Company Summary

| Tasman FX Review Summary | |

| Founded | 2009-03-05 |

| Registered Country/Region | Australia |

| Regulation | Regulated |

| Servies | FX Products, Inward Remittance, Risk Management, Market Orders, and Global Payments |

| Customer Support | Sydney: (02) 8011 1846Melbourne: (03) 9111 0310Brisbane: (07) 3733 1913Perth: (08) 9468 2705Adelaide: (08) 7111 0807 |

| (02) 9098 8217 | |

| Facebook, LinkedIn, Instagram, Twitter | |

| The Commons, Level 1, 285a Crown St, Surry Hills, NSW 2010, Australia | |

Tasman FX Information

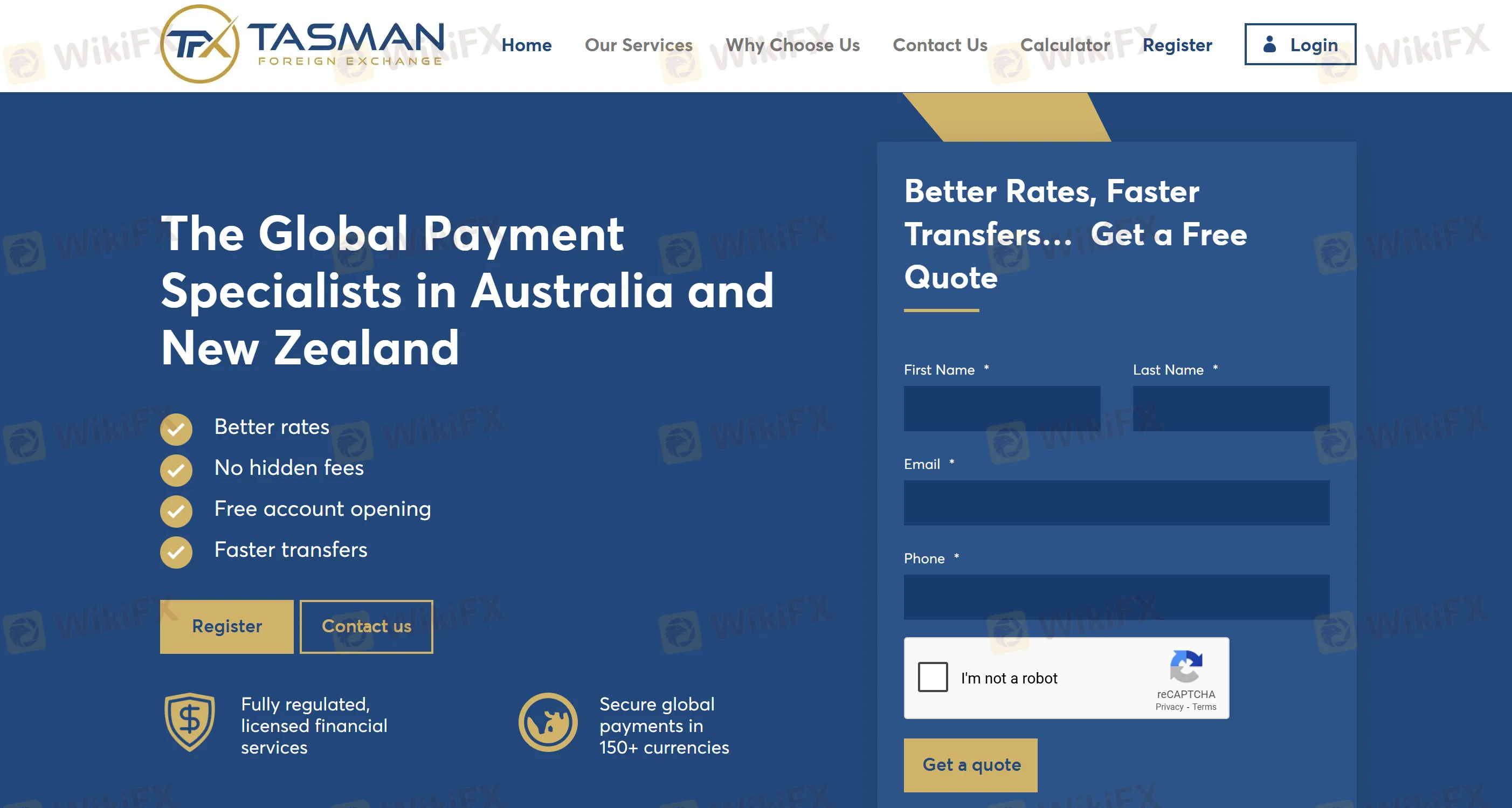

Founded in 2009, Tasman FX is a leading licensed foreign exchange and global payment service provider in Australia and New Zealand. Tasman FX offers cross-border fund solutions for individuals and businesses, supporting secure payments in over 150 currencies across more than 50 countries and regions worldwide.

Pros and Cons

| Pros | Cons |

| Regulated | Limited service scope (focused on the Australian and New Zealand markets) |

| Multiple services | Single product type |

| Global payments in 150+ currencies | Lack of leverage services |

Is Tasman FX Legit?

Yes. Tasman FX holds an Australian Financial Services License (AFSL) and is legally registered and regulated in New Zealand. Its ASIC license number is 000337970.

What Services Does Tasman FX Provide?

Tasman FX provides foreign exchange products such as spot foreign exchange trading and Forward Exchange Contracts (FEC). Investors can choose various methods for fund transfers, including telegraphic transfer, ACH, and SEPA, covering more than 50 currencies.

Account Type

Tasman FX offers individual accounts and corporate accounts, with free account opening. It supports services such as cross-border remittances, foreign exchange conversion, and customized risk management solutions.

小芯

Taiwan

The platform allows you to open an account and invest directly for free. It is very suitable for novices. More importantly, the handling fee is low and the withdrawal speed is fast. The service attitude is very good.

Positive

FX3660481217

Hong Kong

I entered this platform with trepidation. After using it for a while I found it to be a very good platform. I earned extra income here and will continue to use them.

Positive

FX1349771962

New Zealand

I found the process of registering for a free account with Tasman FX to be very time-consuming and tedious. Furthermore, the customer service response time was extremely slow, making it difficult to get answers to important questions. Overall, I had a poor experience with this company and would not consider using their services in the future.

Neutral

FX1299232315

Australia

I've been a client of TASMAN for many years and I have to say, they are the best in the business. The customer service is second-to-none; their platform makes investing so simple!

Positive