Company Summary

| ICAP Review Summary | |

| Founded | 1999 |

| Registered Country/Region | United Kingdom |

| Regulation | FFS (regulated); FCA (suspicious clone) |

| Services | Intermediary services in wholesale finance, energy, commidties markets |

| Trading Platform | Fusion, iSwap |

| Customer Support | Registered address: 22 Grenville Street, St Helier, Jersey, JE4 8PX;Tel: +44 (0)20 7200 7000/ +44 (0)20 7200 7176 |

| Americas Headquarters: 200 Vesey Street, New York, USA, NY 10281 | |

| Contact info for other branches: https://tpicap.com/tpicap/contact-us | |

ICAP Information

ICAP was registered in the United Kingdom and has headquarters in the United States. As an intermediary service provider for wholesale financial, energy and commodities markets, the comopany now operates in 22 countries from 33 locations, which cover Asia, EMEA, and the Americas. Traders can trade on its proprietary Fusion platform, or the electronic iSwap.

The good thing is that the company is regulated by FFS, which means its financial activities are watched by this authority body, guaranteeing a certain level of customer protection if there are disputes.

However, the company holds an FCA license, which is suspected to be fake clone.

Pros and Cons

| Pros | Cons |

| FFS regulated | Limited info on trading conditions |

| Multiple services provided | Suspicious clone FCA license |

| Long operation time | No MT4 or MT5 |

| No handling fees for deposit and withdrawal |

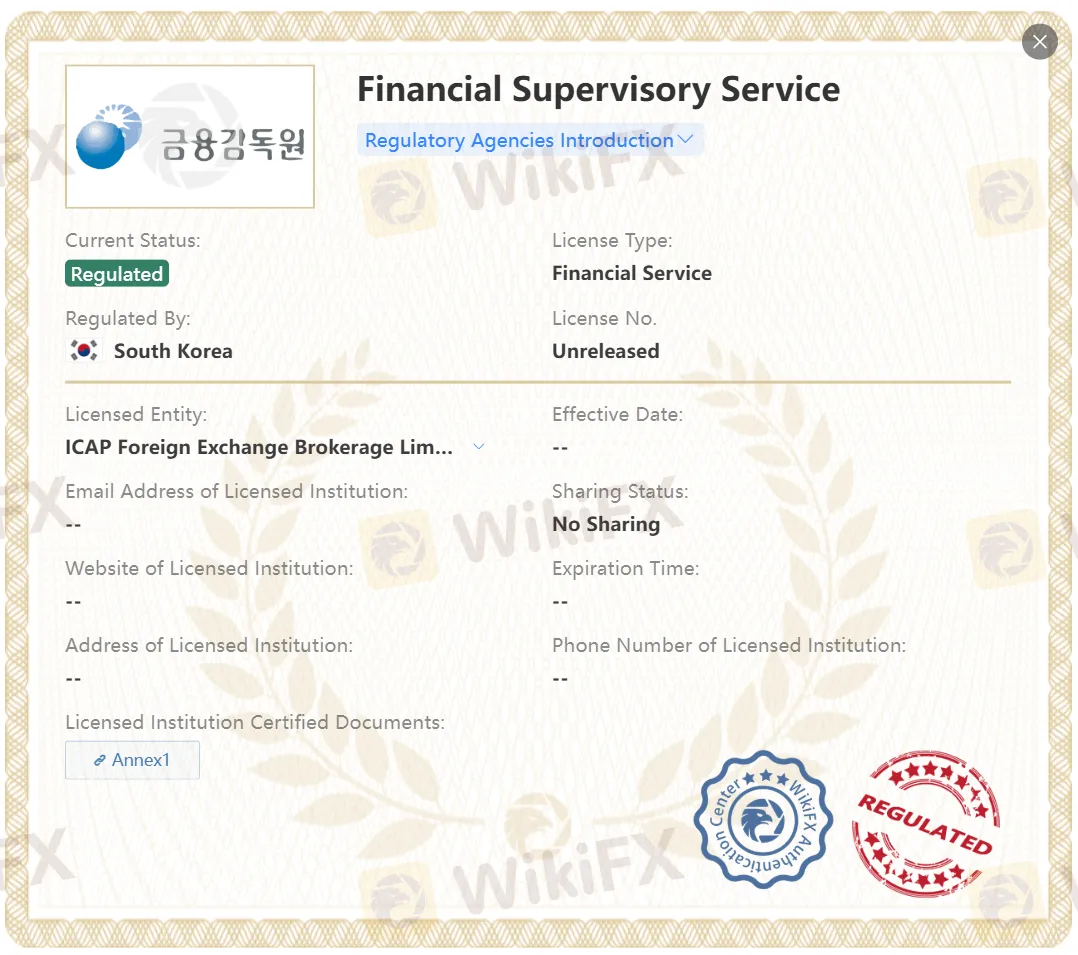

Is ICAP Legit?

ICAP is currently being well regulated by FFS (Financial Supervisory Service).

Nevertheless, the FCA (Financial Conduct Authority) license the company claims to hold is suspected to be fake clone, with regulated entity names at “The Link Asset and Securities Company Limited”, which should raise your great attention for full investgation before commiting actual trading.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| FFS | Regulated | ICAP Foreign Exchange Brokerage Limited | Financial Service | Unreleased |

| FCA | Suspicious clone | The Link Asset and Securities Company Limited | Investment Advisory License | 186764 |

What Can I Trade on ICAP?

Acts as a broker between financial institutions (banks, corporates, funds, central banks, etc.) to facilitate large and complex transactions, ICAP offers products and services in:

- Rates: Government bonds, swaps, repo, options, and more

- FX & Emerging Markets: Spot, forwards, NDFs, FX options

- Credit: Corporate/government bonds, credit derivatives, MBS

- Money Markets: Deposits, CP, CDs, T-Bills, FRNs

- Equities: Cash equities, ETFs, ADRs, equity derivatives

- Structured Finance: Custom and complex instruments

- Energy & Commodities: Synthetic strategies in USTs and futures

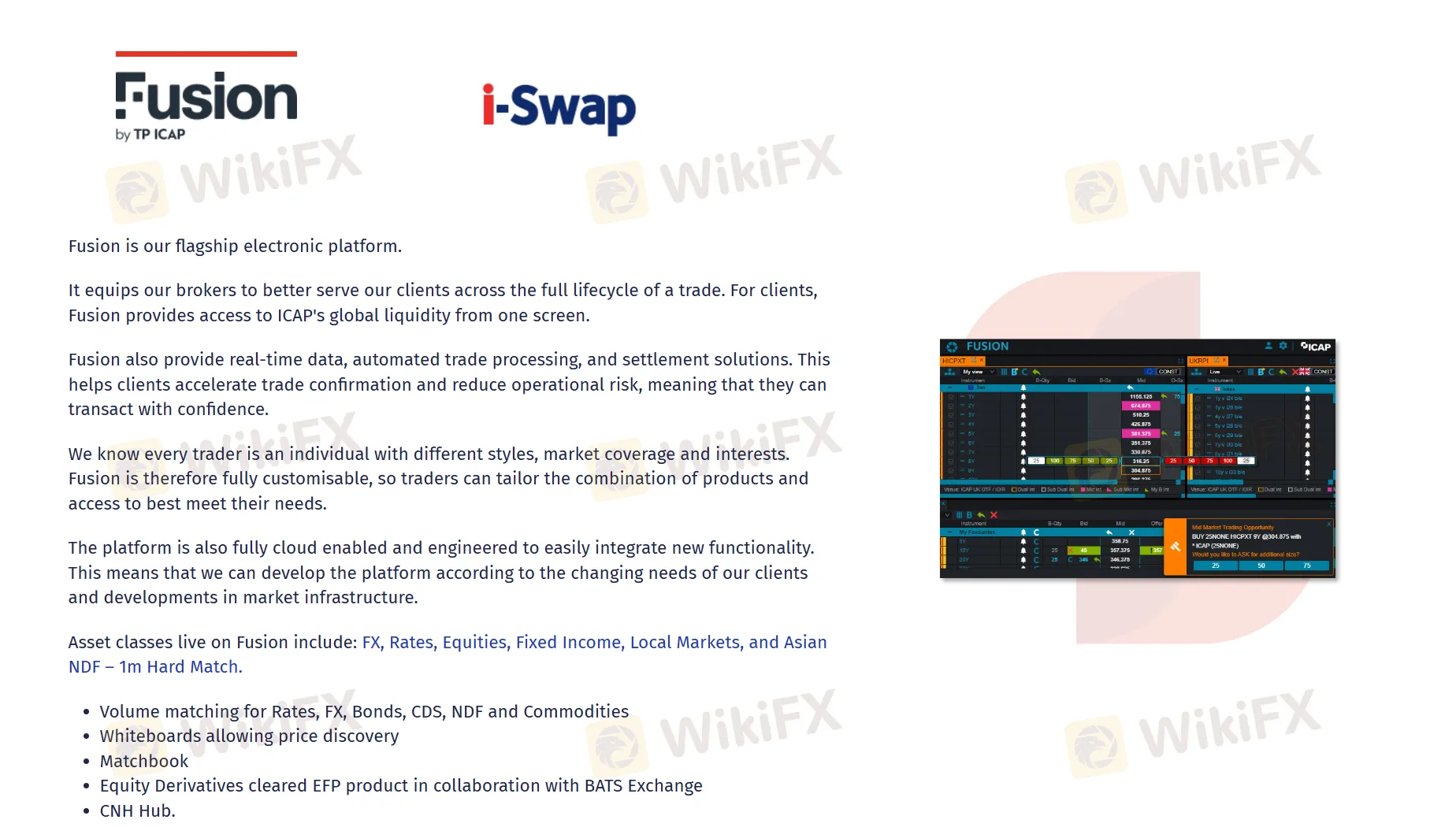

Trading Platform

ICAP offers its own flagship trading platform Fusion, a multi-asset trading platform supporting price entry, execution, and straight-through processing. And it is integrated with voice broking for price discovery as well.

In addition, the company also provides iSWAP, a hybrid electronic trading platform for Interest Rate Swaps in EUR, GBP, and USD, enabling deep liquidity and advanced execution through Dealer-to-Dealer and Dealer-to-Client markets.

Deposit and Withdrawal

Like many futures companies, ICAP accepts payment through Bank-Futures Fund Transfer with no handling fees.