Basic Information

Australia

AustraliaScore

Australia

|

Above 20 years

|

Australia

|

Above 20 years

| https://www.anz.com.au/personal/

Website

Rating Index

Influence

AAA

Influence index NO.1

Australia 9.80

Australia 9.80 Licenses

LicensesLicensed Entity:Australia and New Zealand Banking Group Limited

License No. 234527

Single Core

1G

40G

1M*ADSL

Australia

Australia Australia

Australia anz.com.au

anz.com.au anz.com

anz.com

| ANZ Review Summary | |

| Founded | 1951 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Products and Services | Personal, Business, and Institutional Banking Products (see summary below) |

| Demo Account | ❌ |

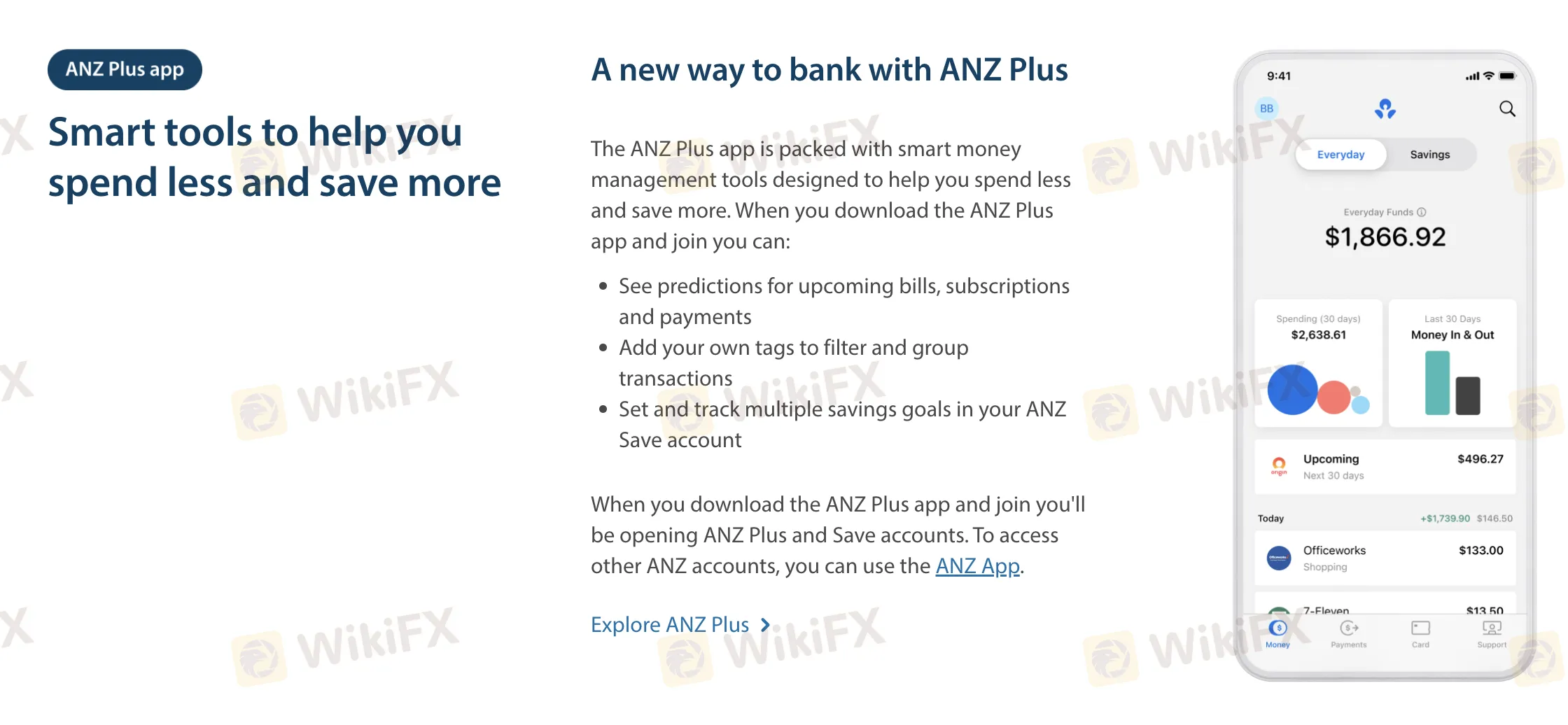

| Trading Platform | ANZ Plus App, ANZ App |

| Min Deposit | No minimum deposit requirement stated |

| Customer Support | Call: 13 13 14 or +61 3 9683 9999 |

ANZ, founded in 1951, is a well-established Australian bank regulated by ASIC. It provides full financial services to retail, commercial, and institutional clients. ANZ has great mobile banking apps, attractive savings rates, and straightforward fees. It doesn't support MT4/MT5 or demo/Islamic accounts.

| Pros | Cons |

| Regulated by ASIC | Does not support trading platforms like MT4/MT5 |

| No monthly account fees on key savings accounts | No demo account available |

| High interest rates up to 4.75% p.a. on select savings products | No Islamic (swap-free) account option |

ANZ (Australia and New Zealand Banking Group Limited) is a legitimate and regulated financial institution, authorized by the Australian Securities and Investments Commission (ASIC). It holds a Market Maker (MM) license under license number 000234527, effective since October 1, 2003. This regulatory oversight ensures that ANZ operates in accordance with Australian financial laws and standards.

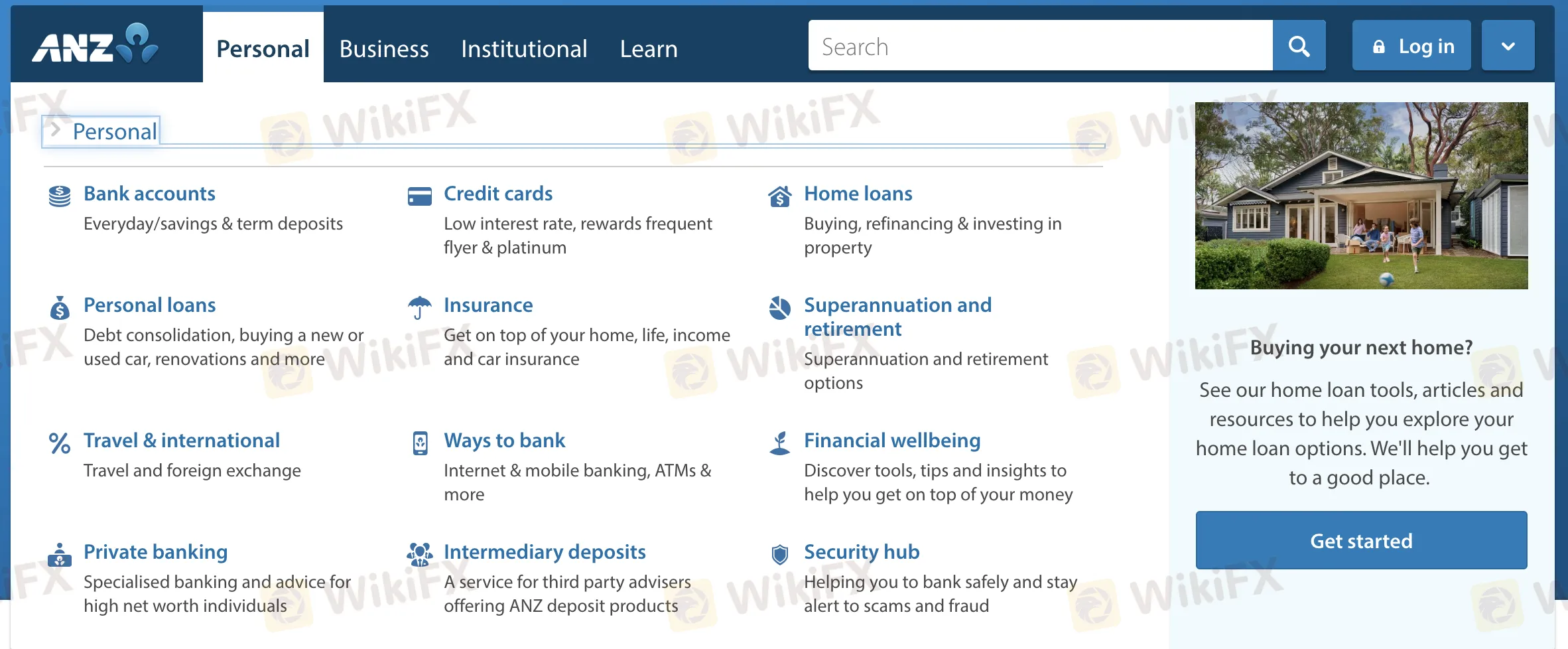

ANZ offers a broad range of financial services across personal, business, and institutional banking. Its products include bank accounts, loans, credit cards, insurance, investment services, superannuation, foreign exchange, and customized banking solutions for both individuals and corporations.

| Category | Products / Services |

| Personal Banking | Bank accounts, Credit cards, Home loans, Personal loans, Insurance |

| Superannuation & retirement, Travel & international, Ways to bank, Private banking | |

| Intermediary deposits, Financial wellbeing tools, Security hub | |

| Business Banking | Business finance, Business credit cards, Business accounts, Payments solutions |

| Online business banking, Business hub, International business, Indigenous banking | |

| Business cyber security | |

| Institutional Banking | Industry solutions, Global insights (ANZ Insights & Research), Digital services |

| FX Online, Global network presence, Risk and rates advisory, Business cybersecurity |

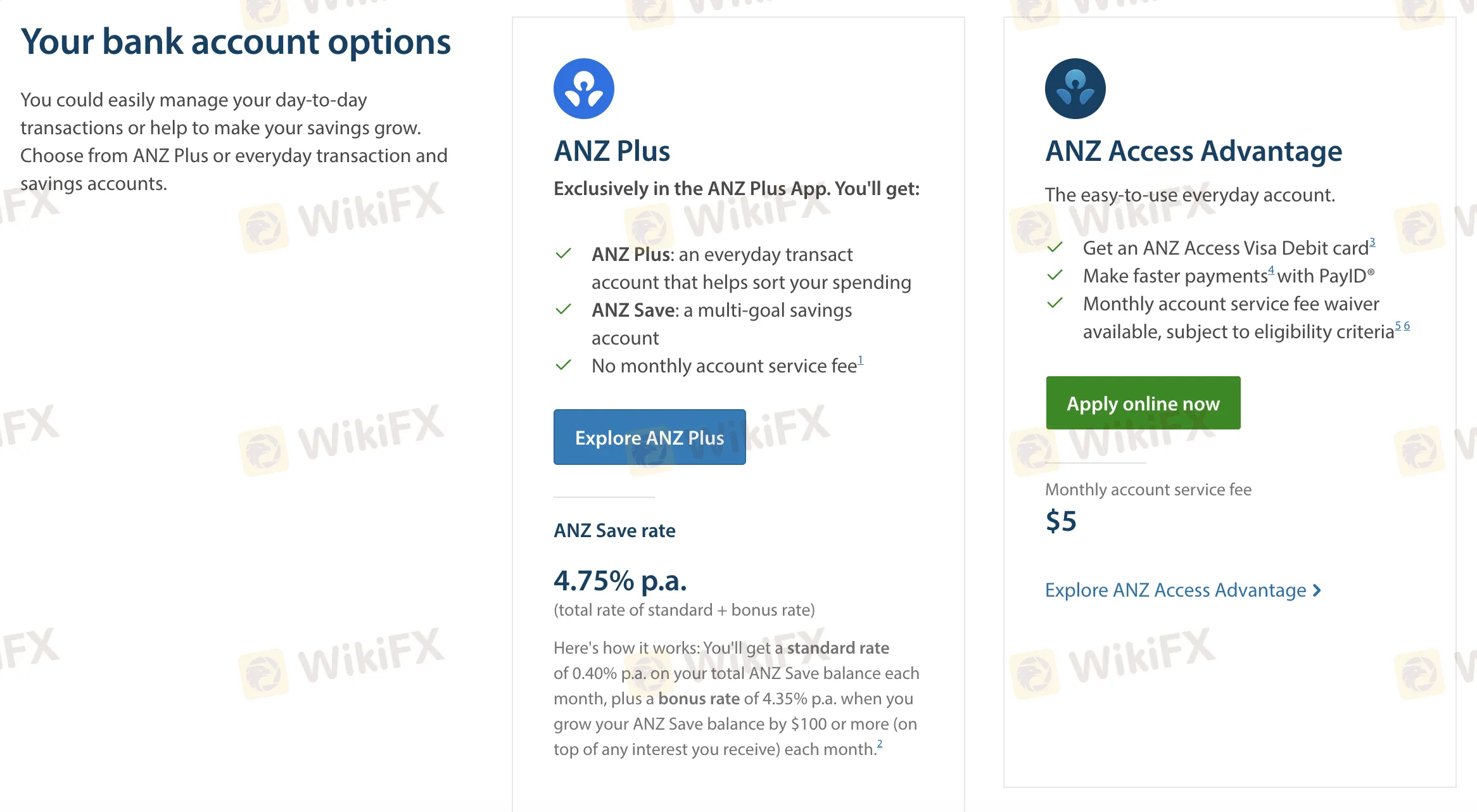

ANZ has a great range of genuine accounts suited for various consumer needs, including daily banking, savings, term deposits, and investment cash flow management. They are not now promoting the availability of Islamic (swap-free) accounts or demo accounts.

| Account Type | Description | Suitable For |

| ANZ Plus | Includes a spending account (ANZ Plus) and a savings account (ANZ Save) | Everyday users and goal-based savers |

| ANZ Access Advantage | Transactional account with Visa Debit, PayID, and fee waivers | General public needing day-to-day banking |

| ANZ Online Saver | High-interest savings with no minimum balance or fees | Savers who want flexibility and no lock-ins |

| ANZ Progress Saver | Bonus interest for regular deposits with no withdrawals | Goal-based savers, including youth accounts |

| ANZ Access Basic | Basic account for concession card holders | Low-income customers or welfare recipients |

| ANZ Pensioner Advantage | Interest-earning account for pensioners with Visa Debit | Retired individuals receiving pensions |

| Migrant Banking | Accounts for those newly arrived in Australia | New migrants needing local banking access |

| Premium Cash Management Account | Investment-linked cash flow management | High-net-worth or investment-focused clients |

| ANZ Term Deposit (Advance Notice) | Fixed-rate account with various term options | Investors seeking secure, predictable returns |

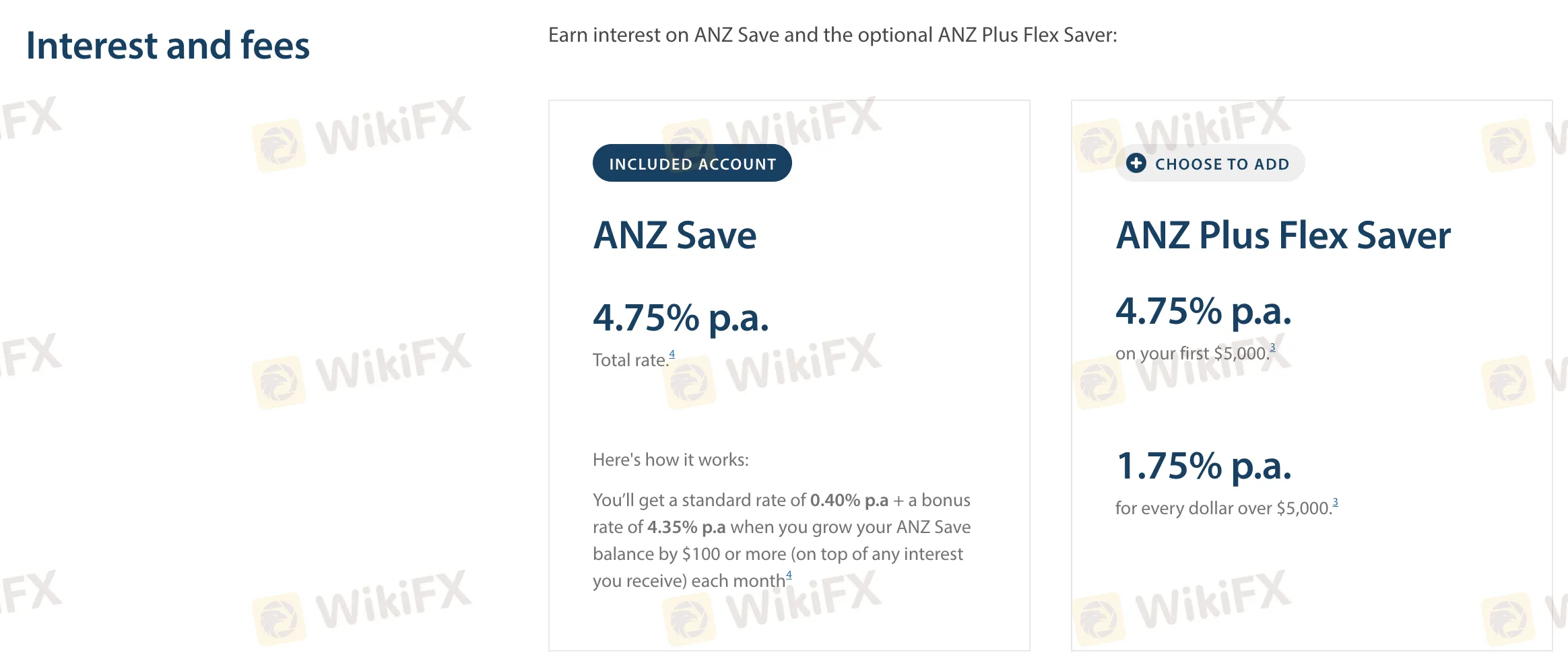

ANZs fees are generally low to moderate compared to industry standards. Interest rates vary depending on account type and conditions met. Most accounts like ANZ Save and ANZ Plus Flex Saver offer no monthly account fees and competitive interest rates up to 4.75% p.a.

| Account Type | Monthly Fee | Interest Rate (p.a.) | Key Features |

| ANZ Plus | $0 | 4.75% (standard + bonus) | Everyday & savings account via app; bonus if balance grows $100+ monthly |

| ANZ Access Advantage | $5 (may be waived) | No interest | Visa Debit Card, PayID payments, easy everyday use |

| ANZ Online Saver | $0 | 1.15% (standard variable) | No min. balance, no monthly fee |

| ANZ Progress Saver | $0 | 3.75% (base 0.01% + bonus) | Bonus if $10+ deposited & no withdrawals or fees in a calendar month |

| Fee Type | Details |

| Deposit Fee | Free (domestic deposits) |

| Withdrawal Fee | Domestic: Free at major bank ATMsInternational: $5 (or free at ANZ ATMs overseas) |

| Inactivity Fee | None mentioned |

| Trading Platform | Supported | Available Devices | Suitable for What Kind of Traders |

| ANZ Plus App | ✔ | iOS, Android (Mobile) | Everyday users focused on spending tracking and savings goals |

| ANZ App | ✔ | iOS, Android (Mobile) | Customers managing traditional ANZ banking and investment accounts |

| MetaTrader (MT4/5) | ❌ | Not supported | Not suitable (no MT4/MT5 access) |

| Web/Desktop Terminal | ❌ | Not supported | Not applicable |

ANZ does not charge fees for most domestic deposits or withdrawals, and there is no stated minimum deposit requirement. However, certain international transactions may incur fees—such as a $5 international ATM withdrawal fee and up to $15 for inward international money transfers. Processing times are generally instant for digital wallet payments and bank transfers within Australia.

| Method | Min. Amount | Fees | Processing Time |

| Domestic Bank Transfer | No minimum | Free | Instant - 1 business day |

| ANZ ATM (Domestic) | No minimum | Free | Instant |

| International ATM Withdrawal | No minimum | $5 or Free at ANZ ATMs | Instant |

| Inward International Transfer | No minimum | Up to $15 | Varies by provider |

| Digital Wallets (Apple Pay, Google Pay, etc.) | No minimum | Free | Instant |

ANZ offers a variety of personal, business, and institutional banking accounts, including savings accounts, credit cards, and loans. These accounts are designed for everyday banking, long-term saving, and managing finances. However, ANZ does not provide ANZ trading accounts or specialized trading accounts for retail clients, and it does not support Islamic accounts or demo accounts. From my perspective, ANZ excels in providing comprehensive banking services but falls short for traders looking for anz broker services. For anyone seeking ANZ trading account options, this platform will not meet your needs.

No, ANZ does not offer demo accounts for retail trading. From my perspective, this is a significant limitation for those who want to practice or familiarize themselves with trading strategies before committing real capital. While ANZ trading account services are not available, the bank’s offerings are more focused on personal banking and savings accounts, making it ideal for savers but not for active traders.

For domestic withdrawals, ANZ is quick and efficient. Most transactions are processed instantly or within one business day, whether you're withdrawing from an ANZ ATM or using the ANZ App for digital wallet payments. However, for international withdrawals, the processing time may vary depending on the location and the financial institutions involved. From my experience, ANZ's domestic withdrawal services are fast, making it convenient for those looking to access their funds. However, international transactions may take longer, and international fees should also be considered.

ANZ (Australia and New Zealand Banking Group) is a regulated financial institution in Australia, authorized by the Australian Securities and Investments Commission (ASIC). With a Market Maker (MM) license under the license number 000234527, effective since October 1, 2003, ANZ is required to adhere to stringent financial regulations set forth by ASIC, ensuring transparency, security, and investor protection for its clients. ASIC’s regulatory oversight also assures customers that ANZ’s financial operations are in line with Australian laws and global best practices. From my perspective, being regulated by ASIC adds a significant layer of trust and credibility to ANZ, particularly for institutional clients who rely on secure financial services. However, it’s important to note that ANZ does not offer ANZ trading accounts for retail traders, meaning that individual traders looking for access to anz broker services for forex or other speculative trading might find the platform lacking. For personal banking and institutional services, ANZ remains a reliable and secure choice, but if you’re specifically looking for a trading account or forex trading access, this would not be the platform to choose.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

kejon

China

I couldn’t withdraw the profit and my account has been froze,being asked for tens of thousand RMB for margin.

Exposure

FX1045284202

China

Is is a scam platform?

Exposure

FX1045284202

China

Hope ANZ give back our hard-earned money, you unfeeling brute.

Exposure

贾灏晨

Australia

ANZ is a regulated Australian bank that offers a wide range of personal financial services, including bank accounts, credit cards, loans, insurance, investments and more. The website provides detailed product information and online services to facilitate customers to manage accounts and conduct transactions.

Positive

FX1045284202

China

The platform gave no access to withdrawal and even asked for a margin. The name of the scam company is Guangzhou aijianxin network technology co. LTD.

Exposure