Company Summary

| LUKFOOK Review Summary | |

| Founded | 1999 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Futures, options, stock, securities |

| Account Type | Securities Account, Options Account |

| Trading Platform | Securities Trading System |

| Payment Method | Bank Transfer, Cheque Deposit, Telegraphic Transfer (including through bank counter, ATM & cheque deposit machine), FPS |

| Customer Support | Phone: (852) 2980 0888 |

| Fax: (852) 2980 0799 | |

| Email: cs@lff.com.hk | |

| Physical Address: Units 2201-2207 & 2213-2214, 22/F, Cosco Tower,183 Queens Road Central, Hong Kong (MTR Sheung Wan Station Exit E2) | |

LUKFOOKR Information

LUKFOOK, founded in 1999, is a brokerage registered in Hong Kong. The trading instruments it provides cover more than 50 types of forex , more than 70 types of shares, indices, metals, and commodities.

Pros and Cons

| Pros | Cons |

| Regulated | No commission information |

| Wide range of trading instruments | No clear information on the minimum deposit for each accounts |

| Generous leverage up to 1:500 | Limited account types offered |

| MT4 and MT5 supported | No Islamic account |

| Copy trading available | |

| Demo account available |

Is LUKFOOK Legit?

LUKFOOK is regulated by SFC in Hong Kong. Its current status is regulated.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| Hong Kong | SFC | Luk Fook Futures (HK) Limited | Dealing in futures contracts | AXW976 | Regulated |

What Can I Trade on LUKFOOK?

LUKFOOK offers traders securities, futures, options, stock to trade.

| Tradable Instruments | Supported |

| Securities | ✔ |

| Fetures | ✔ |

| Options | ✔ |

| Stock | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Metals | ❌ |

| Indices | ❌ |

| Futures | ❌ |

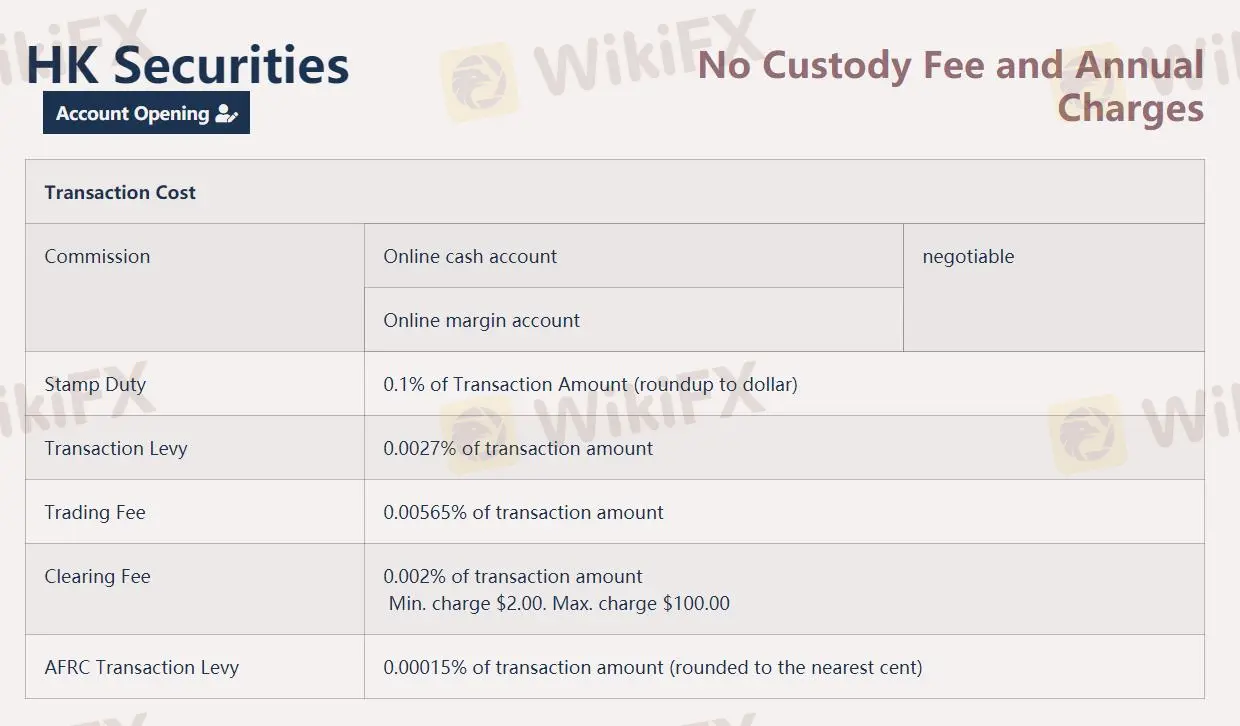

LUKFOOK Fees

The LUKFOOK fees composition are complex. For example, Hong Kong securities transaction fees are included: Commission, Stamp Duty, Transaction Levy, Trading Fee, Clearing Fee, AFRC Transaction Levy and other fees.

| Types | Fees | |

| Commission | Online cash account | Negotiable |

| Online margin account | ||

| Stamp Duty | 0.1% of Transaction Amount (roundup to dollar) | |

| Transaction Levy | 0.0027% of transaction amount | |

| Trading Fee | 0.00565% of transaction amount | |

| Clearing Fee | 0.002% of transaction amountMin. charge $2.00. Max. charge $100.00 | |

| AFRC Transaction Levy | 0.00015% of transaction amount (rounded to the nearest cent) | |

Trading Platform

LUKFOOK's trading platform is Securities Trading System, which supports traders on PC.

| Trading Platform | Supported | Available Devices |

| Securities Trading System | ✔ | Web |

| MT4 Margin WebTrader | ❌ | |

| MT5 | ❌ |

Deposit and Withdrawal

Deposit

Fund Deposit to Securities account

Methods: Bank Transfer, Cheque Deposit, Telegraphic Transfer (including through bank counter, ATM & cheque deposit machine), FPS.

Payable to: Luk Fook Securities (HK) Limited

| Bank | Currency | Bank Account Number | SWIFT ID |

| HSBC | HKD | 511-246613-001 | HSBCHKHH |

| RMB | 848-160834-209 | HSBCHKHH | |

| USD | 848-160834-201 | HSBCHKHH | |

| Standard Chartered Bank | HKD | 447-0789162-3 | SCBLHKHHXXX |

| USD | 447-0789658-7 | SCBLHKHHXXX | |

| Hang Seng Bank | HKD | 275-225738-001 | HASEHKHH |

| Bank of China | HKD | 012-875-0047477-9 | BKCHHKHHXXX |

| RMB | 012-875-06022754 | BKCHHKHHXXX | |

| FPS Identifier (applicable to HKD) | Account Name | ||

| 5561857 | Luk Fook Securities (HK) Limited | ||

Fund Deposit to Futures Account

Methods: Bank Transfer, Cheque Deposit, Telegraphic Transfer (including through bank counter, ATM & cheque deposit machine), FPS.

Payable to: Luk Fook Futures (HK) Limited

| Bank | Currency | Bank Account Number | SWIFT ID |

| HSBC | HKD | 848-161287-001 | HSBCHKHH |

| USD | 848-161295-274 | HSBCHKHH | |

| Standard Chartered Bank | HKD | 447-0788477-5 | SCBLHKHHXXX |

| USD | 447-1-782444-9 | SCBLHKHHXXX | |

| Hang Seng Bank | HKD | 787-466911-002 | HASEHKHH |

| Bank of China | HKD | 012-875-00499941 | BKCHHKHHXXX |

| USD | 012-875-08037976 | BKCHHKHHXXX | |

| RMB | 012-875-06031244 | BKCHHKHHXXX | |

| FPS Identifier (applicable to HKD) | Account Name | ||

| 9006271 | Luk Fook Futures (HK) Limited – HKFE Clients A/C | ||

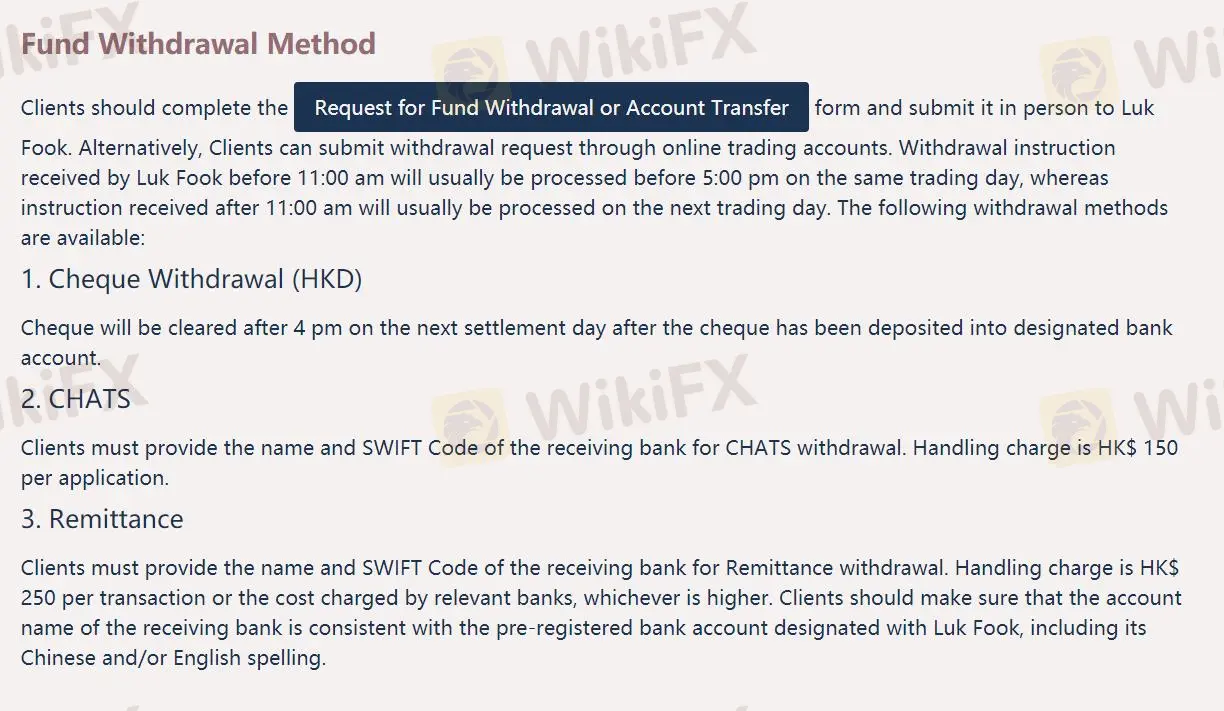

Withdrawal

The following withdrawal methods are available: Cheque Withdrawal (HKD), CHATS, Remittance.