Company Summary

| SBI NEOMOBILE SECURITIES Review Summary | |

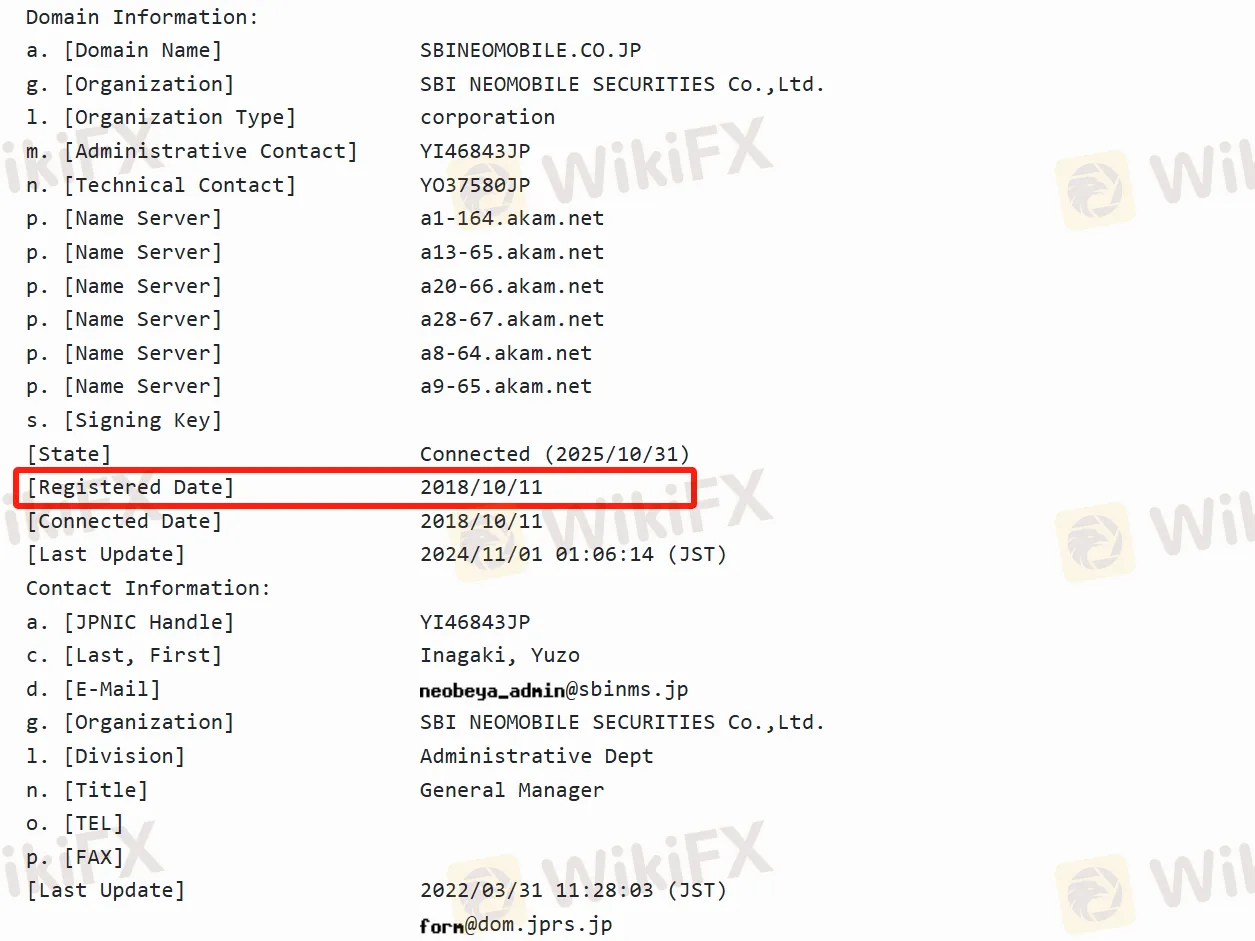

| Founded | 2018/10/11 |

| Registered Country/Region | Japan |

| Regulation | Suspicious Clone |

| Market Instruments | Commodities, Stocks, ETFs, Investment Trusts, and Bonds |

| Customer Support | / |

SBI NEOMOBILE SECURITIES Information

SBI NEOMOBILE SECURITIES has now merged with SBI Securities. It provides investors with a wide range of trading instruments such as domestic and foreign stocks, ETFs, investment trusts, and bonds. There are also preferential policies like commission-free domestic stock trading. Its diverse membership points program brings additional benefits. However, there is uncertainty regarding the merger, and the leverage information is relatively limited.

Pros and Cons

| Pros | Cons |

| Various tradable instruments | Suspicious Clone |

| Fee-free options | Uncertainty related to the merger |

| Multiple membership points programs | Limited leverage information |

Is SBI NEOMOBILE SECURITIES Legit?

SBI NEOMOBILE SECURITIES is not a legitimate brokerage firm. After merging with SBI Securities, the company operates under the umbrella of a well-known financial group. However, there is no accurate information indicating that SBI NEOMOBILE SECURITIES is regulated.

What Can I Trade on SBI NEOMOBILE SECURITIES?

SBI NEOMOBILE SECURITIES offers domestic and foreign stocks, ETFs, investment trusts, and bonds.

| Tradable Instruments | Supported |

| Commodities | ✔ |

| Stocks | ✔ |

| ETFs | ✔ |

| Investment Trusts | ✔ |

| Bonds | ✔ |