Company Summary

| Topstep Review Summary | |

| Founded | 2012 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instruments | CME equity futures, forex futures, agricultural futures, energy futures, metals, interest rate futures |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | TopstepX™, NinjaTrader, Quantower, Tradovate, TradingView, T4 by CTS, R|Trader Pro (Rithmic), ATAS – Order Flow Trading Platform, MotiveWave, VolFix, Bookmap, Investor/RT by Linn Software, Jigsaw Daytradr, MultiCharts, Sierra Chart, and Trade Navigator. |

| Minimum Deposit | / |

| Customer Support | Tel: 1-888-407-1611 |

| Email: support@topstep.com | |

Topstep Information

Topstep is a U.S.-based proprietary trading firm that offers futures traders a chance to trade firm capital after passing a simulated evaluation (Trading Combine). Traders can access futures products, including CME equity futures, forex futures, agricultural futures, energy futures, metals, and interest rate futures. The platform has low entry costs and supports many professional-grade trading platforms, but lack of regulation.

Pros and Cons

| Pros | Cons |

| Various trading instruments | No regulation |

| Demo accounts | Lack of transparency |

| Supports over a dozen advanced trading platforms |

Is Topstep Legit?

Topstep is not a legitimate broker. It is registered in the United States but currently holds no valid regulatory license from the U.S. or any international financial authority. Well-known regulatory bodies such as the FCA (UK), ASIC (Australia), and NFA (USA) do not regulate Topstep.

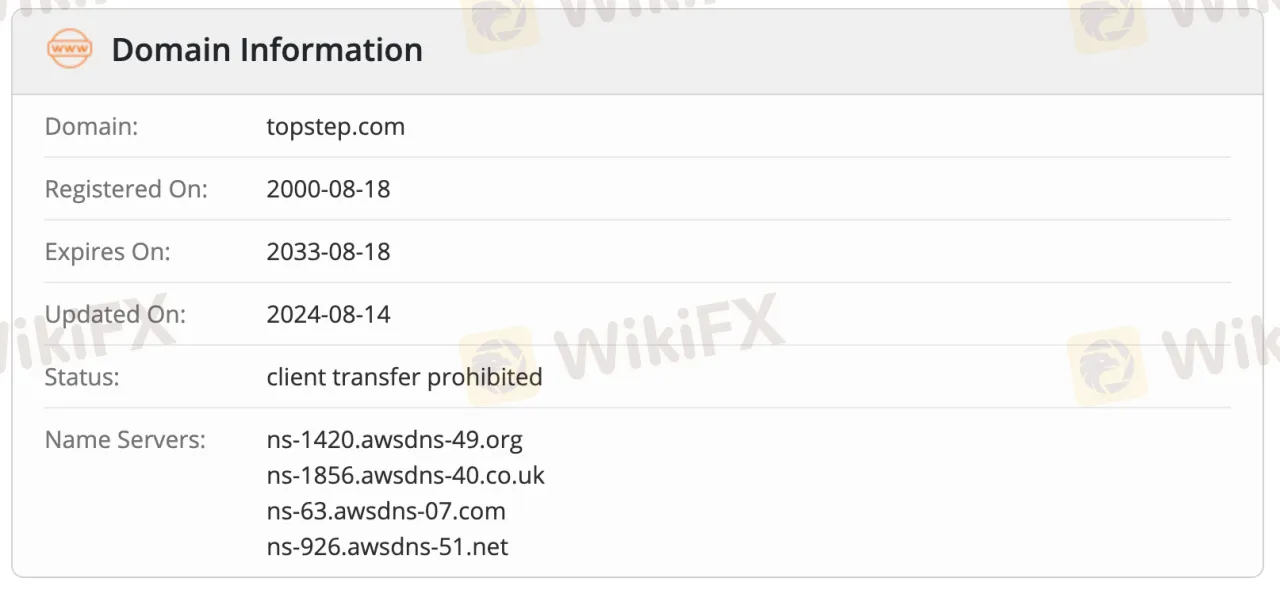

The domain topstep.com was registered on August 18, 2000, and is set to expire on August 18, 2033. The domain is in a locked status “client transfer prohibited”, which prevents it from being transferred to another registrar, ensuring some level of administrative security.

What Can I Trade on Topstep?

Topstep offers trading in futures contracts only, not spot trading. Traders can access futures products, including CME equity futures, forex futures, agricultural futures, energy futures, metals, interest rate futures.

| Tradable Instruments | Supported |

| CME equity futures | ✔ |

| Forex futures | ✔ |

| Agricultural futures | ✔ |

| Energy futures | ✔ |

| Metals | ✔ |

| Interest rate futures | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

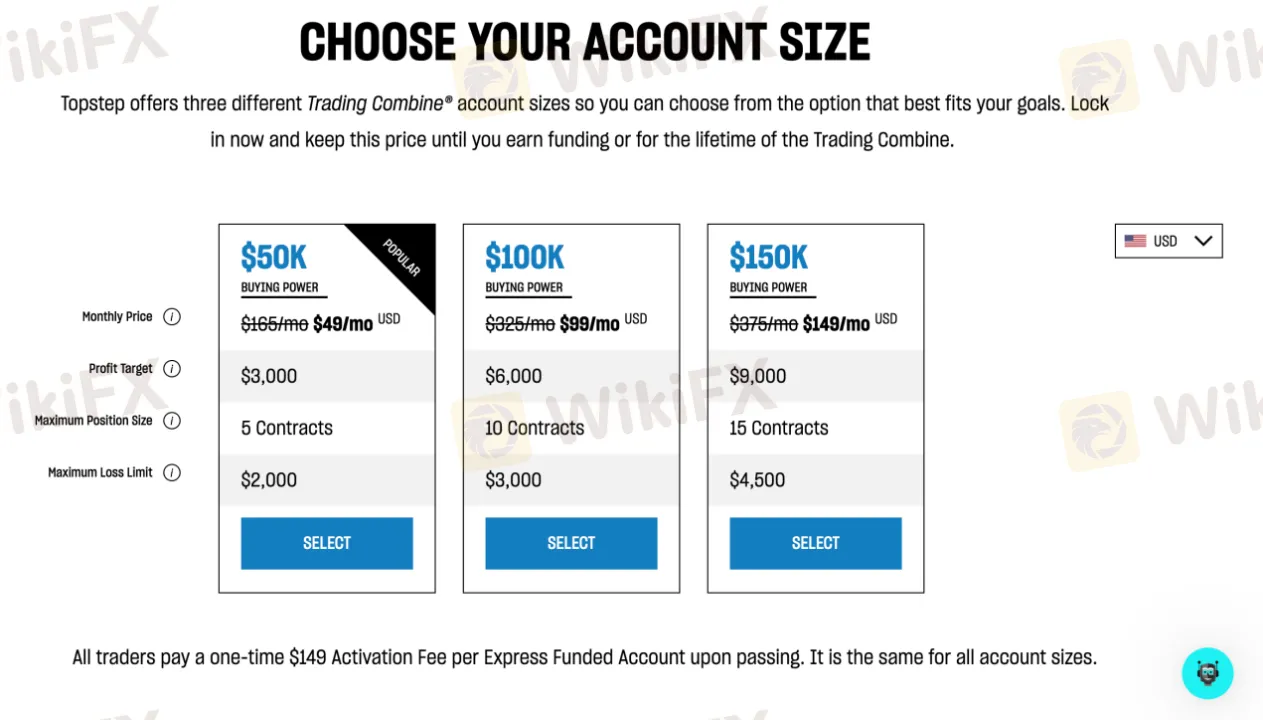

Account Type

Topstep does not offer traditional live accounts like most brokers. Instead, it provides three tiers of evaluation accounts (Trading Combine®): $50K, $100K, and $150K buying power accounts. These are simulated accounts used to assess a traders performance before offering real capital. Once a trader passes the evaluation phase, they can earn access to an Express Funded Account.

| Account Type | Live Trading | Demo Trading | Best for |

| $50K Combine | ❌ | ✔ | Beginners or low-risk traders |

| $100K Combine | ❌ | ✔ | Intermediate traders |

| $150K Combine | ❌ | ✔ | Experienced traders comfortable with risk |

| Express Funded Account | ✔ | ❌ | Traders who passed evaluation |

Topstep Fees

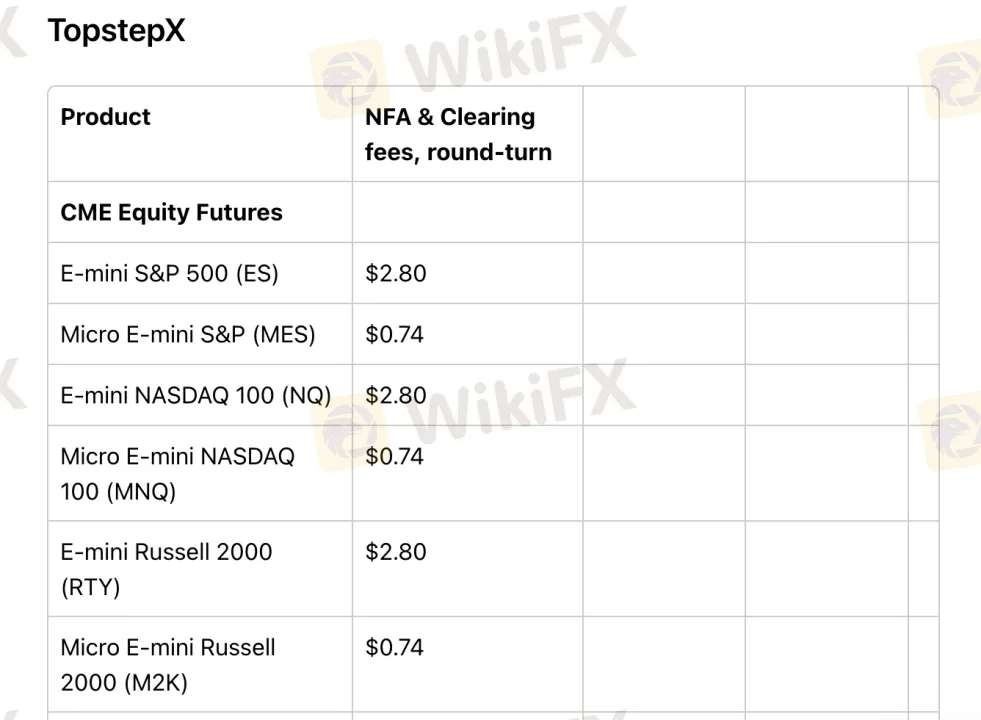

| Trading Product | NFA & Clearing Fees (Round-turn) |

| E-mini S&P 500 (ES) | $2.80 |

| Micro E-mini S&P (MES) | $0.74 |

| E-mini NASDAQ 100 (NQ) | $2.80 |

| Micro E-mini NASDAQ 100 (MNQ) | $0.74 |

Topsteps trading fees are low to moderate compared to industry standards, especially when using its own platform, TopstepX.

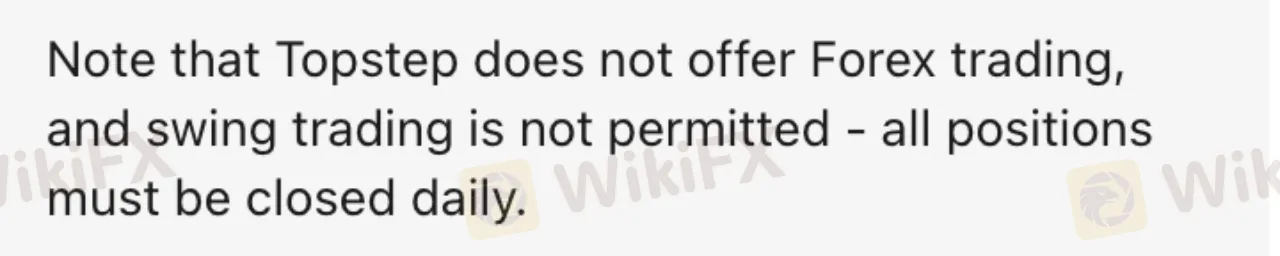

Swap Rates

Topstep does not charge swap rates or overnight rollover fees, because all trading must be done during regular trading hours. Swing trading is not permitted, positions must be closed daily.

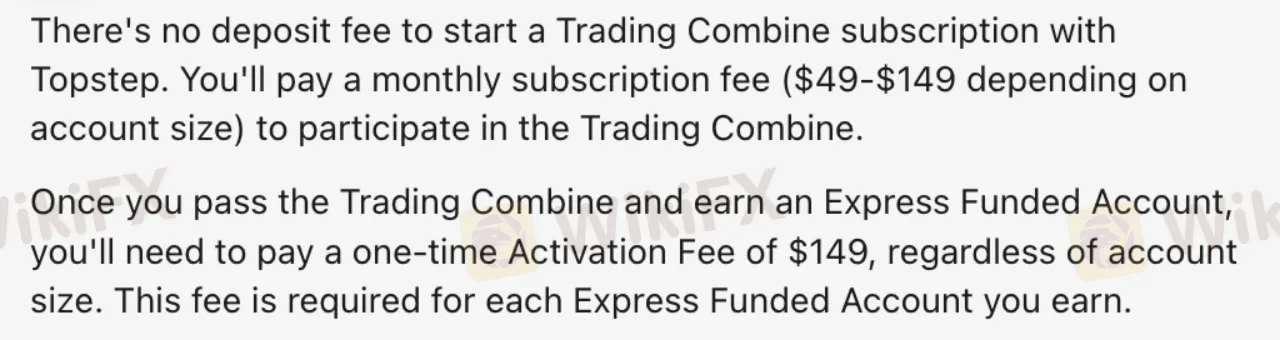

Non-Trading Fees

| Non-Trading Fees | Details |

| Deposit Fee | ❌ |

| Withdrawal Fee | ❌ |

| Inactivity Fee | Not mentioned |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| TopstepX | ✔ | Mobile, Mac | Beginner to intermediate |

| NinjaTrader | ✔ | Desktop | Experienced |

| Quantower | ✔ | Desktop | Experienced |

| Tradovate | ✔ | Mobile | Beginner-friendly |

| TradingView | ✔ | Mac | Chart-focused traders |

| T4 | ✔ | Mobile | Basic futures traders |

| R|Trader Pro | ✔ | Mobile | Pro traders |

| ATAS OrderFlow Trading | ✔ | Desktop | Order flow traders |

| MotiveWave | ✔ | Mobile, Mac | Technical analysts |

| VolFix | ✔ | Mobile, Mac | Volume traders |

| Bookmap | ✔ | Mac | Advanced visualization |

| Investor/RT | ✔ | – | Professional analysis |

| Jigsaw Daytradr | ✔ | – | Scalpers |

| MultiCharts | ✔ | – | Quantitative traders |

| Sierra Chart | ✔ | – | Custom strategy users |

| Trade Navigator | ✔ | – | Charting professionals |

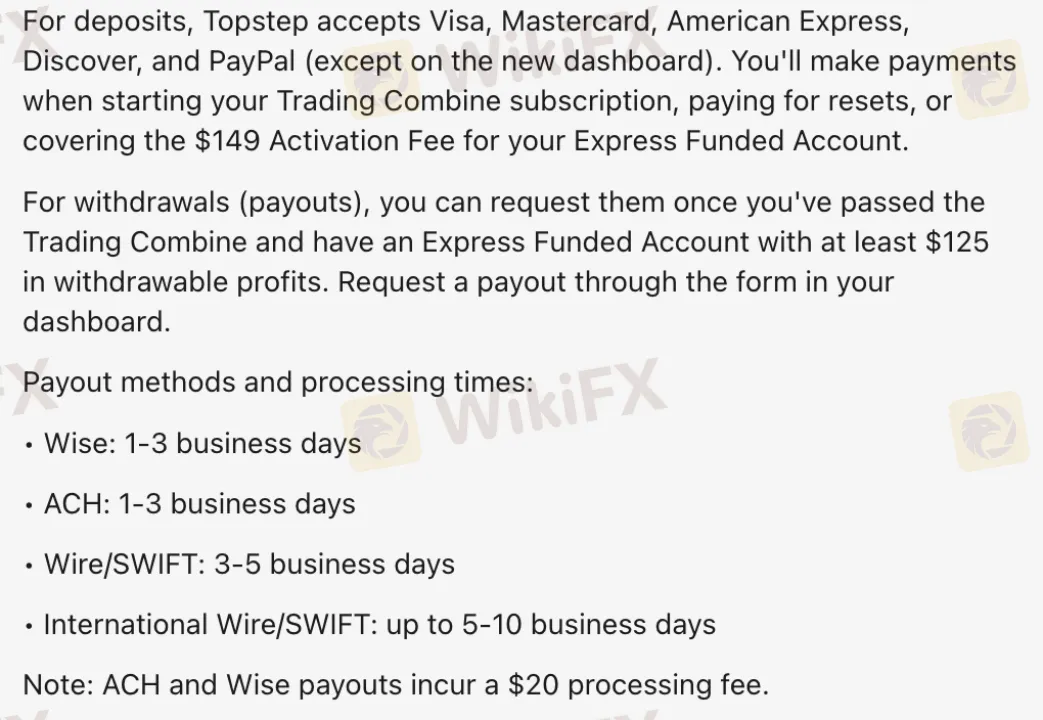

Deposit and Withdrawal

Topstep does not charge deposit fees. However, some withdrawal methods do incur a fee. The minimum withdrawal amount is $125.

Deposit Options

| Deposit Options | Deposit Fees | Deposit Time |

| Visa | ❌ | Instant |

| Mastercard | ||

| American Express | ||

| Discover | ||

| PayPal (old dashboard only) |

Withdrawal Options

| Withdrawal Options | Minimum Withdrawal | Withdrawal Fees | Withdrawal Time |

| Wise | $125 | $20 | 1–3 business days |

| ACH | |||

| Wire/SWIFT | Not mentioned | 3–5 business days | |

| International Wire/SWIFT | 5–10 business days |