Company Summary

| CTBC SECURITIES Review Summary | |

| Founded | 1989 |

| Registered Country/Region | Taiwan |

| Regulation | Taipei Exchange |

| Market Instruments | Secondary Public Offering, Convertible Bonds, Exchangeable Bonds, ECB, GDR, Public Offering, Emerging Stock |

| Demo Account | Not Mentioned |

| Customer Support | TEL:(02)6639-2345 |

| FAX:(02)6639-2339 | |

CTBC SECURITIES Information

CTBC Securities, established in Taiwan in 1989 and regulated by the Taipei Exchange, offers multiple market instruments, including SPOs, various bonds, and handles IPO-related offerings. Information, including trading fees, account types, and the trading platform, is not mentioned on the website.

Pros and Cons

| Pros | Cons |

|

|

|

|

Is CTBC SECURITIES Legit?

CTBC SECURITIES has a “Dealing in securities” license regulated by the Taipei Exchange in Taiwan.

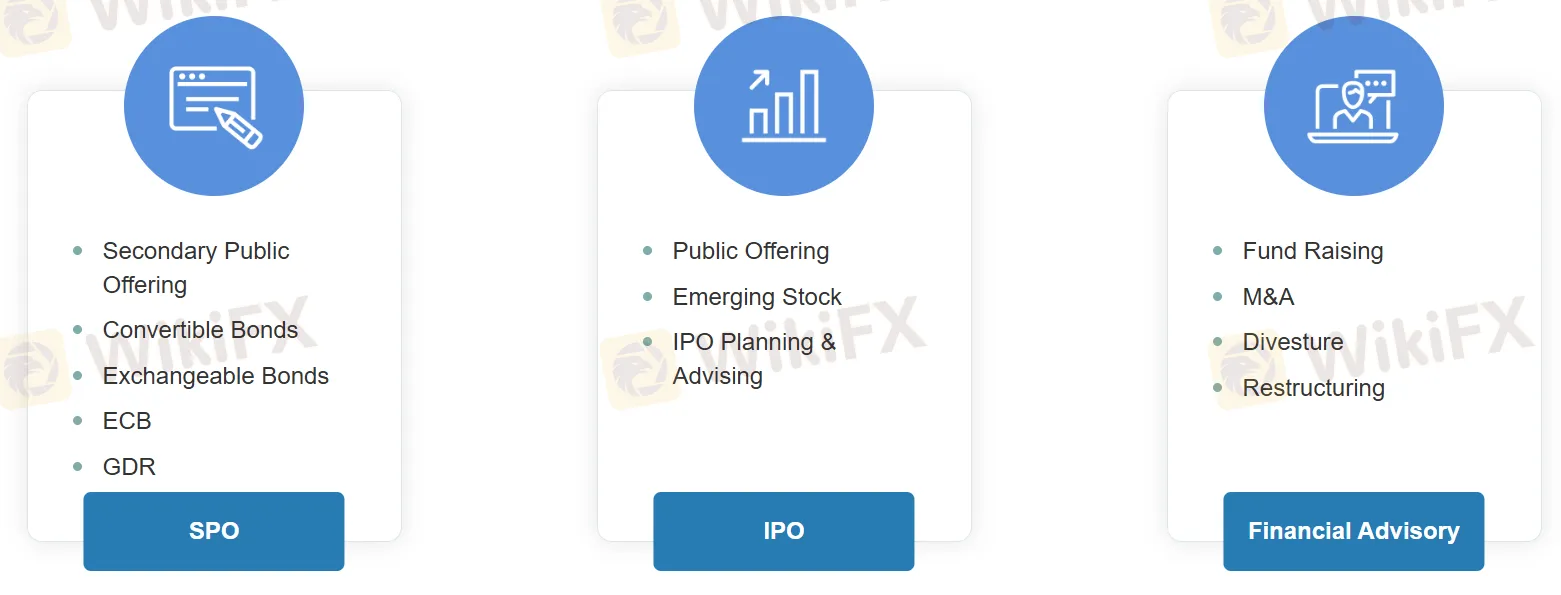

What Can I Trade on CTBC SECURITIES?

CTBC SECURITIES facilitates trading related to Secondary Public Offerings (SPO), Convertible Bonds, Exchangeable Bonds, ECB, and GDR. They also handle Public Offerings and Emerging Stocks associated with Initial Public Offerings (IPO), along with providing Financial Advisory services for fundraising, M&A, divestiture, and restructuring.

| Category | Instruments Offered |

| SPO | Secondary Public Offering |

| Convertible Bonds | |

| Exchangeable Bonds | |

| ECB | |

| GDR | |

| IPO | Public Offering |

| Emerging Stock | |

| IPO Planning & Advising | |

| Financial Advisory | Fund Raising |

| M&A | |

| Divestiture | |

| Restructuring |

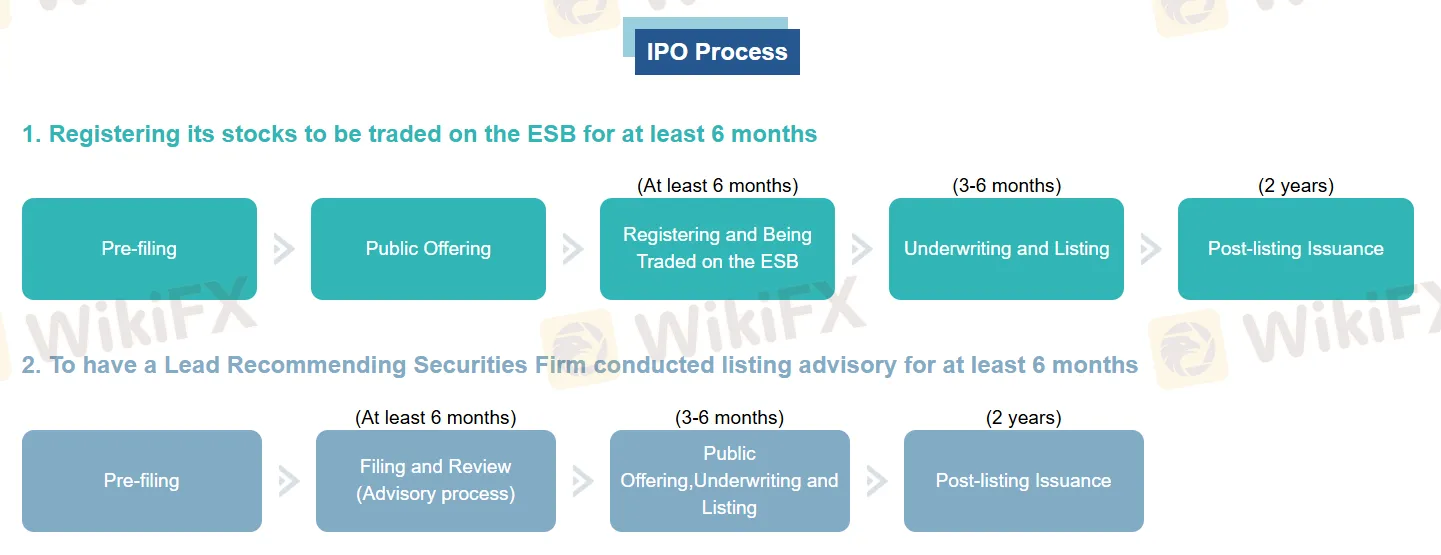

IPO Process

Path 1: Requires registering stocks on the ESB for at least 6 months after pre-filing and a public offering, followed by 3-6 months of underwriting and listing, and then a 2-year post-listing issuance period.

Path 2: Involves having a Lead Recommending Securities Firm conduct listing advisory for at least 6 months after pre-filing and filing/review. This is followed by 3-6 months of public offering, underwriting, and listing, and a 2-year post-listing issuance period.

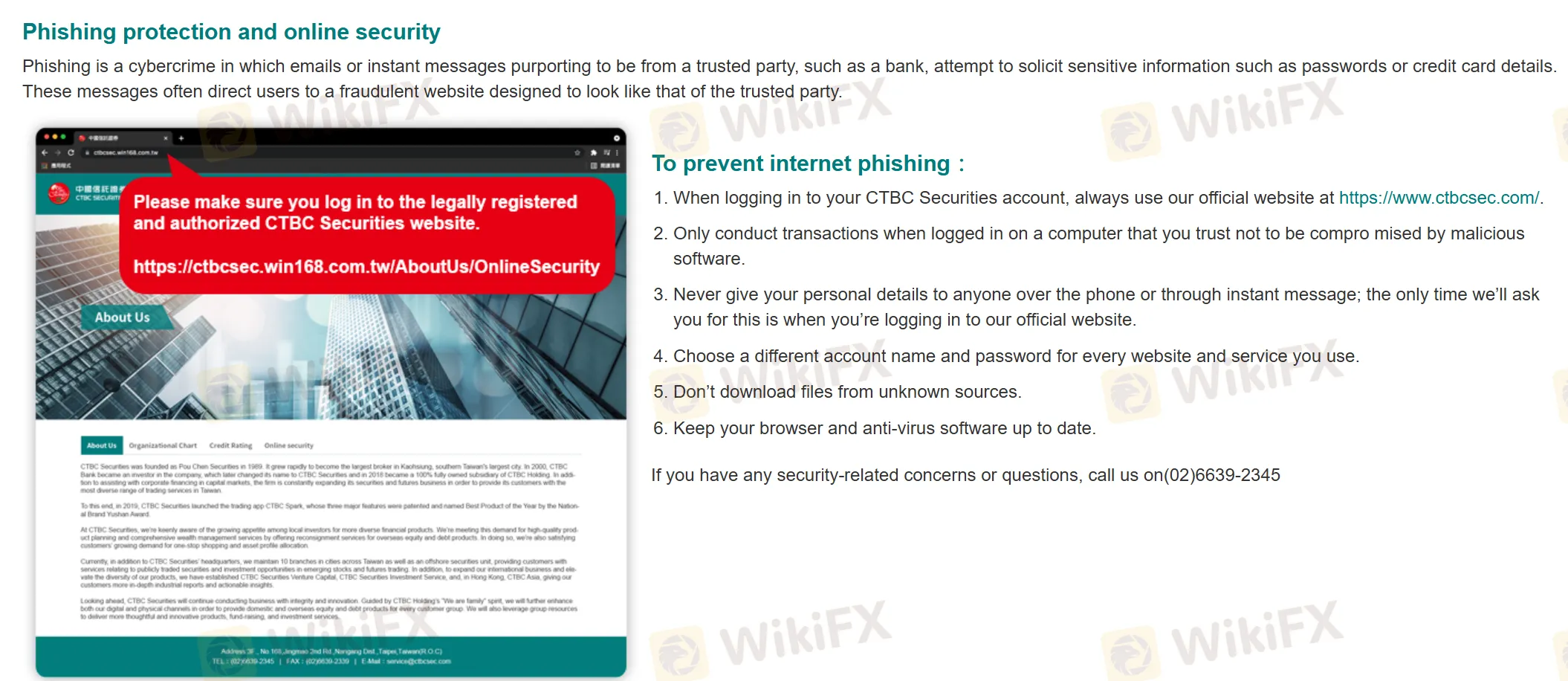

Online security

CTBC Securities emphasizes online security by advising users to always log in through their official website, conduct transactions on trusted devices, and never share personal details via phone or instant messages.