Basic Information

United Kingdom

United Kingdom Score

United Kingdom | 10-15 years |

United Kingdom | 10-15 years |https://www.swissquote.eu/

Website

Rating Index

MT4/5

Full License

SwissquoteLtd-Live5

Influence

A

Influence index NO.1

Switzerland8.05

Switzerland8.05

MT4/5 Identification

Full License

United Kingdom

United KingdomInfluence

A

Influence index NO.1

Switzerland8.05

Switzerland8.05Single Core

1G

40G

1M*ADSL

United Kingdom

United Kingdom

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

swissquoteasia.com

swissquoteasia.com  Switzerland

Switzerland

| Swissquote | Basic Information |

| Founded in | 1996 |

| Headquarters | Gland, Switzerland |

| Regulation | FCA, MFSA, FINMA, DFSA |

| Tradable Instruments | Stocks, currency pairs, precious metals, stock indices, commodities, bonds |

| Demo Account | ✅ |

| Leverage | Up to 1:30 (retail)/1:100 (professional) |

| Spread | From 0.6 pips (Prime account) |

| Trading Platform | Mobile App, MT4, MT5, Money Managers |

| Minimum Deposit | 1,000 EUR/USD/GBP/CHF |

| Customer Support | Phone, Email, Live Chat |

| Regional Restrictions | USA |

Swissquote is a leading online forex and financial trading broker headquartered in Switzerland. It was established in 1996 and has since grown to become a popular choice among traders worldwide. The broker offers a wide range of financial instruments to trade, including forex, stocks, indices, commodities, bonds, and cryptocurrencies. Swissquote provides its clients with access to several trading platforms, including Mobile App, MT4, MT5, and Money Managers.

Swissquote is areputable and regulated broker, offering an array of financial instruments and account types for traders to choose from. As with any broker, there are advantages and disadvantages to consider. In the following table, we present a summary of the key pros and cons of trading with Swissquote.

Swissquote undoubtedly offers a comprehensive range of trading instruments and state-of-the-art trading platforms. However, despite its many strengths, it falls short in terms of customer support, as it does not provide round-the-clock assistance, which can be a major drawback for traders who require immediate assistance during off-hours or in emergency situations.

| Pros | Cons |

| Regulated by reputable authorities | Limited education and research resources |

| Wide range of trading instruments | Inactivity fee charged after 24 months of inactivity |

| Competitive spreads | No 24/7 customer support |

| Demo accounts available | High minimum deposit requirement |

| Various account types with different features | Limited customer support options outside of business hours |

| Availability of advanced trading platforms - MT4, MT5 | No US clients accepted |

| Efficient and reliable customer support during business hours |

Yes, Swissquote is a legitimate broker with four entities under respective jurisdictions:

Swissquote Bank Ltd, which is based in Switzerland, is regulated by the Swiss Financial Market Supervisory Authority (FINMA).

Swissquote Ltd, which is based in the United Kingdom, is regulated by the Financial Conduct Authority (FCA).

Swissquote MEA Ltd, which is based in Dubai, is regulated by the Dubai Financial Services Authority (DFSA).

SWISSQUOTE FINANCIAL SERVICES (MALTA) LTD, is regulated by the Malta Financial Services Authority (MFSA).

These regulatory authorities ensure that Swissquote adheres to strict standards in terms of financial stability, transparency, and investor protection.

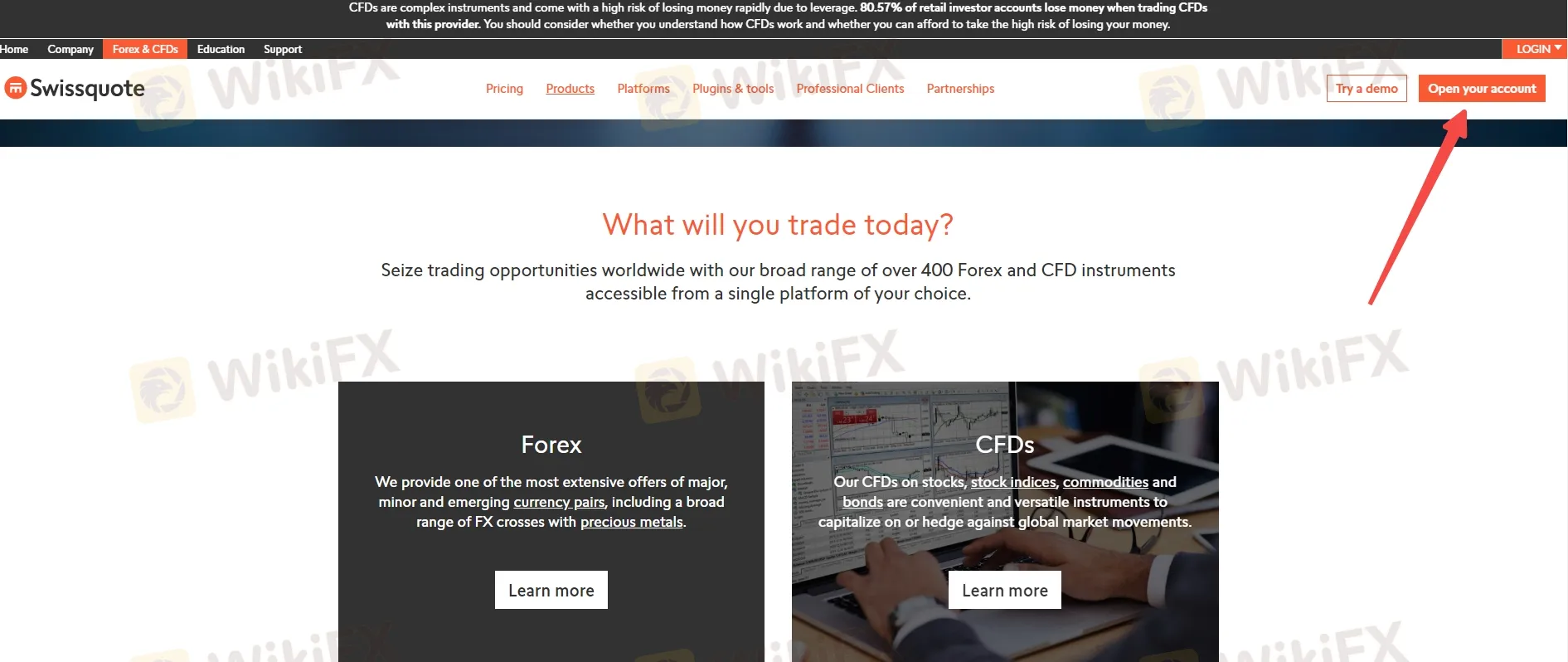

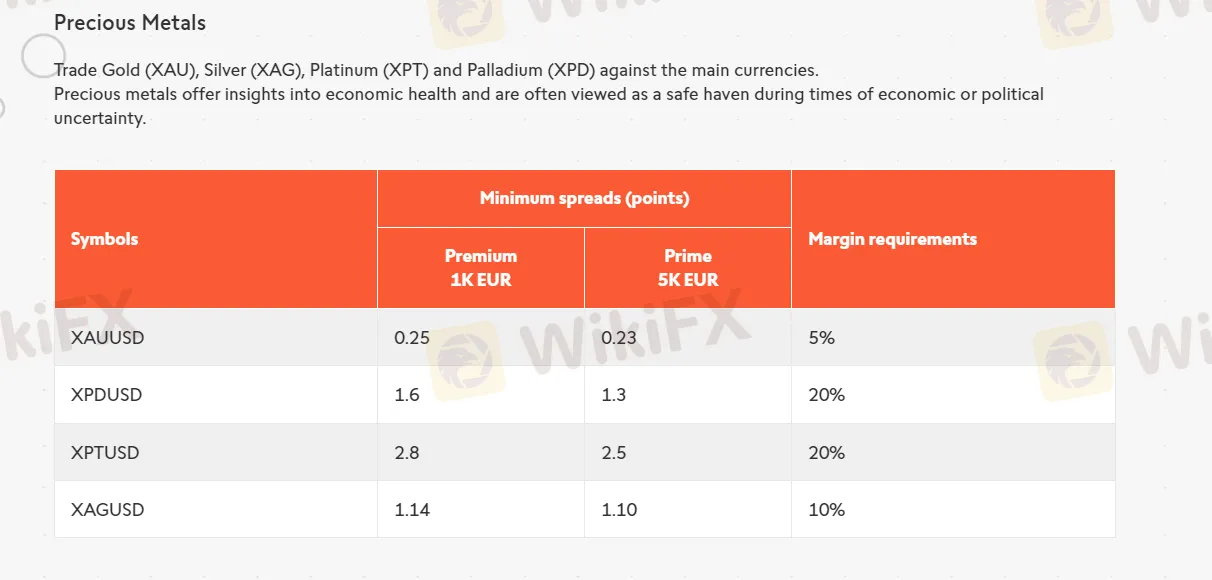

Swissquote offers a wide range of market instruments for trading, including 400+ forex and CFD instruments, commodities, stock indices, shares, bonds, and cryptocurrencies. As a well-established Swiss broker, Swissquote is able to offer trading on several Swiss-specific instruments, such as the Swiss Market Index (SMI) and the Swissquote Group Holding Ltd. (SQN) stock, as well as access to other global exchanges such as the NYSE, NASDAQ, and LSE.

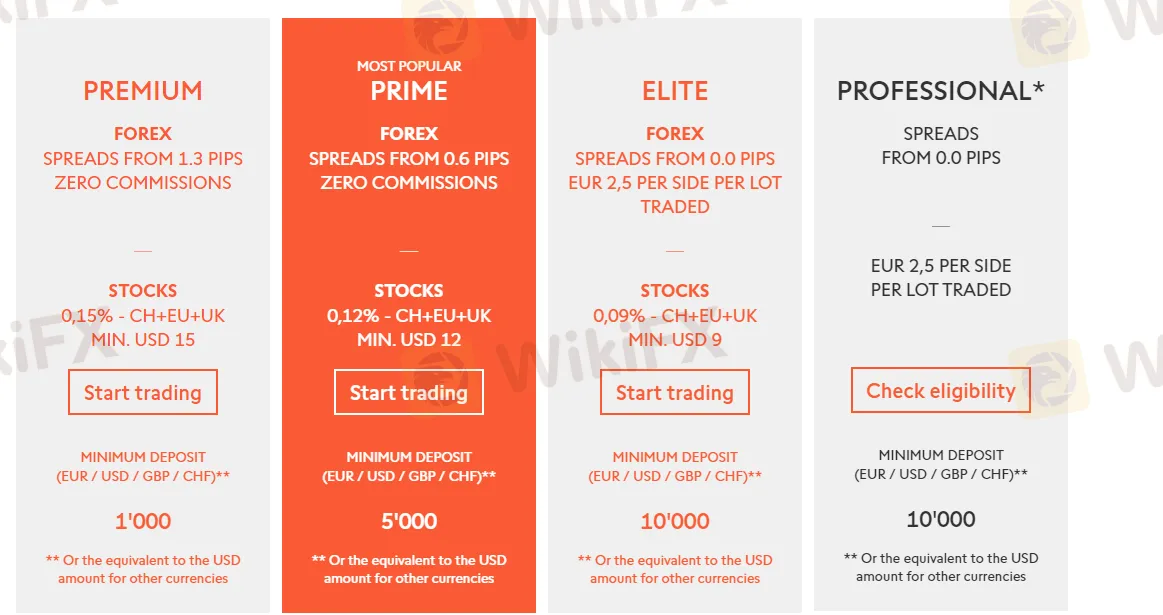

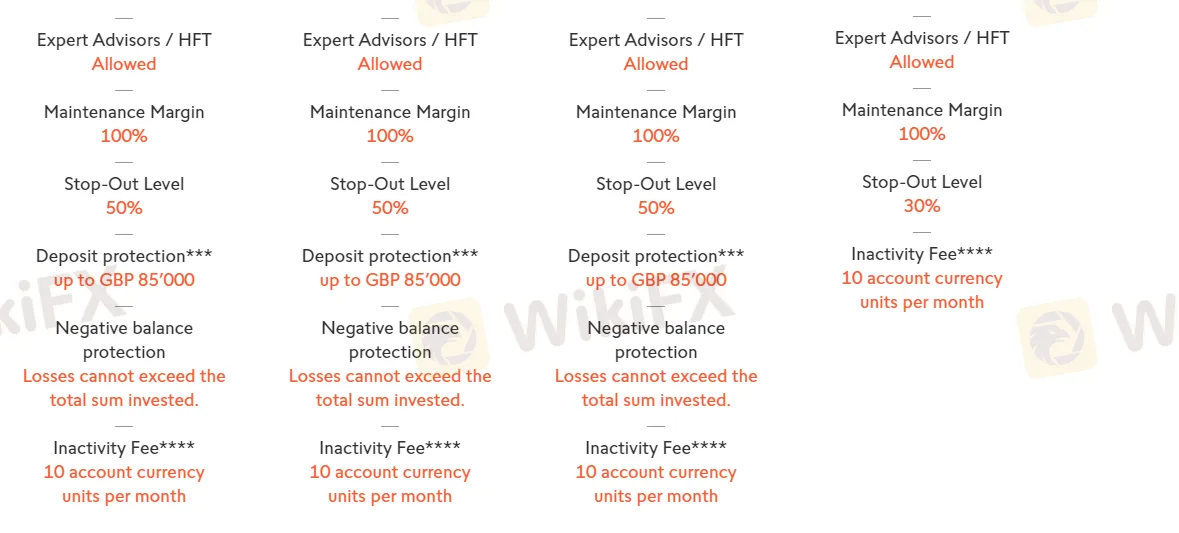

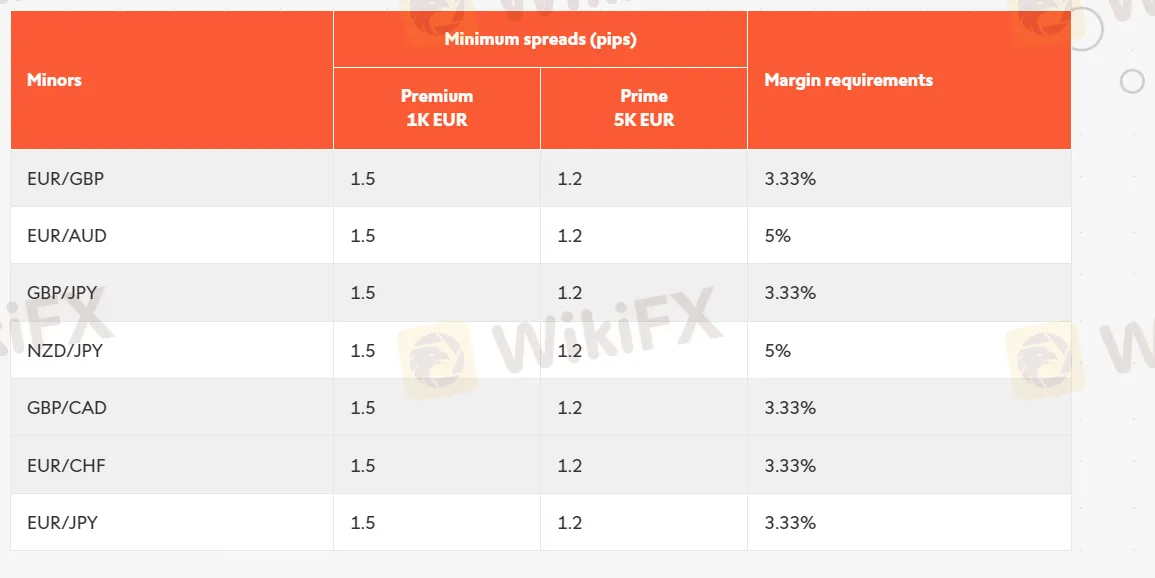

Swissquote offers a range of account types to cater to the varying needs and preferences of its clients. The primary account types available are the Premium Account, Prime Account, Elite Account and Professional Account. Each account type comes with distinct features and benefits, such as different minimum deposit requirements, leverage ratios, and spreads. The Premium Account requires a minimum deposit of 1,000 CHF or equivalent, while the Prime Accounts require a higher minimum deposit of 5,000 CHF or equivalent. The Elite and Professional accounts ask for the highest minimum deposit of 10,0000 CHF or equivalent.

The Standard Account provides clients with access to a wide range of financial instruments, including forex, CFDs, stocks, options, futures, and bonds. The Premium Account, on the other hand, is designed for high-volume traders and offers lower spreads and commissions, as well as personalized service. The Prime Account is designed for institutional clients and provides them with a dedicated account manager, as well as access to exclusive liquidity and pricing.

Moreover, Swissquote also offers an Islamic Account, which is compliant with Sharia law and is available to clients who follow the Islamic faith.

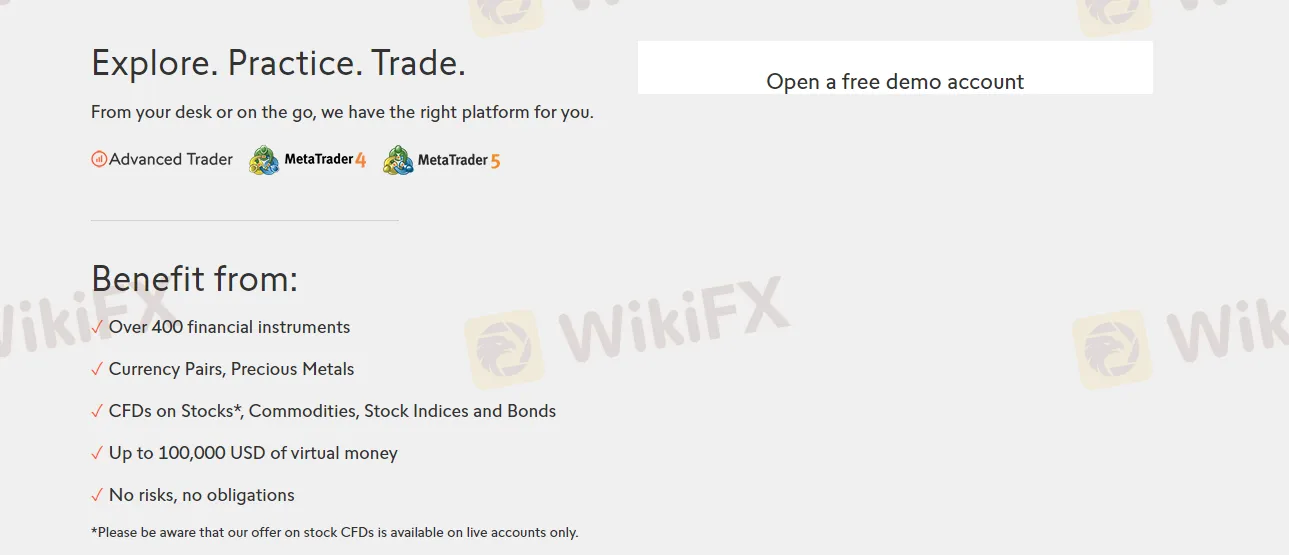

Swissquote offers a free demo account for clients to practice trading strategies and test out the broker's trading platforms without risking any real funds. The demo account provides users with virtual funds to trade on the same live markets as the actual trading accounts. The account comes with real-time pricing and charting tools, allowing traders to simulate trading conditions as closely as possible. This is an excellent opportunity for traders to get familiar with the broker's platforms and trading environment before committing any real money. Moreover, the demo account is ideal for both novice and experienced traders who want to try new trading strategies or test their current trading strategies without incurring any financial risk.

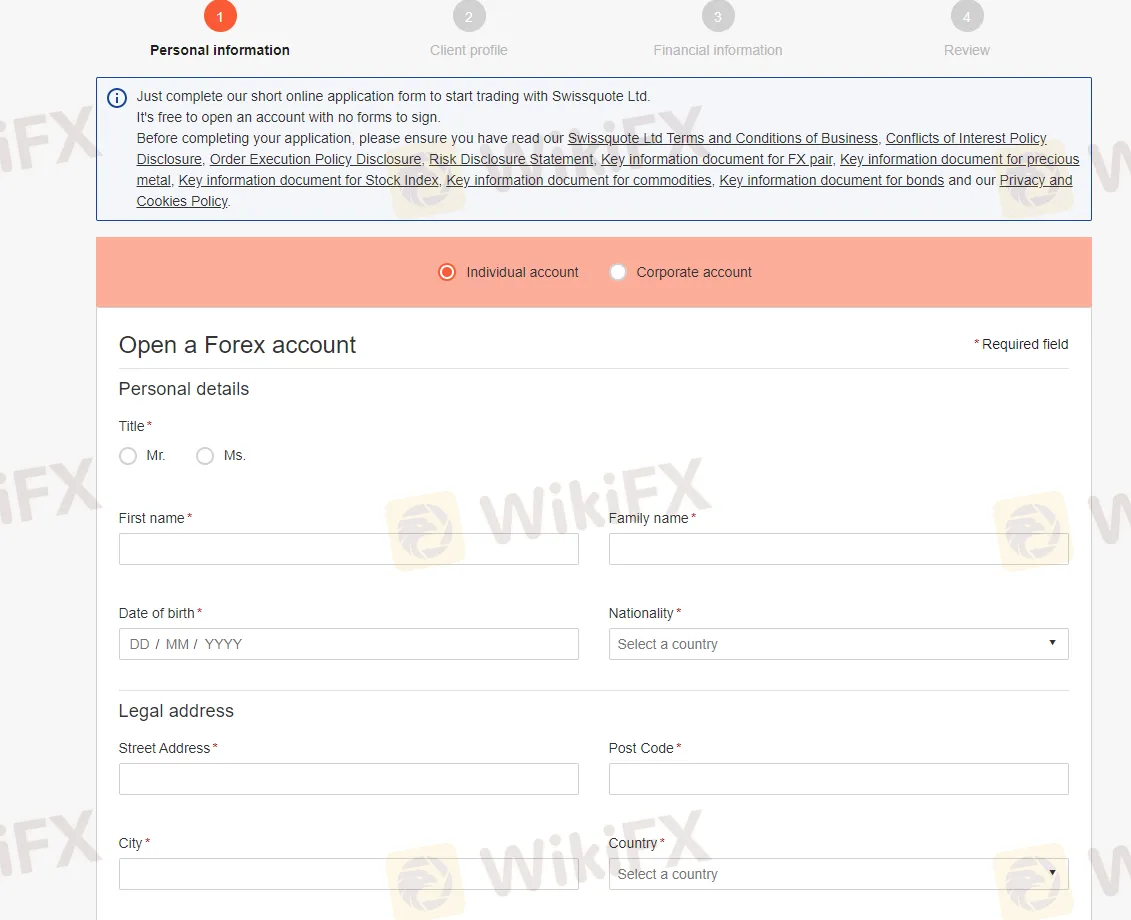

Step 1: Visit the Swissquote website and click on the “Open your account” button.

Step 2: Provide personal information, such as name, email, and phone number, along with a valid identification document, such as a passport or driver's license.

Step 3: After the account is created and verified, the next step is to select the desired account type and deposit funds, such as Premium, Prime or Elite accounts.

Step 4: Agree to the terms and conditions and submit your application.

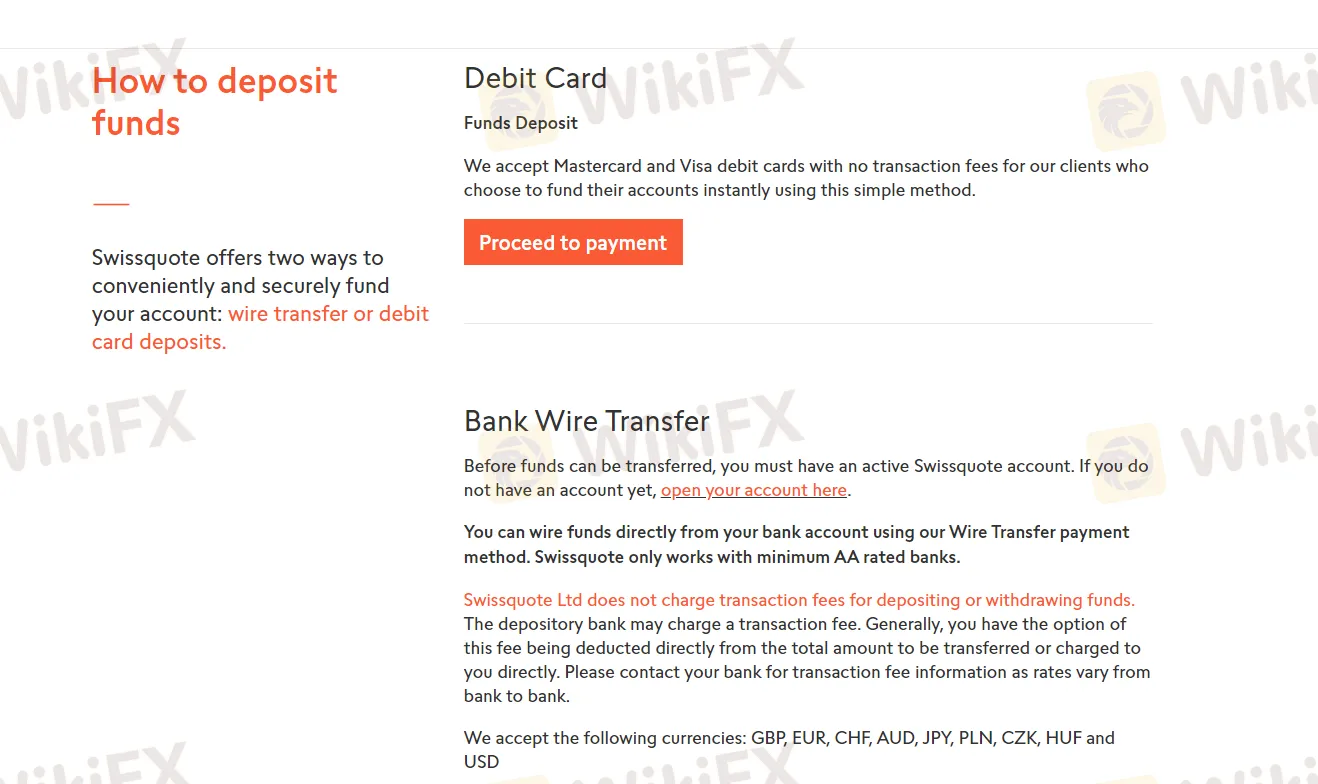

Step 5: Swissquote offers several convenient deposit methods, including debit card (Visa, MasterCard) and bank wire transfer.

Step 6: Once the account is funded, traders can access the trading platforms, begin analyzing the markets, and placing trades on a variety of financial instruments.

Swissquote offers variable leverage levels depending on the financial instrument and the account type. For forex trading, the maximum leverage available is typically 1:30 for retail clients and up to 1:100 for professional clients who meet certain criteria. For CFD trading on indices, commodities, and cryptocurrencies, the maximum leverage ranges from 1:10 to 1:5, depending on the underlying asset.

Always keep in mind that high leverage can significantly increase the potential gains, but it can also magnify the losses, so it's important to use it with caution and always keep in mind the risks involved.

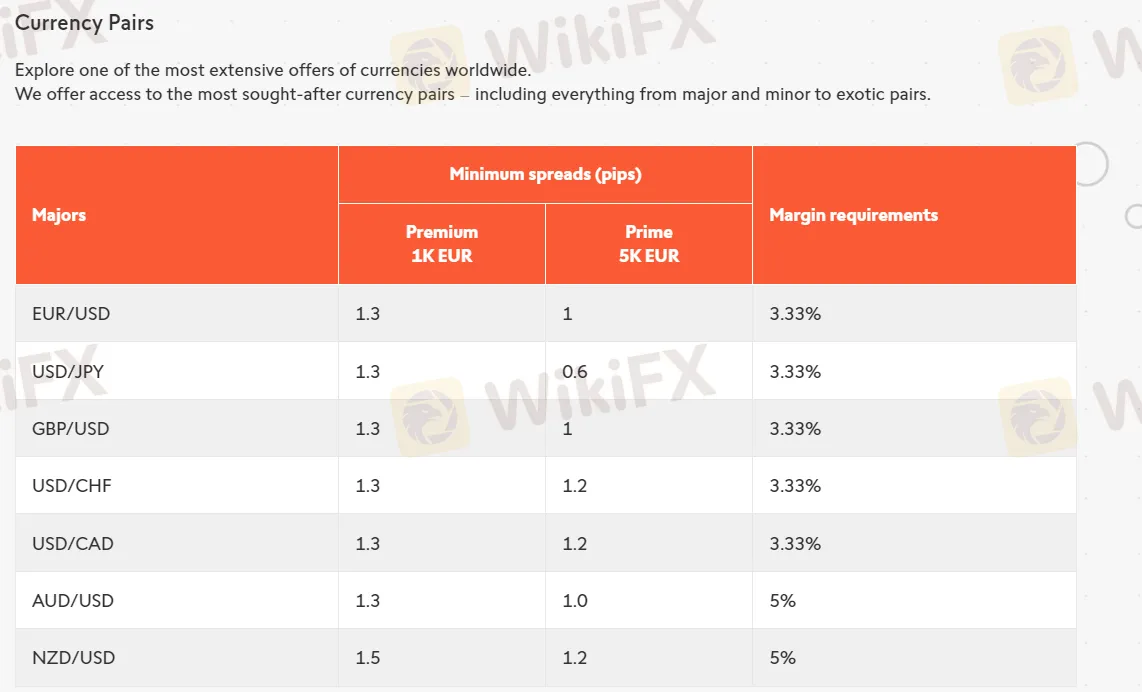

Swissquote offers competitive spreads and commissions to its clients. The exact costs depend on the type of account and the trading instrument being traded. The Premium Account has variable spreads, with the EUR/USD spread starting from 1.3 pips, while the Prime Account offers spreads starting from 0.6 pips. The Elite Account offers spreads as low as 0.0 pips, but it requires a higher minimum deposit and trading volume. The professional accounts provide spreads from 0.0 pips too.

In terms of commissions, the Premium Account and Prime Account charge zero commission. The Elite Account and the Professional Account charge a commission of EUR2.5 per side per lot traded. Overall, Swissquote is often seen as competitive in terms of spreads and commissions when compared to other major brokers.

Non-trading fees are fees that Swissquote charges its clients for services that are not directly related to trading activities. Swissquote has a relatively low level of non-trading fees compared to other brokers. Swissquote does not charge deposit and withdrawal fees, which depend on the method used. Swissquote also charges an inactivity fee of CHF 50 per quarter if no trades have been made during the last 6 months. This fee is lower than the industry average, which is around $15 per month.

Besides, Swissquote also charges overnight swap fees, also known as rollover fees or financing fees, on positions that are held overnight. The amount of the fee depends on the currency pair, the size of the position, and the prevailing interest rates in the respective countries.

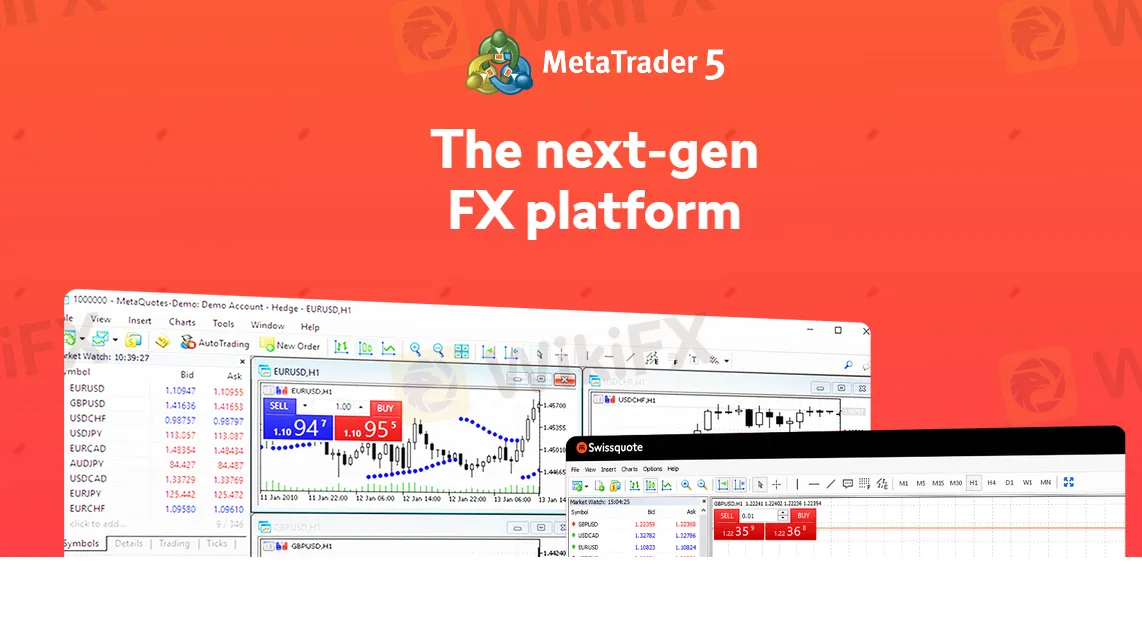

Swissquote offers Mobile App, MT4, MT5, and Money Managers.

MT4: Swissquote offers the popular MetaTrader 4 (MT4) trading platform to its clients, which is widely recognized in the industry for its reliability, speed, and advanced charting tools. MT4 is available for download on desktop, web, and mobile devices, allowing traders to access their accounts and manage their trades from anywhere at any time. Swissquote also offers a range of customized tools and indicators, allowing traders to personalize their trading experience on the platform. Additionally, Swissquote provides free access to Autochartist, a popular technical analysis tool that helps traders identify potential trading opportunities.

MT5: Swissquote also offers the MetaTrader 5 (MT5) platform to its clients, which is the successor to the popular MT4 platform. MT5 has several advanced features such as improved charting capabilities, additional order types, and an economic calendar. Clients can also use MT5's algorithmic trading capabilities through the use of Expert Advisors (EAs) to automate their trading strategies. Swissquote's MT5 platform is available for desktop, web, and mobile devices, making it easily accessible for traders on the go.

Swissquote offers two primary deposit methods: debit card (Visa, MasterCard), bank wire transfer. With wire transfer, clients can make deposits in various currencies, but the process may take longer, typically taking 1 to 2 business days to reflect on their account. On the other hand, debit card deposits are processed faster, typically within a few minutes, and they are available in CHF, EUR, GBP, EUR, AUD, JPY, PLN, CZK, HUF and USD.

For withdrawals, Swissquote typically processes requests within 1 to 2 business days. Clients can withdraw funds using the same methods they used to deposit funds. However, it's important to note that some withdrawal methods may incur fees, so it's essential to check with the broker first before initiating a withdrawal request.

Swissquote offers a plethora of educational resources to help traders of all levels enhance their knowledge and skills. The broker provides various learning materials, including webinars, seminars, online courses, and e-books. Additionally, Swissquote offers market analysis and news to keep clients informed about the latest developments in the financial markets.

In conclusion, Swissquote is a well-established and highly regulated forex broker offering a wide range of trading instruments, advanced trading platforms, and competitive trading conditions. The broker has earned a strong reputation for its commitment to security, transparency, and innovation, which has made it a preferred choice for traders looking for a reliable and trustworthy trading partner. While the broker's high minimum deposit requirement may be a challenge for some traders, its educational resources and excellent customer support help to offset this disadvantage.

Is Swissquote a regulated broker?

Yes, Swissquote is regulated by several financial authorities, including FCA, MFSA, FINMA, and DFSA.

What trading platforms are offered by Swissquote?

Swissquote offers several trading platforms, including the MetaTrader 4 and 5 platforms, Mobile App, and Money Managers.

What is the minimum deposit required to open an account with Swissquote?

The minimum deposit required to open an account with Swissquote is 1,000 EUR/USD/GBP/CHF.

Does Swissquote offer demo accounts?

Yes, Swissquote offers a free demo account with virtual funds for traders to practice trading strategies.

How can I deposit and withdraw funds from my Swissquote account?

You can deposit and withdraw funds from your Swissquote account using bank wire transfer or debit card (Visa, MasterCard),.

Swissquote acquires Yuh, gaining full ownership of the popular finance app amid rising phishing scams targeting users in the Swiss digital banking market.

Swiss regulator Finma has urged Swissquote to tighten cybersecurity after a surge in fraud and impersonation attacks.

Swissquote introduces fractional shares and crypto trading, offering affordable and flexible investment options with a new saving plan for diversified portfolios.

Swissquote recently announced its sponsorship of two ice hockey clubs. ZSC Lions and Genève-Servette Hockey Club are two of Switzerland's most prominent and successful ice hockey clubs. The partnership involves supporting both clubs in various aspects, including financial assistance and promotional activities.

Swissquote reports a 36% profit surge in the first half of 2024, driven by strong market conditions and increased trading activity, benefiting both clients and employees.

Swissquote introduces a novel securities lending service, allowing clients to lend stocks and ETFs to top-tier financial institutions, enhancing income streams without minimum deposits.

Yes, Swissquote offers Islamic Accounts that are compliant with Sharia law, making them available to clients who follow Islamic principles.

Swissquote has competitive spreads and charges commissions based on the account type and financial instrument. For example, the Premium Account offers variable spreads with EUR/USD starting from 1.3 pips, and the Prime Account offers spreads starting from 0.6 pips. The Elite Account provides the lowest spreads, starting from 0.0 pips with a EUR 2.5 per side commission per lot. Swissquote also offers free deposits and withdrawals for most methods but charges an inactivity fee after 6 months of no trades.

The spread on Swissquote’s accounts varies depending on the type. For example, the Premium Account has variable spreads starting from 1.3 pips on EUR/USD, while the Prime Account offers spreads starting from 0.6 pips. The Elite Account provides the lowest spreads, starting from 0.0 pips.

Swissquote offers several trading platforms, including MT4, MT5, and its Money Managers platform. These platforms are accessible on various devices such as Windows, macOS, Android, and iOS, providing flexibility for traders.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

oribi

India

I transferred 10k and after 2 weeks my account has not been activated nor my funds have been returned. Unbelievable how they enable the bank account to receive the money saying that to activate your account you just have to deposit, but after you do so they ask more questions about your background, and the only way you have to contact them is submitting a new contact form on the website each time, to which they reply every 2 days at best. Update: it has now been 3 weeks and I am yet to receive my funds back or have my account active. I have sent 3 more contact forms and still completely ignored. Please don’t ever put your money here.

Exposure

FX1657745320

Germany

Opening the account was already very complicated, and logging in is also difficult. Compared to the apps of Swiss banks, the platform is very complicated to use. I wanted to close the account, but the remaining balance of about 460 francs has been waiting for months. Today, customer service seriously asked me about my last job five years ago, even though I've been retired for five years! I wonder how Swissquote can know the name of my employer from five years ago. That's a matter of data protection, isn't it? And what do these questions have to do with closing my account?

Exposure

珈跃

Hong Kong

I wanted to withdraw the remaining $73, it's been almost two weeks and it still hasn't been credited to my account. The customer service is slow in responding to emails.

Exposure

天機智投-薇琪Vicky

Hong Kong

Since 2020, we have been working with UBS Bank. Our company, Tianji Intelligent Investment, has traded nearly 300,000 lots in the past three years, and the cooperation has been very stable. The capital volume is sufficient, and deposits and withdrawals are also very convenient. Although there may be slippage during major market movements, we have been compensated for several instances of slippage beyond the market conditions. It is still better to choose a large broker.

Positive

Sunnar

Australia

Swissquote delivers competitive spreads, making it a great option for cost-conscious traders. And with their solid regulation, you can trade with confidence.Niceee!

Positive

Maverick Lu

Malaysia

Nice broker, but sometimes connections are lost...

Neutral

瞬间即逝

Hong Kong

In July 2022, in a certain QQ group about stocks, a manager surnamed Huang recommended opening a forex trading account with the option to copy trades. As a complete novice, I had no idea that Swissquote Bank's trades originally had no commissions but such large spreads (which I only learned later)—each standard lot cost $50 to open. Under their guidance, I successfully lost everything. Since the trades were executed by following their lead, I accepted the losses. I ask for nothing else but the return of the total commission fees paid based on the number of lots traded.

Exposure

雨后彩虹5042

Hong Kong

My account is 7148871. I trade on the TMGM platform. I choose to use this platform for its security and stability. But TMGM is a black platform. On December 26th, XAU/USD malicious slippage and expanded more than two hundred pips, resulting in the liquidating of more than 100,000 U.S. dollars. The liquidity provider offer is not so low, the platform's forced leveling mechanism also has a problem. I hope that this matter is exposed so that everyone will be warned not to use this black platform, this platform is not trustworthy.

Exposure

Vx_Forex813

Hong Kong

Funds are securely protected, As Switzerland's largest and only listed forex bank, Each account enjoys a 100,000 CHF protection plan. In the current era of major offshore regulations, Banking institutions are relatively safe. FINMA is also the only institution where mainland Chinese clients can enjoy fund security guarantees!!

Positive

叶子7137

Germany

Third-party transfers were supported when opening the account. It seemed friendly at first. But soon after all funds were deposited, their attitude changed. They no longer support third-party transfers. The transfers I'm referring to are transfers to third-party personal accounts—not risk funds or transfers to other trading platforms, let alone money laundering. Moreover, their official website still states that third-party transfers are supported. I am a frequent trader, but the account manager outright declared: 'We do not support or provide third-party transfer services,' and refused to give any reason. Be cautious: Swissquote Bank's account managers can set their own rules, disregarding the bank's policies. Even complaints won't resolve the issue. This indicates that the bank's management tacitly allows account managers to restrict user account functions without justification, ignoring bank rules. Depositing money is very convenient, but withdrawing it is extremely difficult. Contacting the account manager is futile—they simply ignore you. This bank is completely dishonest and behaves with a 'big business bullying customers' attitude. The account managers are very impolite. Unlike other brokers like Interactive Brokers and XM, which reply to emails 100% of the time and are honest, professional, and at least respectful to clients, Swissquote is the most arrogant and rude platform I've ever traded with. Their lack of integrity and bullying of customers is self-destructive.

Exposure

ttp001

Hong Kong

Swissquote Bank's fund deposits and withdrawals are conducted through bank-to-bank transfers or same-name private-to-private wire transfers, meaning the remitter is yourself and the beneficiary is also yourself—essentially transferring money to yourself. The entire process is similar to transferring funds domestically from your ICBC account to your CCB account, except the banks are different. Since both accounts belong to you, the funds are secure, and the transaction channels are safe. There’s no need to worry about frozen or blocked bank cards. Additionally, multiple deposit and withdrawal methods are available, offering unique advantages in the current market environment (e.g., card restrictions, offshore licenses, private account transfers, etc.).

Positive

ttp001

Hong Kong

The deposit and withdrawal of Swissquote Bank adopts bank-to-bank and private-to-private telegraphic transfer with the same name, that is, the remitter is yourself, and the payee is also yourself, and you transfer money to yourself. The whole deposit and withdrawal process is like transferring money from your own ICBC card to Your own CCB card is the same, but the bank is different, it is your own account, so the funds are safe, and the fund channel is also safe. You don't have to worry about freezing the bank card and blocking the card. At the same time, there are many deposit and withdrawal methods to choose from. Under the current market environment (duan card, offshore license, private account transfer, etc.) has unique advantages

Positive

FX1284110423

Singapore

Swissquiote owns a very complex official website to use, not intuitive at all… I really think that they should redesign their site. As an old client of this broker, I have spent much longer time to find what I need every time…

Neutral

雪华

Taiwan

Well-regulated broker, good execution, professional customer support service, easy and quick deposit and withdrawal process, and many payment options. No issues, have been trading with them for many years.

Positive

Chong Shih Siang Delvin

Nigeria

Except that the deposit threshold is a bit high for me, I am satisfied with everything else! Trading assets are abundant, trading conditions are very competitive, and the trading platforms are very easy to use! If only a mini account could be offered as well.

Positive

rxtd

Hong Kong

The commission is US$50 per standard lot, the pound-US spread is more than 55, and there are some overnight fees. After calculation, it is really the highest in the world. It is seriously inconsistent with the advertisement made by the bank, and there is fraud.

Exposure

。。。2639

Hong Kong

Gold and AUD have severe slippage issues. I've asked customer service multiple times and they just say it's normal. Totally unreliable.

Exposure

孜玛

Hong Kong

Swissquote customer service also failed to inform about trading risks. After executing the trade, the extreme market conditions made me feel there was a risk of margin call. I applied to add funds, but the funds were delayed in arriving. This led to my margin call. Unreliable.

Exposure

喵喵喵23

Hong Kong

During periods of high market volatility, slippage becomes severe and can easily lead to losses.

Exposure

喵喵喵23

Hong Kong

Not withdrawing funds, and making me pay all kinds of fees—a bunch of damn scammers.

Exposure

蔷薇7314

Hong Kong

A bank as big as Swissquote Bank still uses this kind of indiscriminate method to open an account, and then uses handling fees and increased spreads to defraud the hard-earned money of ordinary people. It only needs 250 US dollars in one hand, and it will charge 50 US dollars in handling fees and then at least The difference is about 65 points, the two add up, the cost is more than half, even if you earn half, you still lose money, and the gods can’t make money, and the teacher will make you lose 580,000 or even 1 million for 10 days.

Exposure

蔷薇7314

Hong Kong

Moreover, before opening the account, they did not inform me about the $50 commission per lot or the approximately 65-pip spread. There was no follow-up call either. The instructor and a group of shills just told me to follow the instructor's trades. Most of the instructor's trades ended in stop-losses, but when I traded secretly on my own, I only dared to do a few trades, all of which were profitable. Additionally, when closing positions, the slippage was at least 20 pips or more. Everyone, don’t fall for this scam—don’t let your hard-earned money be stolen.

Exposure

Danai Sripuban

Hong Kong

If you want to trade foreign exchange, choose other foreign exchange platforms. The spread on this platform is so large that it is simply unbearable. The transaction fees are high, and the customer service is unprofessional and does not answer your questions at all. Really one of the worst Forex platforms I've ever seen.

Neutral