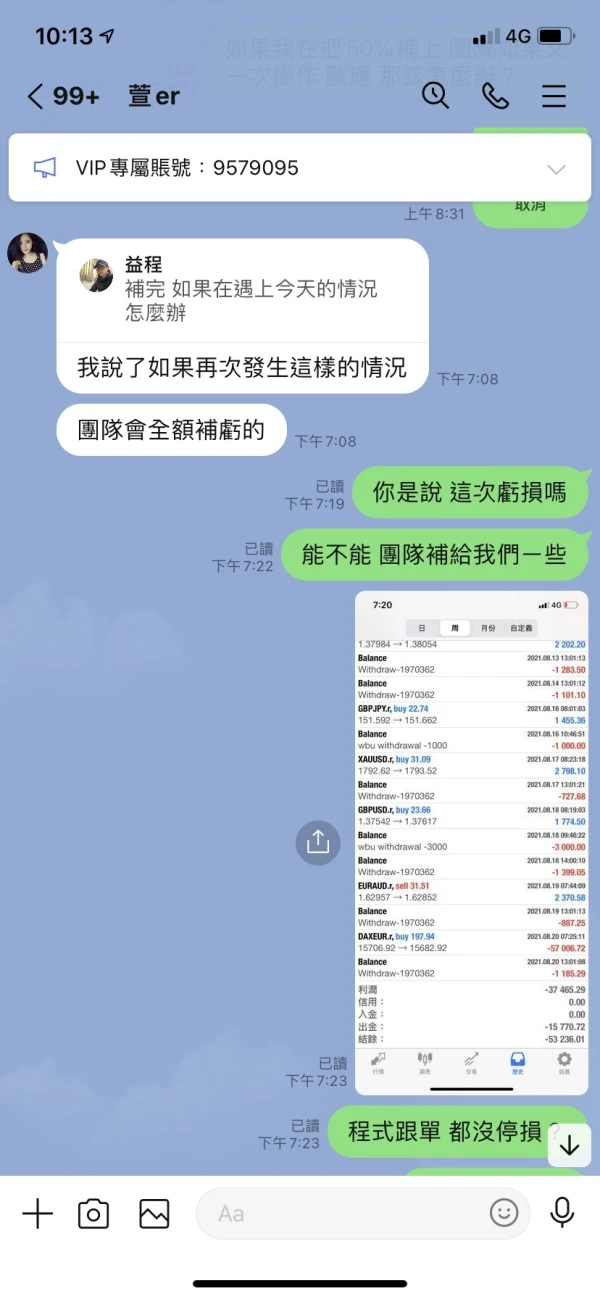

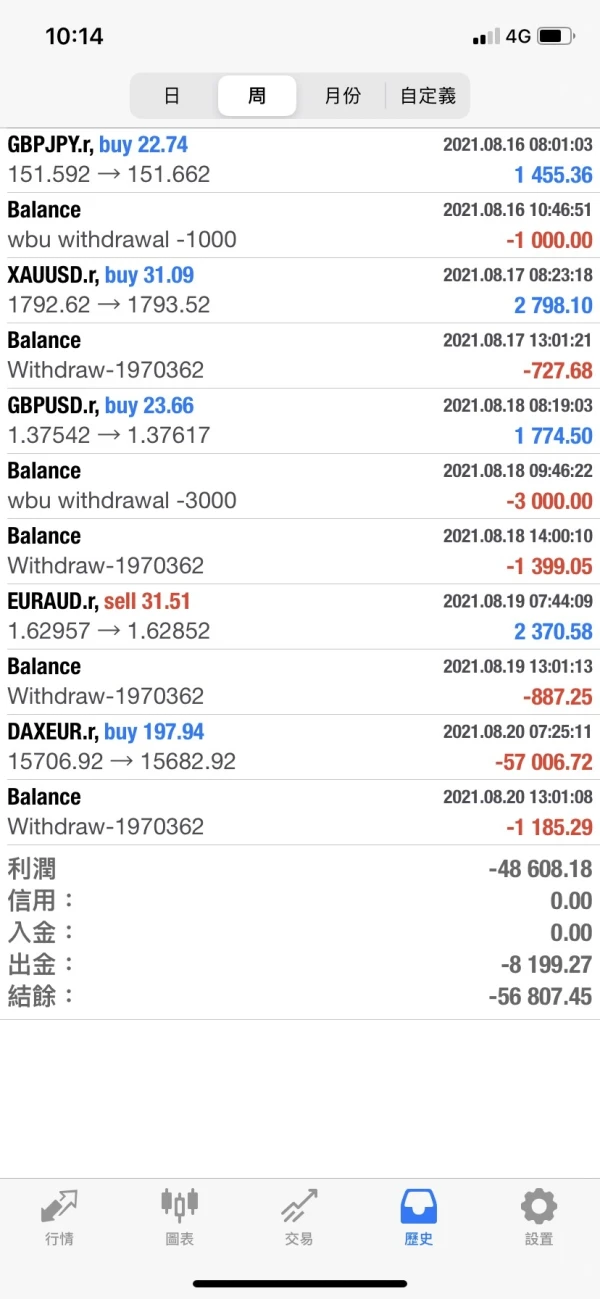

AXA freeze my account and I can’t withdraw. The customer service is out of contact. The website can’ be opened.

Exposure

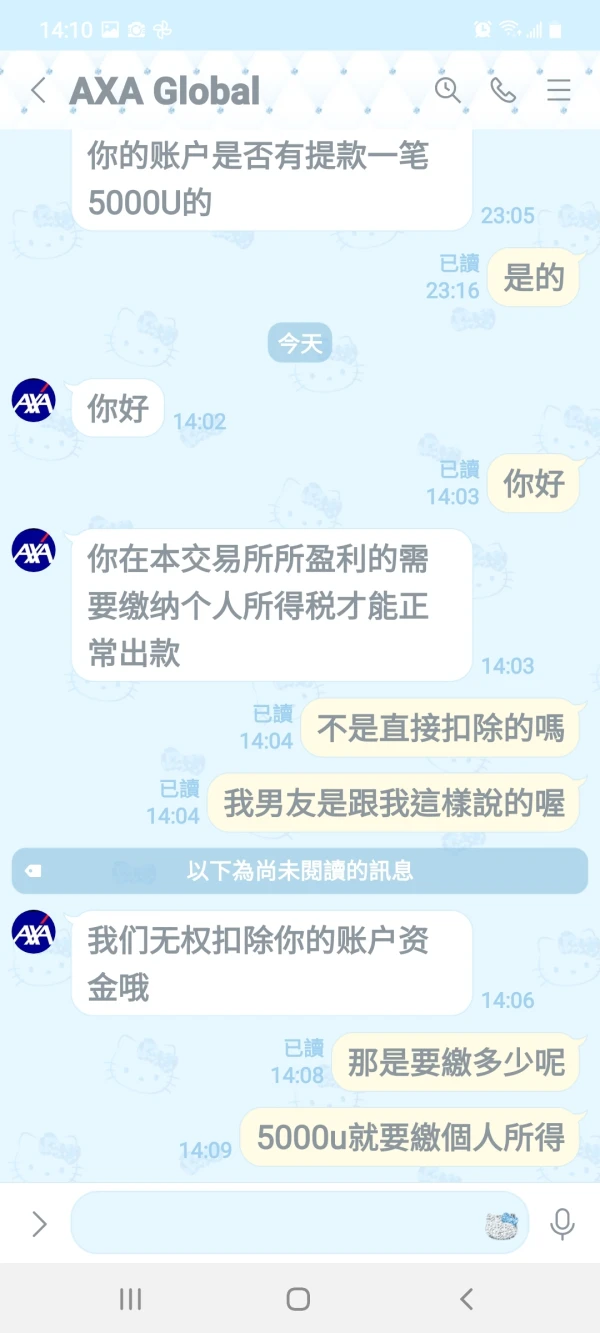

FX1236648509

Taiwan

The customer service refused to pay me the withdrawal.

Exposure

詹孟玟

Taiwan

The customer service said it and I was not sure about its reality. Could I get my money back?

Exposure

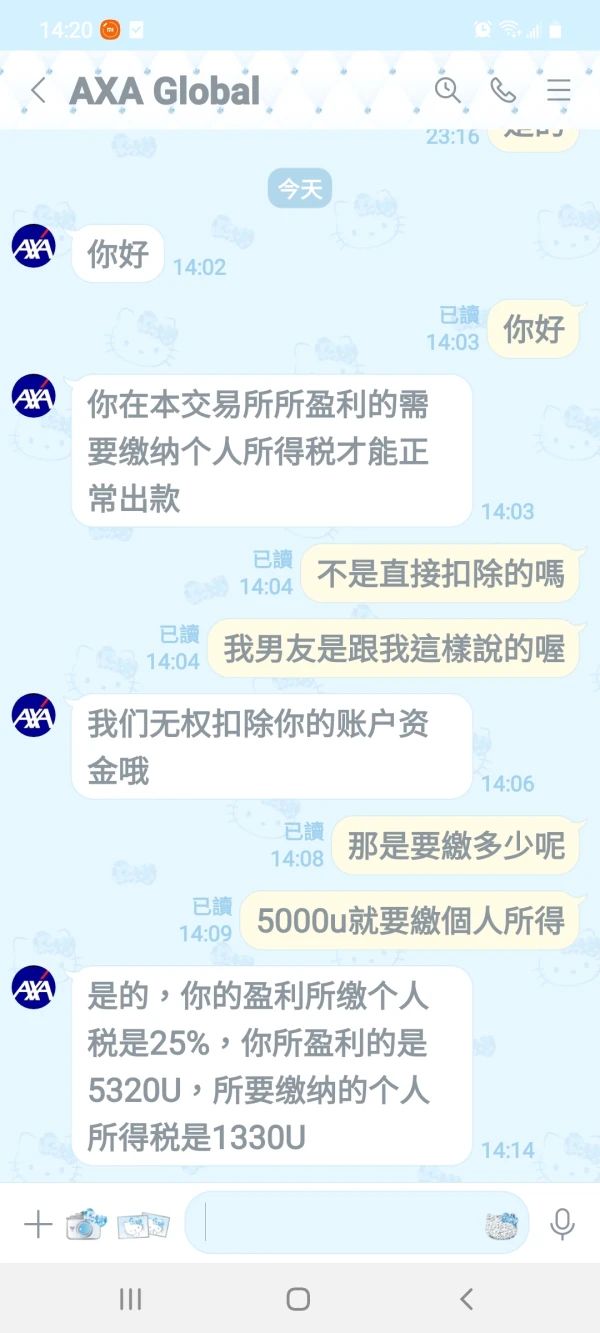

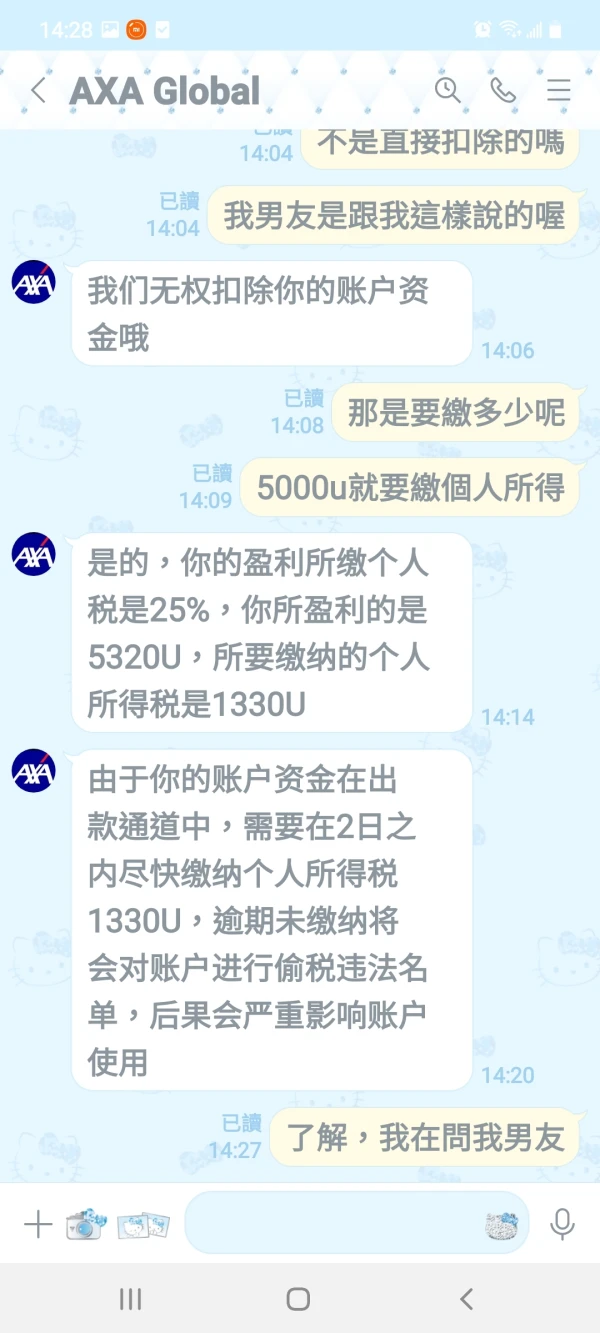

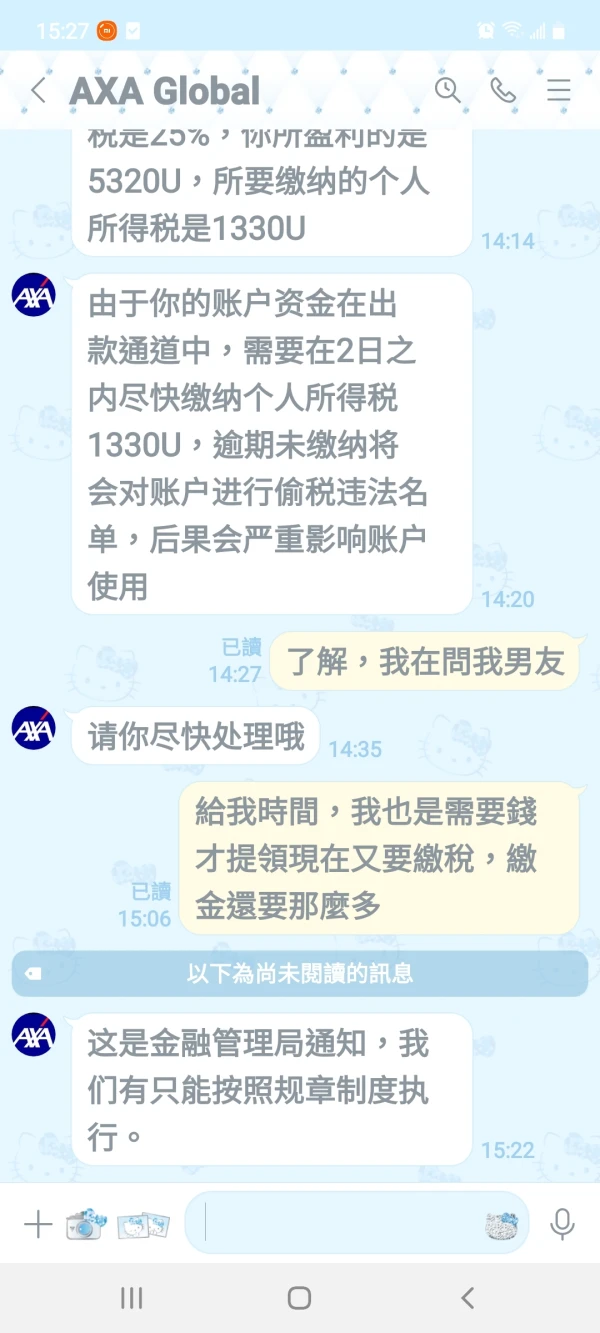

FX1566795049

Cyprus

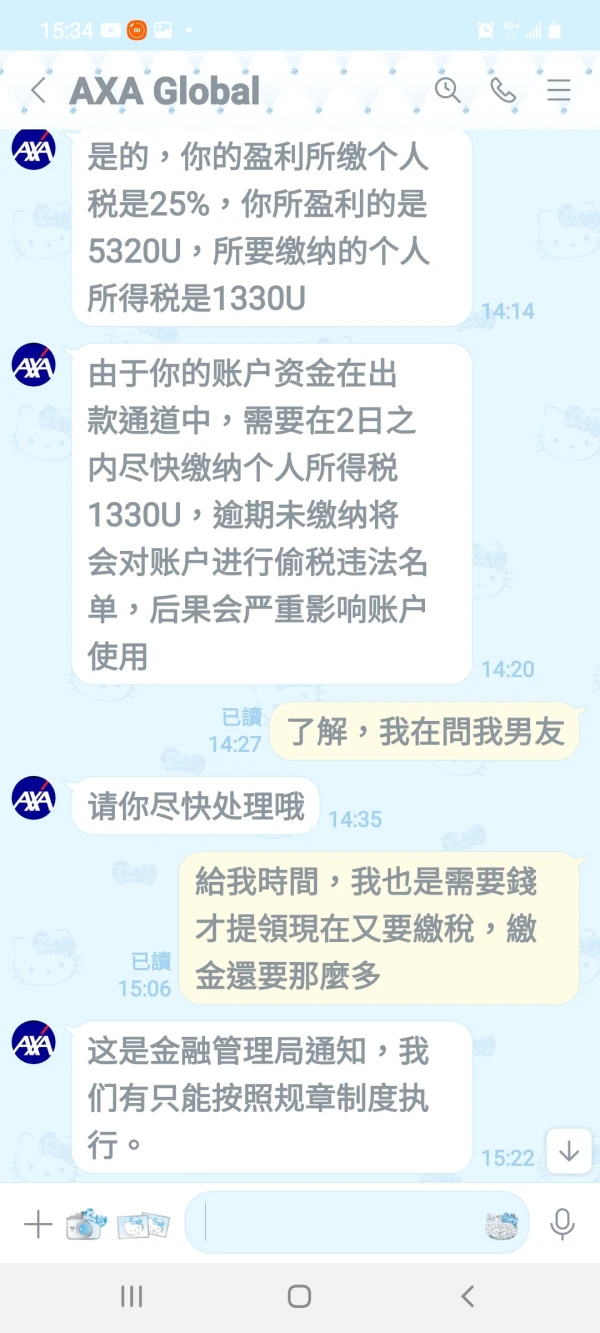

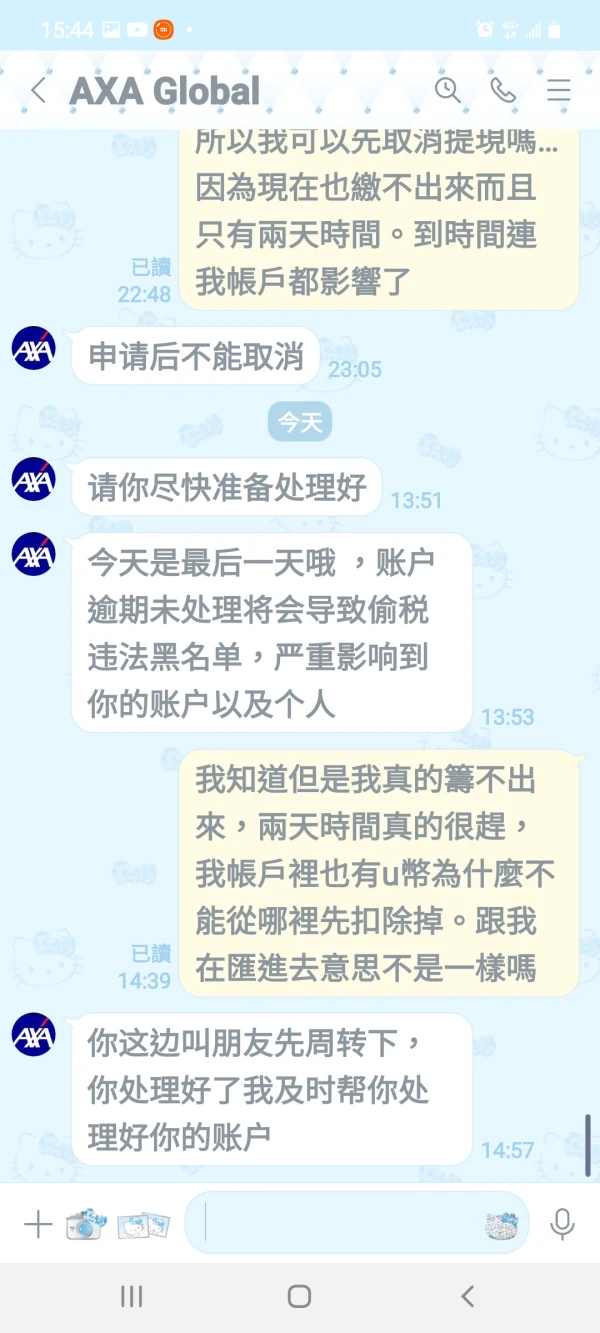

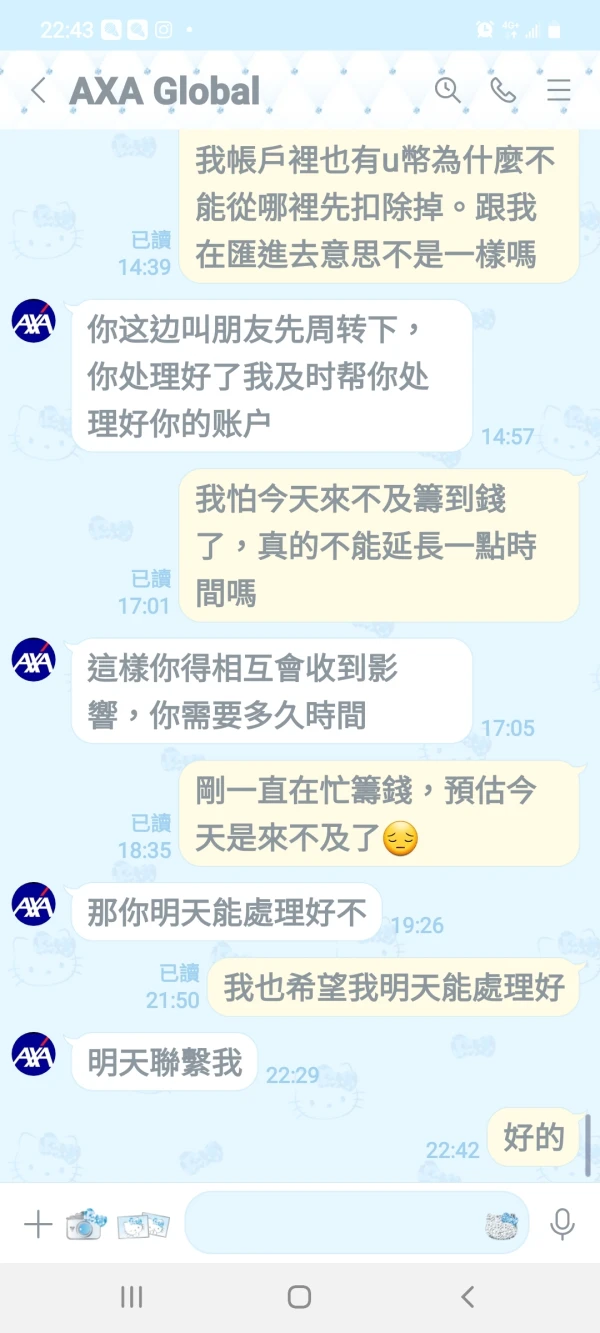

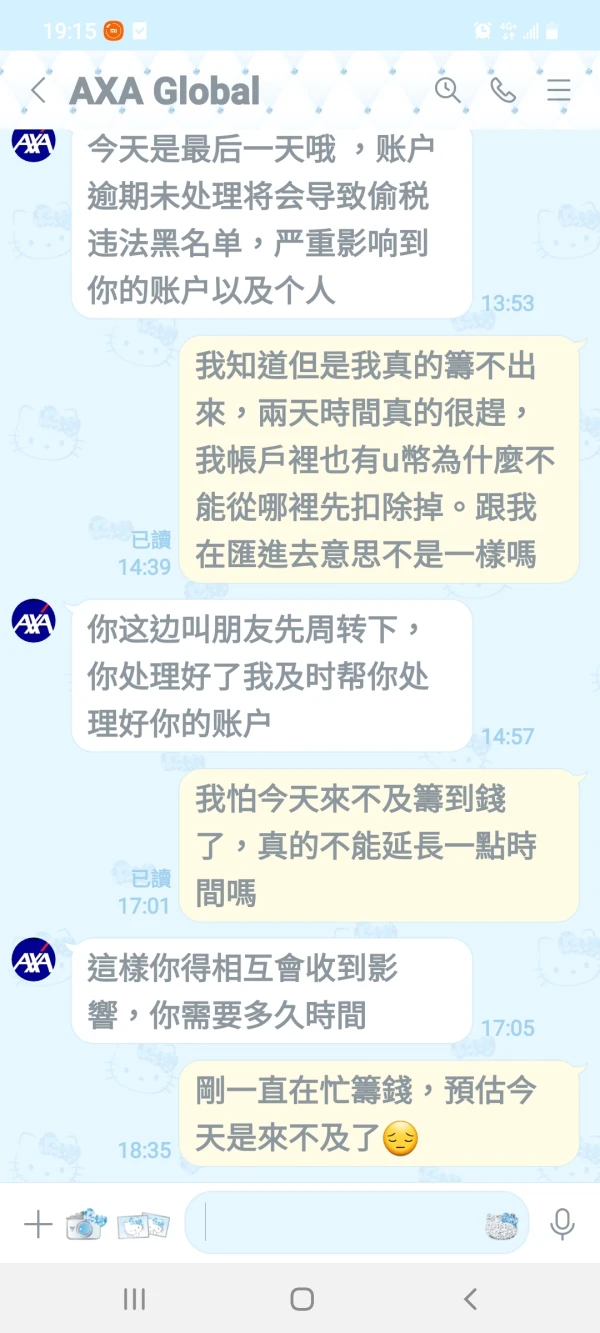

My recent chat with AXA customer service revealed a 25% personal income tax requirement for withdrawals. Unclear about the process and potential reimbursement, I'm concerned about the transparency and reliability of AXA's services. Clarity on these matters would greatly improve the user experience.

Neutral

贫僧悟道ing......

United States

It provides a variety of investment products, including stock funds, bond funds, etc., fund products are also comprehensive, providing detailed fund data and chart analysis, the website page is simple and easy to understand, the transaction process is relatively simple, is an investment platform worth considering.

Positive