Buod ng kumpanya

| Topstep Buod ng Pagsusuri | |

| Itinatag | 2012 |

| Nakarehistrong Bansa/Rehiyon | Estados Unidos |

| Regulasyon | Walang regulasyon |

| Mga Kasangkapan sa Merkado | CME equity futures, forex futures, agricultural futures, energy futures, metals, interest rate futures |

| Demo Account | ✅ |

| Leberahe | / |

| Spread | / |

| Platform ng Paggagalaw | TopstepX™, NinjaTrader, Quantower, Tradovate, TradingView, T4 by CTS, R|Trader Pro (Rithmic), ATAS – Order Flow Trading Platform, MotiveWave, VolFix, Bookmap, Investor/RT by Linn Software, Jigsaw Daytradr, MultiCharts, Sierra Chart, at Trade Navigator. |

| Minimum na Deposit | / |

| Suporta sa mga Customer | Tel: 1-888-407-1611 |

| Email: support@topstep.com | |

Impormasyon Tungkol sa Topstep

Ang Topstep ay isang proprietary trading firm na nakabase sa U.S. na nag-aalok sa mga mangangalakal ng futures ng pagkakataon na mag-trade ng puhunan ng kumpanya pagkatapos pumasa sa isang simuladong pagsusuri (Trading Combine). Maaaring mag-access ang mga mangangalakal ng mga produkto ng futures, kabilang ang CME equity futures, forex futures, agricultural futures, energy futures, metals, at interest rate futures. Ang plataporma ay may mababang mga gastos sa pagsisimula at sumusuporta sa maraming propesyonal na plataporma ng pag-trade, ngunit kulang sa regulasyon.

Mga Kalamangan at Disadvantages

| Kalamangan | Kahinaan |

| Iba't ibang mga kasangkapan sa pag-trade | Walang regulasyon |

| Mga demo account | Kawalan ng transparensya |

| Suporta sa higit sa isang dosenang advanced na mga plataporma ng pag-trade |

Tunay ba ang Topstep?

Ang Topstep ay hindi isang lehitimong broker. Ito ay naka-rehistro sa Estados Unidos ngunit sa kasalukuyan ay walang bisa o lehitimong lisensya mula sa U.S. o anumang pandaigdigang awtoridad sa pinansyal. Hindi nireregulate ng mga kilalang ahensiyang regulasyon tulad ng FCA (UK), ASIC (Australia), at NFA (USA) ang Topstep.

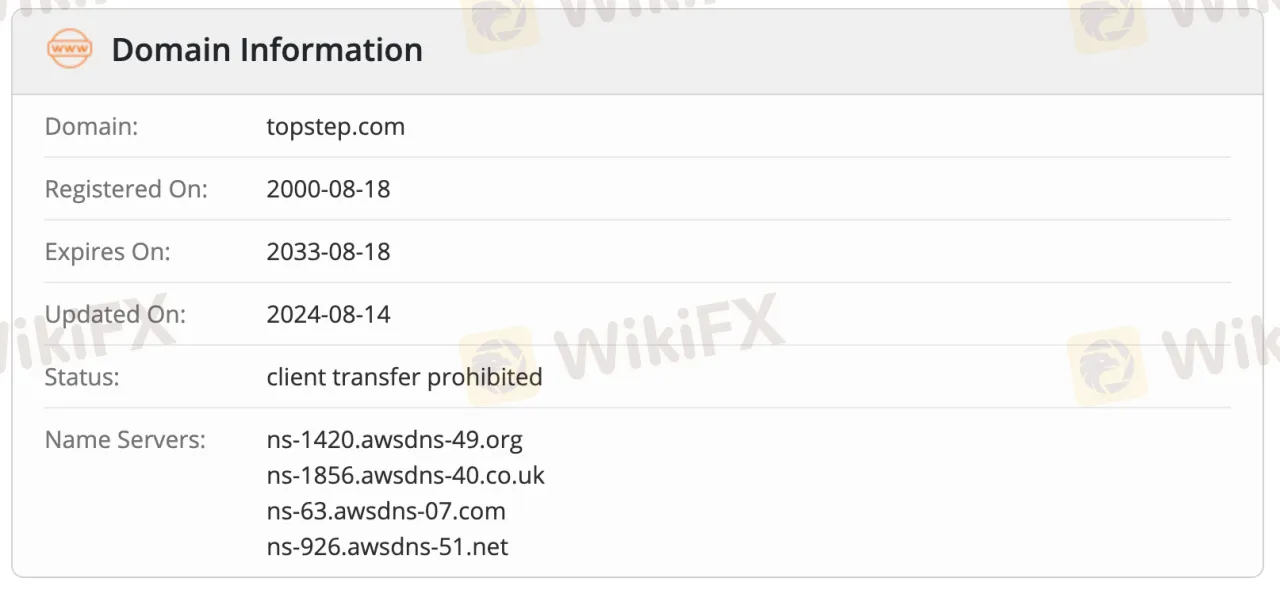

Ang domain na topstep.com ay naka-rehistro noong Agosto 18, 2000, at itinakda na mag-expire sa Agosto 18, 2033. Ang domain ay nasa naka-lock na status na "client transfer prohibited", na nagpapigil sa paglilipat nito sa ibang registrar, na nagbibigay ng antas ng administratibong seguridad.

Ano ang Maaari Kong I-trade sa Topstep?

Topstep nag-aalok ng kalakalan sa mga kontrata ng hinaharap lamang, hindi sa kasalukuyang kalakalan. Maaaring mag-access ang mga mangangalakal sa mga produktong hinaharap, kabilang ang CME equity futures, forex futures, agricultural futures, energy futures, metals, interest rate futures.

| Mga Instrumento na Maaaring Kalakalan | Supported |

| CME equity futures | ✔ |

| Forex futures | ✔ |

| Agricultural futures | ✔ |

| Energy futures | ✔ |

| Metals | ✔ |

| Interest rate futures | ✔ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

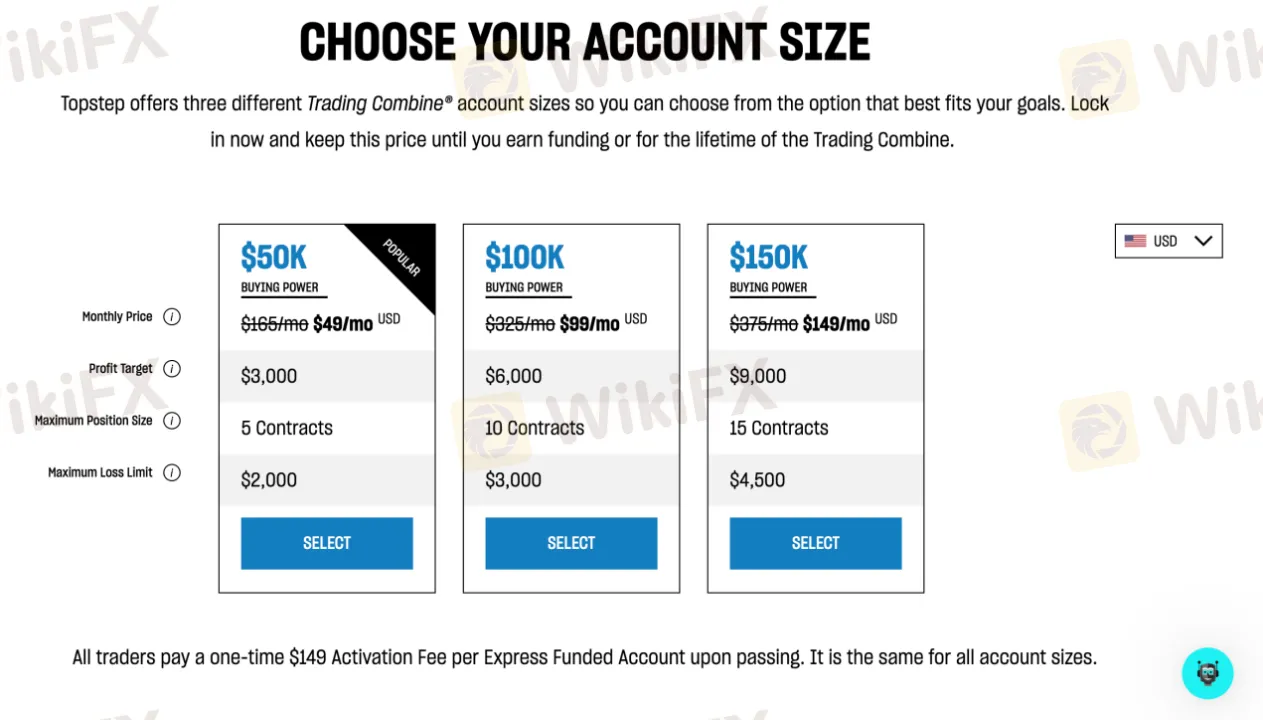

Uri ng Account

Topstep hindi nag-aalok ng tradisyonal na live accounts tulad ng karamihan sa mga broker. Sa halip, nagbibigay ito ng tatlong antas ng mga account sa pagsusuri (Trading Combine®): $50K, $100K, at $150K buying power accounts. Ang mga ito ay mga simuladong account na ginagamit upang suriin ang performance ng isang mangangalakal bago mag-alok ng tunay na kapital. Kapag pumasa ang isang mangangalakal sa yugtong pagsusuri, maaari silang magkaroon ng access sa isang Express Funded Account.

| Uri ng Account | Live Trading | Demo Trading | Pinakamahusay para sa |

| $50K Combine | ❌ | ✔ | Mga nagsisimula o mga mangangalakal na may mababang risk |

| $100K Combine | ❌ | ✔ | Intermediate traders |

| $150K Combine | ❌ | ✔ | Mga experienced traders na komportable sa risk |

| Express Funded Account | ✔ | ❌ | Mga mangangalakal na pumasa sa pagsusuri |

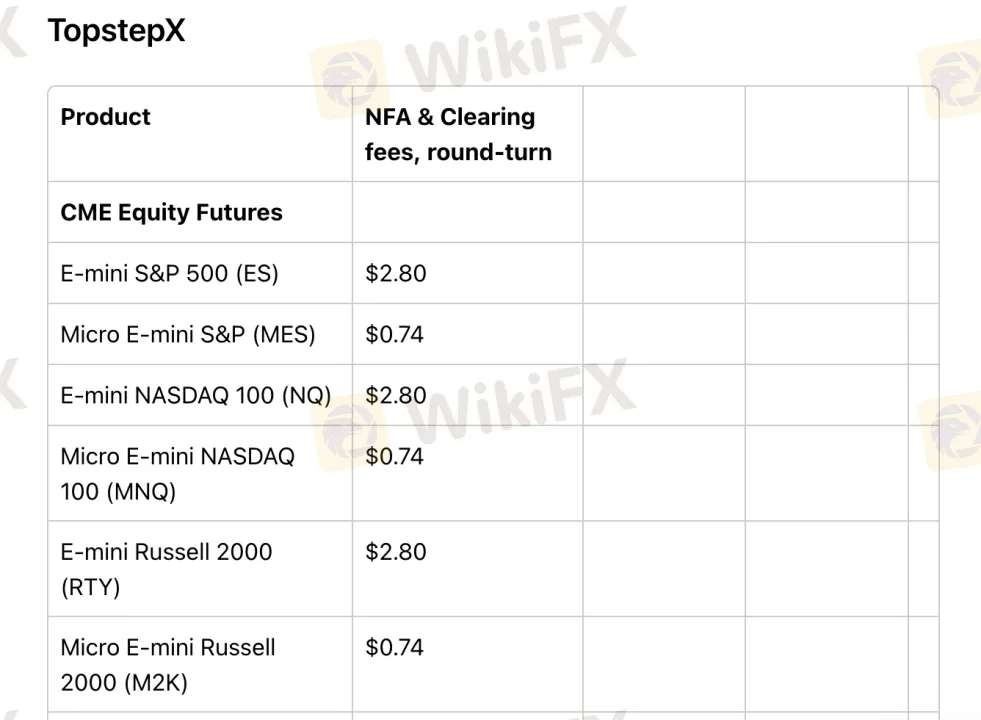

Mga Bayad sa Topstep

| Trading Product | NFA & Clearing Fees (Round-turn) |

| E-mini S&P 500 (ES) | $2.80 |

| Micro E-mini S&P (MES) | $0.74 |

| E-mini NASDAQ 100 (NQ) | $2.80 |

| Micro E-mini NASDAQ 100 (MNQ) | $0.74 |

Ang mga bayad sa pag-trade ng Topstep ay mababa hanggang katamtaman kumpara sa pamantayan ng industriya, lalo na kapag gumagamit ng kanilang sariling plataporma, TopstepX.

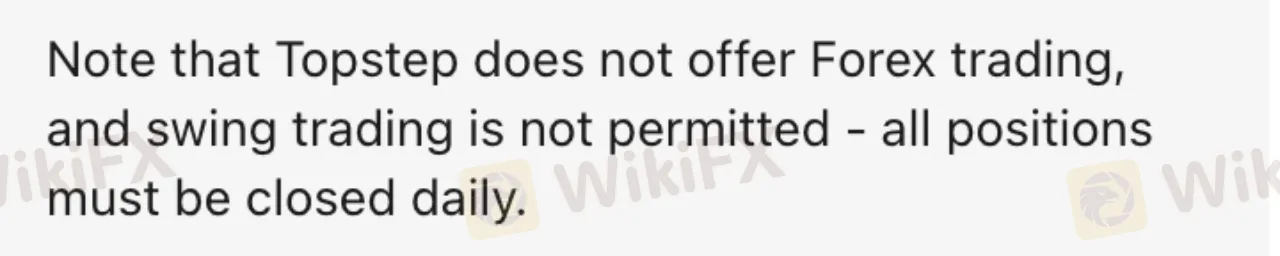

Mga Swap Rate

Ang Topstep ay hindi naniningil ng mga swap rate o overnight rollover fees, dahil lahat ng trading ay dapat gawin sa regular na oras ng trading. Hindi pinapayagan ang swing trading, dapat isara ang mga posisyon araw-araw.

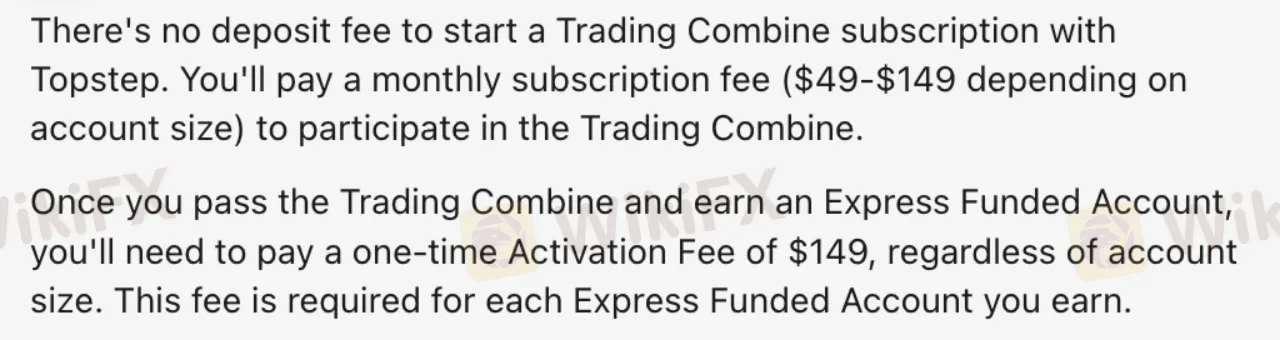

Mga Singil na Hindi kaugnay sa Trading

| Mga Singil na Hindi kaugnay sa Trading | Mga Detalye |

| Singil sa Pagdedeposito | ❌ |

| Singil sa Pagwiwithdraw | ❌ |

| Singil sa Hindi Paggalaw | Hindi binanggit |

Platform ng Pagtetrading

| Platform ng Pagtetrading | Supported | Available Devices | Angkop para sa |

| TopstepX | ✔ | Mobile, Mac | Baguhan hanggang intermediate |

| NinjaTrader | ✔ | Desktop | May karanasan |

| Quantower | ✔ | Desktop | May karanasan |

| Tradovate | ✔ | Mobile | Baguhan-friendly |

| TradingView | ✔ | Mac | Nakatuon sa mga nagtetrade ng chart |

| T4 | ✔ | Mobile | Basic futures traders |

| R|Trader Pro | ✔ | Mobile | Pro traders |

| ATAS OrderFlow Trading | ✔ | Desktop | Mga nagtetrade ng order flow |

| MotiveWave | ✔ | Mobile, Mac | Mga analyst sa teknikal |

| VolFix | ✔ | Mobile, Mac | Mga nagtetrade ng volume |

| Bookmap | ✔ | Mac | Advanced visualization |

| Investor/RT | ✔ | – | Professional analysis |

| Jigsaw Daytradr | ✔ | – | Scalpers |

| MultiCharts | ✔ | – | Mga nagtetrade ng kwantitatibo |

| Sierra Chart | ✔ | – | Mga gumagamit ng pasadyang estratehiya |

| Trade Navigator | ✔ | – | Mga propesyonal sa pag-aanalyze ng chart |

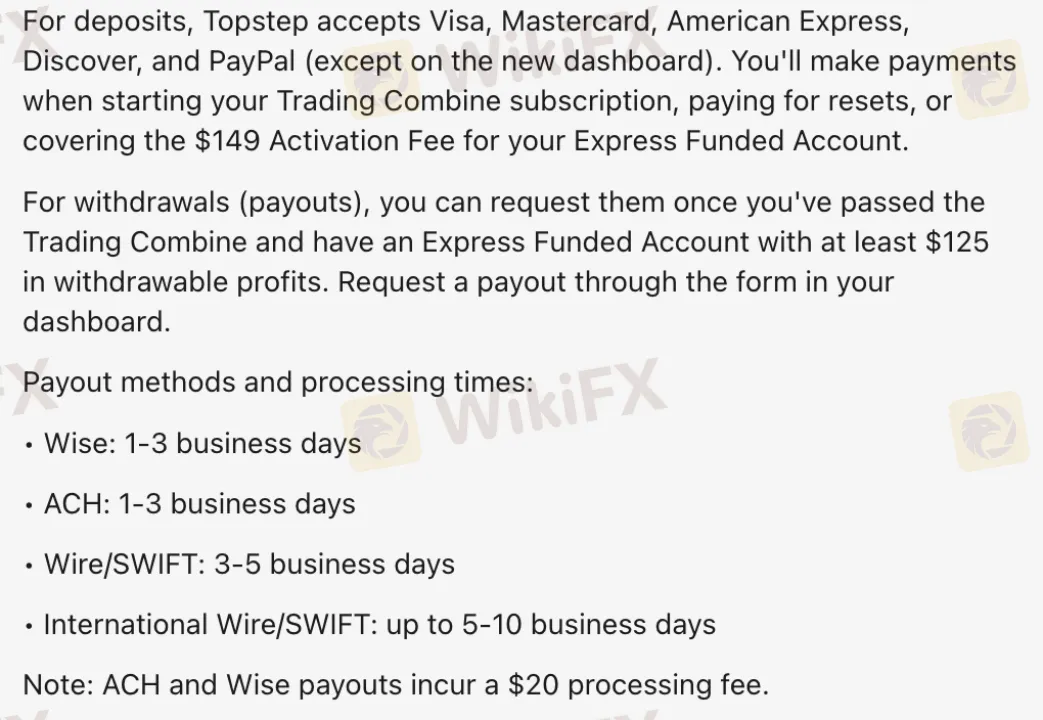

Pagdedeposito at Pagwiwithdraw

Topstep hindi naniningil ng bayad sa pagdedeposito. Gayunpaman, mayroong ilang paraan ng pagwi-withdraw na may bayad. Ang minimum na halaga ng withdrawal ay $125.

Mga Pagpipilian sa Pagdedeposito

| Mga Pagpipilian sa Pagdedeposito | Mga Bayad sa Pagdedeposito | Oras ng Pagdedeposito |

| Visa | ❌ | Instant |

| Mastercard | ||

| American Express | ||

| Discover | ||

| PayPal (old dashboard only) |

Mga Pagpipilian sa Pagwi-withdraw

| Mga Pagpipilian sa Pagwi-withdraw | Minimum na Pagwi-withdraw | Mga Bayad sa Pagwi-withdraw | Oras ng Pagwi-withdraw |

| Wise | $125 | $20 | 1–3 araw ng negosyo |

| ACH | |||

| Wire/SWIFT | Hindi binanggit | 3–5 araw ng negosyo | |

| International Wire/SWIFT | 5–10 araw ng negosyo |