Company Summary

| BBH Review Summary | |

| Founded | 1995 |

| Registered Country/Region | United States |

| Regulation | SFC (regulated), FCA (exceeded) |

| Services | Alternative fund services, BBH Connectors, Cross-Border Fund Services, Custody and Fund Services, Depositary & Trustee, ETF Services, Foreign Exchange, Regulatory Intelligence, Securities Lending, Shared Infrastructure Solutions, Transfer Agency |

| Customer Support | Email: contactus@bbh.com |

| LinkedIn/Facebook/Twitter | |

BBH Information

BBH is a broker registered in the United States with a 30-year history, which offers a wide variety of financial services. BBH is still risky due to its exceeded status.

Pros and Cons

| Pros | Cons |

| Long operational history since 1995 | No 24/7 customer support |

| Regulated by SFC | No specific transfer method |

| Various financial services | Exceeded FCA license |

Is BBH Legit?

| Regulated Country | Current Status | Regulated Authority | Regulated Entity | License Type | License Number |

| China (Hong Kong) | Regulated | Securities and Futures Commission of Hong Kong (SFC) | BROWN BROTHERS HARRIMAN (HONG KONG) LIMITED | Leveraged foreign exchange trading | AAF778 |

| United Kingdom | Exceeded | Financial Conduct Authority (FCA) | Brown Brothers Harriman Investor Services Ltd | Investment Advisory License | 190266 |

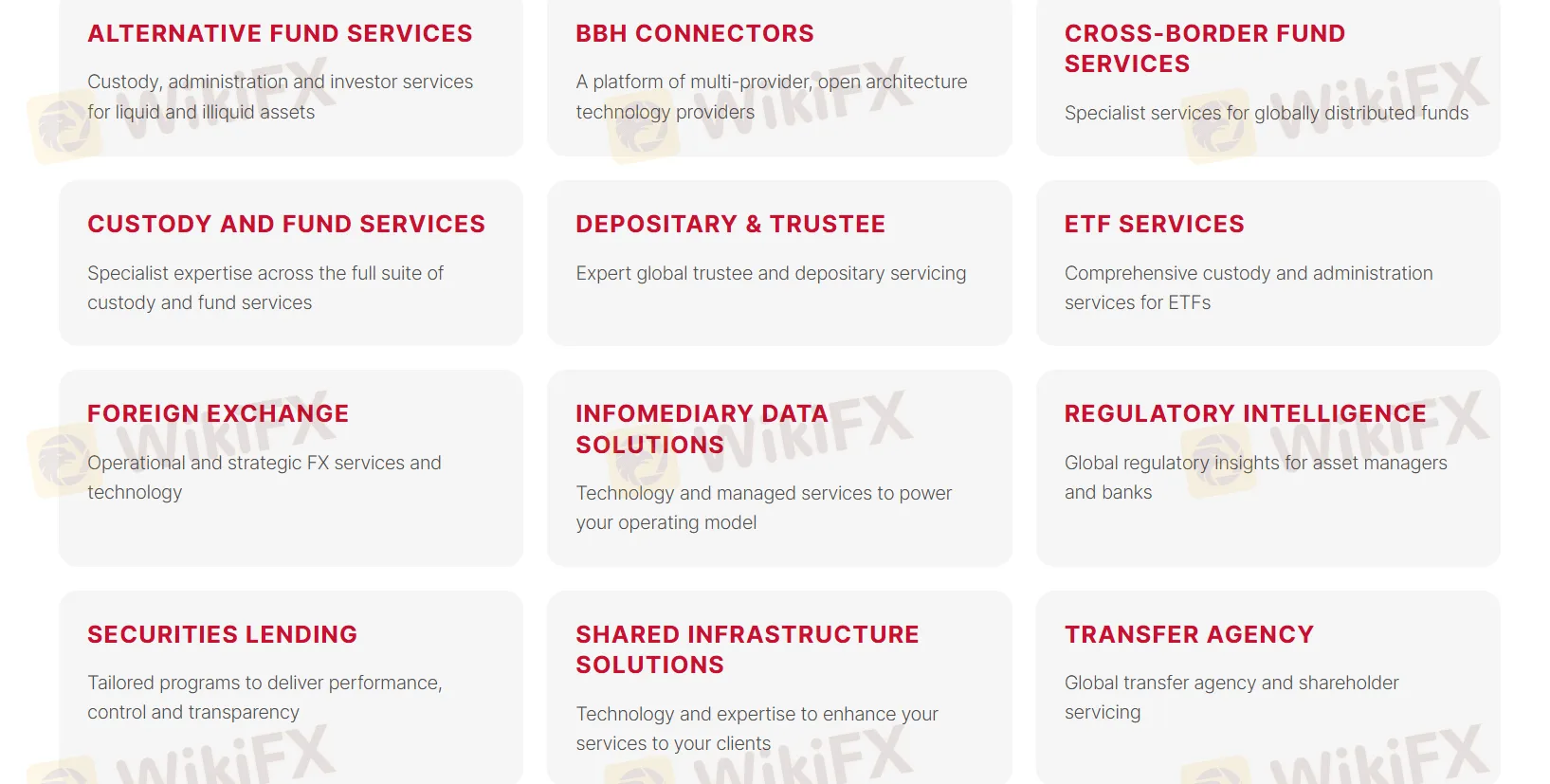

BBH Services

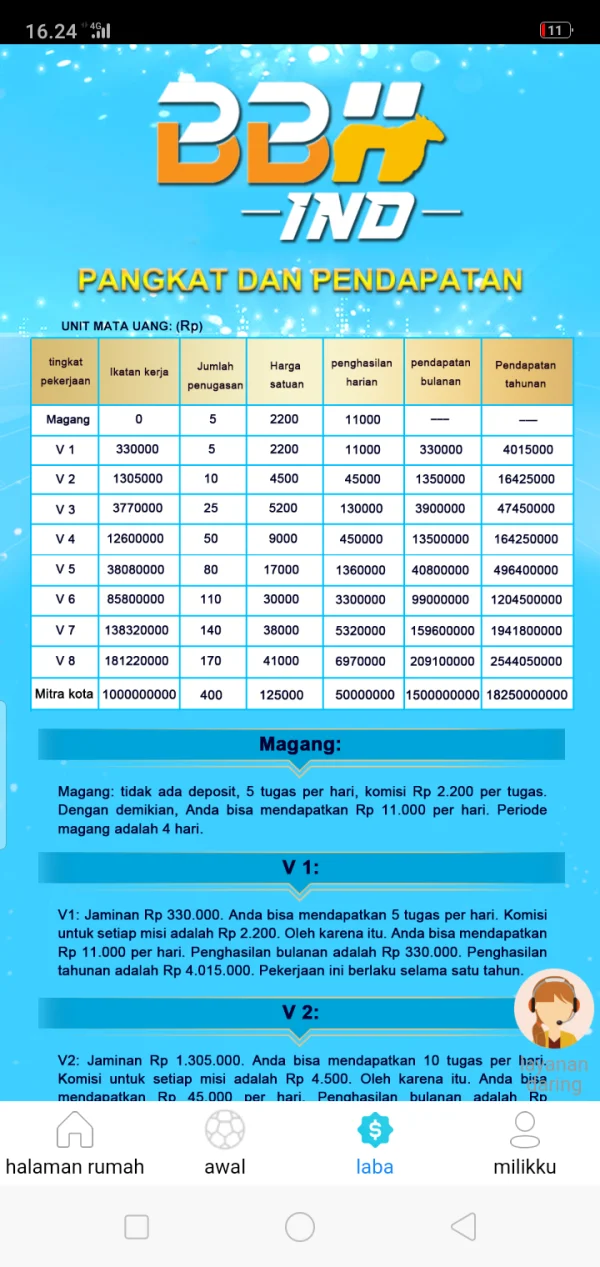

BBH offers a wide range of services, including:

Alternative fund services: Custody, administration, and investor services for liquid and illiquid assets.

BBH Connectors: A platform of multi-provider, open architecture technology providers.

Cross-Border Fund Services: Specialist services for globally distributed funds.

Custody and Fund Services: Specialist expertise across the full suite of custody and fund services.

Depositary & Trustee: Expert global trustee and depositary servicing.

ETF Services: Comprehensive custody and administration services for ETFs.

Foreign Exchange: Operational and strategic FX services and technology.

Regulatory Intelligence: Global regulatory insights for asset managers and banks.

Securities Lending: Tailored programs to deliver performance, control, and transparency.

Shared Infrastructure Solutions: Technology and expertise to enhance your services to your clients.

Transfer Agency: Global transfer agency and shareholder servicing.

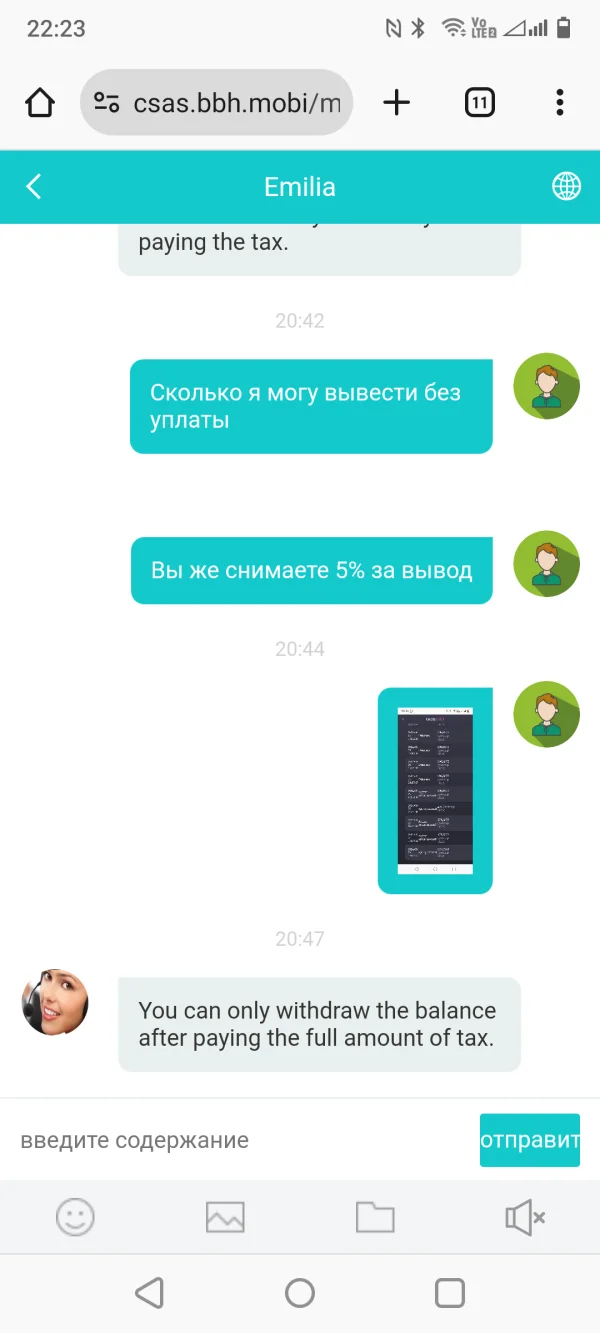

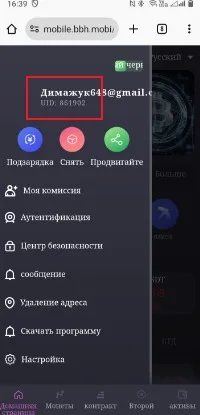

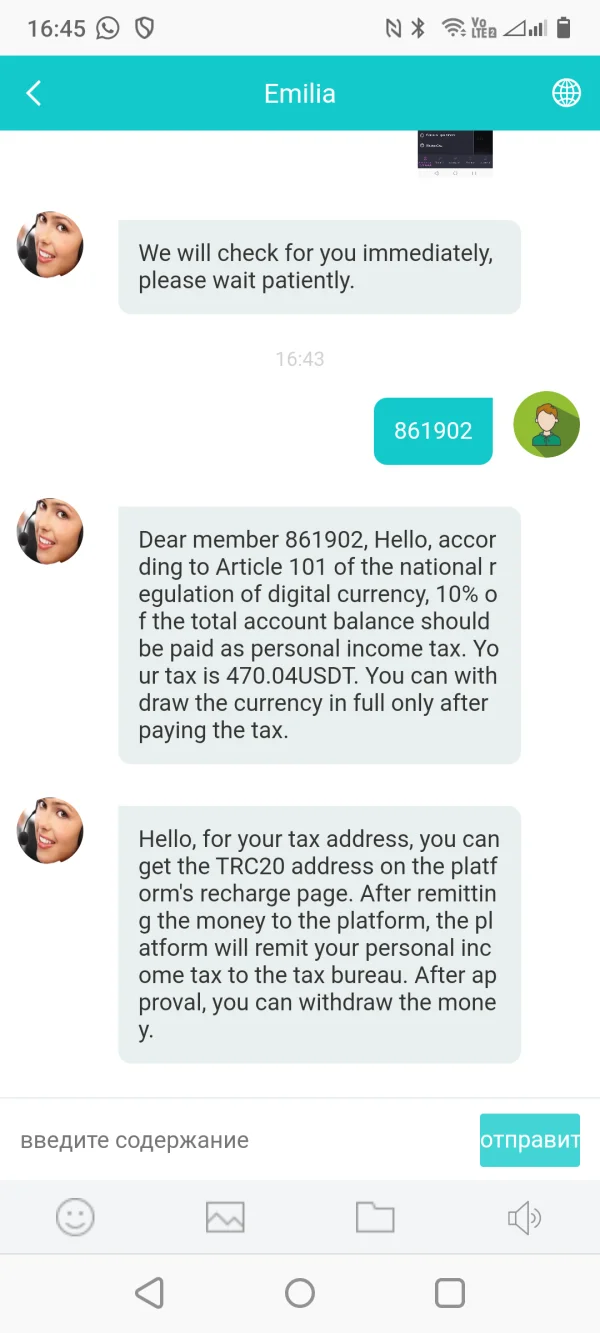

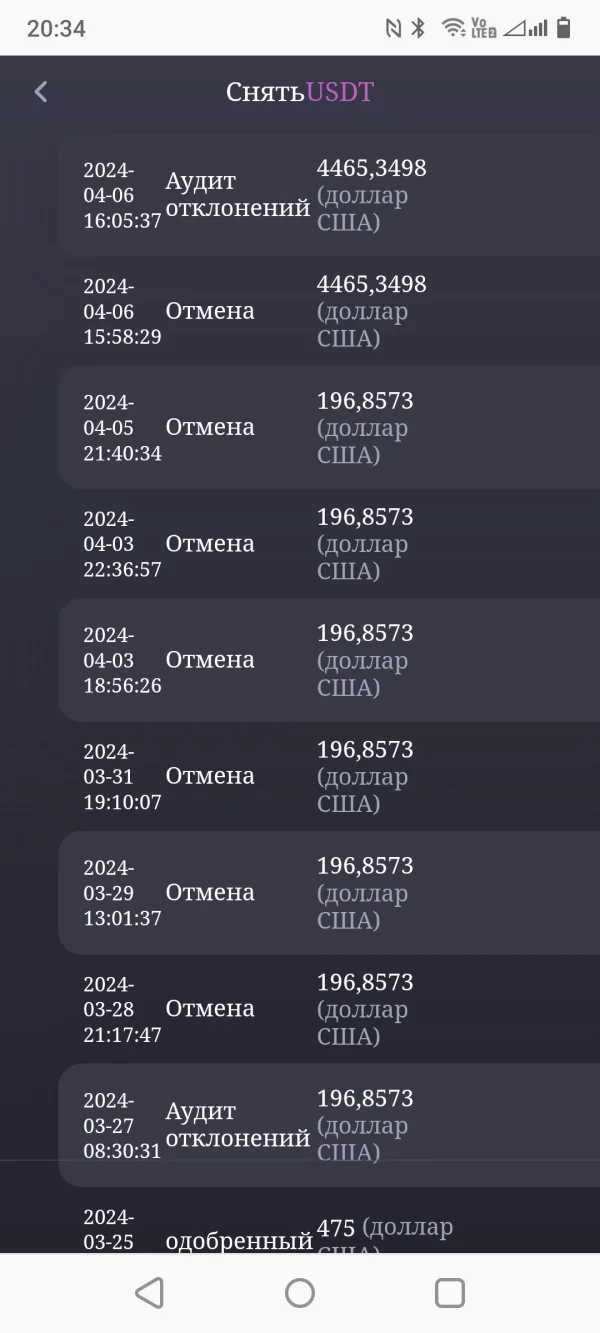

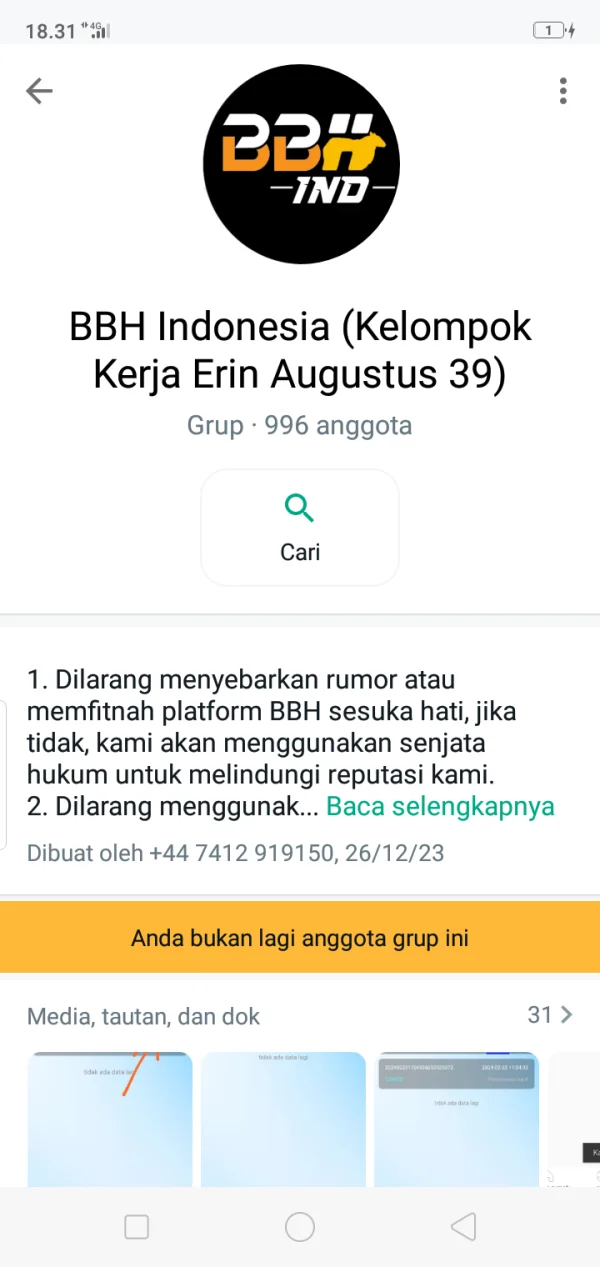

FX3413326667

Russia

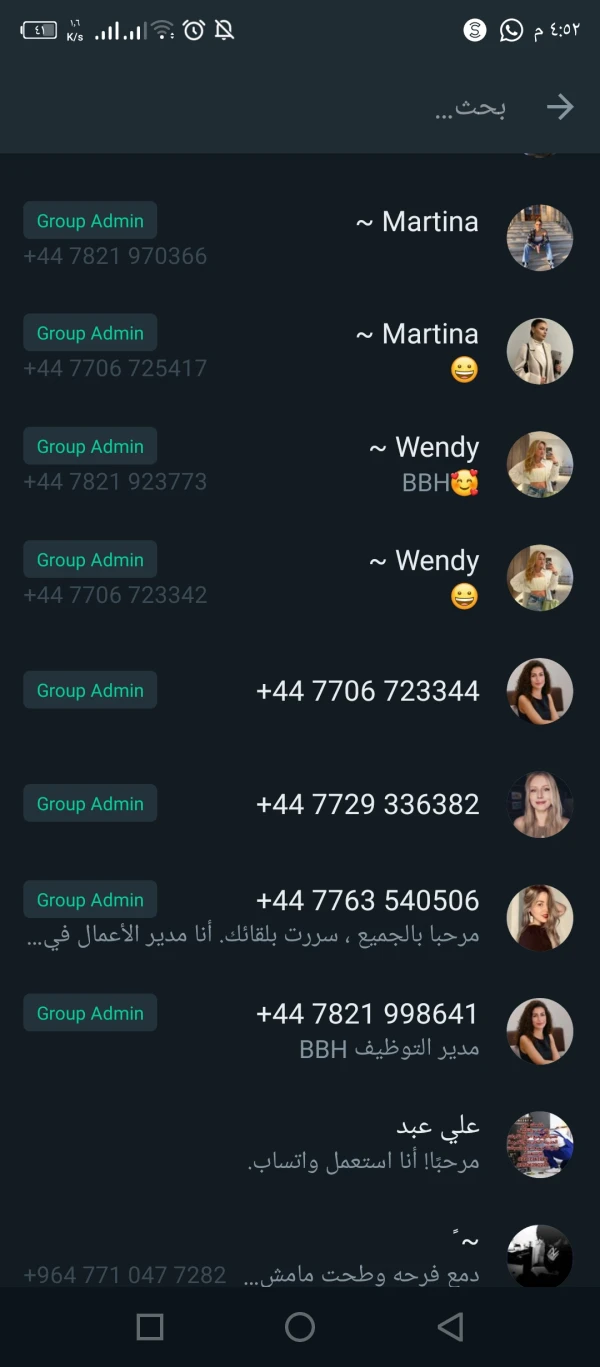

A Chinese girl meets and offers this BBH exchange as an investment. A couple of times they allow me to withdraw money, then withdrawal is not possible. They ask me to pay a 10% tax for withdrawal. Be careful, they are extortionists and scammers!

Exposure

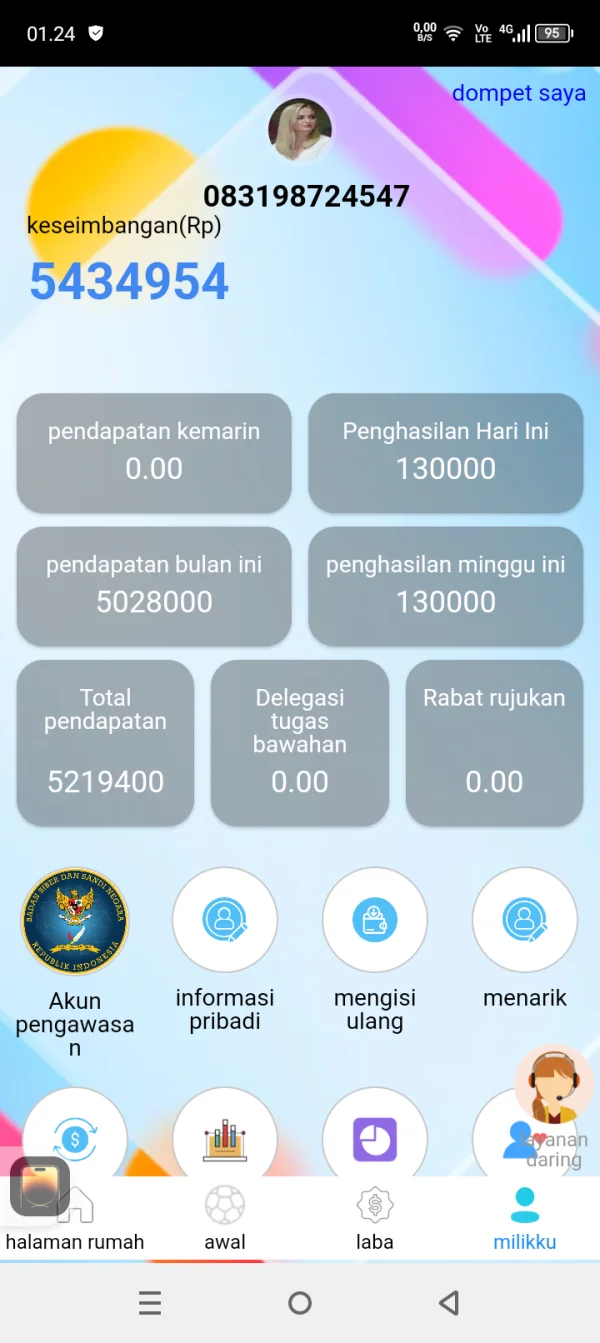

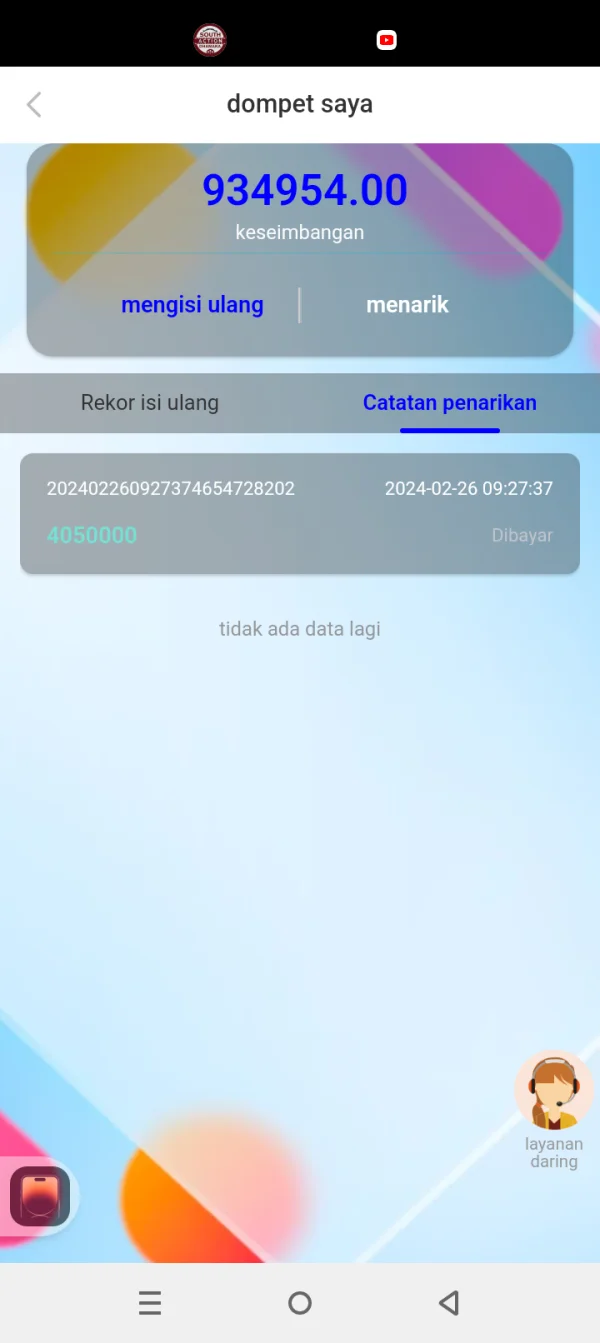

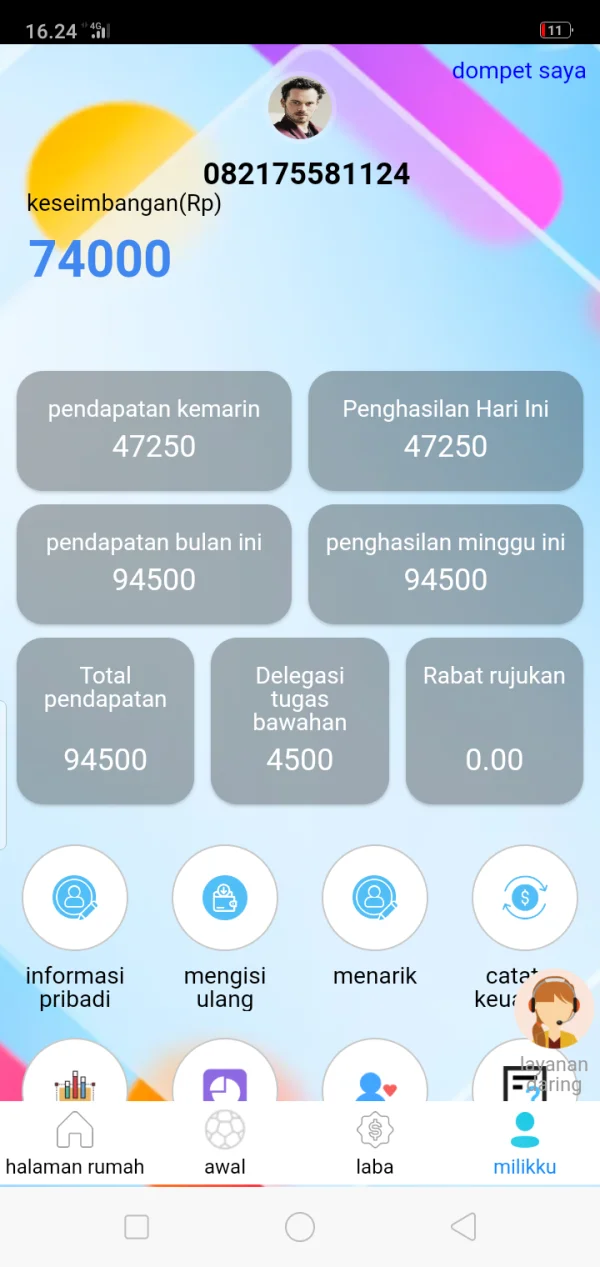

hendra164

Indonesia

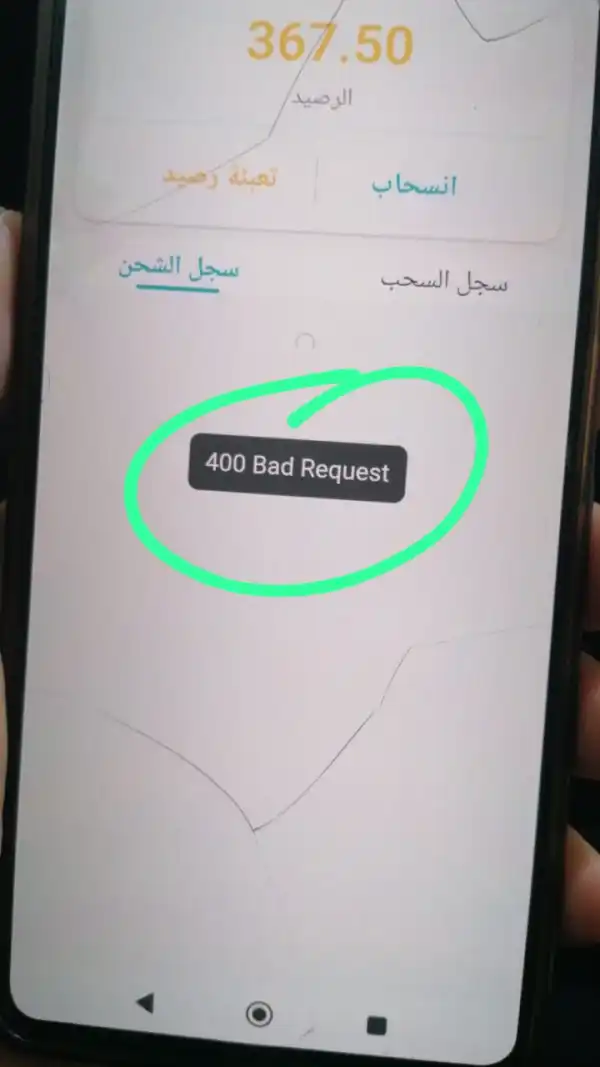

I've made a withdrawal, it hasn't been cashed out yet

Exposure

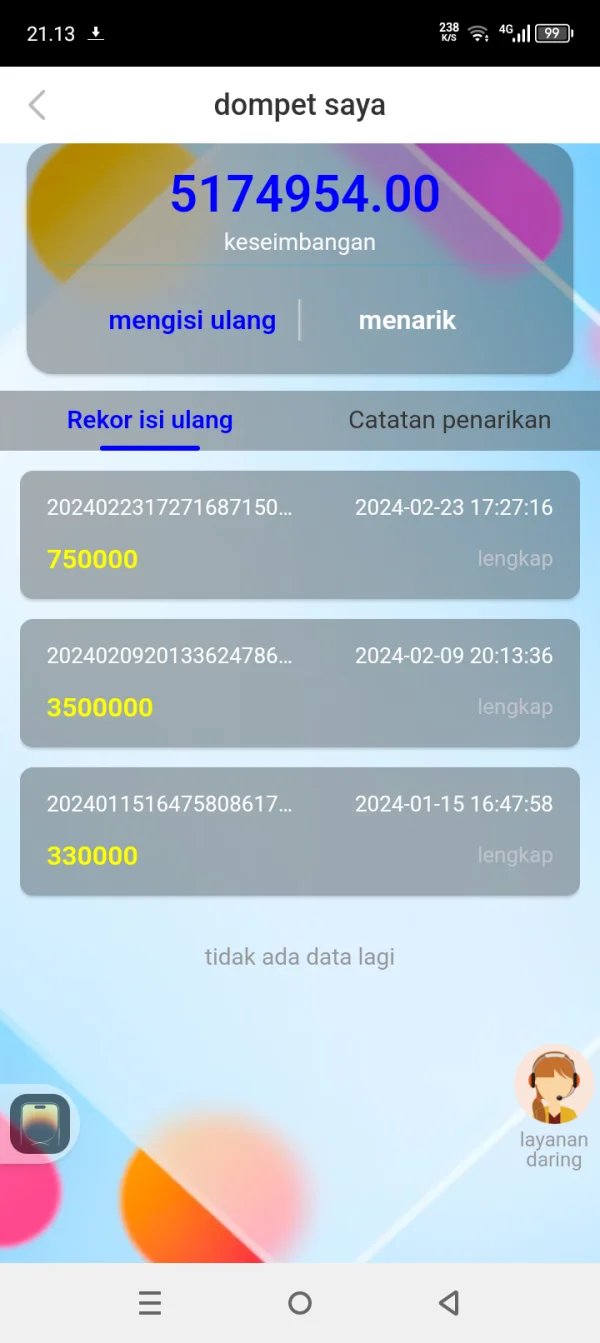

indra518

Indonesia

They have emptied our balance... our balance should have been 2000000 to 0 and they told us to pay tax, we can't withdraw funds for 2 weeks... he told us to pay tax... 2 million for V2... even though our money was empty in balance...how can we pay taxes...

Exposure

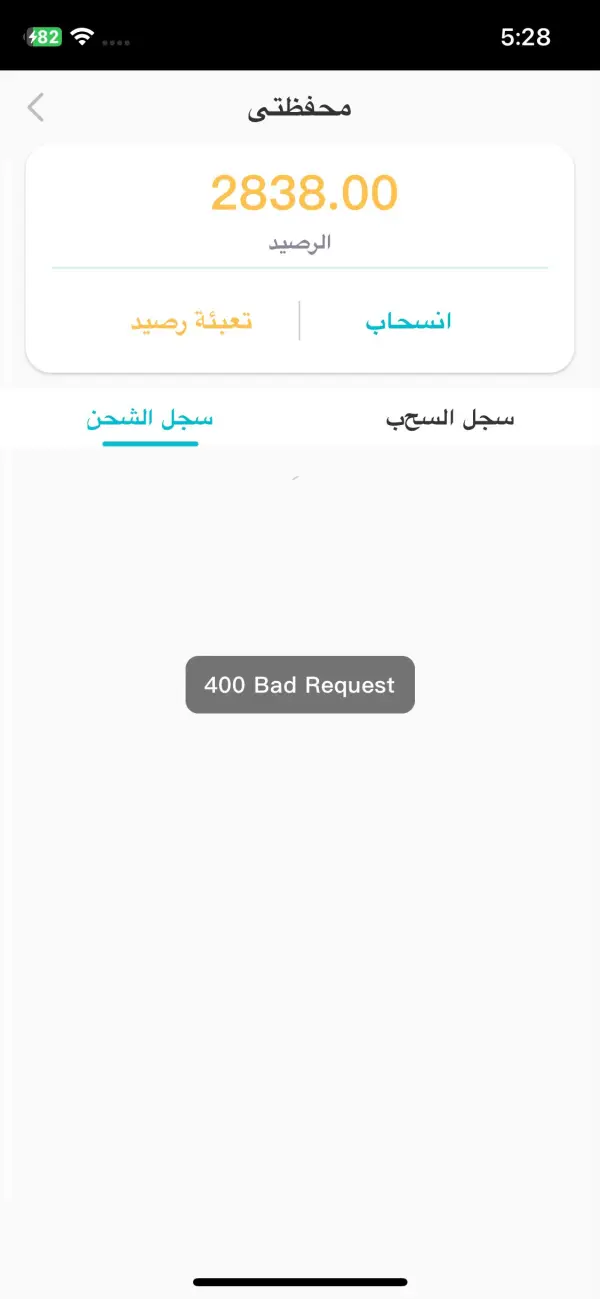

FX3147252051

Iraq

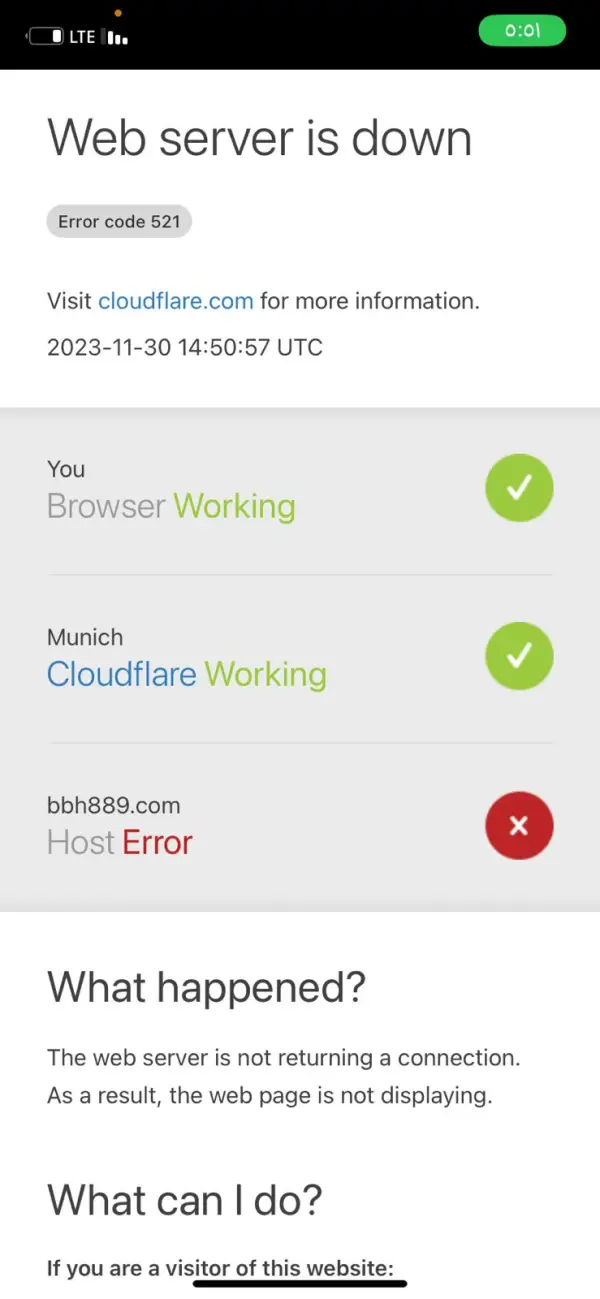

They closed the program. We were scammed with a large amount of money. They promised us we would receive the profits every Thursday, but they broke their word.

Exposure

alfalahi

Iraq

They promised people to withdraw every Thursday, but now they have closed the program and the brokers are not responding to subscribers

Exposure