Company Summary

| RUIDA FUTURES Review Summary | |

| Founded | 1993 |

| Registered Country/Region | China |

| Regulation | CFFEX |

| Products and Services | Commodity & financial futures brokerage, investment consulting, asset & fund management, fintech, and international risk services |

| Platform/APP | Jinshida, Midas Touch, Flagship App, Boyi Master & APP, Polestar V9.3/V9.5, Express Terminal V2/V3, Infinite Easy (Ez/Pro), Caishun, SP Trader, Trading Pioneer/TBQuant, Wenhua, Tonghuashun |

| Customer Support | Phone: 4008-8787-66 |

RUIDA FUTURES Information

Ruida Futures Co., Ltd., founded in 1993, is a licensed Chinese futures company regulated by the China Financial Futures Exchange. It offers a full range of services including commodity and financial futures brokerage, investment consulting, asset management, and international risk management through its subsidiaries.

Pros and Cons

| Pros | Cons |

| Regulated by CFFEX | Some platforms may be too complex for beginners |

| Offers full range of futures and asset management services | Margin requirement 5% higher than exchange base |

| Multiple trading platforms (desktop & mobile) |

Is RUIDA FUTURES Legit?

Ruida Futures Co., Ltd. (瑞达期货股份有限公司) is a legitimate and regulated financial institution in China. It holds a valid Futures License (License No. 0170) issued by the China Financial Futures Exchange (CFFEX).

Products and Services

In China, Ruida Futures Co., Ltd. provides a comprehensive range of licensed financial services, such as brokerage for commodity and financial futures, investment advising, and asset management. In addition, its companies offer offshore risk management, fund management, and fintech services.

| Products & Services | Supported |

| Commodity Futures Brokerage | ✔ |

| Financial Futures Brokerage | ✔ |

| Futures Investment Consulting | ✔ |

| Asset Management | ✔ |

| Overseas Risk Management (via Ruida Intl.) | ✔ |

| Transaction Channel Services (International) | ✔ |

| Public Fund Management (via Ruida Fund) | ✔ |

| Fund Sales Business | ✔ |

| Fintech Services (via Ruida Ruikong) | ✔ |

| Stock Trading | ✘ |

| Cryptocurrency Trading | ✘ |

RUIDA FUTURES Fees

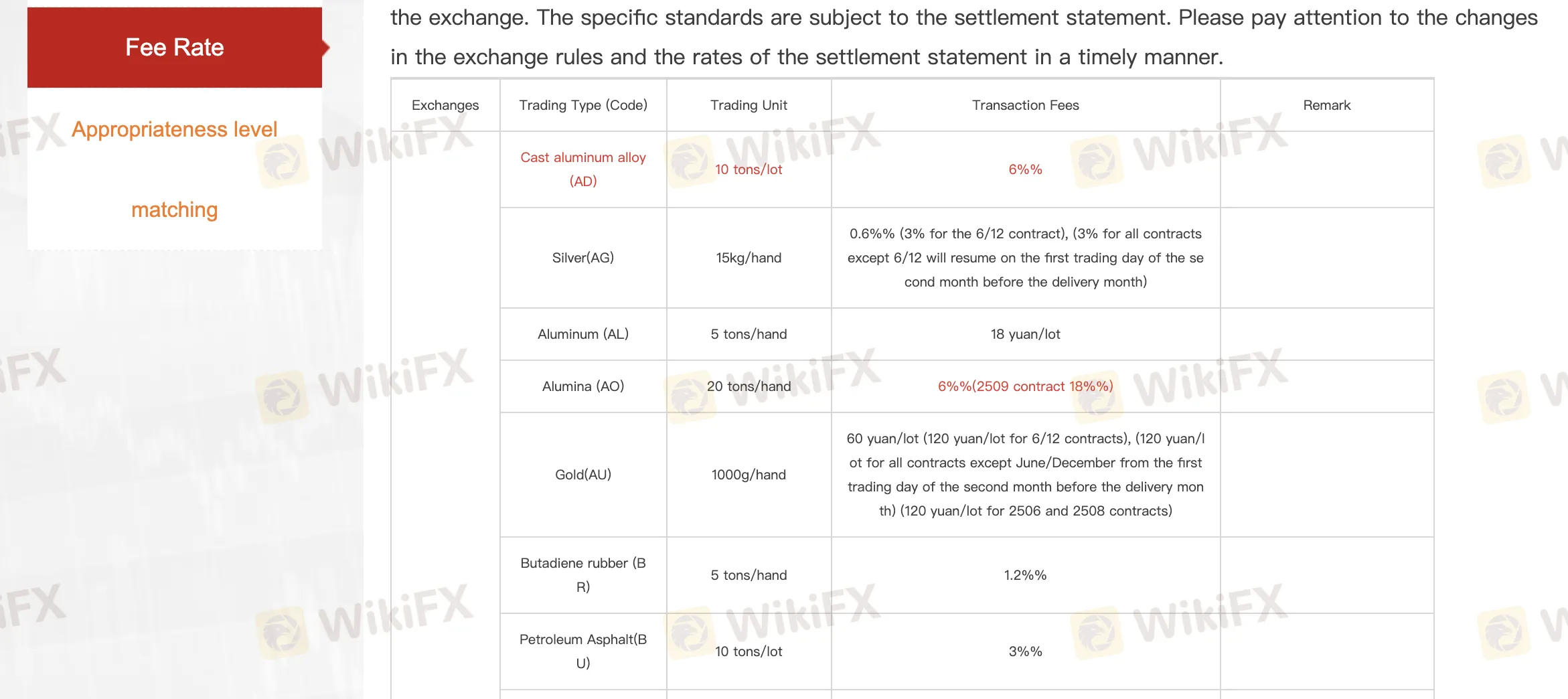

Ruida Futures fees are generally industry-standard, with a 5% margin premium over exchange requirements. Trading costs vary by product—some charged per lot (e.g. ¥18/lot), others by percentage (e.g. 3%). Same-day trades and options may incur higher or additional fees.

| Exchange | Major Products | Typical Fee (per lot) | Intraday Surcharge | Remarks |

| SHFE | Gold, Silver, Copper, Rebar, Rubber | 6–60 RMB or 0.6%–6% | Some products 2× | Fees vary by contract month; margin may increase near delivery |

| DCE | Soybeans, Corn, Iron Ore, PE, PP | 6–36 RMB or 0.6%–9% | Common for iron ore, coking coal | Delivery month pricing differences; soy oil, corn variations |

| CZCE | Methanol, PTA, Rapeseed Meal, Glass | 6–180 RMB or 0.6%–12% | Yes, for contracts like PTA, methanol | Some products have opening volume minimums |

| CFFEX | CSI 300, SSE 50, CGB Futures | 18–90 RMB or 1.38% + 1 RMB/order | Yes (13.8%) | Applies to stock index & bond futures; includes options |

| INE | Crude Oil, Copper, Fuel Oil | 60–120 RMB or 0.6%–3% | Yes (e.g., EC up to 72%) | EC/SC have high delivery month margins |

| GFEX | Lithium Carbonate, Silicon | 4.8%–6% or 12–18 RMB | No special intraday rates | Newer contracts; relatively lower volume |

Platform/APP

| Platform/APP | Supported | Available Devices | Suitable For |

| Jinshida Trading System | ✔ | Desktop | Comprehensive futures trading |

| Midas Touch | ✔ | Desktop | Fast execution, panoramic order view |

| Ruida Futures Flagship App | ✔ | Mobile (iOS/Android) | One-stop account opening + trading |

| Boyi Master (5 & 7) | ✔ | Desktop | Market analysis, integrated “Lightning Hand” |

| Boyi APP | ✔ | Mobile | Mobile futures & options trading |

| Polestar V9.3 / V9.5 | ✔ | Desktop | High-speed trading, deep market analysis |

| Express Trading Terminal (V2/V3) | ✔ | Desktop | Real-time account data and rapid order functions |

| Infinite Easy (Ez & Pro) | ✔ | Desktop | Options trading, Excel export, custom strategies |

| Caishun | ✔ | Desktop | Arbitrage & long-term historical analysis |

| SP Trader (Lightning Trading) | ✔ | Desktop | Global futures with real-time quotes |

| Trading Pioneer / TBQuant | ✔ | Desktop | Systematic trading, multi-account management |

| Wenhua Yingshun / Wenhua Travel | ✔ | Desktop / Mobile | Technical analysis & intelligent trading |

| Tonghuashun Futures | ✔ | Desktop / Mobile | Futures quotes and trading |

薇11六1四3零2七1

Hong Kong

In June,2019,I was pulled into a stock-exchange group.At first,the value of stocks recommended by Jin Yin was increasing constantly,and teachers also taught us the skills of stock investing and recommended better stocks by live broadcast in the morning,afternoon and evening.Then he said that it was difficult to earn money because of the volatile market.Saying that stock investing makes money slowly,he induced us to invest jade and open accounts.He showed screenshots of several thousands of USD and losses,which only can be earned back by investing index.I was tempted and opened an account,since I had enough time and teacher’s instruction of earning fast money.I observed and asked some group members,whom all paid high compliments on the teacher! Having seen so many members following him and making profits,I joined.Until I made a loss of 420000 RMB or so,did I realize that it was a fraud!

Exposure

FX6775882262

Hong Kong

The company induced clients to deposit fund through livestreaming room and gave no access to withdrawal.

Exposure

卿21224

Hong Kong

The withdrawal is unavailable. The customer service asked me to add fund.

Exposure

顺遂

Hong Kong

They beguiled you into depositing via live room by low service fees and bonus. Then they told you that you have to deposit to withdraw. But in the end, you can’t withdraw at all. The teachers are: Robin, JinShan, Zoe, GaoMing, TianYa, DongFang. A gang of frauds. They will change their live room and continue scamming every other time.

Exposure

李纯涛

Hong Kong

A series of traps. Induced deposits. Unable to withdraw then.

Exposure

FX3688361241

Iraq

I saw the exposure from Dawanshang and I was so angry. I experienced the same scam. I paid ¥200,000 for different fees. But in the end, I can’t withdraw! I hope we can get together. Th assistants which Dawanshang mentioned were contacted by me, too. They are sinister. They knew we can’t give up our hard-earned money so they induced us to pay different fees. They even suggest me borrowing money from usurer. The same ending. Can’t get the money back. Please think of a way to get together.

Exposure

FX3688361241

Iraq

I was cheated several times: First the fee about account transfer. They said they didn't receive the money. So I have to pay it again. Then the VIP fee, about tens of thousands of yuan. Then they said my account information was wrong, another 180,000. We should get together to being them to jail!

Exposure

FX1926873034

Hong Kong

I just filed the case. I was cheated. At firdt, I deposited over 100,000. Then I join in an activity called operator plan, profiting 950,000. I need to pay commission of 380,000. Pay commission of 200,000, we can withdraw 300,000. Then pay the rest commission of 180,000, we can withdraw all funds. Yesterday, I paid 200,000 commission but I can’t withdraw. I realized I was cheated. I called the police.

Exposure

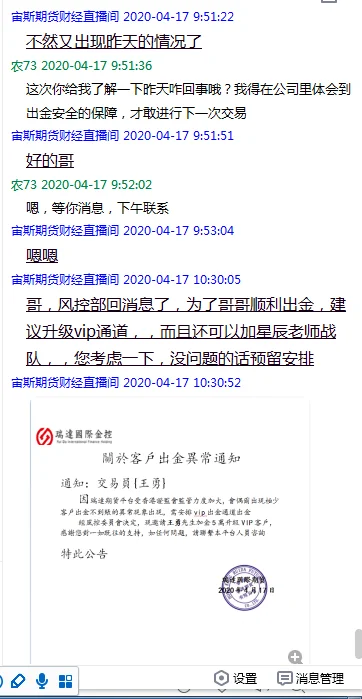

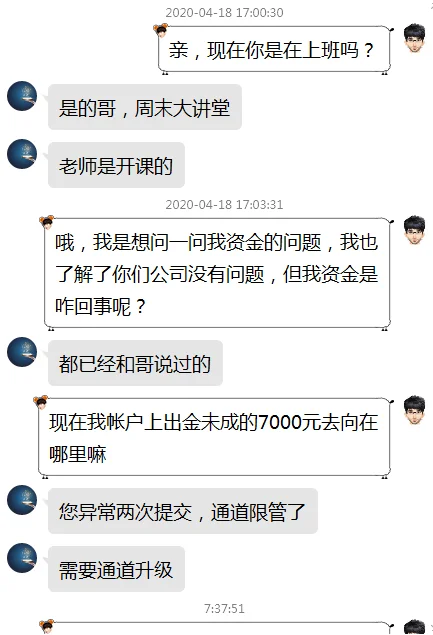

大晚上

Hong Kong

A clone of RUIDA FUTURES. I began investing here since May. And lose over 50,000. I wanna withdraw but my applications were refused with varied reasons. Then I was asked to pay over 20,000 to withdraw. After I paid, they asked me to pay it again, but I still can’t withdraw. The other assistant, called Nana, cheat me of over 70,000. Later, the Director of Operations told me to pay 10,000 to withdraw all my funds. At last, the so-called leader of RUIDA FUTURES told me to pay 7,000 as a safety fee. They swindle you out of money

Exposure

86245

Hong Kong

Induce me to deposit but I can’t withdraw. AT first, they said I has the suspicion of money laundering. Then I was told that my amount of trading wasn’t enough. Now they are impatient.

Exposure

张勇7998

Hong Kong

The service gave no accede to withdrawal with the excuse of the funding channel error. Then it always paltered with me, saying that it was checking for me. Fraud!

Exposure

FX3327602342

Hong Kong

This company is currently tricking customers into depositing by account opening bonus. When opening an account, I double checked with the customer service to confirm that there are no deposit threshold limit. The bonus withdrawal was conditional upon the lot size, which is reasonable. The client's capitals and profits can be freely deposited or withdrawn anyhow, which is a industry-wide standard for a regular platform. However, I failed to withdraw the next day! What's even more unreasonable is that I couldn’t view my account! The customer service explained that it was for the safety of funds. My account couldn’t be activated without reaching the deposit threshold! The exchange had detected high risk! What a nonsense! I had already met the margin opening conditions that allowed me to open positions without any further deposit. But in the end, I have to deposit another CNY 50,000 to withdraw! Still trying to trick me! Withdrawal is what matters most. Any excuse for refusing withdrawal is nonsense! Only the frauds would trick like this! Be cautious!

Exposure

留香

Hong Kong

The fraud inveigled clients to deposit fund and gave non accede to withdrawal on ground of fund risk, asking me to add fund.

Exposure

薇11六1四3零2七1

Hong Kong

In September of this year, I was invited into a live stream studio by chance. There were four advisers who gave lectures. At first, they told about stocks and recommended stocks. Since they gave good lessons and the recommended stocks were also accurate, I followed their advice a few times. There are small profits. So, I would go and listen their lessons. After a period of time when I lost money in the stock suggested by them, they said that the stock market was not good now, and the profits was low. They suggested us to trade stock index and futures, saying they could help everyone to invest in RUIDA FUTURES’s stock index and futures to make a fortune. They also showed their accounts with profits. At first, I just thinking about it, but as I saw more and more people in the group gained profits, I found the account clerk to open an account and invested 560,000. I didn’t expect that all money was lost in two weeks. I was shocked. When I asked the adviser, he did not reply me or said that investment was inherently risky. I was also kicked out of the group.

Exposure