Company Summary

| MTFX Review Summary | |

| Registered On | 2016-03-04 |

| Registered Country/Region | Canada |

| Regulation | Unregulated |

| Services | Currency Exchange, Cross-Border Payments, Risk Hedging |

| Trading Platform | MTFX (iOS and Android apps) |

| Customer Support | Facebook, Twitter, Instagram |

MTFX Information

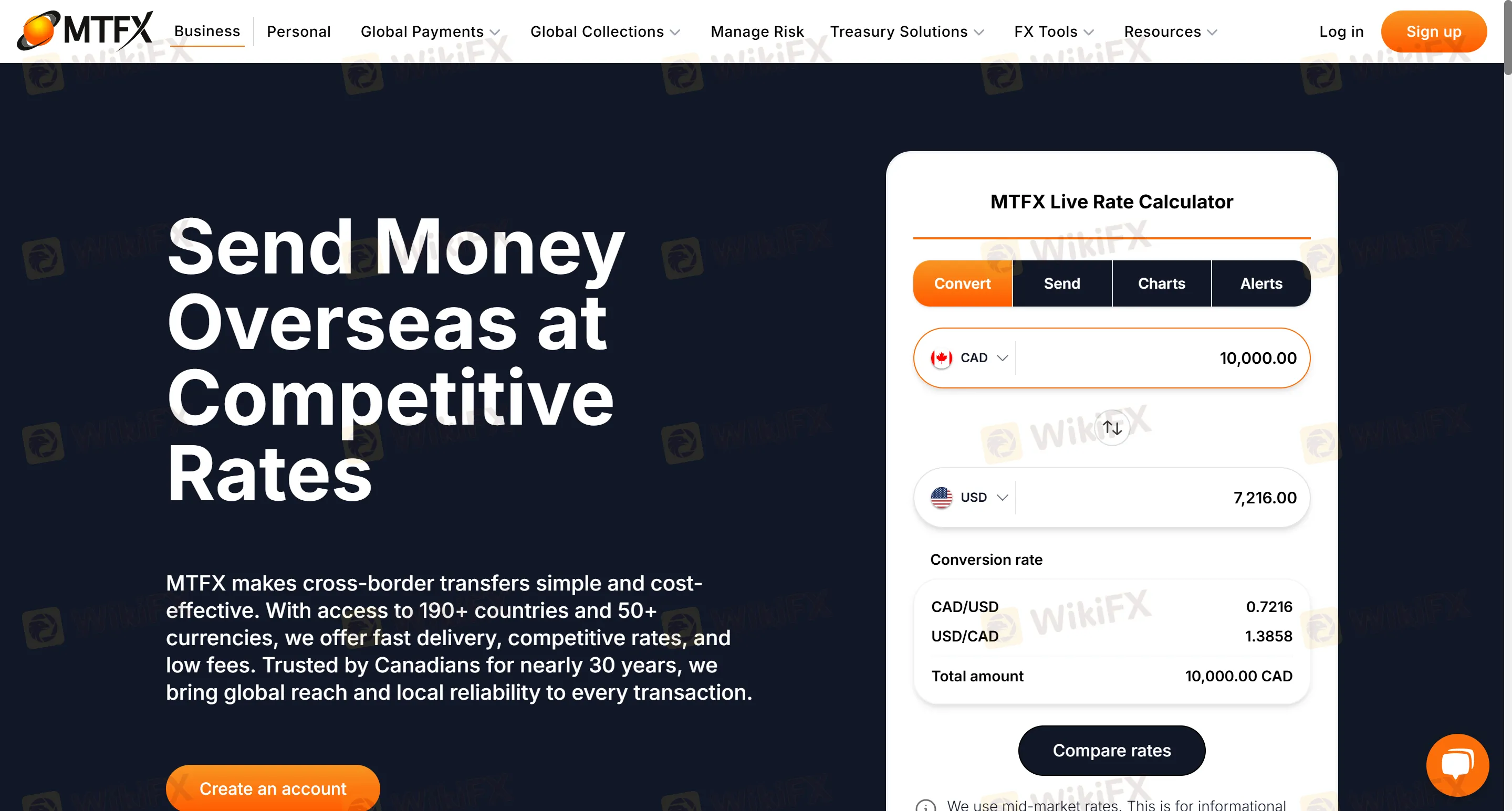

MTFX is an established platform specializing in cross-border payments, supporting the transfer of 50+ currencies to over 190 countries. It offers personal and corporate cross-border transfers, e-commerce fund collection, large-value fund transfers (such as overseas property purchases and luxury item acquisitions), multi-currency account management, and currency risk hedging. It is suitable for users who need frequent cross-border transfers and attach importance to exchange rate costs and fund security, especially in large-value payment and corporate scenarios.

Pros and Cons

| Pros | Cons |

| 4% exchange rate | Unregulated |

| 24/7 access to the online portal | Limitations on currency pairs (focus on major currencies) |

| Multi-scenario coverage | Unclear fee information |

Is MTFX Legit?

MTFX is not regulated, even though MTFX claims to be regulated by FINTRAC (Financial Transactions and Reports Analysis Centre of Canada). This broker has regulatory issues, and it is recommended that traders prioritize choosing regulated brokers.

What Services Does MTFX Provide?

MTFX primarily provides cross-border fund transfers and foreign exchange services, not traditional financial derivatives trading platforms. Services include:

Currency Exchange: Real-time conversion of 50+ currencies, such as mainstream currency pairs like CAD/USD and EUR/GBP.

Cross-Border Payments: Personal remittances (tuition fees, living expenses, home purchase funds) and corporate payments (supplier settlements, payroll, e-commerce collections).

Risk Hedging: Locking exchange rates and customized hedging strategies, suitable for international trade and investment scenarios.

Account Type

MTFX offers two types of accounts. Personal accounts are suitable for individual cross-border transfers, international tuition payments, and regular remittances (such as rent and pension), while business accounts are designed for corporate cross-border payments, supply chain settlements, multi-currency fund management, and e-commerce platform integration (such as Amazon and eBay).

Trading Platform

The online portal supports 24/7 mobile applications, including iOS and Android apps.

Deposit and Withdrawal

Funds are directly deposited into the payee's bank account. For corporate transfers, the funds will arrive within 24-48 hours (same-day wire transfers are prioritized). Most personal transfers are completed on the same day or the next working day.