Company Summary

| Registered Country | Saint Vincent and the Grenadines |

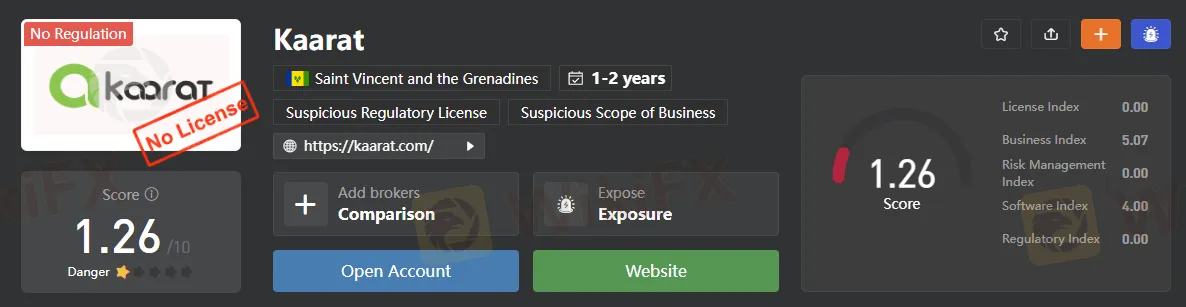

| Regulation | No regulation |

| Minimum Deposit | $250 |

| Minimum Spreads | From 0.1 pips |

| Maximum leverage | 1:400 |

| Trading Platform | Non-MT4/MT5 trading platform |

| Trading assets | Currencies, Commodities, Global Stocks, Indices, Digital Currencies. |

| Payment Methods | N/A |

| Customer support | Email, Phone, Online Chat |

General Information

Registered in Saint Vincent and the Grenadines, Kaarat is forex broker offering a series of trading instruments to both retail and professional traders, including Currencies, Commodities, Global Stocks, Indices, Digital Currencies. With the Kaarat platform, traders have the flexibility to choose from four trading accounts, with the minimum deposit starting at $250.

Here is the screenshot of Kaarats official website:

Kaarat is the trading name of Kaarat Ltd, with operating number 26155BC2021, and registered address at 180 Kingstown, St. Vincent & the Grenadines.

Please note that Kaarat is not authorized or regulated by any regulators. Be aware of the risk involved.

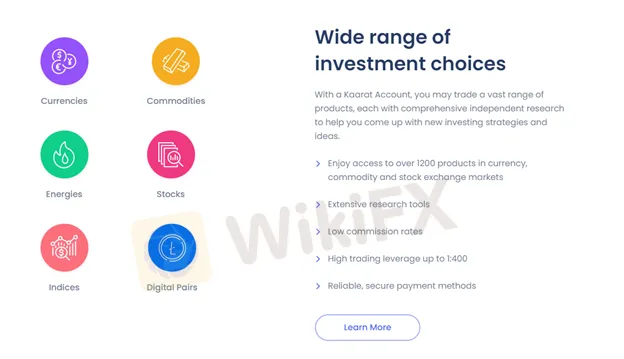

Market Instruments

With the Kaarat platform, investors can diversify their investment portfolios through one account. Different classes of trading assets including Currencies, Commodities, Energies, Stocks, Indices, and Digital Pairs can be traded through this brokerage platform.

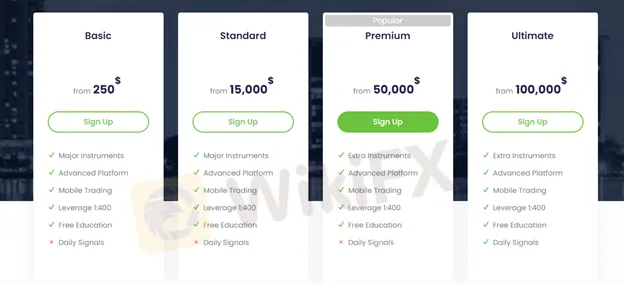

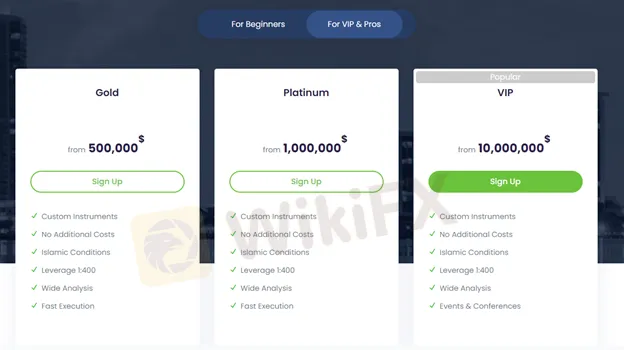

Account Types

Kaarat provides a range of trading accounts for both retail and professional clients: Basic, Standard, Premium, Ultimate, VIP accounts. To open a Basic account, an initial deposit of $250 is required, much higher than its peers requirements. However, minimum deposits become crazy for another six trading accounts, with the Standard account from $15,000, the Premium account from $50,000 and the Ultimate account from $100,000, the Gold account from $500,000, the Platinum account from $1,000,000, the VIP account from $10,000,000.

It seems like, Kaarat is nothing but a scam trying to defraud investors and extracting all their available money. Please be aware of the risk.

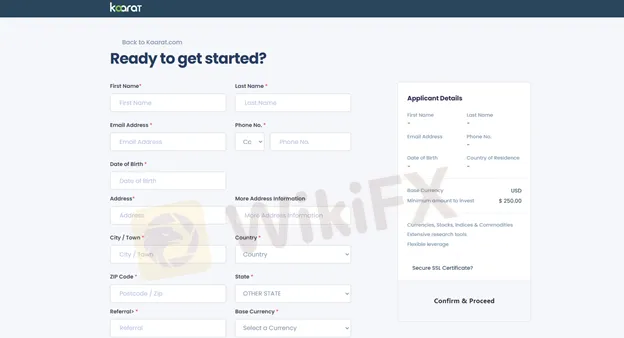

How to open an account with Kaarat?

Opening an account with Kaarat is an easy and simple process:

1. Click the “Sign up” link, and fill up some required details on the popping-up page.

2. Upload your personal data for this company to verify your details.

3. Fund your account and start to trade with this forex broker.

Leverage

When it comes to leverage, Kaarat allows traders to use leverage of up to 1:400, much higher than the levels regarded appropriate by many regulators, with the maximum leverage for major forex up to 1:30 in Europe and Australia, and 1:50 in Canada and U.S.

As leverage can also cause serious fund losses, it is important for inexperienced traders to choose the proper amount that they feel most at ease.

Trading Platform

In terms of trading platform, Kaarat fails to provides its clients the industry-leading MT4 or MT5 trading platform, what it offers a proprietary trading platform available on Windows, PC and Mobile Devices.

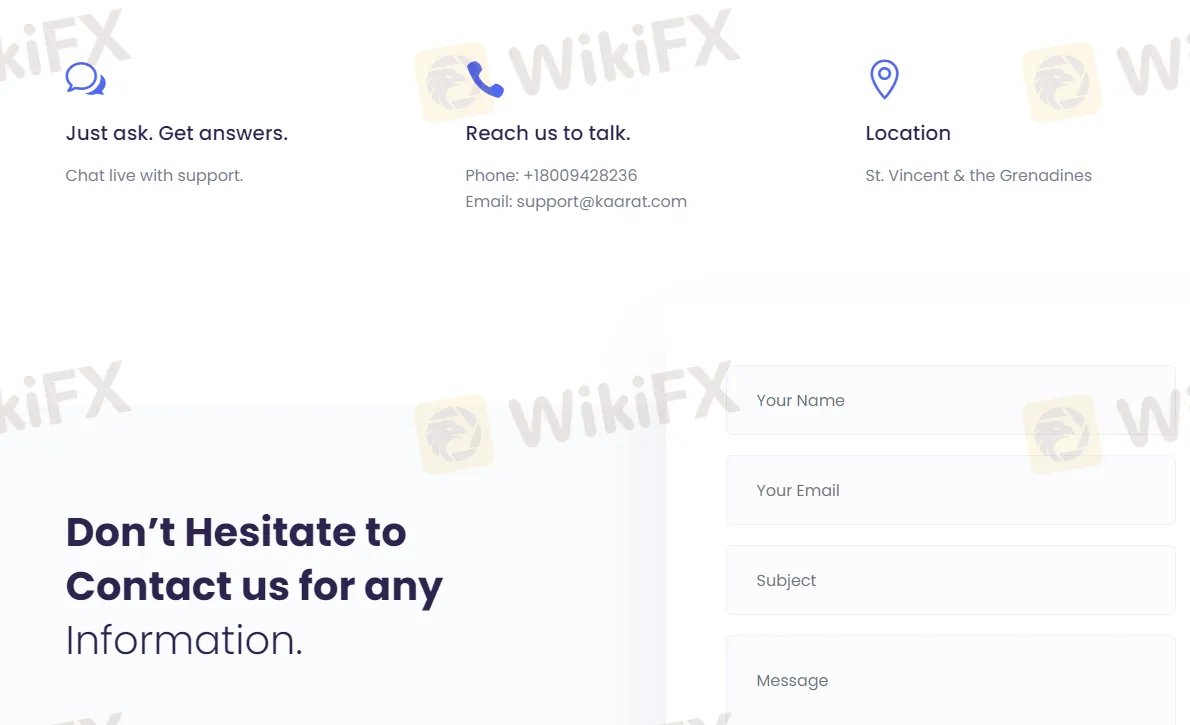

Customer Support

The Kaarat official website is available in multiple languages to offer customer support for clients in different countries. For any questions or concerns they may have about their accounts or their trading can reach out to Kaarat through the following methods:

Telephone: +18009428236

Email: support@kaarat.com

Registered Company Address: 2nd Floor College House,17 King Edwards Road, Ruislip,

London - HA4 7AE, UK.

Or you can also keep up with this forex broker on Facebook and Twitter.

Restricted Regions

Kaarat does not accept traders from Iran, the USA, Irap and North Korea.

Pros & Cons

| Pros | Cons |

| Generous leverage up to 1:400 | No regulation |

| Multiple account types | Weak trading platform |

| Wide selection of trading assets | Not accepting services to traders from some countries |

| High minimum deposit required | |

| No 24/7 customer support |

Frequently Asked Questions

Is Kaarat regulated?

No, Kaarat is not regulated anyway.

What is the minimum deposit required by Kaarat?

The minimum deposit to open a Basic account starts from $250.

What is the maximum trading leverage offered by Kaarat?

The maximum trading leverage offered by Kaarat is up to 1:500.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.