Company Summary

| Swiss CapitalReview Summary | |

| Founded | 2020 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA (Exceeded) |

| Market Instruments | Forex, ETFs, equities, indices, commodities |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | Swiss Capital |

| Minimum Deposit | / |

| Customer Support | Contact form |

Swiss Capital Information

Swiss Capital is a broker that was registered in the United Kingdom. The tradable instruments include forex, ETFs, equities, financial indices, and commodities. Swiss Capital is still risky due to its Exceeded status and limited transparency information.

Pros and Cons

| Pros | Cons |

| Various tradable instruments | Exceeded license |

| Various deposit methods | MT4/MT5 unavailable |

| Demo account unavailable | |

| Unspecific transfer time and fee information | |

| Only contact form support |

Is Swiss Capital Legit?

| Regulated Country | Regulated Authority | Current Status | Regulated Entity | License Type | License Number |

| Financial Conduct Authority (FCA) | Exceeded | SWISS CAPITAL LIMITED | Common Business Registration | 11638236 |

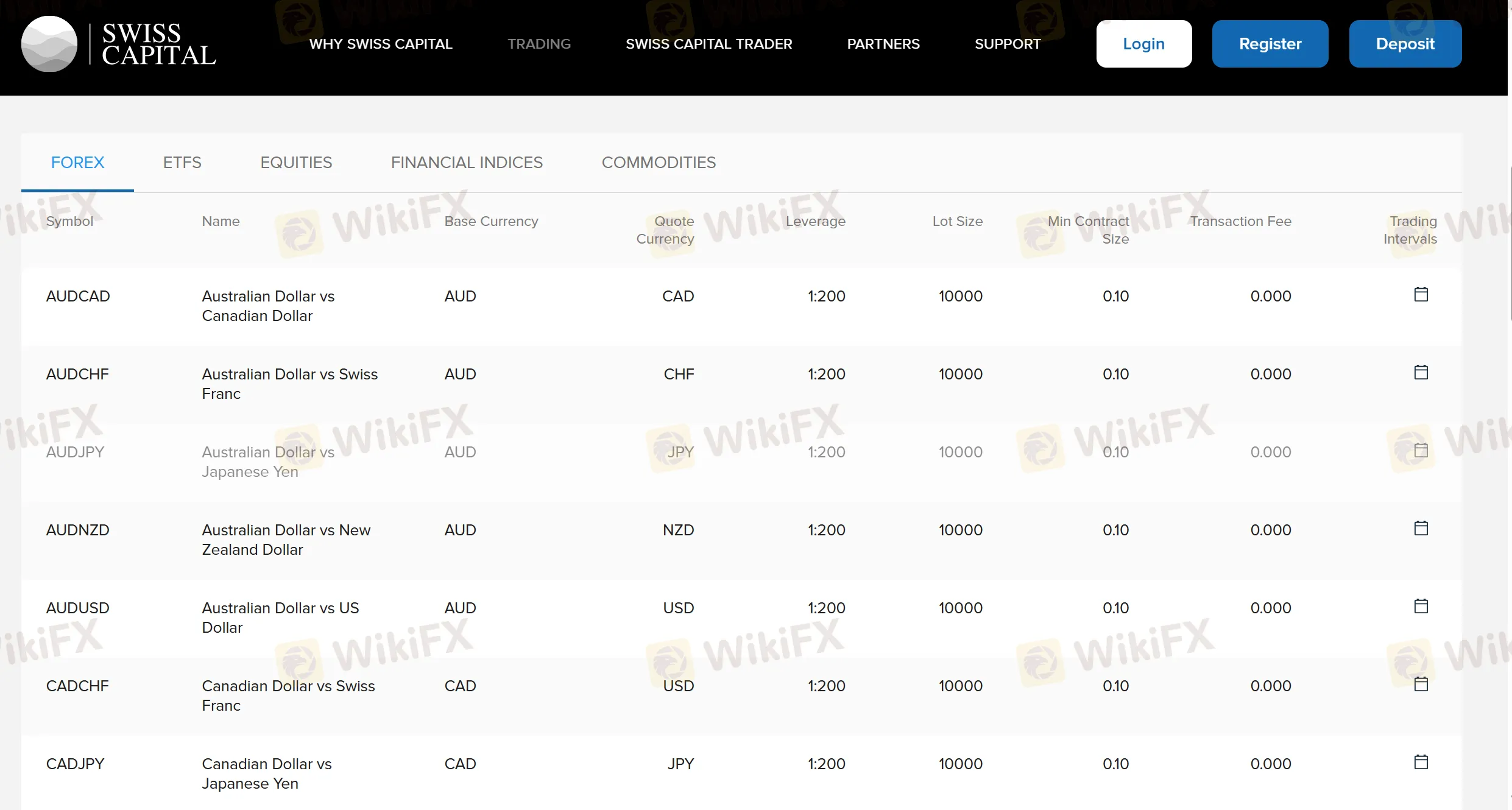

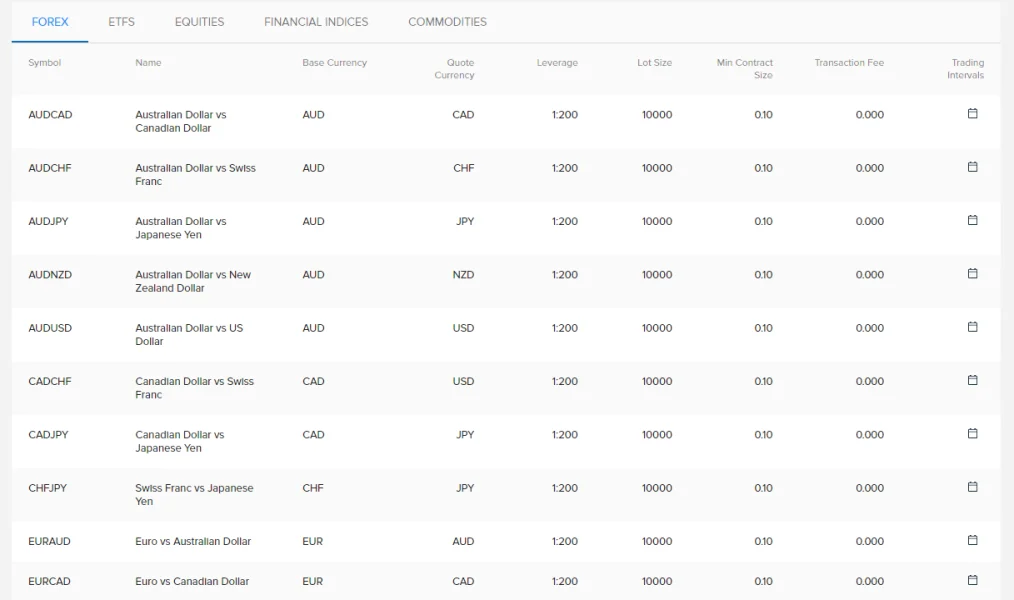

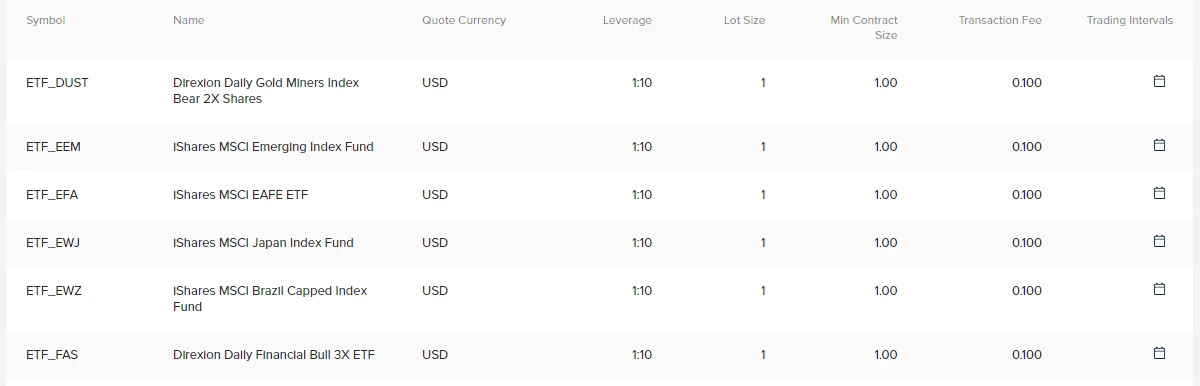

What Can I Trade in the Swiss Capital?

Swiss Capital offers a wide range of market instruments, including forex, ETFs, equities, financial indices, and commodities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| ETFs | ✔ |

| Equities | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Precious Metals | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

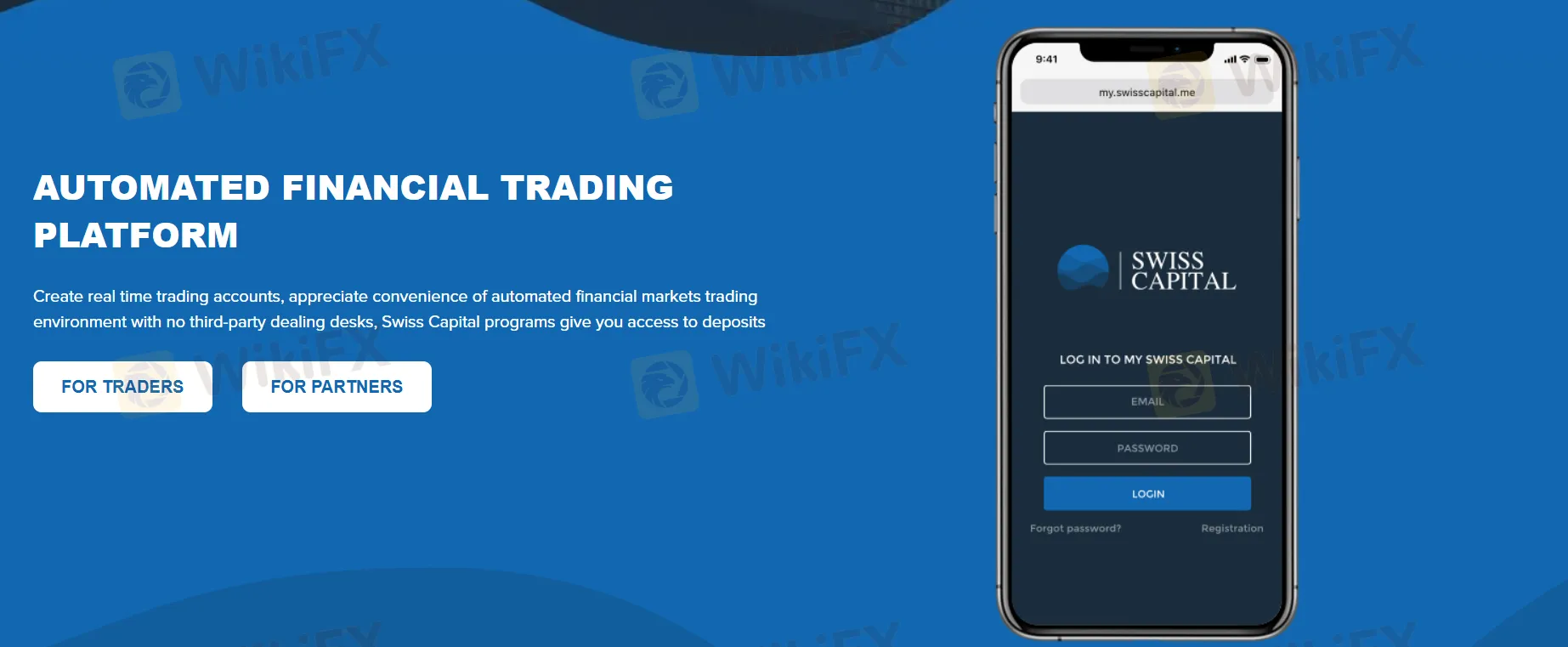

Trading Platform

Swiss Capital provides a proprietarytrading platform available on mobile to trade, instead of the authoritative MT4/MT5 with mature analysis tools and EA intelligent systems.

| Trading Platform | Supported | Available Devices | Suitable for |

| Swiss Capital | ✔ | Mobile | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

Swiss Capital accepts Visa, Mastercard, Apple Pay, Samsung Pay, Union Pay, Alipay, and more for deposits and withdrawals. However, transfer processing times and associated fees are unknown.

TysonM

Albania

I got in knowing there was no crypto, and I was okay with that. Just needed a place for forex and stock trades. Everything works fine, and I’ve had no trouble funding or withdrawing. They seem stable.

Positive

Willi Kohler

Italy

Trading on my phone 90% of the time. The platform's mobile version is clunky but functional.

Neutral

Johann

Germany

Swiss Capital works fine for standard trading on FX, ETFs, and stocks. The web platform is simple, maybe too simple for advanced chart lovers. I'm not a fan of the credit card hold, but the 1-2 day payout afterward is consistent. Overall, if you're okay with a slower support channel and no crypto offerings, it's a decent pick.

Neutral

Gilbert Heb

Germany

Would be nice to have cryptocurrency deposit options, but they don't offer that.

Neutral

Kailash2

Germany

Trades are executed promptly. Haven't experienced significant slippage.

Positive

Andree770

Italy

I like trading ETFs and indices, and they offer a good selection.

Positive

Moritz Lange

Germany

The platform is user-friendly, and setting up an account was easy. I think swiss capital is a solid choice for beginners in trading.

Positive

Holdenkemmer

Slovenia

MT4 is a familiar platform for me, and Swiss Capital's implementation is stable and efficient.

Positive

Blaise

Spain

Wish they had live chat. Email support is okay but not the fastest when you need quick answers.

Neutral

RosarioD

United Kingdom

Good broker for beginners. The platform is easy to navigate, and customer support has answered my emails promptly. I wish they had live chat, though.

Positive

Klemens884

United Kingdom

withdrawals are processed quickly. however, I’d appreciate more trading options, especially cryptocurrencies.

Positive

Juri

Norway

Recommend. Fast execution speed.

Positive

Jayde

Spain

mt4 supported, reliable broker.

Positive

Sandence

Taiwan

Trading software is intuitive, but the range of payment methods is limited. Would like to see more options.

Neutral

gerlinde

United Kingdom

Great platform, easy to use, and fast payments. Very good.

Positive

Liesel Doring

Spain

Everything was OK in my first withdrawal.

Positive

Samuel Harris

South Africa

Ugh, trading here just ain't smooth compared to IC Markets or eToro, you know? Those other platforms, everything feels so intuitive and easy to navigate. Here, it's like they took something simple and made it way more complicated than it needs to be.

Neutral

ArturH

France

Trading the news without worrying too much about slippage.

Positive

Iacopo Parisi

Germany

Low commissions for ECN trading. no eating into my earnings.

Positive

Hohmann

Italy

I like how Swiss Capital doesn't ask for a lot of money upfront. Their margin requirements are low.

Positive